Clo Primer

-

Upload

rockstarlive -

Category

Documents

-

view

423 -

download

58

description

Transcript of Clo Primer

-

The Middle Market CLO Desktop Primer

Please see the disclosure appendix of this publication for certification and disclosure information

David Preston, CFA CDO and Commercial ABS Research (704) 410-3080 [email protected]

Jason McNeilis, CFA CDO and Commercial ABS Research (704) 410-3077 [email protected]

July 24, 2014

-

Contents

2

CLO OverviewWhat is a CLO? 4CLO Structure & Life Cycle 6Balance Sheet vs. Arbitrage CLOs 14

Middle Market Lending: The MarketMiddle Market Definitions 17Market Size / Segments 19Sponsored, Institutional Middle Market Loan Size 25

Middle Market Lending: The LoansSpreads 27Leverage 29Default Data 31Recovery Data 35Covenant Lite Loans in the Middle Market Space 37

Middle Market Lending: The LendersInvestors Base 40Lender Types 43Middle Market Lenders: Banks 45Middle Market Lenders: BDCs 46

Middle Market CLOsVolume and Outstanding Balance 53Spreads 58Structure 61Collateral 64Performance: Rating & Default History 68

Middle Market CLO ManagersMiddle Market CLO Manager Overview 72Servicer Risk 76Top 10 Managers by Deal Count 80Manager CLO Summaries 82

-

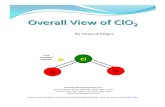

CLO Overview

-

4

Securitization backed by a pool of corporate loans Assets typically floating rate, first lien, senior secured, rated below IG Profit from a funding gap Funding gap = net asset yield liability yield - fees Leveraged to enhance returns

Asset yield is used to pay down creditors in order of seniority Equity gets residual More seniority = lower yield/lower risk

Similar to a synthetic bank with a defined life and stricter covenants Current U.S. market size is approximately $325 billion

For a complete introduction to CLOs, we recommend our CLO Primer.

What is a CLO?

-

5

Cash flow CLOs differ from other ABS, as they have an actively managed portfolio.

Cash flow CLOs also feature reinvestment periods. During the reinvestment period, the manager may buy and sell assets,

subject to asset quality covenants. In balance sheet CLOs, the loan originator may replace assets during the

reinvestment period. The reinvestment period is an IO period for the CLO. Interest proceeds from the portfolio assets pay CLO note interest. During reinvestment, principal proceeds (repayments or amortization)

from the portfolio assets are available for the CLO manager to reinvest by purchasing new collateral assets.

What Is a CLO: Cash Flow CLO

-

6

Asset Portfolio

Collateral Manager

CLO Issuer

(Offshore Special Purpose Vehicle)

Class A Notes [Aaa/AAA]

Equity (NR) Residual Cash Flow

First Loss

Class D Notes [Baa2/BBB]

P & I proceeds

on an ongoing

basis

Collateral Purchase

Wt Avg.

Cost of Funding

Class C Notes [A2/A]

$ $ $ $

$ $

$

$

$

$

$

$

Source: Wells Fargo Securities, LLC

What Is a CLO: Basic Structure

Class B Notes [Aa2/AA]

$

-

7

Interest Proceeds

Taxes, Fees, Hedge Payments

Class A Current Interest

Class A Coverage Test

class B Interest

class B Coverage Test

class A Principal

PASS FAIL

FAIL PASS

Interest Proceeds

Taxes, Fees, Hedge Payments

Class A Interest

Class A Coverage Test

Class B Interest

Class B Coverage Test

Class A Principal

EQUITY

Class A Principal

Class B Principal

PASS FAIL

FAIL PASS

When Cured

Subordinated Mgmt Fees When Cured

Source: Wells Fargo Securities, LLC

What Is a CLO: Structure

-

8

Coverage tests act to protect senior note holders. Par-based asset/liability tests: overcollateralization (OC). Yield-based tests: interest coverage (IC). If a test is failing, cash flows are diverted to senior notes until the test is in

compliance.

Test cures by paying down senior notes (reducing the par amount). This deleverages the deal and cuts off cash flows to all classes below the

failed test.

Many OC tests contain par haircuts for problematic assets For example: Excess CCC loans are haircut to their market value in

CLOs

For example: PIKing assets may be counted as defaults

What Is a CLO: Structure

-

9

0

20

40

60

80

100

120

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41

$ C

ollate

ral

Bala

nce

Warehouse Period: Warehouse Bank provides CLO Manager financing to acquire assets.

Amortization Period:Cash flows from assets are used to pay down the outstanding notes.

Reinvestment Period: Collateral Manager permitted to actively trade underlying assets. Principal cash flows from underlying assets can be used by Collateral Manager to purchase new assets.

CLO Closing Date

Ramp-Up Period:Proceeds from CLO Issuance used to purchase additional assets.

Ramp-Up End Date

Amortization PeriodSource: Wells Fargo Securities, LLC

What Is a CLO: CLO Life Cycle

-

10

Ramping Up The bank may provide a warehouse facility as financing for the CLO

manager prior to note issuance. Closing CLO issues notes and pays the warehouse provider as applicable. CLOs are typically issued with an asset balance slightly less than the

principal balance of the liabilities and equity tranche. Essentially, equity pays the deal fees.

Reinvestment After the end of the ramp-up, the CLO manager monitors and trades

the portfolio to ensure the portfolio remains in compliance with collateral-quality tests and reinvests principal proceeds back into the portfolio.

What is a CLO: CLO Life Cycle

-

11

Amortization Period The manager does not replace prepaying assets; instead, the cash is

used to retire the notes sequentially. Optional Redemptions Types of calls to limit the life of a deal: Optional Redemption - The equity holders have the opportunity to

redeem the notes following a two-thirds or majority vote. Cleanup Call - The call sells assets should the pool par value fall

below a prescribed level. Equity holders may wish to call the deal if the gap between the asset yield

and the total CLO debt cost shrinks this leads to decreased equity distributions.

The equity holders can call the CLO sell the assets, pay off the notes and keep the proceeds.

CLO 2.0 deals often allow tranche refinancing or re-pricing, which can be less onerous than calling the CLO.

What Is a CLO: CLO Life Cycle

-

12

Wt. Avg. Spread Test Wt. Average Life TestMax. Rating Factor Test Diversity TestMin. Wt. Avg. Recovery Rate Test Min. WAC Test

Source: Wells Fargo Securities, LLC

Common CLO Portfolio Tests

What Is a CLO: Reinvestment

During reinvestment, the CLO manager is limited in trading by a series of portfolio quality covenants, dictating asset portfolio characteristics.

Typically, if a CLO is failing a quality test, the manager may not trade except to improve the failing test, but no cash flows are diverted.

Moody's Rating

Rating Factor

Moody's Rating

Rating Factor

Aaa 1Aa1 10 Ba1 940Aa2 20 Ba2 1,350Aa3 40 Ba3 1,766A1 70 B1 2,220A2 120 B2 2,720A3 180 B3 3,490Baa1 260 Caa1 4,770Baa2 360 Caa2 6,500Baa3 610 Caa3 8,070

Ca 10,000C 10,000

Source: Moody's, Wells Fargo Securities, LLC

-

13

% Second Lien % High Yield Bond% Rated CCC+ or below % Fixed Rate Securities% Non US Issuer / Non USD % Specific Countries% Single Issuer / Obligor % Top 3 Issuers% PIK able Securities % Delayed Funding Term Loans% Synthetic Securities % Current Pay Obligations% CDO % Zero Coupon Securities% Current Pay Obligations % Pay Freq. Less Than Qtrly% Participations % Debtor in Possession Loans% Same Industry Category % Revolving Credit Facilities

Source: Wells Fargo Securities, LLC

Common CLO Portfolio Covenants

What Is a CLO: Reinvestment

-

14

CLOs: assets are typically floating rate, senior secured, first-lien leveraged loans.

May allow small allocations (buckets) for high-yield bonds, second-lien loans and revolvers.

Two types of CLOs:

What Is a CLO: Two Types of CLOs

Arbitrage CLO Balance Sheet CLOTypical Issuer Asset manager Specialty finance companyPurpose Management fees Better financing

Funding gap Term financingCollateral Origination Issuer not involved Issuer involved

Asset manager purchases in primary / secondary market Issuer originates

Primary Collateral Type Broadly syndicated loans Middle market loans

Collateral Management Actively managed Actively managed

Manager reinvests principal proceeds during reinv. period

Manager reinvests principal proceeds during reinv. period

Manager can trade the portfolio, subject to portfolio tests

Manager can trade the portfolio, subject to portfolio tests

Actual trading may be limited due to the nature of middle market loans

Source: Wells Fargo Securities, LLC

-

15

Arbitrage CLOs are issued by asset managers as an efficient way to raise AUM.

Assets (loans) are purchased in the primary and secondary markets. Balance sheet CLOs are issued as financing vehicles. Securitization technology often provides a more desirable (cheaper,

longer, better terms) source of term financing than alternatives. The balance sheet CLO issuer typically originates the assets. Balance sheet CLOs are similar in purpose and concept to most

consumer ABS sectors.

What Is a CLO: Two Types of CLOs

-

Middle Market Lending: The Market

-

Middle Market Loans: Definition

What is a Middle Market Loan?

Generally speaking, a loan to a small- or medium-sized firm.

Unfortunately, there is no uniform, standard definition of middle market. However, we present the most common definitions.

1. Loan size: Typically, facility size < $150 million denotes a loan as a middle market loan.

2. Issuer size: EBITDA < $50 million is often the cut-off for a middle market loan.

LCD uses this definition.

3. Combination: Thomson Reuters LPCs definition:

Borrower sales

-

Middle Market Loans: Definition

What is a Middle Market Loan?

There are other ways to think about the difference between middle market loans and broadly syndicated loans.

1. Lending Group: Middle market loans are often the product of single lenders, or small lending clubs.

2. Secondary trading/pricing: Some CLO investors define middle market loans are those without regular trading activity or price data.

3. Direct origination vs. buy-side:. Many middle loan originators are directly involved in origination, while BSL loans are purchased in primary or secondary markets.

18

-

Middle Market Loans: Definition

Middle Market Loan Market Segments: Middle market lending is often broken down into different segments, often by borrower or facility size.

1. General Borrower Size Market Segmentation:

Segment Borrower EBITDA

Small Middle Market $7.5 million to $25 million

Traditional Middle Market $15 million to $35 million

Large Middle Market $30 million to $75 million

2. Thomson Reuters LPC Definition:

Traditional Middle Market Deal Size

-

Middle market new issue total volume is typically $180 billion per year; 2013 saw an increase of approximately 13%.

Since the financial crisis, approximately 60% of new issue volume has been refinancing.

20

Middle Market Loans: The Market

$107.0

$167.8

$183.1 $180.1 $183.2

$101.5

$71.2

$150.0

$182.2 $180.3

$203.6

$98.1

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

$0

$25

$50

$75

$100

$125

$150

$175

$200

$225

$250

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

1H14

% N

ew M

oney$

B

Middle Market Loan Total Issuance

Refi. New money % New MoneySource: Thomson Reuters LPC

Middle market: Borrower sales of $500 million or lessDeal size $500 million or less

Total issuance includes Revolvers, 1st Liens, 2nd Liens, Delayed Draws, etc

-

Much of the middle-market lending is done by regional banks to middle-market companies, which use revolvers for working capital or capex.

LPC splits the middle market lending universe between sponsored and

non-sponsored. Non-sponsored lending is larger but less relevant for CLO investors. As LPC describes it, the non-sponsored deals can be thought of as

relationship lending by regional banks.

In contrast, sponsored lending is typically done by a mix of lenders, including specialty finance companies.

Sponsored issuance accounts for approximately 40% of middle market

loan issuance. 21

Middle Market Loans: The Market

-

LPC splits the middle market lending universe between sponsored and non-sponsored. Non-sponsored lending is larger but less relevant for CLO investors.

22

$107.0

$167.8

$183.1 $180.1

$183.2

$101.5

$71.2

$150.0

$182.2$180.3

$203.6

$98.1

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

$0

$25

$50

$75

$100

$125

$150

$175

$200

$225

$250

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

1H14

Spo

nsor

ed S

Har

e of

New

Iss

ue

$ B

Middle Market Loan Issuance

Non sponsored Sp. Sponsored Share (Rt Axis)Source: Thomson Reuters LPC

Middle market: Borrower sales of $500 million or lessDeal size $500 million or less

Middle Market Loans: The Market

-

CLO investors also traditionally focus on the institutional loan tranches. LPC and LCD define pro rata loans as Term Loan A tranches and revolvers and

institutional loans as the Term Loan B tranche.

According to LCD, the Term Loan A typically has a progressive amortizing schedule and is typically syndicated to banks, along with a revolving credit.

However, Term Loan As are now less common, as institutional tranches make up more

of funded loan issuance. Therefore, most of the pro rata issuance consists of revolvers. Institutional loan issuance covers the Term Loan B, which are facilities for nonbank

investors.

It should be pointed out that banks purchase institutional tranches at times.

23

Middle Market Loans: The Market

-

CLO investors traditionally focus on the institutional loan tranches.

24

$7.2

$10.5

$21.2

$44.9

$58.0

$71.9

$68.8

$10.8

$6.5

$26.3

$33.9 $34.2

$55.5

$22.3

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

$0

$15

$30

$45

$60

$75

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

1H14

Inst

ituio

nal M

M L

oan

Issu

ance

$ BMM Institutional Loan Issaunce

Large MM Inst. Trad MM Inst. Inst. Issuance as % of Total (Rt Axis)

Source: Thomson Reuters LPC

Traditional MM Deal size $100M to $500M

For all: Borrower sales

-

Middle market CLO investors typically focus on sponsored, institutional loans. Sponsored institutional volume was approximately $40 billion per year in 2005-2007,

and 2013. Volume was approximately $30 billion per year in 2011-2012.

25

3.45.2

12.4

30.3

43.1 44.345.8

7.9

4.0

22.5

27.8 28.4

37.9

18.2

12.2 12.4

27.1

51.7

67.6

64.6

71.0

22.6

13.1

52.7

64.2

69.672.5

34.0

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

1H14

Inst

. Sha

re o

f Spo

nsor

ed I

ssua

nce

$ B

Middle Market Sponsored Institutional Loan Issuance

Sp. Inst. Total Sponsored Inst. % of Total Sponsored (Rt Axis)Source: Thomson Reuters LPC

Middle market: Borrower sales of $500 million or lessDeal size $500 million or less

Middle Market Loans: The Market

-

Middle Market Lending: The Loans

-

Middle Market Loans: Spreads

27

-

50

100

150

200

250

300

350

400

450

500

550

600

650

700

750

800

850

900

-

50

100

150

200

250

300

350

400

450

500

550

600

650

700

750

800

850

900

1Q10

Apr-

10M

ay-1

0Ju

n-10

Jul-1

0Au

g-10

Sep-

10O

ct-1

0N

ov-1

0D

ec-1

0Ja

n-11

Feb-

11M

ar-1

1Ap

r-11

May

-11

Jun-

11Ju

l-11

Aug-

11Se

p-11

Oct

-11

Nov

-11

Dec

-11

Jan-

12Fe

b-12

Mar

-12

Apr-

12M

ay-1

2Ju

n-12

Jul-1

2Au

g-12

Sep-

12O

ct-1

2N

ov-1

2D

ec-1

2Ja

n-13

Feb-

13M

ar-1

3Ap

r-13

May

-13

Jun-

13Ju

l-13

Aug-

13Se

p-13

Oct

-13

Nov

-13

Dec

-13

Jan-

14Fe

b-14

Mar

-14

Apr-

14M

ay-1

4Ju

n-14

Mid

dle

Mar

ket L

oan

Prim

ary

Spr

ead

(ex

OID

)

Floor SpreadSource: LPC Thomson Reuters

Traditional MM: Deal Size 100M to $500m; for all Borrower sales < $500m

-

Middle Market Loans: Spreads

28

-

50

100

150

200

250

300

350

400

450

500

550

600

650

700

-

50

100

150

200

250

300

350

400

450

500

550

600

650

700

1Q02

2Q02

3Q02

4Q02

1Q03

2Q03

3Q03

4Q03

1Q04

2Q04

3Q04

4Q04

1Q05

2Q05

3Q05

4Q05

1Q06

2Q06

3Q06

4Q06

1Q07

2Q07

3Q07

4Q07

2008

1Q-3

Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

Mid

dle

Mar

ket L

oan

Prim

ary

Spr

ead

-B

Ps (

ex O

ID)

Spread (does not include Floors or LIBOR)

SpreadSource: LPC Thomson Reuters

Traditional MM: Deal Size 100M to $500m; for all Borrower sales < $500m

-

Middle Market Loans: Leverage

29

2.7 3.0 2.8

2.3

2.9 2.9 2.9 2.9 3.4

3.7 3.4 3.5 3.5

3.6 3.9 3.8

4.0 4.4

3.8 3.8

3.2 2.8

3.2

2.2

- - -

2.8 3.0

3.4 3.1

3.5 3.3

4.0 3.6 3.5

4.1 3.7

3.9 4.0 4.1

3.8 4.0 3.8 4.1

4.5

-

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

5.5

6.0

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

5.5

6.0

1Q03

2Q03

3Q03

4Q03

1Q04

2Q04

3Q04

4Q04

1Q05

2Q05

3Q05

4Q05

1Q06

2Q06

3Q06

4Q06

1Q07

2Q07

3Q07

4Q07

1Q08

2Q08

3Q08

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

MM

LB

O D

eb

t /

EB

ITD

A

1st Lien Debt to EBITDA Junior Debt to EBITDASource: LPC

First-lien leverage on institutional MM LBOs has averaged 3.9x since 2011. Total leverage on institutional MM LBOs peaked at 5.7x.

-

Middle Market Loans: Leverage

30

Total leverage on institutional MM LBOs have been lower than BSL LBO total leverage. MM LBO leverage is typically 1.0x 1.5x lower than BSL LBO leverage.

4.0

4.6

5.3 5.3 5.5

4.5

3.8

4.3 4.6

5.1 5.1 5.3

5.0

5.5 5.7

6.3

7.1

5.5

4.8

5.6 5.6 5.9

6.2 6.3

-

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

5.5

6.0

6.5

7.0

7.5

8.0

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

5.5

6.0

6.5

7.0

7.5

8.0

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

1H14

Tota

l LB

O D

eb

t /

EB

ITD

A

MM (Inst. LBO) BSL LBOSource: LPC

-

Middle Market Loans: Default and Recovery

There is limited market-wide default data for middle market loans, for several reasons. The lack of a standardized definition of a middle market loan is part of the problem.

Middle market lending groups are typically smaller than those in the broadly syndicated space.

Smaller lending groups can lead to lower default rates, if lenders are more involved with

the borrower. Middle market lenders are typically less able to sell the loan if the issuers credit profile

decreases; therefore, they may be more likely to step in and work on a cure before a default.

On the other hand, looser structures in broadly syndicated loans can lead to lower default rates for broadly syndicated loans.

Middle market CLO managers tend to specialize in sectors or types of loans. Therefore, we believe that individual manager performance statistics are more significant than market-wide data.

31

-

Middle Market Loans: Default and Recovery

We present middle market loan default data, with the understanding that the data may not represent the entire middle market loan universe.

In addition, structural differences, such as covenant-lite broadly syndicated loans, may have led to lower default rates for broadly syndicated loans in 2009-2012.

32

0.0%

2.5%

5.0%

7.5%

10.0%

12.5%

15.0%

0.0%

2.5%

5.0%

7.5%

10.0%

12.5%

15.0%Ja

n-01

Jan-

02

Jan-

03

Jan-

04

Jan-

05

Jan-

06

Jan-

07

Jan-

08

Jan-

09

Jan-

10

Jan-

11

Jan-

12

Jan-

13

Jan-

14

12m

Def

ault R

ate

(%)

MM (#) Lg Corp (#)Source: LCD

MM Avg: 2.4%

Lg Corp Avg: 3.2%

-

Middle Market Loans: Default History During 2009

Moodys compared the default rates on CLO collateral loans during the credit crisis, broken down by BSL CLOs versus small and medium enterprise CLOs (SME CLOs) for the period of December 2008 to December 2009.

Both CLO collateral pool default rates rise as WARF increases, which indicates

that the lower asset ratings (and higher WARF) are related to higher default risk.

For most of the WARF stratifications, the SME CLO collateral posts lower

default rates. Moodys believes, and we agree, that the lower default rates may be related to

the substitution provision in many SME/MM CLOs. On the other hand, BSL loans may have avoided default due to covenant-lite

provisions, waivers, or other structural benefits.

33

-

Middle Market Loans: Default History During 2009

34

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

3800

% o

f C

LO U

niv

ers

e w

ith

Ap

plic

ab

le W

AR

F

12

m D

efa

ult

Ra

te (

CLO

Co

llate

ral

Ass

ets

)

CLO WARF % of BSL CLOs % of SME CLOs BSL CLO 12-Month Default % SME CLO 12-Month Default %

Source: Moody's

76% of BSL CLOs had WARFs below 2,800, as of Dec. 2008

Over the next 12 months, BSL CLOs with WARFs below 2,800 had an asset default rate of 8.4%

Over the next 12 months, SME CLOs with WARFs below 2,800 had an asset default rate of 7.6%.

18% of SME CLOs had WARFs below 2,800, as of Dec. 2008

During 2009, SME CLO assets had lower default rates than assets in BSL CLOs, when comparing CLOs with similar WARFs, for most WARF stratifications.

-

Middle Market Loans: Default and Recovery

There is a lack of time series recovery data for middle market loans.

We can reference two studies on middle market loan recoveries.

Churchill Financial and S&P CreditPro produced recovery rates for loans, based on loan size, for the time period 1990-2010.

The study showed that smaller loans ( $200 mm

Nominal Rec. 86.12% 81.04%Discounted Rec. 75.42% 70.06%

Nominal Rec.: Value at emergence as a pct of principal at time of defaultDiscounted Rec.: Nominal recovery, discounted back to period in which interest was last paidSource: Churchill Financial, S&P CreditPro

Recovery Rates, 1990-2010

-

Middle Market Loans: Default and Recovery

There is a lack of time series recovery data for middle market loans.

We can reference two studies on middle market loan recoveries.

In 2014, LCD and S&P CreditPro updated the data with recovery figures for 2010-2013.

The data again showed the smaller loans had better recovery values than larger loans.

36

Smaller Loans Larger LoansLoans < $200 mm Loans > $200 mm

Recovery Rate 81% 74%Source: LCD, S&P CreditPro

Recovery Rates, 2010-2013

-

Middle Market Loans: Covenant-Lite Loans

Middle market loans are much less likely to be covenant-lite. Lenders are less able to sell loans, which may lead to a stronger focus on loan structure. LCD reports that only five of 57 new traditional middle market deals (defined here by

LCD as deal size less than $200 million ) in H1 2014 was covenant-lite.

By volume, 21% of traditional middle-market volume in H1 2014 was covenant-lite. While the smaller end of the middle market may be more resistant to more issuer-

friendly structures, the large middle market sector is often more likely to mimic the broadly syndicated market.

LCD also reported that, by volume, 41% of larger middle market deals (deals with a deal size of $201 million-$350 million ) in H1 2014 were covenant-lite.

This is an increase from 2013s covenant-lite market share of 27%.

For comparison, approximately 60% of broadly syndicated loans issued in 2013 and 2014 were covenant-lite.

37

-

Middle Market Loans: Covenant Lite Loans

Middle market loans are much less likely to be covenant-lite. In 2013, only 24% of middle market loans issued were covenant-lite. Traditional middle market loans were less likely to be covenant-lite. For comparison, in 2013, 57% of broadly syndicated loan issuance was covenant-lite.

38

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

% o

f Ins

t. I

ssau

cne

that

is C

ov-L

iteMiddle Market Cov-Lite Issuance

Trad. MM Cov-Lite % of Inst. Issuance Lg. MM Cov-Lite % of Inst. Issuance BSL Cov-Lite % of Inst. Issuance

Source: LCD

Traditional Middle market: $200 million or lessLarge Middle Market: $201-$350 million

In 2013, only 13% of traditional middle market loans issued were covenant-lite; in 2013, 57% of broadly syndicated loan issuance was covenant-lite.

2014 data as of Q2 2014

-

Middle Market Lending: The Lenders

-

Middle Market Loans: Investor Base

LCD data show that institutional investors were the largest buyers of primary middle market loans from 2004 to 2007.

In our opinion, as overall credit spreads tightened, institutional investors looked to the

middle market sector to add yield; the appetite of institutional investors dwarfed the middle market world, leading to the large share of purchases.

We believe that the higher end of the middle market is a logical place for excess capital

from the broadly syndicated world. However, in 2008 and 2009, finance companies were the largest primary investors in

middle market loans. We believe that as the credit crisis deepened, institutional investors exited the middle

market sector for the more well-known pastures of broadly syndicated loans. Meanwhile, those firms that specialize in middle market lending continue to lend, albeit

at wider spreads and lower multiples.

40

-

Middle Market Loans: Investor Base

In 2010 and 2011, as credit assets recovered, institutional investors returned to middle market lending.

As spreads tightened, and loans prepaid, institutional investors were faced with falling

spreads and declining asset balances, leading to increased middle market loan interest. LCD data show that since 2003 institutional investors have consistently made up at least

two-thirds of the total loan market. In the middle market sector, institutional investors buy during good times, but may exit

during times of stress. This provides opportunities for the middle market specialists during downturns. Of course, as in any lending business, this may cause problems during extended periods

of credit strength, as newer investors may push spreads tighter and standards looser.

Middle market investors may take comfort from middle market specialists lower market shares during times of deteriorating lending standards.

41

-

Middle Market Loans: Investor Base

42

26%22%

20%

13%

4% 3%

26%

67%65%

58%

67%

29%30%

49% 46%57%

68% 74%8%

9%12%

16%

18%

25%

40%

14% 11%

17%

13%

39% 35%

21% 23%

21%

13%

14%

62% 64% 65% 68% 76% 69% 35% 19% 20% 21% 14% 30% 32% 29% 28% 23% 17% 12%0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 1H 14

Prim

ary

Mar

ket

for

MM

Lev

erag

ed L

oans

Primary Market for Middle Market Leveraged Loans

Bank (Dom & For.) Finance Co. Institutional Investors Securities FirmSource: LCD

Fin. Co.

Inst. Inv.

Banks

-

Sources of Capital in the Middle Market

Middle market companies have several sources of capital available.

43

Finance Mezzanine Pvt. EquityTraditional Banks Companies CLOs BDCs Hedge Funds Funds Funds

Senior Senior Term Unitranche Second Subordinated Preferred CommonRevolver Loans Loans* Lien Debt Stock Stock

SecuritySecured by 1st lien. Top of the

capital stack

Secured by 1st lien behind the bank revolver

Secured by 1st lien behind the bank revolver

Secured by 2nd lien behind the

bank/senior debt.

Secured/Unsecured; however, If secured it is behind all senior

(incl. 2nd lien)

Unsecured Unsecured

Coupon L+150-300 L+300-700 10-12% 12-14% 13-15% - -Leverage 0-0.5x 0.5-3.5x 0.5-4.0x 3.5x-5.0x 4.0-6.0x - -

**The highlighted items are the asset classes that generally comprise BDC portfolios***Leverage is denominated by leverage turns to TTM EBITDA

Source: Wells Fargo Equity Research, The BDC Almanac, Jan. 2014

*This is a combination of senior/subordinated into one loan with a blended interest rate. It is often referred to as a "one stop" debt solution

Middle Market Loans: The Lenders

-

Middle Market Lenders:

Banks

JP Morgan, BAML, Wells Fargo, PNC

Specialty Finance Companies

GE Capital, Madison Capital, NXT

BDCs

ARCC, GBDC, PSEC

Source: Wells Fargo Equity Research, The BDC Investors Almanac, Jan. 2014.

44

Middle Market Loans: The Lenders

-

Thomson Reuters LPC data show the most active bookrunners in the Large Middle Market and Traditional Middle Market Sectors.

45

Rank Institution # Deals Vol. ($ mm)

Mkt Share (%) Rank Institution # Deals

Vol. ($ mm)

Mkt Share (%)

1 Bank of America Merrill Lynch 169 20,115 13% 1 JP Morgan 136 5,659 13%2 Wells Fargo & Company 177 19,392 12% 2 Wells Fargo & Company 125 4,491 10%3 JP Morgan 141 17,761 11% 3 Bank of America Merrill Lynch 84 4,487 10%4 GE Capital 115 12,016 7% 4 PNC Bank 81 3,118 7%5 PNC Bank 61 6,335 4% 5 U.S. Bancorp 66 2,876 7%6 BMO Capital Markets 69 6,333 4% 6 GE Capital 62 2,624 6%7 Credit Suisse 42 5,848 4% 7 Madison Capital Funding LLC 56 2,276 5%8 Jefferies Finance LLC 35 5,004 3% 8 BMO Capital Markets 52 1,892 4%9 U.S. Bancorp 44 4,764 3% 9 RBS 45 1,737 4%10 RBC Capital Markets 34 4,542 3% 10 Fifth Third Bank 32 1,385 3%11 BNP Paribas SA 31 4,399 3% 11 SunTrust Bank 33 1,330 3%12 SunTrust Bank 52 4,376 3% 12 KeyBank 26 1,277 3%13 Deutsche Bank 35 4,350 3% 13 PrivateBancorp Inc 24 900 2%14 Barclays 27 4,303 3% 14 CIT Group Inc 19 732 2%15 Citi 31 3,788 2% 15 Regions Bank 16 630 1%16 RBS 34 3,250 2% 16 BNP Paribas SA 7 543 1%17 KeyBank 35 3,154 2% 17 RBC Capital Markets 25 501 1%18 Mitsubishi UFJ Financial Group 25 3,008 2% 18 Mitsubishi UFJ Financial Group 11 480 1%19 Fifth Third Bank 30 2,858 2% 19 Citi 11 434 1%20 Morgan Stanley 21 2,365 1% 20 NXT Capital LLC 11 380 1%

Source: Thomson Reuters LPC

2013 Middle Market Bookrunner League TablesLarge Middle Market

2013 Middle Market Bookrunner League TablesTraditional Middle Market

Middle Market Loans: The Lenders

-

BDCs are active lenders in the middle market space, and this expanding asset class continues to grow as a provider of capital.

46

Middle Market Loans: The Lenders

Ticker BDC AUM ($ in mm)ARCC Ares Capital Corp $7,800PSEC Prospect Capital Corp $6,006FSIC FS Investment Corp $4,078AINV Apollo Investment Corp $3,479FSC Fifth Street Finance Corp $2,684PNNT PennantPark Investment Corp $1,257GBDC Golub Capital BDC Inc $1,254TSLX TPG Specialty Lending Inc $1,196NMFC New Mountain Finance Corp $1,180BKCC BlackRock Kelso Capital Corp $1,106SLRC Solar Capital Ltd $1,028TICC TICC Capital Corp $960MCC Medley Capital Corp $959HTGC Hercules Technology Growth Cap $891TCPC TCP Capital Corp $816TCRD THL Credit Inc $739TCAP Triangle Capital Corp $690SUNS Solar Senior Capital Ltd $275HRZN Horizon Technology Finance Cor $229TPVG TriplePoint Venture Growth BDC $144

$36,768represents Wells Fargo BDC Equity Research Coverage UniverseSource: Company Reports, Wells Fargo BDC Equity Research

Publicy Traded BDC AUM as of 3/31/14

-

Middle Market Lenders: The BDCs

In its simplest form, a Business Development Company or Registered Investment Company (BDC/RIC) is a type of closed-end mutual fund designed as a way to lend to private middle market businesses.

Congress created the BDC in 1980 through Section 54 of the Investment Company Act.

This BDC/RIC would be a tax pass-through entity, would register and sell shares in public offerings, and would trade on public exchanges.

The new entity would, in effect, be the first publicly traded mezzanine limited partnership, with the BDC fund manager acting as the general partner (GP) and the BDC shareholders taking on the role of limited partners (LP).

Source: Wells Fargo Equity Research, The BDC Investors Almanac, Jan. 2014.

47

Middle Market Loans: The Lenders

-

Middle Market Lenders: The BDCs

In order to become a BDC/RIC, Congress specified a few rules of the road under the Small Business Incentive Act of 1980, and these are as follows:

Leverage: A BDC must not fall below an asset coverage ratio (total assets-to-total debt) of 200%.

Stated differently, a BDCs total leverage (total debt-to-total equity) cannot exceed a 1:1 threshold.

This is more commonly referred to as the 1:1 leverage test for a BDC.

Income requirement: At least 90% of a BDCs gross annual income must be derived from dividends, interest and realized capital gains from the investment portfolio.

Source: Wells Fargo Equity Research, The BDC Investors Almanac, Jan. 2014.

48

Middle Market Loans: The Lenders

-

Middle Market Lenders: The BDCs

In order to become a BDC/RIC, Congress specified a few rules of the road under the Small Business Incentive Act of 1980, and these are as follows:

Asset diversification. Congress required BDCs to remain adequately diversified to

help limit a BDC from taking unnecessary or concentrated risks. Thus, to maintain RIC status, a BDC must have at least 70% of its investment portfolio

in qualifying assets.

Qualifying assets are defined as private debt or equity investment in private, or thinly traded companies (i.e., below $250 million market cap).

In addition, a BDC must have more than 50% of its portfolio in investments that make

up less than 5% of a companys total assets and must limit its investment size to no more than 25% of a companys total assets.

Source: Wells Fargo Equity Research, The BDC Investors Almanac, Jan. 2014.

49

Middle Market Loans: The Lenders

-

Middle Market Lenders: The BDCs

In order to become a BDC/RIC, Congress specified a few rules of the road under the Small Business Incentive Act of 1980, and these are as follows:

Distribution requirement. To maintain RIC status, a BDC must distribute at least

90% of its gross annual income to shareholders.

It is possible to carry over amounts in excess of 90% of gross annual income; however, the BDC is subject to a 4% excise tax on those spillover earnings.

To the extent that a BDC distributes at least 98% of its gross annual income, the BDC will not be subject to an excise tax penalty on the remainder.

Managerial assistance: BDCs are required to offer managerial assistance to the small-

and medium-sized businesses in which they invest.

Assistance is often provided through board observer rights and active board participation. Source: Wells Fargo Equity Research, The BDC Investors Almanac, Jan. 2014.

50

Middle Market Loans: The Lenders

-

51

BDC AUM has increased substantially since the financial crisis.

Since year-end 2010, BDC loan balance

(cost value) has increased from $16.5 billion to $43.3 billion (as of Q1 2014).

Assets of publicly traded BDCs have

increased from $25.4 billion at year-end 2010 to $48.3 billion (Q1 2014).

Assets include loans plus cash, structured products and equity.

Since 2009, there have been 22 BDC

IPOs, with more than $2 billion raised.

The market has absorbed 92 follow-ons by BDCs, with more than $8.9 billion raised, since 2009.

BDC Asset Growth

BDC Equity Capital Raises

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

$40,000

$45,000

$50,000

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

$40,000

$45,000

$50,000

1Q 2

004

2Q 2

004

3Q 2

004

4Q 2

004

1Q 2

005

2Q 2

005

3Q 2

005

4Q 2

005

1Q 2

006

2Q 2

006

3Q 2

006

4Q 2

006

1Q 2

007

2Q 2

007

3Q 2

007

4Q 2

007

1Q 2

008

2Q 2

008

3Q 2

008

4Q 2

008

1Q 2

009

2Q 2

009

3Q 2

009

4Q 2

009

1Q 2

010

2Q 2

010

3Q 2

010

4Q 2

010

1Q 2

011

2Q 2

011

3Q 2

011

4Q 2

011

1Q 2

012

2Q 2

012

3Q 2

012

4Q 2

012

1Q 2

013

2Q 2

013

3Q 2

013

4Q 2

013

1Q 2

014

$ M

M

Loans at Cost Assets of Publicly Traded BDCs

Source: Company Reports, Wells Fargo Equity Research

Year End 2010

0

5

10

15

20

25

30

35

40

45

50

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

# O

ffer

ing

s

BD

C C

apit

al R

aise

d $

in M

M

BDC IPOs ($ mm) BDC Follow-Ons ($ mm) BDC Rights Offerings ($ mm)IPO (#) FO (#) Rights Offerings (#)

Source: Company Reports, Wells Fargo Equity Research

Middle Market Loans: The Lenders

-

Middle Market CLOs

-

Middle CLOs: Issuance

53

$0.6

$3.6

$2.2

$3.8

$6.8

$9.9$10.6

$20.3

$11.8

$1.5

$0.0

$1.5 $1.4

$4.2

$5.4

$3.9

0.0

2.5

5.0

7.5

10.0

12.5

15.0

17.5

20.0

22.5

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

$ B

Source: Intex, S&P, Moody's, Wells Fargo Securities, LLC

as of 7/22/2014

-

Middle CLOs: Issuance

54

14.2 15.8

13.8 15.4 14.9

28.4

49.1

75.7

89.2

20.6

0.5 2.9

13.8

51.9

77.7

66.5

0.6 3.6

2.2 3.8

6.8 9.9 10.6

20.3

11.8

1.5 -

1.5 1.4 4.2 5.4 3.9

0

10

20

30

40

50

60

70

80

90

100

0

10

20

30

40

50

60

70

80

90

100

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

$ B

US CLO Issuance

BSL CLO MM CLOSource: Intex, Wells Fargo Securities, LLC

as of 7/22/2014

Since 2011, MM CLO issuance has been 6%-9% of total U.S. CLO Issuance.

-

Middle CLOs: Market Size History

55

-

5

10

15

20

25

30

35

40

45

50

0

5

10

15

20

25

30

35

40

45

50

Q1

2000

Q1

2001

Q1

2002

Q1

2003

Q1

2004

Q1

2005

Q1

2006

Q1

2007

Q1

2008

Q1

2009

Q1

2010

Q1

2011

Q1

2012

Q1

2013

Q1

2014

Bill

ions

US

MM

CLO

Ou

tsta

nd

ing

Ba

lan

ce (

$ B

)

Bill

ions

1.0 MM CLO 2.0 MM CLOSource: Intex, Wells Fargo Securities LLC

1.0 = pre-crisis deals2.0 = post - crisis deals

-

Middle CLOs: Market Size History Compared to BSL CLOs

56

-

25

50

75

100

125

150

175

200

225

250

275

300

325

0

25

50

75

100

125

150

175

200

225

250

275

300

325

Q3

1996

Q3

1997

Q3

1998

Q3

1999

Q3

2000

Q3

2001

Q3

2002

Q3

2003

Q3

2004

Q3

2005

Q3

2006

Q3

2007

Q3

2008

Q3

2009

Q3

2010

Q3

2011

Q3

2012

Q3

2013

Bill

ions

US

CLO

Ou

tsta

nd

ing

Bal

ance

($

B)

Bill

ions

1.0 BSL 1.0 MM 2.0 BSL 2.0 MMSource: Intex, Wells Fargo

1.0 = pre-crisis deals2.0 = post - crisis deals

-

Middle CLOs: Currently Outstanding MM CLO Universe

57

#Trustee WARF

Curr Bal ($mm) % Cash % Def. % B3

% Caa1 - Ca

# Deals Fail IC

# Deals Fail OC

# Deals Fail Sr

OC2001 1 126 77.3% 22.7% 0.0% 0.0% 0 0 02002 1 8,070 26 0.0% 59.7% 0.0% 40.3% 0 0 02003 1 7,143 100 0.1% 78.9% 0.0% 11.2% 0 0 02004 3 5,482 215 22.1% 36.5% 1.2% 22.5% 0 0 02005 5 2,807 262 12.3% 13.2% 12.0% 6.6% 1 1 02006 12 3,159 1,844 4.1% 6.0% 8.8% 4.3% 0 0 02007 13 2,835 5,284 3.8% 1.9% 17.4% 3.9% 0 0 02010 1 3,807 350 1.4% 2.1% 61.1% 18.9% 0 0 02011 2 3,359 540 14.2% 1.2% 16.2% 11.4% 0 0 02012 9 3,412 2,565 4.2% 1.1% 8.6% 8.0% 0 0 02013 12 3,290 4,551 3.4% 0.2% 4.9% 5.5% 0 0 02014 3 3,902 1,123 10.4% 0.0% 0.9% 7.5% 0 0 0

63 3,215 16,986 4.6% 1.9% 11.3% 6.0% 2 1 0

as of 7/18/2014

MML CLO: 63 Deals / $17B

"WARF", "% Assets B3" and "% Caa1-Ca" calculations only include Moody's rated assets.

Source: Intex, Wells Fargo Securities, LLC

Due to data lags in Intex data, this data do not include all new issue deals. Data on assets CCC rated assets may be low, as we only show the percentage of publicly

rated assets.

-

Middle CLOs: Spreads

58

0

50

100

150

200

250

300

350

400

450

500

550

600

650

700

750

800

850

900

950

1000

0

50

100

150

200

250

300

350

400

450

500

550

600

650

700

750

800

850

900

950

1000

Dec

-10

Mar

-11

Jun-

11

Sep-

11

Dec

-11

Mar

-12

Jun-

12

Sep-

12

Dec

-12

Mar

-13

Jun-

13

Sep-

13

Dec

-13

Mar

-14

Jun-

14

BP

s

AAA AA A BBBSource: Wells Fargo Securities, LLC

Ratings refer to original rating, and spreads are generic. Actual spreads may differ based on structure, WAL, collateral, and manager. Middle market CLO spreads have more variance from an average.

-

Middle CLOs: AAA Spread Comparison

59

100

110

120

130

140

150

160

170

180

190

200

210

220

230

240

250

100

110

120

130

140

150

160

170

180

190

200

210

220

230

240

250Ja

n-12

Feb-

12

Mar

-12

Apr-

12

May

-12

Jun-

12

Jul-1

2

Aug-

12

Sep-

12

Oct

-12

Nov

-12

Dec

-12

Jan-

13

Feb-

13

Mar

-13

Apr-

13

May

-13

Jun-

13

Jul-1

3

Aug-

13

Sep-

13

Oct

-13

Nov

-13

Dec

-13

Jan-

14

Feb-

14

Mar

-14

Apr-

14

AA

A C

pn

Sp

rea

d (

bp

s)

BSL AAA MM AAASource: Moody's, S&P, Wells Fargo Securities, LLC

In general, since 2012, MM CLO AAAs have priced 25 bps 50 bps wider than BSL CLO AAA tranches.

-

Middle CLOs: Spread History

60

0

50

100

150

200

250

300

350

400

450

500

550

600

0

50

100

150

200

250

300

350

400

450

500

550

600

Jan-

03

Apr-

03

Jul-

03

Oct

-03

Jan-

04

Apr-

04

Jul-

04

Oct

-04

Jan-

05

Apr-

05

Jul-

05

Oct

-05

Jan-

06

Apr-

06

Jul-

06

Oct

-06

Jan-

07

Apr-

07

Jul-

07

Oct

-07

BP

s

AAA AA A BBBSource: Wells Fargo Securities, LLC

Ratings refer to original rating, and spreads are generic. Actual spreads may differ based on structure, WAL, collateral, and manager. Middle market CLO spreads have more variance from an average.

-

Middle CLOs: Structure

61

BSL CLO MM CLO2012 - 2014 Median Structure

AAA = 61.0%

AA = 10.8%

A = 7.6%

BBB = 4.9%

AAA = 55.7%

AA = 8.1%

BB = 4.4%

Equity = 10.0%

A = 7.8%

BBB = 4.9%BB - 5.0%

Equity = 14.9%

Source: S&P, Moody's, Creditflux, Intex, Wells Fargo Securities, LLC

Avg. Structure, by Vintage

MM CLOs are less leveraged and have more credit support than BSL CLOs.

MM CLOs have less diverse collateral pool, and typically feature higher WARFs, which requires more subordination.

The AAA tranche of the average MM CLO is 56% of the structure, compared to BSL CLO AAAs, which are 61% of the structure.

-

Middle CLOs: Structure

62

MM CLO BSL CLOAAA 55.7% 60.8%AA 8.1% 11.3%A 7.8% 7.4%BBB 4.9% 5.0%BB 5.0% 4.4%EQ 14.9% 9.8%

Source: Moody's, S&P, Wells Fargo Securities, LLC

2012-2014 CLO Median Structure

Credit Support, based on AssetsMM CLO BSL CLO

AAA 41.3% 36.2%AA 33.2% 24.9%A 25.4% 17.5%BBB 20.5% 12.6%BB 15.5% 8.2%

Source: Moody's, S&P, Wells Fargo Securities, LLC

MM CLOs are less leveraged and have more credit support than BSL CLOs.

MM CLOs have less diverse collateral pool, and typically feature higher WARFs, which requires more subordination.

MM CLO AAA tranches have more than 40% credit support, compared to 36% credit support on BSL CLO AAAs.

-

Middle CLOs: Asset Coverage

63

-5

0

5

10

15

20

25

30

-5

0

5

10

15

20

25

30

Jan-

04

Jul-

04

Jan-

05

Jul-

05

Jan-

06

Jul-

06

Jan-

07

Jul-

07

Jan-

08

Jul-

08

Jan-

09

Jul-

09

Jan-

10

Jul-

10

Jan-

11

Jul-

11

Jan-

12

Jul-

12

Jan-

13

Jul-

13

Jan-

14

Jul-

14

Cu

rre

nt

Min

OC

Cu

shio

n

Issue Date

Current Min. OC Test Cushion, by Issue Date

CLO Min OC Cushion MML Min OC CushionSource: Intex, Wells Fargo Securities, LLC

As of 7/9/2014

MM CLOs have OC cushions in line with BSL CLOs.

-

Middle CLOs: Structure

64

MM CLO collateral portfolios have lower average ratings and are less diverse.

MM CLO collateral assets have higher coupons, and are less likely to be covenant-lite.

Mat.WAS (ex Floors) WAS CCC

Cov Lite WARF WAS WAC WAL Div A/B Trigger A/B Cushion

MM CLO (2012-2014) 5.1 5.2 5.9 17.5% 15.0% 3,340 4.8 7.0 7.5 35 142.8% 9.1%

BSL CLO (2012-2014) 6.0 3.9 4.6 7.5% 50.0% 2,720 3.8 7.0 8.0 50 124.0% 10.2%

BSL CLO (2014 Only) 6.1 3.8 4.4 7.5% 60.0% 2,706 3.8 7.0 8.0 58 124.3% 10.6%

as of 7/22/2014Source: S&P, Moody's, Wells Fargo Securities, LLC

OvercollateralizationInitial Portfolio Covenant Limits

-

Middle CLOs: Loan Spreads vs. MM CLO AAA Spreads

65

Middle market CLOs posted an initial WAS (ex-floors) that is 105 bps wider than BSL CLOs, on average.

Based on a total debt cost of a MM CLO that is generally about 25 bps50 bps higher, we see that middle market CLOs offer 50 bps75 bps of additional excess spread.

0

50

100

150

200

250

300

350

400

450

500

550

600

650

700

750

800

850

900

0

50

100

150

200

250

300

350

400

450

500

550

600

650

700

750

800

850

900M

ay-1

0

Aug-

10

Nov

-10

Feb-

11

May

-11

Aug-

11

Nov

-11

Feb-

12

May

-12

Aug-

12

Nov

-12

Feb-

13

May

-13

Aug-

13

Nov

-13

Feb-

14

bp

s

MM Loan Spreads vs. MM CLO AAA Spreads

Middle Market CLO (AAA) Spread MM Inst. Loan Spread (ex OID)

Source: Wells Fargo Securities, LLC, Thomson Reuters, LLC

-

Middle CLOs: Collateral Portfolio Yield

66

Vintage Median WAC Mean WAC Median WAC Mean WAC2003 7.41 7.41 5.37 4.912004 6.20 7.13 3.62 4.042005 7.61 8.61 4.06 3.842006 5.50 6.21 4.08 4.192007 4.91 4.91 4.07 4.112008 NA NA 3.77 3.342010 7.43 7.43 3.89 3.892011 6.41 6.41 4.35 4.522012 5.89 6.18 4.60 4.672013 6.19 6.68 4.63 4.692014 5.91 6.41 4.72 4.70Total 5.83 6.15 4.39 4.39

MM CLO BSL CLO

Source: Intex, Wells Fargo Securities, LLC

WAC = Calculated WAC per Intexas of 7/11/2014

WAC in %

Collateral portfolios in MM CLOs tend to have average yields 150 bps 175 bps higher than those of BSL CLOs.

This table shows current CLO collateral portfolio coupons, by vintage.

-

Middle CLOs: Collateral

67

We present WAC and WARF statistics on outstanding MM CLOs as proxy for risk/reward.

3.0

3.5

4.0

4.5

5.0

5.5

6.0

6.5

7.0

7.5

8.0

2,000 2,200 2,400 2,600 2,800 3,000 3,200 3,400 3,600 3,800

MM

L C

urr

ent

WA

C

MML CLO Trustee Reported WARF

Collateral Portfolio WAC and WARF, U.S. BSL CLOs Outstanding

Source: Intex, Wells Fargo Securities, LLC

Median WARF = 3,286

Median WAC = 5.89

as of July 9, 2014

-

Middle CLOs: Rating Performance: 2009 Downgrades

68

Aaa Aa A Baa Ba B Caa Ca/C WR Aaa 56.7% 29.8% 5.3% 1.2% 0.6% 1.2% 0.0% 0.0% 5.3%Aa 1.9% 40.2% 38.3% 8.4% 4.7% 0.9% 0.9% 0.0% 4.7%A 0.0% 0.0% 21.7% 42.2% 30.1% 2.4% 0.0% 0.0% 3.6%Baa 0.0% 0.0% 2.4% 7.3% 48.8% 32.9% 7.3% 1.2% 0.0%Ba 0.0% 0.0% 0.0% 0.0% 1.9% 36.5% 48.1% 7.7% 5.8%B 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 50.0% 50.0% 0.0%

Aaa Aa A Baa Ba B Caa Ca/C WR Aaa 34.8% 48.0% 13.6% 0.6% 0.6% 0.2% 0.3% 0.0% 2.0%Aa 0.2% 16.3% 51.8% 26.2% 3.5% 0.2% 0.5% 0.2% 1.2%A 0.0% 0.0% 2.7% 34.1% 54.8% 4.7% 1.5% 1.1% 1.1%Baa 0.0% 0.0% 0.1% 2.1% 21.3% 42.8% 22.0% 8.0% 3.7%Ba 0.0% 0.0% 0.0% 0.0% 0.9% 14.6% 47.1% 36.1% 1.4%B 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 35.3% 41.2% 23.5%Caa 0.0% 0.0% 0.0% 0.0% 0.0% 8.3% 16.7% 58.3% 16.7%Ca/C 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 52.2% 47.8%

Source: Moody's

Dec

. 08

Rat

ing

Dec

. 08

Rat

ing

U.S. Cash SME CLOsDec. 2009 Rating

Dec. 2009 RatingU.S. Cash CLOs (ex. SME CLOs)

In 2009, Moodys downgraded fewer MM CLO tranches than BSL CLO tranches.

-

Middle CLOs: Rating Performance: After the Crisis

69

After 2009, as the credit recovery began to take hold, CLOs in general, including middle market CLOs, began to see tranche upgrades.

CLO note rating transitions were already showing upgrades when Moodys again changed its rating methodology in 2011.

Indeed, 26% of middle market CLO notes rated Ba in July 2010 had been upgraded one year later

Aaa Aa A Baa Ba B Caa Ca/C WR Aaa 86.7% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 13.3%Aa 13.8% 79.3% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 6.9%A 5.8% 13.0% 72.5% 0.0% 0.0% 0.0% 0.0% 0.0% 8.7%Baa 2.0% 5.9% 5.9% 76.5% 2.0% 0.0% 0.0% 0.0% 7.8%Ba 0.0% 1.4% 9.6% 15.1% 65.8% 8.2% 0.0% 0.0% 0.0%B 0.0% 0.0% 0.0% 8.3% 14.6% 72.9% 0.0% 0.0% 4.2%Caa 0.0% 0.0% 0.0% 2.6% 5.1% 5.1% 87.2% 0.0% 0.0%Ca/C 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 100.0% 0.0%

Source: Moody's

U.S. Cash SME CLOsRating % as of 7/22/11

Rat

ing

(as

of 7

/22/

10)

-

Middle CLOs: Default History

70

CLO tranche default rates are low: between 1994 and 2013, only 0.52% of rated tranches have defaulted (including seven tranches currently rated CC).

Per S&P, only six of the 25 CLO tranches that already defaulted were from MM CLOs.

S&P states that three MM CLOs that had defaulted tranches were due to market value

provisions, which are rarely found in CLOs.

Original rating Total tranchesDefaulted tranches Default rate

Default Rate, inc. 7 tranches rated CC

AAA 1,992 0 0.00% 0.00%AA 1,005 0 0.00% 0.00%A 1,119 5 0.45% 0.45%BBB 1,069 3 0.28% 0.47%BB 841 14 1.66% 2.26%B 115 3 2.61% 2.61%Total 6,141 25 0.41% 0.52%

Source: S&P

S&P also counts 7 tranches currently rated CC, which implies default is a "virtual certainty." These tranches were all originally rated BBB or BB.

S&P Rated U.S. CLO Tranches, 1994-2013

For a complete look at CLO default rates, and a comparison between CLO tranche default rates and corporate default rates, please see The CLO Salmagundi: CLOs vs. Corporates, Wells Fargo Research, 3/14/14.

-

Middle Market CLO Managers

-

72

Balance-sheet MM CLOs are typically issued by nondepository SFCs that issue loans to small- and middle-market businesses.

These middle-market businesses are typically too large to obtain financing from small-business lenders and too small to obtain funding from large commercial banks and the institutional loan markets.

SFCs hone in on this niche and offer a variety of loan products and financing options that include (but are not limited to); first- and second-lien term loans, mezzanine debt, revolvers and uni-tranche loans.

SFCs earn income through loan structuring fees, interest on their loan products, advisory fees, dividend distributions and servicing fees (fees earned for collecting payments from the loan portfolio).

Middle CLO Managers: Overview

-

73

We believe that the manager is more important to MM CLO investors than to BSL CLO investors, for several reasons.

First, MM CLO managers are typically involved in the origination of the

assets, while BSL CLO managers are essentially choosing from the same universe of collateral assets in the primary and secondary markets.

Second, middle-market lenders, and by extension MM CLOs, tend to be

more specialized. Lenders may focus on certain types of financing, or on specific industries, possibly leading to large differences in CLO collateral stratifications and collateral limits.

Third, MM CLOs may have fewer assets in the collateral pool, making

each asset selection decision more important.

Middle CLO Managers: Overview

-

74

Finally, transfer of management of a CLO may be more difficult in MM CLOs than in BSL CLOs, since the MM CLO manager is typically the underwriter of the loans, or involved in the origination.

Therefore, the manager will likely be more involved in the company

throughout the life of the loan and should have a deeper understanding of the company and management.

Consequently, a replacement manager could be at a significant disadvantage assuming management of the portfolio, whereas BSL CLO assets should largely be familiar to a new CLO manager.

A mitigant to this disadvantage is that banks have had success selling portfolios, and more managers are familiar with the credits.

Middle CLO Managers: Overview

-

75

Investors in middle market CLOs need to understand and analyze the performance of middle market loans.

After all, structural protections and collateral manager have a large effect on CLO performance but, ultimately, the best structure can not overcome bad assets.

We believe that investors should carefully examine the particular CLO managers performance data. While past performance may not provide a look into the future, we believe that an individual managers record is most important.

In cases in which the CLO issuer is publicly traded, CLO investors may be able to access company reports and equity research to get a better understanding of the companys performance, style and management.

Investors should understand what type of assets are contributed to the CLO.

Middle CLO Managers: Overview

-

76

Investors in MM CLOs may wonder about servicer bankruptcy risk.

Although MM CLOs are structured to be bankruptcy remote, insolvency of the SFC (or its affiliated transaction parties) can potentially change the risk profile of a MM CLO.

In addition, notes senior in the capital structure may be affected differently than notes that are subordinate in the capital structure.

Our general rule of bankruptcy is that investors should expect the unexpected.

Isolated cases in sectors such as future-flow transactions, whole business securitizations and CMBS indicate that the risk of consolidation is not zero.

CLO investors, particularly in financing transactions, should not be complacent, and may have to be especially vigilant in protecting themselves should the servicer enter bankruptcy.

Middle CLO Managers: Servicer Risk

-

77

We recommend that investors check to see if either servicer default or bankruptcy of the servicer/originator constitutes an event of default under the indenture (typically section 5.01 of the indenture).

Bankruptcy is often defined as an insolvency event within the transaction documents.

Typically, the backup servicer (if applicable) will assume the role of servicing the underlying collateral, acting as the successor servicer.

Some transactions enable the servicer or majority holders to instruct the backup servicer to sell servicing rights to an eligible third party.

In this case, the backup servicer will typically be responsible to negotiate the sale and will direct net sales proceeds back to the SFC (servicer) or its estate

Middle CLO Managers: Servicer Risk

-

78

The transfer of servicing may have a negative effect on the loan performance of the underlying collateral.

Since there is a limited trading market for middle market loan collateral, distressed loans are likely go through a workout with the servicer (rather than be sold).

A successor servicer may be at a disadvantage when going through the loan workout process, as it was not involved in the upfront due diligence, underwriting and structuring of a middle market loan.

MM CLO investors should be aware that a servicing transfer could potentially adversely affect the recovery values of defaulted collateral.

MM CLO investors should be aware that upon bankruptcy of the SFC (servicer), there is a potential for a third-party to assume the role of servicer, without consent of the noteholders (in some cases).

Middle CLO Managers: Servicer Risk

-

79

American Capital (ACAS) approached bankruptcy in Q2 2010, as corporate debt covenant violations granted lenders the right to accelerate maturity of $2.4 billion in unsecured debt, which would have likely led to a default.

However, lenders eventually agreed to a debt exchange plan in June 2010 and avoided bankruptcy.

Moodys reported that while the backup servicers were in place then, ultimately, ACAS remained as the servicer.

Moodys covered this case in a 2011 report that pointed out that manager and servicer problems had little effect on CLOs during the financial crisis (CLO Interest, April 2011).

Middle CLO Managers: Servicer Risk: History

-

80

We present the top 10 MM CLO managers, by count, according to Intex data. We also present deal summaries on the CLOs for these CLO managers. These deal summaries should help illustrate the difference in manager style,

and how some MM CLOs are actually blends of MM and BSL loans. We also note that not all structures are the same; some CLOs may actually

be bilateral lending facilities structured with CLO technology.

Middle CLO Managers: Overview

Manager Deal #Issued ($ mm)

Outstanding ($ mm)

Golub Capital Incorporated 8 3,415 3,137Ivy Asset Management Corp. 7 2,689 1,531NewStar 6 2,584 2,064GSC Partners 6 2,512 529Denali Capital LLC 5 2,537 1,118Fortress Investment Corp 4 2,223 2,070NXT Capital Investment Advisers 3 1,023 1,023MCF Capital Management 3 938 938Cerberus 3 1,597 916GSO/Blackstone Debt Funds Management 3 1,392 575

Source: Intex, Wells Fargo Securities

As of 7/23/2014

Some managers may have more CLOs outstanding, but we only include those CLOs in Intex with recent updates. For example, Fortress has more CLOs than listed, but they are not in Intex.

-

81

These deal summaries should help illustrate the difference in manager style, and how some MM CLOs are actually blends of MM and BSL loans.

For example, Denali Capital CLOs have a smaller allocation to MM loans than true originator MM CLOs, and therefore have higher diversity scores.

Platforms have different strategies, which makes comparing certain metrics in some MM CLOs less worthwhile, due to the collateral differences.

For example, Cerberus deals are less levered, and have higher WARFs but

much higher asset WACs, than traditional MM issuers such as NewStar.

This is because the Cerberus platform is pursuing a different strategy than more traditional MM lenders such as NewStar.

We also note that not all structures are the same; some CLOs may actually

be bilateral lending facilities structured with CLO technology.

Middle CLO Managers: Overview

-

82

Middle CLO Managers: Golub Capital

CLO Deal Name Manager FactorOrig Bal ($ mm)

Curr Bal ($

mm)

Collat. Bal ($

mm)Issue Date

Orig WARF

Stated WARF

Wt. Avg. Liab.

Spread (bps)

Asset WAC

Asset WAS

(bps)

GOLUB INTERNATIONAL LOAN I Golub Capital Incorporated 73% 500.0 366.4 415.0 Mar-06 - 3,503 50 7.64 614

GOLUB CAPITAL PARTNERS FUNDING 2007-1 Golub Capital Incorporated 64% 400.0 255.7 285.8 Mar-07 2,948 3,679 42 7.33

GOLUB CAPITAL BDC 2010-1 Golub Capital Incorporated 100% 350.0 350.0 358.1 Jul-10 3,232 3,663 178 7.49 700

GOLUB CAPITAL PARTNERS CLO 12 Golub Capital Incorporated 100% 250.6 250.6 253.7 Jan-12 3,125 3,658 259 6.89 661

GOLUB CAPITAL PARTNERS CLO 16 Golub Capital Incorporated 100% 502.5 502.5 502.1 Aug-13 3,686 3,515 193 6.95 661

GOLUB CAPITAL PARTNERS CLO 17 Golub Capital Incorporated 100% 556.2 556.2 553.1 Nov-13 - 3,311 224 5.99 577

GOLUB CAPITAL PARTNERS CLO 18(M) Golub Capital Incorporated 100% 453.1 453.1 Mar-14 - - 223 6.73

GOLUB CAPITAL BDC CLO 2014 Golub Capital Incorporated 100% 402.6 402.6 Jun-14 - 3,500 205 6.88

Total 3,415 3,137 2,368Data on recent deals may be missing as collateral fields are updatedSource: Intex, Wells Fargo SecuritiesAs of 7/23/2014

CLO Deal Name Manager IssuedReinv.

End

Asset WAC % Cushion

Trigger Cushion

Trigger Cushion

Trigger

Div. Score

Div. Score

Trigger

GOLUB INTERNATIONAL LOAN I Golub Capital Incorporated Mar-06 Aug-13 7.64 24.0 125.9 24.0 125.9 18.7 131.2 28.0 37.0

GOLUB CAPITAL PARTNERS FUNDING 2007-1 Golub Capital Incorporated Mar-07 Mar-13 7.33 0.0 0.0 0.0 0.0 0.0 0.0 28.9 37.0

GOLUB CAPITAL BDC 2010-1 Golub Capital Incorporated Jul-10 Jul-15 7.49 6.0 158.0 6.0 158.0 3.5 160.5 37.0 34.0

GOLUB CAPITAL PARTNERS CLO 12 Golub Capital Incorporated Jan-12 Mar-15 6.89 11.4 144.8 6.2 133.5 6.2 133.5 34.0 30.0

GOLUB CAPITAL PARTNERS CLO 16 Golub Capital Incorporated Aug-13 Jul-16 6.95 9.6 144.8 5.6 130.1 5.6 130.1 44.0 43.0

GOLUB CAPITAL PARTNERS CLO 17 Golub Capital Incorporated Nov-13 Oct-17 5.99 10.8 142.8 5.8 121.4 5.8 121.4 48.0 46.0

GOLUB CAPITAL PARTNERS CLO 18(M) Golub Capital Incorporated Mar-14 Apr-18 6.73 9.0 156.0 6.0 128.4 6.0 128.4 0.0 0.0

GOLUB CAPITAL BDC CLO 2014 Golub Capital Incorporated Jun-14 Apr-18 6.88 9.0 153.6 5.0 136.1 5.0 136.1 35.0 32.0

Note: Min Test is OC Test lowest in the Capital Structure, and includes Interest Diversion TestsSource: Intex, Wells Fargo SecuritiesAs of 7/23/2014

SR OC Test Min OC Test Min Test

-

83

Middle CLO Managers: Ivy Hill

CLO Deal Name Manager FactorOrig Bal ($ mm)

Curr Bal ($

mm)

Collat. Bal ($

mm)Issue Date

Orig WARF

Stated WARF

Wt. Avg. Liab.

Spread (bps)

Asset WAC

Asset WAS

(bps)

EMPORIA PREFERRED FUNDING I Ivy Asset Management Corp. 10% 426.0 42.4 8.3 Oct-05 2,900 3,490 6.70 475

COLTS 2005-2 LTD Ivy Asset Management Corp. 16% 407.0 67.0 11.9 Jan-06 - - 6.41

EMPORIA PREFERRED FUNDING II LTD Ivy Asset Management Corp. 33% 365.9 122.2 98.9 Jun-06 2,883 2,676 175 5.56 420

EMPORIA PREFERRED FUNDING III Ivy Asset Management Corp. 70% 414.8 289.0 269.4 Mar-07 3,012 2,958 73 5.36 399

IVY HILL MIDDLE MARKET CREDIT FUND III Ivy Asset Management Corp. 100% 315.0 315.0 316.6 Dec-11 3,043 3,254 306 5.82 559

IVY HILL MIDDLE MARKET CREDIT FUND IV Ivy Asset Management Corp. 84% 400.0 336.0 341.4 Jul-12 2,988 3,286 210 5.69 544

IVY HILL MIDDLE MARKET CREDIT FUND VII Ivy Asset Management Corp. 100% 359.8 359.8 Oct-13 3,264 3,237 241 5.72

Total 2,689 1,531 1,047Data on recent deals may be missing as collateral fields are updatedSource: Intex, Wells Fargo SecuritiesAs of 7/23/2014

CLO Deal Name Manager IssuedReinv.

End

Asset WAC % Cushion

Trigger Cushion

Trigger Cushion

Trigger

Div. Score

Div. Score

Trigger

EMPORIA PREFERRED FUNDING I Ivy Asset Management Corp. Oct-05 Oct-11 6.70 0.0 0.0 0.0 0.0 0.0 0.0 1.0 40.0

COLTS 2005-2 LTD Ivy Asset Management Corp. Jan-06 Feb-09 6.41 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

EMPORIA PREFERRED FUNDING II LTD Ivy Asset Management Corp. Jun-06 Jul-12 5.56 129.3 118.2 7.9 101.7 5.9 103.7 19.0 40.0

EMPORIA PREFERRED FUNDING III Ivy Asset Management Corp. Mar-07 Apr-13 5.36 39.7 112.4 4.2 101.4 1.7 103.9 40.0 45.0

IVY HILL MIDDLE MARKET CREDIT FUND III Ivy Asset Management Corp. Dec-11 Mar-15 5.82 11.9 159.6 6.4 114.1 6.4 114.1 51.0 46.0

IVY HILL MIDDLE MARKET CREDIT FUND IV Ivy Asset Management Corp. Jul-12 Jul-15 5.69 8.3 125.8 8.3 125.8 8.3 125.8 55.0 50.0

IVY HILL MIDDLE MARKET CREDIT FUND VII Ivy Asset Management Corp. Oct-13 Oct-17 5.72 10.1 135.1 5.1 108.3 3.6 109.8 53.0 43.0

Note: Min Test is OC Test lowest in the Capital Structure, and includes Interest Diversion TestsSource: Intex, Wells Fargo SecuritiesAs of 7/23/2014

SR OC Test Min OC Test Min Test

-

84

Middle CLO Managers: NewStar

CLO Deal Name Manager FactorOrig Bal ($ mm)

Curr Bal ($

mm)

Collat. Bal ($

mm)Issue Date

Orig WARF

Stated WARF

Wt. Avg. Liab.

Spread (bps)

Asset WAC

Asset WAS

(bps)

NEWSTAR COMMERCIAL LOAN TRUST 2006-1 NewStar 37% 500.0 183.8 181.1 Jun-06 - 3,695 73 5.53 616

NEWSTAR COMMERCIAL LOAN TRUST 2007-1 NewStar 72% 600.0 431.2 438.1 Jun-07 - - 77 4.91 577

NEWSTAR COMMERCIAL LOAN FUNDING 2012-2 NewStar 100% 325.9 325.9 325.9 Dec-12 3,044 3,221 312 5.72 543

NEWSTAR COMMERCIAL LOAN FUNDING 2013-1 NewStar 91% 400.0 365.0 368.7 Sep-13 - 3,286 247 5.64 539

NEWSTAR COMMERCIAL LOAN FUNDING 2014-1 NewStar 100% 348.4 348.4 Apr-14 - 3,000 272 5.71

NEWSTAR ARLINGTON SENIOR LOAN PROGRAM NewStar 100% 409.4 409.4 Jun-14 - 2,950 256 5.95

Total 2,584 2,064 1,314Data on recent deals may be missing as collateral fields are updatedSource: Intex, Wells Fargo SecuritiesAs of 7/23/2014

CLO Deal Name Manager IssuedReinv.

End

Asset WAC % Cushion

Trigger Cushion

Trigger Cushion

Trigger

Div. Score

Div. Score

Trigger

NEWSTAR COMMERCIAL LOAN TRUST 2006-1 NewStar Jun-06 Jun-11 5.53 0.0 0.0 0.0 0.0 0.0 0.0 28.1 32.0

NEWSTAR COMMERCIAL LOAN TRUST 2007-1 NewStar Jun-07 May-13 4.91 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

NEWSTAR COMMERCIAL LOAN FUNDING 2012-2 NewStar Dec-12 Jan-16 5.72 9.4 141.0 3.4 113.2 3.4 113.2 39.0 30.0

NEWSTAR COMMERCIAL LOAN FUNDING 2013-1 NewStar Sep-13 Sep-16 5.64 21.6 131.7 6.3 108.6 6.3 108.6 41.0 30.0

NEWSTAR COMMERCIAL LOAN FUNDING 2014-1 NewStar Apr-14 Apr-18 5.71 9.0 139.5 3.0 110.6 3.0 110.6 33.0 30.0

NEWSTAR ARLINGTON SENIOR LOAN PROGRAM NewStar Jun-14 Jul-18 5.95 9.0 138.5 3.0 108.2 3.0 108.2 40.0 38.0

Note: Min Test is OC Test lowest in the Capital Structure, and includes Interest Diversion TestsSource: Intex, Wells Fargo SecuritiesAs of 7/23/2014

SR OC Test Min OC Test Min Test

-

85

Middle CLO Managers: GSC Partners

CLO Deal Name Manager FactorOrig Bal ($ mm)

Curr Bal ($

mm)

Collat. Bal ($

mm)Issue Date

Orig WARF

Stated WARF

Wt. Avg. Liab.

Spread (bps)

Asset WAC

Asset WAS

(bps)

GSC PARTNERS CDO FUND IV GSC Partners 23% 440.0 100.0 26.2 Dec-03 2,741 7,143 7.41 700

GSC PARTNERS CDO FUND V GSC Partners 14% 600.0 81.0 44.1 Dec-04 2,863 5,624 5.63 421

GSC PARTNERS CDO FUND VI GSC Partners 10% 400.0 41.0 7.7 Oct-05 2,988 - 9.56

GSC CAPITAL CORP. LOAN FUNDING 2005-1 GSC Partners 8% 300.0 24.0 4.1 Jan-06 3,008 10,000 9.35 850

GSC PARTNERS CDO FUND VII GSC Partners 29% 413.1 121.1 103.9 May-06 3,111 3,489 241 5.46 441

GSC GROUP CDO FUND VIII GSC Partners 45% 359.4 161.8 150.7 Mar-07 2,531 3,001 71 5.27 497

Total 2,512 529 337Data on recent deals may be missing as collateral fields are updatedSource: Intex, Wells Fargo SecuritiesAs of 7/23/2014

CLO Deal Name Manager IssuedReinv.

End

Asset WAC % Cushion

Trigger Cushion

Trigger Cushion

Trigger

Div. Score

Div. Score

Trigger

GSC PARTNERS CDO FUND IV GSC Partners Dec-03 Jan-09 7.41 0.0 0.0 0.0 0.0 0.0 0.0 4.0 42.0

GSC PARTNERS CDO FUND V GSC Partners Dec-04 May-10 5.63 0.0 0.0 0.0 0.0 0.0 0.0 4.0 60.0

GSC PARTNERS CDO FUND VI GSC Partners Oct-05 Oct-11 9.56 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

GSC CAPITAL CORP. LOAN FUNDING 2005-1 GSC Partners Jan-06 Feb-12 9.35 0.0 0.0 0.0 0.0 0.0 0.0 1.0 45.0

GSC PARTNERS CDO FUND VII GSC Partners May-06 May-12 5.46 1408.3 123.0 12.2 104.8 12.2 104.8 13.0 48.0

GSC GROUP CDO FUND VIII GSC Partners Mar-07 Apr-14 5.27 28.8 113.2 5.7 101.2 4.7 102.2 30.0 52.0

Note: Min Test is OC Test lowest in the Capital Structure, and includes Interest Diversion TestsSource: Intex, Wells Fargo SecuritiesAs of 7/23/2014

SR OC Test Min OC Test Min Test

-

86

Middle CLO Managers: Denali Capital

CLO Deal Name Manager FactorOrig Bal ($ mm)

Curr Bal ($

mm)

Collat. Bal ($

mm)Issue Date

Orig WARF

Stated WARF

Wt. Avg. Liab.

Spread (bps)

Asset WAC

Asset WAS

(bps)

DENALI CAPITAL CLO IV Denali Capital LLC 3% 400.0 13.8 3.0 Aug-04 2,424 3,403 0 9.60 448

DENALI CAPITAL CLO V Denali Capital LLC 18% 410.0 73.1 56.6 Sep-05 2,525 2,660 167 4.80 356

DENALI CAPITAL CLO VI Denali Capital LLC 23% 500.9 115.6 88.5 Mar-06 2,431 2,688 154 4.98 366

DENALI CAPITAL CLO VII Denali Capital LLC 100% 812.9 812.9 787.6 May-07 2,453 2,674 42 4.56 356

SPRING ROAD CLO 2007-1 Denali Capital LLC 25% 413.3 103.0 87.4 Jul-07 3,130 2,997 255 5.05 381