Class 1 Introduction To Bollinger Band Trading · Bollinger Band Trading Overview: • History of...

Transcript of Class 1 Introduction To Bollinger Band Trading · Bollinger Band Trading Overview: • History of...

PAGE 1

Bollinger Bands Essentials Class 1

Class 1 Introduction ToBollinger Band Trading

Overview:• History of Bollinger Bands

• Bollinger Band Components

• Settings & Variations

• The Main Plays Objectives

History of Bollinger Bands

What are Bollinger Bands? “Bollinger Bands are bands drawn in and around the price structure on a chart. Their purpose is to provide relative definitions of high and low prices. - John Bollinger: from Bollinger on Bollinger Bands

PAGE 2

Bollinger Bands Essentials Class 1

John Bollinger

• Former analyst on Financial News Network (later CNBC)

• Bollinger Capital Management

• Creator of the Bollinger Bands

• A Modern Technical Analysis Titan!

Why B. Bands are Powerful

• Show where a stock is high or low on a relative basis

• Reveal stock trends

• Provide visual trade setups that are easy to identify

• Can be a complete trading system

5 Steps of Trade Confirmation

1. Support & Resistance

2. Identify the trend

3. Chart Patterns

4. Candlestick Patterns

5. Indicators

Indicator vs. Overlay

• Bands, like indicators, derive their signals from the OHLC

• Slightly different in that the presentation is an “overlay”

• More like clouds than indicators

• Can replace other techniques

PAGE 3

Bollinger Bands Essentials Class 1

Trading Band Systems

• Trading Band Systems are not new

• MA Percent Bands were well known by the 1950s

• Chester Keltner “perfected” the bands in the 60’s

• Richard Donchian (Donchian channel)

The Concept

• Intended to encompass “most” of the price action

• Push beyond the envelopes represents an extreme

• Helps establish trends

• Helps identify overbought/oversold

Donchain Channel

Keltner Bands

Percent Band Envelopes

PAGE 4

Bollinger Bands Essentials Class 1

They Worked

• All of these systems worked

• Donchian was/is probably the best

• Bollinger was working with the percent system and frustrated

• The challenge was setting the bands correctly

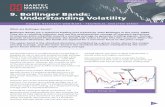

Volatility is the Problem

• Discovered that volatility was the key messing up the bands

• Needed a way to allow the bands to expand regardless of how volatility looked

• Needed a relative system rather than an absolute system

Too Loose Here

Worked “OK” Here

Percent Band Envelopes

PAGE 5

Bollinger Bands Essentials Class 1

The Solution

• A band system based on a standard deviation

• Allowed for the volatility

• In the end created a band system that encompasses approximately 90% of the price

Bollinger Band ComponentsKey Components

• Moving Average

• Upper & lower band

• Standard deviation

Moving Average

• Used to define the intermediate trend

• Bollinger always uses the simple ave.

• Works just like any other moving average setup:

➡ Above the average = Bullish

➡ Below the average = Bearish

Bollinger Bands

PAGE 6

Bollinger Bands Essentials Class 1

The Bands

• The bands establish the upper and lower range of the trade

• Bollinger uses a standard deviation calculation to allow for volatility

• Bands expand as the average price movement increases and contract when it decreases

PAGE 7

Bollinger Bands Essentials Class 1

Combination

• With these components we can use the Bollinger bands to:

➡ Define relative highs and lows

➡ Define trends

➡ Define a structure for price analysis

Confirmation Tools

• Candles

• W & M Patterns

• Some indicators

PAGE 8

Bollinger Bands Essentials Class 1

Settings & VariationsPrimary Settings

• Moving Average = 20 SMA*

• Band average = 20

• Standard Deviation = 2.0

*Use of an exponential Moving Average will not improve the performance of the band system

These are some “possible” alternative settings. John Bollinger contends the primary settings of 20 and 2 are still the best settings.

Motive Wave

Trade Navigator

Alternate Settings

Periods Std. Dev.

John Bollinger’s Alternates

10 1.9

20 2

50 2.1

Other “popular” alternates

18 1.8

14 2

PAGE 9

Bollinger Bands Essentials Class 1

The Main PlaysThe Main Plays

• The Squeeze

• The False Break

• Walking the Band

• The Reversal

The Squeeze

• During periods of low volatility the bands will squeeze together

• This contraction can only last for a little bit of time

• When it breaks out it typically leads to a new trend

PAGE 10

Bollinger Bands Essentials Class 1

The False Break

• This trade starts as a BB Squeeze

• The trade breaks to one side

• Within 2-4 sessions it displays candlestick reversal signals

• Take the trade in the opposite direction to the other side of the band

PAGE 11

Bollinger Bands Essentials Class 1

Walking The Band

• This is the “trend trade”

• Stock will “walk” between the upper and middle band, or the lower and middle band, as the trend progresses

• This is very similar to a moving average trend trade

PAGE 12

Bollinger Bands Essentials Class 1

The Reversal

• Bands provide a framework for the price action of the stock

• M patterns and W patterns will appear inside the bands

• These typically lead to reversals and provide insight

PAGE 13

Bollinger Bands Essentials Class 1

Homework• Set up the bands in your charting software

• Pull up several stocks and look for the main plays

• Take note of how they have played out in the past

![Bollinger Bands Trading Strategies That Work [ForexFinest]](https://static.fdocuments.in/doc/165x107/577c80821a28abe054a8fc4b/bollinger-bands-trading-strategies-that-work-forexfinest.jpg)

![The Bollinger Bands Swing Trading System[1]](https://static.fdocuments.in/doc/165x107/547eeaf25906b597718b47c9/the-bollinger-bands-swing-trading-system1.jpg)