CMBS/Subprime Financial Crisis: E&O And D&O Insurance Issues May 16, 2008 Carl Schwartz Elliott M....

-

Upload

carmella-gardner -

Category

Documents

-

view

213 -

download

0

Transcript of CMBS/Subprime Financial Crisis: E&O And D&O Insurance Issues May 16, 2008 Carl Schwartz Elliott M....

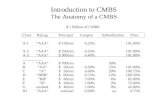

CMBS/Subprime Financial Crisis:E&O And D&O Insurance IssuesMay 16, 2008Carl SchwartzElliott M. Kroll

3

Index Performance Comparison(From ING Clarion Real Estate Securities, U.S. Real Estate Securities, Market Commentary)

• Index Performance• • 5 Year•

• •

• MSCI US REIT Index• • 18.2%•

• Dow Jones Wilshire Real Estate Securities Index• • 18.9%•

• FTSE NAREIT • -• Equity REIT Index• • 18.3%•

• S&P 500 Index• • 11.3%•

• Russell 2000 Index• • 14.9%•

• Lehman Government/Corporate Bond• • 5.0%• •

4

Holders of Commercial & Multifamily Mortgage Leases ($ billions)(From Commercial Mortgage Securities Association, Compendium of Statistics)

5

CMBS Issuance ($ billions)(From Commercial Mortgage Securities Association, Compendium of Statistics)

6

CMBS Weekly Spreads to Treasuries and Swaps (From Commercial Mortgage Securities Association, Compendium of Statistics)

7

Insurance Coverage Issues

• Who is suing whom?

• What is the nature of claims asserted?

• What are the potential E&O and D&O coverage issues?

8

Categories of Real Estate-Related Claims

• Subprime mortgage sales to homeowners and bundling of groups of mortgage loans

• CMBS market disruptions

• Rating, securitization and insurance of real estate debt

• Distribution of securitized debt

9

Real Estate Related Securities and Mortgage Claims/Defendants

• Consumer actions (including class actions) v. Mortgage lenders, title insurers, mortgage brokers:

• Mortgage insurers v. Subprime lenders:

• Shareholder derivative suits

• Lenders v. Banks • Suits by State Attorney

Generals against Investment banks and investment advisors

• Hedge fund investors against Asset managers

• Claims against rating agencies

• Suits against Bond insurers, loan originators,

• Actions against debt securities underwriters for alleged SEC violations.

• Claims by Plan beneficiaries against Plan fiduciaries

• Criminal and regulatory investigations into subprime mortgage sales practices:

10

Real Estate Related Securities and Mortgage Claims/Defendants• Borrowers (likely class actions) v. Mortgage lenders:

– Inadequate disclosure of terms of loans (e.g. failure to properly disclose points, pre-payment penalties, “teaser” rates and adjustable nature of loan

– Failure to investigate brokers or supervise employees– Improper reporting to credit agencies– Discriminatory/predatory lending/advertising practices– Statutory violations (Truth in Lending Act/Unfair Competition Act)

• Mortgage insurers v. Subprime lenders:– force lenders to buy back or replace loans that insurer insured

and that were made fraudulent or in violation of lender’s standards

• Lenders v. Banks – improper margin calls and flawed valuation of underlying

collateral by banks that purchased or financed the loans• Criminal and regulatory investigations into subprime mortgage sales

practices:– FBI investigations of companies that participated in subprime

lending

11

Rating, Securitization and Insurance Claims/Defendants• Claims against Rating agencies

– failure to properly rate CDOs• Regulatory investigations into anticompetitive conduct in debt rating

industry• Claims against bond insurers unable to make contractually-obligated

payments• Borrowers v. Investment banks

– providing financial backing to an aggressive lender despite its questionable business practices

• Shareholders v. Lenders– misrepresentation and omission related to accounting for

residuals; bad valuation; poor underwriting standards• Investors in mortgage backed securities v. Funds

– misrepresentation, bad pricing, failing to follow investment guidelines

• Bond purchasers v. bond issuers and affiliates• Bond issuers and affiliates v. Loan originators• Loan originator shareholders v. Underwriters and auditors of loan

originators.

12

Distribution of Securitized Debt Claims/Defendants

• Plan beneficiaries v. Plan fiduciaries

• Clients v. Investment advisors

• Shareholders v. Public companies with substantial subprime securities holdings

• Institutional Investors v. Underwriters/Banks who securitized and sold mortgages (e.g. misrepresenting quality of underlying loans, covering up delinquencies, misrepresenting coverage available for foreclosures)

13

Estimates Of E&O/D&O Exposure To Subprime Losses• $2 -3 billion in D&O losses

(Guy Carpenter Specialty Practice Briefing, Nov. 2007)

• $3.6 billion for D&O losses (Advisen Ltd. 2/08)

• $8-9 billion for both E&O and D&O losses (National Underwriter P&C, Jan 28, 2008 referring to January 2008 Bear Stearns analyst report)

• Estimates do not include investment losses incurred by insurers through investment of their premium dollars

• Basis for estimates unclear– Valuation of loss

entirely problematical at this point

• Insured v. uninsured losses

• Who are the actual defendants? – What is the actual

impact on D&O - Side A Coverage?

14

Number of Subprime-Related Lawsuits

• According to Navigant Consulting Study:

– As of 12/31/07 -- 278 subprime related lawsuits

– As of 3/31/08 – 478 subprime related lawsuits

15

E&O/D&O Coverage• Is there a “Claim”?

– Does definition expressly include administrative/regulatory proceedings and investigations?

• E.g. “. . . a civil, administrative or regulatory proceeding against any Insured Person commenced by the filing of a notice of charges, investigative order or similar document.”

– “formal” vs. “informal” investigation – some definitions only cover “formal” investigations

– Some definitions expressly include:• subpoenas• target letters• “investigations” without distinguishing

between “formal”/”informal”

16

“First Made And Reported During Policy Period”

• Claim Must Be First Made And Reported During Policy Period

– Did the insured become aware, prior to the policy period, of a Claim, or notice of facts and circumstances that may give rise to a Claim, concerning alleged subprime-related losses?

17

Who Is An “Insured”

• E&O policies often define “insured” more broadly to include the company itself, as well as directors, officers, employees and third parties for whose actions the insured is legally responsible.

• D&O policies typically include directors and officers and, in some circumstances, the company and/or employees– Does policy provide “entity coverage” (Part C

Coverage)?– Is Part C Coverage limited to “Securities

Claims”

18

Definition of “Loss”

• Typically excludes:– Punitive damages– Taxes– Fines– Penalties (civil or criminal)– Multiple Damages– Restitution

19

“Professional Services”

• E&O policies expressly afford coverage for “professional services”

• Definitions can vary depending upon industry:– Lenders (“the origination, sale, pooling and

servicing of mortgage loans secured by real property . . .)

– Financial services firms (“services that an Insured renders pursuant to an agreement with a customer or client, as long as the customer pays a fee, commission, or other compensation . . .”

• D&O policies generally exclude claims related to rendering of “professional services”

20

“Professional Services” (cont.)

– Investment Banks (“those services performed . . . by the Insured (or by any other person or entity for whose acts, errors, or omissions the Insured is . . . legally responsible for), for the benefit of, or on behalf of a Customer . . . for a fee, commission or other consideration”).

21

E&O/D&O Exclusions

• Dishonesty/Fraud• Violation of Statutes• predatory lending claims exclusion• Fiduciary liability

22

Dishonesty/Fraud Exclusions

• Did the insured act in a fraudulent manner/ engage in intentional conduct/obtain a profit or advantage to which it was not legally entitled:– Improper mortgage sales practices, including

discriminatory lending practices– Improper property valuation practices– Improper waiver of financial requirements

applicable to borrowers– Reckless/intentional misrepresentations to:

• homebuyers• buyers of securitized subprime loans• Investors regarding exposure to

housing/credit crisis• Final adjudication v. “in fact” standard

23

Violation of Statutes

• Some policies only exclude “willful” violation of statute

• Some policies exclude only certain statutory violations (e.g. civil rights laws, antitrust laws and/or unfair competition statutes)

• Some policies do not exclude statutory violations

24

Specific Endorsements

• Some policies have an endorsement excluding predatory lending claims.

• Some policies contain exclusions barring claims arising from any investor’s interest in mortgage-backed securities or the filing of any registration statement therewith, unless the claim results from the rendering of “Professional Services.”

25

Fiduciary Liability Insurance

• Most D&O/E&O policies exclude fiduciary liability exposures and those exposures pertaining to the ERISA

• Fiduciary liability policy may apply if a pension/retirement fund is largely invested in subprime securities.

• Under ERISA, plan fiduciaries can be held personally liable for losses to a benefit plan incurred as a result of their alleged errors, omissions, or breach of fiduciary duties.

26

Fiduciary Liability Insurance (cont.)

• Insureds: – trust or employee benefit plan – any trustee, officer or employee of the trust or

employee benefit plan– employer who is sole sponsor of a plan– any other individual or organization

designated as a fiduciary.

27

Fiduciary Liability Insurance (cont.)

• Alleged “wrongful acts” may include:– Improper advice or disclosure – Inappropriate selection of advisors or service

providers – Imprudent investments – Lack of investment diversity – Breach of responsibilities or fiduciary duties

imposed by ERISA – Negligence in the administration of a plan – Conflict of interest with regard to investments

28

CONCLUSION

• Litigations will be prevalent• The list of target defendants will be wide• Plaintiff attorneys will be “imaginative”

– New types of claims should be expected by state agencies, regulators, investors and consumers

• Policyholders need to promptly cooperate and coordinate with their insurers– Choice of counsel– Response to investigations/pre-suit claims

• Compliance with policy terms regarding notice to insurer (in writing, within policy period, specific address, etc.)