Clyde Area UK4459

-

Upload

muzameer-syam-omar -

Category

Documents

-

view

100 -

download

2

description

Transcript of Clyde Area UK4459

Europe (UK) - Central North Sea

October 2012

Clyde Area

Key Facts

Onstream Offshore

Location Timetable

Sector, Basin: Central North Sea, Central Graben Issue Date Nov-77

Block: 30/17B, Area: 99 km2 Discovery Date: Clyde Jun-78

Water Depth: 75 - 82m Discovery Date: Leven Oct-83

Discovery Date: Medwin May-79

Discovery Date: Nethan May-04

Devt Consent: Clyde Dec-82

Devt Consent: Leven Sep-92

Devt Consent: Medwin Nov-93

Devt Consent: Nethan May-04

Production Started: Clyde Mar-87

Production Started: Leven Sep-92

Production Started: Medwin Mar-94

Production Started: Nethan May-04

Peak Gas Production (23 mmcfd): Clyde Area 1988

Peak Oil Production (51,500 b/d): Clyde Area 1988

Final Expiry Nov-14

Operator Participants %

Talisman Talisman 95

First Oil 5

Primary Reservoir(s):

Clyde Area: Jurassic\Upper Jurassic\Kimmeridgian\Humber\Fulmar

Recoverable Reserves (p+p) Hydrocarbon Quality

167 mmbbl Oil Gravity (°API) 37 - 39

36 bcf Sales Gas Sulphur (%) 0.4

Remaining Reserves at 01/01/2013

12 mmbbl Oil

0 bcf Sales Gas

Contract Financial Summary

Concession

Capital costs (2013 terms) US$2,455M

Capital costs per boe (2013 terms) US$14.18/boe

Operating costs (2013 terms) US$2,874M

Operating costs per boe (2013 terms) US$16.60/boe

Remaining PV (10.0% nominal) US$46M

Remaining PV per boe (10.0% nominal) US$3.85/boe

Rate of return 12.5% Source: Wood Mackenzie

We assume that the licence will be extended until the reserves are depleted.

Summary and Key Issues

Summary

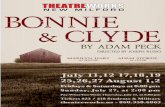

The Clyde Area consists of four separate Jurassic structures (Clyde, Leven, Medwin and Nethan). The Clyde field has been developed with a single lightweight fixed steel platform. The Leven (formerly Clyde Alpha), Medwin and Nethan fields have each been exploited via extended reach drilling (ERD) from the Clyde platform.

Clyde Area Central North Sea

Europe (UK) Upstream Service - October 2012 Page 2 of 19

Production is transported from the Clyde platform to Fulmar, ten kilometres to the west. Gas is then exported via the Fulmar gas pipeline to the terminal facilities at St Fergus. Since early 1997, oil has been exported via a spurline connection that runs from Fulmar to the J-Block/Norpipe evacuation route. Liquids land at the ConocoPhillips-operated terminal facilities at Teesside. Prior to 1997, crude was evacuated from Fulmar via the Fulmar offshore loading system.

The Medwin field ceased production in 1996. However, during 2005 an appraisal well targeting a possible field extension to the west was successful and was completed as a producer. The field came back onstream in November 2005.

The Nethan field was shut-in during 2005 due to gas lift capacity constraints on the Clyde platform. Production from the field resumed in October 2009.

The Talisman-operated Orion field has been developed as a subsea tie-back to the Clyde platform, which has helped to prolong the economic life of the facilities. The Cawdor and Flyndre fields are also expected to be developed as subsea tie-backs to the Clyde platform.

Key Issues

A development well was completed on Clyde in August 2012. We expect a further three wells to be drilled on Clyde by the end of 2013. The wells will target a number of structures including the Clyde North Terrace and East Flank. This is expected to extend field life to 2026.

The Flyndre and Cawdor fields, which we assume will be tied back to Clyde, are expected to come onstream in late 2013 and 2014 respectively. We assume the Clyde partners will receive a production tariff for the use of its processing and export facilities. However, following commercial negotiations, it is also possible that Flyndre and Cawdor will join the existing Clyde Area opex share agreement, which includes Orion.

In July 2012, Sinopec announced the acquisition of a 49% interest in Talisman's UK assets for a consideration of US$1.5 billion. The deal is effective from January 2012 and is still to complete at the time of writing.

Clyde Area Central North Sea

Europe (UK) Upstream Service - October 2012 Page 3 of 19

Location Maps

Index Map

Ka m a

Yen

isei

Amga

Aldan

Yenise

i

Ang

ara

Ust-Illimskiy Reservoir

Riv

er

Irty

sh

Riv

er T

obol

River Irtysh

River Ir ty sh

Riv

er O

b

Ob

Riv er

Chulym

River O

b

Riv

er O

b

Riv

er O

b

River T

om

Lena

Riv

er

Volg a

Volg a

Orkney Islands

UK- Scotland

Grampian

Tayside

Lothian

Borders Region

Fife

Wick

Flotta

Aberdeen

Dundee

Perth

EdinburghGrange-

mouth

Mossmorran

Cruden Bay

St. Fergus

NiggShandwick

BEATRICE

CAPTAIN

EVEREST

ARMADABRITANNIA

FORTIES

BRAEMILLER

SLEIPNER

EKOFISK

FIFE

J-BLOCK

AUK

GANNET

BUCHAN

MARNOCK

ROSS

PIPERCLAYMORE

SCOTT BALMORAL

NELSON

MONTROSEKITTIWAKE

BERYL

BRUCE

30" Claymore-Flotta oil

36"

FL

AG

S B

rent-S

t.F

erg

us

2 x

32"

Frigg-S

t.Fe

rgus g

as 30"

SA

GE

Bery

l-S

t.F

erg

us

Heim

da

l-B

rae

oi l

32" Forties-Cruden Bay o il

gas

gas

20" Fulmar-St.Fergus gas

36"

CA

TS

Eve

rest

/Lom

ond-

Tee

sid

e g

as

34" Norp

ipe

E

kofis

k-

Teess

ide o

il

26" Britannia-St.Fergus gas30" S

AGE, 30"Mil le

r

20" Goldeneye

gas34"

SE

AL

ga

s

to

Bacto

n

FULMAR

CURLEW

FRANKLIN

ELGIN

LOMOND

EAST BRAE

KINGFISHER

GYDA

BUZZARD

44" Langeled (South)

gas pipeline

NOR.

DEN.

NETH.

2°E

2°E

0°

0°

2°W

2°W

4°W

4°W

58°N

58°N

56°N

56°N

0 50 100 km

Source: Wood Mackenzie

Clyde Area Central North Sea

Europe (UK) Upstream Service - October 2012 Page 4 of 19

Clyde Map

Clyde Area Central North Sea

Europe (UK) Upstream Service - October 2012 Page 5 of 19

Participation

Participation in the Clyde Area fields at the time of publication is detailed in the accompanying table.

Participation

Company (%)

Talisman 95.00 *

First Oil 5.00

Total 100.00 Source: Wood Mackenzie

* Operator

The Clyde, Leven, Medwin and Nethan accumulations are all wholly contained within block 30/17b which was allocated to a BNOC-led group in the Fifth UK Offshore Licensing Round in November 1977. Recent asset deals involving block 30/17b and the Clyde Area fields include:

In August 2001, First Oil announced that, as part of an earlier deal between Talisman and ExxonMobil, it had acquired a 5% stake in 30/17b. No consideration was disclosed and the deal was effective from 1 July 2000. The deal involved the acquisition, by Talisman, of ExxonMobil's 18.5% stake in block 30/17b (Clyde Area) in March 2001. The final result of the deal was that Talisman effectively increased its equity in the Clyde Area by 13.5%, whilst First Oil acquired ExxonMobil's remaining 5% stake.

In July 2012, Sinopec announced the acquisition of a 49% interest in Talisman's UK assets for a consideration of US$1.5 billion. The deal is effective from January 2012 and is still to complete at the time of writing.

More detailed analysis of deals relating to this asset can be found in Wood Mackenzie's M&A Service.

Geology

Each of the Clyde Area fields produce from Jurassic sandstone reservoirs. The Clyde structure itself comprises a rotated fault block underlain by a Zechstein salt wedge. The northern edge of the field has been truncated by crestal erosion beneath a major unconformity at the base of the Upper Cretaceous. The Clyde reservoir is a combined structural and stratigraphic trap, consisting of a north-south trending anticline with general dip and local fault closure. Two oil types are present. In the west and south of the field, the uppermost sand unit is separated from the underlying sands by shale and contains 36.7° API oil with a GOR of 340 scf/barrel. The bulk of the oil has an API of 38.1° and a GOR of 490 scf/barrel. Clyde oil was sourced from the Upper Jurassic, Kimmeridge Clay Formation. The top seal is provided by the overlying Kimmeridge Clay Formation and up-dip seal by the truncation of the Fulmar Formation beneath the Base Chalk unconformity. Down-dip simple three-way dip closures provide the trapping mechanism.

The Clyde Area reservoirs are developed within the Fulmar Formation of Early Kimmeridgian age. The dominant facies are heavily bioturbated, arkosic, fine grained sandstones and siltstones deposited in a shallow marine shelf environment. Appraisal and development drilling have defined that the field comprises three separate coarsening upward cycles termed the Upper, Middle and Lower reservoir units, zones A, B and C respectively. The Upper reservoir unit thickens towards the west downflank from the crest. Conversely, the Middle and Lower reservoir units thicken onto the crest of the field to the east. The reservoirs have moderate to excellent porosity and permeability.

Field Hydrocarbon Characteristics

Field Reservoir Depth GOR Gravity Sulphur Total Acid No.

m scf/bbl °API % mg KOH/g

Clyde Area 3901 415 38 0.4 0.1 Source: Wood Mackenzie

Clyde Area Central North Sea

Europe (UK) Upstream Service - October 2012 Page 6 of 19

Well Data

Clyde and Nethan

Well Name Operator Spudded TMD(m) Result Discovery Field Comment

Type Completed WD(m)

30/17B-2 BNOC 3-Mar-78 3906 + Oil Clyde Clyde oil field discovery well. Tested 4,975 b/d of 37° API oil. Exploration 21-Jun-78 79

30/17B-3 BNOC 29-Aug-78 3938 Oil Clyde oil field appraisal well. Tested 5,843 b/d of 36° API oil. Appraisal 2-Dec-78 79

30/17B-6 BNOC 4-May-79 3954 Oil Clyde oil field appraisal well.

Appraisal 6-Aug-79 81

30/17B-7 BNOC 4-Jul-80 3977 Oil Clyde oil field appraisal well. Tested 5,674 b/d of oil.

Appraisal 22-Sep-80 78

30/17B-A34 Talisman 11-Dec-00 5739 Tight Hole Well targeted incremental reserves in the Jurassic Clyde field reservoir but was subsequently abandoned due to technical difficulties.

Exploration 15-Feb-01 81

30/17B-A34Z Talisman 2-Jun-02 5902 Oil Exploration well targeted the ETA2 prospect. Completed as an oil producer. Exploration 19-Mar-03 81

30/17B-A39 Talisman 13-Feb-04 1442 Clyde Area exploration well.

Exploration 1-Mar-04 81

30/17B-A39Z Talisman 1-Mar-04 5706 + Oil Nethan Nethan discovery well. Completed as a producer.

Exploration 26-May-04 81

30/17B-A34Y Talisman 21-Nov-08 4570 Tight Hole Clyde northeast flank appraisal well drilled from the Clyde platform. Appraisal 25-Dec-08 81

30/17B-A34X Talisman 25-Dec-08 4955 Tight Hole Clyde northeast flank appraisal well drilled from the Clyde platform. Appraisal 19-Jan-09 81

Source: Wood Mackenzie

+ Commercial Discovery

Leven and Leven North

Well Name Operator Spudded TMD(m) Result Discovery Field Comment

Type Completed WD(m)

30/17B-8 BNOC 24-Jun-81 4285 Oil Shows Targeted the Leven prospect.

Exploration 29-Aug-81 82

30/17B-9 Britoil 7-Jun-83 4156 + Oil Leven Leven field discovery well (originally Clyde Alpha). Tested 5,300 b/d of oil. Exploration 21-Oct-83 81

30/17B-A32 Talisman 5-May-00 6870 Oil Leven appraisal/development well. Tested 12,080 b/d of 39° API oil from good quality Upper Jurassic sands.

Appraisal 8-Aug-00 81

Source: Wood Mackenzie

+ Commercial Discovery

Medwin

Well Name Operator Spudded TMD(m) Result Discovery Field Comment

Type Completed WD(m)

30/17B-5 BNOC 25-Jan-79 4265 + Oil Medwin Medwin discovery well. Located east of Clyde oil field. Tested 3,510 b/d of 37.7° API oil. Exploration 2-May-79 75

30/17B-A42 Talisman 9-Sep-05 7075 Oil Medwin West appraisal well drilled from the Clyde platform. Completed as an oil producer. Appraisal 11-Nov-05 81

Source: Wood Mackenzie

+ Commercial Discovery

Clyde Area Central North Sea

Europe (UK) Upstream Service - October 2012 Page 7 of 19

Exploration

Clyde was the first commercial discovery made on acreage allocated in the Fifth UK Offshore Licensing Round. Most of the early drilling in this part of the Central Graben was aimed at the Cretaceous and Zechstein chalk reservoirs first found with the Ekofisk discovery in the Norwegian Sector. Clyde, like Fulmar which lies ten kilometres to the west, lies in the deeper Jurassic sandstone horizon.

The Clyde Area consists of four separate Jurassic structures (Clyde, Leven, Medwin and Nethan). Clyde (formerly Clyde Beta) is the largest field and forms the main development project. Medwin (formerly Clyde Gamma) identified by well 30/17b-5 in 1979, has been developed by a deviated well from the Clyde platform. Leven (formerly Clyde Alpha), identified by well 30/17b-9 in 1983, consists of a predominantly dip closed elongated anticlinal structure which trends southwest to northeast. The reservoir sands are of inferior quality to the main Clyde structure.

A 3D seismic survey undertaken in 1992 suggested that the Medwin field could be larger than originally thought. The survey showed that the discovery well had penetrated the flank of a larger structure capable of being developed via extended reach drilling (ERD). Once appraised by a sidetrack of the disused 30/18b-A21 well in November 1993, the well was brought onstream in March 1994. The well ceased flowing in August 1996. During 2005, the 30/18b-A21Z well was sidetracked to appraise a possible field extension to the west. This well, 30/18b-A42, was subsequently completed as a producer and came onstream in November 2005.

In July 2000, the Leven North accumulation was discovered by exploration/development ERD well 30/17b-A32. The well tested 39° API oil at a maximum rate of 12,080 b/d from an Upper Jurassic, Fulmar sand and was brought onstream through the Clyde facilities in August 2000.

The 30/17b-A34 exploration well targeting the ETA-2 prospect to the north of the Clyde field was re-entered in June 2002 but encountered problems and was abandoned. This well was subsequently redrilled as well 30/17b-A34Z.

A further exploration well, 30/17b-A39Z, was drilled in the first half of 2004 and discovered the Nethan accumulation. The well, which was drilled from the Clyde platform, was brought onstream following an extended well test.

The Clyde North East Flank well (NEF), 30/17b-A34Y was drilled in November 2008, and a further sidetrack was drilled in December 2008, 30/17b-A34X. Both wells were unsuccessful, as they only encountered water.

Reserves

Oil in place in the Clyde Area reservoirs is estimated to be around 500 million barrels.

In addition to the oil, a small amount of associated gas is produced. Gas reserves of around 75 bcf are expected to be recovered. However, after fuel requirements, sales gas reserves are thought to be around half this figure. Gas sales from the Clyde field ceased at the end of 1999.

Estimated reserves for the Clyde Area fields are detailed in the accompanying table.

Commercial Recoverable Reserves (p+p)

(Remaining Reserves at 01/01/2013)

Init Init Rem Rem

Oil Gas Oil Gas

(mmbbl) (bcf) (mmbbl) (bcf)

Clyde 152.7 36.2 11.6 0.0

Leven 11.1 - 0.0 -

Medwin 2.6 - 0.0 -

Nethan 0.4 - 0.1 -

Total 166.8 36.2 11.7 - Source: Wood Mackenzie

Production

Clyde

When the Clyde field came onstream in March 1987, six months ahead of schedule, production levels were high as two producers were drilled prior to the commissioning of the platform. Output then built up to average 52,000 b/d of oil and 23 mmcfd of gas in 1988.

Clyde Area Central North Sea

Europe (UK) Upstream Service - October 2012 Page 8 of 19

Production from Clyde was seriously affected by damage to the Fulmar floating storage unit (FSU) in late 1988. The removal of the FSU facilities following an accident on 24 December 1988 resulted in a total loss of production for 74 days. Partial production from Clyde was restored on 8 March 1989 using the floating production vessel Petrojarl as a temporary storage and loading facility. Full production resumed once the Fulmar FSU was recommissioned in November 1989 at levels of around 40,000 b/d. Since 1997, liquids export has been via the Central North Sea Evacuation Project (see Transportation section).

Gas sales from Clyde ceased at the end of 1999. In total, 36 bcf of sales gas was produced from the field. Produced gas from Clyde (and the Clyde Area) is now used for fuel consumption and gas lift on the platform.

Leven and Leven North

Output from Leven started in September 1992, immediately after development approval was granted. A peak rate of 5,000 b/d occurred in 1993. Following the completion of a novel dual purpose water injector/oil producer well in 1995, peak production reached 6,000 b/d over the period of a few weeks.

The Leven North accumulation was discovered in July 2000 and was immediately brought onstream via the extended reach drilling (ERD) exploration/development well, drilled from the Clyde facilities. Output averaged 1,700 b/d in 2001, the first full year of production.

Medwin

Medwin came onstream in March 1994 at around 5,000 b/d and declined to an annual average of 200 b/d in 1996. The well was shut-in from the end of 1996. During 2005, appraisal well 30/18b-A42, targeting a possible field extension to the west, was subsequently completed as a producer and came onstream in November 2005 with an average production of about 1,900 b/d in 2006.

Nethan

First production from the Nethan field was in May 2004. This small oil accumulation was discovered with well, 30/17b-A39Z, drilled from the Clyde platform. The Nethan field was shut-in during 2005 due to gas lift capacity constraints on the Clyde platform. Production from the field resumed in October 2009.

Production (2002-2011)

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Oil ('000 b/d)

Clyde 7.1 6.0 5.9 5.6 4.5 3.2 2.3 2.7 2.2 2.0

Leven 1.4 1.1 3.2 1.7 0.7 0.2 0.2 0.2 0.2 0.1

Nethan - - 0.3 0.0 - - - 0.1 0.2 0.2

Medwin - - - 0.1 1.9 0.6 0.3 0.3 0.2 0.1

Total Liquid ('000 b/d) 8.5 7.1 9.4 7.4 7.1 4.0 2.8 3.3 2.8 2.4 Source: Wood Mackenzie

Production (2012-2021)

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

Oil ('000 b/d)

Clyde 2.7 3.9 4.2 3.6 3.0 2.6 2.4 2.1 1.9 1.7

Leven 0.1 0.1 0.1 - - - - - - -

Nethan 0.3 0.2 0.1 - - - - - - -

Medwin 0.1 0.1 0.1 - - - - - - -

Total Liquid ('000 b/d) 3.1 4.2 4.4 3.6 3.0 2.6 2.4 2.1 1.9 1.7 Source: Wood Mackenzie

Clyde Area Central North Sea

Europe (UK) Upstream Service - October 2012 Page 9 of 19

Clyde Area Production Profile

0

50

100

150

200

250

300

0

10

20

30

40

50

60

1982 1987 1992 1997 2002 2007 2012 2017 2022 2027

mmcfd'000b/d

Liquid Gas

Source: Wood Mackenzie

Development

Platforms

The Clyde Area has been developed with a conventional fixed steel platform, consisting of a combined drilling production and accommodation unit. Designed by John Brown/Earl and Wright and fabricated by McDermott at the Ardersier yard, the jacket was installed on the field in July 1985. The topsides equipment comprising drilling, production, power and accommodation modules were installed in June 1986. Development drilling started in the autumn of 1986.

Platform Summary

Clyde

Water Depth 80m

Type Fixed Jacket

Function Prod/Drilling/Accomm

Yard McDermott, Ardersier

Ordered Jan-84

Installed Jul-85

Processing Capacity:

Oil ('000 b/d) 60

Water ('000 b/d) 100

Injection Capacity:

Water ('000 b/d) 105

Accommodation 205

Weight:

Jacket (t) 10400

Topsides (t) 17900

Well Slots 30

Legs 8

Piles 26 Source: Wood Mackenzie

Clyde Development Drilling

All the Clyde Area development wells have been drilled from the platform. Production initially started from Clyde via a single well, and a further 24 wells have been completed. A high-risk Clyde well was successfully drilled from the platform in 1995 and initially added 5,000 b/d to production levels. Further infill drilling took place between 1996 and1999, and output levels were again maintained.

In August 2001, Talisman completed a successful horizontal well with a 792 metre horizontal section in the southern horst A zone sands (SHAZ) within the Fulmar Formation in the southern area of the Clyde field. BJ Well Services carried out what is believed to be a coiled tubing conveyed perforating record, by reverse-deploying 865 metres of 2.5-inch perforating guns in a single run to depths of 5,425 metres. The well started production at an initial rate of 5,000 b/d.

Clyde Area Central North Sea

Europe (UK) Upstream Service - October 2012 Page 10 of 19

Development drilling continued through 2003 and 2004, with two wells drilled on Clyde. In 2005, two further development wells were drilled on Clyde (30/17b-A41Z and 30/17b-A43Z). One successful infill well was completed in 2007. A North East Flank (NEF) appraisal well was drilled in 2008 with the intention of being converted to a producer. However, the well encountered water and was abandoned.

A development well was completed on Clyde in August 2012. We assume a further three infill wells will be drilled on Clyde by the end of 2013. In addition to the Crestal B and Lambda wells, two of the four wells will target the Clyde North Terrace and East Flank. We expect this to extend field life to 2026.

Secondary Recovery

Water injection is used to maintain the reservoir pressure on Clyde. The produced water system on the platform has 100,000 b/d capacity and was upgraded in 2004 at a cost of around £1 million. In addition, gas lift was partially implemented in 1990 to enhance the performance of the Clyde production wells. In order to minimise oil to sea discharges, significant modifications to the Clyde platform topsides have been carried out to install Produced Water Re-injection (PWRI) capability, which began in early 2007.

Clyde Area Satellite Fields

Leven received development approval in September 1992 and immediately started production. A deviated well drilled from the Clyde platform has been used to develop the reservoir. A second well (a dual purpose injector and producer) was drilled in 1995.

Medwin received development approval in November 1993 and started production in March 1994. The field was developed via an extended reach well, also drilled from the Clyde platform. At the time, with a step-out of 5.3 kilometres and a measured depth of 7,163 metres, the well was the longest and deepest step-out well to have been drilled by BP. The well ceased production in 1996. In 2005, the well was sidetracked to appraise a possible field extension to the west. This well (30/18b-42), was subsequently completed as a producer and came onstream in November 2005.

The Orion field, which came onstream in September 1999, was initially developed as a single-well, subsea tie-back to the Clyde platform. Two further wells were drilled on Orion in 2005 and 2006.

Leven North began production via an extended reach well drilled from the Clyde platform in August 2000. A second producer was drilled during late 2003.

The Nethan field, which was discovered by well 30/17b-A39Z drilled from the Clyde Platform, was brought onstream via an extended well test during May 2004.

Transportation

Clyde Area crude is transported by a 16-inch diameter pipeline to the Fulmar platform, located ten kilometres to the west.

Since early 1997, liquids have been exported from Fulmar via the CNSEP (Central North Sea Evacuation Project) spurline, then onward to the ConocoPhillips-operated terminal facilities at Teesside. The CNSEP is 16 kilometres long and 24-inches in diameter, running from the Fulmar 'AD' platform to a 'Y' piece midway in the J-Block to Norpipe line. Due to lower operating costs than those of the offshore loading system, the CNSEP line has extended the life of the Fulmar fields. In addition, the line was designed with excess capacity to handle further third party exports.

Prior to 1997, crude was evacuated from Fulmar via the Fulmar offshore loading system. The Fulmar floating storage unit was damaged in 1989, which seriously affected production from Clyde in 1989 (see Production section).

Gas used to be exported from Clyde to Fulmar via a 16-inch diameter line, then onward via the Fulmar Gas pipeline to the terminal facilities at St Fergus.

Pipeline Summary

Pipeline Type From To Length Diameter Capacity

(km) (inches) ('000 b/d,mmcfd)

Fulmar A - St Fergus

Gas Fulmar St Fergus(Shell) 289 20 500

Norpipe Oil Pipeline

Oil Ekofisk I

Teesside (Oil) Terminal

350 34 810

Source: Wood Mackenzie

Clyde Area Central North Sea

Europe (UK) Upstream Service - October 2012 Page 11 of 19

Costs

Capital Costs

The estimated capital costs of the Clyde project are detailed in the accompanying table. Capital expenditure for gas disposal has not been included. The final development cost total represents a substantial saving on the original budget of just under £1 billion. All exploration and appraisal costs have been excluded.

Capital Costs Pre-2003 to 2011 (£ million)

Pre-2003 2003 2004 2005 2006 2007 2008 2009 2010 2011

Clyde Production Facilities 199 - 3 - 9 6 - - - -

Clyde Processing Equipment 183 1 1 - - - - - - -

Medwin Production Facilities - - - - 0 0 - - - -

Medwin Processing Equipment 2 - - - - - - - - -

Leven Product. Facilities - - - - 1 1 - 1 - -

Nethan Product. Facilities - - 1 - 0 0 - - - -

Clyde Development Drilling 170 8 8 18 8 20 20 - - -

Medwin Development Drilling 7 - - 9 - - - - - -

Leven Development Drilling 17 - - - - - - - - -

Leven North Development Drilling 8 8 4 - - - - - - -

Nethan Development Drilling - - 1 - - - - - - -

Pipeline 20 - - - - - - - - -

Sustaining Capex 30 - - - - - - 9 6 12

Decommissioning Costs - - - - - - - - - -

Total 636 17 18 27 18 27 20 10 6 12 Source: Wood Mackenzie

Nominal to 2012 and real (in 2012 terms) thereafter.

Capital Costs 2012 to Post-2020 (£ million)

2012 2013 2014 2015 2016 2017 2018 2019 2020 Post-2020

Clyde Production Facilities - - - - - - - - - -

Clyde Processing Equipment - - - - - - - - - -

Medwin Production Facilities - - - - - - - - - -

Medwin Processing Equipment - - - - - - - - - -

Leven Product. Facilities - - - - - - - - - -

Nethan Product. Facilities - - - - - - - - - -

Clyde Development Drilling 40 40 - - - - - - - -

Medwin Development Drilling - - - - - - - - - -

Leven Development Drilling - - - - - - - - - -

Leven North Development Drilling - - - - - - - - - -

Nethan Development Drilling - - - - - - - - - -

Pipeline - - - - - - - - - -

Sustaining Capex 2 2 16 5 5 5 5 5 3 7

Decommissioning Costs - - - - - - - - - 144

Total 42 42 16 5 5 5 5 5 3 151 Source: Wood Mackenzie

Nominal to 2012 and real (in 2012 terms) thereafter.

Operating Costs

Prior to 1997, a tariff of approximately £2.00/barrel was payable for use of the Fulmar facilities including export costs. Between January 1997 and January 2001, we have assumed a tariff of £1.00/barrel payable to the Fulmar group to cover handling costs and £1.00/barrel payable for the use of Norpipe and for processing at the Teesside terminal facilities. From the start of 2001, these tariffs were believed to have been renegotiated to £0.70/barrel payable to the Fulmar facilities, and £0.80/barrel payable to the Norpipe and Teesside Oil Terminal facilities. The fields are currently assumed to pay £0.85/bbl to Fulmar, and £1.00/bbl to Norpipe and Teesside Oil Terminal.

The Flyndre and Cawdor fields, which we assume will be tied back to Clyde, are expected to come onstream in late 2013 and 2014 respectively. We assume the Clyde partners will receive a production tariff for the use of its processing and export facilities. However, following commercial negotiations, it is also possible that Flyndre and Cawdor will join the existing Clyde Area opex share, which includes Orion.

Clyde Area Central North Sea

Europe (UK) Upstream Service - October 2012 Page 12 of 19

We have modelled costs associated with the European Union Emission Trading Scheme (EUETS) from 2013. We have shared costs between the carbon dioxide (CO2) emitting facilities at Clyde and tie-backs on a production throughput basis. Please refer to the Economic Assumptions section to view our carbon price assumptions.

Total operating costs for the Clyde Area are detailed in the accompanying table.

Operating Costs 2011 to 2020 (£ million)

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Direct Costs 23.4 26.3 35.0 41.2 33.0 31.0 31.0 27.0 27.0 27.0

Tariff Oil 1.6 2.1 2.8 3.0 2.4 2.0 1.8 1.6 1.4 1.3

EUETS Costs - - 0.6 0.4 0.4 0.4 0.4 0.5 0.5 0.4

G&A 2.3 2.3 2.3 2.3 2.0 2.0 2.0 2.0 2.0 2.0

Total 27.3 30.7 40.7 46.9 37.8 35.4 35.2 31.1 30.9 30.7 Source: Wood Mackenzie

Nominal to 2012 and real (in 2012 terms) thereafter.

Sales Contracts

Talisman originally sold its volumes of sales gas from the Clyde Area to Shell and ExxonMobil. Export of sales gas ceased in 1999 and all associated gas production is now used for fuel and gas lift purposes on the Clyde platform.

Taxation

Development Approval after 1 April 1982 but prior to 15 March 1993

The Clyde, Leven and Medwin fields received development approval after 1 April 1982 but prior to 15 March 1993 and are therefore exempt from royalty payments but are liable for Petroleum Revenue Tax (PRT), Corporation Tax and Supplementary Charge. Please refer to the Fiscal Terms section in the Country Overview for a detailed description of the terms applying.

Development Approval post 15 March 1993

The Nethan field is liable for Corporation Tax and Supplementary Charge. Please refer to the Fiscal Terms section in the Country Overview for a detailed description of the terms applying.

Economic Assumptions

A cash flow has been prepared for the Clyde Area, using the following economic assumptions. It has been run on a stand-alone basis using Wood Mackenzie's Global Economic Model (GEM). It does not reflect corporate synergies. These are included in company valuations, which can be produced in GEM and also in Wood Mackenzie's Corporate Analysis Tool (CAT).

Cash flow

The following cash flow is in nominal terms.

Discount rate and date

Wood Mackenzie's discount rate is 10% nominal. The discount date is 1 January 2013.

Inflation rate

Wood Mackenzie's inflation rate is 2% from 2012 onward.

Oil price

Wood Mackenzie's Brent oil price assumption (nominal terms) is US$109.37/bbl in 2012, US$105.25/bbl in 2013, US$100.00/bbl in 2014, US$96.00/bbl in 2015 and US$92.00/bbl in 2016, inflated at 2% per annum thereafter. This equates to a long-term Brent price assumption of US$85.00/bbl (real, 2012 terms) from 2016 onward.

We assume that Clyde Area crude receives the Brent price.

Clyde Area Central North Sea

Europe (UK) Upstream Service - October 2012 Page 13 of 19

Carbon price

The Wood Mackenzie carbon price assumption for UK installations participating in the European Union Emissions Trading Scheme (EUETS) in nominal terms is €20.56/CO2 tonne in 2013, €23.72/CO2 tonne in 2014 and €26.88/CO2 tonne in 2015.

Exchange rate

The £/US$ exchange rate is £0.64/US$1 in 2012, £0.65/US$1 in 2013 and £0.63/US$1 from 2014 onward.

The £/€ exchange rate is £0.84/€1 in 2013 and £0.84/€1 from 2014 onward.

Fiscal terms

We have incorporated all approved changes to the UK fiscal regime, up to and including September 2012.

Global Economic Model (GEM) file

The corresponding GEM company file name is ZZ_Grp Clyde Area.cpy

The corresponding GEM file names are Clyde, Leven, Medwin and Nethan.

Cash Flow

Cash Flow (US$ million)

Clyde Area Central North Sea

Europe (UK) Upstream Service - October 2012 Page 14 of 19

Cash Flow Dollars

Year Production Gross Op Capital Royalty PRT + Corp. Suppl. Bonus Total Field

Liquids Gas Revenue Costs Costs SPD/APRT Tax Charge Cash Flow

000b/d mmcfd US$M US$M US$M US$M US$M US$M US$M US$M US$M

1982 0.0 0.0 0.0 0.0 10.3 0.0 0.0 0.0 0.0 0.0 -10.3

1983 0.0 0.0 0.0 0.0 68.1 0.0 0.0 0.0 0.0 0.0 -68.1

1984 0.0 0.0 0.0 0.0 139.8 0.0 0.0 0.0 0.0 0.0 -139.8

1985 0.0 0.0 0.0 0.0 155.3 0.0 0.0 0.0 0.0 0.0 -155.3

1986 0.0 0.0 0.0 0.0 176.1 0.0 0.0 0.0 0.0 0.0 -176.1

1987 32.0 9.0 227.8 71.0 103.5 0.0 0.0 0.0 0.0 0.0 53.3

1988 51.5 23.0 313.2 111.5 35.6 0.0 0.0 0.0 0.0 0.0 166.1

1989 35.0 9.0 244.3 84.5 32.8 0.0 0.0 0.0 0.0 0.0 127.1

1990 38.0 0.0 329.0 96.0 8.9 0.0 0.0 0.0 0.0 0.0 224.1

1991 34.5 6.0 262.5 90.5 8.8 0.0 0.0 0.0 0.0 0.0 163.1

1992 28.5 6.0 211.0 84.8 61.8 0.0 0.0 38.0 0.0 0.0 26.5

1993 25.5 7.0 168.4 66.1 6.0 0.0 0.0 13.1 0.0 0.0 83.1

1994 21.5 7.5 136.2 64.1 6.6 0.0 0.0 28.9 0.0 0.0 36.6

1995 19.3 8.0 133.0 56.7 7.1 0.0 0.0 19.6 0.0 0.0 49.6

1996 15.6 6.0 128.0 50.0 10.5 0.0 0.0 20.7 0.0 0.0 46.9

1997 16.7 6.0 128.0 52.1 32.8 0.0 0.0 21.5 0.0 0.0 21.7

1998 13.9 5.5 76.5 47.0 24.9 0.0 0.0 12.3 0.0 0.0 -7.7

1999 12.9 6.3 95.7 42.0 8.1 0.0 0.0 11.4 0.0 0.0 34.2

2000 11.7 0.0 123.8 36.3 12.1 0.0 0.0 17.0 0.0 0.0 58.4

2001 10.2 0.0 92.3 33.1 17.3 0.0 0.0 20.9 0.0 0.0 20.9

2002 8.5 0.0 77.8 29.8 18.0 0.0 0.0 12.5 0.9 0.0 16.6

2003 7.1 0.0 74.5 31.9 27.0 0.0 0.0 5.3 1.4 0.0 9.1

2004 9.4 0.0 131.5 37.4 31.5 0.0 0.0 9.6 3.2 0.0 49.7

2005 7.4 0.0 148.8 37.1 49.1 0.0 0.0 24.3 8.1 0.0 30.2

2006 7.1 0.0 170.6 46.2 33.2 0.0 0.0 23.7 10.4 0.0 57.1

2007 4.0 0.0 106.0 48.3 54.1 0.0 0.0 4.2 2.8 0.0 -3.4

2008 2.7 0.0 96.9 79.2 37.1 0.0 0.0 0.0 0.0 0.0 -19.3

2009 3.2 0.0 72.7 57.9 14.9 0.0 0.0 0.0 0.0 0.0 0.1

2010 2.7 0.0 79.3 33.6 9.2 0.0 0.0 3.4 2.3 0.0 30.8

2011 2.4 0.0 98.6 44.0 19.4 0.0 0.0 8.7 7.9 0.0 18.6

2012 3.1 0.0 125.4 47.8 65.6 0.0 0.0 5.6 5.7 0.0 0.7

2013 4.2 0.0 162.1 63.7 65.9 0.0 0.0 7.5 8.0 0.0 16.9

2014 4.4 0.0 164.9 77.2 26.4 0.0 0.0 15.5 16.5 0.0 29.3

2015 3.6 0.0 131.2 63.6 8.4 0.0 0.0 17.9 19.0 0.0 22.2

2016 3.0 0.0 105.1 60.9 8.6 0.0 0.0 13.0 13.8 0.0 8.9

2017 2.6 0.0 93.1 61.7 8.8 0.0 0.0 8.0 8.6 0.0 6.1

2018 2.4 0.0 87.7 55.5 8.9 0.0 0.0 6.9 7.3 0.0 9.1

2019 2.1 0.0 78.7 56.3 9.1 0.0 0.0 4.9 5.3 0.0 3.1

2020 1.9 0.0 72.8 57.0 5.6 0.0 0.0 3.3 3.6 0.0 3.3

2021 1.7 0.0 66.7 56.1 3.8 0.0 0.0 2.4 2.5 0.0 2.0

2022 1.5 0.0 60.4 51.1 2.9 0.0 0.0 1.9 2.1 0.0 2.3

2023 1.4 0.0 57.6 50.1 3.0 0.0 0.0 1.5 1.6 0.0 1.4

2024 1.3 0.0 54.0 46.1 2.0 0.0 0.0 1.6 1.7 0.0 2.5

2025 1.2 0.0 50.4 42.9 2.1 0.0 0.0 1.7 1.8 0.0 2.0

2026 1.1 0.0 46.3 41.0 0.0 0.0 0.0 1.6 1.7 0.0 2.0

2027 0.0 0.0 0.0 0.0 92.9 0.0 0.0 -18.1 -11.9 0.0 -63.0

2028 0.0 0.0 0.0 0.0 93.7 0.0 0.0 -28.0 -18.7 0.0 -47.0

2029 0.0 0.0 0.0 0.0 126.7 0.0 0.0 -34.7 -23.1 0.0 -68.8

2030 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -12.7 -8.5 0.0 21.1

2031 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Totals: 166.8 36.2 5082.9 2262.0 1754.2 0.0 0.0 294.8 74.0 0.0 697.8

PVs Total PV 22421.6 8286.9 11547.6 0.0 0.0 1257.5 123.4 0.0 1206.1

Rem PV 788.1 456.4 193.4 0.0 0.0 40.9 51.9 0.0 45.5

Source: Wood Mackenzie

Discounted at 10.0% from 01/01/2013

Clyde Area Central North Sea

Europe (UK) Upstream Service - October 2012 Page 15 of 19

Discount Total PV Remaining PV Remaining PV/boe Total Total Remaining Remaining P/I Capex Opex

Rate Post-Tax Pre-Tax Post-Tax Pre-Tax Post-Tax Pre-Tax Gov. Take Gov. Take Gov. Take Gov. Take Ratio Boe Boe

% US$M US$M US$M US$M US$ US$ US$M % US$M % US$ US$

0.0 697.8 1066.7 -46.6 -21.0 -3.95 -1.78 368.9 34.6 25.6 n/a 1.4 10.13 13.06

5.0 1266.8 1997.1 19.5 97.6 1.65 8.27 730.3 36.6 78.1 80.0 1.3 22.77 22.33

7.0 1416.2 2356.1 33.0 119.7 2.79 10.13 939.9 39.9 86.7 72.5 1.2 34.45 29.72

8.0 1428.8 2496.0 38.0 127.5 3.22 10.79 1067.3 42.8 89.5 70.2 1.2 42.78 34.65

9.0 1369.8 2583.0 42.1 133.6 3.57 11.31 1213.2 47.0 91.4 68.5 1.2 53.33 40.63

10.0 1206.1 2587.1 45.5 138.2 3.85 11.70 1381.0 53.4 92.8 67.1 1.1 66.69 47.86

11.0 893.4 2467.6 48.2 141.7 4.08 12.00 1574.1 63.8 93.5 66.0 1.1 83.57 56.60

12.0 372.8 2169.6 50.4 144.3 4.27 12.21 1796.8 82.8 93.9 65.1 1.0 104.85 67.15

15.0 -3340.0 -647.5 54.5 147.5 4.61 12.48 2692.5 n/a 93.0 63.1 0.9 207.64 113.58

25.0 -124272.5 -

113459.1 55.0 136.7 4.65 11.57 10813.3 n/a 81.7 59.8 0.6 1937.11 681.15

Source: Wood Mackenzie

Discount Date Jan-13

Remaining Liquid Reserves (mmbbl) 11.8

Remaining Gas Reserves (bcf) 0

Total Remaining Reserves (mmboe) 11.8

Total Reserves (mmboe) 173.2

Company IRR (post tax) 12.51%

Pre-tax IRR 14.58%

Payback Period (years) 9.7

Reserve life at current production (years) 7.7

Source: Wood Mackenzie

Split of Revenues

-300

-200

-100

0

100

200

300

400

1982

1984

1986

1988

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

2018

2020

2022

2024

2026

2028

2030

Net Cash Flow Govt. Take Costs$M

Source: Wood Mackenzie

Cumulative Net Cash Flow - Undiscounted

Cumulative Net Cash Flow - Discounted at 10% from 01/01/2013

-1000

-500

0

500

1000

1982

1986

1990

1994

1998

2002

2006

2010

2014

2018

2022

2026

2030

$M

Source: Wood Mackenzie

-10000-8000-6000-4000-2000

02000

1982

1987

1992

1997

2002

2007

2012

2017

2022

2027

$M

Source: Wood Mackenzie

Clyde Area Central North Sea

Europe (UK) Upstream Service - October 2012 Page 16 of 19

Remaining Revenue Distribution (Discounted at 10% from 01/01/2013)

Opex58%

Capex25%

Corp. Tax5%

Suppl. Chg.6%

Net Cash Flow6%

Total = $ 788M

Source: Wood Mackenzie

Remaining Present Value Price Sensitivities

-20

-10

0

10

20

30

40

50

60

70

-20% -10% 0% +10% +20%

Rem

ain

ing

PV

Po

st-

tax (

£M

)

LiquidProduction

GasProduction

Liquid Price

Gas Price

Capex

Opex (excl.Tariffs)

TariffPayments

Tariff Receipts

Source: Wood Mackenzie

Cash Flow (£ million)

Clyde Area Central North Sea

Europe (UK) Upstream Service - October 2012 Page 17 of 19

Cash Flow Local

Year Production Gross Op Capital Royalty PRT + Corp. Suppl. Bonus Total Field

Liquids Gas Revenue Costs Costs SPD/APRT Tax Charge Cash Flow

000b/d mmcfd £M £M £M £M £M £M £M £M £M

1982 0.0 0.0 0.0 0.0 5.9 0.0 0.0 0.0 0.0 0.0 -5.9

1983 0.0 0.0 0.0 0.0 44.9 0.0 0.0 0.0 0.0 0.0 -44.9

1984 0.0 0.0 0.0 0.0 104.6 0.0 0.0 0.0 0.0 0.0 -104.6

1985 0.0 0.0 0.0 0.0 121.1 0.0 0.0 0.0 0.0 0.0 -121.1

1986 0.0 0.0 0.0 0.0 120.0 0.0 0.0 0.0 0.0 0.0 -120.0

1987 32.0 9.0 138.9 43.3 63.1 0.0 0.0 0.0 0.0 0.0 32.5

1988 51.5 23.0 175.8 62.6 20.0 0.0 0.0 0.0 0.0 0.0 93.2

1989 35.0 9.0 149.1 51.6 20.0 0.0 0.0 0.0 0.0 0.0 77.5

1990 38.0 0.0 184.3 53.7 5.0 0.0 0.0 0.0 0.0 0.0 125.5

1991 34.5 6.0 148.4 51.2 5.0 0.0 0.0 0.0 0.0 0.0 92.2

1992 28.5 6.0 119.5 48.0 35.0 0.0 0.0 21.5 0.0 0.0 15.0

1993 25.5 7.0 112.1 44.0 4.0 0.0 0.0 8.7 0.0 0.0 55.3

1994 21.5 7.5 88.9 41.9 4.3 0.0 0.0 18.9 0.0 0.0 23.9

1995 19.3 8.0 84.3 35.9 4.5 0.0 0.0 12.4 0.0 0.0 31.4

1996 15.6 6.0 82.0 32.0 6.7 0.0 0.0 13.2 0.0 0.0 30.1

1997 16.7 6.0 78.1 31.8 20.0 0.0 0.0 13.1 0.0 0.0 13.2

1998 13.9 5.5 46.1 28.4 15.0 0.0 0.0 7.4 0.0 0.0 -4.7

1999 12.9 6.3 59.2 26.0 5.0 0.0 0.0 7.1 0.0 0.0 21.1

2000 11.7 0.0 81.7 24.0 8.0 0.0 0.0 11.2 0.0 0.0 38.5

2001 10.2 0.0 64.1 23.0 12.0 0.0 0.0 14.5 0.0 0.0 14.5

2002 8.5 0.0 51.8 19.8 12.0 0.0 0.0 8.3 0.6 0.0 11.1

2003 7.1 0.0 45.6 19.5 16.5 0.0 0.0 3.2 0.8 0.0 5.5

2004 9.4 0.0 71.8 20.4 17.2 0.0 0.0 5.3 1.8 0.0 27.1

2005 7.4 0.0 81.8 20.4 27.0 0.0 0.0 13.4 4.5 0.0 16.6

2006 7.1 0.0 92.6 25.1 18.0 0.0 0.0 12.9 5.7 0.0 31.0

2007 4.0 0.0 53.0 24.1 27.1 0.0 0.0 2.1 1.4 0.0 -1.7

2008 2.7 0.0 52.3 42.8 20.0 0.0 0.0 0.0 0.0 0.0 -10.4

2009 3.2 0.0 46.5 37.0 9.5 0.0 0.0 0.0 0.0 0.0 0.0

2010 2.7 0.0 51.6 21.8 6.0 0.0 0.0 2.2 1.5 0.0 20.0

2011 2.4 0.0 61.1 27.3 12.0 0.0 0.0 5.4 4.9 0.0 11.5

2012 3.1 0.0 80.2 30.6 42.0 0.0 0.0 3.6 3.6 0.0 0.4

2013 4.2 0.0 105.4 41.4 42.8 0.0 0.0 4.9 5.2 0.0 11.0

2014 4.4 0.0 103.9 48.6 16.7 0.0 0.0 9.8 10.4 0.0 18.4

2015 3.6 0.0 82.7 40.1 5.3 0.0 0.0 11.3 12.0 0.0 14.0

2016 3.0 0.0 66.2 38.3 5.4 0.0 0.0 8.2 8.7 0.0 5.6

2017 2.6 0.0 58.6 38.8 5.5 0.0 0.0 5.1 5.4 0.0 3.8

2018 2.4 0.0 55.3 35.0 5.6 0.0 0.0 4.3 4.6 0.0 5.7

2019 2.1 0.0 49.6 35.5 5.7 0.0 0.0 3.1 3.3 0.0 1.9

2020 1.9 0.0 45.9 35.9 3.5 0.0 0.0 2.1 2.2 0.0 2.1

2021 1.7 0.0 42.0 35.3 2.4 0.0 0.0 1.5 1.6 0.0 1.2

2022 1.5 0.0 38.0 32.2 1.8 0.0 0.0 1.2 1.3 0.0 1.5

2023 1.4 0.0 36.3 31.5 1.9 0.0 0.0 1.0 1.0 0.0 0.9

2024 1.3 0.0 34.0 29.0 1.3 0.0 0.0 1.0 1.1 0.0 1.6

2025 1.2 0.0 31.8 27.1 1.3 0.0 0.0 1.1 1.1 0.0 1.2

2026 1.1 0.0 29.2 25.8 0.0 0.0 0.0 1.0 1.1 0.0 1.3

2027 0.0 0.0 0.0 0.0 58.6 0.0 0.0 -11.4 -7.5 0.0 -39.7

2028 0.0 0.0 0.0 0.0 59.0 0.0 0.0 -17.7 -11.8 0.0 -29.6

2029 0.0 0.0 0.0 0.0 79.8 0.0 0.0 -21.9 -14.6 0.0 -43.4

2030 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -8.0 -5.3 0.0 13.3

2031 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Totals: 166.8 36.2 3079.2 1380.6 1128.0 0.0 0.0 180.9 44.6 0.0 345.1

PVs Total PV 13350.6 4956.3 7855.7 0.0 0.0 776.1 73.7 0.0 -311.2

Rem PV 499.6 288.8 123.1 0.0 0.0 25.9 32.8 0.0 29.0

Source: Wood Mackenzie

Discounted at 10.0% from 01/01/2013

Clyde Area Central North Sea

Europe (UK) Upstream Service - October 2012 Page 18 of 19

Discount Total PV Remaining PV Remaining PV/boe Total Total Remaining Remaining P/I Capex Opex

Rate Post-Tax Pre-Tax Post-Tax Pre-Tax Post-Tax Pre-Tax Gov. Take Gov. Take Gov. Take Gov. Take Ratio Boe Boe

% £M £M £M £M £ £ £M % £M % £ £

0.0 345.1 570.6 -29.0 -12.6 -2.46 -1.06 225.5 39.5 16.5 n/a 1.3 6.51 7.97

5.0 475.8 924.6 12.6 62.2 1.07 5.26 448.8 48.5 49.5 79.7 1.2 15.15 13.47

7.0 369.2 947.2 21.1 76.0 1.79 6.44 578.0 61.0 54.9 72.3 1.1 23.16 17.86

8.0 235.1 891.6 24.3 80.9 2.05 6.85 656.5 73.6 56.7 70.0 1.1 28.88 20.78

9.0 18.4 764.8 26.9 84.8 2.27 7.18 746.4 97.6 57.9 68.3 1.0 36.15 24.33

10.0 -311.2 538.6 29.0 87.7 2.45 7.43 849.8 157.8 58.7 67.0 1.0 45.37 28.62

11.0 -793.5 175.3 30.7 89.9 2.60 7.61 968.7 552.7 59.2 65.9 0.9 57.03 33.81

12.0 -1480.2 -374.4 32.1 91.5 2.71 7.75 1105.8 n/a 59.4 65.0 0.9 71.75 40.06

15.0 -5541.0 -3884.2 34.6 93.5 2.93 7.92 1656.9 n/a 58.9 63.0 0.8 143.05 67.56

25.0 -109905.8 -103270.0 34.9 86.7 2.96 7.34 6635.8 n/a 51.8 59.7 0.5 1351.17 402.44

Source: Wood Mackenzie

Discount Date Jan-13

Remaining Liquid Reserves (mmbbls) 11.8

Remaining Gas Reserves (bcf) 0

Total Remaining Reserves (mmboe) 11.8

Total Reserves (mmboe) 173.2

Company IRR (post tax) 9.07%

Pre-tax IRR 11.36%

Payback Period (years) 9.7

Reserve life at current production (years) 7.7

Source: Wood Mackenzie

Clyde Area Central North Sea

This report is published by, and remains the copyright of, Wood Mackenzie Limited ("Wood Mackenzie"). This report is provided to clients of Wood Mackenzie under the terms of subscription agreements entered into between Wood Mackenzie and its clients and use of this report is governed by the terms and conditions of such subscription agreements. Wood Mackenzie makes no warranties or representation about the accuracy or completeness of the data contained in this report. No warranty or representation is given in respect of the functionality or compatibility of this report with any machine, equipment or other software. Nothing contained in this report constitutes an offer to buy or sell securities and nor does it constitute advice in relation to the buying or selling of investments. None of Wood Mackenzie's products provide a comprehensive analysis of the financial position, assets and liabilities, profits or losses and prospects of any company or entity and nothing in any such product should be taken as comment or implication regarding the relative value of the securities of any company or entity.

Europe (UK) Upstream Service - October 2012 Page 19 of 19