City & County of Denver Disability Insurance Claim Packet … · 2019-08-26 · 642061 SI 2047 3 of...

Transcript of City & County of Denver Disability Insurance Claim Packet … · 2019-08-26 · 642061 SI 2047 3 of...

642061SI 2047 1 of 9 (8/19)

Your Disability Benefit Claim

This packet contains the forms necessary to apply for disability benefits. It also addresses common questions about Disability claims. Please save this material for your future reference. For specific information about your Disability insurance coverage, refer to your group insurance certificate. The certificates are the ultimate authority for Disability claim decisions. If you need other information, please contact your employer’s benefit administrator or call our customer service line at (800) 368-2859.

How To Apply For Benefits

The Disability benefits application includes claim forms and an Authorization.

1. Your employer should complete their portion of the claim form and forward it directly to The Standard.

2. Complete and sign your part of the claim form.

3. Your treating physician should complete the Attending Physician’s Statement. If more than one physician is treating you for your disabling condition, each should complete a form. Additional forms are available from your employer’s benefit administrator.

4. Sign and date the Authorization, and send it, along with the claim forms, to Standard Insurance Company (The Standard) at the above address. This authorization allows us to request further information about your claim, if necessary.

Once we receive your completed claim application, it will take approximately one week to make a claim decision. If we have not reached a decision within one week, you will be notified with the details.

Other Benefits That May Reduce Your Disability Benefits

Other benefits you receive may reduce the amount of Disability benefits due you. Your group insurance certificate lists these benefits, which may include, but are not limited to, sick leave, Workers’ Compensation, State Disability, Social Security, and Retirement.

To avoid a possible overpayment of your claim, please inform The Standard if you receive other benefits.

When You Return To Work

Your disability benefits usually stop when you return to work. Be sure that you or your employer notify The Standard immediately when you plan to return, or have returned to work to assure no overpayment occurs.

Standard Insurance Company800.368.2859 Tel 800.378.6053 FaxPO Box 2800 Portland OR 97208

City & County of DenverDisability Insurance

Claim Packet Instructions

642061SI 2047 2 of 9 (8/19)

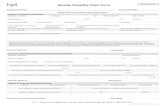

Job Title: (Please attach a copy of the job description.) Employee’s Full Name: Social Security No.:TO BE COMPLETED BY EMPLOYER

City & County of DenverDisability InsuranceEmployer Statement

Standard Insurance Company800.368.2859 Tel 800.378.6053 FaxPO Box 2800 Portland OR 97208

1. A. Is employee insured for Short Term Disability? Yes No Effective date:

Voluntary Plan City Paid Plan Has the employee’s coverage changed in the past 12 months? Yes No

Date of Change:

Type of Change: No Election Decrease in Benefit Waiting Period Increase in Benefit Waiting Period

B. Is employee insured for Long Term Disability – 622518? Yes No Effective date: C. Is employee insured for Group Life Insurance through The Standard? Yes No

Work Location: Address: State: Zip Code:

3. Has the employee filed for: Workers’ Compensation Yes No

Other: Yes No

Weekly Amount:

7. Last day through which any compensation was paid by employer:

2. Is disability work related? Yes No Undetermined

4. Last active day at work:

5. Date employee returned to work:

8. Is employee subject to: Social Security taxes? Yes No

Medicare taxes? Yes No

Acknowledgement

I hereby certify that the answers I have made to the foregoing questions are both complete and true to the best of my knowledge and belief. I acknowledge that I have read the fraud notice on page 3 of this form.

Signature: Date:

Employer: Payroll Coordinator Name: Phone No.: Policy No.:

( )Mailing Address: City: State: Zip Code:

6. Last day through which sick leave benefits were paid by employer:

9. What percentage of the STD premium does the employer pay? _______%

What percentage of the LTD premium does the employer pay? _______%

Has either percentage changed within the last three years? Yes No

Are employer paid premiums included in the employee’s salary? Yes No

CO

642061City & County of Denver

10. Are employee premiums paid with pre-tax dollars (IRC Section 125 cafeteria plans)? Yes No

642061SI 2047 3 of 9 (8/19)

City & County of DenverDisability Insurance

Claim Form Fraud Notices

Standard Insurance Company800.368.2859 Tel 800.378.6053 FaxPO Box 2800 Portland OR 97208

Some states require us to provide the following information to you:

ALABAMA, MARYLAND AND RHODE ISLAND RESIDENTS

Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

CALIFORNIA RESIDENTS

For your protection, California law requires the following to appear on this form: Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

COLORADO RESIDENTS

It is unlawful to knowingly provide false, incomplete or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance, and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to the policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado division of insurance within the department of regulatory agencies.

DISTRICT OF COLUMBIA RESIDENTS

WARNING: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits, if false information materially related to a claim was provided by the applicant.

FLORIDA RESIDENTS

Any person who knowingly and with intent to injure, defraud or deceive an insurance company, files a statement of claim or an application containing false, incomplete or misleading information is guilty of a felony of the third degree

NEW JERSEY RESIDENTS

Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

NEW YORK RESIDENTS

Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim, containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

PENNSYLVANIA RESIDENTS

Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

ALL OTHER RESIDENTS

Some states require us to inform you that any person who knowingly and with intent to injure, defraud or deceive an insurance company, or other person, files a statement containing false or misleading information concerning any fact material hereto commits a fraudulent insurance act which is subject to civil and/or criminal penalties, depending upon the state. Such actions may be deemed a felony and substantial fines may be imposed.

642061SI 2047 4 of 9 (8/19)

TO BE COMPLETED BY EMPLOYEEFull Name: Social Security No.: Phone No.: ( )

1. Is your disability work related? Yes No

3. Do you intend to file? Yes No

5. Date you became unable to work at your occupation because of disability:

7. Accident. When and where did it happen?

Illness. When did you first notice and what is the nature of your disability?

2. Have you filed a Workers’ Compensation claim? Yes No

4. Last active day at work:

6. Date you returned or expect to return to work:

8. How does your disability prevent you from working?

9. Have you had a previous disability claim with The Standard? Yes No

10. Pregnancy: Expected delivery date: _____________________

Actual delivery date: ________________________

Type of delivery: Vaginal C-section

Acknowledgement

I hereby certify that the answers I have made to the foregoing questions are both complete and true to the best of my knowledge and belief. I acknowledge that I have read the fraud notice on page 5 of this form.

Signature: Date:

M F

Birthdate: Sex: No. of Dependent Children: Birthdate of Youngest:

Address: City: State: Zip Code:

Employer: Group Policy No.:

642061City & County of Denver

City & County of DenverDisability Insurance

Employee Statement

Standard Insurance Company800.368.2859 Tel 800.378.6053 FaxPO Box 2800 Portland OR 97208

642061SI 2047 5 of 9 (8/19)

City & County of DenverDisability Insurance

Claim Form Fraud Notices

Standard Insurance Company800.368.2859 Tel 800.378.6053 FaxPO Box 2800 Portland OR 97208

Some states require us to provide the following information to you:

ALABAMA, MARYLAND AND RHODE ISLAND RESIDENTS

Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

CALIFORNIA RESIDENTS

For your protection, California law requires the following to appear on this form: Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

COLORADO RESIDENTS

It is unlawful to knowingly provide false, incomplete or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance, and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to the policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado division of insurance within the department of regulatory agencies.

DISTRICT OF COLUMBIA RESIDENTS

WARNING: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits, if false information materially related to a claim was provided by the applicant.

FLORIDA RESIDENTS

Any person who knowingly and with intent to injure, defraud or deceive an insurance company, files a statement of claim or an application containing false, incomplete or misleading information is guilty of a felony of the third degree

NEW JERSEY RESIDENTS

Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

NEW YORK RESIDENTS

Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim, containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

PENNSYLVANIA RESIDENTS

Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

ALL OTHER RESIDENTS

Some states require us to inform you that any person who knowingly and with intent to injure, defraud or deceive an insurance company, or other person, files a statement containing false or misleading information concerning any fact material hereto commits a fraudulent insurance act which is subject to civil and/or criminal penalties, depending upon the state. Such actions may be deemed a felony and substantial fines may be imposed.

642061SI 2047 6 of 9 (8/19)

TO BE COMPLETED BY EMPLOYEEFull Name: Employer: Group Policy No.:

TO BE COMPLETED BY THE ATTENDING PHYSICIAN1. DiagnosisA. Diagnosis: ICDA Classification:

B. Symptoms: C. Objective Findings:

Height: Weight: B/P:

2. Pregnancy (if applicable)

A. Expected date of delivery: B. Actual date of delivery: C. Type of delivery: Vaginal C-section

D. Significant complications, if any:

3. History

A. Date you recommended the patient stop work: B. When did symptoms appear or accident happen?

C. Has the patient ever had the same or similar condition? Yes No If yes, when?

D. Is this condition related to the patient’s employment? Yes No E. Did you complete a workers’ compensation claim form? Yes No

4. Treatment

A. Date of first visit: B. Date(s) of subsequent visits: C. Date of most recent visit:

D. Planned course and duration of treatment (include surgery and medications, if any):

5. Level of Functional ImpairmentA. Describe the patient’s mental and cognitive

limitations, if any.

C. Is this patient competent to manage insurance benefits? Yes No If no, is the patient competent to appoint someone to help manage the insurance benefits? Yes No

B. In a work day given two breaks and a meal break, your patient can:

Lift (in pounds) 1-10 11-20 21-50 51-75 76+

Carry (in pounds) 1-10 11-20 21-50 51-75 76+

Total Hours With positional change

Sit 8 7 6 5 4 3 2 1 (hrs) ______________________ Stand 8 7 6 5 4 3 2 1 (hrs) ______________________ Walk 8 7 6 5 4 3 2 1 (hrs) ______________________ Alternately sit/stand 8 7 6 5 4 3 2 1 (hrs) ______________________Bend/stoop: Never Occasionally Frequently

6. Hospitalization (if applicable)

A. Date admitted: B. Date discharged: C. Reason:

D. Name of hospital:

7. Prognosis

A. Since onset of symptoms, the patient’s condition has: Improved Not changed Retrogressed

B. When do you anticipate the patient can return to work? Date: Unable to determine, follow up in: weeks Never

8. Physician Information (Please type or print.)

Name of physician completing this form: Phone No.: ( )

Specialty: Tax ID. No.: Fax No.: ( )

Address: City: State: Zip Code:

AcknowledgementI hereby certify that the answers I have made to the foregoing questions are both complete and true to the best of my knowledge and belief. I acknowledge that I have read the fraud notice on page 7 of this form.

Signature: Date:

The following information is needed to document the patient’s inability to work. The patient is responsible for completing this form without expense to The Standard. Please complete this form and mail it to The Standard at the address listed above.

642061City & County of Denver

City & County of DenverDisability Insurance

Attending Physician’s Statement

Standard Insurance Company800.368.2859 Tel 800.378.6053 FaxPO Box 2800 Portland OR 97208

642061SI 2047 7 of 9 (8/19)

City & County of DenverDisability Insurance

Claim Form Fraud Notices

Standard Insurance Company800.368.2859 Tel 800.378.6053 FaxPO Box 2800 Portland OR 97208

Some states require us to provide the following information to you:

ALABAMA, MARYLAND AND RHODE ISLAND RESIDENTS

Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

CALIFORNIA RESIDENTS

For your protection, California law requires the following to appear on this form: Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

COLORADO RESIDENTS

It is unlawful to knowingly provide false, incomplete or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance, and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to the policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado division of insurance within the department of regulatory agencies.

DISTRICT OF COLUMBIA RESIDENTS

WARNING: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits, if false information materially related to a claim was provided by the applicant.

FLORIDA RESIDENTS

Any person who knowingly and with intent to injure, defraud or deceive an insurance company, files a statement of claim or an application containing false, incomplete or misleading information is guilty of a felony of the third degree

NEW JERSEY RESIDENTS

Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

NEW YORK RESIDENTS

Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim, containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

PENNSYLVANIA RESIDENTS

Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

ALL OTHER RESIDENTS

Some states require us to inform you that any person who knowingly and with intent to injure, defraud or deceive an insurance company, or other person, files a statement containing false or misleading information concerning any fact material hereto commits a fraudulent insurance act which is subject to civil and/or criminal penalties, depending upon the state. Such actions may be deemed a felony and substantial fines may be imposed.

642061SI 2047 8 of 9 (8/19)

Authorization to Obtain and Release Information

I AUTHORIZE THESE PERSONS having any records or knowledge of me or my health: • Any physician, medical practitioner or health care provider. • Any hospital, clinic, pharmacy or other medical or medically related facility or association. • Kaiser Permanente.• Any insurance company or annuity company. • Any employer, policyholder or plan sponsor. • Any organization or entity administering a benefit or leave program (including statutory benefits) or an annuity program. • Any educational, vocational or rehabilitation counselor, organization or program. • Any consumer reporting agency, financial institution, accountant, or tax preparer. • Any government agency (for example, Social Security Administration, Public Retirement System, Railroad Retirement Board, Workers’

Compensation Board, etc.).TO GIVE THIS INFORMATION:

• Charts, notes, x-rays, operative reports, lab and medication records and all other medical information about me, including medical history, diagnosis, testing and test results. Prognosis and treatment of any physical or mental condition, including: • Any disorder of the immune system, including HIV, Acquired Immune Deficiency Syndrome (AIDS) or other related

syndromes or complexes. • Any communicable disease or disorder. • Any psychiatric or psychological condition, including test results, but excluding psychotherapy notes. Psychotherapy notes

do not include a summary of diagnosis, functional status, the treatment plan, symptoms, prognosis and progress to date. • Any condition, treatment, or therapy related to substance abuse, including alcohol and drugs.

and: • Any non-medical information requested about me, including such things as education, employment history, earnings

or finances, return to work accommodation discussions or evaluations and eligibility for other benefits or leave periods including but not limited to claims status, benefit amount, payments, settlement terms, effective and termination dates, plan or program contributions, etc.

TO STANDARD INSURANCE COMPANY, THE STANDARD LIFE INSURANCE COMPANY OF NEW YORK, THE STANDARD BENEFIT ADMINISTRATORS AND THEIR AUTHORIZED REPRESENTATIVES (referred to as “The Companies”, individually and collectively), AND MY EMPLOYER’S ABSENCE MANAGEMENT PROGRAM ADMINISTRATOR (“Absence Manager”).

• I acknowledge that any agreements I have made to restrict my protected health information do not apply to this authorization and I instruct the persons and organizations identified above to release and disclose my entire medical record without restriction.

• I understand that each of The Companies and Absence Manager will gather my information only if they are administering or deciding my disability or leave of absence claim(s), and will use the information to determine my eligibility or entitlement for benefits or leave of absence.

• I understand that I have the right to refuse to sign this authorization and a right to revoke this authorization at any time by sending a written statement to The Companies and Absence Manager, except to the extent the authorization has been relied upon to disclose requested records. A revocation of the authorization, or the failure to sign the authorization, may impair The Companies and Absence Manager’s ability to evaluate or process my claim(s), and may be a basis for denying or closing my claim(s) for benefits or leave of absence.

• I understand that in the course of conducting its business The Companies and Absence Manager may disclose to other parties information about me. They may release information to a reinsurer, a plan administrator, plan sponsor, or any person performing business or legal services for them in connection with my claim(s). I understand that The Companies and Absence Manager will release information to my employer necessary for absence management, for return to work and accommodation discussions, and when performing administration of my employer’s self-funded (and not insured) disability plans.

• I understand that The Companies and Absence Manager comply with state and federal laws and regulations enacted to protect my privacy. I also understand that the information disclosed to them pursuant to this authorization may be subject to redisclosure with my authorization or as otherwise permitted or required by law. Information retained and disclosed by The Companies and Absence Manager may not be protected under the Health Insurance Portability and Accountability Act [HIPAA].

• I understand and agree that this authorization as used to gather information shall remain in force from the date signed below:• For Standard Insurance Company, the duration of my claim(s) or 24 months, whichever occurs first.• For The Standard Life Insurance Company of New York, the duration of my claim(s) or 24 months, whichever occurs first.• For The Standard Benefit Administrators, the duration of my claim(s) administered by The Standard Benefit

Administrators or 24 months, whichever occurs first.• For Absence Manager, 24 months.

• I understand and agree that The Companies and Absence Manager may share information with each other regarding my disability and leave of absence claim(s). This authorization to share information shall remain valid for 12 months from the date signed below.

• I acknowledge that I have read this authorization and the New Mexico notice on page 9. A photocopy or facsimile of this authorization is as valid as the original and will be provided to me upon request.

Name (please print) Social Security No.

Signature of Claimant/Representative Date

If signature is provided by legal representative (e.g., Attorney in Fact, guardian or conservator), please attach documentation of legal status.

642061SI 2047 9 of 9 (8/19)

Standard Insurance Company is a licensed insurance company in all states except New York. The Standard Life Insurance Company of New York is an insurance company licensed only in New York. An absence manager may be hired by your employer and may be one of The Companies.

FOR RESIDENTS OF NEW MEXICO The state of New Mexico requires Standard Insurance Company to provide you with the following information pursuant to its Domestic Abuse Insurance Protection Act.

The Authorization form allows Standard Insurance Company to obtain personal information as it determines your eligibility for insurance benefits. The information obtained from you and from other sources may include confidential abuse information. “Confidential abuse information” means information about acts of domestic abuse or abuse status, the work or home address or telephone number of a victim of domestic abuse or the status of an applicant or insured as a family member, employer or associate of a victim of domestic abuse or a person with whom an applicant or insured is known to have a direct, close personal, family or abuse-related counseling relationship. With respect to confidential abuse information, you may revoke this authorization in writing, effective ten days after receipt by Standard Insurance Company, understanding that doing so may result in a claim being denied or may adversely affect a pending insurance action.

Standard Insurance Company is prohibited by law from using abuse status as a basis for denying, refusing to issue, renew or reissue or canceling or otherwise terminating a policy, restricting or excluding coverage or benefits of a policy or charging a higher premium for a policy.

Upon written request you have the right to review your confidential abuse information obtained by Standard Insurance Company. Within 30 business days of receiving the request, Standard Insurance Company will mail you a copy of the information pertaining to you. After you have reviewed the information, you may request that we correct, amend or delete any confidential abuse information which you believe is incorrect. Standard Insurance Company will carefully review your request and make changes when justified. If you would like more information about this right or our information practices, a full notice can be obtained by writing to us.

If you wish to be a protected person (a victim of domestic abuse who has notified Standard Insurance Company that you are or have been a victim of domestic abuse) and participate in Standard Insurance Company’s location information confidentiality program, your request should be sent to Standard Insurance Company.

Authorization to Obtain and Release Information

Form W-4SDepartment of the Treasury Internal Revenue Service

Request for Federal Income Tax Withholding From Sick Pay

Give this form to the third-party payer of your sick pay. Go to www.irs.gov/FormW4S for the latest information.

OMB No. 1545-0074

2019Type or print your first name and middle initial Last name Your social security number

Home address (number and street or rural route)

City or town, state, and ZIP code

Claim or identification number (if any) . . . . . . . . . . . . . . . . . . . . . . .I request federal income tax withholding from my sick pay payments. I want the following amount to be withheld from each payment. (See Worksheet below.) . . . . . . . . . . . . . . . . . $

Employee’s signature Date

Separate here and give the top part of this form to the payer. Keep the lower part for your records.

Worksheet (Keep for your records. Do not send to the Internal Revenue Service.)1 Enter amount of adjusted gross income that you expect in 2019 . . . . . . . . . . . . 1

2

If you plan to itemize deductions on Schedule A (Form 1040), enter the estimated total of your deductions. See Pub. 505 for details. If you don’t plan to itemize deductions, enter the standarddeduction. (See the instructions on page 2 for the standard deduction amount, including additionalstandard deductions for age and blindness.) Note: There is no deduction for personal exemptionsfor 2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . 34 Tax. Figure your tax on line 3 by using the 2019 Tax Rate Schedule X, Y-1, Y-2, or Z on page 2. Do

not use any tax tables, worksheets, or schedules in the 2018 Form 1040 instructions . . . . . 45 Credits (child tax and higher education credits, credit for child and dependent care expenses, etc.) . 56 Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . 6

7

Estimated federal income tax withheld or to be withheld from other sources (including amounts withheld due to a prior Form W-4S) during 2019 or paid or to be paid with 2019 estimated tax payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . 89 Enter the number of sick pay payments you expect to receive this year to which this Form W-4S will

apply . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 910

Divide line 8 by line 9. Round to the nearest dollar. This is the amount that should be withheld fromeach sick pay payment. Be sure it meets the requirements for the amount that should be withheld, as explained under Amount to be withheld below. If it does, enter this amount on Form W-4S above 10

General InstructionsPurpose of form. Give this form to the third-party payer of your sick pay, such as an insurance company, if you want federal income tax withheld from the payments. You aren’t required to have federal income tax withheld from sick pay paid by a third party. However, if you choose to request such withholding, Internal Revenue Code sections 3402(o) and 6109 and their regulations require you to provide the information requested on this form. Don’t use this form if your employer (or its agent) makes the payments because employers are already required to withhold federal income tax from sick pay.Note: If you receive sick pay under a collective bargaining agreement, see your union representative or employer.Definition. Sick pay is a payment that you receive:• Under a plan to which your employer is a party, and• In place of wages for any period when you’re temporarily absent from work because of your sickness or injury.Amount to be withheld. Enter on this form the amount that you want withheld from each payment. The amount that you enter:• Must be in whole dollars (for example, $35, not $34.50).• Must be at least $4 per day, $20 per week, or $88 per month based on your payroll period.

• Must not reduce the net amount of each sick pay payment that you receive to less than $10.

For payments larger or smaller than a regular full payment of sick pay, the amount withheld will be in the same proportion as your regular withholding from sick pay. For example, if your regular full payment of $100 a week normally has $25 (25%) withheld, then $20 (25%) will be withheld from a partial payment of $80.Caution: You may be subject to a penalty if your tax payments during the year aren’t at least 90% of the tax shown on your tax return. For exceptions and details, see Pub. 505, Tax Withholding and Estimated Tax. You may pay tax during the year through withholding or estimated tax payments or both. To avoid a penalty, make sure that you have enough tax withheld or make estimated tax payments using Form 1040-ES, Estimated Tax for Individuals. You may estimate your federal income tax liability by using the worksheet above.Sign this form. Form W-4S is not valid unless you sign it.Statement of income tax withheld. After the end of the year, you’ll receive a Form W-2, Wage and Tax Statement, reporting the taxable sick pay paid and federal income tax withheld during the year. These amounts are reported to the Internal Revenue Service.

(continued on back)

For Paperwork Reduction Act Notice, see page 2. Cat. No. 10226E Form W-4S (2019)

Form W-4S (2019) Page 2

Changing your withholding. Form W-4S remains in effect until you change or revoke it. You may do this by giving a new Form W-4S or a written notice to the payer of your sick pay. To revoke your previous Form W-4S, complete a new Form W-4S and write “Revoked” in the money amount box, sign it, and give it to the payer.

Specific Instructions for WorksheetYou may use the worksheet on page 1 to estimate the amount of federal income tax that you want withheld from each sick pay payment. Use your tax return for last year and the worksheet as a basis for estimating your tax, tax credits, and withholding for this year.

You may not want to use Form W-4S if you already have your total tax covered by estimated tax payments or other withholding.

If you expect to file a joint return, be sure to include the income, deductions, credits, and payments of both yourself and your spouse in figuring the amount you want withheld.Caution: If any of the amounts on the worksheet change after you give Form W-4S to the payer, you should use a new Form W-4S to request a change in the amount withheld.

Line 2—DeductionsItemized deductions. Itemized deductions include qualifying home mortgage interest, charitable contributions, state and local taxes (up to $10,000), and medical expenses in excess of 10% of your adjusted gross income. See Pub. 505 for details.Standard deduction. For 2019, the standard deduction amounts are: Standard Filing Status Deduction

Married filing jointly or qualifying widow(er) . . . . . $24,400*Head of household . . . . . . . . . . . . $18,350*Single or Married filing separately . . . . . . . . $12,200** If you’re age 65 or older or blind, add to the standard deduction amount the additional amount that applies to you as shown in the next paragraph. If you can be claimed as a dependent on another person’s return, see Limited standard deduction for dependents, later.

Additional standard deduction for the elderly or blind. An additional standard deduction of $1,300 is allowed for a married individual (filing jointly or separately) or qualifying widow(er) who is 65 or older or blind, $2,600 if 65 or older and blind. If both spouses are 65 or older or blind, an additional $2,600 is allowed on a joint return ($2,600 on a separate return if your spouse is your dependent). If both spouses are 65 or older and blind, an additional $5,200 is allowed on a joint return ($5,200 on a separate return if your spouse is your dependent). An additional $1,650 is allowed for an unmarried individual (single or head of household) who is 65 or older or blind, $3,300 if 65 or older and blind. See Pub. 505, Worksheet 2-4.

Limited standard deduction for dependents. If you are a dependent of another person, your standard deduction is the greater of (a) $1,100 or (b) your earned income plus $350 (up to the regular standard deduction for your filing status). If you’re 65 or older or blind, see Pub. 505 for additional amounts that you may claim.

Certain individuals not eligible for standard deduction. For the following individuals, the standard deduction is zero.• A married individual filing a separate return if either spouse itemizes deductions.• A nonresident alien individual.• An individual filing a return for a period of less than 12 months because of a change in his or her annual accounting period.

Line 5—CreditsInclude on this line any tax credits that you’re entitled to claim, such as the child tax and higher education credits, credit for child and dependent care expenses, earned income credit, or credit for the elderly or the disabled. See Pub. 505, Table 1-2, for credits.

Line 7—Tax Withholding and Estimated TaxEnter the federal income tax that you expect will be withheld this year on income other than sick pay and any payments made or to be made with 2019 estimated tax payments. Include any federal income tax already withheld or to be withheld from wages and pensions.

2019 Tax Rate SchedulesSchedule X—SingleIf line 3 is:

Over—But not over—

The tax is: of the amount over—

$0 $9,700 $0 + 10% $09,700 39,475 970.00 + 12% 9,700

39,475 84,200 4,543.00 + 22% 39,47584,200 160,725 14,382.50 + 24% 84,200

160,725 204,100 32,748.50 + 32% 160,725204,100 510,300 46,628.50 + 35% 204,100510,300 and greater 153,798.50 + 37% 510,300

Schedule Z—Head of householdIf line 3 is:

Over—But not over—

The tax is: of the amount over—

$0 $13,850 $0 + 10% $013,850 52,850 1,385 + 12% 13,85052,850 84,200 6,065 + 22% 52,85084,200 160,700 12,962 + 24% 84,200

160,700 204,100 31,322 + 32% 160,700204,100 510,300 45,210 + 35% 204,100510,300 and greater 152,380 + 37% 510,300

Schedule Y-1—Married filing jointly or Qualifying widow(er)If line 3 is:

Over—But not over—

The tax is: of the amount over—

$0 $19,400 $0 + 10% $019,400 78,950 1,940 + 12% 19,40078,950 168,400 9,086 + 22% 78,950

168,400 321,450 28,765 + 24% 168,400321,450 408,200 65,497 + 32% 321,450408,200 612,350 93,257 + 35% 408,200612,350 and greater 164,709.50 + 37% 612,350

Schedule Y-2—Married filing separatelyIf line 3 is:

Over—But not over—

The tax is: of the amount over—

$0 $9,700 $0 + 10% $09,700 39,475 970.00 + 12% 9,700

39,475 84,200 4,543.00 + 22% 39,47584,200 160,725 14,382.50 + 24% 84,200

160,725 204,100 32,748.50 + 32% 160,725204,100 306,175 46,628.50 + 35% 204,100306,175 and greater 82,354.75 + 37% 306,175

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue

law. Generally, tax returns and return information are confidential, as required by Code section 6103.

The average time and expenses required to complete and file this form will vary depending on individual circumstances. For estimated averages, see the instructions for your income tax return.

If you have suggestions for making this form simpler, we would be happy to hear from you. See the instructions for your income tax return.

SI 9571 1 of 2 (10/14)

Section III. Request and Agreement with Standard Insurance Company (The Standard)• IauthorizeandrequestTheStandardtoelectronicallydepositmydisabilitybenefitpaymentsintomybankaccount

indicatedonthisform.IauthorizeTheStandardtocontactmybanktoverifytheinformationonthisrequestformandresolveproblemsrelatedtoelectronicdepositsorerrorsindeposits.

• IunderstandImayreceivebenefitchecksviaU.S.MailforuptotwobenefitperiodsaftersubmittingthisforminordertoallowthenecessarytransactionstotakeplacebetweenTheStandardandmyfinancialinstitution.Iunderstandthatnotallfinancialinstitutionsupdatetheirrecordsatthesametime,somydepositmaynotbepostedtomyaccountuntiltheeveningofthepaymentduedate.IunderstandthattheremaybeadelayinreceivingmybenefitselectronicallyifIdonotprovideaccurateandnecessaryinformationonthisform.

• I agree tonotifyTheStandardas soonas reasonablypossibleof any changes tomydesignatedbankaccount.Thisagreementwillterminateifmydesignatedbankaccountisclosedortheaccountnumberischanged.Ifthisagreementterminates,IunderstandthatmydisabilitybenefitpaymentswillbepaidbycheckviaU.S.MailuntilanewEFTrequestissuccessfullysubmitted.AnyfutureEFTrequestssubmittedtoTheStandardwillreplacethisrequest.

• IunderstandthatdepositofmydisabilitybenefitsintomyaccountwillsatisfyTheStandard’sobligationtopaybenefitstome,andthatmyentitlementtobenefitsissubjecttothetermsofmypolicywithTheStandard.

• Iacknowledgethatelectronicdepositsunderthisrequestaremadeinpaymentofdisabilitybenefitsbecauseofmyinabilitytowork.WitheachdepositIacceptintomyaccount,IamcertifyingthatIhavemadenofalseclaimsorstatementsorconcealed any material fact.

• ImayterminatethisauthorizationatanytimebycontactingTheStandard.Iunderstandthatdiscontinuationofmyelectronicpaymentsmaytakeuptotwobenefitperiodstotakeeffect,andoncethechangeoccursIwillreceiveanyremainingbenefitsduetomebycheckunlessIselectanotherpaymentoption.

Bysigningthisdocument,IauthorizeandrequestTheStandardtoelectronicallydepositmydisabilitybenefitpaymentsintomybankaccountindicatedonthisform.

Automatic Electronic Deposit (EFT)Disability Payment Option Request

Standard Insurance CompanyPO Box 2800 Portland OR 97208-2800

Full Name Phone Number Claim Number(s)

Address City State ZIP Code

Section II. Banking Information Note: there may be a delay in receiving your benefits electronically if you do not provide accurate and necessary information on this form.

As proof of account ownership, I have attached an official bank-printed document with the following:(Seereverseforacceptabletypesofdocumentation) - Claimant’s name - Account number - Routing number - Financial institution’s logo

Type of account Account number Routing number w Checking w Savings

Section I. Claimant Information

Claimant Signature Date

Please sign and return this form with documentation proving account ownership. See FAQ on page two for more information.

FOR INTERNAL USE ONLY

Analyst: Routing code:

SI 9571 2 of 2 (10/14)

Automatic Electronic Deposit (EFT)Disability Payment Option Request

Standard Insurance CompanyPO Box 2800 Portland OR 97208-2800

FAQ

What type of banking documentation do I need to provide?

Astheclaimant,youmustprovidebankingdocumentationthatshowsproofofaccountownership. Examplesofapprovedformsofdocumentation:

• Voidedcheckwithyournameprintedonit• Directdepositenrollmentformpreprintedbyyourfinancialinstitution• Letterfromyourfinancialinstitutiononofficialletterhead

Bankingdocumentationmustbepreprintedwithyouraccountnumber,routingnumberandyourfulllegalname,aswellasyourfinancialinstitution’slogo.Wecannotacceptbankingdocumentationwithhandwrittenaccountinformation. Wecannotacceptdepositslipsduetoroutingnumberinconsistencies.

What if The Standard has a different name for me than my banking documentation? BankingdocumentationneedstohavethesamenamethatisprintedonclaimdocumentsorlettersreceivedfromTheStandard.Pleasecontactusifyournamehaschanged.

What if I don’t have a check with my full legal name printed on it? Contactyourfinancialinstitutionandaskforprinteddocumentationonofficialletterheadoraformthatincludesyouraccountnumber,routingnumberandfulllegalname.Wewillnotacceptstartercheckswithoutyournameprintedonthemorchecksthatonlyshowyourinitials.

My financial institution is an online bank and I don’t have checks. What can I do? Contactyourbank’scustomerservicedepartmentandaskforaletterorformwithyourname,fullaccountnumberandroutingnumber on letterhead.

What happens if my banking information changes (for instance, because of a bank merger, new account, etc.)? ContactTheStandardandaskforanewEFTformtofillout.Youwillneedtoprovidebankingdocumentationifyourbankinginformationchanges.

TheStandardwillneeddocumentationsupportingthatyouhavelegalauthoritytosignthisformonbehalfoftheclaimant,suchasacopyofthePOAorcourtorderandlettersofguardianshiporconservatorship.Inaddition,thebankdocumentationyousubmitmustshowthattheclaimantisanowneroftheaccount.

I am a personal representative of the claimant, such as an attorney-in-fact under a power of attorney (POA) or legal guardian or conservator. What do I need to submit?