CIB Registration Form

-

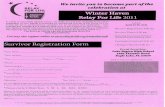

Upload

ashrafkhan -

Category

Documents

-

view

233 -

download

0

Transcript of CIB Registration Form

-

8/2/2019 CIB Registration Form

1/14

Corporate Internet Banking

Registration Form

Section 1 - Company Profle

1.1 Company Details

Company Name:

Valid CR No.:

Company Address:

Telephone Number/Mobile No.:

Company Web Address:

1.2 Representative Contact DetailsPrimary Contact Person:

Valid QID No.:

Title: First Name Last Name

E-mail Address:

Secondary Contact Person:

Valid QID No.:

Title: First Name Last Name

E-mail Address:

Section 2 - Services Required

Please provide a tick against the service(s) required.

CIB - Complete section 4

Enquiry Reporting Merchant A/C Instructions Trade Finance

Section 3 - Billing Inormation

RSA Token Charge - Debit A/C

For Bank Use Only

Transactional sales (BDM)

Credit Ofcer Tel: Email:

Admin Assistant Email:

Risk Ofcer

CIB Terms o Service

Utility PaycardBook

Transer

Third Party

Transer

Telex

TranserDrat

Cheque

Book Request

Bulk

Remittance

Payment Type Required

Preerential FX Rates (i any)

Trade Finance L/C L/G Collection

Advice Delivery Method (MT103) eMail eMail eMail eMail N/A eMail

SMS Notifcation SMS SMS SMS SMS SMS SMSDelivery o User ID & Password Through Email

Delivery o RSA Secure ID Courier or Hand delivery

Transaction Charges (QAR) Free Charge Charge Charge N/A N/A

One-time: Installation + RSA Token

1 1.1

:

: :

: / :

1.2: :

:

: :

: :

2

/ 4

3

: -

1

-

8/2/2019 CIB Registration Form

2/14

-

8/2/2019 CIB Registration Form

3/14

Section 4 - CIB (Continued)

4.3 RSA Token Request or users (Hotmail IDs not acceptable)

Do not pay cash on receipt o the token(s).

Name of User:

Preerred User name:

Signature

Department Name:

e-Mail Address:

//// :Group: A/B/C/D/E

Mobile No.:

Name of User:

Preerred User name:

Signature

Department Name:

e-Mail Address:

//// :Group: A/B/C/D/E

Mobile No.:

Name of User:

Preerred User name:

Signature

Department Name:

e-Mail Address:

//// :Group: A/B/C/D/E

Mobile No.:

Name of User: Preerred User name: Signature Department Name:

e-Mail Address:

//// :Group: A/B/C/D/E

Mobile No.:

Name of User:

Preerred User name:

Signature

Department Name:

e-Mail Address:

//// :Group: A/B/C/D/E

Mobile No.:

4.4 Debit Account Set-up (Payment Initiation)

The Company reeres to our agreement or Commercialbanks Payment Services. Please nominate the accounts(s) listed below and/or on the

attached addendum, or use by this service. This supersedes any prior nomination.

Account Name

Account Number

Currency

) ( Other Instruction (I any)

150 )Hotmail ( 4.3

) ( 4.4

/ / / . . .

)( 4

/.

3

-

8/2/2019 CIB Registration Form

4/14

Section 4 - CIB (Continued)

4.5 Signing Limit Matrix & Levels

Please Indicate Base Currency i not the local currency:

Group A

Group B

Group C

Group D

Group E

Single Limit

Single Limit

Single Limit

Single Limit

Single Limit

Dual With B

Dual With B

Dual With A

Dual With A

Dual With A

Dual With C

Dual With C

Dual With B

Dual With B

Dual With B

Unspecifed

Dual With D

Dual With C

Dual With C

Dual With C

Releaser

Pre-Releaser

Validator

Checker

Originator

I / We acknowledge that my/our use o the service(s) required will be governed by the relevant terms and conditions applicable to such

services(s) as indicated below and terms & conditions o related documents (Terms & Conditions). I / We hereby certiy that the inormation

provided in this orm is and will be true and accurate at all times and, i it is not, I/We will notiy you o the inaccuracy o such inormation and

orthwith provide to you the up-to-date inormation.

Customer

Authorised signatory or the Company Authorised signatory or the Company

Name: Name:

QID No: QID No:

Title:

Signature: Signature:

Date: Date:

)( 4 4.5

/ / / / / ) (

/ .

4

-

8/2/2019 CIB Registration Form

5/14

The Commercial Bank of Qatar (Q.S.C)P.O.Box 3232, Doha, State of Qatar

Telephone: +974 4449 0000Fax: +974 4449 0070www.cbq.com.qa

TERMS AND CONDITIONS

FOR CORPORATE INTERNET BANKING

CORPORATE INTERNET BANKING AGREEMENT (Mandatory)

This Agreement is made in Doha,

State of Qatar on ................................................... (the Signing Date)

by and between:

The Commercialbank of Qatar (Q.S.C.), CR No. 150, with address at

3232, Doha, Qatar

represented by its authorised signatory

Mr. ............................................................................................. in his

capacity as ................................here in after referred to as (the Bank)

and..................................................................................... Company,

CR No. ....................................................................., with address at

......................................................................................, Doha, Qatar

represented by its authorised

signatory Mr. .....................................................................................,

ID No. ................................ in his capacity as ....................................

and Mr. ...............................................................................................

ID No. ................................. in his capacity as ..................................

hereinafter referred to as (the Corporate

1. INTRODUCTION

1.1 The Corporate wishes to use the Corporate Internet Banking

service (the Online Service) provided by The Commercialbank

of Qatar (Q.S.C.) and The CommercialBank of Qatar (Q.S.C.) is

willing to make the service available to the Corporate.

1.2 The Commercial Bank of Qatar (Q.S.C.) and the Corporate agree

that the Corporate Internet Banking service shall be supplied to

the Corporate by providing the Corporate with an online account

through which the Corporate can access the Accounts it holdswith Commercialbank, send Instructions to the Bank, and submit

requests. The provision of the Corporate Internet Banking service

is subject to acceptance of these Terms and Conditions which

the Bank may amend from time to time as it reasonably sees

necessary at its absolute discretion and without prior notice to, or

consent of, the Corporate.

2. DEFINTIONS AND INTERPRETATIONS

2.1 Defined terms used in this Agreement are set out below:

Account(s) means any bank accounts held with The Commercial

Bank of Qatar (Q.S.C.), including but not limited to current

accounts, savings accounts, call accounts, deposit accounts,

tumuh accounts, and investment accounts.

Agreement means the Corporate Internet Banking Agreement

entered into between The Commercial Bank of Qatar (Q.S.C.) and

the Corporate for the provision of a Corporate Internet Banking

account through which Corporates can access and operate their

Accounts held with the Bank.

eG MCGh hTcd fhdEG aG

(QLEG) cd fhdEG aG eG bJG

,MhdG j bJG g GHEG

(bdG jQJ)..............................................jQH b dhO

:e c H

,,U fGY ,150 bQ Q ` S ,(...` T) dG QdG dG,b ,MhdG ,3232

bdH VG

H ................................................................../dG

(dG) `dH H a d Qoj ...................................................bQ Q S ,.......................................................cT h

,U fGY ,.................................................................

,b ,MhdG ,..................................................................

VG

,................................................................./dG bdH

..........................H............................bQ T bH

,........................................................................./dGh

...........................H...........................bQ T bH

(cdG) `dH H a d Qoj

.1

cd fhdEG aG eG SG cdG ZJ M 1,1dG QdG dG b e eG (fhdEG aG eG)g aH (...T) dG QdG dG j Mh ,(...T)

.cd eG

cdGh (...``T) dG QdG dG H JG ,Y AH 1,2jhJ Y cd cd fhdEG aG eG J YEG NdG e SGH cdG J hdEG e H cdGJh d LdG SQEG ,QdG dG H MG JHMb Y cd fhdEG aG eG J bj ,dGM NB bh e jJ d Rj dGh MCGh hdG gSQEG EG LG hOh G jd kah e H kjQhV Gj

.aGe Y G hCG cd e QTEG

GJh jJ .2

:dG dG Y bJG g eG G jJ 2,1

dG QdG dG H ae HM CG J zHG{,adG HM ,jQdG HG M hO dP jh (...T)

HMh dG HM ,` FGO` dG HM ,dG Y HM.QSG

eG cd fhdEG aG eG bJG J zbJG{e M d cdGh (...T) dG QdG dG HaG JHM EG NdG e cdG dGh cd hdEG

. Jh dG H

5

-

8/2/2019 CIB Registration Form

6/14

The Commercial Bank of Qatar (Q.S.C)P.O.Box 3232, Doha, State of Qatar

Telephone: +974 4449 0000Fax: +974 4449 0070www.cbq.com.qa

Bank means The Commercial Bank of Qatar (Q.S.C.) or

Commercialbank.

Business Day means presently Sundays to Thursdays (bothdays inclusive) excluding public holidays. For a transaction to be

carried out on an immediate business day, Instructions must be

submitted before the cut off time of that business day.

Corporates and their Delegates should refer to Clause 6.11

regarding Instructions that may not be possible to be carried out

on the immediate business day an Instruction is submitted.

Corporate shall mean an entity, other than Personal Customers,

that maintains an Account relationship with the Bank and wishes

to utilize the Corporate Internet Banking service through a

Delegate.

Cut-off Times shall mean the cut off time for Instructions to be

acted on by the Bank.

The Cut-off time is currently 1.00 pm Qatar time, Sunday through

Thursday.

Delegate shall mean the individual nominated by the Corporate

to access the Online Service on behalf of the Corporate and

authorised to use the Online Service to submit Instructions in the

name of the Corporate.

Instruction shall mean any request or instruction, including but

not limited to instructions concerning Trade Finance, submitted

to the Bank by the Delegate through the Online Service.

Online Service means the Corporate Internet Banking service

provided by the Bank to the Corporate whereby the Corporate,

through its Delegates, may access Account information and

convey Instructions to the Bank in respect of certain Accounts

held by the Corporate with the Bank. Not all Accounts may be

accessed through the Online Service; for details of Accounts

currently available on the Online Service, please refer to the Help

link within the Online Service.

Trade Finance shall mean Letter of Credit (including import and

export); Letters of Guarantee (including Performance Bond;

Tender Bonds; and Payment Guarantees); and Collection.

Authentication Level shall mean User ID, Passcode and

Password.

User ID means User name to be entered by the Delegate to gain

access to the Online Service and which the Bank uses to identify

the user.

Passcode means the RSA token provided to the Delegate which

is an electronic token that generates a new passcode access

number every 60 seconds and which must be used in conjunction

with the User ID and Password to gain access to the Online

Service.

Terms means these Terms and Conditions, together with

information contained within the Help link of the Online Service,

and any supplementary terms which the Bank notifies to the

Corporate through the Online Service, as amended from time to

time.

Time means Qatar local time.

.QdG dG hCG (...T) dG QdG dG j zdG{

MCG ej dP ) G EG MCG e ``jCG j zY j{dG jCG MCG eG J d .edG dG ASH (GhdG j eG jEG bh b LdG J j ,jQG

.G

LdH G 6,11 IOd LdG Hheh cdG Y j.G dG j J Y gJ j b dG

M bY jd ,OGaCG AdG N ,fb c J zcdG{cd fhdEG aG eG e IOSG Zjh dG e

.Hhe MCG SGH

dG j M eG J jEG bh j zeG jEG bh{.LdG H

M dG H IMGdG YdG g kdM eG J jEG bhc e G `j EG ` MCG ` j e kGQYG d G bdG

.SCG

eG EG NdG V H cdG b e G OdG j zhe{fhdEG aG eG SH VGh fhdEG aG

.cdG SH LdG d

eG EG NdG VH cdG b e G OdG j :zLJ{jdH G LdG ,M hO dP jh ,fhdEG aG

.QdG

fhdEG aG `e`G J z``fh``dEG aG `e`G{Y ,SGH cdG J dGh cd dG b eG cdd LdG QGUEGh G ee EG NdG e ,Hhe fCG G e .dG H cd e HH j a,fhdEG aG eG SGH HG G`fCG ad NdGdEG `N`dG dG HH G eG Y deG V OLG IYG HGQ GSG Lf eG Y kdM

.fhdEG aG

dP ) OYG HH G eG j :zQ` j{dP ) dG HN ,(jdGh OGSG OYG HNYh (OG`` ` dG fVh bG fV ,dG fV

.dG

.QhG ch QhG eQ ,G SEG j zdG ie{

hG b e dNOEG j dG G SEG j zG SEG{dG j `dGh fhdEG aG eG EG NdG V H

.G jg Y SGH

hd j dGh dG Y e eBG NdG eQ j zQhG eQ{60 c jL Qhe eQ bd NdG j hdEG eQ Y IQY ghNdG VH QhG ch G SEG e eGSG j dGh fK

.fhdEG aG ed

G eG EG aVEG ,MCGh hdG g J zhdG{dG j J hT CGh fhdEG ed IYG `HGQ j M fhdEG aG eG jW Y cd ZHEH

.NB bh e jJ

.b dhd G bdG j zbdG{

6

-

8/2/2019 CIB Registration Form

7/14

The Commercial Bank of Qatar (Q.S.C)P.O.Box 3232, Doha, State of Qatar

Telephone: +974 4449 0000Fax: +974 4449 0070www.cbq.com.qa

Value Date shall mean the date an Instruction is submitted to the

Bank.

The clause headings in these Terms and Conditions are for easeof reference only.

3. CORPORATE AUTHORIZATION

The Corporate must nominate two (2) authorised representatives

to act as Delegates of the Corporate authorised to access the

Online Service on behalf of the Corporate and to submit Instructions.

The nominees must be notified to the Bank immediately upon

application for use of the Online Service. If the nominees are not

named in the Corporates Commercial Registration , the Bank will

require a corporate board resolution in a form acceptable to the

Bank and in conformity with the Corporates Memorandum and

Articles of Association or equivalent constitutional documents

naming the appointees as Delegates empowered to use theOnline Service on behalf of the Corporate. The board resolution

should explicitly state who the Delegates are and what authority

and limitations they have and must be submitted before the Online

Service will be provided to the Corporate and access granted to

the Delegates.

4. SECURITY DUTIES AND OBLIGATIONS OF THE

CORPORATE AND DELEGATE

4.1 The Corporate and its nominated Delegates agree to comply with

these Terms and any security procedures mentioned herein.

4.2 Delegates must keep the User ID and Password secure and secret

at all times and take all reasonable steps to prevent unauthorisedaccess to and use of them.

4.3 The Delegate must advise the Bank immediately of any

unauthorised access to the Online Service or any unauthorised

Instruction which the Delegate knows of or suspects or if the

Delegate suspects that someone else knows the Delegates

Password. In such an event the Delegate must change their

Password immediately through the Online Service. The Bank may

request the Delegate to assist the Bank and the police in trying to

recover any losses incurred by unauthorised access to the Online

Service. The Bank may disclose information about the Corporate

or the Corporates Accounts to the police or other authorised third

parties if the Bank believes it will help prevent or recover losses.

4.4 The Delegate agrees to check carefully and regularly its records of

transactions and statement of Accounts with the Bank and inform

the Bank immediately of any discrepancy.

4.5 The Corporate agrees to keep the Bank indemnified against all

actions, proceedings, costs, losses and damages of any kind

which the Bank may suffer as a result of the Bank acting on

Instructions of the Delegate, or as a result of a Delegates failure to

comply with its security duties and obligations under this Clause

5. ACCOUNT TYPES AND ACCESS TO CORPORATE

ACCOUNTS

5.1 The Corporate, through its Delegates, may request the Bank

to provide or withdraw the Online Service, to request additionalAccounts opened at any time with the Bank be added to their

online account and to issue Instructions. Any Accounts for which

the Online Service are provided will be subject to these Terms and

the board resolution (if any) provided by the Corporate at the time

of the creation of the Online Service.

.d LdG J jQJ j zdG jQJ{

LdG J V H MCGh hdG g OGG jhY NOEG .a dEG

cdG jJ .3

Ve Hhc dH ed (KEG) J CG cdG Y jJh cdG Y Hf fhdEG aG eG EG NdHQa HhG qSEH dG HEH J CG cdG Y j ,LdGJ J GPEG .fhdEG aG eG SG W JJ j CG d j gY ,cd QdG dG HhGe Gh d dG dH cdG IQGOEG e QOU QGbd dOe SCJ Ge CG hCG cdG SCJ Yh J IOTaG eG SH dfl Hhc G J L jVH IQGOEG QGb j CG j .cdG Y Hf fhdEG

Y Vhe Ob CGh H j S CGh HhG g e YfhdEG aG eG J b d G QGdG J jh.Hhd NdG PEG eh cd

GAG`````LEG P````JG C```H ``Hh```Gh `c```dG ``eG```dGh ```LGh .4eCG

GAGLEG CHh MCGh hdG H dG Y gHheh cdG aGJ 4,1.a IOQGh eCG

QhG ch G SEH ,bhCG c ,MG HhG Y j 4,2

SGh NdG dG GG ac PJGh Sh eBG H.fhdEG aG ed H VG Z

eG EG H Ve Z NO CH QdG Y dG HEH hG j 4,3TG hCG H dG NCG H Ve Z LJ CG hCG fhdEG aG .QhG c Y WG b kGNBG kT CH hG TG GPEG hCG aY QhG c H QdG Y j CG hG Y j ,dG ghG e j CG d Rj .fhdEG aG eG jWAGL e gJ FN CG jJ dhfi WdGh dG IYeAaEG d Rj .fhdEG aG ed H VG Z NdGGPEG Ve dK W CG hCG Wd JHM hCG cdG Y ee CGODS hCG dMEG FN bh e Yj S dP CG dG YG

.dH bh dG FG jJ EG

eG S LG fGh UH j C`H h``G j 4,4CH QdG Y dG HEGh dG e IQOdG cdG HM ch

.G adGh dG H hJ

,ddG ,GAG`LEG ,ihYdG ac Y dG jH cdG J 4,5c dG gj `b ``dG Yf ` c k```jCG QG````VCGh FGdG HhG d c hCG HhG LJ Y kAH ad

.(4) IOG Y UG eCG eGdGh WMH

cdG HM EG NdGh HG GfCG .5

eG S hCG J dG e J CG ,Hhe Y ,cd Rj 5,1H a aVEG HM CG aVEG W ,fhdEG aGCG .L LdG QGUEGh hdEG HM EG bh CG dGd J S fhdEG aG eH gjhJ j HMcdG b e G (Lh EG) IQGOEG QGbh MCGh hdG

.fhdEG aG eG AfEG bh

7

-

8/2/2019 CIB Registration Form

8/14

The Commercial Bank of Qatar (Q.S.C)P.O.Box 3232, Doha, State of Qatar

Telephone: +974 4449 0000Fax: +974 4449 0070www.cbq.com.qa

5.2 All Accounts the Corporate holds with the Bank are available to

be added to the Online Service. The Delegate may de-select the

availability of certain Accounts on the Online Service through the

relevant screen page. Any Account opened via the Online Servicewill be automatically added to the service; Accounts opened

through any other means will be available for selection from the

relevant screen page within the Service.

6. INSTRUCTIONS

6.1 Instructions submitted by the Delegate will be accepted by the

Bank only if and once the authenticity of the User ID, Passcode

and Password have been verified by the system.

6.2 The Corporate authorizes the Bank to rely and act upon all

Instructions as instructions properly authorised and submitted

by the Delegate, even if they conflict with any other mandate

previously given to the Bank at any time concerning theCorporates Accounts or affairs.

6.3 The Corporate authorizes the Bank to debit the Corporates

Accounts with any amounts the Bank has paid or incurred in

acting in accordance with any seemingly valid and authorised

Instructions.

6.4 The Corporates liability for transactions or Instructions not

genuinely authorised or conveyed by the Delegate will be limited

as set out in Clause 7 (Liability for Unauthorised Instructions)

below.

6.5 The Bank may refuse to act on an Instruction if, for example, a

transaction exceeds a particular value or other limit or if the Bank

knows of or suspects a breach of security. Please refer to the

Help link within the Online Service for details of limits imposed

on transactions carried out through the Online Service. The Bank

will notify the Corporate of any changes to these limits.

6.6 The Bank will not be liable for any failure by any third party

financial institution with which the Corporate holds accounts or

any other third party, to execute instructions, nor for any delay or

other shortcoming of any such party in connection with the Bank

executing Instructions, howsoever caused.

6.7 The Bank may suspend any service provided to the Corporate

under the Online Service without notice where the Bank considers

it necessary or advisable to do so.

6.8 The Bank will use reasonable efforts to inform the Corporate

through the Online Service and/or the Banks website if any

service within the Online Service is not available without undue

delay.

6.9 Where the Delegate so requests, the Bank will make reasonable

efforts to modify, not process or delay processing any Instruction

submitted by the Delegate but the Bank shall not be liable for any

failure to fulfill such requests unless it is due to the Banks failure

to make reasonable efforts to do so.

6.10 The Delegate must ensure that any Instructions submitted by

them are accurate and complete; the Bank will not be liable if this

is not the case.

6.11 An Instruction being carried out is not always simultaneous with an

Instruction being given; some matters may take time to process,

in particular after Cut-off Times and during certain periods of time

when the Online Service may be suspended for maintenance or

eG EG dG H cdH UG HG ac aVEH j 5,2eG e e HM OSG hd Rj .fhdEG aGM CG .dG GP TdG U N e fhdEG aGkFJ j S fhdEG aG eG jW Y a jS iNCG FSh CG Y a j HM CG .G eG EGaG eG V dG GP TdG U e QNd Me

.fhdEG

LdG .6

U e dG GPEG hG b e eG LdG dG j 6,1.QhG ch QhG eQ ,G SEG

LdG ac L dGh Y OYH dG cdG VJ 6,2CG e VQJ d M hG b e Fe H eG hCG VGhCG cdG HH j a bh CG d kHS QU NBG jJ

.fhDT

Z hCG H VG Z LdG hCG eG Y cdG dhDe J 6,3IOG IOQG`dG OhG f hG b e a H IQOdG

.(H VG Z LdG Y dhDG) fOCG (7)

LdG ac L dGh Y OYH dG cdG VJ 6,4CG e VQJ d M hG b e Fe H eGh VGhCG cdG HH j a bh CG d HS QU NBG jJ

.fhDT

S Y ,e LJ L dG aj CG d Rj 6,5hCG dG Y GPEG hCG e M hCG IOfi b eG Rh GPEG ,GV IYG HGQ EG LdG Lf .eCG WMG H TGY VhG OdG UJ Y d fhdEG aG eGdG j .fhdEG aG eG SGH J dG eG

.G OdG Y CGJ jJ CH cdG HEH

CG fL e j LdG J a CG Y khDe dG j 6,6id j dK W CG b e hCG dK H UN de SDeJ hCG NCJ CG YkhDe dG j c aH HM cdGkjCG G Ld dG H j a dK W CG b e j

.dG hCG NCdG dP S c

aG eG L cd ee eN CG d Rj 6,7.FU hCG QhV AGLEG dP CG dG iCGQ GPEG QTEG hO fhdEG

cdG HE e L H Qe Z NCJ hO j CH dG j 6,8 hdG be Y hCG/h fhdEG aG eG jW YaG eG V eG ``e`G e eN CG fG ``M

.fhdEG

J Y ,jd e L H ,hG W Y AH ,dG j 6,9khDe dG j CG Y hG b e e LJ CG J NCJ hCGdG GPEG EG dG Gg e W C HSG a CG Y

.dH dG LCG e e L H dG b Y Y G

LJ g fL e ee LJ CG CG e cCdH hG j 6,10.dP Y K GPEG khDe dG j h ,eh bO

a ,QOdG LdG e keGe G LdG j CG IQhdH d 6,11jEG bhCG H UG Lh Yh ,kbh FG H J jj eY e eR Ga N eh fhdEG aG eGhd .iNCG SCG C h CG fdG YCG H eG

8

-

8/2/2019 CIB Registration Form

9/14

The Commercial Bank of Qatar (Q.S.C)P.O.Box 3232, Doha, State of Qatar

Telephone: +974 4449 0000Fax: +974 4449 0070www.cbq.com.qa

other reasons. The Delegate can find further details regarding this

on the Help link within the Online Service.

6.12 The Bank shall carry out post-dated transaction on the post-dated date or on the Business Day following the indicated date if

the date indicated is not a Business Day.

6.13 When using the Online Service to effect payments overseas, or to

non-resident Accounts, the Delegate undertakes to:

a) Submit satisfactory supporting evidence that the Bank may

require, i.e. invoice, valid trade import license (if applicable),

contracts, statement of Accounts, or sales reports. Such

documentation must be submitted to the Bank within two (2)

business days from the date the transaction is processed. In the

event of an investigation or a random check described in Clause

6.14 below such documentation must be submitted within two (2)

business days from receiving such a request.

The Delegate must indicate the Online Service reference number

(as indicated in the Account statements) and the date of payment

on each document submitted.

b) Retain for a period of three (3) years from the date the payment

is processed original copies of supporting evidence where such

evidence is submitted to the Bank by electronic means.

6.14 The Corporate authorises the Bank to conduct random checks

on the supporting evidence mentioned in Clause 6.13.a above for

the Bank to ensure that Corporates and Delegates are compliant

with regulatory requirements in respect of payments overseas or

to non-resident accounts. The Corporate accepts and hereby

authorizes the Bank to disclose to Qatar Central Bank and any

other government regulatory authority any information required in

connection with any transactions performed through the Online

Service.

6.15 Any breach of the law and/or failure to submit to the Bank the

supporting evidence in accordance with Clause 6.13.a above will

result in the automatic suspension of the Online Service provided

to the Corporate. Qatar Central Bank will be notified accordingly.

6.16 The Delegate warrants that all details submitted under Online

Service are true and correct and that any foreign currency will be

used solely for the purpose stated.

6.17 Foreign currency transactions will be converted at the rate ofexchange applicable at the time of processing by the Bank. The

Bank reserves the right to suspend all or any part of a functionality

which requires the use of an exchange rate if there are valid

reasons for doing so, including but not limited to during a volatile

market.

6.18 In the event of rejection of a transaction because of incomplete

Instructions, information, or insufficient funds in the Corporates

Account any costs, losses and expenses arising therefrom will be

for the Corporates Account.

6.19 The attention of Corporate and Delegates is drawn to their duty

to abide by the laws of the State of Qatar and any regulatory

provisions of Qatar Central Bank including regulations pertainingto the prevention of terrorism, financing, and anti-money

laundering.

OLG IYG HGQ VG Gg M aVEG UJ Y G.fhdEG aG eG V

OG MdG jQdG MdG jQdG GP eG AGLEH dG j 6,12j G jQdG j GPEG jQdG dP j dG dG j hCG d.Y

QN de aO OGd fhdEG aG eG SG Y 6,13:j hG j ,LQN HM hCG dhdG

NQ ,IQ`J`a ,e ,dG j M ac Ife H J CGaJ hCG HM c ,OY ,(eCG d GPEG) jQS Q OGSGjCG e (2 ej N d G GG J j .eLGe hCG H dG M .eG AGLEG jQJ e kGQYG dGGG J a fOCG 6,14 IOG UG dG Y FGY

.dG SG jQJ ekGQYG dG jCG e (2) ej N G

fhdEG aG ed LG bdG EG j CG hG Y j.e e c OGdG jQJh (G c OQGh g M)

e UCG dH OGdG jQJ e GS (3) K I MG FSdG jW Y d G dG J j eY IfG dG

.fhdEG

IfG dG Y FGY LGe AG``LE`H dG cdG VJ 6,14ee HhGh cdG CG e cCd YCG CG 2,13 IOG IOQGdGHG hCG dhdG QN OGdH j a dG He j CH dG VJh cdG J dP L .LQGa He ee CH iNCG J eM S CGh cG b

.fhdEG aG eG Y gDhGLEG j ee CH j

kah d IfG dG H dG Y hCG/h fdH NEG CG 6,15aG ed FdG dG EG OD``j S ``YCG 6,13 IOdcG b e Q ```NEG j S .cd eG fhdEG

.dH

aG eG L eG UdG ac C`H hG j 6,16J S LCG Y CGh Uh M UJ g fhdEG

.d OG Vd a

bh QdG dG d kah LCG dG ee j j 6,17AL CG hCG c H dG j .dG b e gDhGLEGU SCG Lh GPEG dG S GSG J ee CG e

.G dG hX M hO dP jh QcG AGLEG PJ

GeCG hCG eG ,LdG f H ee AGLEG aQ M 6,18Y LdG dGh FG ,ddG ac Ea,cdG M

.cdG M Y S dP

CGh b dhO fGH dG LGH dH HhGh cdG J 6,19G dG dP cG b e e IQOU J

.GeCG Z aeh gQEG j ,gQEG a

9

-

8/2/2019 CIB Registration Form

10/14

The Commercial Bank of Qatar (Q.S.C)P.O.Box 3232, Doha, State of Qatar

Telephone: +974 4449 0000Fax: +974 4449 0070www.cbq.com.qa

7. LIABILITY FOR UNAUTHORISED INSTRUCTIONS

7.1 The Corporate will be responsible for all losses including the

amount of any transaction carried out without the Corporatesauthority, if such losses result from any seemingly valid and

authorised Instructions.

7.2 Once the Delegate has notified the Bank of any unauthorised

access to the Online Service or unauthorised Instruction or the

Delegate suspects someone may know the User ID and Password,

and once the Bank has acknowledged receiving such notice, the

Corporate will not be responsible for any unauthorised Instructions

carried out after notifying the Bank and after reasonable time

for the Bank to suspend the Online Service in respect of the

Corporates Account(s) unless it is established that the Corporate

and/or its Delegates have acted fraudulently or negligently.

8. OBLIGATIONS OF THE BANK

8.1 In the case of an error relating to the Online Service, the Bank will

take all reasonable steps to correct the defective service and/or

retransmit or reprocess any Instructions at no additional cost to

the Corporate.

8.2 In the event that the Bank has levied any charge on the Corporate

which is specifically expressed to be for a particular service

which has not been or is not currently available on the Online

Service (which, for the avoidance of doubt, shall not mean any

fee charged for the Online Service under Clause 9 (Fees) below)

then the Bank will reimburse the Corporate only this sum. Other

than reimbursing any fee as set out herein the Bank will have no

further liability to the Corporate.

8.3 The Bank will not be liable to the Corporate for any loss or damage

arising out of the Corporates use of Online Service through any

unauthorised or fraudulent use on the part of the Delegate or

caused by any breach of contract, or any negligence of the Bank,

to the extent that such loss or damage is indirect, consequential

or special, whether or not the Bank has been advised of the

possibility of such loss or damage.

8.4 The Bank does not exclude or limit liability for loss of interest on

the Corporates credit balances or interest incurred on the debit

balances as a result of a Delegates Instruction that the Bank

has processed in breach of the Banks duties to the Corporate

hereunder.

8.5 The Bank is not liable if an act or omission on the Delegates part,

by way of negligence, tort or default, contributes to the cause of

such loss.

8.6 The Corporate acknowledges that the Bank shall have no liability

whatsoever for any equipment, software or associated user

documentation which any party other than the Bank produces at

any time for use in connection with the Online Service.

8.7 The Bank will not be liable to the Corporate for any loss or damage

arising out of the Delegates use of Online Service to the extent

that such loss or damage is a loss of profits, a loss of data or

whether or not the Bank has been advised of the possibility of

such loss or damage.

8.8 Nothing in these Terms and Conditions or this Clause 8 shall

limit the Banks liability for gross negligence or fraudulent

misrepresentation.

H VG Z LdG Y cdG dhDe .7

j ee CG e dP FG ac Y dhDe cdG J 7,1

QhU Y FG J GPEG cdG e jJ hO gJ.gdG M H Veh U LJ

eG EG H Ve Z `NO C`H dG HEH hG b Y 7,2CH hG TG hCG H Ve Z LJ QhU hCG fhdEG aGdG QGbEG Yh ,QhG ch G SG Y WG b e kTCG Y dhDe cdG J gY ,dG Gg e QTEG SEHQhe Hh dH dG QNEG H gJ j H Ve Z LJj a fhdEG aG eG d j e bhaJ b hG hCG/h cdG CH dG KCG GPEG EG cdG HH

.gEH hCG dMEG jH

dG eGdG .8hCG/h e eN CG dG GG ac PJH dG j 8,1cdG Y aVEG J hO LJ CG J IOYEG hCG SQEG IOYEG

.fhdEG aG eH j CN bh M

kMGU dG h cdG Y dG b e SQ CG Va M 8,2 M IO`L`e `Z hCG Iae `Z e eH UN ```fCG YCG J SdG g Ea ,dG ) fhdEG aG eG-fOCG 9 IOG L fhdEG aG eG Y Vhe SQOQ H .cd G G O`H dG j gY ,(- `S`dGVEG GdG CG dG Y j ,dG Gg L cd SdG

.cdG b

Y Tf QGVCG hCG FN CG Y cdG b khDe dG j 8,3Ve Z SG CG Y fhdEG aG ed cdG SGCG hCG bJ `NEG CG Y Tf hCG hG fL e MG hCG HZ G QGVCG hCG FG a J dG QdH dG b e gEG

. CG Ybh MH dG HEG CG AGS UN hCG dMEG ,ITe

Y IFdG IQN `Y dG dhDe `e `G hCG OSG j 8,4c jG IUQCG Y G IFdG hCG cd FGdG IUQCGb e dG LGh dj hG e QOU Ld dG d

.bJG g L cdG

fL e eG hCG a QU GPEG IQN CG Y khDe dG j 8,5dP gSh NEG hCG jdG dhDG ,gEG jW Y hG

.G IQG J

eGH ,Ge CG Y Yf c k``jCG dG dhDe H cdG J 8,6CG b e bh CG QJ dG dG P G FKh hCG JcaG eH j a eGSG VH dG N NBG W

.fhdEG

Y Tf QV hCG IQN CG Y cdG b khDe dG j 8,7J a J dG QdH fhdEG aG ed hG SGCG AGS ee Ga hCG HQCG IQN Y IQY QdG hCG IQG

. CG QdG dP hCG IQG J bh MH dG HEG

dhDe e je (8) IOG dh MCGh hdG g d 8,8.MEG jdG hCG G gEG Y dG

10

-

8/2/2019 CIB Registration Form

11/14

The Commercial Bank of Qatar (Q.S.C)P.O.Box 3232, Doha, State of Qatar

Telephone: +974 4449 0000Fax: +974 4449 0070www.cbq.com.qa

9. FEES

The Corporate agrees to pay the Banks scale of charges (if any)

for providing the Online Service as the Bank may advise theCorporate from time to time and authorizes the Bank to debit any

(or as specified by the Corporate) Accounts held by the Corporate

with any such charges. The Bank may vary its charges and the

frequency and dates of payment on giving the Corporate no less

than thirty (30) days notice.

LIABILITY FOR INSTRUCTIONS ISSUED THROUGH

TELEPHONE, FACSIMILE, TELEX, EMAIL OR ANY SIMILAR

ELECTRONIC MEANS

The Bank shall be authorised (but not obliged) to rely on and act

in accordance with any notice, demand or other communication

relating to any transaction which has been issued or expected

to be issued from time to time through telephone, facsimile,telex, email or any similar electronic means by the Corporate

after inquiring about the authority or identity of the Delegate

who has issued or expected to issue such notice, demand or

communication.

The Corporate shall pay all banking fees and expenses

resulting from using telephone, facsimile, telex, email or any

similar electronic means whether incurred by the Bank or any

correspondent bank and the Bank shall not be liable for any error

resulting from bona-fide relying or acting on any such notice,

demand or communication.

The Bank shall not be liable for any damages or losses sustained

by the Corporate as a result of non-receipt or delayed receiptof instructions sent by the Corporate via telephone, facsimile,

telex, email or any similar electronic means if such non-receipt or

delayed receipt is caused by a third party service providers.

10. ONLINE RECORDS AND TRANSACTION TERMS

10.1 The Banks records, save for manifest error, will be evidence of

the Corporates dealings with the Bank in connection with the

Online Service.

10.2 The Corporate agrees not to object to the admission of the Banks

records as evidence in any legal proceedings because such

records are not originals, are not in writing, or are documents

produced by a computer.

10.3 Where the Delegate gives the Bank an Instruction or request

through the Online Service these Terms will apply in addition to:

a) any terms and conditions applicable to the various services

available on the Online Service (including but not limited to Trade

Finance); and

b) any terms and conditions applicable to the various Accounts

held by the Corporate. In the event of any inconsistencies between

the numerous terms and conditions, these Terms will apply.

11. EXCEPTIONAL CIRCUMSTANCES

The Corporate agrees to hold the Bank harmless from any and

all claims and agrees that the Bank shall not be liable for delay in

performing or failure to perform any of its obligations under this

Contract caused by circumstances beyond its reasonable control,

including but not limited to the failure, malfunction or unavailability

of telecommunications, data communications and computer

SdG .9

J Y JG (``Lh EG) SdG d aJ C``H cdG J

NB bh e cd dG j b M fhdEG aG eGcdG HM e M CG e G SdG H dG VJhjH j CG d Rj .(cdG gO dG HG e hCG)(30) KK Y Je J QTEG L adG jQGJh Ga ,SdG

.cd dSQEG j kej

hdEG jdG ,dG ,cdG ,JdG J Y dhDG.iNCG fhdG FSh CG hCG

L dGh Y OYH (kee j CG hO)kVe dG je QhU bj hCG Qj ee CH j NBG JG hCG W ,QTEG CGhdG jdG ,dG ,cdG ,JdG Y ,NB bh e cdG

hG jgh jJ e dG H dPh K fhdEG Sh CG hCG.JG hCG dG ,QTEG QGUEH eb bG hCG QG

GSG Y TdG aG dGh SdG ac cdG JiNCG fhdEG Sh CG hCG hdEG jdG ,dG ,cdG ,JdGYkhDe dG j h SGG dG hCG dG b e gJ AGSW ,QTEG CG L f M dG hCG OYG e Cj CN CG

.dG Gg e JG hCG

cdG b e Ie FN hCG QGVCG CG Y khDe dG j

cdG b e SG LdG SG NCJ hCG SG d cfhdEG Sh CG hCG ,hdEG jdG ,dG ,cdG ,JdG YdK W EG Lj SG NCJ hCG SG Y S c GPEG iNCG

.eN e

eG hTh fhdEG dG .10

ee YkdO ,gX CH HG J GY a dG S J 10,1.fhdEG aG eH j a dG e cdG

CG c dG S b Y VGYG Y Y cdG aGJ 10,2fCG hCG He Z ,UCG Z S fCG iYH ffb GAG` `LEG

.JdG RL e IQOU

W hCG LJ H hG b Y MCGh hdG g J 10,3hdG e J c fhdEG aG eG jW Y d

:JBG MCGh

eG jW Y IaG G eG Y jQS MCGh hT CG.QdG jdG eN M hO dP jh fhdEG aG

.cdH UG G HG Y jQS MCGh hT CGhdG g Ea ,IOG MCGh hdG H VQJ CG OLh M

.OJ S dG g MCGh

FSG hdG .11

NCdG Y JG dG ac Y dG dhDe H cdG Jc GPEG bJG g L JeGdG e GdG CG J dG hCGdP jh ,dG JS f QN J hX Y b dP,SdGh dG JG aJ Y hCG J ,fG ,M hOHGVG ,hG ,JdG eNh fCG ,JG eeYRG ,YdG GQGdG ,HGVEG ,eG GQGdG ,fG

11

-

8/2/2019 CIB Registration Form

12/14

The Commercial Bank of Qatar (Q.S.C)P.O.Box 3232, Doha, State of Qatar

Telephone: +974 4449 0000Fax: +974 4449 0070www.cbq.com.qa

systems and services; war; civil unrest; government action;

strikes, or other industrial action or trade disputes; computer

viruses; worms or other malicious code. Any delay or failure of this

kind will not be deemed to be a breach of this Contract and thetime for performance of any affected transaction will be extended

by a reasonable period under the circumstances.

12. SOFTWARE LICENSE AND ENCRYPTION

12.1 The Corporate will not be able to use the Online Service unless

the software the Corporate is using has a minimum level of

encryption. Further details of this can be found on the Help link

within the Online Service.

12.2 The Corporate agrees to be bound by the terms of the license or

similar agreement governing the use of any software enabling the

Corporate to access and use the Online Service, if the Corporate

does not agree to such terms or agreement it should not utilizethe Service.

12.3 The Corporate should be aware of any export restrictions

contained in any software used to access and use the Online

Service and should keep up to date with such restrictions and

the other terms of the software license or other agreement by

regularly checking the relevant software publishers website.

12.4 The Bank uses a very high level of encryption and accordingly

the Corporate should take advice from the local jurisdiction from

which the Corporate is accessing the Online Service to ensure

that the encrypted software can be taken into or out of and/or

used in the relevant country or countries without breaching any

applicable laws.

13. NOTICES

All notices and advices to be given by the Bank to the Corporate

under this Contract may be given in writing or electronically over

the Online Service. All such notices and advices will be deemed

to have been received by the Corporate:

a) In the case of delivery by post, 48 hours from dispatch to the

last address provided by the Corporate; and

b) In the case of notification via the Online Service when the

Delegate acknowledges having read the notice or advice via the

Online Service.

14. CONFIDENTIALITY

14.1 The Bank will take reasonable care to ensure that information

about the Corporate which is stored or transmitted using the

Online Service remains confidential and is not disclosed to any

third parties without the Corporates written permission. However,

the Corporate authorizes the Bank to disclose information relating

to the Corporate and its Accounts where the Bank is obliged to

comply with Court orders, government agencies or other lawful

authorities anywhere in the world or where the Bank considers it

necessary to give effect to an Instruction.

14.2 In order to provide the Online Service, it may be necessary to

store or transmit information relating to the Corporate and/or itsAccounts through the proprietary international telecommunications

network or other communications networks. The Corporate

hereby authorizes the Bank to do so where the Bank considers

this necessary for the effective provision of the Online Service.

NCJ CG .IQdG RedG e NBG eQ CGh JdG Sha ,jQdGj j Sh bJH kNEG j d S dG Gg e a hCGY de Ia EG dP e CH IKCe ee CG d OG bdG

.G hdG AV

dGh JdG eGH NQ .12

efH c GPEG EG fhdEG aG eG SG cd j 12,1dG ie e fOCG H j cdG eJ dG JdGeG V IYG HGQ dP CH cCG UJ LJ .G

.fhdEG aG

K bJG CG hCG NdG MCH dH cdG J 12,2eG EG `N`dG e cdG qo Jc efH CG GSGhCG MCG Y cdG aGJ GPEG ,eGSGh fhdEG aG

.eG SG Y Y a G bJG

Jc efH CG e jJ Ob C``H cdG Y Voj 12,3jh eGSGh fhdEG aG eG EG Nd eNH UG iNCG hdGh OdG H kehO J CG cdG YhdEG bG LGe Y dPh iNCG bJG hCG JdG efH

.e H JdG efH HH UG

Yh ,dG e Y ie j dG CG cdG id G e 12,4dN e NJ dG G IFGdG GOTQEH NCJ CG cdG Y jG efdG CG e cCdGh fhdEG aG eG EG cdG eGSG hCG/h G h`dG hCG dhdG e LGNEG hCG dNOEG

.jQS fGb CH NEG hO dG GP hdG hCG dhdG

GQTEG .13

dG fhdEG aG eH UG GQTEG ac J CG RjJ .fhdG hCG Hc bJG g L cd dG ej

:G GQTEG ac SH eb b cdG

cdG b e e GY NBG Y SQEG jQJ e YS 48 N .BG.OdG jdH SQG GPEG dPh

aG `e``G Q```TEG Y ``Y``WE``H h````G QG```bEG ``bh ..fhdEG aG eG jW Y SQEG M fhdEG

jd G .14

cdH G eG CG e cCd G UG AGHEH dG j 14,1S fhdEG aG eG SH dSQEG hCG jJ dG,M CG Yh .cdG e e PEG hO d gDhaEG j dh jSJHMh cdH G eG AaEH dG VJ cdG EahCG eG dG ,G eGhCH dH ee dG j eYCG dG j eY hCG dG e CG iNCG YdG dG

.G LdG d QhV eCG dH dG

SQEG hCG jJ fhdEG aG eG J j CG Rj14^2

dG JG T Y JHM hCG/h cdH G eGVJ dP L .i``NCG JG T hCG dhdG SdGhAG``LEG GH dG CG dG iCGQ c dH dH dG cdG

.qa H fhdEG aG eG d QhV

12

-

8/2/2019 CIB Registration Form

13/14

The Commercial Bank of Qatar (Q.S.C)P.O.Box 3232, Doha, State of Qatar

Telephone: +974 4449 0000Fax: +974 4449 0070www.cbq.com.qa

15. SUPPLEMENTARY TERMS AND CHANGES TO THE

CONTRACT

15.1 When the Bank introduces new services under the Online Servicethe Bank may provide them on supplementary terms which will

be notified to the Corporate from time to time in accordance with

these Terms.

15.2 The Bank may modify these Terms at any time without notice to

the Corporate as reasonably necessary for the effective operation

of the Online Service.

16. ANTI MONEY LAUNDERING

It is understood by the Corporate that Account opening and

availing of facilities offered by the Bank is subject to all information

requested by the Bank and required in accordance with Qatar

Central Bank anti-money laundering regulations and the Banksregulations and policies being provided by the Corporate; if the

information criteria are not met or information so provided proves

to be incorrect or fraudulent the Bank is under no obligation

to, and has the absolute right to refuse to, offer any facilities to

the Corporate. In the event of suspicion arising concerning the

Corporates involvement in money laundering, terrorism financing

or other illegal activities, Qatar Central Bank shall be notified

accordingly of all such suspicion and the Bank may be required

by Qatar Central Bank to set aside funds transferred to or held in

the Corporates Accounts.

17. TERMINATION

17.1 The Online Service may be terminated at any time by the Corporategiving at least thirty (30) days notice in writing to the Bank. Such

termination shall be without prejudice to the execution of all

outstanding transactions entered into between the Bank and the

Corporate.

17.2 The Bank shall be entitled to terminate or suspend the Online

Service at any time without prior notice if any of the following

events occur:

a) Failure by the Corporate to make, when due, any payment

required to be made by it;

b) Failure by the Corporate to comply with or perform any

obligation under the Terms if such failure is not remedied within

thirty (30) days from notice of failure;

c) If a resolution is passed for the winding up or liquidation of the

Corporate, or the Corporate becomes insolvent or is unable to

pay its debts generally as they become due;

d) A representation made or deemed to be made by the Corporate

proves to be incorrect or misleading in any material respect when

made or deemed to have been made;

e) Upon court order; and

f) Upon receiving instructions from any regulatory authority

including Qatar Central Bank.

17.3 The Bank shall be entitled to receive all fees and other monies

due up to the date of termination of the Online Service and may

deduct any sum payable to it from any amounts the Bank may be

obliged to remit to the Corporate.

bJG jJh dG MCGh hdG .15

,fhdEG aG eG L eN NOEH dG j eY 15,1EG ZHEG j J MCGh hT L ej CG d Rj.MCGh hdG d kah NB bh e cdG

QTEG J hO bh CG MCGh hdG g jJ d Rj 15,2aG `e`G d Qh` `V ` dP CG dG iCGQ GPEG cd

.fhdEG

GeCG Z ae .16

eG eG e IOSGh G a CG cdG id G ej dG eG ac H cdG b EG j dG b eCH dG SSh fCGh cG b e dkah dG

G e d jh eGdG e dG j .GeCG Z aeHG eG j AadG j GPEG cd eN CG J aQQH T Af M .dMG hCG U Z ee J hCGiNCG ffb Z fCG CG hCG gQEG j ,GeCG Z cdGb cG b e CH kY dH cG b e HEG jIOLG hCG cdG H dG IUQCG dG e j

.a

AfEG .17

H cdG b e bh CG fhdEG aG eG AfEG Rj 17,1j CG j .kej (30) KK Y Je J dG EG e QTEGeGHEG dG FdG eG ac H Se hO G AfEG

.cdGh dG H

hO bh CG fhdEG aG eG hCG AfEG d j 17,2:ddG G e dM CG bh Y e QTEG J

.SG Y gOGS j aO CG OGS Y cdG J .CG

hdG g L J hCG GdG C`H dG cdG a .jQJ e kej (30) KK N dG dP e ``Yh MCGh

.dG dH QTEGY gY hCG kde cdG J hCG cdG J hCG H QGb QhU .

.OGdG e J eY Y H fjH AadG

hCG U Z cdG e QhU VG hCG QOdG QGbEG CG K .O.QhU VGaG hCG QhU Y Oe Lh CG e

.G e eCG QhU .`g

b e dP J L CG e LJ SG Y .h.cG

EG G i`NCG G`eCGh SdG ac Y G d j 17,3e e CG N d jh fhdEG aG eG AfEG jQJ

.cdG EG jH kee dG j e CG e d adG

13

-

8/2/2019 CIB Registration Form

14/14

The Commercial Bank of Qatar (Q.S.C)P.O.Box 3232, Doha, State of Qatar

Telephone: +974 4449 0000Fax: +974 4449 0070www.cbq.com.qa

18. LANGUAGE

This Agreement was drawn up in both Arabic and English

languages, in case of any discrepancy between the texts, theArabic text shall prevail.

19. GOVERNING LAW AND JURISDICTION

19.1 The Corporate Online Service Agreement and these Terms and

Conditions are governed by and construed in accordance with

the laws of the State of Qatar.

19.2 Both parties irrevocably submit to the non-exclusive jurisdiction of

the courts of Qatar in respect of any proceedings, which may be

initiated in connection with this Online Service.

In Witness whereof, this Agreement has been signed on the date

mentioned first above.

Authorised Signatory for the Bank

Name:

Signature:

Authorised Signatory(s) for the Corporate

Name:

Signature:

Name:

Signature:

Corporates Stamp

dG .18

VQJ CG OLh M jEGh HdG dH bJG g QM

.Oj S dG g HdG dG Ea ,dG H

UNGh dG LGdG fdG .19

hdG gh cd fhdEG aG eG bJG oJh o 19,1.b dhO fGb L MCGh

jdG cd G Z UNd f hH adG j 19,2aG eH j a gPJG j b GAG`LEG CH j a

.fhdEG

QcG jQdG bJG g Y bdG ,S e Y kGOTEG

.YCG

dG Y bdH VG

:SEG

:bdG

cdG Y bdH VG

:SEG

:bdG

:SEG

:bdG

cdG N