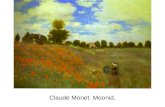

Claude Monet The greatest impressionist. Oscar Claude Monet Oscar Claude Monet.

Claude R Lambe Charitable Foundation 480935563 2009 06890C37

-

Upload

michael-fisher -

Category

Documents

-

view

217 -

download

0

description

Transcript of Claude R Lambe Charitable Foundation 480935563 2009 06890C37

if ·,.

EXTENSION GRANTED Return of Private Foundation

or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation

OMB No 1545-0052

Oeparbnent of the Treasury Internal Revenue Service Note: The foundation ma be able to use a co of this return to satis state re ortin re uirements ~@09 For calendar vear 2009, or tax year beginning , 2009, and ending , 20

G Check all that apply H Initial return

Amended return

LJ Initial return of a former public charity LJ Final return n Address chanoe n Name change

Use the IRS label.

Otherwise, print

or type. See Specific Instructions

Name of foundation

CLAUDE R. LAMBE CHARITABLE FOUNDATION

Number and street (or P O box number~ mall is not delivered to street address) Room/suite

P.O. BOX 2256

City or town, state, and ZIP code

WICHITA, KS 67201-2256

H Check type of organization [JU Section 501(c).@Lexempt private foundation n Section 4947(a)(1) nonexempt chantable trust I I Other taxable private foundation

A Employer 1dent1flcatlon number

48-0935563 B Telephone number (see page 10 or the 1nstructJOns)

(316) 828-5552 C If exemption application 1s

pending, check here • • • • • •

D 1 Foreign orgamzatlons, check here

2 Foreign organizations meeting the 85% test, check here and attach computation • • • • • • • •

E If pnvate foundation status was terminated o I Fair market value of all assets at end J Accounting method LJ Cash lJ9 Accrual under secbon S07(b)(1)(A). check here • ....

of year (from Part II, col (c), /me O Other (specify) _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ __ __ _ F 16) .... $ 7 , 3 4 9, O O O . (Part I, column (d) must be on cash basis)

•::r.•·•• Analysis of Revenue and Expenses (The total of amounts m columns (b). (c). and (d) may not necessanly equal the amounts m column (a) (see page 11 of the mstruct,ons))

ConblbutJon~, grants etc , received (attach schedule) •

(a) Revenue and expenses per

books

(b) Net investment income

If the foundation IS In a 60-month term1natJon n under secbon 507(b)(1)(8) check here • ....

(c) AdJusted net income

(d) Disbursements for chantable

purposes (cash basis onlvl

1

2 Ch k .... ~ d the foundation 1s not required to ec attach Sch B •••••••••• 1---------+---------+---------+---------

3 Interest on savings and temporary cash investments

4 D1v1dends and interest from securities

5 a Gross rents • • • • . • • • • . . • • . • .

81,536. 81,536.

32,478. 32,478.

b Net rental income or (loss) -------- >---------->----------+----------+---------(U) a, 6 a Net gain or (loss) from sale of assets not on line 10 -19,155.

S? ~ z a, z a:

b Gross sales pnce for all 1 2 O 6 O 7 2 . assets on line 6a ' ' >----------+----------+----------+---------

7 Capttal gain net income (from Part IV, hne 2)

m 0 :z C> < ~

~

F'.:I C> -~

8 Netshort ermca~l~EIVED" .• ·j 9 Income n od1fi.alld~ · · · · · · · · · · · • >----------+----------+----------+---------

1 O a Gross sale lesi returns I I (.) I and allowa ces · · · · · >-------....,'-""""""-+----------+----------+----------+----------

b Less Cos1 oi! >dsM@V. l-1-Q_,7,,,..n.,...I 1n..,.,__,!~d,....l ______ --+-------+--------+-------

c Gross pr< fit on (loss) (attach s~hed~I~) • j~ ! 1---------+---------+---------+---------

11 Other 1n«jme aT)~'t·'j~~ · u:r-~ -:' I l---------+--------+--------------12 Total.AdiiJtDec 'H- , ... _. I 94,859. 114,014.

13 Compensation of officers, directors, trustees, etc

14 Other employee salaries and wages

:C 15 Pension plans, employee benefits . • . • 1/)

5; 16 a Legal fees (attach schedule) • • . . . . •

~ b Accounting fees (attach schedule) ':T~~ .1.

w c Other professional fees (attach schedule) . *. ~ ;; 17

22,320. 3,525. 0. 16,150.

15,982. 15,982.

Interest .................• ~ 18 1/) Taxes (attach schedule) (see page 14 of the instructions{ *,__ ______ 9_4_5-+----------+----------+---------"i: 19

! 20 < "'O 21

i 22

g1 23

i 24 .. QI Q.

O 25

Depreaation (attach schedule) and depletion

Occupancy ••••••••••.

Travel, conferences, and meetings ••••

Pnnbng and publications . • . . . . . .

Other expenses (attach schedule) lfJ;C.H. 1 Total operating and administrative expenses .

1,778. 1,339

Add Imes 13 through 23 •.•.•...•• _____ 4_1_,_0_2_5_.+-____ 1_9_,_5_0_7--t. ________ 0_. _____ 1_7"-, _4_8_9

Contnbutions, gifts, grants paid 2,819,461. 2,713,796. .....•• 1---------+---------+---------+-----'------"--26 Total e•-nses and disbursements Add Imes 24 and 25 2,860,486. 19,507. 0. 2,731,285.

27 Subtract hne 26 from hne 12

a Excess of revenue over expenses and disbursements • • 1-----2~,_7_6_5~,_6_2_7_.+---------+---------+---------b Net investment income (1f negative, enter -0-)

c Adiusted net income (1f neoat1ve, enter -0-) ..

94,507.

-0-Form 990-PF (2009) For Privacy Act and Paperwork Reduction Act Notice, see page 30 of the instructions. * ATCH 2 JSA * * ATCH 3

9E

14102000 29145H K932 11/12/2010 4: 28: 45 PM V 09-8. 5 85651

7

Form 990-PF (2009) 48-0935563 Page2

1111111 Bala~ce Sheets Attached schedules and amounts in the Beginning of year End of year descnpt1on column should be for end-of-year amounts only (See instructions ) (a) Book Value (b) Book Value (c) Fair Market Value

1 Cash - non-1nterest-beanng • .. 2 Savings and temporary cash investments 7,337,267. 4,509,294. 4,509,294

3 Accounts receivable ~ 168. ------------------------Less allowance for doubtful accounts ~ 0. 168. 168 -------------

4 Pledges receivable ~ ------------------------Less allowance for doubtful accounts ~ -------------

5 Grants receivable .. . . . . 6 Receivables due from officers, directors, trustees, and other

disqualified persons (attach schedule) (see page 16 of the instructions)

7 Other notes and loans receivable (attach schedule) ~ - - - - -Less allowance for doubtful accounts ~ -------------

Ill 8 lnventones for sale or use .. -(I) 9 Prepaid expenses and deferred charges • • 9 I 021. 9,378. 9,378 Ill .. Ill

10 a c:( Investments - U S and state government obligations (attach schedule)

b Investments - corporate stock (attach schedule)

c Investments - corporate bonds (attach schedule) • • .. 11 Investments - land, buildings, ~ and equipment basis ------------------

Less accumulated deprec1at1on ~ (attach schedule) -------------------12 Investments - mortgage loans . . . . .. 13 Investments - other (attach schedule) z-rrc;:I:I ~ .. 2,623,804. 2,663,574. 2,830,160 14 Land, bu1ld1ngs, and ~ equipment basis ------------------Less accumulated deprec1at1on ~

(attach schedule) ---------- _ - -- ___ ---15 Other assets (describe ~ --------------------) 16 Total assets (to be completed by all filers - see the

instructions Also, see page 1, item I) 9,970,092. 7,182,414. 7,349,000

17 Accounts payable and accrued expenses 28,146. 6,095.

18 Grants payable .. . . . . Ill 19 Deferred revenue (I) .. ~ 20 Loans from officers, directors, trustees, and other disqualified persons

:g 21 Mortgages and other notes payable (attach schedule) .. ::i 22 Other hab1ht1es ( descnbe ~ ___________________ )

23 Total liabilities (add Imes 17 through 22) .. 28,146. 6,095.

Foundations that follow SFAS 117, check here ~w and complete lines 24 through 26 and lines 30 and 31.

:l 24 Unrestricted • 9,941,946. 7,176,319. u l; 25 Temporanly restricted .. iii 26 m Permanently restncted -.. 'ti Foundations that do not follow SFAS 117, c: ~o ::::, check here and complete lines 27 through 31. u.. .. 27 Capital stock, trust prinapal, or current funds 0

J!! 28 Paid-in or caprtal surplus, or land, bldg , and equipment fund (I)

::l 29 Retained earnings, accumulated income, endowment, or other funds

~ 30 Total net assets or fund balances (see page 17 of the (I) 9,941,946. 7,176,319. z instructions) .. . . . . . .

31 Total liabilities and net assets/fund balances (see page 17

of the instructions) .. . . . . 9,970,092. 7,182,414. •• F.T-•11• Analysis of ChanQes in Net Assets or Fund Balances 1 Total net assets or fund balances at begmnmg of year - Part II, column (a), hne 30 (must agree with

end-of-year figure reported on pnor year's return) 1 9,941,946

2 Enter amount from Part I, hne 27a 2 -2,765,627 .. 3 Other increases not included m hne 2 (1tem1ze) ~ ------------------------------------ 3

4 Add Imes 1, 2, and 3 4 7,176,319 . . .. . . . . . . . . . . . . . . 5 Decreases not included m hne 2 (1tem1ze) ~ 5 6 Total net assets or fund balances at end of vear (hne 4 minus hne 5l - Part II, column (bl, hne 30 .. 6 7,176,319

Form 990-PF (2009)

JSA

9E14201 000

29145H K932 11/12/2010 4: 28: 45 PM V 09-8.5 85651

. ' ..

Form 99Q>.PF (2009)' 48-0935563 Page 3

·~lil·U- Capital Gains and Losses for Tax on Investment Income (a) List and describe the kmd(s) of property sold (e g , real estate,

(D)How (c) Date {id) Date sold acquired acquired 2-story brick warehouse, or common stock, 200 shs MLC Co ) P-Purchase (mo, day, yr) mo, day, yr)

D-DonatJon

1a SEE PART IV SCHEDULE

b

c d

e

(e) Gross sales price (f) Depreciation allowed (g) Cost or other basis (h) Gain or (loss) (or allowable) plus expense of sale (e) plus (f) minus (g)

a

b

c d

e Complete only for assets showmq qam m column (h) and owned by the foundation on 12/31/69 (I) Gains (Col (h) gain minus

(1) FM V as of 12/31/69 (J) AdJusted basis (k) Excess of col (1) col (k), but not less than -0-) or as of 12/31169 over col (J), 1f any

a

b

c d

e

2 Capital gam net income or (net capital loss) { If gam, also enter m Part I, hne 7

} ..... If (loss), enter -0- m Part I, hne 7 2

3 Net short-term capital gam or (loss) as defined 1n sections 1222(5) and (6)

If gam, also enter m Part I, hne 8, column (c) (see pages 13 and 17 of the instructions) } If (loss), enter -0- m Part I, hne 8 ........................••••• .... 3 ·~-Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income

(For optional use by domestic private foundations sub1ect to the section 4940(a) tax on net investment income )

If section 4940(d)(2) apphes, leave this part blank

Was the foundation hable for the section 4942 tax on the distributable amount of any year m the base period?

If ''Yes," the foundation does not quahfy under section 4940(e) Do not complete this part

Losses (from col (h))

-19,155.

O Yes[]] No

1 Enter the appropriate amount m each column for each year, see page 18 of the instructions before making any entries (a) (b) (c) (d)

Base penod years D1stnbut1on ratio Calendar year (or tax year beginning 1n) AdJusted qualifying d1stnbut1ons Net value of nonchantable-use assets (col (b) d1v1ded by col (c))

2008 2,456,244. 11,492,427. 0.213727

2007 4,085,883. 15,540,497. 0.262918

2006 4,231,735. 17,229,773. 0.245606

2005 3, 796, 938. 19,799,454. 0.191770

2004 3, 110, 086. 21,925,067. 0.141851

2 Total of hne 1, column (d) ................................... . . 2 1.055872

3 Average d1stribut1on ratio for the 5-year base period - d1v1de the total on hne 2 by 5, or by the

number of years the foundation has been m existence 1f less than 5 years . . . . . . . . . .. 3 0.211174

4 Enter the net value of noncharitable-use assets for 2009 from Part X, hne 5 4 8,782,857. ..........

5 Multiply hne 4 by hne 3 5 1,854,711. . . . . . . . . . . . . . . . . . . ....................

6 Enter 1 % of net investment income (1 % of Part I, hne 27b) 6 945. ....................

7 Add Imes 5 and 6 7 1,855,656. . . . . . . . . . . . . . . . . . .........................

8 Enter quahfymg d1stnbut1ons from Part XII, hne 4 ......................... 8 2,731,285. If hne 8 1s equal to or greater than hne 7, check the box m Part VI, hne 1b, and complete that part using a 1% tax rate See the Part VI instructions on page 18

JSA 9E14301000

29145H K932 11/12/2010 4: 28: 45 PM V 09-8.5

Form 990-PF (2009)

85651

·I .,

Fann 990-PF (2009) 48-0935563 Page4

•::r.1·•••• Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948 - see page 18 of the instructions)

Date of ruhng or detennmat1on letter ____________ (attach copy of ruling letter If necessary - see Instructions)

1a Exempt operating foundations descnbed 1n section 4940(d)(2), check here .... LJ and enter "NIA" on hne 1 •.• }

b Domestic foundations that meet the section 4940(e) requirements 1n Part V, check 1--1 __________ 9_4_5_.

here .,.. IZJ and enter 1 % of Part I, line 27b • . . . . . . . . . . . . . . . . . . . . • • . . . . .

2

3

4

5

s

7

8

c All other domestic foundations enter 2% of line 27b Exempt foreign organizations enter 4% of Part I, line 12, col (b)

Tax under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only Others enter -0-)

Add lines 1 and 2

Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only Others enter -0-)

Tax based on investment income Subtract line 4 from line 3 If zero or less, enter -O

Cred1tsfPayments

a 2009 estimated tax payments and 2008 overpayment credited to 2009 Sa 9, 021.

b Exempt foreign organizations-tax withheld at source • • • . • • Sb 0.

c Tax paid with application for extension of time to file (Form 8868) Sc 0.

d Backup w1thhold1ng erroneously withheld Sd

Total credits and payments Add lines 6a through 6d

Enter any penalty for underpayment of estimated tax Check here

2

3 945.

4 0.

5 945.

7 9,021.

8

9 Tax due. If the total of Imes 5 and 8 1s more than hne 7, enter amount owed . . . . . . • • . • .,_l--'9"--+-----------

10 Overpayment If line 7 1s more than the total of lines 5 and 8, enter the amount overpaid .,_f--'1.,.0-+-------8-',_0_7_6_. 11 Entertheamountofhne10tobe Creditedto2010estimatedtax .,.. 8,076. Refunded.,.. 11

•O:..:•·-·•• ... ·- Statements Rec:1ardinc:1 Activities 1a Dunng the tax year, did the foundation attempt to influence any national, state, or local leg1slat1on or did 11 Yes No

1a x participate or intervene 1n any political campaign? . . . . . . . . . . . . . . • • • • • • • . • . . • • • . . . . . . . . . 1--'-+----i--

b Did 1t spend more than $100 during the year (either directly or 1nd1rectly) for political purposes (see page 19

1b x of the instructions for definition)? . . . . . . . ...................................... -------If the answer is "Yes" to fa or 1b, attach a detailed descnpt1on of the act1v1t1es and copies of any matenals

pubflshed or d1stnbuted by the foundation m connection with the act1v11tes

c Did the foundation file Form 1120-POL for this year? .•...........•.•••

d Enter the amount (1f any) of tax on political expenditures (section 4955) imposed dunng the year

(1) On the foundation .,.. $ (2) On foundation managers .... $ __________ _

e Enter the reimbursement (1f any) paid by the foundation during the year for poht1cal expenditure tax imposed

on foundation managers .,.. $ ___________ _

2 Has the foundation engaged m any act1v1t1es that have not previously been reported to the IRS? . . . . . • . . . •

If "Yes," attach a detailed descnplton of the act1v1t1es

3 Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles of

1c x

2 x

1ncorporat1on, or bylaws, or other s1m1lar instruments? If "Yes," attach a conformed copy of the changes . • . . . . . •

4a Did the foundation have unrelated business gross income of $1,000 or more during the year?

3 X . . . . . -~-----4a x

b lf"Yes," has 11 filed a tax return on Form 990-T for this year? ....•.••.•..•• 4b

5 Was there a hqu1dat1on, termination, d1ssolut1on, or substantial contraction during the year? 5 x If "Yes,• attach the statement reqwred by General Instruction T

S Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either

• By language in the governing instrument, or

• By state legislation that effectively amends the governing instrument so that no mandatory directions that

confhct with the state law remain in the governing instrument? • • • • . • . s x 7 Did the foundation have at least $5,000 in assets at any time during the year? If "Yes,• complete Part II, col (c), and Part XV 7 x Sa Enter the states to which the foundation reports or with which 11 1s registered (see page 19 of the

instructions) .,.. KS, VA, ______________________ ---------------------- ________________ _

b If the answer 1s "Yes" to line 7, has the foundation furnished a copy of Form 990-PF to the Attorney General

(or designate) of each state as required by Generallnstruclton G?lf "No,· attach explanation • • . . .......•••••• t-=S=b-+_X_-+---

9 ls the foundation claiming status as a private operating foundation w1th1n the meaning of section 4942~)(3) or

49420)(5) for calendar year 2009 or the taxable year beginning in 2009 (see instructions for Part XIV on page

27)? If "Yes, "complete Part XIV. . . • . . • • • . . . . • . . . . . . . . . . • • • • • . • . ......•. . . 1---"9--+---+-x_ 10 Did any persons become substantial contributors dunng the tax year? If "Yes," attach a schedule hstmg their

names and addresses. • . . . . • • . • . . • • • • . • • • . • • . . . . . . . • • • . • . • • . . . . . . . . . • • . . • 10 x Fann 990-PF (2009)

JSA 9E1440 1000

2 9145H K932 11/12 /2 010 4: 28: 45 PM V 09-8.5 85651

48-0935563

Statements Re

11 At any time during the year, did the foundation, directly or 1nd1rectly, own a controlled entity w1th1n the

meaning of section 512(b)(13)? If "Yes," attach schedule (see page 20 of the instructions)

12 Did the foundation acquire a direct or indirect interest in any applicable insurance contract before

August 17, 2008? ••••••••••••.••••••••••••••••••.••••••

Page5

11 x

12 x

13 Did the foundation comply with the public inspection requirements for its annual returns and exemption applicatlon? 13 X

Website address ~ ____ NI A ____________________________________________________________________ _

14 The books are in care of ~ VONDA HOLLIMAN --------------------- Telephone no ~ _____ ( 316) 82 8-5552 ____ _ Located at ~jlll_E._37TH_STREET NORTH WICHITA, KS _________________ ZIP+ 4 ~ 67220 ________ _

15 Section 4947(a)(1) nonexempt charitable trusts filing Form 990-PF in lieu of Form 1041 - Check here •••••••••••••••.•• ~ LJ and enter the amount of tax-exempt interest received or accrued during the year • • • • • . . • • • • • • • • • • • ~ I 1 s I

: Statements Regarding Activities for Which Form 4720 May Be Required

File Form 4720 if any item is checked in the "Yes" column, unless an exception applies.

1a Dunng the year did the foundation (either directly or indirectly)

(1) Engage in the sale or exchange, or leasing of property with a disqualified person?

(2) Borrow money from, lend money to, or otherwise extend credit to (or accept 1t from) a

disqualified person? • • • • • • • • • • • • • • • . • • • • • • • • • • • • • •

(3) Furnish goods, services, or faalit1es to (or accept them from) a disqualified person?

(4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person?

.......

(5) Transfer any income or assets to a disqualified person (or make any of either available for

the benefit or use of a disqualified person)? • • • • • • • • • • • . • • . . . • • • • • •

(6) Agree to pay money or property to a government official? ( Exception. Check "No" 1f

0Yes

~y~ Yes

Yes

0Yes

the foundation agreed to make a grant to or to employ the official for a penod after D termination of government service, 1f term1nat1ng within 90 days) • • • • • • • • • • • • • • • . Yes

b If any answer 1s "Yes" to 1 a(1)-(6), did any of the acts fail to qualify under the exceptions described in Regulations

section 53 4941 (d)-3 or in a current notice regarding disaster assistance (see page 20 of the instructions)?

Organizations relying on a current notice regarding disaster assistance check here • • • • • • • • . • . •

c Did the foundation engage in a pnor year 1n any of the acts described 1n 1 a, other than excepted acts, that

were not corrected before the first day of the tax year beginning 1n 2009?

2 Taxes on failure to d1stnbute income (section 4942) (does not apply for years the foundation was a pnvate

operating foundation defined in section 4942())(3) or 4942(])(5))

[RI No

~No No

No

a At the end of tax year 2009, did the foundation have any undistributed income (lines 6d and

6e, Part XIII) for tax year(s) beginning before 2009? • • . • • • • • • • • • • • • • • • • • • • • • • D Yes CRJ No If "Yes," list the years ~ _ _ _ _ _ _ _ _ _ _ , _ _ _ _ _ _ _ _ _ , _ _ _ _ _ _ _ _ , _______ _

b Are there any years listed in 2a for which the foundation 1s not applying the prov1s1ons of section 4942(a)(2)

(relating to incorrect valuation of assets) to the year's und1str1buted income? (If applying section 4942(a)(2)

to all years listed, answer "No" and attach statement - see page 20 of the 1nstruct1ons )

c If the provisions of section 4942(a)(2) are being applied to any of the years listed 1n 2a, list the years here

~---------- ·--------- ·-------- ·--------3a Did the foundation hold more than a 2% direct or indirect interest in any business

enterprise at any time dunng the year? • • • • • • • • • • • • • • . • . • . . • • • • • • • • • • • D Yes CRJ No

b If "Yes," did 1t have excess business holdings in 2009 as a result of (1) any purchase by the foundation or

disqualified persons after May 26, 1969, (2) the lapse of the 5-year period (or longer period approved by the

Comm1ss1oner under section 4943(c)(7)) to dispose of holdings acquired by gift or bequest, or (3) the lapse

of the 10-, 15-, or 20-year first phase holding period? (Use Schedule C, Form 4720, to determine tf the

foundalton had excess business holdings in 2009 ) • • • • • • • • • • • . • • . . . . . . . • • . • . • . .

4a Did the foundation invest during the year any amount in a manner that would Jeopardize its charitable purposes?

b Did the foundation make any investment in a pnor year (but after December 31, 1969) that could Jeopardize its chantable purpose that had not been removed from Jeopardy before the first day of the tax year beginning 1n 2009?

JSA

9E14501000

29145H K932 11/12/2010 4: 28: 45 PM V 09-8.5 85651

Yes No

1b x

1c x

2b

3b

4a x

4b x Fonn 990-PF (2009)

•/

Form 990-PF (2009) 4 8-09355 63 Statements Regarding Activities for Which Form 4720 May Be Required (continued)

5 a Dunng the year did the foundation pay or incur any amount to (1) Carry on propaganda, or otheiw1se ~ttempt to influence leg1slat1on (section 4945(e))?

(2) Influence the outcome of any specific public elec!lon (see section 4955), or to carry on,

directly or indirectly, any voter registration dnve? •••••••••••.••••••

(3) Provide a grant to an ind1v1dual for travel, study, or other similar purposes? •••••••

(4) Provide a grant to an organization other than a charitable, etc , organization described m

section 509(a)(1 ), (2), or (3), or section 4940(d)(2)? (see page 22 of the instructions)

(5) Provide for any purpose other than religious, charitable, scientific, literary, or educational

purposes, or for the prevention of cruelty to children or animals? • • • • • • • • • • • •

0Yes

0Yes

0Yes

~Yes

0Yes

b If any answer 1s "Yes" to 5a(1)-(5), did any of the transactions fail to qualify under the exceptions descnbed in

~No

~No

~No

0No

~No

Page6

Regulations section 53 4945 or 1n a current notice regarding disaster assistance (see page 22 of the instructions)? • • • • • • • 1-S_b_+---+--X-

..... ~D Organizations relying on a current notice regarding disaster assistance check here • • • •

c If the answer 1s "Yes" to question 5a(4), does the foundation claim exemption from the tax

because 1t ma1nta1ned expenditure respons1b11ity for the grant? •• l\:r:r l\~.Hf"l.EN.T .. 6. If "Yes," attach the statement required by Regulations section 53 4945-S(d)

6 a Did the foundation, dunng the year, receive any funds, directly or indirectly, to pay premiums

on a personal benefit contract? . . . • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • •

b Did the foundation, dunng the year, pay premiums, directly or indirectly, on a personal benefit contract?

If "Yes" to 6b, file Form 8870

7 a At any time during the tax year, was the foundation a party to a proh1b1ted tax shelter transaction?

~Yes 0No

0Yes ~No

6b

0Yes ~No

b If yes, did the foundation receive any proceeds or have any net income attributable to the transaction? • • • • • • • • 7b

Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees, and Contractors

List all officers, directors, trustees, foundation managers and their compensation (see page 22 of the instructions).

x

(b) Trtle, and average (c) Compensation (d) Contnbu~ons to (e) Expense account, (a) Name and address de~~~~~ror

0~:~i~n (If not P~'.~· enter an~m/.lri:.:'dbc':,n~:~~~;:on other allowances

SEE ATTACHMENT C -0- -0- -0-

2 Compensation of five highest-paid employees (other than those included on line 1 - see page 23 of the instructions). If none, enter "NONE."

(a) Name and address of each employee paid more than $50,000

NONE

Total number of other employees paid over $50,000

JSA

9E14601 000

29145H K932 11/12/2010 4:28:45 PM

(b) Trtle, and average hours per week

devoted to posrt1on

V 09-8.5

( c) Compensation

85651

(d) Contnbut1ons to employee benefrt plans and deferred

comDensat1on

( e) Expense account, other allowances

... -~I Form 990-PF (2009)

•/

Form990:PF(2009)0

48-0935563 Page 7

1iflfWI Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees, and Contractors (contmued)

3 Five highest-paid independent contractors for professional services (see page 23 of the instructions). If none, enter "NONE." (a) Name and address of each person paid more than $50,000 (b) Type of service (c) Compensation

NONE

.............................. I NONE

•iflitf,j Summary of Direct Charitable Activities

List the foundation's four largest direct chantable act1vrt1es during the tax year Include relevant stat1st1cal information such as the number of organizations and other beneficiaries served, conferences convened, research papers produced, etc

NONE

2

3

4

•':.lffi••-=• Summary of Program-Related Investments (see paqe 23 of the mstruct1ons) Descnbe the two largest progranwelated investments made by the foundation dunng the tax year on lines 1 and 2

NONE

2

All other program-related investments See page 24 of the instructions

3 NONE ---------------------------------------------------------------------------

Total. Add Imes 1 throuqh 3 ............................................... ..,

JSA

9E14651000

29145H K932 11/12/2010 4: 28: 45 PM V 09-8.5 85651

Expenses

Amount

Form 990-PF (2009)

•I

Form 990-PF (2b09) 4 8-09355 63

UIMQ Minimum Investment Return (All domestic foundations must complete this part Foreign foundations, see page 24 of the instructions )

2 3

Fair mark.et value of assets not used (or held for use) directly m carrying out charitable, etc,

purposes

a Average monthly fair mark.et value of securities ........... .

b Average of monthly cash balances . . . . . . . . . . . . . . . . . . . c Fair mark.et value of all other assets (see page 24 of the instructions)

d Total (add Imes 1a, b, and c) ..................... . e Reduction claimed for blockage or other factors reported on Imes 1a and

1c (attach detailed explanation) .................... . Acqu1s1t1on indebtedness applicable to line 1 assets Subtract lme 2 from line 1 d

1e

4 Cash deemed held for charitable activities Enter 1 1/2 % of line 3 (for greater amount, see page 25 of the 1nstruct1ons)

1a

1b 1c 1d

2 3

4

Page8

2,381,950.

6,534,656. 0.

8,916,606.

0. 8,916,606.

133,749.

5

6

Net value of noncharitable-use assets. Subtract lme 4 from lme 3 Enter here and on Part V, lme 4 5 8 , 7 8 2 , 8 5 7 . t--~t--~~~~~~~~~-

M in i mum investment return. Enter 5% of line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 4 3 9, 14 3 .

Distributable Amount (see page 25 of the instructions) (Section 4942(1)(3) and (J)(5) private operating foundations and certain foreign organizations check here ~ D and do not complete this part )

1 Minimum investment return from Part X, line 6 i 2~ i

. . . . .. 1 439,143.

2a Tax on investment income for 2009 from Part VI, line 5 945. .. b Income tax for 2009 (This does not include the tax from Part VI ) I 2b I c Add lines 2a and 2b 2c 945. . . ..

3 Distributable amount before ad1ustments Subtract line 2c from lme 1 .. 3 438,198.

4 Recoveries of amounts treated as qualifying d1stribut1ons .. . . 4

5 Add Imes 3 and 4 5 438,198. . . . . .. . . . . 6 Deduction from distributable amount (see page 25 of the instructions) . . .. 6 7 Distributable amount as adJusted Subtract line 6 from lme 5 Enter here and on Part XIII,

line 1 .. . . . . . . . . 7 438,198.

1:ifff:iil Qualifying Distributions(see page 25 of the instructions)

1 a b

2

3 a b

4

5

6

JSA

Amounts paid (mcludmg admm1strat1ve expenses) to accomplish charitable, etc , purposes Expenses, contributions, gifts. etc - total from Part I, column (d), line 26 1a .......... Program-related investments - total from Part IX-8 ...................... 1b Amounts paid to acquire assets used (or held for use) directly m carrying out charitable, etc, purposes 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ...... Amounts set aside for specific charitable proiects that satisfy the Su1tab11ity test (prior IRS approval required) 3a . . . . . . . . . . . ..................... Cash d1stribut1on test (attach the required schedule) 3b ........................ Qualifying distributions. Add Imes 1a through 3b Enter here and on Part V, line 8, and Part XIII, line 4 . . . ... 4

Foundations that qualify under section 4940(e) for the reduced rate of tax on net investment income Enter 1 % of Part I, lme 27b (see page 26 of the instructions) 5 Adjusted qualifying distributions. Subtract line 5 from lme 4 .................... 6

Note: The amount on lme 6 will be used m Part V, column (b}, m subsequent years when calculating whether the foundation qualifies for the section 4940(e) reduction of tax m those years

2,731,285. 0.

0.

0. 0.

2,731,285.

945. 2,730,340.

Form 990-PF (2009)

9E14701000

29145H K932 11/12/2010 4: 28: 45 PM V 09-8. 5 85651

Form 99Q..PF (2009) 48-0935563 Page 9 . Undistributed Income (see page 26 of the instructions)

(a) (b) (c) (d)

1 Distributable amount for 2009 from Part XI, Corpus Years pnor to 2008 2008 2009

line 7 ••.•••••.••••••.••••• 438,198.

2 Und1stnbuted income, If any, as of the end of 2009

a Enter amount for 2008 only .......... b Total for pnor years 20 -- ,20 __ ,20 __

3 Excess d1stnbut1ons carryover, 1f any, to 2009

a From 2004 2,020,055.

b From 2005 2,373,221.

c From 2006 3,384,774.

d From 2007 3,348,840.

e From 2008 1,896,993.

f Total of lines 3a through e . . ......... 13,023,883.

4 Qualifying d1stribut1ons for 2009 from Part XII,

line 4 ~ $ 2,731,285.

a Applied to 2008, but not more than line 2a ... b Applied to und1stnbuted income of pnor years (Election

required - see page 26 of the instructions) ...... c Treated as d1stribut1ons out of corpus (Election

required - see page 26 of the 1nstruct1ons) .

d Applied to 2009 distributable amount 438,198. .. e Remaining amount distributed out of corpus 2,293,087.

5 Excess d1stribut1ons carryover applied to 2009 (If an amount appears m column (d), the sam~ amount must be shown m column (a))

6 Enter the net total of each column as indicated below:

a Corpus Add Imes 3f, 4c, and 4e Subtract line 5 15,316,970.

b Pnor years' undistributed income Subtract lme 4b from line 2b . . . . . . . . . .....

c Enter the amount of prior years' undistributed income for which a notice of deficiency has been issued, or on which the section 4942(a) tax has been previously assessed. • • . . . • • . . • •

d Subtract line 6c from line 6b Taxable amount - see page 27 of the instructions ....

e Undistributed income for 2008 Subtract line 4a from line 2a Taxable amount - see page 27 of the instructions .............

f Undistributed income for 2009 Subtract lines 4d and 5 from line 1 This amount must be d1stnbuted 1n 2010 ...............

7 Amounts treated as d1stnbut1ons out of corpus to satisfy requirements imposed by section 170(b)(1)(F) or 4942(g)(3) (see page 27 of the mstrucbons) • • • • • • • . . . • . • . . . • •

8 Excess d1stnbubons carryover from 2004 not applied on line 5 or line 7 (see page 27 of the

2,020,055. instructions) • • . • • • • . • • • • • • .... 9 Excess distributions carryover to 2010.

Subtract lines 7 and 8 from line 6a 13, 296, 915. . . . .... 10 Analysis of line 9

a Excess from 2005 2,373,221. b Excess from 2006 3,384,774. c Excess from 2007 3,348,840. d Excess from 2008 1,896,993. e Excess from 2009 2,293,087.

Form 990-PF (2009)

JSA

9E14801 000

29145H K932 11/12/2010 4:28:45 PM V 09-8.5 85651

'I

Forni 990-PF (2009) 48-0935563 Page 10

E •:1:11•-•u• Private Ooeratina Foundations see caae 27 of the instructions and Part VII-A, auest1on 9) NOT APPLICABL

1a If the foundation has received a ruling or determination letter that It IS a private o~e:a~ng~ I

foundation, and the ruling 1s effective for 2009, enter the date of the ruling .. b Check box to indicate whether the foundabon 1s a pnvate operating foundation descnbed in section I I 4942(])(3) or I I 4942(])(5)

2a Enter the lesser of the ad-Tax year Pnor 3 years

(e) Total Justed net income from Part (a) 2009 (b) 2008 (c) 2007 (d) 2006 I or the minimum investment return from Part X for each year listed

b 85% of hne 2a

c Quahfymg d1stnbutJons from Part

XII, hne 4 for each year hsted

d Amounts mciuded in line 2c not

used directly for act.JVe conduct

of exempt actJv1tJes • . . e Qualifying d1stnbubons made

directly for active conduct of

exempt acllv1t1es Subtract line 2d from hne 2c

3 Complete 3a, b, or c for the alternative test rehed upon

a "Assets" alternative test - enter

(1) Value of all assets

(2) Value of assets quahfymg

under section

4942W(3)(B)(1) • . . b "Endowment" alternatlve test-

enter 2/3 of mm1mum invest-

ment return sha.-m m Part X,

hne 6 for each year hsted

c "Support" alternat.Jve test - enter

(1) Total support other than gross investment income (interest, d1V1dends, rents, payments on securities loans {section 512(a)(5)),

or royalties) • . . . . (2) Support from general

pub he and 5 or more exempt organizations as provided tn section 4942 0)(3)(8)(111) •

(3) Largest amount of SUI)-

port from an exempt organization ..

(4) Gross investment income

.!..: ... - ......... Supplementary Information (Complete this pai:t only !f the foundation had $5,000 or more in assets at any time during the year - see page 28 of the instructions.)

Information Regarding Foundation Managers: a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation

before the close of any tax year (but only 1f they have contributed more than $5,000) (See section 507(d)(2) )

NONE b List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the

ownership of a partnership or other entity) of which the foundation has a 10% or greater interest

NONE 2 lnfonnation Regarding Contribution, Grant, Gift, Loan, Scholarship, etc., Programs:

Check here ~ D 1f the foundation only makes contributions to preselected charitable organizations and does not accept unsolicited requests for funds If the foundation makes gifts, grants, etc (see page 28 of the instructions) to ind1v1duals or organizations under other cond1t1ons, complete items 2a, b, c, and d

a The name, address, and telephone number of the person to whom applications should be addressed

ATTACHMENT 7 b The form 1n which applications should be submitted and information and matenals they should include

ATTACHMENT 8 c Any subm1ss1on deadlines

NONE d Any restnct1ons or hm1tat1ons on awards, such as by geographical areas, chantable fields, kinds of inst1tut1ons, or other

factors

JSA 9E1490 1 000

ATTACHMENT 9

29145H K932 11/12/2010 4:28:45 PM Forni 990-PF (2009)

V 09-8.5 85651

Form 990:PF (2009)0

4 8-0 9355 63 Hlffi@j Supplementary Information (continued)

3 Grants and Contributions Paid During the Year or Approved for Future Payment Rec1p1ent

Name and address (home or business)

a Paid dunng the year SEE ATTACHMENT D

Total. b Approved for future payment

Total.

JSA 9E14911 000

If rec1p1ent 1s an md1v1dual, Foundation show any relat.Jonsh1p to status of any foundation manager recipient or substant.Jal contnbutor

29145H K932 11/12/2010 4: 28: 45 PM V 09-8.5

Purpose of grant or contnbut1on

85651

Page 11

Amount

2,819,461.

..... 3a 2,819,461 .

..... 3b Form 990-PF (2009)

'I

Form 99o'.PF (2009) 48-0935563

11.m!D Analysis of Income-Producing Activities Enter gross amounts unless otherwise indicated Unrelated business income Excluded bi section 512 513, or 514

(a) (b) (c) (d)

1 Program service revenue Business code Amount Exdus1on code Amount

a

b

c

d

e

f

g Fees and contracts from government agencies

2 Membership dues and assessments .... 3 Interest on savings and temporary cash investments 14 81,536.

4 D1v1dends and interest from securities 14 32,478. .. 5 Net rental income or (loss) from real estate

a Debt-financed property ....... b Not debt-financed property .....

6 Net rental income or (loss) from personal property

7 Other investment income ........ 8 Gain or (loss) from sales of assets other than inventory 18 -19,155.

9 Net income or (loss) from special events .. 10 Gross profit or (loss) from sales of inventory •

11 Other revenue a

b

c

d

e

12 Subtotal Add columns (b), (d), and (e) .... 94,859.

13 Total. Add line 12, columns (b), (d), and (e) •••.••.•••••••••••••.•.••••••.••••• 13 (See worksheet 1n line 13 instructions on page 28 to venfy calculations )

·~·-ZJ:;11 Relationship of Activities to the Accomplishment of Exempt Purposes

Page 12

(e) Related or exempt function income ~ee page 28 of

e 1nstruct1ons )

94,859.

Line No Explain below how each act1v1ty for which income 1s reported in column (e) of Part XVI-A contributed importantly to

T the accomplishment of the foundation's exempt purposes (other than by providing funds for such purposes) (See page 29 of the instructions )

NOT APPLICABLE

Form 990-PF (2009) JSA 9E1492 1 000

29145H K932 11/12/2010 4: 28: 45 PM V 09-8.5 85651

Form 990-PF (2009) 4 8-09355 63 Page 13

•ifit\911 'Information Regarding Transfers To and Transactions and Relationships With Exempt Organizations

Noncharitable

1 Did the organization directly or 1nd1rectly engage 1n any of the following with any other organization descnbed 1n section 501 (c) of the Code (other than section 501 (c)(3) organizations) or in section 527, relating to political organizations?

Yes No

a Transfers from the reporting foundation to a nonchantable exempt organization of

(1) Cash •

(2) Other assets

b Other transactions

(1) Sales of assets to a noncharitable exempt organization

(2) Purchases of assets from a nonchantable exempt organization

(3) Rental of fac1ht1es, equipment, or other assets

(4) Reimbursement arrangements .

(5) Loans or loan guarantees

(6) Performance of services or membership or fundra1s1ng solicitations

c Sharing of facilities, equipment, mailing lists, other assets, or paid employees

d If the answer to any of the above 1s "Yes," complete the following schedule

value of the goods, other assets, or services given by the reporting foundation

1al1l x 1al2l x

1b{1l x 1bl2l x 1b(3l x 1b(4) x 1b(5) x 1b(6) x

1c x Column (b) should always show the fair market

If the foundation received less than fair market

value 1n any transaction or sharing arrangement, show in column (d) the value of the goods, other assets, or services received

(a) Line no (b) Amount involved (c) Name of nonchantable exempt organization (d) Descnpt1on of transfers, transad1ons, and shanng arrangements

N/A N/A

2a Is the foundation directly or indirectly affiliated with, or related to, one or more tax-exempt organizations descnbed in

section 501 (c) of the Code (other than section 501 (c)(3)) or 1n section 527? • • • • • • • • • • . . . • • • • • • • • • • • . 0 Yes [29 No

b If "Yes," comolete the follow1na schedule (a) Name of organization (b) Type of organization (c) Descnpt1on of relat1onsh1p

Under penalties of pel')ury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and behef, rt 1s true, corred, and complete Declaration of preparer (other than taxpayer or fiduciary) 1s based on all information of which preparer has any knowledge

~ o,/~~ I //-/ 5-:Z.010 ~ t:.-r e.. 'l. J"'f.. LC../'" Cl) Signature of officer or trustee Date Trtle ... Cl)

Preparers identifying ::i:::: Date Check1f O

~~ A. number (See Signature on c -~ ~ Preparers ~ ri/1~/ioto self-employed .... page 30 of the instrud1ons) Cl

en 'C .. c signature P00770702 ·; ~ 0 0.. CL a, Firm's name (or yours 1f ~BKD, LLP EIN .... 44-0160260 .. "' a: ::J self-employed), address, 1551 N WATERFRONT PKWY, STE 300

and ZIP code WICHITA, KS 67206-6601 Phone no 316-265-2811

Form 990-PF (2009)

JSA 9E14931000

29145H K932 11/12/2010 4: 28: 45 PM V 09-8.5 85651

CLAUDE R. LAMBE CHARITABLE FOUNDATION 48-0935563 . FORM 990-PF - PART IV CAPITAL GAINS AND LOSSES FOR TAX ON INVESTMENT INCOME

Kind of Property

Gross sale I Depreciation price less allowed/

exoenses of sale allowable

1 ,206,072.

TOTAL GAIN (LOSS) . . . . . . .

JSA 9E1730 1 000

p Description 01

D Cost or

I FMV

I AdJ basis

I Excess of

other as of as of FMVover h,.c,c 1?/''11/1',Q 12/31/l',Q ad1 basis

SEE ATTACHMENT A p

PROPERTY TYPE: SECURITIES 1,225,227.

........................................

29145H K932 11/12/2010 4:28:45 PM V 09-8.5 85651

Date acquired

Gam or

Oossl

VAR

-19,155.

-19,155.

Date sold

VAR

CLAUDE R. LAMBE CHARITABLE FOUNDATION EIN 48-0935563

SCHEDULE OF INFORMATION FOR 2009 form 990-PF

Part IV Capital Gains and Losses for Tax on Investment Income (a) List and descnbe the kmd(s) of property sold (e.g , (b) How acquired

real estate, 2-story bnck warehouse; P - Purchase

or common stock, 200 shs MLCCo) D - Donation

1a Zazove Associates, LLC Bond Fund · Sale of Bonds p

b Mellon Bonds & Cash - Corporate Actions p

c

d

e

f

g

(e) Gross sales price (I) Deprec1allon allowed (g) Cost or

minus expense of sale (or allowable) other basis

a 1,205,742 0 1,225,227

b 330 0 0

c

d

e

f

g

Complete only for assets showing gain in column (h) and owned by the foundation on 12/31/69

(i) FM V as of 12/31/69 O) AdJusted basis (k) Excess of col (1)

as of 12/31/69 over col 0), 1! any

a 0

b 0

c 0

d 0

e 0

I 0

g 0

If gam, also enter in Part I, line 7

2 Capital gain net income or (net capital loss) If (loss), enter -0- 1n Part I, hne 7

3 Net short-tenn capital gain or (loss) as defined 1n secllons 1222(5) and (6)

If gain, also enter in Part I, line 8, column (c) (see pages 11 and 16 of the

instructions) If (Joss), enter -0- 1n Part I, line 8

ATTACHMENT A

(c)

Date acquired (d) Date sold

(mo., day, yr.) (mo., day, yr)

04/04 - 07 /09 01/09 - 12/09

12/31/08 01/15/09

(h) Gain or (loss)

(e) plus (f) minus (g)

(19,485)

330

0

0

0

0

0

(1) Gains (Col (h) gain minus col (k),

but not less than -0-)

or Losses (from col. (h))

(19,485)

330

0

0

0

0

0

2 (19, 155)

3 0

CLAUDE R. LAMBE CHARITABLE FOUNDATION EIN 48-0935563

ATTACHMENT TO FORM 990-PF TO REPORT EXPENDITURE RESPONSIBILITY GRANT

For the Year Ended 12/31/09

PART VII-B, Question on Line Sc: ATTACHMENT B

Expenditure Responslbllity Statement for the year 2009

Pursuant to IRC Regulation section 53.4945-5(d)(2), the CLAUDE R. LAMBE CHARITABLE FOUNDATION provides the following information:

(i) Name & Address of Grantee:

(ii) Date and Amount of Grants:

(iii) Purpose of Grants:

Allen-Lambe House Foundation 255 N. Roosevelt Wichita, KS 67208

April11,2008 September 30, 2009

$110,800 $105,665

General program operating support for the Allen-Lambe House Foundation, an educational foundation which operates a museum and study center in a house located in Wichita, Kansas, designed by Frank Lloyd Wright in 1915. The house museum is open to the general public. The program of the Foundation includes restoration and conservation of the house, gardens, and its interiors, with furnishings to showcase the "Prairie Style" designs of Frank Lloyd Wright and to maintain a library archive study center for the study of Frank Lloyd Wnght and other interrelated areas of design.

(iv) Amounts expended: Reports received from the Allen-Lambe House Foundation show the following expenditures: $100,717 total funds were spent from the April, 2008 grant for operating support of the museum. No funds of the September, 2009 grant were spent in the calendar year 2009.

(v) Diversions: To the knowledge of this granter foundation, no funds have been diverted to any activity other than the activity for which the grant was originally made.

(vi) Date of Reports: On March 30, 2010, the Allen-Lambe House Foundation submitted a full and complete report of its expenditures of the April 2008 and September 2009 operating support grants.

(vi) Verification: The granter has no reason to doubt the accuracy or reliability of the report from the grantee; therefore, no independent verification of the reports were made.

'I

CLAUDE R. LAMBE CHARITABLE FOUNDATION EIN 48-0935563

SCHEDULE OF INFORMATION FOR 2009 FORM 990 PF

PART VIII, Line 1 - Officers, Directors,Trustees, Managers, Etc.

(b) Title, and average (d) Contributions hours per week to employee

(a) Name and Address devoted to position (c) Compensation benefit plans

Richard H Fink President I Director 0 0 1515 N. Courthouse Rd, Suite 200 1 hour per week Arlington, VA 22201

Logan Moore Secretary 0 0 1515 N Courthouse Rd, Suite 200 1 hour per week average Arlington, VA 22201

Vonda Holliman Treasurer 0 0 P 0. Box 2256 1 hour per week average Wichrta, KS 67201

Charles G Koch Director 0 0 P.O. Box 2256 Less than 1 hour per week Wichita, KS 67201

Elizabeth B. Koch Director 0 0 P.O. Box 2256 Less than 1 hour per week Wichita, KS 67201

Elizabeth R. Koch Director 0 0 PO Box 2256 Less than 1 hour per week W1ch1ta, KS 67201

Charles C. Koch Director 0 0 PO Box 2256 Less than 1 hour per week Wichita, KS 67201

TOTAL 0 0

ATTACHMENT C

(e) Expense account, other

allowances

0

0

0

0

0

0

0

0

'I

CLAUDE R. LAMBE CHARITABLE FOUNDATION EIN 48-0935563

SCHEDULE OF INFORMATION FOR 2009 FORM 990 PF

Part XV, Line 3a& b - Grants and Contributions Paid During the Year or Approved for Future Payment

If radplenl Is an lndrildtJal, Foundation Recipient show any nilatlonnp lo status of Purpose of grant

any lo\ndabon manager recipient or contribution Name and address (home or business) ar subslanllal ccntril>u1ar

a Paid during the year.

Allen-Lambe House Foundation Private General Operating Support Wichita, KS

American Council for Capital Formation, Public General Operating Support Center for Policy Research

Washington, DC

American Spectator Public Educational Programs Arlington, VA

American Council on Science & Health Public Return of General Operating New York, NY Grant Paid in Prior Year

American Legislative Exchange Council Public Educational Programs Washington, DC General Operating Support

Americans for Prosperity Foundation Public Educational Programs Washington, DC General Operating Support

Ayn Rand Institute Public General Operating Support Irvine, CA

Cato Institute Public General Operating Support Washington, DC

Center for Independent Thought Public Educational Programs New York, NY

Competitive Enterprise Institute Public General Operating Support Washington, DC

ConSource Inc Public General Operating Support Washington, DC

Federalist Society Public Educational Programs Washington, DC

Foundation for Research on Economics & Public General Operating Support the Environment (FREE)

Bozeman, MT

George Marshall Institute Public General Operating Support Arlington, VA

George Mason University Foundation Public Educational Programs Fairfax, VA

The Heritage Foundation Public Educational Programs Washington, DC

Independent Women's Forum Public Educational Programs Washington, DC

Manhattan Institute for Policy Research Public Educational Programs New York, NY

Page 1 of 2

ATTACHMENT D

Amount

$ 105,665

100,000

4,500

(30,000)

75,000 50,000

12,000 354,725

25,000

250,000

35,000

10,000

4,000

175,000

65,000

70,000

20,000

618,571

150,000

200,000

CLAUDE R. LAMBE CHARITABLE FOUNDATION EIN 48-0935563

SCHEDULE OF INFORMATION FOR 2009 FORM 990 PF

Part XV, Line 3a& b - Grants and Contributions Paid During the Year or Approved for Future Payment

If reap1811l IS en oncfMduat, Foundation Recipient show any relabOnShtp to status of Purpose of grant

any foundabon manager recipient or contribution Name and address (home or business) or substanbal contnllular

a Paid during the year:

National Center for Policy Analysis Public Educational Programs Dallas, TX

Pacific Research Institute Public General Operating Support San Francisco, CA

Reason Foundation Public Educational Programs Los Angeles, CA

Tax Foundation Public Educational Programs Washington, DC

Texas Public Policy Foundation Public General Operating Support Austin, TX

Washington Legal Foundation Public General Operating Support Washington. DC

TOTAL GRANTS PAID TO ORGANIZATIONS

Page 2 of2

ATTACHMENT D

Amount

25,000

100,000

50,000

50,000

100,000

200,000

$ 2,819,461

CLAUDE R. LAMBE CHARITABLE FOUNDATION 48-0935563

ATTACHMENT 1

FORM 990PF, PART I - ACCOUNTING FEES

REVENUE AND NET ADJUSTED

EXPENSES INVESTMENT NET CHARITABLE DESCRIPTION PER BOOKS INCOME INCOME PURPOSES

ACCOUNTING FEES 18,795. 16,150. INVESTMENT ACCTG SERVICE FEES 3,525. 3,525.

TOTALS 22,320. 3 525. 0. 16 150.

ATTACHMENT 1 29145H K932 11/12/2010 4:28:45 PM V 09-8.5 85651

CLAUDE R. LAMBE CHARITABLE FOUNDATION

FORM 990PF, PART I - OTHER PROFESSIONAL FEES

DESCRIPTION

INVESTMENT MANAGEMENT FEES

TOTALS

REVENUE AND

EXPENSES PER BOOKS

15,982.

15. 982~.

29145H K932 11/12/2010 4:28:45 PM V 09-8.5

NET INVESTMENT

INCOME

15,982.

15.982.

85651

48-0935563

ATTACHMENT 2

ATTACHMENT 2

"I

CLAUDE R. ~AMBE CHARITABLE FOUNDATION

FORM 990PF, PART I - TAXES

DESCRIPTION

FEDERAL EXCISE TAX

TOTALS

REVENUE AND

EXPENSES PER BOOKS

945.

945.

29145H K932 11/12/2010 4:28:45 PM V 09-8.5

48-0935563

ATTACHMENT 3

ATTACHMENT 3 85651

CLAUDE R. LAMBE CHARITABLE FOUNDATION

FORM 990PF, PART I - OTHER EXPENSES

DESCRIPTION INSURANCE BANK FEES SUPPLIES MISC EXPENSES

TOTALS

REVENUE AND

EXPENSES PER BOOKS

875. 317. 147. 439.

l_,__]_]__8__.

29145H K932 11/12/2010 4:28:45 PM V 09-8.5 85651

48-0935563

ATTACHMENT 4

CHARITABLE PURPOSES

875. 317. 147.

L 339.

ATTACHMENT 4

CLAUDE R. LAMBE CHARITABLE FOUNDATION

FORM 990PF, PART II - OTHER INVESTMENTS

DESCRIPTION

ZAZOVE ASSOC CONVERTIBLE BONDS

TOTALS

29145H K932 11/12/2010 4:28:45 PM V 09-8.5 85651

ATTACHMENT 5

ENDING BOOK VALUE

2,663,574.

2,663.574.

ENDING FMV

48-0935563

2,830,160.

2,830.160.

ATTACHMENT 5

. "'

CLAUDE R. ~AMBE CHARITABLE FOUNDATION 48-0935563

ATTACHMENT 6

FORM 990PF, PART VII-B, LINE SC-EXPENDITURE RESPONSIBILITY STATEMENT

GRANTEE'S NAME: SEE ATTACHMENT B GRANTEE'S ADDRESS: CITY, STATE & ZIP: GRANT DATE: GRANT AMOUNT: GRANT PURPOSE: AMOUNT EXPENDED: ANY DIVERSION? NO DATES OF REPORTS: VERIFICATION DATE: RESULTS OF VERIFICATION:

ATTACHMENT 6 29145H K932 11/12/2010 4:28:45 PM V 09-8.5 85651

\ • I

CLAUDE R. LAMBE CHARITABLE FOUNDATION 48-0935563

ATTACHMENT 7

FORM 990PF, PART XV - NAME, ADDRESS AND PHONE FOR APPLICATIONS

GRANT ADMINISTRATOR 1515 N. COURTHOUSE RD., SUITE 200 ARLINGTON, VA 22201 703-875-1601

29145H K932 11/12/2010 4:28:45 PM V 09-8.5 ATTACHMENT 7

85651

' . ,,

CLAUDE R. LAMBE CHARITABLE FOUNDATION 48-0935563

ATTACHMENT 8

990PF, PART XV - FORM AND CONTENTS OF SUBMITTED APPLICATIONS

LETTER EXPLAINING PROJECT AND AMOUNT REQUESTED, PLUS A COPY OF THE IRS DETERMINATION LETTER SHOWING EXEMPTION.

ATTACHMENT 8 29145H K932 11/12/2010 4:28:45 PM V 09-8.5 85651

' ' . CLAUDE R. LAMBE CHARITABLE FOUNDATION 48-0935563

ATTACHMENT 9

990PF, PART XV - RESTRICTIONS OR LIMITATIONS ON AWARDS

GRANTS ARE GENERALLY RESTRICTED TO PUBLIC CHARITY ORGANIZATIONS AS DEFINED IN SECTION 501(C) (3) OF THE INTERNAL REVENUE CODE. THE FOUNDATION DOES NOT MAKE GRANTS TO INDIVIDUALS OR FOR-PROFIT CORPORATIONS.

ATTACHMENT 9 29145H K932 11/12/2010 4:28:45 PM V 09-8.5 85651

Name of Exempt OrgamzatJon Type or print CLAUDE R. LAMBE CHARITABLE FOUNDATION F,le by the Number, street, and room or suite no If a P.O box. see instructions

Employer ldentlflcaUon number

48-0935563 For IRS use only

extended p . O . BOX 2 2 5 6 dueda!Bfor t--::-c--------,-=----,,----,-=::---:---:---:--:---:-----:-----t---__.--------------fillng the City, town or post office, state. and ZIP code. For a foreign address. see instrudlons. return SeB instructions. WICHITA, KS 67201-2 2 5 6

Check type of return to be filed (File a separate application for each return): Form 990 X Form 990-PF Form 990-BL Form 990-T (sec 401 (a) or 408(a) trust) Form 990-EZ Form 990-T trust other than above

Form 1041-A Form 4720 Form 5227

D Form 6069 D Form 8870

STOPI Do not complete Part II if you were not already granted an automatic 3-month extension on a previously flied Fonn 8868. • The books are in the care of • _v_O_N_DA __ H_O_L_L_I_MA_N _____________________ _

TelephoneNo. • 316 828-5552 FAXNo.• • If the organization does not have an office or place of business 1n the Unrted States. check th1S box . • • . • . . • . . • • • • . • 0 • If this 1s for a Group Return, enter the organization's four digit Group Exemption Number (GEN) If this 1s for the whole group, check this box .•. • 0. If rt 1s for part of the group, check this box ••. • D and attach a list with the names and EINs of all members the extension is for.

4 I request an add1t1onal 3-month extension of time until NOVEMBER 15, 2010

5 For calendar year 2 0 0 9 . or other tax year beginning ~------~-~ and ending -r---.----------6 If this tax year 1s for less than 12 months, check reason- 0 Initial return D F'mal return D Change 1n accounting period

7 State in detail why you need the extension -------------------------------THE TAXPAYER REQUESTS ADDITIONAL TIME IN ORDER TO GATHER THE NECESSARY INFORMATION FOR A COMPLETE AND ACCURATE RETURN.

Sa If this application 1s for Form 990-BL. 990-PF, 990-T, 4720, or 6069, enter the tentative tax, less any nonrefundable credits. See instructions. Ba $

b If thlS application 1s for Form 990-PF, 990-T, 4720, or 6069, enter any refundable credits and estimated tax payments made Include any prior year overpayment allowed as a credit and any amount paid -previously with Form 8868 8b $

c Balance Due. Subtract line 8b from line Ba. Include your payment with this form, or, 1f required, deposit with FTD coupon or, if required, bv usmg EFTPS (Electronic Federal Tax Payment Svstem) See instructions 8c $ 0

Signature and Verification Under penalties of perJury, I dedare that I have exarmned this form, including accompanying schedules end statements, and to the best of my knowledge and behel, ,t ,s true, correct, and complete, and that I am authorized to prepare this form.

JSA

9F8055 3 000

BKD,UP 1551N.~~U.300

Wldtfta, KS fflDNlo1 ~180280

Title ... C.P.A.

Fann 8868 (Rev. 4-2009)