CIRCULAR TO ALERT STEEL SHAREHOLDERS - jse.co.za · Claw-back Offer may be affected by the laws of...

Transcript of CIRCULAR TO ALERT STEEL SHAREHOLDERS - jse.co.za · Claw-back Offer may be affected by the laws of...

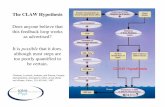

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION

The definitions commencing on page 3 of this Circular have been used on this front cover.

ACTION REQUIRED

• Detailed action required by shareholders is set out on page 2 of this Circular.

DISCLAIMER• Alert Steel does not accept responsibility and will not be held liable for any failure on the part of the CSDP or broker of a dematerialised shareholder to

notify such Shareholder of the details of this Circular.• The summary of the Exchange Control Regulations detailed in paragraph 11 of this circular is intended only as a guide and is therefore not a

comprehensive statement of the Exchange Control Regulations. Alert Steel shareholders who are in any doubt as to the appropriate course of action to take should consult their professional advisors.

JURISDICTION

All transactions arising from the provisions of this circular and the form of instruction shall be governed by and be subject to the laws of South Africa. The Claw-back Offer may be affected by the laws of the relevant jurisdictions of foreign shareholders. Such foreign shareholders should inform themselves about and observe any applicable legal requirements of such jurisdictions in relation to all aspects of this circular that may affect them, including the Claw-back Offer. It is the responsibility of any foreign shareholder to satisfy himself/herself as to the full observation of the laws and regulatory requirements of the relevant jurisdiction in connection with the Claw-back offer, including the obtaining of any governmental, exchange control or other consent or the making of any filings which may be required, the compliance with other necessary formalities, the payment of any issue, transfer or other taxes or requisite payments due in such jurisdiction. The Claw-back Offer is further subject to any other applicable laws and regulations, including the Exchange Control Regulations. Any foreign shareholder who is in doubt as to his/her position, including without limitation his/her tax status, should consult an appropriate independent professional adviser in the relevant jurisdiction without delay.

The rights that are represented by the form of instruction in respect of the Letters of allocation are valuable and may be sold on the JSE. Letters of allocation can, however, only be traded in dematerialised form and accordingly, all Letters of allocation have been issued in dematerialised form.

Alert Steel Holdings LimitedIncorporated in the Republic of South Africa

(Registration number 1999/009701/06)Share code: AET ISIN: ZAE000170395

(“Alert Steel” or “the company”)

CIRCULAR TO ALERT STEEL SHAREHOLDERSregarding:

• a renounceable Claw-back offer to Alert Steel shareholders of 48 000 000 Claw-back shares of no par value in the share capital of Alert Steel at a Subscription Price of 200 cents per Claw-back share, in the ratio of 92.44345 Claw-back shares for every 100 Alert Steel shares held at the close of trade on Friday, 14 February 2014;

and enclosing:

• a form of instruction in respect of a Letter of allocation providing for the acceptance and/or renunciation and/or sale of all or part of the Claw-back Entitlement(s) embodied in the Letter of allocation in terms thereof for the use of certificated shareholders only; and

• revised listings particulars.

Claw-back offer opens at 09:00 on Monday, 17 February 2014Claw-back offer closes at 12:00 on Friday, 7 March 2014An English copy of this circular, together with the Letter of allocation and the documents referred to in paragraph 23 of this circular, have been approved by the JSE as required by section 95(1)(k) of the Companies Act.

Designated Adviser Auditors Attorneys

Date of issue: 17 February 2014This circular is available in English only. Copies of this circular may be obtained from the office of the company from the date of issue until Friday, 28 February 2014, or it can be downloaded from the company’s website at www.alertsteel.co.za from Monday, 17 February 2014.

CORPORATE INFORMATION

Registered office of Alert Steel

Corner of Engelbrecht and Lanham StreetsEast LynnePretoria, 0186(PO Box 29607, Sunnyside, 0132)Telephone: (012) 800 0000Facsimile: (012) 800 0013

Transfer secretaries

Computershare Investor Services Proprietary Limited(Registration number 2004/003647/07)Ground Floor70 Marshall StreetJohannesburg, 2001(PO Box 61051, Marshalltown, 2107)Telephone: (011) 370 5000Facsimile: (011) 688 5210

Reporting accountants

KPMG Incorporated(Registration number 1999/021543/21)KPMG Crescent85 Empire RoadParktown, 2193(Private bag X9, Parkview, 2122)Telephone: (011) 647 7111Facsimile: (011) 647 8000

Date of incorporation: 3 July 2003

Place: Pretoria

Company secretary

M Pretorius (BCom (Law) LLB)Corner of Engelbrecht and Lanham StreetsEast LynnePretoria, 0186(PO Box 29607, Sunnyside, 0132)Telephone: (012) 800 0000Facsimile: 086 696 1270

Designated Adviser

Exchange Sponsors (2008) Proprietary Limited(Registration number 2008/019553/07)44a Boundary RoadInanda, 2196(PO Box 411216, Craighall, 2024)Telephone: (011) 880 2113Facsimile: (011) 447 4824

Attorneys

Fluxmans Inc.(Registration number 2000/024775/21)11 Bierman AvenueRosebank, 2196Telephone: (011) 328 1725Facsimile: (011) 880 2261

1

TABLE OF CONTENTS

Page

COrpOrATE iNFOrmATiON Inside front cover

ACTiON rEquirEd By ShArEhOLdErS 2

dEFiNiTiONS 3

SALiENT dATES ANd TimES 6

CirCuLAr TO ShArEhOLdErS1. Introduction 72. Purpose and rationale of the Claw-back offer 83. Terms of the Claw-back offer 84. Directors and executive management 95. Major and controlling shareholders 96. JSE listings 107. Financial information 108. Share capital 119. Claw-back Entitlement 1110. Procedure for acceptance, renunciation and sale of Claw-back Entitlement 1211. Exchange Control Regulations 1412. Tax consequences of Claw-back offer 1613. Jurisdiction 1614. Opinion and recommendations 1615. Directors’ authority to issue shares 1616. Directors’ responsibility statement 1717. Litigation statement 1718. Corporate governance 1719. Material contracts 1720. Expenses of the Claw-back offer 1721. Consents 1722. Material changes 1823. Documents and consents available for inspection 18

Annexure 1 Proforma consolidated financial information of Alert Steel 19Annexure 2 Independent reporting accountants’ report on the compilation of proforma

consolidated financial information 22Annexure 3 Table of Entitlement 24Annexure 4 Price history of Alert Steel shares on the JSE 25Annexure 5 Corporate Governance 26Annexure 6 Information relating to the directors 36Annexure 7 Information on the Subscriber 40

Revised listing particulars 41

LETTEr OF ALLOCATiON Enclosed

2

ACTiON rEquirEd By ShArEhOLdErS

The definitions commencing on page 3 of this circular apply to this section.

1. dEmATEriALiSEd ShArEhOLdErS

If you hold Alert Steel shares in dematerialised form (including where you have elected own-name registration) you will not receive a printed form of instruction.

Your CSDP or broker will contact you to ascertain:

• whether you wish to follow all or some of your Entitlements in terms of the Claw-back offer and in respect of how many Claw-back offer shares;

• whether you wish your CSDP or broker to endeavour to procure the sale of your Entitlements on the JSE on your behalf and if so, in respect of how many rights;

• whether you wish to renounce your Entitlements and if so, how many Entitlements you wish to renounce and the details of the renouncee; or

• whether you wish for your Entitlements in respect of the Claw-back offer to lapse.

Your CSDP or broker will credit your account with the number of Entitlements to which you are entitled in terms of the Claw-back offer. If you do not hear from your CSDP or broker, you should contact them and furnish them with your instructions. If your CSDP or broker does not obtain instructions from you, they are obliged to act in terms of the custody agreement entered into between you and them.

2. CErTiFiCATEd ShArEhOLdErS

A form of instruction is enclosed for use by certificated shareholders only. The rights in respect of such forms are renounceable and can be sold on the JSE.

If you hold your Alert Steel shares in certificated form and you wish to subscribe for some or all of the Claw-back offer shares allocated to you, you must complete the form of instruction enclosed herewith in accordance with the instructions contained therein and lodge it, together with payment for the amount due in respect thereof, with the transfer secretaries, whose details are set out on the inside front cover of this circular, by not later than 12:00 on Friday, 7 March 2014.

If you do not wish to subscribe for all or some of the Claw-back offer shares allocated to you, you may sell or renounce your Entitlements or allow them to lapse. In such event, you must complete the relevant section of the form of instruction and return it to the transfer secretaries to be received not later than 12:00 on Friday, 28 February 2014, if you wish to sell, and by no later than 12:00 on Friday, 7 March 2014, if you renounce your Entitlements. If you intend to allow your Entitlements to lapse, you need not take any action.

3. iF yOu hAVE diSpOSEd OF yOur ShArES

If you have disposed of your Alert Steel shares, please forward this circular to the purchaser of such shares or to the broker or agent through whom the disposal was effected.

Note:

If you are in any doubt as to the action you should take, please consult your CSDP, broker, banker, legal advisor, accountant or other professional advisor immediately. Alert Steel does not accept responsibility and will not be held liable for any failure on the part of the CSDP or broker of a dematerialised shareholder to notify such shareholder of the Claw-back offer.

3

dEFiNiTiONS

In this circular, unless otherwise stated or the context so requires, the words in the first column have the meanings stated opposite them in the second column, words in the singular shall include the plural and vice versa,words denoting one gender include the other and expressions denoting natural persons include juristic persons and associations of persons:

“Alert Steel” or “the company” Alert Steel Holdings Limited (Registration number 2003/005144/06), a public company incorporated in accordance with the laws of South Africa and the shares of which are listed on the Altx of the JSE;

“Alert Steel shareholders” or “shareholders”

the registered holders of Alert Steel shares as appearing on the Alert Steel register;

“Altx” the Alternative Exchange of the JSE;

“business day” any day other than a Saturday, Sunday or public holiday in the Republic;

“Cannistraro” Cannistraro Investments 282 Proprietary Limited (Registration number 2011/008136/07), a private company incorporated in accordance with the laws of South Africa, the sole shareholder of which is Mr Rayhaan Hassim;

“Capital Africa Steel” or “CAS” Capital Africa Steel Proprietary Limited (Registration number 2003/008668/07), a private company incorporated in accordance with the laws of South Africa, the shares in which are owned by WBHO Limited and Brait Private Equity;

“certificated shareholders” Alert Steel shareholders who have not dematerialised their Alert Steel share certificates in terms of the Strate system;

“circular” all the documents and annexures contained in this bound circular, dated 17 February 2014, including the form of instruction;

“Claw-back offer” a renounceable Claw-back offer to Alert Steel shareholders of 48 000 000 Claw-back shares at a Subscription Price of 200 cents per Claw-back share in the ratio of 92.44345 Claw-back shares for every 100 ordinary shares held at the close of trade on the Record Date;

“Claw-back shares” 48 000 000 new ordinary shares which are the subject of the Claw-back offer;

“common monetary area” South Africa, the Republic of Namibia and the Kingdoms of Lesotho and Swaziland;

“CSDP” Central Securities Depository Participant accepted as a participant in terms of the Financial Markets Act, 2012 (Act 19 of 2012), as amended, appointed by an individual shareholder for purposes of the dematerialisation of documents of title for purposes of incorporation into the Strate system;

“Companies Act ” the Companies Act, 2008 (Act 71 of 2008), as amended;

“dematerialisation” the process by which certificated shares are converted to an electronic form as uncertificated shares and recorded in the sub-register of shareholders maintained by a CSDP;

“dematerialised shareholders” Alert Steel shareholders who hold shares which have been incorporated into the Strate system and which are no longer evidenced by physical documents of title in terms of the Custody and Administration of Securities Act, 1992 (Act 85 of 1992), as amended;

4

“directors” or “board of directors”

the board of directors of Alert Steel, further details of whom appear in Annexure 6 of this circular;

“Designated Adviser” Exchange Sponsors (2008) Proprietary Limited (Registration number 2008/019553/07), a private company registered and incorporated under the laws of South Africa, the Designated Advisor of Alert Steel;

“emigrants” former residents of the common monetary area;

“Entitlement” or “Claw-back Entitlement(s)”

a Shareholder’s Entitlement to subscribe for Claw-back shares in the ratio of 92.44345 Claw-back shares for every 100 ordinary shares held on the Record Date, which Entitlement arises as a result of the Claw-back offer;

“form of instruction” form of instruction (attached to this circular in the case of certificated shareholders) in respect of the Letters of allocation reflecting the Entitlement of certificated shareholders and on which certificated shareholders are required to indicate whether they wish to take up, sell or renounce their Claw-back Entitlement;

“Group” Alert Steel and its subsidiaries, all incorporated in accordance with the laws of South Africa;

“incorporation” the date of incorporation of Alert Steel, being 3 July 2003;

“ independent reporting accountants” and/or “auditors”

KPMG Incorporated. (Registration number 1999/021543/21), a company incorporated in accordance with the laws of South Africa;

“JSE” the JSE Limited (Registration number 2005/022939/06), a limited liability public company incorporated in accordance with the laws of South Africa which operates a securities exchange licensed in terms of the Financial Markets Act, 2012 (Act 19 of 2012);

“the last practicable date” the last practicable date prior to the finalisation of this circular, which date was 15 February 2014;

“Listings Requirements” the Listings Requirements of the JSE, as amended from time to time;

“Letter/s of allocation” or “LAs” renounceable (nil paid) letters of allocation to be issued to Alert Steel shareholders pursuant to the Claw-back offer, conferring a Claw-back Entitlement on the holder to subscribe for Claw-back shares in terms of the Claw-back offer;

“Record Date” last date for Alert Steel shareholders to be recorded in the register in order to participate in the Claw-back offer, being the close of trade on Friday, 14 February 2014;

“ Revised Build Kwik Sale Agreement”

the Sale Agreement between Build Kwik Wholesalers Proprietary Limited and Alert Steel Proprietary Limited, dated 27 November 2013, for the purchase of furniture, fixtures, fittings and other moveable assets for R6 300 000;

“SARS” the South African Revenue Services;

“SENS” The Stock Exchange News Service;

“shares” the issued ordinary no par value shares in the share capital of the company;

“South Africa” the Republic of South Africa;

“Strate” the settlement and clearing system used by the JSE, managed by Strate Limited (Registration number 1998/022242/06), a company incorporated in accordance with the laws of South Africa;

5

“the Subscriber” Cannistraro Investments 282 Proprietary Limited (Registration number 2011/008136/07), a private company incorporated in accordance with the laws of South Africa and which is 100% owned by Mr Rayhaan Hassim;

“Subscription Agreement” the Subscription Agreement dated 27 November 2013, entered into between Alert Steel and the Subscriber in terms of which the Subscriber has, subject to the rights of Alert Steel shareholders in terms of the Claw-back offer, agreed to subscribe for 48 000 000 new ordinary shares of no par value in the share capital of Alert Steel at a Subscription Price of 200 cents per Claw-back share for the total amount of R96 000 000 (ninety six million Rand);

“Subscription Amount” the amount of R96 000 000 (ninety six million Rand) payable by the Subscriber for the Claw-back shares in terms of the Subscription Agreement;

“Subscription Price” a subscription price of 200 cents per Claw-back share;

“Southern Palace” Southern Palace Investments 265 Proprietary Limited (Registration number 2005/005086/07), a company duly registered and incorporated with limited liability in accordance with the laws of South Africa and which is 100% owned by Mr Rayhaan Hassim;

“transfer secretaries” Computershare Investor Services Proprietary Limited (Registration number 2004/003647/07), a private company duly incorporated in accordance with the laws of South Africa;

“VAT” value-added tax levied in terms of the Value-Added Tax Act, 1991 (Act 89 of 1991), as amended from time to time; and

“ZAR” or “Rand” or “R” South African Rand.

6

SALiENT dATES ANd TimES

2014

Last day to trade in Alert Steel shares in order to qualify to participate in the Claw-back offer (cumEntitlement) on Friday, 7 February

Listing of Letters of allocation on the JSE under the JSE code AETN and ISIN ZAE000187357 at commencement of trading on Monday,10 February

Allotment of Claw-back shares to Subscriber Monday, 10 February

record date for participation in the Claw-back offer at the close of trade on Friday, 14 February

Claw-back offer Circular and form of instruction posted to shareholders, where applicable Monday, 17 February

Claw-back offer opens at commencement of trading on Monday, 17 February

Dematerialised shareholders’ accounts at their CSDP or broker automatically credited with their Entitlement Monday, 17 February

Certificated shareholders’ Entitlements will be credited to an account held with the transfer secretaries Monday, 17 February

Last day to trade in Letters of allocation on the JSE on Friday, 28 February

Trade in Claw-back shares commences Monday, 3 March

Claw-back offer closes – payments to be made and form of instruction in respect of Letters of allocation lodged by certificated shareholders by 12:00 (see note 5) on Friday, 7 March

record date for Letters of allocation Friday, 7 March

Claw-back shares not accepted in terms of the Claw-back offer issued to the Subscriber Monday, 10 March

Dematerialised shareholders’ accounts updated with Claw-back shares to the extent accepted and debited with the relevant costs by their CSDP or broker and new Alert Steel share certificates posted to certificated shareholders (see note 5) on Monday, 10 March

Results of Claw-back offer announcement released on SENS on or about Monday, 10 March

Notes:

1. Dematerialised shareholders are required to notify their duly appointed CSDP or broker of their acceptance or otherwise of the Claw-back offer in the manner and time stipulated in the agreement governing the relationship between such shareholder and their CSDP or broker.

2. All times indicated are South African times unless otherwise stated.

3. Share certificates may not be dematerialised or rematerialised between Monday, 10 February 2014, and Friday, 14 February 2014, both days inclusive.

4. The CSDP/broker accounts of dematerialised shareholders will be automatically credited with new Alert Steel shares to the extent to which they have accepted the Claw-back offer. Alert Steel share certificates will be posted, by registered post at the shareholders’ risk, to certificated shareholders in respect of the Claw-back shares which have been accepted.

5. CSDPs or brokers effect payment in respect of dematerialised shareholders on a delivery versus payment method.

7

Alert Steel holdings LimitedIncorporated in the Republic of South Africa

(Registration number 1999/009701/06)Share code: AET ISIN: ZAE000170395

(“Alert Steel” or “the company”)

directors

Non-executive

MM Patel(Independentnon-executivechairman)WP van der Merwe(Independentnon-executivedirector)BS Mahuma (Independentnon-executivedirector)AE Loonat (Independentnon-executivedirector)

Executive

PN Dodson(ChiefExecutiveOfficer)MSI Gani(ChiefFinancialOfficer)MJ Gani (ChiefOperatingOfficer)

All directors are South African.

CirCuLAr TO ALErT STEEL ShArEhOLdErS

1. iNTrOduCTiON

1.1 Shareholders of Alert Steel were informed on 4 February 2013 that Nedbank had assigned all of its rights and obligations under a 5-Year Term Loan Agreement, to Southern Palace.

1.2 On 8 February 2013, Cannistraro entered into an agreement with Capital Africa Steel, in terms of which Cannistraro agreed to acquire 47.5% of the shares in issue in Alert Steel from Capital Africa Steel for R6 million and also undertook to procure the release of Capital Africa Steel from a bank guarantee of R7.5 million. Therefore the aggregate purchase consideration in respect of the sale equated to a price of 54.58 cents per share.

1.3 On 15 February 2013, Cannistraro entered into the Nedbank Sale with Nedbank in terms of which Cannistraro agreed to acquire a further 19.78% of the shares in issue in Alert Steel from Nedbank for R1 million (and therefore at a purchase price of 9.72 cents per share).

On 11 April 2013, it was announced, inter alia, that Southern Palace informed Alert Steel that it had assigned the rights and obligations which it had acquired from Nedbank (referred to in paragraph 1.1 above) to Cannistraro, with effect from 27 February 2013.

1.4 On 15 July 2013, Cannistraro made an unconditional mandatory offer to all of the shareholders other than CAS and Nedbank at 54.58 cents per share. 239 189 ordinary shares at an offer price of 54.58 cents were acquired by Cannistraro from Alert Steel shareholders in pursuance of such mandatory offer.

1.5 On 11 April 2013, it was announced that Alert Steel had decided to change the previously announced subscription and claw-back offer to a specific issue of shares for cash to Cannistraro. The Specific Issue Agreement was concluded on the 19 August 2013, subject to the fulfilment of certain conditions precedent.

1.6 On 17 September 2013, Alert Steel issued a circular to shareholders for the approval of interalia, the specific issue of 48 000 000 shares to Cannistraro at 200 cents per share for cash to raise R96 million. At the general meeting of shareholders to approve the resolutions pertaining, inter alia, to the specific issue, the resolutions were withdrawn and not voted on by shareholders.

8

1.7 In an announcement released on SENS on 28 November 2013, shareholders were advised that the company and the Subscriber entered into the Subscription Agreement which provides for the subscription by the Subscriber of 48 000 000 new ordinary shares of no par value in the share capital of Alert Steel at a Subscription Price of 200 cents per share for the total Subscription Amount, which subscription is subject to the rights of Alert Steel shareholders in terms of the Claw-back offer.

1.8 The Subscription Price represents a premium of approximately 30% to the 30-day volume weighted average share price of Alert Steel over the 30 days ended 11 April 2013, which was the date on which the issue price for the specific issue of shares for cash as announced on SENS was agreed upon by the board of Alert Steel. The Subscription Price represents a discount of approximately 28% to the 30-day volume weighted average share price of Alert Steel over the 30 days ended 28 November 2013, which was the date on which the Claw-back offer was announced on SENS. There is no subscription or other fee payable to the Subscriber.

1.9 Alert Steel has received the Subscription Amount from the Subscriber. The amount is held in Alert Steel’s bank account.

1.10 The attached form of instruction in respect of the Letters of allocation contains details of the Claw-back Entitlement to which certificated shareholders are entitled, as well as the procedures for acceptance, sale or renunciation of that Claw-back Entitlement.

1.11 Dematerialised shareholders will be advised by their CSDP or broker of the Claw-back Entitlement to which they are entitled as well as the procedure for acceptance, sale or renunciation of those Claw-back Entitlement.

1.12 The JSE has approved the listings of the:

1.12.1 Claw-back shares from the commencement of trade on Monday, 3 March 2014; and

1.12.2 Letters of allocation from the commencement of trade on Monday, 10 February 2014, until the close of trade on Friday, 28 February 2014, both days inclusive.

1.13 Upon allotment and issue, the Claw-back shares will rank pari passu in all respects including dividends with the ordinary shares currently in issue.

1.14 The Claw-back shares will not have any convertibility or redemption provisions.

1.15 The purpose of this circular is to furnish shareholders with relevant information concerning the Claw-back offer and the implications thereof in accordance with the Listings Requirements and the Companies Act. Included in the circular are revised listing particulars as the Claw-back offer of 48 000 000 shares equates to more than 50% of the shares in issue.

2. purpOSE ANd rATiONALE OF ThE CLAW-BACK OFFEr

2.1 The purpose of the Claw-back offer is to redeem debt owing by Alert Steel to Cannistraro. This will be redeemed from the subscription amount received from the Claw-back offer. Refer to paragraph 1.9 above.

2.2 The Claw-back shares, upon their issue, will be issued under the general authority of directors to issue unissued, but authorised shares for cash which was authorised at the annual general meeting of shareholders held on 15 November 2013.

2.3 In terms of a special resolution passed on 9 January 2014, shareholders approved the issue of 48 000 000 new ordinary no par value shares at 200 cents per ordinary share in terms of section 41(3) of the Companies Act (which represent more than 30% of the shares in issue prior to such issue) to enable the company to implement the Claw-back offer.

3. TErmS OF ThE CLAW-BACK OFFEr

3.1 particulars of the Claw-back offer

3.1.1 Alert Steel shareholders and/or their renouncees are hereby offered for subscription, by way of a renounceable Claw-back offer, a total of 48 000 000 Claw-back shares at a Subscription Price of 200 cents per Claw-back share in the ratio of 92.44345 Claw-back shares for every 100 ordinary shares held in Alert Steel at the close of trade on the Record Date, upon the terms and conditions set out in this circular.

9

3.1.2 The issue by the company of the Subscription Shares to be issued by the company in terms of the Claw-back offer was approved by the shareholders at the general meeting held on 9 January 2014, in accordance with the provisions of section 41(3) of the Act.

3.1.3 The Subscription Price is payable in ZAR and in full upon acceptance by certificated shareholders, or on a delivery versus payment basis by the CSDP or broker of dematerialised shareholders who have accepted the Claw-back offer.

3.1.4 Holders of dematerialised shares who wish to accept the Claw-back offer should ensure that the necessary funds are deposited with the relevant CSDP or broker.

3.1.5 The Subscription Price represents a premium of approximately 30% to the 30-day volume weighted average share price of Alert Steel shares over the 30-day period ended on 11 April 2013, which was the date on which the issue price for the specific issue of shares for cash as announced on SENS was agreed upon by the board of Alert Steel.

3.1.6 Alert Steel shareholders (recorded in the register at the close of trade on the Record Date) or their renouncees in terms of the Claw-back offer will be entitled to participate in the Claw-back offer. The Letters of allocation may only be traded in dematerialised form and, accordingly, Alert Steel has issued all Letters of allocation in dematerialised form.

3.1.7 The Claw-back shares issued to the Subscriber on Monday, 10 February 2014 will be issued in certificated format and held by the transfer secretaries.

3.2 Opening and closing dates of the Claw-back offer

The Claw-back offer will open at the commencement of trade on Monday, 17 February 2014 and will close at 12:00 on Friday, 7 March 2014.

3.3 Excess applications

The Claw-back offer does not include the right for shareholders to apply for excess Claw-back offer shares.

4. dirECTOrS ANd EXECuTiVE mANAGEmENT

Details of the directors and executive management, including the appointment, remuneration, borrowing powers of directors, and director’s interests and declarations are set out in Annexure 6 to this circular.

5. mAJOr ANd CONTrOLLiNG ShArEhOLdErS

Set out below are the names of those shareholders that, directly or indirectly, are beneficially interested in 5% or more of the total shares in the company in issue at the last practicable date:

Name %

Cannistraro 67.35WF&JC Familie Trust 11.70

5.1 Should no shareholder, apart from Cannistraro, Claw-back any of the Claw-back shares, resulting in the Subscriber subscribing for all the Claw-back shares, the shareholding of Cannistraro will increase as a result of the implementation of the Claw-back offer as follows:

Number of shares

percentage shareholding

%

Cannistraro before Claw-back offer 35 021 939 67.35Claw-back offer 48 000 000

Cannistraro after Claw-back offer* 83 021 939 83.02

Total shares in issue after Claw-back offer 99 999 636 100

* BasedontheassumptionthatnoneoftheshareholderswillfollowtheirEntitlementsintermsoftheClaw-backoffer.

10

5.2 Should all shareholders, including Cannistraro, follow their Entitlements in terms of the Claw-back, the percentage shareholding of Cannistraro will remain the same as a result of the implementation of the Claw-back offer as follows:

Number of shares

percentage shareholding

%

Cannistraro before Claw-back offer 35 021 939 67.35Claw-back offer 48 000 000

Cannistraro after Claw-back offer* 67 349 939 67.35

Total shares in issue after Claw-back offer 99 999 636 100

* Based on the assumption that all of the shareholders including Cannistraro will follow theirEntitlementsintermsoftheClaw-backoffer.

There will not be a change in the controlling shareholder of Alert Steel resulting from the Claw-back offer, which will be Cannistraro both before and after the implementation of the Claw-back offer.

Insofar as the directors of Alert Steel are aware, no other shareholder will hold, directly or indirectly, 5% or more of the issued share capital of Alert Steel following the Claw-back offer save for WF&JC Familie Trust who will own 6.08% of the issued shares should it not follow its Entitlement in terms of the Claw-back offer.

6. JSE LiSTiNGS

The JSE has granted listings for the Letters of allocation and the Claw-back shares as follows:

6.1 48 000 000 new Alert Steel shares will be issued and listed with effect from the commencement of business on Monday, 3 March 2014;

6.2 Letters of allocation in respect of 48 000 000 new Alert Steel shares will be listed from the commencement of business on Monday, 10 February 2014, to close of business on Friday, 28 February 2014, both days inclusive; and

6.3 as the Claw-back offer is fully subscribed, no minimum subscription is required.

7. FiNANCiAL iNFOrmATiON

The table below sets out the summary of the proforma financial effects of the Claw-back offer on Alert Steel’s, on basic loss, headline loss, net asset value and net tangible asset value per share.

The summary of the proforma financial effects have been prepared to illustrate the impact of the Claw-back offer on the audited published financial information of Alert Steel for the year ended 30 June 2013, had the Claw-back offer occurred on 1 July 2012 for the purpose of the statement of comprehensive income and on 30 June 2013 for the purpose of the statement of financial position.

The summary of the pro forma financial effects have been prepared using accounting policies that comply with International Financial Reporting Standards and that are consistent with those applied in the audited, published financial statements of Alert Steel for the year ended 30 June 2013.

The summary of the proforma financial effects set out below are the responsibility of the directors and have been prepared for illustrative purposes only and because of their nature may not fairly present the financial position, changes in equity, and results of operations or cash flows of Alert Steel after the Claw-back offer.

The reporting accountants’ report on the compilation of the proforma financial information of Alert Steel is set out in Annexure 2 to this circular.

11

“Before the Claw-back

offer” audited results for

the year ended

30 June 2013

Pro forma “After the

Claw-back offer”

unaudited 30 June 2013 % change

Basic loss per share (cents) (106.10) (44.77) 58Headline loss per share (cents) (132.90) (58.20) 56Net asset value per share (cents) (48.64) 72.00 248Net tangible asset value per share (cents) (60.50) 66.28 209Weighted average number of shares 48 238 204 96 238 204Shares in issue as at 30 June 2013 (including shares held by the share option scheme) 51 999 636 99 999 636

Detailed assumptions in respect of the above financial effects are included in Annexure 1 to this circular.

8. ShArE CApiTAL

The authorised stated capital and issued stated capital of Alert Steel, before and after the Claw-back offer, will be as follows:

Authorised stated capital – before the Claw-back offer rand

400 000 000 ordinary shares of no par value –

issued share capital – before51 999 636 ordinary no par value shares 51 999 636Less: 76 000 treasury shares (76 000)

Total issued share capital 51 923 636

Authorised share capital – after Claw-back offer rand400 000 000 ordinary shares of no par value –

issued share capital – after99 999 636 ordinary no par value shares 99 999 636Less: 76 000 treasury shares (76 000)

Total issued share capital 99 923 636

* TheJSEhasgrantedthelistingoftheClaw-backshares,subsequenttotheClaw-backoffer.

9. CLAW-BACK ENTiTLEmENT

9.1 Alert Steel shareholders will receive the right to subscribe for 92.44345 new Alert Steel shares for every 100 shares held on the initial Record Date, being Friday, 14 February 2014.

9.2 Alert Steel shareholders are entitled to participate in the Claw-back offer in accordance with Annexure 3 to this circular.

9.3 The allocation of Claw-back shares will be such that shareholders will not be allocated a fraction of a Claw-back share and as such, any Entitlement to receive a fraction of a Claw-back shares which:

9.3.1 is less than one-half of a Claw-back share, will be rounded down to the nearest whole number; and

9.3.2 is equal to or greater than one-half of a Claw-back share but less than a whole Claw-back share will be rounded up to the nearest whole number.

9.4 Certificated shareholders will have their Entitlements credited to a nominee account in electronic form, which will be administered by the transfer secretaries on their behalf. The enclosed form of instruction reflects the number of shares for which the certificated shareholder is entitled to subscribe. The procedure to be followed by certificated shareholders for the acceptance, sale or renunciation of their Entitlements is reflected on the form of instruction.

12

9.5 Dematerialised shareholders will have their Entitlements to subscribe for Claw-back shares credited in electronic form to their account held by their appointed CSDP or broker. The CSDP or broker will advise dematerialised shareholders of the procedure to be followed and the timing for the acceptance, sale, renunciation or lapsing of such Entitlements.

9.6 The Letters of allocation to which the forms of instruction relate are negotiable and can be sold on the JSE.

10. prOCEdurE FOr ACCEpTANCE, rENuNCiATiON ANd SALE OF CLAW-BACK ENTiTLEmENT

10.1 Certificated shareholders

The Claw-back Entitlement of certificated shareholders will be credited to an account in electronic form, which will be administered by the transfer secretaries on their behalf. The enclosed form of instruction reflects the number of Claw-back shares for which the certificated shareholder is entitled to subscribe. Any instruction by certificated shareholders to accept, sell or renounce all or part of the Claw-back shares allocated to them may only be made by means of the form of instruction.

10.1.1 Acceptance

Full details of the procedure for acceptance of the Claw-back offer by certificated shareholders are contained in the form of instruction enclosed with this circular. It should be noted that:

10.1.1.1 acceptances are irrevocable and may not be withdrawn;

10.1.1.2 acceptances may be made only by means of the form of instruction;

10.1.1.3 any instruction to sell or renounce all or part of the Claw-back shares may only be made by means of the form of instruction;

10.1.1.4 the properly completed form of instruction and a banker’s draft or cheque in ZAR crossed “not transferable” and “or bearer” deleted in payment of the Subscription Price payable for the relevant Claw-back shares must be received by the transfer secretaries at either of the addresses referred to in paragraph 10.1.3.2 by not later than 12:00 on Friday, 7 March 2014. No late postal acceptances will be accepted;

10.1.1.5 the form of instruction to take up the Claw-back Entitlement in question will be regarded as complete only when the cheque or banker’s draft has been cleared for payment;

10.1.1.6 such payment will constitute an irrevocable acceptance of the Claw-back offer upon the terms and conditions set out in this circular and in the form of instruction once the banker’s draft or cheque has been cleared for payment;

10.1.1.7 if any form of instruction is not received as set out above, the Claw-back offer will be deemed to have been declined and the Claw-back Entitlement to subscribe for the Claw-back shares in terms of the form of instruction will lapse regardless of who holds it; and

10.1.1.8 no acknowledgement of receipt will be given for a cheque or banker’s draft received in respect of the Claw-back offer.

10.1.2 Renunciation or sale of Claw-back Entitlement

10.1.2.1 Alert Steel has issued the LAs in dematerialised form and the electronic record for certificated shareholders is being maintained by the transfer secretaries.

10.1.2.2 The LAs to which the form of instruction relates are negotiable and can be traded on the JSE.

10.1.2.3 Certificated shareholders who do not wish to subscribe for all, or some of the Claw-back shares allocated to them as reflected in the form of instruction, may sell or renounce or lapse their Claw-back Entitlement.

10.1.2.4 In addition, certificated shareholders who wish to sell the Claw-back Entitlement allocated to them as reflected in the form of instruction must complete the relevant section of the form of instruction and return it to the transfer secretaries

13

in accordance with the instructions contained therein, to be received by not later than 12:00 on Friday, 7 March 2014.

10.1.2.5 The transfer secretaries will endeavour to procure the sale of the Claw-back Entitlement on the JSE on behalf of such certificated shareholders and will remit the proceeds in accordance with the payment instructions reflected in the form of instruction, net of brokerage charges and associated expenses. Neither the transfer secretaries nor the company nor any broker appointed by either of them will have any obligation or be responsible for any loss or damage whatsoever in relation to or arising out of the timing of such sales, the price obtained or any failure to sell such Claw-back Entitlement. References in this paragraph to a certificated shareholder include references to the person or persons executing the form of instruction and any person or persons on whose behalf such person or persons executing the form of instruction is/are acting and in the event of more than one person executing the form of instruction, the provisions of this paragraph shall apply to them, jointly and severally.

10.1.2.6 Certificated shareholders who do not wish to sell the Claw-back Entitlement allocated to them as reflected in the form of instruction, and who do not wish to subscribe for the Claw-back shares offered in terms of the form of instruction but who wish to renounce their Claw-back Entitlement, should complete the relevant section of the form of instruction and return it to the transfer secretaries in accordance with the instructions contained therein, to be received by no later than 12:00 on Friday, 7 March 2014.

10.1.2.7 Certificated shareholders who wish to subscribe for only a portion of the Claw-back Entitlement allocated to them must indicate on the form of instruction the number of Claw-back shares for which they wish to subscribe.

10.1.2.8 Certificated shareholders wishing to sell their Claw-back Entitlement will be liable to pay the transfer secretaries an amount of R131.10 (one hundred and thirty one Rand and 10 cents) (all inclusive) for trades having a value of less than or equal to R40 000 and an amount equal to R131.10 (one hundred and thirty one Rand and 10 cents) plus 0.25% of the value of the trade for trades with a value of R40 000 (forty thousand Rand) or more.

10.1.3 Payment

10.1.3.1 Currency

The amount due on acceptance of the Claw-back offer is payable in ZAR.

10.1.3.2 Paymentterms

A banker’s draft drawn on a registered bank or a cheque drawn on a South African bank (either of which should be crossed and marked “not transferable” and, in the case of a cheque, with the words “or bearer” deleted) in favour of “Alert Steel Holdings Limited – Claw-back offer” in respect of the amount due, together with a properly completed form of instruction, must be lodged by certificated shareholders and/or their renouncees by no later than 12:00 on Friday, 7 March 2014, in accordance with the instructions contained in the form of instruction and clearly marked “Alert Steel Holdings Limited – Claw-back offer”.

By hand to:

Computershare Investor Services Proprietary LimitedGround Floor, 70 Marshall StreetJohannesburg2001

or

14

sent by post, at the risk of the shareholder or renouncee concerned, to:

Computershare Investor Services Proprietary LimitedPO Box 61763Marshalltown2107

All cheques or banker’s drafts received by the transfer secretaries will be deposited immediately for payment.

In the event that any cheque or banker’s draft is dishonoured, Alert Steel, in its sole discretion, may treat the relevant acceptance as void or may tender delivery of the relevant Claw-back shares to which it relates against payment in cash of the Subscription Price for such Claw-back shares.

10.1.3.3 Sharecertificates

Where applicable, share certificates in respect of Claw-back shares will be posted, by registered post, by the transfer secretaries, at the risk of the certificated shareholders concerned, on or about Monday, 10 March 2014. As Alert Steel uses the “certified transfer deeds and other temporary documents of title” procedure approved by the JSE, only “block” certificates will be issued in respect of Claw-back shares.

Certificated shareholders receiving Claw-back shares in certificated format must note that such shares cannot trade on the JSE until they have been dematerialised. This could take between one and ten days.

10.2 dematerialised shareholders

10.2.1 Acceptance, renunciation or sale of Claw-back Entitlement

The CSDPs or brokers appointed by dematerialised shareholders should contact them to ascertain:

10.2.1.1 whether the shareholder concerned wishes to follow his Claw-back Entitlement in terms of the Claw-back offer (in which case CSDPs effect payment on a delivery versus payment basis) and if so, in respect of how many Claw-back shares;

10.2.1.2 whether the shareholder concerned wishes to renounce his Claw-back Entitlement and if so, in respect of how many Claw-back shares;

10.2.1.3 whether the shareholder concerned wishes to sell those Claw-back Entitlement which he/she does not wish to follow or renounce and if so, how many Claw-back Entitlement are to be sold. Shareholders not contacted by their CSDPs or brokers should contact them and furnish them with their instruction; and

10.2.1.4 should a CSDP or broker not obtain instructions from a dematerialised shareholder, they are obliged to act in terms of the mandate entered into between them and the dematerialised shareholder, or if the mandate is silent in this regard, not to accept the Claw-back Entitlement on behalf of such shareholder.

10.2.2 Payment

The CSDP or broker will effect payment directly on behalf of dematerialised shareholders in respect of Claw-back Entitlement followed, in ZAR, on Friday, 7 March 2014, on a delivery versus payment basis. Holders of dematerialised shares who wish to accept the Claw-back offer should ensure that the necessary funds are deposited with the relevant CSDP or broker.

10.2.3 Claw-back shares

Dematerialised shareholders’ accounts will be credited with the Claw-back shares subscribed for in terms of the Claw-back offer, on Monday, 10 March 2014.

11. EXChANGE CONTrOL rEGuLATiONS

The following summary is intended only as a guide and is therefore not a comprehensive statement of the Exchange Control Regulations. Alert Steel shareholders who are in any doubt as to the appropriate course of action to take should consult their professional advisors.

15

The new Alert Steel shares to be issued pursuant to the Claw-back offer are not freely transferable from South Africa and must be dealt with in terms of the Exchange Control Regulations.

Alert Steel shareholders who are not resident in the common monetary area should obtain advice as to whether any governmental and/or other legal consent is required and/or whether any other formality must be observed to follow their rights in terms of the Claw-back offer.

11.1 Non-resident of the common monetary area

11.1.1 In terms of the Exchange Control Regulations, non-residents of the common monetary area will be allowed to:

11.1.1.1 take up rights allocated to them in terms of the Claw-back offer;

11.1.1.2 purchase Letters of allocation; and

11.1.1.3 subscribe for the new Alert Steel shares in terms of the Claw-back offer, provided payment is received in foreign currency through normal banking channels or in ZAR from a non-resident account.

11.1.2 Share certificates issued pursuant to the application must be endorsed “non-resident”. In respect of Alert Steel shareholders taking up their rights in terms of the Claw-back offer:

11.1.2.1 a “non-resident” endorsement will be applied to forms of instruction issued to non-resident certificated shareholders; or

11.1.2.2 a “non-resident” annotation will appear in the CSDP or broker’s register for non-resident dematerialised shareholders.

11.1.3 All applications by non-residents for the above purposes must be made through a South African authorised dealer. Where rights are sold on the JSE on behalf of non-residents, the proceeds of such sale are freely remittable through a South African authorised dealer in foreign exchange.

11.2 Former residents of the common monetary area (“emigrants”)

11.2.1 Where an Entitlement in terms of the Claw-back offer falls due to an emigrant, which right is based on shares blocked in terms of Exchange Control Regulations, only then may blocked funds be used to:

11.2.1.1 take up rights allocated to such emigrant in terms of the Claw-back offer;

11.2.1.2 purchase Entitlements on the JSE; and

11.2.1.3 subscribe for new Alert Steel shares in terms of the Claw-back offer.

11.2.2 Applications by emigrants using blocked ZAR for the above purposes must be made through the South African authorised dealer controlling their blocked assets. Alert Steel share certificates issued pursuant to blocked ZAR transactions must be endorsed “non-resident” and placed under the control of the authorised dealer through whom the payment was made.

11.2.3 In respect of Alert Steel shareholders taking up their Entitlement in terms of the Claw-back offer:

11.2.3.1 a “non-resident” endorsement will be applied to forms of instruction issued to non-resident certificated shareholders; or

11.2.3.2 a “non-resident” annotation will appear in the CSDP or broker’s register for non-resident dematerialised shareholders.

11.2.4 Where Entitlements are sold on the JSE on behalf of emigrants, which Entitlement are based on an investment which is blocked in terms of the South African Exchange Control Regulations, the proceeds of such sales will be credited to the blocked ZAR accounts of the Alert Steel shareholders concerned.

11.2.5 Non-resident and emigrant dematerialised shareholders will have all aspects relating to exchange control managed by their CSDP or broker.

16

12. TAX CONSEquENCES OF ThE CLAW-BACK OFFEr

The directors of the issuer are of the opinion that the purchase, holding and disposal of the Letters of allocation or Claw-back shares should, for taxation purposes, be treated according to the usual rules relating to the categorisation of an asset and its return as capital or revenue and accordingly Alert Steel shareholders are advised to consult their professional advisors regarding the tax consequences of the Claw-back offer.

13. JuriSdiCTiON

The distribution of this circular and/or accompanying documents and/or the transfer of the new Alert Steel shares and/or the rights to subscribe for new Alert Steel shares in jurisdictions other than South Africa may be restricted by law and failure to comply with any of those restrictions may constitute a violation of the laws of any such jurisdiction in which it is illegal to make such a Claw-back offer. In such circumstances this circular is not addressed to such shareholders and the Claw-back offer is made only to qualifying shareholders.

Any shareholder resident outside the common monetary area who receives the circular and form of instruction, should obtain advice as to whether any governmental and/or any other legal consent is required and/or any other formality must be observed to enable such a subscription to be made in terms of such form of instruction.

The Claw-back offer does not constitute and offer in any jurisdiction in which it is illegal to make such an offer and the circular and form of instruction should not be forwarded or transmitted by recipients thereof to any person in any territory other than where it is lawful to make such an offer.

The Claw-back offer shares have not been and will not be registered under the Securities Act of the United States of America. Accordingly, the Claw-back offer shares may not be offered, sold, resold, delivered or transferred, directly or indirectly, in or into the United States or to, or for the account or benefit of, United States persons, except pursuant to exemptions from the Securities Act. The circular and the accompanying documents are not being, and must not be, mailed or otherwise distributed or sent in, into or from the United States. The circular does not constitute an offer of any securities for sale in the United States or to United States persons.

The Claw-back offer contained in the circular does not constitute an offer in the District of Colombia, the United States, the Dominion of Canada, the Commonwealth of Australia, Japan or in any other jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer. Non-qualifying shareholders should consult their professional advisers to determine whether any governmental or other consents are required or other formalities need to be observed to allow them to take up he Claw-back offer, or trade their Entitlement. Shareholders holding Alert Steel shares on behalf of persons who are non-qualifying shareholders are responsible for ensuring that taking up the Claw-back offer, or trading in their Entitlements under that offer, do not breach regulation in the relevant overseas jurisdictions.

To the extent that non-qualifying shareholders are not entitled to participate in the Claw-back offer as a result of the aforementioned restrictions, the allocated rights in respect of such non-qualifying shareholders shall revert to Alert Steel who shall be entitled to sell or place same or failing which such rights will lapse.

14. OpiNiONS ANd rECOmmENdATiONS

14.1 The board of directors have considered the terms and conditions of the Claw-back offer and are of the opinion that such terms and conditions are fair and reasonable to Alert Steel shareholders.

14.2 Shareholders are recommended to consult their professional advisers regarding the action to be taken in relation to the Claw-back offer.

15. dirECTOrS’ AuThOriTy TO iSSuE ShArES

15.1 Section 41(3) of the Act requires that shareholders approve by way of special resolution, an issue of shares if the voting power of the class of shares that are to be issued will be equal to or exceed 30% of the voting powers of all the shares of that class already issued immediately before the issue.

15.2 The section 41(3) special resolution was passed at the general meeting held on Thursday, 9 January 2014.

17

16. dirECTOrS’ rESpONSiBiLiTy STATEmENT

The directors, whose names are given in Annexure 6 to this circular, collectively and individually, accept full responsibility for the accuracy of the information given and certify that to the best of their knowledge and belief there are no facts which have been omitted which would make any statement in the circular false or misleading and that all reasonable enquiries to ascertain such facts have been made by them and that the circular contains all information required by law and the Listings Requirements.

17. LiTiGATiON STATEmENT

The Group is not party to any legal or arbitration proceedings, nor, as far as the directors of the Group are aware are there any legal or arbitration proceedings pending or threatened against Alert Steel, which may have, or have had in the 12 months preceding the date of this circular, a material effect on the Group’s financial position.

18. COrpOrATE GOVErNANCE

The Group’s corporate governance policy is set out in Annexure 5.

19. mATEriAL CONTrACTS

There have been no materials contracts entered into by the company, other than in the ordinary course of business, two years prior to this circular, that contains an obligation or settlement that is material to Alert Steel at the last practical date save for:• the Subscription Agreement; and• Alert Steel Tshwane, a subsidiary of Alert Steel Holdings, has entered into a three year supply

contract with Transnet from 1 July 2012. The contract entails the supply of Carbon steel to Transnet’s Koedoespoort and Germiston plants for a three-year period. The total contract value is estimated to be at least R90 000 000 over the contract period.

20. EXpENSES OF ThE CLAW-BACK OFFEr

The following expenses and provisions are expected or have been provided for by the company in connection with the Claw-back offer and will be settled out of the proceeds received in accordance with the Subscription Agreement or pursuant to the Claw-back offer. All costs are stated exclusive of VAT:

r

Corporate advisory fee - Exchange Sponsors 200 000Independent reporting accountants’ fee – KPMG Inc 50 000Transfer secretaries fees – Computershare Investor Services Proprietary Limited 50 000Legal fees – Fluxmans 100 000Printing and other related costs 50 000JSE documentation fee 21 873JSE listing fees 69 180

541 053

The company has not incurred any preliminary expenses within the three years preceding the date of this document.

21. CONSENTS

Each of the company’s advisors as listed on the inside front cover of this circular have consented in writing to act in the capacities stated and to their names appearing in this circular and have not withdrawn their consent prior to the publication of this circular.

The Independent reporting accountants have consented to the inclusion of their reports in the form and context in which it is included in the circular, which consent has not been withdrawn prior to the publication of this circular.

18

22. mATEriAL ChANGES

The directors report that no material changes in the affairs or financial position of the Group have taken place since the publication of the audited financial results for the year ended 30 June 2013, save for:

• On 19 August 2013, Cannistraro entered into a specific issue of shares for cash agreement, subject to the fulfilment of the conditions precedent, to issue 48 million shares at 200 cents per share for cash. At the general meeting of shareholders to approve the resolutions pertaining to, interalia, the specific issue, the resolutions were withdrawn and not voted on by shareholders.

• In an announcement released on SENS on 28 November 2013, shareholders were advised that the company and the Subscriber entered into the Subscription Agreement which provides for the subscription by the Subscriber of 48 000 000 new ordinary shares of no par value in the share capital of Alert Steel at a Subscription Price of 200 cents per share for the total Subscription Amount, subject to the rights of shareholders in terms of the Claw-back offer.

23. dOCumENTS ANd CONSENTS AVAiLABLE FOr iNSpECTiON

The following documents, or copies thereof, will be available for inspection during normal business hours at the registered office of Alert Steel or its Designated Advisor’s office, from Monday, 17 February 2014, up to and including Friday, 28 February 2014:

23.1 a signed copy of this circular;

23.2 the current memorandum of incorporation of Alert Steel and its subsidiaries;

23.3 the audited financial statements of Alert Steel for all the years since incorporation until 30 June 2013;

23.4 the signed Subscription Agreement;

23.5 a signed copy of the supply contract with Transnet;

23.6 the letters of consent referred to in paragraph 21 of this circular;

23.7 the Independent reporting accountants’ signed report included in Annexure 2 to this circular; and

23.8 copies of service agreements with directors entered into during the last three years.

Signed by PN Dodson on behalf of the directors of Alert Steel in terms of the powers of attorney granted to him by the board.

By order of the board

________________________17 February 2014

19

ANNEXurE 1

PRO FORMA CONSOLidATEd FiNANCiAL iNFOrmATiON

The definitions and interpretations commencing on page 3 of the circular apply throughout this annexure.

This proforma financial information has been prepared for illustrative purposes only and because of its nature may not fairly present Alert Steel’s financial position, changes in equity, results of operations or cash flows.

The proforma financial information has been prepared to illustrate the impact of the Claw-back offer, on the audited, published financial information of Alert Steel for the year ended 30 June 2013, had the Claw-back offer occurred on 1 July 2012 for the purpose of the statement of comprehensive income and on 30 June 2013 for the purpose of the statement of financial position.

The proforma financial effects have been prepared using accounting policies that comply with IFRS and that are consistent with those applied in the audited annual financial statements of Alert Steel’s for the year ended 30 June 2013.

The reporting accountants’ report on the compilation of proforma financial information of Alert Steel’s is set out in Annexure 2 to this circular.

The proforma financial information is the responsibility of the directors of Alert Steel.

20

PRO FORMA CONSOLidATEd STATEmENT OF FiNANCiAL pOSiTiON

FiguresinR

“Before Claw-back offer”

30 June 2013(1)“Claw-back

offer”“After Claw-back offer”

ASSETS

Non-current assets 60 493 806 60 493 806

Property, plant and equipment 54 773 370 54 773 370Goodwill 5 720 436 5 720 436

Current assets 176 536 634 176 536 634

Inventories 119 572 890 119 572 890Trade and other receivables 45 256 837 45 256 837Amounts owing by associate 5 575 020 5 575 020Taxation receivable 201 392 201 392Assets held for sale 294 000 294 000Cash and cash equivalents 5 636 495 5 636 495

Total assets 237 030 440 – 237 030 440

EquiTy ANd LiABiLiTiES

Equity attributable to equity holders of the company (23 461 573) 95 458 947 71 997 374

Share capital(2) 269 719 677 95 528 127 365 247 804Share-based payment reserve 311 921 311 921Accumulated loss (293 493 171) (69 180) (293 562 351)

Non-current liabilities 141 142 962 (96 000 000) 45 142 962

Loans and borrowings(3) 136 809 704 (96 000 000) 40 809 704Straight-line lease accrual 4 333 258 4 333 258

Current liabilities 119 349 051 541 053 119 890 104

Trade and other payables(3) 117 574 892 541 053 118 115 945Straight-line lease accrual 550 324 550 324Provisions 1 223 835 1 223 835

Total equity and liabilities 237 030 440 – 237 030 440

Shares in issue at year-end(4) 51 999 636 48 000 000 99 999 636Net asset value per share (cents) (45.18) 72.00Net tangible asset value per share (cents) (56.20) 66.28

Notes:1. The “Before the Claw-back offer” column has been extracted, without adjustment, from the audited results for the year ended

30 June 2013.

2. Share capital has been adjusted for the following assumptions:

• the issue of the 48 million ordinary shares in terms of the Claw-back offer at 200c per share; and

• the incurrence of estimated transaction costs of R471 873,relating directly to the issue of shares and written off against share capital. These costs equate to 87% of the total transaction costs of R541 053 per paragraph 20 of the circular.

3. Current and non-current liabilities have been reduced by the cash received as a result of the Claw-back offer. Accounts payable has been adjusted to include amounts owing in respect of the total estimated transaction costs amounting to R541 053.

4. The number of shares in issue has been adjusted to include the issue of 48 million Claw-back offer shares based on the assumption that the Claw-back offer was fully subscribed for at a price of 200 cents per share.

5. All the above adjustments with the exception of transaction costs, are expected to have a continuing effect.

21

PRO FORMA CONSOLidATEd STATEmENT OF COmprEhENSiVE iNCOmE

FiguresinR

“Before Claw-back offer”

30 June 2013(1)“Claw-back

offer”“After Claw-back offer”

Revenue 716 780 430 716 780 430Cost of sales (561 788 858) (561 788 858)

Gross profit 154 991 572 154 991 572Other income 3 093 410 3 093 410Operating expenses(4) (198 018 833) (69 180) (198 088 013)

Operating loss (39 933 851) (69 180) (40 003 031)Investment revenue 2 239 718 2 239 718Finance costs(2) (13 866 803) 8 160 000 (5 706 803)

Loss before taxation (51 560 936) 8 090 820 (43 470 116)Taxation 380 280 380 280

Loss from continuing operations (51 180 656) 8 090 820 (43 089 836)discontinued operationsProfit from discontinued operations –

Loss for the year (51 180 656) 8 090 820 (43 089 836)

reconciliation of headline lossBasic loss attributable to ordinary shareholders (51 180 656) 8 090 820 (43 089 836)Profit on sale of business (15 456 306) (15 456 306)Losses arising from the impairment of goodwill 500 000 500 000Losses arising from the impairment of investment property 206 000 206 000Adjusted for loss arising on discontinuance of operations 1 965 016 1 965 016Adjusted for profit on disposal of property, plant and equipment (135 600) (135 600)

Headline Loss attributable to ordinary shareholders (64 101 546) 8 090 820 (56 010 726)

Weighted average shares in issue on which earnings are based(3) 48 238 204 48 000 000 96 238 204

Fully diluted weighted average shares in issue 48 238 204 48 000 000 96 238 204

Loss per share (cents) (106.10) (44.77)Headline loss per share (cents) (132.90) (58.20)

Notes:1. The “Before the Claw-back offer” column has been extracted, without adjustment, from the audited results for the year ended

30 June 2013.

2. Finance cost has been adjusted to include the assumption that the after interest saving on the reduction of the interest-bearing debt calculated at the prime interest rate of 8.5%.

3. The weighted average number of shares has been adjusted to include the issue of 48 million Claw-back shares based on the assumption that the Claw-back offer was fully subscribed for at a price of 200 cents per share.

4. Transaction costs of R69 180 equating to 13% of the total transaction costs of R541 053 per paragraph 20 of the circular, that do not relate directly to the issue of shares, has been expensed. The balance of estimated transaction costs of R471 873 have been written off against share capital.

5. All the above adjustments with the exception of transaction costs, are expected to have a continuing effect.

22

ANNEXurE 2

iNdEpENdENT rEpOrTiNG ACCOuNTANTS’ rEpOrT ON ThE COmpiLATiON OF PRO FORMA CONSOLidATEd FiNANCiAL iNFOrmATiON

The directorsAlert Steel Holdings LimitedCorner of Engelbrecht and Lanham StreetsEast LynnePretoria, 0186PO Box 29607Sunnyside, 0132

27 January 2014

Dear Sirs

rEpOrT ON ThE COmpiLATiON OF ThE PRO FORMA FiNANCiAL iNFOrmATiON

The definitions commencing on page 3 of the circular have been used in this report.

We have completed our assurance engagement to report (“Report”) on the compilation of proforma loss and headline loss, net asset value and net tangible asset value per Alert Steel share, pro forma statement of financial position of Alert Steel, the pro forma statement of comprehensive income of Alert Steel and the related notes, including a reconciliation showing all of the proforma adjustments to the share capital, reserves and other equity items relating to Alert Steel, (collectively, “Proforma Financial Information”). The Proforma Financial Information is set out in paragraph 7 and Annexure 1 of the circular.

The Proforma Financial Information has been compiled by the directors of Alert Steel to illustrate the impact of the proposed Claw-back offer as detailed in the circular on Alert Steel financial position and changes in equity as at 30 June 2013 and Alert Steel’s financial performance for the period ended 30 June 2013 .

As part of this process, Alert Steel’s basic loss and headline loss per share, statement of comprehensive income and statement of financial position have been extracted by the directors from Alert Steel published financial statements for the period ended 30 June 2013 (“Published Financial Information”), on which an audit report has been published. In addition, the directors have calculated the net asset value and net tangible asset value per share as at 30 June 2013 based on financial information extracted from the Published Financial Information.

directors’ responsibility for the Pro forma Financial information

The directors are responsible for compiling the Proforma Financial Information on the basis of the applicable criteria as detailed in paragraphs 8.15 to 8.33 of the Listings Requirements and the SAICA Guide on Proforma Financial Information, revised and issued in September 2012 (“Applicable Criteria”).

reporting accountants’ responsibility

Our responsibility is to express an opinion about whether the Pro forma Financial Information has been compiled, in all material respects, by the Directors on the basis of the Applicable Criteria, based on our procedures performed.

We conducted our engagement in accordance with International Standard on Assurance Engagements (ISAE) 3420, Assurance Engagements to Report on the Compilation of Pro Forma Financial InformationIncludedinaProspectus, issued by the International Auditing and Assurance Standards Board. This standard requires that the reporting accountants’ comply with ethical requirements and plan and perform procedures to obtain reasonable assurance about whether the directors have compiled, in all material respects, the Proforma Financial Information on the basis of the Applicable Criteria.

For purposes of this engagement, we are not responsible for updating or reissuing any reports or opinions on any Published Financial Information used in compiling the Proforma Financial Information, nor have we, in the

23

course of this engagement, performed an audit or review of the Published Financial Information used in compiling the Proforma Financial Information.

The purpose of Proforma Financial Information included in the circular is solely to illustrate the impact of the amendments on the unadjusted Published Financial Information as if the Claw-back offer had been undertaken on 1 July 2013 for purposes of the pro forma loss, headline loss per Alert Steel share and the pro forma statement of comprehensive income and on 30 June 2013 for purposes of the net asset value and net tangible asset value per share and statement of financial position. Accordingly, we do not provide any assurance that the actual outcome of the amendments, subsequent to its implementation, will be as presented in the Pro forma Financial Information.

A reasonable assurance engagement to report on whether the Pro forma Financial Information has been properly compiled, in all material respects, on the basis of the Applicable Criteria involves performing procedures to assess whether the Applicable Criteria used by the directors in the compilation of the Proforma Financial Information provide a reasonable basis for presenting the significant effects directly attributable to the amendments and to obtain sufficient appropriate evidence about whether:

• the related proforma adjustments give appropriate effect to the Applicable Criteria; and

• the Proforma Financial Information reflects the proper application of those proforma adjustments to the unadjusted Published Financial Information.

The procedures selected depend on the reporting accountants’ judgement, having regard to the reporting accountants’ understanding of the nature of Alert Steel, the Claw-back offer in respect of which the Proforma Financial Information has been compiled and other relevant engagement circumstances.

The engagement also involves evaluating the overall presentation of the Proforma Financial Information.

We believe that the evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Opinion

In our opinion, the Proforma Financial Information has been compiled, in all material respects, on the basis of the Applicable Criteria.

Yours faithfully

KpmG inc.

Per Pierre FourieChartered Accountants (SA)Director”

24

ANNEXurE 3

TABLE OF ENTiTLEmENT

No fractions of Claw-back shares will be issued to shareholders and the Claw-back shares will be issued based on the rounding principle (up or down, as the case may be). The table of Entitlement of shareholders to receive Claw-back shares in the ratio of 92.44345 Claw-back shares for every 100 Alert Steel shares held is set out below:

Number of existing ordinary shares held

Number of Claw-back shares to which a shareholder recorded on the record date is entitled

Number of existing ordinary shares held

Number of Claw-back shares to which a shareholder recorded on the record date is entitled

Number of existing ordinary shares held

Number of Claw-back shares to which a shareholder recorded on the record date is entitled

1 1 37 34 73 672 2 38 35 74 683 3 39 36 75 694 4 40 37 76 705 5 41 38 77 716 6 42 39 78 727 6 43 40 79 738 7 44 41 80 749 8 45 42 81 7510 9 46 43 82 7611 10 47 43 83 7712 11 48 44 84 7813 12 49 45 85 7914 13 50 46 86 8015 14 51 47 87 8016 15 52 48 88 8117 16 53 49 89 8218 17 54 50 90 8319 18 55 51 91 8420 18 56 52 92 8521 19 57 53 93 8622 20 58 54 94 8723 21 59 55 95 8824 22 60 55 96 8925 23 61 56 97 9026 24 62 57 98 9127 25 63 58 99 9228 26 64 59 100 9229 27 65 60 1 000 92430 28 66 61 10 000 9 24431 29 67 62 100 000 94 44332 30 68 6333 31 69 6434 31 70 6535 32 71 6636 33 72 67

25

ANNEXurE 4

priCE hiSTOry OF ALErT STEEL ShArES ON ThE JSE

dailyhigh

(cents)Low

(cents)Close (cents) Volume

15/01/2014 135 135 135 31214/01/2014 130 130 130 –13/01/2014 130 130 130 –10/01/2013 130 130 130 –09/01/2014 130 130 130 1 00008/01/2014 155 155 155 –07/01/2014 155 155 155 –06/01/2014 155 155 155 1 10503/01/2014 155 140 155 1 03502/01/2014 125 125 125 –31/12/2013 125 125 125 4 00030/12/2013 130 130 130 3 00027/12/2013 140 140 140 60624/12/2013 140 140 140 5 84623/12/2013 140 140 140 69520/12/2013 140 140 140 3 31219/12/2013 130 130 130 –18/12/2013 130 130 130 –17/12/2013 130 130 130 3 035

monthlyhigh

(cents)Low

(cents)Close

(cents) Volume

October 2013 155 140 140 123 056September 2013 190 175 175 265 873August 2013 139 138 138 353 668July 2013 110 95 95 271 582June 2013 110 110 110 116 711May 2013 102 102 102 311 850April 2013 140 102 102 205 894March 2013 180 136 136 399 560February 2013 179 175 175 877 294January 2013 218 175 175 250 564December 2012 249 218 218 390 120November 2012 300 200 300 59 685 239

quarterlyhigh

(cents)Low

(cents)Close (cents) Volume

December 2012 300 300 300 32 769 704September 2012 400 100 300 137 417 500June 2012 800 200 400 29 844 706March 2012 1 000 600 700 27 637 666December 2011 1 000 400 800 28 164 850September 2011 2 700 1 100 1 200 4 835 951June 2011 2 300 1 500 2 000 2 875 576March 2011 3 100 1 500 2 000 2 326 277December 2010 2 400 1 500 1 700 1 191 277

26

ANNEXurE 5

COrpOrATE GOVErNANCE

Sound corporate governance is a vital ingredient for ensuring that all dealings and decisions of the business are conducted with honesty and fairness.

During a difficult trading year, which included major internal restructuring, this remained a vital element of Alert Steel’s business. Every employee remains committed to acting in line with the company’s values of integrity, respect, transparency and accountability.

STATEmENT OF COmpLiANCE

During the year under review, the board materially complied with the King III Report recommendations, as outlined in the code of corporate practices and conduct. All areas of improvement that have been identified are being actively dealt with. Shareholders are referred to an analysis of the application of the 75 corporate governance principles, as recommended in the King III Report, which is published on the company’s website at www.alertsteel.co.za/wp-contents/uploads/CorporateGovernance.pdf.

BOArd OF dirECTOrS

The board consists of four independent non-executive directors and three executive directors. All the directors are high-merit objective individuals who collectively contribute a wide range of skills and knowledge to the decision-making processes of the board and who also ensure proper deliberation of all matters requiring the board’s attention.

The board subscribes to a unitary board structure with a balance of executive and non-executive directors. There is a clear division of responsibilities between the executive running of the company’s business and the leadership of the board, such that no individual has unfettered decision-making powers. The two primary tasks of the running of the board and the executive responsibility of the day to day running of the business are managed by the chairperson and CEO, respectively.

The chairman of the board is Mitesh Patel, an independent non-executive director. The chairman provides leadership and guidance to the board as a whole and encourages proper deliberation of all matters requiring the board’s attention.

CEO Peter Dodson ensures sound and efficient operation of the business as well as the implementation of all strategies and policies adopted by the board. He is responsible for clearly conveying communication from the board to the executive management. He is assisted by CFO Mahomed Gani and an executive committee consisting of strategic head office employees who take responsibility for the smooth daily running of the business.

The CEO, CFO and executive management team meet collectively on a weekly basis and more frequently on an individual basis when more intensive focus is required.

In terms of the board charter, the board meets no less than once each quarter, and more frequently if circumstances require. When necessary, they also confer through round robin deliberations.

Meetings are conducted in accordance with formal agendas and annual work plans, ensuring that all substantive matters are properly addressed. Any director may request that additional matters be added to the agenda. Copies of board papers are circulated to the directors well in advance of board meetings to ensure proper preparation to enhance the constructive and informed nature of deliberations. A representative from the company’s Designated Advisor attends the board meetings as required in terms of the JSE Listings Requirements.

Attendance by directors at board meetings during the reporting period is provided below. Owing to the restructuring of the company, the number of meetings held increased substantially in the past year.

27

rOLE ANd rESpONSiBiLiTiES OF ThE ChAirmAN