CMD 2015 - Mobile Systems

Transcript of CMD 2015 - Mobile Systems

…personal

…portable

…connected

Dialog Semiconductor

Capital Markets Day

16 September 2015, London

Mobile Systems

Udo Kratz

SVP Mobile Systems

Introduction Mobile Systems Group

Areas of strategic focus

Other market trends

Dialog Charger innovation

Key takeaways

3

Agenda

• Leading PMIC supplier for portable devices

• Delivering to leading OEMs in high volume,

high growth portable device segments

• At the forefront of mobile power management

innovation

– Highest PMIC integration in the industry

– Broad power management IP portfolio including

high efficiency power conversion, fast battery

charging and advanced packaging

– Optimised electrical, thermal, mechanical design

– Agnostic to processor architectures

Dialog Semiconductor Mobile Systems Group

4

Applications using PMIC and audio

5

Car & in-vehicle Infotainment (IVI)

Tablets Smartphones Chromebooks

Gaming Headset Headphones

Wearables

0

1,000

2,000

3,000

4,000

5,000

6,000

2014 2018

Mobile Power New segments Audio

2014-2018 SAM expansion of 11% CAGR

• New segments:

– Premium wearable

– Mobile Computing systems

Further potential for market share gains

• Greater China opportunity

– Establishing strategic partnerships

with leading players in the region

Continue to add value with

• New technology

• Highly integrated and differentiated

solutions

Power Management and Audio SAM 2014-2018 expansion

6

$3.4B

$5.2B

11% CAGR

Introduction Mobile Systems Group

Areas of strategic focus

Other market trends

Dialog Charger innovation

Key takeaways

7

Agenda

• Collaboration with leading Asian platform vendors

to expand market share in Greater China

• Power management for IoT and wearables

• Expanding into adjacent markets – power

management for Mobile Computing Systems

Diversifying our strategic focus Mobile Systems Group

8

• In 2013 we discussed the

proliferation of sub-PMICs to

address the multicore processor

architecture more effectively

• The trend is for higher currents

and performance which

translates to higher content

opportunity

Progress in China smartphone Platform Partnership Program yielding results

9

• During the past two years this

strategy has been widely

adopted by China smartphone

makers resulting in multiple

design wins

Progress in China smartphone Platform Partnership Program yielding results

10

Technology for IoT and wearables Emerging needs for more efficient System Power Management

11

SmartMeters

• Long periods of sleep/standby

• Short activity bursts with low communication content

• Applications with Always-on sensors/voice control

High power density

High current peaks

• Targeting full day battery life

• Slim form factors, no fan, thermal

constraints

• Low duty cycle of high peak current

drawn by CPU/GPU/AP

Always on

Low current

• One week between charges is becoming

reality

• Ultra low quiescent current

• Strategies to help reduce leakage

current

Power Management technology Supporting low standby current and high current use cases

12

Consumer expectations

for mobile devices

continue to increase as

the devices are used

interchangeably

Accommodating such

diverse requirements whilst

maintaining battery life

• Adds complexity

to the PMIC

• Increases its value-add

within the system

Power Management complexity

13

Wearable, hybrid devices

Sensors, camera, GPS, audio

Always-on sensing USB-C.

wireless, harvesting

Single or multiple

(series/parallel)

New customer

applications

Increased context

awareness

Expanding use cases

New charging scenarios

Different battery configs

PMIC

• Expanding into adjacent markets –

power management for Mobile

Computing Systems

• Higher currents and bigger screens are

better served by multi-cell batteries

• Power management technology from

mobile systems adapted for convertible

tablets - the convergence area for

mobile computing productivity

• SAM approximately $800m by 2018

Dialog Semiconductor achieves highest power density

and efficiency in powering future computing platforms

Powering future computing platforms Bringing to market a new standard of efficiency

14

Introduction Mobile Systems Group

Areas of strategic focus

Other market trends

Dialog Charger innovation

Key takeaways

15

Agenda

Charging Power is increasing

• Battery capacity and size

anticipated to increase

3000mAh 6000mAh

• Batteries are accepting higher charge

currents >1C charging

• Reduce Charge time by fast charging

Quick Charge 2.0, Pump Express,

USB-PD, +others

Market trend - Battery Chargers Smartphone and tablet

16

DisplayPort

Power USB Type-C Combines all in one

USB Type-A

USB Type-B

USB Micro-B

USB Type C recently introduced

in Android Smartphones

• Video, Audio, Data & Power over one

port supported by all major OS

• Replicates the slim and reversible

advantages of Apple lightning connector

• Enabler for 3A current delivery for

faster charging

• First products from LeTV, Xiaomi,

Google/LG Nexus 5

Market trends - Connectors Smartphone connectors

17

Introduction Mobile Systems Group

Areas of strategic focus

Other market trends

Dialog Charger innovation

Key takeaways

18

Agenda

New Dialog Charger IP for Fast Charging Efficiency achievable with best available external components

19

Current Dialog Charger (ASIC)

Next Generation Dialog

Charger

8%

<½ Efficiency Loss

4%

Charger Efficiency Vin=9V

New Dialog Charger IP for Fast Charging Efficiency achievable with best available external components

20

Current Dialog Charger (ASIC)

Next Generation Dialog

Charger

8%

<½ Efficiency Loss

4%

Charger Efficiency Vin=9V

Sufficient Efficiency for Standard USB Charging (7.5W)

Overheating for Rapid USB Charging (15W)

• Reduces the Heat Dissipation by 50%

Improved efficiency at 3A solves

thermal challenge

• Possibility of smallest PCB size

Reduce external component size by

50% compared to standalone charger

• Low profile external components ≤0.8mm

Dialog Next Generation Charger Bringing new innovation to the China smartphone market

21

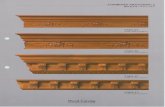

Huawei P8 6.4mm thickness

2.8Ah Battery

Samsung Galaxy A8 5.9mm thickness

3.0Ah Battery

Gionee Elife S7 5.5mm thickness

2.8Ah Battery

Oppo R5 4.85mm thickness

2.0Ah Battery

Introduction Mobile Systems Group

Areas of strategic focus

Other market trends

Dialog charger innovation

Key takeaways

22

Agenda

• At the forefront of PMIC technology

– Investment in power-efficient technology to

maintain leadership position

– Platform Partnership Programme to diversify

customer base now encompassing Asia chipset

vendors

• Focus on Greater China through strategic

partnerships with leading OEMs

• Expansion strategy into adjacent consumer

mobile markets

– IoT and high end wearable devices

– Power management for Mobile Computing

systems

• Bringing innovation to market

– Next generation chargers

Key takeaways Mobile Systems

23

…personal

…portable

…connected

Thank you...

24