China Operation - EuropElectro We create and drive ... The efforts deployed by EuropeElectro to...

Transcript of China Operation - EuropElectro We create and drive ... The efforts deployed by EuropeElectro to...

Public Version

ZVEI - German Electrical and Electronic Manufacturers’ Association, Frankfurt am Main

In cooperation with:

Orgalime - The European Engineering Industries Association, Brussels

EuropElectro Annual Report

2013China Operation

EuropElectrobrings Europe andChina closer together

Vision

EuropElectro helps to bring Europe and China closer together in technical legislation, standardization and certification for electrical and electronic products in order to facilitate the trade with these products in both directions.

Mission

We create and drive a network of people communicating in the field of technical legislation, standardization and certification. In these fields we build up an exchange of experiences between European electrical and electronics companies and Chinese authorities, administration and organisations. We provide information about developments in national Chinese technical legislation, standardization and certification for the support of our member companies. We also provide such information from Europe for the support of the Chinese administration, standardization and certification. We aim for supporting Chinese authorities to use international ISO and IEC standards in the Chinese standardization system. Our goal is to facilitate the trade of electrical and electronic products with regard to technical requirements. Through the cooperation with ORGALIME we are the voice of our member companies from all over Europe in China.

Member benefit, tasks and objectives:

■ Get information about developments in national Chinese technical legislation, standardisation and certification

■ Support the member companies in China regarding questions in the above named issues and protection of intellectual property rights

■ Create an effective interest group and build up an exchange of experiences by establishing a network of the local subsidiaries of European electrical and electronics companies

■ Aim for a reduction of costs by removing obstacles in the certification procedure

■ Lobby for an opening of the markets through the implementation of international ISO and IEC standards in the Chinese standardisation system

WANG XuHead of office

EuropElectroEuropean Electrical and Electronics IndustryAdd: Landmark Tower II. Unit 0830/08, 8 North Dongsanhuan Road, Chaoyang District, Beijing 100004, P.R. ChinaTel: +86 (10) 6539 6718Fax: +86 (10) 6539 6719E_mail: [email protected]

The astonishing economic and societal developments in China over the past decades have had great impact on the global economy and value chains, and the end of these developments is not in sight yet. They create both challenges and opportunities for European electro technical industries. As Chinese middle and higher classes grow and become wealthier, the still strongly exports driven economy will shift to thrive more on domestic demand as well.

Europe and China have a strong and long lasting trade relationship and the European electro technical industries therefore can contribute strongly to these developments. To capture this potential it is of the essence that market access conditions in China are proportionate and effective, transparently documented, accessible and comprehensible, as much as possible uniform with European and global regulations, and get enforced in a level playing field providing legal certainty.

Next to China’s economic development also the political shifts have been and are substantial. These dynamics complicate the regulatory and standards situation for economic actors as they lead to changes in responsibilities and powers in the ranks of regulators and public authority entities, as well as in the regulations, standards and enforcement methods themselves. China works on an ambitious regulatory reform program already for years and more is in the 5-year plans.

Active engagement in these reform discussions can make an important difference in the outcomes. Therefore it is essential to have a strong foothold in this game play that is intimately aware of these developments, stays on top and looks after the interests of the European electro technical industries. Over the past 7 years EuropElectro has positioned itself uniquely to do exactly that. Staffed with local experts in the heart of Beijing and equipped with a strong relationships network it has created an impressive list of tangible outcomes that provide value to its members. These include early notifications and in-depth information on regulatory changes; positioning EuropElectro in technical standards committees through the delegation of member experts; and successful pleas for regulatory adjustments and fair play enforcement. Not in the least, EuropElectro provides its members with practical assistance in specific cases, be it to find their way in the intricate Chinese arrangements or supporting policy advocacy on immediate issues.

EuropElectro sets its priorities in direct alignment with its members through board and GA discussions and decisions, and executes these plans also in close cooperation with the members base. 2013 witnessed the important step to formally establish it as a ZVEI working party which launches a new era in which EuropElectro can work under clearly defined governance and gain the interest for its valuable work in a broader membership base. As its first official board chairman, I am confident that this will give new and larger impetus and make available this highly valuable work to a strong and truly European electro technical members community.

Coebergh van den Braak, Paul Chairman of EuropElectro Board IP&S Manager/Senior Director, Philips

Board Chairman’s Note

Board Deputy Chairman’s Note

EuropeElectro has grown in the past years into a competent and reliable partner to the Chinese legislation and standardization organizations for electrical and electronic products, communicating European perspectives and experiences pertaining relevant regulations, policies and standards. The continuous work of EuropeElectro in China is dedicated to foster a relationship of mutual trust and understanding with the Chinese government bodies on one hand, and on the other hand grow and strengthen the membership for this industry platform of European Companies to facilitate common interest in one strong voice.

The efforts deployed by EuropeElectro to promote the values and benefits of the European Standardization System in China showed some impressive results in 2013, which became most evident in the re-structuring of the CCC regulations.

The electrical and electronics industry is playing a leading role in making Europe smarter, safer and provide environmentally sustainable solutions. Let us co-operate to strengthen the market access of European companies in China by competently promoting European Standardization, Technical Legislation and Conformity Assessment structures. If you have not yet, then join EuropeElectro and make it our voice in China.

Matthias Gunkel Deputy Chairman of EuropElectro Board Managing Director of Pepperl+Fuchs China and Regional Sales Director for Asia Pacific

EuropElectro Board

EuropElectro board after the election on the board meeting in September 2013 in Beijing

Chairman:Coebergh van den Braak, Paul IP&S Manager/Senior Director, Philips

Deputy Chairman:Gunkel, Matthias Managing Director of Pepperl+Fuchs China and Regional Sales Director for Asia Pacific

Board Members: (Names shown are in alphabetical order)Du, Pinsheng Dr. Vice General Manager, Phoenix Contact Nanjing RD Engineering Centre Ltd.

Starke, Andreas Dr. General Manager, Intellectual Property and Standardisation, Harting

Wartmann, Gerd Dr. Director, Information Security, Endress+Hauser

Yao, Baoling Senior Director, BSH Home Appliance Holding (China) Co., Ltd.

ABB www.abb.com

Balluff www.balluf.com

Bang & Olufsenwww.bang-olufsen.com

Bender www.bender-de.com

Block www.block-trafo.de

Boschwww.bosch.de

BSH Bosch und Siemens Hausgeräte www.bsh-group.com

CLAGE www.clage.de

CONTRINEX www.contrinex.de

Electrostar www.starmix.com

Endress+Hauser www.endress.com

EPCOS www.epcos.com

ERCOwww.erco.com

Franz Wölfer www.woelfer-motoren.com

Gustav Hensel www.hensel-electric.de

Harting www.harting.com

ifm electronic www.ifm.com

JUMO www.jumo.net

Kärcher www.karcher.com

LTi Driveswww.lt-i.com

mdexx www.mdexx.com

Melitta www.melitta.de

Miele www.miele.com

Pepperl + Fuchs www.pepperl-fuchs.com

Pfannenberg www.Pfannenberg.com

Philips www.philips.com

Phoenix Contact www.phoenixcontact.com

PULS www.pulspower.de

Ruhstrat www.ruhstrat.com

Schmersal www.schmersal.com

SIBA www.siba.de

Sirona www.sirona.com

SPINNER www.spinner-group.com

Synflex www.synflex.com

Hans Turck www.turck.com

VEGA www.vega.com

Weidmüllerwww.weidmueller.com

Our Member Companies in 2013

Background

2013 was the first year of operations for the new China government. Environmental protection is considered the most critical challenge for China’s economic development. “Reform and Development” became the key words for the new government’s work.

The EU, with exports of 2.2 billion US dollars, retained first place as the largest exporter to China. With imports of 3.39 billion US dollars, it was the third largest importer from China, after Hong Kong, and the United States in 2013.

During 2013 EuropElectro has continually built a professional network with the Chinese government and authorities and has become a recognized significant partner by them. In China, EuropElectro not only opened the door to the Chinese government but also engaged in representing the European industry to the Chinese government and European Commission cooperation program.

We have completed our 2013 task plan under the leadership of ZVEI and the cooperation of ORGALIME, and built a network of experts from our member companies by organizing four work groups, one information platform and one task force to address priority and emergency tasks. We actively brought our member interests in the key areas related to China market access conditions into the China regulations and standards drafting processes.

We are particularly proud of the following two 2013 achievements which help and will continue to help our members save significant costs and time.

In 2013, CCC (China Compulsory Certification) started to be reformed. The regulator announced that the CCC reform principles are ‘to establish a more scientific, reasonable and systematic CCC design by borrowing the EU’s idea of using conformity assessment to guarantee quality and taking EU’s technical regulation system as reference.” We have made significant contributions to the CCC in pursuing the adoption of a EU directive system through much hard work over the past seven years. We gained two expert memberships in the new term of the CCC regulation team in 2013, and furthermore, EuropElecto’s experts are unique in that they are from industry associations in the 2 TCs (Technical Committee). This is valuable in bringing our industry interests directly into CCC reform via our membership in TC04 for household and similar-use appliances and TC06 for low-voltage electrical appliances.

In 2013, EuropElectro succeeded in postponing the implementation of the compulsory standard GB5296.1-2012 (Instructions for Use of Products of Consumer Interest - Part 1: General principles), which provided one more year for member companies to deal with their packaging and inventory and to save themselves from potential noncompliance fines and having to withdraw products requiring repackaging from the China market.

The EuropElectro board meeting was held in China for the 1st time in 2013. Mr. Paul Coebergh van den Braak, IP&S Manager/Senior Director of Philips, was elected Chairman of the EuropElectro Board and Mr. Matthias Gunkel, Managing Director of Pepperl+Fuchs China and Regional Sales Director for Asia Pacific, was elected Deputy Chairman of the Board. EuropElectro board members from BSH, Endress+Hauser, Harting, Pepperl+Fuchs, Philips, Phoenix-Contact, as well as ZVEI and EuropElectro participated in the meeting.

I know that, together and under the guidance of our new board, we can accomplish even more in 2014.

Head of EuropElectro

1. Executive Summary 1

- Key Points of 2013 China Regulations and Standardisation 1

- 2013 EuropElectro Achievements 3

- 2013 EuropElectro Events and Publications 4

2. 2013 EuropElectro Task Plan and Action 8

2.1 2013-2014 Horizontal Issue Task Plan 8

3. Country Profile and Economic Environment 10

3.1 2013 GDP 10

3.2 2013 Manufacturing PMI 10

3.3 Exports & Imports in 2013 11

3.4 Value-added for Industry in 2013 12

4. Technology Environment 12

4.1 Expenditure of R&D 12

4.2 Authorised Patents 13

5. Regulation Environment 14

5.1 2013 General Economic Environment and Achievements 14

5.2 2014 Government Targets 14

5.3 Policy Environment for the Electro Industry 14

6. Status of High Priorities 15

6.1 China Marketing Access Conditions Development in 2013 15

6.1.1 CCC 16

6.1.2 Energy Efficiency 17

6.1.3 China RoHS 18

6.1.4 China WEEE 19

Index

General Policy:

2013 was the first year of operations for the new China

government. They announced that they would start deep

reforms in the economic area, e. g. open financial services

market; open the first FTZ (Free Trade Zone) in Shanghai in

2013 August, and make plans to expand FTZs to other cities

e.g. Tianjin, Xiamen, Nansha etc. The EU, with exports of 2.2

billion US dollars, retained first place as the largest exporter

to China. With imports of 3.39 billion US dollars, it was the

third largest importer from China, after Hong Kong, and the

United States in 2013.

Foreign invested enterprises in China were involved in

government actions such as

– Antitrust antimonopolies and

– Anti-corruption.

2013 was the first year for the implementation of the 12th

Five-Year Plan (2011-2015) (hereinafter referred to as the 12th

FYP). Environmental protection is the most critical challenge

for China’s economic development.

China‘s economic development speed is still attractive. PMI

(Purchase Management Index) was over 50 in the last 3

months of 2013; however, the production size is slightly high.

Industrial Policy:

In the 12th FYP the emphasis is on fostering and developing

the Seven Emerging Industries of Strategic Importance.

These include energy conservation, environmental protection,

next generation information technology, biology, high-

end equipment manufacturing, new energy resources, new

materials, and new energy vehicles.

Actions: As part of this initiative, new energy automobiles,

IoT (Internet of Things), the smart grid and demand-side

management will continue to receive government investment

and support. Smart cities was among the hot topics in China

in this area in 2013.

SAC (Standardisation Administration of China), together with

8 other ministries, published ‘Standardisation Development

Plan of the Seven Emerging Industries of Strategic

Importance’.

Standards Policy:

China standardisation law is under revision.

At the request of the state council, SAC will develop a plan for

1. Executive Summary

China standardisation system reform. By the end of 2013, the

reform plan for China compulsory standards was submitted to

the state council. ‘National Measures on National Standards

Involving Patents’ has been published. This regulation is a

milestone in China standardisation development.

Some industry alliances from industries with new and high

technology were encouraged to develop their own standards.

Energy Savings and Emissions Reduction Policy:

The major task for 2013 was to carry out policies and

implement plans that had been developed.

According to the working status report from NDRC (National

Development and Reform Commission), targets for energy

savings and emissions reduction are close to being achieved

- energy consumption and CO2 per unit GDP fell by 3.7% and

4.36% respectively.

Product Safety:

CCC – CCC has already been revised twice and further

drafts and revisions of the CCC implementation rules have

been underway since May 2013. This reform will gradually

cover the whole product catalogue. The regulator, CNCA

(Certification and Accreditation Administration of China), has

stated that the CCC reform principles are “Match rights with

responsibilities, control risk, and guarantee quality”.

With 2 expert members on the CCC technical committees,

EuropElectro has direct access to the CCC legislation process

for TC04: for Household and Similar-use Appliances and

TC06: for Low-voltage Electrical Appliances.

Functional Safety – Functional safety is also one of the

key tasks in China standardisation activities due to too many

safety-related accidents on work sites.

Product-Related Environmental Requirements:

China RoHS – The revision of the China RoHS Regulations

– ‘Measures for Administration of the Pollution Control of

Electronic Information Products’ was not completed in 2013.

The regulator solicited public comments for a new draft

version in 2012 and called for discussions throughout 2013.

China RoHS Regulation (2007 version) is still valid.

RoHS CCC certification did not start in 2013. State-promoted

China RoHS Voluntary Certification has remained valid since 1

July 2012.

Key Points of 2013 China Regulations and Standardisation

EuropElectro Annual Report 2013 – China Operation 1

China WEEE – The China WEEE Regulations – ‘Regulations

on the Administration of the Recovery and Disposal of Waste

Electrical and Electronic Equipment’ was implemented on 1

July 2012. Since then, the GAC (General Administration of

Customs) has been levying the fund on imported products

and, since 1 October 2012, the SAT (State Administration of

Taxation) commenced levying the fund on domestic products.

At the end of 2013, NDRC solicited public comments on the

‘Amendments to the China WEEE Product Catalogue (exposure

draft version)’. An additional 23 products were listed in the

exposure draft version catalogue.

Energy Efficiency & Energy Labelling – 2013 was

the second year of the ‘100 Energy Efficiency Standards

Promotion Programme’. By the end of 2013, there were a

total of 59 compulsory energy efficiency standards.

China Low-Carbon – ‘ In ter im Measures for the

Administration of Low-Carbon Product Certification’ was jointly

published by NDRC and CNCA in February 2013. However,

this voluntary certification didn’t start in 2013 because the

certification/test body lists had not yet been published.

EuropElectro Annual Report 2013 – China Operation2

2013 EuropElectro Achievements

Government Network/Communications: EuropElectro has built a professional network with the Chinese government and authorities and has been recognised by them as a reliable and significant European industry representative during their regulation establishment process.

Our greatest success in 2013 was in convincing SAC to postpone the implementation of the compulsory standard, GB5296.1-2012 (Instructions for the Use of Products of Consumer Interest - Part 1: General Principles), for one year. That meant that, instead of the market surveillance under this standard starting on 1 May 2013, it will start on 1 May 2014. EuropElectro’s efficient and effective lobbying has saved our member companies both time and money.

EuropElectro also serves as a bridge for EU and China bilateral cooperation, as well as SINO-German cooperation e.g. EuropElectro participated in this year’s EU-China Regulatory Dialogue WG on Standardisation meeting, the SINO-German Standardisation annual meeting, and the SINO-German Expert Workshop on Product Safety of Electrical Appliances. As the European industry representative, these meetings provided excellent opportunities for us to present EuropElectro’s industry positions to the regulators.

Membership on Chinese TCs and Organisations:In 2013 EuropElectro was granted 2 additional positions on the CNCA CCC TC (expert TC for drafting CCC implementation rules): TC04 for Household and Similar-use Appliances and TC06 for Low-Voltage Electrical Appliances. Altogether we have a total of 14 member positions on Chinese organisations and on standardisation TCs related to our task list. With our active work in these organisations and TCs, we continue to advance EuropElectro’s interests into the drafting process of the Chinese regulations and standards.

Public Forums:EuropElectro has jointly organised 4 forums: - The 12 th Fo r um on I ndu s t r y Au t oma t i o n and

Standardisation 2013 – Suitability & Realisation of Measurement and Control System Security & Safety (jointly organised with SAC/TC124 – China mirror TC of IEC/TC65 on industry automation and ITEI – Instrumentation Technology and Economy Institute)

- The 2013 International Conference on Technology & Standardisation of Fuel Cell Batteries and Flow Batteries (jointly organised with CEEIA and SAC/TC342 – China national TC on fuel cell and flow batteries)

- Workshop on Transformer Energy Efficiency Standards (jointly organised with CNIS – China National Institute of Standardisation)

- Functional Safety & Energy Efficiency Conference (jointly organised with ZVEI and Deutsche Messe)

Work Groups:To work closely with experts from our member companies, EuropElectro has established 4 work groups focusing on China RoHS, Energy Efficiency, China WEEE and CCC and 1 information platform focusing on China Smart Grid and Demand-side Management Information as well as 1 task force on ’IP Involved in Standards’. These work groups, and the platform and task force, are always open to new participants from our member companies.

Information:EuropElectro published 5 newsletters to ensure our members were immediately informed of further developments. We wrote 7 study reports to analyse and summarise topics of great concern to our members.

Position Papers:EuropElectro published 2 public position papers on ‘Standards Involving Patents’ and ‘China RoHS’: - EuropElectro Position Paper on ‘Regulatory Measures on

National Standards Involving Patents (Interim)( For Public Comment)’

- EuropElectro Position Paper on the SJ/T11364-201X – ‘Labels Restricting the Use of Hazardous Substances in Electrical and Electronic Products (version for approval)’

EuropElectro published 1 internal position paper (only available to members) on the topic of CCC:- EuropElectro Internal Position Paper – ‘Components

or Parts within the CCC Scope but installed in Finished Equipment should be permitted to be placed on the Market in the PRC without Certificates’.

Internal Events:The EuropElectro General Assembly meeting was held in Frankfurt on 2 March 2013. A EuropElectro board meeting was held in Beijing on 17 September 2013. EuropElectro board members from BSH, Endress+Hauser, Harting, Pepperl+Fuchs, Philips, Phoenix-Contact, as well as ZVEI and EuropElectro, participated in this meeting.Mr. Paul Coebergh van den Braak, IP&S Manager/Senior Director of Philips, was elected Chairman of the EuropElectro Board and Mr. Matthias Gunkel, Managing Director of Pepperl+Fuchs China and Regional Sales Director for Asia Pacific, was elected Deputy Chairman of the Board.

EuropElectro Annual Report 2013 – China Operation 3

18 January(China RoHS)EuropElectro became “P” member of the second term of China IEC/TC111 – SAC/TC297.

19 January(General)EuropElectro submitted position paper on “Regulatory Measures on National Standards Involving Patents (Interim)( for public comment)” to relevant regulators

23 January (China Smart Grid and Demand-side Management Information)EuropElectro visited SAC/TC426, part of MoHURD and is in charge of city digital development of China.

EVENT

20 February(General)EuropElectro delivered proposal for EuropElectro’s Horizontal Tasks List for our China Operation 2013-2014 for all members’ comments.

2 March(General)EuropElectro general assembly meeting was held in Frankfurt am Main

12-13 March(General)EuropElectro, as the European industry representative, participated in Sino-German Expert Workshop on Safety of Electrical Appliances.

26 April(General)EuropElectro participated in CEEIA standardisation committee annual meeting as board member.

2 May(General)EuropElectro succeeded in convincing to postpone the implementation of GB5296.1-2012 for one year.

11 May (China Smart Grid and Demand-side Management Information)EuropElectro, together with DKE, initiated visit to SAC/TC426 to discuss EEBus.

12-14 May(General)EuropElectro, as the European industry representative, participated in Sino-German standardisation annual meeting.

22-23 May(General)EuropElectro supported to organize the “12th Forum on Industry Automation and Standardisation 2013- Suitability & Realisation of Measurement and Control System Security & Safety” with SAC/TC124 and ITEI.

23 May(China RoHS & China WEEE)EuropElectro participated in the annual meeting of the second term of SC1 & SC4 of SAC/TC297 as the “O” member.

4-5 June(General)EuropElectro, together with ZVEI, visited several member companies’ China local subsidiaries.

January February March April May June

EuropElectro Annual Report 2013 – China Operation4

July August September October November December

29-30August(General)EuropElectro supported to organize the 2013 International Conference on Technology & Standardization of Fuel Cell Battery and Flow Battery with SAC/TC342 and CEEIA.

2 December(China RoHS)EuropElectro submitted position paper on the SJ/T 11364-201X - ‘Labels Restricting the Use of Hazardous Substances in Electrical and Electronic Products (version for approval)’ to relevant regulators.

3 September(Energy Efficiency)EuropElectro supported CNIS workshop on Transformer Energy Efficiency standards

11 September(CCC)EuropElectro holds 2 expert members on CNCA (CCC Regulator) CCC Technical Committees: TC04: for household and similar use appliances and TC06: for low-voltage electrical appliances

17 September(General)EuropElectro board meeting held in Beijing.

17 September(China Smart Grid and Demand-side Management Information)EuropElectro participated in annual meeting of SAC/TC426 as “O” member.

16 October (China Smart Grid and Demand-side Management Information)EuropElectro participated in the annual meeting of the fifth-term of SAC/TC104 as “O” member.

31 October(CCC)EuropElectro participated in CNCA CCC TC06 expert meeting to discuss the revision of CCC implementation rules for low-voltage electrical appliances

5-7 November(Functional Safety & Energy Efficiency)EuropElectro supported to organize the “Functional Safety & Energy Efficiency Conference” organized by ZVEI and DeutscheMesse.

6 November(General)EuropElectro, as the European industry representative, participated in EU-China standardisation WG meeting.

6 November (CCC)EuropElectro participated in CNCA CCC TC04 expert meeting to discuss the revision of CCCimplementation rules for household appliances.

26-28 November (China RoHS)EuropElectro participated in the annual meeting of IEC/TC111 as “P” member.

EuropElectro Annual Report 2013 – China Operation 5

PUBLICATION

28 February(Energy Efficiency)Updated Energy Management and its Tendency in China - 201302 version

20 February(General)Features of EuropElectro Horizontal Tasks List 2013-2014 - Draft

15 January (China RoHS)Updated China RoHS Development and Tendency Report-20130114

19 January(General)EuropElectro Position Paper on ‘Regulatory Measures on National Standards Involving Patents (Interim)( for public comment)’

31 January(China RoHS)‘China RoHS Current Key Points (2012-2013)

1 March(General)NEWSLETTER 2013-01

7 March(CCC)EuropElectro Unofficial Translation of the New Version of the CCC Catalogue & Comparison Analysis and Conclusions between the New and Old Versions

15 March (General)A Diagrammatic View for China's Government Reshuffle for the Next Five Years

25 April(General)EuropElectro Annual Report 2012 – Public version & Member version

15 May(General)NEWSLETTER 2013-02

23 May(CCC)CCC Reform in 2013

JuneMayAprilMarchFebruaryJanuary

EuropElectro Annual Report 2013 – China Operation6

July August September October November December

1 July(China WEEE)EuropElectro updated China WEEE Development and Trends Report

2 August (General)NEWSLETTER 2013-03

25 November(CCC)EuropElectro Internal Position Paper - Components or parts within the CCC scope but installed in finished equipment could be permitted to be placed on the market in the PRC without certificates

8 October(General)NEWSLETTER 2013-04

6 December (General)NEWSLETTER 2013-05

2 December(China RoHS)EuropElectro Position Paper on the SJ/T 11364-201X – ‘Labels Restricting the Use of Hazardous Substances in Electrical and Electronic Products (version for approval)’

EuropElectro Annual Report 2013 – China Operation 7

2. 2013 EuropElectro Task Plan and Action

EuropElectro’s work has two levels. In general, EuropElectro focuses on horizontal issues.

■ Horizontal issues– General standardisation policy and state

industry policy– Market access condit ions (technical

requirements)– Smart Grid and demand-side management

information in China

■ Product related issues – At member request through member

suggestions

In the areas of Standardisation, Technical Legislation and Certification, we offer the following services:– Information platforms– Lobbying for our industry interests – Bridges between the European electronics/electrical industry and the China government and authorities

Standard projectas requested by member companies

EuropElectroVision/Mission

Horizontal issues

- Smart Grid and Demand-side management information in China, including Smart metering; E-mobility; Smart Buildings; Smart Homes

- General standardisation policy and state industry policy- Market access conditions (technical requirements) -

standardisation, technical legislation and certification

Product-related issue per member request by members’ suggestions

In the areas of STANDARDISATION, TECHNICAL LEGISLATION, and CERTIFICATION

■ Information platform

■ Lobby for industry interests

■ Bridge to European electrical/electronic industry and China authorities

2.1 2013-2014 Horizontal Issue Task Plan

On 17 September 2013, a EuropElectro Board Meeting was held in Beijing.

The newly elected Chairman, Mr. Paul Coebergh van den Braak from Philips, chaired the meeting. The board reviewed and discussed EuropElectro’s task list. They agreed that EuropElectro’s tasks should focus on product-related market access conditions rather than production-site related ones. In total, there are 15 tasks on the list including 2 new ones – Health & Safety (focus on machinery safety) and Low Carbon Certification/Low Carbon Footprint.

During 2013 - 2014, EuropElectro is continuing to focus on market access conditions for entry into the China market. These consist of standardisation, technical legislation and certification related to our electrical/electronics industry. Together with our work groups, we will closely monitor the

five high priority tasks, including CCC, Energy Efficiency, China RoHS, China WEEE and China General Standardisation and Industry Policy. We will help our members receive the most up-to-date status and translations of regulations and compulsory requirements, assist them in their understanding of the requirements, and lobby the regulators for our industry interests in these high priority tasks.

We will also continue to track and report standardisation information on Functional Safety, Smart Grid and Smart Buildings, Smart Homes and E-mobility.

Compared to the 2011-2012 task list, in the 2013-2014 task list, there are 15 tasks including 2 new tasks, 1 cancelled task and 3 revised tasks.

EuropElectro Annual Report 2013 – China Operation8

Horizontal issues: EuropElectro key areas in 2013-2014(Modified at 17 September board meeting in Beiing: 15 tasks, of which there are 2 new tasks; 1 canncelled task; 3 revised tasks)

Priority (High, Middle, Low)

General policy of standardisation, technical legislation and certification

1. General Science & Technology policy/General trade policy/General industry policy/Government relations management

H

Product safety 2. CCC, including EMC requirements. H

3. Functional safety M

Product related environmental issues

4. Climate change policy M (watch dog)

4.1 Energy efficiency H

4.2 Low carbon certification/Low carbon footprint, new since 2013 M (watch dog)

5. China environmental legislation landscape status M (watch dog)

5.1 China RoHS H

5.2 China WEEE H

IPR 6. Provide source information on important platforms e.g. EU IPR2 project and EU IPR SME Help desk, etc.

L (not a focus of EuropElectro)

State security 7. IT security regulations - issue status report about the development in China, then driven by members' attention and decision

M (watch dog)

8. Radio frequency regulations L

Market surveillance 9. Market surveillance regulations on CCC, product quality etc. for China market M

Smart Grid and Demand-side Management standardisation information in China

10. Grid side and demand side – e-mobility, buildings, homes, metering M

Health & safety 11. Health & safety regulations – machinery safety, which influnces our members' product

M (watch dog)

remark:New tasksRevised tasks

EuropElectro Annual Report 2013 – China Operation 9

3. Country Profile and Economic Environment

3.1 2013 GDP

The national economy remained stable and experienced comparatively fast growth in 2013. The GDP (gross domestic product) for the year was 56,884.5 billion yuan, up by 7.7 percent over the previous year. (100 US dollars = 611 yuan)

Of the total GDP, the value-added for primary industry was 5,695.7 billion yuan, up by 4.0 percent; that of secondary industry was 24,968.4 billion yuan, up by 7.8 percent; and tertiary industry was 26,220.4 billion yuan, up by 8.3 percent. Value-added for primary industry accounted for 10.0 percent of the GDP; that of secondary industry accounted for 43.9 percent; and that of the tertiary industry accounted for 46.1 percent. For the first time, the share of value-added for tertiary industry surpassed that of secondary industry. Source: National Bureau of Statistics of China

in billion of RMB

Primary industry

Secondary industry

Third industry

GDP growth of three sectors in 2013

Growth Rate

4.00

7.80 8.30

0.00

1.00

2.00

3.00

4.00

5.00

6.00

7.00

8.00

9.00

0.00

5,000.00

10,000.00

15,000.00

20,000.00

25,000.00

30,000.00

Source: National Bureau of Statistics of China

Gross Domestic Product and the Growth Rates, 2009-2013

340903401513

473104519470

568845

GDP GDP growth rate over previous year

0

100000

200000

300000

400000

500000

600000

2009 2010 2011 2012 2013

100 million yuan %

0

2

4

6

8

10

12

3.2 2013 Manufacturing PMI

In 2013, China's PMI stayed above the threshold (50%), which indicates that the manufacturing industry continued to sustain growth throughout the year.

Source: National Bureau of Statistics of China

50.450.1

50.9

50.6

50.8

50.150.3

5151.1

51.4

51

51.4

49

49.5

50

50.5

51

51.5

Jan-

13

Feb-

13

Mar

-13

Apr-

13

May

-13

Jun-

13

Jul-1

3

Aug-

13

Sep-

13

Oct

-13

Nov

-13

Dec-

13

2013 China Manufacturing PMI(%)

PMI(%)

EuropElectro Annual Report 2013 – China Operation10

3.3 Exports & Imports in 2013

Imports and exports continued to rise. The total value of imports and exports in 2013 reached 25,826.7 billion yuan, or 4,160.0 billion US dollars – up by 7.6 percent over the previous year. Of this total, the value of goods exported was 13,717.0 billion yuan, or 2,209.6 billion US dollars (up by 7.9 percent) and the value of goods imported was 12,109.7 billion yuan, or 1,950.4 billion US dollars (up by 7.3 percent). The balance of imports and exports (exports minus imports) was 1,607.2 billion yuan, 151.4 billion yuan over the previous year or 259.2 billion US dollars - an increase of 28.9 billion US dollars.

10059 13948 17435 18178 19504

12016

15779 18986 20489

22096

0 5000

10000 15000 20000 25000 30000 35000 40000 45000

2009 2010 2011 2012 2013

100 million USD

Year

Export and Import, 2009 - 2013

Value of Export Value of Import

Source: National Bureau of Statistics of China

Source: National Bureau of Statistics of China

China Export & Import in 2013

Total Value of export in 2013 year-on-year growth(%)

Total Value of import in 2013 year-on-year growth(%)

21.8

1014.7

1

-3.1

7.2

-0.35.6

12.7

28.8

-15.2

14.116.8

-0.3

10.9

7 7.4

7.6

5.3

8.3

-20

-10

0

10

20

30

40

Jan-

13

Feb-

13

Mar-1

3

Apr-1

3

May-1

3

Jun-

13Ju

l-13

Aug-

13

Sep-

13

Oct-13

Nov-1

3

Dec-1

3

%

-0.7

25

4.35.1

The EU, with exports of 2.2 billion US dollars, retained its first place as the largest exporter to China. With imports of 3.39 billion US dollars, the EU dropped to being the third largest importer from in 2013, after Hong Kong, and the United States.

Source: National Bureau of Statistics of China

Source: National Bureau of Statistics of China

3.7 1.9

8.5

-8.7

18.5

14.8

-10.2

-9.6 -9.3

-15

-10

-5

0

5

10

15

20

0

500

1,000

1,500

2,000

2,500

Euro

pean

Unio

n

ASEA

N

Repu

blic o

f Kor

ea

Japa

n

Taiw

an, C

hina

Unite

d Stat

es

Russ

ia In

dia

Hong K

ong,

China

100 million USD

Imports by Major Countries and Regions and the Growth Rates in 2013

Imports Increase over 2012 (%)

19

4.7 1.1

19.5

-0.9

4

12.6

1.6

10.5

-5

0

5

10

15

20

25

0 500

1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500

Hong K

ong,

China

Unite

d Stat

es

Euro

pean

Unio

n

ASEA

N

Japa

n

Repu

blic o

f Kor

ea

Russ

ia In

dia

Taiw

an, C

hina

100 million USD

Exports by Major Countries and Regions and the Growth Rates in 2013

Exports Increase over 2012 (%)

EuropElectro Annual Report 2013 – China Operation 11

4. Technology Environment

4.1 Expenditure of R&D (research & development)

As reported by the Bureau of Statistics in 2013, China’s total expenditures on R&D continued to maintain rapid growth. Expenditures on R&D were 1,190.6 billion yuan in 2013, up 15.6 percent over 2012, accounting for 2.09 percent of GDP. Of this total, 56.9 billion yuan was appropriated for fundamental research programmes.

Source: National Bureau of Statistics of China

2009 2010 2011 2012 2013

17.7

20.3 21.9

17.9

15.6

0

5

10

15

20

25

0

2000

4000

6000

8000

10000

12000

14000 as a %

in 100 million of RMB

Statistics on China's R&D Expenditure from 2009 - 2013

R&D Expenditure Increase (as a %)

3.4 Value-added for Industry in 2013

Industrial production grew steadily. In 2013, the total value-added for the industrial sector was 21,068.9 billion yuan, up by 7.6 percent over the previous year.

Source: National Bureau of Statistics of China

8.9

9.39.2

8.9

9.7

10.4

10.2

10.3

10 9.7

8

8.5

9

9.5

10

10.5

11

Value-added for Industry in 2013year-on-year growth (%)

Jan-

13

Feb-

13

Mar

-13

Apr-

13

May

-13

Jun-

13

Jul-1

3

Aug-

13

Sep-

13

Oct

-13

Nov

-13

Dec-

13

Value-added of Industry in 2013year-on-year growth (%)

no data

EuropElectro Annual Report 2013 – China Operation12

4.2 Authorised Patents

1,313 thousand patents were authorised by SIPO in 2013. Among them, inventions accounted for 208,000 (with a growth rate of -4.3% over 2012), utility models accounted for 692,845 (with a growth rate of 21% over 2012) and design accounted for 412,467 (with a growth rate of -11.70% over 2012).

Source: State Intellectual Property Office

16%

53%

31%

Authorized Patents in 2013

Inventions

Utility Model

Design

Source: State Intellectual Property Office

-4.30%

21%

-11.70%-15.00%

-10.00%

-5.00%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

InventionsUtility Model Design

2013 Authorized Patents Growth rate over 2012

Inventions Utility Model Design

EuropElectro Annual Report 2013 – China Operation 13

5. Regulation Environment

5.1 2013 General Economic Environment and Achievements

2013 was the middle year in China’s 12th FYP. Policies and plans previously established were implemented smoothly during the year and the major targets have almost been achieved as indicated below:

Macro-Indexes

Target Achievement Surplus

GDP Growth 7.5% 7.7% 0.2%New Jobs 9 million 13.10 million 4.10 millionCPI 3.5% 2.6% 0.9%Foreign Trade Growth

8% 7.6% -0.4%

According to the government work report, in spite of increased downward pressure on the economy, China still fully attained its main targets for economic and social development and made impressive achievements in reform as well as the economic structure adjustment.

5.2 2014 Government Targets

As entrusted by the State Council, NDRC submitted a report on the 12th FYP implementation status in 2013 and targets for 2014. According to the report, the implementation status in 2013 progressed as expected and the major targets for 2014 are:

– Maintain reasonable economic growth. GDP growth is about 7.5%.

– Upgrade quality and efficiency improvement. R&D input is to be improved and energy consumption per unit of GDP is to be reduced continuously.

– Ensure the stability of CPI growth at 3.5% and further enhance living standards.

– Keep the international balance of payments situation healthy. Foreign trade growth is expected to be about 7.5%.

5.3 Policy Environment for the Electro Industry

In terms of the general policy environment, the government will continue its proactive fiscal and steady monetary policies. Of importance is the continuation of action by the government to reduce administrative examination and approval procedures, which should benefit our members who have businesses in China.

In the past year, policy documents most related to our industry are:

State Council & NDRC Level

– State Council Suggestions on Accelerating the Development of Energy Conservation and Environmental Protection Industries

– State Council Announcement on ‘Broadband China’ Strategy and Implementation Plan

– Several State Council Advices about to Expand Domestic Information Consumption

– State Council Forward Notice about Implementation Advice on Integrating Testing and Certification Bodies

Ministries Level

– Strategic Emerging Industry Standardisation Development Plan

– 2014 - 2015 Specific Action Plan on Energy Conservation and Emissions Reduction Technology

– Key Points of National Standardisation Work for 2014

EuropElectro Annual Report 2013 – China Operation14

6. Status of High Priorities

6.1 Ch ina Market ing Access Cond i t ions Development in 2013

In 2013, the remarkable change in the area of technical requirements for market access was CCC reform. CCC reform started in May 2013.

Other technical requirements for market access still remain the same, but the scopes of the regulations have expanded.

Market Access Conditions

Regulation in China Product Scope 2013 Key Words

Product safety - CCC (China Compulsory Certification)

- China compulsory standards for product safety

- Total of 22 Product categories, 157 products

- CNCA reforms to CCC system to introduce more competition began

- 2 pilot projects for CCC reform announced- new lists of certification bodies and testing bodies

published

Product related environmental issues

- China RoHS

- 10 types of EIPs (Electric Information Products)

- China RoHS regulation revision is still in process. Its 2007 version is still valid.

- Revision of labelling standards is out for public comment

- China RoHS voluntary certification remains valid (since 1 July 2012)

- China WEEE - 5 products - Since 2012, the China WEEE fund has been levied. The levy process continues to run but the performance & quality of the process and system need improvement.

- Public comments requested for amendments of product catalogue

Energy Efficiency- China regulations on

Energy Labelling - China compulsory

standards for energy efficiency

- 28 products in 7 catalogues

- 59 product standards (still expanding)

- Extended product scope- More compulsory standards related industry

products published

State security - Information security certification for I&CT

- 13 products - Voluntary certification

EuropElectro Annual Report 2013 – China Operation 15

6.1.1 CCC

Status of Development in 2013As a compulsory condition for market access, CCC influences electrical and non-electrical products, with a total of 22 product categories and 157 products according to the latest version of the CCC product catalogue.

As the result of 2 pilot projects, CCC began to be reformed. This reform will gradually cover the whole product catalogue. As introduced by the regulator, CNCA, the CCC reform principles are ‘Match rights with responsibilities, control risk, and guarantee quality’.

They would like to establish a more scientific, reasonable and systematic CCC scheme by borrowing the EU’s idea of using conformity assessments to guarantee quality and the EU’s technical regulation system as a reference.

Industry Concerns EuropElectro supports the CCC simplification and reduction of the administrative burden for manufacturers. Self-Declarations of Conformity (SDoC) by manufacturers is always our industry position. Our concerns are:■ How fair and transparent this new system will be■ How the application process will be impacted; Follow-up

process; Cost and timing■ How new product units and the key components scope of

every product group scope will be handled; Does it really help to reduce the quantity of certifications for the same group of products

■ How we can protect our technical secrets during ‘design validation’

Actions for our Members■ With 2 expert memberships on the CCC TCs, EuropElectro

has a window for introducing our industry interests into the CCC legislation process for:

TC04: for household and similar use appliances and TC06: for low-voltage electrical appliances.■ Analysed and reported on the reform of CCC for members;

Kept our members abreast of the news on revisions to CCC standards and CCC regulation development

■ Participated in the EU-China Regulatory Dialogue on Conformity Assessments WG meeting in China

■ Prepared unofficial translations and comparisons of new CCC documents:

General CCC implementation rules issued by CNCA: – CCC Implementation Rules for Cancellation, Suspending

and Revoking of CCC – Supplementary Provisions in the OEM Module in CCC

Implementation Rules – CNCA-00C-003 CCC Implementation Rules for Enterprise

Classification Management, Selection and Determination of Certification Mode

– CNCA-00C-004 CCC Implementation Rules for Utilisation of Enterprise Testing Resources and Other Certification Results in CCC

Product CCC implementation rules issued by CNCA: – Implementation Rules for Compulsory Certification - Low-

voltage switchgear assemblies Detailed CCC Implementation rules issued by individual CB

– CQC: – CQC-C010-2013 Detailed Implementation Rules for

Compulsory Products Certification - Low-voltage Electrical Apparatus - Low-voltage Switchgear Assemblies

EuropElectro Annual Report 2013 – China Operation16

6.1.2 Energy Efficiency

Programs and Incentive Policies in 2013 ■ Energy Conservation Products Benefit People Program■ Promoted High Energy Efficiency Motors Directory (5th

batch) Vendor List Announced in December ■ National Key Energy Conservation Technology Promotion

Catalogue Announced■ Aside from the first 5 catalogues announced in previous

years, comments on the 6th edition of the catalogue were solicited in December 2013.

■ High Energy Efficiency Lighting Products Promotion – As of 1 October 2014, imports and sales of regular

illumination incandescent lamps 60W and above will be banned

– Midterm evaluation period will be from 01 October 2015 to 30September 2016.

– As of 1 October 2016, imports and sales of regular illumination incandescent lamps 15W and above will be banned

■ 100 Energy Efficiency Standards Promotion Programme finished

By the end of 2013, 105 standards have been developed or revised.

■ Compulsory Energy Efficiency Standards and Energy Labelling

By the end of 2013, a total of 59 compulsory energy efficiency standards have been published. No added product catalogue is required to be labelled, i.e. there are still 28 catalogues that are required to have energy efficiency labelling.

Actions for Members■ Regular tracking and reporting on energy management

trends in China: – regularly track and report to members up-to-date

changes to standards, implementation rules and incentive policies on energy conservation products

■ Facilitated communication between members and major official management and administration departments in China (eg. SAC & CNIS, etc.):

– collected, summarised and delivered our members’ opinions when SAC solicits public comments

– leaded member companies when visiting related government departments at their request

■ Promotion or temporary issues – Played an active role as a supporter to the CNIS

Workshop on Transformer Energy Efficiency Standards – Provided support for ‘Functional Safety & Energy

Efficiency Conference’ in Shanghai IAS (Industry Automation Show) 2013

EuropElectro Annual Report 2013 – China Operation 17

■ Organised our members to formulate and then delivered our Common Position Paper on the SJ/T11364-201X – ‘Labels Restricting the Use of Hazardous Substances in Electrical and Electronic Products (version for approval)’ to the regulators.

Industry Concerns To promote the self-declaration of conformity and determine how manufacturers can comply with RoHS requirements in China■ Track and influence transparency of the China RoHS

compliance process ■ Get involved early enough to influence decisions on China

RoHS■ Determine that China RoHS is accordant with EU RoHS

directive■ Continue to develop our industry position in legislation

process■ Promote the self-declaration of conformity in China RoHS■ Lobby the regulator to accept the ‘exclusion’ and ‘exemption’

scopes allowed in EU RoHS Directive in China RoHS

6.1.3 China RoHS

Status of Development in 2013Generally speaking, there are NO new changes regarding China RoHS in 2013. All activities are ongoing - but only at the discussion level.

Regulation status: The revision of the China RoHS Regulation was not completed in 2013. According to our communications with the core regulator, MIIT, in 2013, the revision of China RoHS regulations publication has been postponed. The 2007 version of the regulation is still valid.

Actions for Members ■ Continually communicated with the China RoHS regulators

and promoted the manufacturer self-declaration of conformity in the China RoHS conformity assessment system construction process.

■ Our China RoHS WG remained active (launched in 2007). ■ Monitored developments and kept our members informed.■ Updated the ‘China RoHS Development and Trends Report’

for our members.■ EuropElectro, as the representative of European industry,

was granted ‘P’ membership for the second term of China IEC/TC111 – SAC/TC297.

EuropElectro Annual Report 2013 – China Operation18

6.1.4 China WEEE

Status of Development in 2013General ly speaking, in 2013, the basic China WEEE legal system was established and the fund levy process continued to run. But its performance and quality still need improvement.

The unique development is that, in the end of 2013, NDRC solicited public comments on the ‘Adjustment of the China WEEE Product Catalogue (exposure draft version)’. An Additional 23 products were listed in the exposure draft version catalogue.

Since 1 July 2012, the China WEEE Regulation – ‘Regulation on the Administration of the Recovery and Disposal of Waste Electrical and Electronic Equipment’, has been fully implemented. The WEEE fund for imported products has been levied since 1 July 2012; the fund for domestic products has been levied since 1 October 2012.

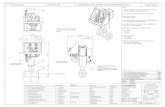

| P 2

EEE Producers

EEE Distributors

Repair Institutions

After-sales Service

Institutions

Operators dealing in the collection

of WEEE

Waste HA*

Disposing enterprise

with qualification

Disposal

Old HA*

Second hand Market

Centralized Disposal

WEEE

Multi- channels Collection

Marked as Second-hand goods Managed

cificeps yb measures

Pay the fee for WEEE Fund

EEE EEE Producers

Consignees of imported EEE or their agents

EEE users

Overview- Flow Charter of “China WEEE” System

Remark:

Regulated by"China WEEE"

Not covered by "China WEEE"

HA: Household Appliance

Actions for Members■ Continued to track the development of the legal system

development; ■ Required the regulators to report on the WEEE fund levy

and usage status ■ Maintained our membership in related TCs and promoted

the European electrical and electronics industry position■ Delivered a position paper on the China WEEE exposure

draft version catalogue to the responsible regulator. ■ Held a WG tele-conference to review WG targets and

exchange information.■ Updated our ‘China WEEE Development and Tendency

Report’■ Continued communicating with the other relevant

associations to ensure that we would be informed of the latest information in this area.

Industry Concerns■ Involvement for manufacturers in the management of the

WEEE funds■ Fund levy and use status for the 1st batch product catalogue■ Product catalogue amendments

EuropElectro Annual Report 2013 – China Operation 19