CMBS Pitchbook Ver 1 13112011

-

Upload

rashdan-ibrahim -

Category

Documents

-

view

94 -

download

5

Transcript of CMBS Pitchbook Ver 1 13112011

CONFIDENTIAL & PROPRIETORY

Collateralised Mortgage Backed

Securities

for UAE Properties

November 2011

CONFIDENTIAL & PROPRIETARY

EXEC

UTIV

E SUM

MA

RY

Important Notice It is the purpose of this document to provide the latest Overview of the products & services provided by Al Bashayer Investment Company LLC (“BASHAYER”) These product & services shown may change in the future and BASHAYER reserves the rights to change these without notice This document may be deemed as a preliminary offer to parties who are interested in participating, engaging, investing in the products & services shown. This document is submitted to you on a confidential basis. By accepting this document the recipient agrees that neither it nor any of its employees or advisers shall use the information for any purpose other than for evaluating its interest in the Company or divulge such information to any other party. This document shall not be photocopied, reproduced or distributed to others without prior written consent of BASHAYER. Some statements contained herein that are not historical facts are forward-looking statements. These forward-looking statements are based on current expectations, estimates and projections about the industry and markets in which the Company operates, management’s beliefs and assumptions made by the management. Words such as “expects”, “anticipates”, “should”, “intends”, “plans”, “believes”, “seeks”, “estimates”, “projects”, variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecast in such forward-looking statements. Prospective recipients of this document should not treat the contents of this document as advice relating to legal, taxation, financial, investment of any other matters. The recipients of this document should inform themselves as to: (a) legal requirements within their own countries; (b) any foreign exchange restrictions which they might encounter; and (c) the income and other tax consequences which may apply in their own countries relevant to the project. Recipients of this document must rely upon their own representatives, including their own legal advisers and accountants, as to legal, tax, investment, financial and related matters concerning the project. All information is correct at the time of printing and subject to change without notice By accepting this document, the recipient hereof agrees to be bound by the foregoing.

CONFIDENTIAL & PROPRIETARY

CMBS is Asset Securitisation

POOLING

PACKAGING

DISTRIBUTION

A CMBS is similar to any generic asset securitization process which involves :

i) The process of pooling assets

ii) The process of packaging them into marketable debt securities

iii) The process of distributing the marketable securities to investors

The ‘Assets’ can be :

i) Any tangible assets which has income generating capability (land or buildings, aircraft & vessels)

ii) Or those based on future receivables, these could be : Mortgage loan repayments, long / medium term periodic purchase contract, deferred payments on sales contract, long / medium term leasing contract, rental payments, concession revenue / income.

The eventual credit strength of the sukuks / bonds will depends on its variability and defined payback, these are in-turn affected by :

i) The assets / receivables cash flows (Contractual, Retail, Valuation Driven, Event Driven)

ii) The performance to achieve the receivable cash flows (by the Issuer / Sponsor / Operator / Servicer)

iii) The strengths of the receivables’ source i.e. Obligors.

Issuer / Sponsor /

Operator /

Servicer

Obligor(s)

Issuance Conduit

(SPV / SPC)

Assets /

Receivables

Investors

1

CONFIDENTIAL & PROPRIETARY

CMBS Structure - Tranching

2

Typically the CMBS will be issued in different tranches.

The level of tranches and the actual amount of each tranch, depends on the interplay between the :

i) The amount of collateral available & the amount to be raised (LTV)

ii) The cash flow strength of the properties portfolio to cover the debt repayment (DSCR).

iii) The blended costs of funding (based on rating achieved through the tranching).

Equity Note holder : usually this will be the property owner / client itself.

Moody’s Rating Aa2 A2 Baa1 Baa2

LTV Constraints (%) 48% 56% 60% 65%

DSCR Constraints (Abu Dhabi) 2.21 1.88 1.56 1.46

CONFIDENTIAL & PROPRIETARY

CMBS Rating Process – Assets Rating

5

The rating process will look into the real estate asset (on a standalone basis) first and subsequently on a portfolio basis.

The areas that will be looked upon and scrutinised by the rating agency are as shown below

Market Projection and Revenue

Contract

Competitive Market Position

Market Risk Exposure

Financial Strength

Technology, Construction & Operations

Legal & Finance Structure

Implied Project Rating

Final Project Rating

Adjustment for

Country Risk Cap

Force Majeure Adjustment

Credit Enhancements

Credit Risk Drivers for RE income Producing Template

Revenue Contracts

Portfolio Quality

Market Risk Exposure

Financial Strength

Asset Manager Evaluation

Legal & Finance Structure

Implied Pooled Asset Rating

Final Pooled Asset Rating

Adjustment for

Country Risk Cap

Force Majeure Adjustment

Credit Enhancements

Credit Risk Drivers for Real Estate Asset Pool Template

CONFIDENTIAL & PROPRIETARY

CMBS Rating Process – Servicer Rating

6

SQ Ratings measure the quality of the servicing operations rather than the probability of default of the servicer.

While a servicer’s financial stability will be taken into account in the SQ analysis, it will be used mainly to determine the potential deterioration in servicing quality, e.g., the potential effect it may have on staff motivation, future recruitment and training, management focus.

The SQ score would be affected to the extent that such financial condition is perceived as having a likely negative affect on the servicing operations.

Summary of SQ Rating Process

Step 1 Preliminary Document Review

-sample of receivable/asset files

-Servicing guidelines and general company information

Step 2 Operational Review (scoring each of the following areas)

-Management

-Staff

-Asset administration

-Arrears management

-Recoveries

-IT system and reporting

-General quality and historical performance

Step 3 Financial Strength Analysis

-if rated by Moody’s, mapping such rating to a financial “score”

-if not rated, using MKMV models or other techniques to derive a

financial “score”

Step 4 SQ Scoring

-Aggregating the scores of all the above 8 areas (Steps 2 & 3

above) resulting in the Total SQ Score.

-The scores will reflect the servicer’s capacity (primary or special)

Step 5 SQ Rating Committee

-Review and discussion of the scores of each servicing area

-Adjustments based on the nature of servicer’s portfolio

-Historical performance of assets, and overall assessments of

servicing quality

-Voting on SQ Rating

Step 6 Dissemination of Rating

-Servicer will be notified of its SQ Rating

-Servicer will decide whether the SQ Rating will become public

-If SQ Rating is made public, a SQ Report and a press release will

be issued

Step 7 Use of SQ Rating

-Moody’s will use the SQ Rating in its analysis of all ABS deals

whose underlying receivables are serviced by the rated servicer

Step 8 Monitoring

-SQ Rating will be monitored on an on-going basis

SQ Rating SQ Rating Scale Description

SQ1 Servicer rated SQ1 exhibit strong servicing ability and financial and operational

stability. The servicer anticipates and makes modifications in advance of changing

market conditions

SQ2 Servicer rated SQ2 exhibit above average servicing ability. The company is judged

to have good financial and operational stability. The servicer is responsive to

changing market conditions.

SQ3 Servicer rated SQ3 exhibit average servicing ability. The company is judged to

have average financial and operational stability. The servicer is prepared for

changing market conditions.

SQ4 Servicer rated SQ4 exhibit elements of weakness in servicing ability and financial

and operational stability.

SQ5 Servicer rated SQ5 exhibit weak servicing ability and poor financial and

operational stability

CONFIDENTIAL & PROPRIETARY

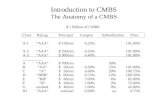

Previous UAE’s ABS Issuances – Real Estate Related

7

ENSEC Home Finance 1 Limited – 17 May 2005, UAE

This is considered as the first GCC securitisation. However, while this structure involved pre-

purchase payments on property assets of Nakheel’s Plam Jumeirah development, this (now

redeemed) transaction was fully cash collateralised in an onshore account and as a result

was rated Aaa by Moody’s

Class Rating Investor Balance %age CCY Spread Maturity

A Aaa Public 350 100% USD L+20

matured

Tamweel ABS (CI) 1 / Tamweel PJSC – 26 July 2007, UAE

This was the first international and publicly rated islamic securitisation of Ijara receivables of

residential properties located in Dubai. It is the first true sale, rated, asset backed Sukuk in the

GCC. In a rather unusual way for an RMBS deal but driven by the islamic and legal elements of the

deal, the freehold titles of all the financed properties were passed to the issuing SPV. The

originator (tamweel) is unrated but multiple back-up servicing mechanisms are in place to

mitigate the rating linkage of the Sukuk to Tamweel.

Class Rating Investor Balance %age CCY Spread Maturity

A

B

C

D

Aa2

Baa1

Ba3

NR

Public

Public

Public Originator

177.45

15.33

9.87

7.35

84.5%

7.3%

4.7%

3.5%

USD

USD

USD

USD

L+35

L+120

L+395

NA

Aug 2037

Aug 2037

Aug 2037

Aug 2037

Sun Finance Limited / Sorouh Real Estate PJSC – 11 Sept 2008, UAE

This first Abu Dhabi transaction is an innovative example of an asset backed sukuk financing.

Sorouh securitised AED5.7 bil of payments due to it under the land purchase contracts of 109

sub-developers working on the estate. A sizable portion (approx AED 1.7 bil) was put into escrow

to fund the construction costs and helped further delink the sukuk performance from that of

Sorouh. The credit risk of the transaction is related (among other things) to the credit worthiness

of the sub-developer pool, involvement of the Abu Dhabi Urban Planning Council and low

(effective) LTVs of the contracts were key deal features. Certificates are amortising with full pass

through of asset cashflows.

Class Rating Investor Balance %age CCY Spread Maturity

A

B

C

Sub’n

Aa3

A3

Baa3

NR

Public

Public

Public Originator

2761

251

1004

1004

55.0%

5.0%

20.0%

20.0%

AED

AED

AED

AED

E+200

E+250

E+350

0

Jan 2015

Jan 2015

Jan 2015

Jan 2015

UAE CMBS No.1 Limited / Arabian Real Estate Investment Trust – 27 July

2007, UAE

This is the first publicly rated conventional securitisation of a single commercial real estate

loan secured by a single, multi tenanted property in Dubai within the Technology and Media

Free Zone. The new funding was used to refinance a bridge loan which was initially used to

acquire the property. The security package for investors was promarily a first ranking

mortgage over the property, and assignment by way of security of all shares in the SPV, its

rights, title and interests in the management and leasing agreement, and various other

contractual rights

Class Rating Investor Balance %age CCY Spread Maturity

A

B

C

D

Aa3

A3

Baa1

Baa3

Public

Public

Public

Public

28.1

12.9

12.5

13.5

41.9%

19.3%

18.7%

20.1%

USD

USD

USD

USD

L+50

L+70

L+140

L+170

Jun 2016

Jun 2016

Jun 2016

Jun 2016

CONFIDENTIAL & PROPRIETARY

CMBS Proposed Transaction Structure

8

Asset / Property

Manager

(Servicer)

Borrower

(onshore)

Properties

Lessees

(Obligors)

Borrower Security

Agent

(onshore bank)

Issuer Security

Trustee

Issuer SPV

(offshore)

CMBS

investors

Liquidity Facility

Provider (onshore

bank)

Swap Provider

(onshore bank)

Property

Management

Agreement

Title

PMLA

payments

Grant of security

under the Borrower

Security Documents

Borrower Security Agents

holds Borrower Security on

trust for the issuer

Liquidity

Facility

Interest and Principal

Issuer / Borrower Term Advances

FX and Interest

Rate Swap

Grant of security

under the Issuer

Deed of Charge

Issuer Security Trustee holds

security granted by issuer on

trust for CMBS investors

CMBS Issuance Proceeds

Interest and Principal

PMLA

payments

CONFIDENTIAL & PROPRIETARY

CMBS Proposed Transaction Structure - Explanation

9

On the Issue Date, the SPV will issue the CMBS, subject to the satisfaction of certain conditions. The gross proceeds of the issuance will be applied by the Issuer to make a term loan made to the Borrower in accordance with the terms of a facility agreement between them.

The Issuer will have the benefit of a liquidity facility (the Liquidity Facility) to be provided on the Issue Date by a local UAE bank (onshore bank) pursuant to a facility agreement (the Liquidity Facility Agreement).

The Issuer, and the onshore bank (in such capacity, the Swap Provider) will enter into a cross currency fixed/floating swap agreements (the Swap Agreement) on the Issue Date.

The Issuer will grant first priority fixed and floating security over all its assets and undertaking to the Issuer Security Trustee pursuant to a deed of charge (the Issuer Deed of Charge) as security for, inter alia, its payment obligations under the CMBS and amounts owing from it to the Liquidity Facility Provider and the Swap Provider.

The Borrower will grant a first ranking mortgage under United Arab Emirates law (UAE Law) over the Property in favour of the Onshore Bank (the Borrower Security Agent) pursuant to a mortgage (the Borrower Mortgage) registered at the respective emirate’s Lands Department as security for, inter alia, repayment of the Term Loans.

The Borrower will also assign by way of security under UAE Law, to the Borrower Security Agent, all the Borrower's right, title and interest in the Insurance Policies on the properties. The Borrower will grant a first ranking fixed charge under English law over its interest in the Borrower Transaction Account and will assign by way of first fixed security under English law its rights under those of the Transaction Documents governed by English law to which it is a party.

On the Issue Date, the Borrower will enter into an asset management agreement with an Asset / Property Manager (the Asset Management Agreement) pursuant to which the Borrower will appoint the Asset Manager to undertake certain property management and reporting functions.

The Issuer will use, inter alia, amounts received by it in its capacity as lender under the Issuer/Borrower Facility Agreement, in making payments to, among others, the holders of the Notes (the Noteholders).

CONFIDENTIAL & PROPRIETARY 10

Items Explanation

Description A debt instrument based on Ijarah principle (Leasing)

Denomination Currency USD

LTV (Cash) 48% - 65% (depending on rating)

Credit Rating Required

Coupon Fixed rate

Tenor Up to 10 years

Principal Redemption i) Redemption Value is Fixed upfront

ii) Client must choose upfront for either Lump-sum redemption at maturity or fixed periodic

redemption.

Principal Redemption options One-time early full-redemption option at Year 5

Issuance Costs Depending on amount of individual tranche :

2.00% for AA rating (0.2% p.a.), 2.50% for A rating (0.25% p.a.), 3.00% for BBB rating

(0.30% p.a.), 3.50% for BB rating (0.35% p.a.)

Swap Costs 0.50% p.a.

Current Market Yield 3.80% p.a. to 5.65% p.a. (depending on credit rating)

All-in funding costs 4.50% to 6.50% (fixed rate, depending on credit rating)

Size Smaller (multiple tranches with multiple credit ratings)

Covenants i) Maximum LTV (from 65% for BB rating to 48% for AA rating)

ii) Minimum DSCR (from 1.46x for BB rating to 2.21x for AA rating)

Issuer base Debt investors

Indicative Terms

CONFIDENTIAL & PROPRIETARY

CMBS Issuance Mandate – Scope of Work

11

Bashayer’s will be the Financial Advisor to the Client, Bashayer’s role will be to advise on all matters relating to, and throughout the CMBS issuance processes. Bashayer’s responsibilities are :

i) Prepare an Initial Pitch which includes an overview of the funding requirements and profile of the Client

ii) Prepare a Preliminary Private Information Memorandum , which includes the funding objectives, structuring the financing structures, Issuer profile, financials and indicative terms & conditions. The aim of this document is to effectively sell the Client’s ‘Credit Story’ to the local lead manager & rating agencies.

iii) Source, arrange and/or negotiate for and on behalf of the Client in securing a Lead Manager who will act as the arranger & submission agent for the CMBS issuance.

iv) Advise and/or Negotiate for and on behalf of the Client, on the appointment of all other 3rd parties recommended by the Lead Manager, these parties are :

a) Rating Agencies

b) Legal Counsel & Reporting Accountant

c) Shariah Advisor

d) Any other parties relevant to the CMBS issuance

v) Identify, Source and Arrange for participations from financial institutions & investors during the placement and issuance stage of the CMBS. This is done independently or together with the Lead Manager.

vi) Deliver an opinion to any Related Board of Directors, if requested by the Client, as to the fairness from a financial point of view on any or all parts of the CMBS issuance.

CONFIDENTIAL & PROPRIETARY

CMBS Issuance Mandate – Timeline

12

Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

Mandate signed with

Bashayer

Developed & finalised

Transaction Structure

Preliminary Information

Memorandum

Marketing & securing

commitments from

transaction parties

Formal Appointment of Lead

Manager & transaction

parties

Kick-off Meeting with Lead

Manager & other transaction

parties

Credit Rating process

Business, Financial and

Legal Due Diligence

(including Bringdown)

Offering Circular Drafting

Terms & Conditions

Discussion / Drafting

Drafting of various Legal

Documents and Agreements

Submit Offering Circular to

SGX

Obtain SGX In-Principle

Approval

Prepare Roadshow Materials

Roadshow Rehearsal

Print Reds

Announce Transaction

Roadshow

Pricing

Closing

Ph

ase 1

Ph

ase 2

Ph

ase 3

CONFIDENTIAL & PROPRIETARY

CMBS Issuance Program – Indicative Costs

13

Issuance Size $175,000,000.00 3

rd Party Fees Costs (est) Annualised over

10 years Moody’s & Fitch Rating Fees $400,000.00 0.23%

Survey Appraisal and Market Report $50,000.00 0.03%

Legal Counsel (International & UAE) $200,000.00 0.11%

Establishment of SPV (incl legal costs) $50,000.00 0.03%

Accounting & Audit $35,000.00 0.02%

Lenders Due Diligence $50,000.00 0.03%

Travel, Road Show & Misc $60,000.00 0.03% Trustee & Paying Agent $20,000.00 0.01%

Listing Agent & Listing Fee $25,000.00 0.01% $890,000.00 0.51%

Bashayer & Lead Manager Fee Costs (est) Annualised over

10 years

All-in Fees

(per annum)

Advisory Fee $150,000 0.09% Out of Pocket Expenses $10,000 0.01%

Success Fee Aa 2.25% 0.225% 0.73%

A 2.75% 0.275% 0.78%

Baa 3.50% 0.350% 0.86%

Ba 4.00% 0.400% 0.91%

CONFIDENTIAL & PROPRIETARY

AL BASHAYER INVESTMENT COMPANY LLC

PO BOX 31665 ABU DHABI, UNITED ARAB EMIRATES

T : +971 2 4418800 F : +971 2 4418844

www.bashayer.com

Al Bashayer Investment Company LLC (“Bashayer”) , is an investment company based in Abu Dhabi, and licensed by the Central Bank of the UAE. It was established in 2008 with a paid-up capital of AED 50 million. Bashayer is owned by prominent shareholders including members of the Al Jaber family, Addax Investment Bank (Bahrain) and Waha Capital (Abu Dhabi). Under its current license, Bashayer can provide fund management, investment services & financial advisory to its clients. Other related activities that can be undertaken by Bashayer includes carrying the business of a fund manager, creating trusts, appointment of trustees, investment managers, custodian, brokers and agent. It also carries the business of holding of investments in securities, stocks, shares, loans, deposits & sukuks .

Head, Capital Markets

Rashdan Ibrahim [email protected]

Mob (UAE) : +(971) 50 44 55 749

Mob (KUL) : +6012 3988 170

CO

NTA

CT IN

FOR

MA

TION

Contact Information