CIC Payroll - Computer Information Concepts, Inc. Payroll.pdf · 430-A03 Change Code ... 430-C03...

Transcript of CIC Payroll - Computer Information Concepts, Inc. Payroll.pdf · 430-A03 Change Code ... 430-C03...

Copyright © 2009 Computer Information Concepts, Inc. (CIC) All Rights Reserved. This document contains proprietary information, which is protected by copyright. No part of this document may be photocopied, reproduced, adapted, or transmitted in any form or by any means without the prior written consent of Computer Information Concepts, Inc. All other product names and/or logos mentioned in this guide are used for identification purposes only and may be registered trademarks of their respective companies. Computer Information Concepts, Inc. makes no warranty of any kind with regard to this material, including, but not limited to, the implied warranties of merchantability and fitness for a particular purpose. Computer Information Concepts, Inc. shall not be liable for errors contained herein or for incidental or consequential damages in connection with the furnishing, performance, or use of the material. The information contained in this document is subject to change without notice. Printed in the USA September 17, 2009

CIC Payroll Contents • i

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2009 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457

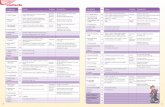

Contents 430-A00 Site Parameters 1

430-A01 Site Parameters .......................................................................................................... 2 430-A01a Site Specific Parameters - Preparation ....................................................... 2 430-A01b Site Parameters – Main .............................................................................. 3 430-A01c Organizations ............................................................................................. 6 430-A01d Formats ...................................................................................................... 9 430-A01e ACH ......................................................................................................... 11

430-A02 Employee Maintenance Log (PRST01-03) .............................................................. 14 430-A02a Employee’s Maintenance Log By Date (PRST01) .................................. 15 430-A02b Employee’s Maintenance Log by Employee (PRST02) .......................... 16 430-A02c Employee Maintenance Log by Alpha (PRST03) ................................... 17

430-A03 Change Code............................................................................................................ 18 430-A04 Pro-Ration Of Leave ................................................................................................ 19

430-A04a Leave Pro-Ration Approach .................................................................... 19 430-A05 User Tables .............................................................................................................. 20

430-A05a User Table Approach ............................................................................... 20 430-A05b User Table 100 (Valid Payroll Types) ..................................................... 21 430-A05c User Table 102 (Leave Compute Methods) ............................................. 22 430-A05d User Table 103 (Income / Deduction Compute Methods) ....................... 22 430-A05e User Table 104 (Filing Status) ................................................................. 23 430-A05f User Table 108 (Pay Method) .................................................................. 23 430-A05g User Table 110 (Bargaining Units) ......................................................... 24 430-A05h User Table 120 (Tax Table Groups) ........................................................ 24 430-A05i User Table 140 (Payroll Frequency) ........................................................ 25 430-A05j User Table 141 (Full time / Part time) ...................................................... 25 430-A05k User Table 160 (Insurance Coverage) ..................................................... 26 430-A05l User Table 180 (MICR Fonts) .................................................................. 26 430-A05m User Table 181 (Post Net Fonts) ............................................................ 27 430-A05n User Table 182 (Signature Diskette Drive) ............................................. 27 430-A05o User Table 200 (More Employee Fields) ................................................ 28 430-A05p User Table 210 (OverTime Recompute Categories) ............................... 28 430-A05q User Table 440 (Organizational ID) ........................................................ 29 430-A05r User Table 900 (Report Launcher)........................................................... 29 430-A05s User Table 910(Payroll Group Types) ..................................................... 30

430-A06 Signature File Location ............................................................................................ 31 430-A07 Reduce Leaves to Max ............................................................................................. 31 430-A08 Renumber – Reset – Readd ...................................................................................... 32

430-A08a Change Employee Number ...................................................................... 32 430-A08b Renumber Jam Checks ............................................................................ 33 430-A08c Renumber One Check (Before Update) ................................................... 34 430-A08d Renumber after Update ........................................................................... 34 430-A08e Reset Accounting ..................................................................................... 35 430-A08f Re-Add MTD / QTD / YTD ..................................................................... 36 430-A08g Backup Database Location ...................................................................... 36 430-A08h Backup Databases .................................................................................... 37 430-A08i Remove Database Backups ...................................................................... 38

430-A09 CIC Support Tools ................................................................................................... 43 430-A09a Modifications ........................................................................................... 43 430-A09b Testing ..................................................................................................... 43

ii • Contents CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2009 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457

430-A09c Installation ............................................................................................... 43 430-A09d Log In ...................................................................................................... 43 430-A09e Database Lockdown ................................................................................ 43

430-A10 Access ...................................................................................................................... 44 430-A10a User Access ............................................................................................. 45

430-B00 Setup 47 430-B01 Setup Time ............................................................................................................... 48 430-B02 Federal Identification Setup ..................................................................................... 50 430-B03 Departments ............................................................................................................. 52

430-B03a Departments Report – PRLT23 ............................................................... 53 430-B04 Cost Centers ............................................................................................................. 54

430-B04a Cost Center Report – PRSU40 ................................................................. 56 430-B05 Change Income / Deduction / Match Rates .............................................................. 57 430-B06 Calendar of Payrolls ................................................................................................. 58 430-B07 Tax Tables ............................................................................................................... 60

430-B07a Sample FICA tax table ............................................................................. 60 430-B07b Fica (Single) Sample Tax Table .............................................................. 62 430-B07c Fica (Married) Sample Tax Table ............................................................ 62 430-B07d Medicare (Single) Sample Tax Table ...................................................... 63 430-B07e Medicare (Married) Sample Tax Table .................................................... 63 430-B07f EIC (Married) Sample Tax Table ............................................................. 64 430-B07g EIC (Single) Sample Tax Table ............................................................... 64 430-B07h Federal (Single) Sample Tax Table ........................................................ 65 430-B07i Federal (Married) Sample Tax Table ....................................................... 65 430-B07j Kansas Withholding (Single) Sample Tax Table ..................................... 66 430-B07k Kansas Withholding (Married) Sample Tax Table .................................. 66 430-B07l Oklahoma Withholding (Married) Sample Tax Table .............................. 67 430-B07m Oklahoma Withholding (Single) Sample Tax Table .............................. 67 430-B07n Unemployment Tax (Single) Sample Tax Table ..................................... 68 430-B07o Unemployment (Married) Sample Tax Table .......................................... 68 430-B07p Additional Information on Tax Computations ......................................... 69

430-B08 Income / Deduction Definitions ............................................................................... 70 430-B08a Income / Deduction / Match Approach ................................................... 70 430-B08b Sample of the Voluntary Type Deduction ............................................... 75 430-B08c Sample of an Income ............................................................................... 75 430-B08d Sample of a Leave Pay Income ............................................................... 76 430-B08e Sample of a Retirement Match ................................................................ 76 430-B08f Sample of Net ........................................................................................... 77

430-B09 Leave Types ............................................................................................................. 78 430-B09a Leave Type Approach .............................................................................. 78

430-B10 Group Life Rates ...................................................................................................... 82 430-B10a Group Life Insurance Approach .............................................................. 82

430-B11 Longevity Parameters .............................................................................................. 87 430-B11a Longevity Set Up and Calculation ........................................................... 88

430-B12 Imaging / Keyword Setup ........................................................................................ 93 430-B12a Select Imaging Data Source ..................................................................... 94 430-B12b Create Imaging Document Types ............................................................ 96 430-B12c Select Keyword Report Data Source ....................................................... 98 430-B12d Create Keyword Document Type .......................................................... 100 430-B12e Assigning Imaging Task Doc Types ...................................................... 102 430-B12f Assigning Keyword Task Doc Types ..................................................... 104 430-B12g Set Automatic Imaging .......................................................................... 106 430-B12h CIC Image Server Setup Information .................................................... 107

CIC Payroll Contents • iii

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2009 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457

430-B13 Time Center Crosswalk .......................................................................................... 113

430-C00 Employee Information 115 430-C01 Employee Basic Information ................................................................................. 115

430-C01a Employee Basic Information- Function Buttons .................................... 115 430-C02 Employee Information ........................................................................................... 119

430-C02a Employee Information – Maintenance ................................................... 125 430-C02b Employee Information – Report Print Buttons ...................................... 126 430-C02c Employee Print Button - PRHS10 ......................................................... 127 430-C02d Employee Val Button Report ................................................................. 128 430-C02e Employee YTD$ Button - PRPE25-26 ................................................. 129 430-C02f Employee Refresh from HR Button ....................................................... 131

430-C03 Adding an Employee ............................................................................................. 138 430-C04 Deleting An Employee ........................................................................................... 140 430-C05 Searching for Employees ....................................................................................... 142

430-C05a Employee Search by Employee Number ............................................... 143 430-C05b Employee Search by Employee Social Security Number ...................... 144 430-C05c Employee Search by Employee Name ................................................... 145

430-C06 Employee Incomes ................................................................................................. 146 430-C06a Employee Income Establishment Approach ........................................... 146 430-C06b Employee Incomes Additional Information - Field Definitions ............ 150 430-C06c Employee Incomes – Maintenance ........................................................ 153

430-C07 Employee Deductions ............................................................................................ 155 Employee Deduction - Field Definitions ................................................................. 156 430-C07a Employee Deduction Additional Information - Field Definitions ......... 158 430-C07b Employee Deductions – Maintenance ................................................... 161

430-C08 Employee Matches ................................................................................................. 163 Employee Match - Field Definitions ....................................................................... 164 430-C08a Employee Match Additional Information - Field Definitions ................ 166 430-C08b Employee Match – Maintenance ........................................................... 169

430-C09 Employee Leave Information ................................................................................. 171 Employee Leave - Field Definitions ........................................................................ 172 430-C09a Employee Leave - Maintenance ............................................................. 174 430-C09b Employee Leave History – More Button ............................................... 175

430-C10 Employee Check Information ................................................................................ 178 430-C10a Check Copy ........................................................................................... 182 430-C10b Void Check ............................................................................................ 183 430-C10c Find ........................................................................................................ 186 430-C10d Print ....................................................................................................... 187 430-C10e Employee Check – Operations ............................................................... 188

430-C11 Employee Previous Years Inquiry ......................................................................... 189 430-C12 Employee W-2 Inquiry .......................................................................................... 190

430-C12a W-2 Inquiry Approach ........................................................................... 190 430-C12b Employee W-2 Inquiry .......................................................................... 191

430-C13 Employee Direct Deposits ..................................................................................... 192 430-C13a Employee Direct Deposit - Maintenance ............................................... 195 430-C13b Employee Direct Deposit – Set Up for Multiple Accounts ................... 196

430-C14 Employee User Defined Fields ............................................................................... 199 430-C15 Employee Position Inquiry ..................................................................................... 201

430-C15a Employee Position History Maintenance ............................................... 203 430-C16 Employee Maintenance Log .................................................................................. 204

430-C16a Adding An Employee Log Entry ........................................................... 205 430-C17 Establishing a Profile ............................................................................................. 207

430-C17a Profile Income and Deductions .............................................................. 209

iv • Contents CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2009 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457

430-C17b Profile Leaves ........................................................................................ 210 430-C18 New Employee from Profile .................................................................................. 211

430-C18a Required Changes to Employee Record ................................................ 213

430-D00 Checks 214 430-D01 Steps in Processing a Payroll ................................................................................. 215 430-D02 Time Entry ............................................................................................................. 218

430-D02a Quick Time Entry .................................................................................. 225 430-D03 Delete Empty Time ................................................................................................. 226 430-D04 Reset No Time Employees .................................................................................... 226 430-D05 Explode Time Entry ............................................................................................... 227 430-D05 Time Entry Reports – PRCK04 to PRCK07 .......................................................... 229

430-D05a Time Entry Report PRCK04 .................................................................. 230 430-D05b Time Entry Out of Department Report PRCK05 .................................. 232 430-D05b Department Time Entry Approval Report PRCK06 .............................. 233 430-D05c Time Entry Detail Report PRCK07 ....................................................... 234

430-D06 Time Entry Exception Reporting – PRCK15 ......................................................... 235 430-D07 Leave Accrual ........................................................................................................ 236

430-D07a Leave Accrual Set Up – Payroll Compute Process Option .................... 236 430-D07b Leave Accrual Set Up – Menu Option Selected .................................... 237 430-D07c Leave Accrual Calculation ..................................................................... 238 430-D07d Leave Accrual Menu Option ................................................................. 241

430-D08 Process/Computing Payroll ................................................................................. 250 430-D08a Employees Not Being Paid – PRCK25 .................................................. 251 430-D08b Calculating Pay for One Employee ....................................................... 253

430-D09 Print Payroll Registers ........................................................................................... 253 430-D09a Payroll Register Report – PRCK20 ....................................................... 254 430-D09b Payroll Register Earnings – PRCK21 .................................................... 256 430-D09c Payroll Register Deduction Report – PRCK22 ...................................... 257 430-D09d Payroll Register Benefits Report – PRCK23 ......................................... 258 430-D09e Employee’s Not Paid Report – PRCK26 ............................................... 259 430-D09f Payroll Calculation Totals PRCK67c ..................................................... 260 430-D09 g Payroll Register – PRCK 20g-23......................................................... 261

430-D10 Employees Not Paid – PRCK25 ............................................................................ 262 430-D11 Deductions with Future Dates Report – PRCK27 ................................................. 263 430-D12 Department Totals Report – PRCK30 .................................................................. 264 430-D13 Grand Totals Report – PRCK31 ............................................................................ 266 430-D14 Check Register Report – PRCK35 ......................................................................... 267 430-D15 Gross Wages PRCK36 ........................................................................................... 268 430-D16 Employee Leave Reports ....................................................................................... 269

430-D16a Leave Used Report – PRCK45 .............................................................. 269 430-D16b Leave Accrued Report – PRCK46......................................................... 270 430-D16c Leave Balances – PRCK47 .................................................................... 270 430-D16d Leave Balances – Negative PRCK47 ................................................... 272

430-D17 Print Checks and Direct Deposits .......................................................................... 273 430-D17a Print Checks ........................................................................................... 273 430-D17b Print Direct Deposit Slips ....................................................................... 275 430-D17c Print MICR Checks ............................................................................... 277

430-D18 Bank ACH Tape & Register – PRCK50 ................................................................ 281 430-D19 Federal Tax Deposit ................................................................................................ 282 430-D20 Update Files ............................................................................................................ 283 430-D21 Set PreNotes to YES .............................................................................................. 284 430-D22 Accounting Update ................................................................................................ 284

430-D22a Accounting Load Table ......................................................................... 285

CIC Payroll Contents • v

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2009 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457

430-D22b Accounting Interface Report – PRCK60 ............................................... 287 430-D22c Accounting by Ledger Report – PRCK61 .............................................. 288 430-D22d Accounting Totals Report – PRCK62d .................................................. 289 430-D22e Accounting Detail - PRCK62 ................................................................ 290 430-D22f Labor Distribution Report – PRCK63 .................................................... 291 430-D22g Labor Distribution Summary Report – PRCK64 ................................... 292 430-D22h Payroll Fund Appropriation Report – PRCK65 ..................................... 293 430-D22i Net Pay Fund Report – PRCK70 ............................................................ 294 430-D22j Payroll Calculations Totals Report – PRCK67 ....................................... 295 430-D22k Claim Ordinance – PRCK66 .................................................................. 296 430-D22l Create Accounts Payable Invoices ......................................................... 298 430-D22m Accounting By Ledger Report with AP – PRCK68 .............................. 300 430-D22n General Ledger Update ......................................................................... 301

430-D23 Clean Up After Update .......................................................................................... 302

430-E00 Time Entry Restricted 303 430-E01 Time Entry – Restricted ......................................................................................... 303 430-E02 Payroll Worksheet – PRTM01 ............................................................................... 304 430-E03 Time Entry ............................................................................................................. 305 430-E03a Time Entry Detail ................................................................................................. 306 430-E03b Time Entry Quick Time Entry ............................................................................. 308 430-E04 Monthly Time Entry ............................................................................................... 310 430-E05 Time Entry Reports – Restricted ............................................................................ 310 430-E06 Lock Out Time Entry ............................................................................................. 311

430-F00 Reports 313 430-F01 Report Menu Options ............................................................................................. 313 430-F02 Report Launcher ..................................................................................................... 314 430-F04 Multi-Organization Reports ................................................................................... 314

430-F04a Payroll Organizational Detail Report – PRLT01 ................................... 315 430-F04b Payroll Organizational Summary Report – PRLT02 .............................. 316

430-F05 Leave Liability Report – PRLT05 ........................................................................... 317 430-F06 Open Checks – PRLT10 ......................................................................................... 320 430-F07 Void Checks Report – PRLT11 .............................................................................. 321 430-F08 Employee Overtime by Department – PRLT14 ..................................................... 323 430-F09 Payroll Expense By Department Report – PRLT15 ............................................... 325 430-F10 Retirement Reporting – PRLT16 & PRLT17 ......................................................... 327 430-F11 Prior Year Wages – PRLT18 .................................................................................. 331 430-F12 Payroll Calculation Totals by Date – PRCK67d .................................................... 333 430-F13 Leave Definition Report – PRLT20 ....................................................................... 335 430-F14 Calendar Report – PRLT21 .................................................................................... 336 430-F15 Tax Definition Report – PRLT22 ........................................................................... 337 430-F16 Department Report – PRLT23 .............................................................................. 337 430-F17 User Tables Report – PRLT24 ............................................................................... 338 430-F18 Cost Center Ledger Report – PRLT25 ................................................................... 339 430-F19 Income Deduction Match Setup Report – PRLT30 ................................................ 340 430-F20 YTD Earnings Report – PRLT32 ........................................................................... 342 430-F21 Longevity Parameter Report – PRLT33 ................................................................. 344 430-F22 Employee By Dept Report – PRLT34 .................................................................... 345 430-F23 Employee Income Deduction Match Set Up Report – PRLT40 ............................. 346 430-F24 Rate Change Log Report – PRLT45 ...................................................................... 347 430-F25 Probation List Report – PRLT50 ............................................................................ 348 430-F26 Income Deduction Match Listing Report – PRLT55 ............................................. 350 430-F27 Missing Cost Center Report – PRLT60 .................................................................. 352

vi • Contents CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2009 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457

430-F28 Birthdays by Department – PRLT70 ...................................................................... 353

430-G00 Employee Inquiry 354 430-G01 Employee Inquiry Menu Option ............................................................................ 354

430-H00 Employee History Reports 356 430-H02 Employee Current Pay History – PRHS10 ............................................................ 357 430-H03 Employee Check History Report – PRHS15 ......................................................... 359 430-H04 Employee Time Entry History – PRHS18 and PRHS18s ....................................... 361 430-H05 Employee Hours Worked Report – PRHS20-21 ................................................... 364 430-H06 Employee Check With Hours Report – PRHS22 .................................................. 367 430-H07 Employee Available Leave Report – PRHS23 ...................................................... 369 430-H08 Leave Time History – PRHS24 ............................................................................. 371 430-H09 Employee Deduction Setup – PRHS25.................................................................. 373 430-H10 Employee Benefits Setup – PRHS30 ..................................................................... 375 430-H11 Employee Direct Deposit Setup – PRHS35 ........................................................... 377 430-H12 Employee Wage Set Up – PRHS40 ........................................................................ 379 430-H13 Wage / Withholding History – PRHS36 ................................................................ 381 430-H14 Benefit / Deduction History – PRHS45 ................................................................. 384 430-H15 Earnings History – PRHS50-52 ............................................................................. 386

430-H15a Earnings by Category PRHS50 ............................................................. 387 430-H15b Earnings by Category Summary PRHS50S ........................................... 388 430-H15c Earnings by Check # PRHS51 ............................................................... 389 430-H15d Earnings by Check # Summary PRHS51S ............................................ 390 430-H15e Earnings Gross with Detail PRHS52 ..................................................... 391 430-H15f Earnings Gross Summary PRHS52S...................................................... 392

430-H16 Employee Benefit History – PRHS60 ................................................................... 393 430-H17 Employee Deduction History – PRHS62 ............................................................... 395 430-H18 Employee Detail Pay History – PRHS65................................................................ 397 430-H19 Employee’s Over Max Leave – PRHS70 ............................................................... 400

430-I00 Period End 401 430-I01 Quarterly Reports .................................................................................................... 402

430-I01a Federal Wages – (PRPE02) ..................................................................... 403 430-I01b State Wages – (PRPE03) ........................................................................ 404 430-I01c 941 Report – (PRPE04) ........................................................................... 405 430-I01d 941 Detail Report – PRPE05 .................................................................. 409 430-I01e One 941 ................................................................................................... 411

430-I02 Kansas Quarterly Reporting .................................................................................... 414 430-I02a KPERS Reporting ................................................................................... 415 430-I02b Kansas Unemployment Reporting .......................................................... 420

430-I03 YTD by Department – PRPE15 .............................................................................. 426 430-I04 YTD Grand Totals – PRPE16 ................................................................................. 427 430-I05 Leave Liability Report with KPERS – PRPE21 ...................................................... 429 430-I06 W-2 Processing ........................................................................................................ 430

430-I06a Processing Steps ...................................................................................... 433 430-I06b Re-Add Gross Amts ................................................................................ 434 430-I06c Re-Add W-2 Boxes ................................................................................. 435 430-I06d Print Register .......................................................................................... 436 430-I06e Print W-2’s .............................................................................................. 437 430-I06f Create Media ........................................................................................... 438

430-I07 W-2 Totals Update .................................................................................................. 439 430-I08 Employee YTD Summary – PRPE25-26 ................................................................ 440

CIC Payroll Contents • vii

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2009 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457

430-I09 Workers Compensation Reporting .......................................................................... 443 430-I09a Workers Compensation Rate Setup ......................................................... 444 430-I09b Workers Compensation Audit Setup ....................................................... 445 430-I09c Workers Compensation and Position Setup ............................................ 446 430-I09d Workmen’s Compensation Income Type Setup ...................................... 447 430-I09e Workers Compensation Reports ............................................................... 448

430-I10 Year End Process ..................................................................................................... 460 430-I10a Year End – What Happens ..................................................................... 460 430-I10b Year End Process – PRPE29 ................................................................... 461 430-I10c Year End Process, Step 1. Year End History Report............................... 461 430-I10d Year End Process, Step 2. Clear Totals ................................................... 463 430-I10e Payroll Year End Checklist ...................................................................... 464

430-I11 Check Redemption (Payroll Only) ........................................................................... 472

Index 477

CIC Payroll 430-A00 Site Parameters • 1

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2009 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457

430-A00 Site Parameters General Overview The site parameters are a series of definition forms that create databases used by the application to control its functions and how the program will function at your particular site (location). Each of these definitions is necessary prior to beginning to process a payroll or to enter employees. This documentation should guide you through the setup of the Site Parameters.

2 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A01 Site Parameters The CIC Payroll application contains a number of user-definable parameters that cause the programs to operate in the manner desired by the users. Some of these parameters cannot be modified, and others are defined for each individual installation. This section in the manual covers how to establish the site definitions and parameters.

430-A01a Site Specific Parameters - Preparation The site parameters are a series of definition forms that create databases used by the application to control its functions. This chapter will assist in establishing how the Payroll program will function. Go to the CIC Payroll Application Main Menu. Click on the “Site” button at the top of the screen. This will advance to the screen shown below. Next, click on the “Site Parameters” option from the left-hand side of the screen. This will advance to the Site Specific Parameters Menu.

CIC Payroll 430-A00 Site Parameters • 3

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A01b Site Parameters – Main There are four tabs available at the top of this window; Site Parameters- Main, Organizations, Formats and ACH. The example shown below is the Site Parameters- Main menu. To access the other menus click on the corresponding tab and the window will be displayed. Three command buttons are also located at the top of this window, “OK,” “Exit” and “Help.”

Main Field Definitions

Field/Section Required Explanation Site ID YES This field identifies your site location. This is a

required field and once it has been established it should not be changed.

Organization YES Insert the name of your organization. Note that

this is the name that will appear on the payroll reports.

Address YES Insert the street address as you want it to appear on reports. Enter the Street, City, State,

and Zip Code.

4 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

Name of State YES Enter the name of the State. This information is reported on the W-2 Form.

State ID YES Enter the State ID. This is a two letter

abbreviation for your state. I.e. KS, OK, CO and so forth. This is used to identify the state

withholding tables to use for state taxes. Time Entry Period YES Enter the current payroll cycle number.

Normally the first payroll of the year is one and the next one is two, etc. This is the sequence associated with the Calendar entry describing the current time entry period. (Note: the calendar of payroll is located on the Setup menu selection box and later explained.)

Dates YES The information displayed in this field comes

from the Calendar and the dates are associated with the time entry period entered in the previous box. The user cannot change this information on this screen. If a change is needed it must be done in the Calendar.

W-2 Tax Year YES Enter the current tax year (4 digits). Normally this coincides with the calendar year. Reporting Qtr YES Enter the calendar quarter used for reporting of 941 information. This field should contain: 1, 2, 3 or 4.

Multiple FEDID’s NO This is a yes-or-no question which indicates whether more than one federal organization applies. A check mark in this box indicates yes and a blank box indicates no. A “yes” response causes the accounting allocation to be distributed between organizations, however one check is issued.

Distribute Matches NO This is a yes-or-no question, which indicates

whether the matches in each payroll are to be distributed among the Cost Centers which proportionally make up the employee’s income. A check mark in this box indicates yes and a blank box indicates no. A “yes” response causes the matches to be distributed.

CIC Payroll 430-A00 Site Parameters • 5

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

Quick Time Entry NO This is a yes-or-no question, which indicates whether the quick time entry method is used. A check mark in this box indicates yes and a blank box indicates no. A “yes” response will allow you to use the quick time entry method. A “no” response will not allow the quick time entry and the long form time method where individual day entries is used.

Pro-Rate Net NO This is a yes-or-no question which indicates

whether the pro-rate net method is used. A check mark in this box indicates yes and a blank box indicates no. A “yes” response will distribute the net amount of a payroll check among the associated Cost Centers. A “no” response will not distribute the net amount of the payroll check among multiple Cost Centers

if the employee is paid from more that one cost center.

Use Alternate Group Life Calc NO This is a yes or no question which indicates

whether the alternate group life calculation will be used. A “yes” response will use this alternate calculation method for group life. A “no” response will use the original calculation method.

Salary Decimals YES Enter the number of decimals used in salary

amounts. Normal entry in this field is 2. Leave Accrual Methods NO Enter “STD” or site name for custom methods. Current Bank Name NO This field is an informational field and is not

updateable, by the user. When payroll checks are generated the name of the bank the checks are currently being written on is displayed in this field.

Current Bank NO This field is an informational field and is not Account Number updateable by the user. During the process in which payroll checks are generated the name of the bank account that the checks are currently

being written on is displayed in this field.

6 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A01c Organizations Click on the Organizations tab to access the screen shown below.

Organization Field Definitions Field/Section Required Explanation Date Labels YES Enter the two dates that you would use on

each employee record. It is required that one of these fields is a Birth Date and the second date is user defined.

Currency Labels YES Enter the names of 2 currency fields to use

on each employee record. The user is required to use Yearly Inc (Yearly Income) in one of these fields.

Flag Labels NO Enter the names of two user-defined fields to use

on each employee record.

CIC Payroll 430-A00 Site Parameters • 7

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

Note: The CIC payroll application supports multiple organizations (from the federal government’s viewpoint) together within a single payroll. This could occur if your organization had a subsidiary organization with a separate Federal ID. If your organization has more than 26 separate organizations please contact CIC. Below is a sample of the screen with multiple organizations.

Org ID YES Enter an “A” for the first organization. Enter a“B” for a second organization, if multiple organizations will be used, and so on. At least one organization must be entered. Fed ID YES Enter your Federal Identification Number

provided to you by the Internal Revenue Service for your organization. If using multiple organizations, each organization must have a separate Federal ID number entered for each organization.

Org Name/Address YES Enter the name of your organization and

mailing address as it should appear on the W-2 Forms. If using multiple organizations, each organization must have an organization name and address entered.

8 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

City/State/Zip YES Enter the City, State and Zip Code for your

organization. If using multiple organizations the user must have the City, State and Zip Code information entered for each organization.

State ID YES Enter your State ID. This is the ID provided to your organization by your State. If using multiple organizations, enter a State ID for each organization.

State EC ID NO Enter your State Employment Commission

identification number.

CIC Payroll 430-A00 Site Parameters • 9

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A01d Formats Click on the Formats tab to access the screen shown below.

The information on the screen identifies to the system which format you choose to use when performing the printing functions. Format Field Definitions Field/Section Required Explanation Check Format YES Enter the name of the report file that

represents the check format being used for printing payroll checks in your organization. Once this field is set up it should not be changed unless a new check format has been established.

Check Copy NO Enter the name of the report file that is

used when a copy of the payroll check is printed.

Draft Format NO Enter the name of the report file that is used when an ACH draft is printed. Timesheet NO Enter the name of the report file that is used

when time sheets are printed. At this time a uniform time sheet report has not been developed for quick or detail time entry. Future development will be based upon a format agreed upon by the user groups.

10 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

MICR Font NO Enter the name of the MICR font file that is

used when printing MICR fonts on the checks. Postnet Font NO Enter the name of the Postnet font file that is

used when printing Postnet.

CIC Payroll 430-A00 Site Parameters • 11

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A01e ACH Click on the ACH tab to access the screen shown below.

ACH Field Definitions

(File Header Record (1)) Field/Section Required Explanation Immediate Destination YES Enter the bank routing number of the immediate

destination. The immediate destination is normally the Federal Reserve Bank in your area and this field would contain the routing number for the Federal Reserve Bank.

Immediate Origin YES This field contains the bank routing number for

your bank where the ACH transactions would originate.

12 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

File ID Modifier YES This field normally contains a “D”. Immediate Destination YES This field contains the name of the immediate Name destination bank name. Normally the name of your local Federal Reserve Bank. Immediate Origin Name YES This field contains the name of your bank where the ACH transactions are written.

(Company/Batch Header/Control (5/8)) Field/Section Required Explanation Company Identification YES This field contains a number that identifies your

organization. Often this number is a one (1) followed by your Federal Identification Number.

Originating DFI YES This field contains the originating designated Identification financial institute identification. Often this is the same number as the routing number.

(Entry Detail (6)) Field/Section Required Explanation Trace Number YES This field contains a trace number that is

associated with the ACH Transactions. Often the trace number is the originating bank’s routing number.

(Company Offset (6)): Field/Section Required Explanation Generate Offset NO To generate the off setting banking entry for the ACH into your account, check this box. Company Bank YES Enter the name of your bank. Routing YES Enter the Routing Number of your bank Company Bank Account YES Enter your bank account number. Path YES Enter the path where you want to

CIC Payroll 430-A00 Site Parameters • 13

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

Place the data file. i.e. C:\payroll ACH Transfers Note: this file can be renamed so it can be retained if needed.

After the user has completed entering the site parameters on this menu, press the “Exit” button to return to the Payroll Main Menu.

14 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A02 Employee Maintenance Log (PRST01-03) STEP 1. From the Payroll Main Menu, click on the “Site” button located at the top of the menu. The “Site” options will be displayed. STEP 2. Click on “Employee Maintenance Log PRST01-03” in order to access the screen shown below.

An Employee Maintenance Log report is a listing generated by the program that will identify the activity of changes which was “logged” within the payroll program on the employee records. From Date Enter the date from which to begin reporting the activity. To Date Enter the date on which to end the reporting of activity. The log report will print the following information:

• Employee ID # • Employee Name • Action • Date/Time • Operator • What Happened

There are three types of reports to select: By Date (PRST01), By Employee (PRST02), Alphabetic (PRST03). Select one of the function buttons at the bottom of the screen to select the type of log report to print. Examples of each report are shown on the following pages.

CIC Payroll 430-A00 Site Parameters • 15

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A02a Employee’s Maintenance Log By Date (PRST01) This report is sorted by the action date for the activity within the period you select. See the sample report below.

16 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A02b Employee’s Maintenance Log by Employee (PRST02) This report is sorted alphabetical by the employee (the user name of the person) who made the change for the activity within the period you select. See the sample report below.

CIC Payroll 430-A00 Site Parameters • 17

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A02c Employee Maintenance Log by Alpha (PRST03) This report is sorted alphabetically by the employee name for the activity within the period you select. See the sample report below.

18 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A03 Change Code On occasion you may determine that you wish to change the currently used income, deduction or leave codes and move them to a new code. This menu option is a maintenance tool. We suggest you backup the database prior to making changes using this option, as a safeguard. Below is a sample of the Change Code selection screen.

In the From Code field enter the currently used income, deduction or leave code. In the To Code field enter the new code you want to change to. Then if your code type was an income or deduction code, press the Income / Deduct button to execute the change. If the code type you are changing is a Leave code press the “Leaves” button to execute the code change. You will receive the following message asking you if you are sure you want to continue.

If you are sure and want to continue, press the “Yes” button. If you are not sure and you do not want to continue, press the “No” button and the change request will be cancelled. If you have answered “Yes” to continue, the system will update the code and, when finished, issue you the following message.

Press the “OK” button. The change has occurred and your code used is now the NEW code. Review the employee information to verify the change.

CIC Payroll 430-A00 Site Parameters • 19

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A04 Pro-Ration Of Leave

430-A04a Leave Pro-Ration Approach If one or more of the leave definitions use an “Hourly” method for the accrual, then the leave pro-ration definition must be defined. This simple form tells the system what the normal number of work hours are for each department. If you are not using the hourly-method, this segment can be ignored. If using the hourly-method, this element must be defined.

Select the Frequency from the drop-down menu. Select the Department from the drop-down menu. Enter the Standard Hours for the department for the payroll period.

20 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A05 User Tables

430-A05a User Table Approach While the forms below indicate User Defined Fields, these tables actually are used to provide pertinent selections on the pull-down lists throughout the application. In most cases, the entries cannot be changed, and should not be changed. In certain cases, additional entries can be added to the table of valid entries. Normally, however, CIC will make suitable changes in these tables, as there is usually code in support of each change. Under no circumstances should entries be removed from the tables.

CIC Payroll 430-A00 Site Parameters • 21

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A05b User Table 100 (Valid Payroll Types)

22 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A05c User Table 102 (Leave Compute Methods)

430-A05d User Table 103 (Income / Deduction Compute Methods)

CIC Payroll 430-A00 Site Parameters • 23

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A05e User Table 104 (Filing Status)

430-A05f User Table 108 (Pay Method)

24 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A05g User Table 110 (Bargaining Units)

430-A05h User Table 120 (Tax Table Groups)

CIC Payroll 430-A00 Site Parameters • 25

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A05i User Table 140 (Payroll Frequency)

430-A05j User Table 141 (Full time / Part time)

26 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A05k User Table 160 (Insurance Coverage)

430-A05l User Table 180 (MICR Fonts)

CIC Payroll 430-A00 Site Parameters • 27

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A05m User Table 181 (Post Net Fonts)

430-A05n User Table 182 (Signature Diskette Drive)

28 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A05o User Table 200 (More Employee Fields)

430-A05p User Table 210 (OverTime Recompute Categories)

CIC Payroll 430-A00 Site Parameters • 29

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A05q User Table 440 (Organizational ID)

430-A05r User Table 900 (Report Launcher)

30 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A05s User Table 910(Payroll Group Types)

CIC Payroll 430-A00 Site Parameters • 31

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A06 Signature File Location You have the option to print a signature or multiple signatures on the checks. If you wish to use the option to print signatures on checks then the location of where the signature file resides is needed. As shown in the sample screen below, enter the path to the location of your signature file. If you are not using this option then leave the form blank.

Note: CIC recommends that you place the signature file in a security location where access is restricted to authorized users only. In this sample, the check signature file resides on a CD which is kept in a vault until check printing time, then it is removed and used to print checks. After checks are printed the CD is returned to the vault.

430-A07 Reduce Leaves to Max This as a utility tool that is used to reduce the amount of leave accumulated if greater than the maximum accrual amount shown in the leave type. This option will adjust the amount of leave on an employee down and make the amount equal to the amount of the maximum if the employee has an amount greater than the maximum. Caution, this option does all leaves and does not select only one particular leave type. When you open this menu option the following message will appear.

If you wish to proceed and adjust the employee leave amounts down to the maximum accrual amount for the leave, press the “OK” button to continue. If you do not want to proceed with this adjustment, press the “Cancel” button and no adjustments will be made.

32 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A08 Renumber – Reset – Readd This area of the menu contains options that are maintenance tools that will assist you when needed. Please read the specific instructions associated with each function to insure you get the results you need.

430-A08a Change Employee Number On occasion, you may find that you have assigned an employee a number and you want the number to be changed to a different number that is not used by another employee. This menu option is designed to assist you in accomplishing this task. We do not recommend that you change employee ID’s during a payroll process. This function should be used after a payroll is posted and before time entry is loaded for the next payroll. This function will update records in the payroll and personnel application using the employee ID.

Enter the current employee ID number in the From EMP # field and enter the new number you want to assign to the employee in the To EMP # field. If you do not want to proceed with making this change, press the “Exit” button. If you want to continue and make the change, press the “Execute” button. When the change has been completed, you will receive the following message.

NOTE: Prior payroll setups included employee ID’s which were the employee’s social security numbers. Due to security reasons we recommend that you no longer use the social security number as the employee ID. This option can be used to change the employee ID from their social security number to a identification you assign.

CIC Payroll 430-A00 Site Parameters • 33

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A08b Renumber Jam Checks On occasion, you may have a check that gets jammed in the computer and the paper form is no longer suitable for printing on. In this case, you have a spoiled check. Prior to running the payroll update, you have the ability to enter your spoiled check number in the system. Click on the Renumber Jam Checks option, the following screen will appear. Type in the Spoiled Check Number (in our example the check number would be #78123), then click on the “Execute” button.

34 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A08c Renumber One Check (Before Update) If you need to renumber only one check, click on the Renumber One Check option from the menu. Next, fill in the Spoiled Check Number and the New Check Number in their appropriate fields. Click the “Execute” button.

430-A08d Renumber after Update To renumber a check after the update has been performed; choose Renumber After Update from the menu. Type in the Old Check Number, New Check Number or the Employee Name. Once those fields have been filled in, click the “Execute” button.

Caution: This function contains no editing. It finds the old check number in check history and updates the record to the new check number entered. Please verify the number that you wish to change prior to using this function. Changes made to the check numbering using this option does not update check numbers in the Budgetary Fund Accounting application.

CIC Payroll 430-A00 Site Parameters • 35

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A08e Reset Accounting If, during the interface process to the GL, you have a problem, this tool is available to allow you to regenerate the accounting entries again. This option performs two separate functions when it is executed. In the first step, the system removes all payroll accounting entries in the accounting table, which is used in the GL update step. In the 2nd step, the system resets the accounting flag on the employee check records, which will then indicate that the transactions associated with the checks has not been interfaced and allows us to regenerate the accounting. In order for this option to work properly, you must enter the EXACT date that is printed on the checks. The user is allowed to reset the accounting for all checks written on that date or for one specific pay group. Select the desire pay group from the drop down box or leave it blank to reset the accounting for all pay groups.

After using this function, return to the payroll checks menu, select the Accounting menu option and begin recreating the entries using Option 1, LOAD TABLE. Continue on through the regular update process.

36 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A08f Re-Add MTD / QTD / YTD This is a maintenance tool. On occasion, the need to read the totals for the month to date, quarter to date and year to date will need to be recalculated. When this menu option is selected, the following message will be displayed.

As indicated in the message, this process clears the totals and then re-adds the information for the totals from the employee checks. If you do not want to continue, press the “No” button and your request will be cancelled. If you wish to continue with the process, press the “Yes” button. The system will then clear the MTD, QTD, and YTD amount fields and will re-add the transactions to establish the correct amounts.

430-A08g Backup Database Location During routine processing you may determine that you want to backup the database. This backup is used in addition to a recommended daily backup. In this menu option you should enter the location on your system where you want the backup to be placed when the backup has completed. If the location of your backup is to a file server use a UNC (universal naming convention) path as shown in the sample below. Please note that ALL databases are backed up at the same time to insure that the data saved is complete and includes all other data at the time the save occurred.

Enter the specified location and press the “Save” and “OK” button. Exit when you have completed entering the information you desire to keep.

CIC Payroll 430-A00 Site Parameters • 37

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A08h Backup Databases As described on the screen, this option will back-up all databases to the location entered in the box displayed when the “Backup” button is executed. When you open this form the screen will display the default backup location set up in the previous menu option. If you wish to change the location you can type in a new location or continue with the default setting.

After reviewing or changing the location of where you want the backup copy of the database to go, press the “Backup” button to begin the backup. Your screen will provide a message that the backup has begun and ask you to wait before you continue with another function. When the backup has completed the screen will display a message indicating that the backup completed successfully and the message will contain the location of where the backup was placed in the system and is followed by the name of the user who performed the backup and the date and time of the backup. If you find that you need to restore data from the backup, please contact CIC support for assistance to insure that the needed data is restored.

38 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A08i Remove Database Backups This option will allow you to remove the older copies of the database Backups that were previously created and you no longer need them. The delete function will allow you to delete by a date range which also includes the time of day. Go to the Site Menu and locate the “Remove Database Backups” menu option.

CIC Payroll 430-A00 Site Parameters • 39

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

Select the menu option “Remove Database Backups” and the Cleanup Database back-ups screen, as shown in the sample below, will be displayed.

The Back-up Folder field displays the location that is used by the system to store user backups. This location is designated using the menu option “Default Database Location” which is also on the site menu. The existing backups found in this location are shown in ascending date/time order. These are backups built by users when running the “Backup Database” menu option. These backups are saved with a file name that indicates the date, time and user. Below is a sample of the backup folders saved on the system when the backups are created.

40 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

This option will delete the backup copies in the default backup location based upon the criteria entered in the From Date/Time and To Date/Time fields. Enter the desired beginning date, time and AM or PM in the From Date/Time field and enter the desired ending date, time and AM or PM in the To Date/Time fields. Press the “Delete” button to execute the delete of the backups which match your selection criteria. To demonstrate, please note in the sample screen below:

• The default user backup database location is “C:\User Backups\” • There are five (5) database backups on the system, the oldest one is Sally’s on

08/31/2006 at 11:32 and the most recent is sysmgr on 10/06/2007 at 18:31. • We wish to delete the older 2006 backups and completed the From Date/Time and To

Date/Time fields to indicate the desired date range.

CIC Payroll 430-A00 Site Parameters • 41

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

Press the “Delete” button to execute the delete function. The system provides the following message showing that two (2) backup sets were deleted.

Press the “OK” button and you will return to the screen. You can make additional selections if needed. When you return to the Cleanup Database back-ups screen notice the two (2) backups previously deleted and no longer found in the backup folder.

42 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

Note: If you select the “Remove Backup Databases” menu option and you have not designated a default backup location you will receive the following message.

To resolve the problem, go to the menu option “Default Database Location” and set the location on your system for user backups.

CIC Payroll 430-A00 Site Parameters • 43

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A09 CIC Support Tools

430-A09a Modifications This menu option contains information maintained by the CIC staff. It is used when changes are made to the program. The information contained is the revision number, who made the revision, the date the revision was made, the name of the tables, forms, macro, procedures, queries or reports that were modified, and a description of the modification.

430-A09b Testing This menu option contains information maintained by the CIC staff. It is used when changes are made to the program and the testing of the change. The information contained is the name of the staff member doing the testing, the testing date, the testing stage, the release version, the testing procedure used, a brief description of the change, the menu and menu item where the change occurred, and notes for use when the change is released.

430-A09c Installation This menu option contains information maintained by the CIC staff. It is used when changes are made to the program. This contains information related to installing changes at the customer site.

430-A09d Log In This menu option contains a log in screen, which is used by the CIC staff. It is used when changes are made in security and allows the support staff to log in and verify the new security settings.

430-A09e Database Lockdown This menu option is a tool used by CIC support staff, which will allow them to unlock the database and gain access to the supporting data tables, forms, queries, reports and program code when needed.

44 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A10 Access Users added in during the site security setup are viewed using this option. The current users with access to your system are displayed on the Site Access screen as shown in the sample screen below.

The fields are as follows: Field Name Description Name The name identifying the user in the system Password This is the password required for logging

in. It is not hidden on this screen. Delete button This is used to remove the user so they will

no longer have access to the system. This removes them as a user from all applications because it is site access. If you want to remove them from an application, this is done in the security setup.

CIC Payroll 430-A00 Site Parameters • 45

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-A10a User Access For each user that has access to the Payroll application, you will need to identify all of the screens and menu items they are permitted to use in the Payroll application. On the User Menu Definition screen located in Site Parameters, the various options are listed. When you initially set up a user in Payroll and enter this screen, the screen will appear blank for the new user (as shown in the example screen below). To install the default menu set, click on the “Refresh” button on the toolbar by the screen title.

After the Refresh option has been executed, the new user will have the default options as shown in the following example screen. The system will grant the new user ALL menu options and you must uncheck the user field on those menu options that the particular user should not have access to.

46 • 430-A00 Site Parameters CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

The fields as you read across the screen are as follows: Field Description / Function System This field Identifies what system the menu

is associated with. In this case it is “pr” meaning Payroll.

System Menu This field is the reference number of the menu.

Order Order in which this item will display on the screen.

Menu Option Description This field contains the description of the menu option that is displayed.

Macro This field contains the macro that is used for the menu item.

User access? Is this menu item enabled for this user? A check mark indicates that the user is allowed to see and use the menu option.

CIC Payroll 430-B00 Setup • 47

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.

430-B00 Setup This menu contains options that require setup information that relates to how the payroll application will function.

48 • 430-B00 Setup CIC Payroll

REPRODUCTION OR QUOTATION, IN WHOLE OR IN PART, IS STRICTLY PROHIBITED. Copyright© 2006 Computer Information Concepts, Inc. (CIC), Greeley, CO 80631 (800) 437-7457.