CHI C apital Management

description

Transcript of CHI C apital Management

CHICapital

Management

2

Disclaimer

These materials are not a solicitation to invest capital with CHI Capital Management. Thorough review of the Disclosure Document should be made before placing capital with CHI Capital Management.

THE RISK OF LOSS IN TRADING COMMODITIES CAN BE SUBSTANTIAL. YOU SHOULD THEREFORE CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. THE HIGH DEGREE OF LEVERAGE THAT IS OFTEN OBTAINABLE IN COMMODITY TRADING CAN WORK AGAINST YOU AS WELL AS FOR YOU. THE USE OF LEVERAGE CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS LARGE GAINS. THE DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF THE PRINCIPAL RISK FACTORS AND EACH FEE TO BE CHARGED TO YOUR ACCOUNT BY CHI CAPITAL MANAGEMENT.

3

Definition of CHI

Chi [chee] Pronunciation Key

Chi is the Chinese word to describe the natural energy of the Universe. The key concept of chi is of harmony and where trouble/volatility is a function of things being out of balance and in need of restoration to equilibrium.

4

The Currency Advantage

$3 Trillion Traded Everyday Extreme Liquidity

24 Hours 5.5 Days Per Week Major Markets – Geographical

Dispersion New York London Tokyo Singapore

Large Number of, and Variety of, Traders

Commercial Banks Central Banks Governments Multi-national Corporations Investment Management Firms Hedge Funds Retail Foreign Exchange Brokers Retail Traders

Profit in “Up” and “Down” Markets Variety of Factors that Affect

Exchange Rates Economic Political Market Psychology

Little or No “Inside Information” Low Commissions “True” Asset Class

Supplements Alpha Smoothes Portfolio Volatility

5

The Fund

Emerging Fund Seasoned Principals with a Proven Track Record in Currency Trading High Alpha Fund Seeking High Returns for Select Investors Event-driven (Opportunistic) and Trending Trading Strategies Focus on Trading Currencies in the Futures and Cash Market

Major Currency Pairs US Dollar, Eurodollar, Swiss Franc, Japanese Yen, British Pound, Australian, Canadian, and New Zealand Dollars

Liquid Emerging Markets Currencies South African Rand, Mexican Peso, Scandinavian Currencies, and Correlated Commodities (See Appendix A)

Secondary Event-driven (Opportunistic) Interest in Indices via the Futures Market Oil Gold Equity

6

Management Team

Steven MatsuoManaging Partner24 Years Experience

PrincipalDirector of Trading27 Years Experience

PrincipalDirector of Sales

17 Years Experience

PrincipalChief Financial Officer

14 Years Experience

7

Competitive Edge

Experienced Team 50+ Years of Combined Experience Proven Track Record Of Excellence Highly Motivated Through Ownership, Personal Assets In-strategy, and Incentives

A Better Approach Fund size capped to:

Facilitate Trading Increase Manageability of Positions Enhance Risk Management Maximize Impact of Positions on Performance

Event-driven (Opportunistic) and Trending Trading Strategies Diversify Portfolios Currency Time Correlated Commodities

High Expectations, High Standards Strive to Achieve 15% to 20% Returns, with Integrity and Diligence for a Select Investors

8

Implementation Process

1

Analytical Tools andMarket Assessment

Moving Average Convergence/Divergence

Fibonacci Retracement Market Dialogue

2

Trend Identification and Trading

Judgment Honed by 25 Years of ExperienceShort-term Supply and DemandMacroeconomic FactorsGeopolitical RisksMarket PsychologyPositions Held by Market Participants

Proprietary Momentum Model

3

5Reporting (Prime Broker)

Daily -- E-mail Monthly -- Hard Copy

Risk-Managed FOREX

Program

Portfolio Construction/ Management

Short-term Portfolio Long-term Portfolio

4Risk Management

Market Liquidity Position Re-evaluation Leverage Real Time Monitoring Stop Loss/ Limit Orders Multi-dimensional Trading Strategies Scale In/Out of Positions Defined Margin Limits Daily Position, Profit/Loss, and

Margin Reporting External Custodian

9

Investment Implementation, Trend Identification

Economic Factors Economic Policy Economic Growth and Health

Gross Domestic Product Capacity Utilization Retail Sales

Interest Rates Balance of Trade Levels and

Trends Government Budget Deficits

and Surpluses Inflation Levels and Trends

Political Conditions

Market Psychology Flights to Quality Long-term Trends Buy the Rumor, Sell the Fact Economic Numbers Technical Trading Considerations

Monetary Flows Equities and Bonds Central Bank Intervention Interest Rates

Positions by Market Participants

Supply and Demand Factors Affecting Currencies

10

Investment Implementation, Analytical Tools Moving Average Convergence/Divergence (MACD)

MACD is a trend-following momentum indicator that shows the relationship between two moving averages of prices. The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA. A nine-day EMA of the MACD, called the "signal line", is then plotted on top of the MACD, functioning as a trigger for buy and sell signals. There are three common methods used to interpret the MACD:

Crossovers: When the MACD falls below the signal line, it is a bearish signal, which indicates that it may be time to sell. Conversely, when the MACD rises above the signal line, the indicator gives a bullish signal, which suggests that the price of the asset is likely to experience upward momentum. Many traders wait for a confirmed cross above the signal line before entering into a position to avoid getting being "faked out" or entering into a position too early, as shown by the first arrow.

Divergence: When the security price diverges from the MACD. It signals the end of the current trend.

Dramatic Rise: When the MACD rises dramatically, that is, the shorter moving average pulls away from the longer-term moving average, it is a signal that the security is overbought and will soon return to normal levels.

Traders also watch for a move above or below the zero line because this signals the position of the short-term average relative to the long-term average. When the MACD is above zero, the short-term average is above the long-term average, which signals upward momentum. The opposite is true when the MACD is below zero. As you can see from the chart above, the zero line often acts as an area of support and resistance for the indicator.

11

Investment Implementation, Analytical Tools

Fibonacci RetracementFibonacci Retracement is a very popular tool among technical traders and is based on the key numbers identified by mathematician Leonardo Fibonacci in the thirteenth century. In technical analysis, Fibonacci retracement is created by taking two extreme points (usually a major peak and trough) on a stock chart and dividing the vertical distance by the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8% and 100%. Once these levels are identified, horizontal lines are drawn and used to identify possible support and resistance levels.

The Fibonacci sequence of numbers is as follows: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, etc. Each term in this sequence is simply the sum of the two preceding terms and sequence continues infinitely. One of the remarkable characteristics of this numerical sequence is that each number is approximately 1.618 times greater than the preceding number. This common relationship between every number in the series is the foundation of the common ratios used in retracement studies.

The key Fibonacci ratio of 61.8% - also referred to as "the golden ratio" or "the golden mean" - is found by dividing one number in the series by the number that follows it. For example: 8/13 = 0.6153, and 55/89 = 0.6179.

The 38.2% ratio is found by dividing one number in the series by the number that is found two places to the right. For example: 55/144 = 0.3819.

The 23.6% ratio is found by dividing one number in the series by the number that is three places to the right. For example: 8/34 = 0.2352.

These ratios seem to play an important role in the stock market, just as they do in nature, and can be used to determine critical points that cause an asset's price to reverse. The direction of the prior trend is likely to continue once the price of the asset has retraced to one of the ratios listed above. The chart illustrates how Fibonacci retracement can be used. Notice how the price changes direction as it approaches the support/resistance levels.

12

Trading Implementation

Trading Instruments

Spot: A spot transaction is a two-day delivery transaction, as opposed to the futures contracts, which are usually three months. This trade represents a “direct exchange” between two currencies, has the shortest time frame, involves cash rather than a contract; and interest is not included in the agreed-upon transaction.

Forward: One way to deal with the Forex risk is to engage in a forward transaction. In this transaction, money does not actually change hands until some agreed upon future date. A buyer and seller agree on an exchange rate for any date in the future, and the transaction occurs on that date, regardless of what the market rates are then. The duration of the trade can be a few days, months or years.

Future: Futures are forward transactions with standard contract sizes and maturity dates — for example, 500,000 British pounds for next November at an agreed rate. Futures are standardized and are usually traded on an exchange created for this purpose. The average contract length is roughly 3 months. Futures contracts are usually inclusive of any interest amounts.

Option: A foreign exchange option (commonly shortened to just FX option) is a derivative, where the owner has the right, but not the obligation, to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date. The FX options market is the deepest, largest and most liquid market for options of any kind in the world.

Trading Style Leverage Momentum Indicators and Proprietary Model to Establish Long-term Positions in

Trending Markets Actively Trade Spot Markets to Capitalize on Event-driven, Short-term Fluctuations (0.5% - 1.0%)

13

Risk Management

Market Risk Position Re-evaluation: Occurs when a daily

drawdown exceeds 5% Leverage: Maximum of 10X, reduced to (1 –

5X) in the event of a 10%+ monthly drawdown

Stop/Loss and Limit Orders: Automated stop/loss execution, with limited slippage

Scale Into and Out of Positions

Liquidity Risk Credit Risk

Sovereign Risk Establish Ceilings for Specific Countries Monitor Regulatory Changes Watch Credit Ratings

Counterparty Risk Defined Margin Limits Daily Position, Profit/Loss, and Margin

Reporting

Settlement Risk Netting Exchange Clearing Arrangements

Interest Rate Risk Event-driven (Opportunistic) Spot and

Forward/Future Trading Strategies Operational Risk

External Custodian

14

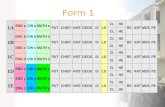

Performance

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

The performance track record reflects the personal account of the Principal. The account is traded with a higher degree of leverage than we would recommend for our investors.

Rate of Return

Month 2008 2007 2006 2005 2004

January 20.39% -5.36% -4.17% 4.09% 5.41%

February -1.77% 9.35% -2.49% 15.51% 2.07%

March 0.67% -16.00% -0.52% 6.55% 7.45%

April -4.81% 8.86% 12.81% 4.31% 13.59%

May -6.96% -14.33% -2.77% 0.80% -4.28%

June 4.25% -2.69% -0.59% 5.91% 6.46%

July -3.43% 17.42% 0.64% 1.77% 6.30%

August 1.87% 10.39% -12.78% 4.94% -5.49%

September 5.10% 11.75% -9.88% 0.35% -9.11%

October 4.39% -4.35% -0.86% 12.27%

November 27.40% 8.94% 0.07% 24.90%

December 7.21% -16.99% 0.87% -1.52%

Year 15.29% 58.40% -32.17% 44.32% 63.30%

15

Performance

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

The performance track record reflects the personal account of the Principal. The account is traded with a higher degree of leverage than we would recommend for our investors.

Cumulative Return Combined

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

120.0%

140.0%

160.0%

1/1

/20

04

3/1

/20

04

5/1

/20

04

7/1

/20

04

9/1

/20

04

11

/1/2

00

4

1/1

/20

05

3/1

/20

05

5/1

/20

05

7/1

/20

05

9/1

/20

05

11

/1/2

00

5

1/1

/20

06

3/1

/20

06

5/1

/20

06

7/1

/20

06

9/1

/20

06

11

/1/2

00

6

1/1

/20

07

3/1

/20

07

5/1

/20

07

7/1

/20

07

9/1

/20

07

11

/1/2

00

7

1/1

/20

08

3/1

/20

08

5/1

/20

08

7/1

/20

08

9/1

/20

08

Time

Re

turn

____CHI

____SP

16

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

The performance track record reflects the personal account of the Principal. The account is traded with a higher degree of leverage than we would recommend for our investors.

Performance

Value of $1000 Invested 1/1/2004

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

1/1

/20

04

3/1

/20

04

5/1

/20

04

7/1

/20

04

9/1

/20

04

11

/1/2

00

4

1/1

/20

05

3/1

/20

05

5/1

/20

05

7/1

/20

05

9/1

/20

05

11

/1/2

00

5

1/1

/20

06

3/1

/20

06

5/1

/20

06

7/1

/20

06

9/1

/20

06

11

/1/2

00

6

1/1

/20

07

3/1

/20

07

5/1

/20

07

7/1

/20

07

9/1

/20

07

11

/1/2

00

7

1/1

/20

08

3/1

/20

08

5/1

/20

08

7/1

/20

08

9/1

/20

08

Time

Re

turn

17

Structure and Terms

Fund Assets: Minimum Investment:

Subscriptions: Redemptions:

Redemption Notice: Management Fee:

Incentive Fee: Other Fees:

High Water Mark: Benchmark:

Instruments Traded: Options:

Futures: Broker:

$1.5 Million$200,000 (initial) $25,000 (additions)MonthlyQuarterly 30 Day Notice2.0% 20%NoneYesAbsolute ReturnCurrencies, Equity Indexes and CommoditiesYesYes

Man Financial

18

Glossary of Terms

Custodian: An agent, bank, trust company, or other organization which holds and safeguards an individual's, mutual funds, or investment company’s assets for them.

Fibonacci Retracement: A tool used in technical analysis which plots the Fibonacci ratios on a graph which displays a stock's price over time. The key Fibonacci ratios are 23.6%, 38.2%, 61.8%, and 78.6%. The different Fibonacci ratios are used to predict how likely it is for the stock to return to that price by retracing its previous actions.

Futures: A standardized, transferable, exchange-traded contract that requires delivery of a commodity, bond, currency, or stock index, at a specified price, on a specified future date. Unlike options, futures convey an obligation to buy. The risk to the holder is unlimited, and because the payoff pattern is symmetrical, the risk to the seller is unlimited as well. Dollars lost and gained by each party on a futures contract are equal and opposite. Futures are distinguished from generic forward contracts in that they contain standardized terms, trade on a formal exchange, are regulated by overseeing agencies, and are guaranteed by clearinghouses. Also, in order to insure that payment will occur, futures have a margin requirement that must be settled daily. Finally, by making an offsetting trade, taking delivery of goods, or arranging for an exchange of goods, futures contracts can be closed.

Leverage: The degree to which an Investor or business is utilizing borrowed money.

Limit Order: An order to a broker to buy a specified quantity of a security at or below a specified price, or to sell it at or above a specified price (called the limit price).

Liquidity: The ability of an asset to be converted into cash quickly and without any price discount.

Margin: Using money borrowed from a broker/dealer to purchase securities.

Moving Average Convergence/Divergence (MACD): Technical analysis term for the crossing of two exponentially smoothed moving averages.

Retracement: A price movement in the opposite direction of the trend.

Spot Trading: A market for trading where currencies are bought and sold with other currencies, and are exchanged immediately .

Stop-loss Order: A stop order for which the specified price is below the current market price and the order is to sell.

Biographies

20

Biographies

Steven K. Matsuo, CPA, MBAPrincipal

Steve has traded the foreign exchange markets since 1981. He currently manages futures accounts trading a combination of foreign exchange, bonds, and stock indices. Additionally, he is a senior currency trader for the US Bank. Steve also served as Director for Deerhurst Management, trading and executing the firm’s foreign exchange transactions. Prior to that he was Chief Operating Officer of Vector Financial Group, a Commodity Trading Advisor he co-founded. At VFG, Steve managed a 24-hour trading operation, which included risk monitoring and management and proper execution of trading signals.

Steve held other positions, including Vice President Senior Proprietary Dealer for the Bank of Montreal, Chicago and First Vice President and Manager Chief Dealer of the trading operations at First Chicago-Chicago and Continental Bank-Chicago.

Steve chose a career in foreign currency trading following earlier experiences at First Chicago as a senior auditor and as an analyst responsible for heading their $350MM foreign currency balance sheet exposure. He holds a Master’s Degree in Business Administration from DePaul University, Chicago and a Bachelor’s Degree in Accountancy from the University of Illinois, Champaign.

21

Biographies

Principal Trading

The Principal is an accomplished proprietary trader and has 25 years of foreign exchange experience. His expertise and success span a broad range of trading disciplines, including spot and forward FX, exchange-traded commodities and options. The Principal skillfully researches and forecasts market changes and in turn develops and implements low-risk/high-return trading strategies. His approach leads him to new tools that aid him in determining efficient entry points for capturing the medium term trends. By coupling these tools with his options expertise, he has generated many profitable, long-term options strategies.

As Vice President, Senior Trader for ABN Amro, the Principal managed the risk for the spot desk’s options positions, managed the desk’s proprietary spot positions and assisted management with global initiatives. He also served as head trader providing liquidity to the bank’s customers and training personnel. Robert served in similar capacities with Bank One and Continental Bank, both Chicago.

The Principal holds a Bachelors in Finance from Loyola University, Chicago.

22

Principal Marketing, CPA, MBA

The Principal has been involved in the foreign exchange markets for over 15 years. For the past year, he has been selling FX products to corporate and institutional clients for Bank of Montreal. His experience also includes 11 years at JP Morgan Chase Chicago, and its predecessor organizations, where he sold foreign exchange and interest rate risk management products. Prior to that, he managed foreign exchange and commodity risk at FMC Corp in Chicago.

The Principal holds a Bachelor of Science degree in Accounting from Northern Illinois University and has successfully passed the Illinois CPA exam. He also holds a Masters Degree in Business Administration in International Finance from De Paul University.

Biographies

23

Principal CFO, MBA

The Principal has over 15 years of experience in foreign exchange and corporate finance, including five years as Vice President and Senior Foreign Exchange Dealer at First Chicago NBD Corp. He is currently with Ford Motor Credit Company, where he is responsible for profit analysis, forecasting, budgeting and business planning for Ford Credit worldwide ($145 billion in assets). Other positions and responsibilities with Ford have included finance leadership roles in Treasury, and Marketing and Sales Finance and development of quarterly SEC filings (10Q, 10K).

The Principal was meritorious graduate in economics from the University of Wisconsin, Stevens Point in 1991, where he was also a 5-time All American swimmer. He earned a Masters Degree in Business Administration from the University of Chicago Graduate School of Business in 1996.

Biographies