Charity_Bank_Report_online 15 07 15

-

Upload

mark-howland -

Category

Documents

-

view

235 -

download

0

Transcript of Charity_Bank_Report_online 15 07 15

A bank for good2015 Loan Portfolio Report

Contents

A bit about us 3

Where you fit into banking for good 4

Our approach to lending 6

Borrow to support your mission 8

The nuts and bolts of charitable business 10

Case Studies

Arts 12

Community 16

Education 20

Environment 24

Faith 28

Health and social care 32

Housing 36

Regeneration 40

Sports 44

What are the key things to think about before you apply for a loan? 48

Taking the next step 49

Our shareholders 50

Thank you 51

2

Charity Bank was always going to be different. What drives us isn’t profits, but a shared idea about the world we want to live in.

We were founded in 2002 to support charities with loans and to show people how their savings could be invested in ways that would make them happy.

Today, charities have never been more needed, but also more challenged. That’s why we take care to understand exactly what they are trying to achieve and provide loans that will support them.

Our promise is to be a bank that enables borrowers, savers, shareholders and staff to work together to create lasting social change in our communities.

We are the bank for everyone who knows that banks can do better. We are the bank for people who believe that banking should always work for good.

A bit about us:

George Blunden, chairman Patrick Crawford, chief executive

3

The result – banking for good

You join a community of like-minded individuals all working towards one goal. Our borrowers, savers, shareholders and

staff are helping to make charities and social enterprises stronger so that they can always

be there when people and communities in difficulty need them.

Join us:T: 01732 441900

W: charitybank.org

SaversYou’re looking for a bank that will help you to put your money where your values are. You believe that banks can do better and you want your money to be a powerful force for good. You open an individual or business savings account with Charity Bank.

BorrowersYou’re an organisation with charitable goals and you want to borrow from a bank that is wholeheartedly committed to what you do. You’d like to work with a regional manager that you can rely on as a partner in doing good. You apply for a Charity Bank loan.

ShareholdersYou’re a trust, charity or foundation that wants to invest in a business that puts people and the environment before profit. You’d like a modest return but a central purpose of your investment is to see your money do social good. You invest in Charity Bank.

StaffYou’re passionate about using finance to support charities and social enterprises. You believe that banks have a vital role to play in creating a world we all want to live in. You want to live your values at work. You apply for a job at Charity Bank.

Where you fit into banking for good

4

Apprentices at the East Lancashire Deaf Society help to build a new training centre; a Charity Bank loan is helping to fund the project.

5

Our approach to lending

“ Our mission is to support your mission”

If you could borrow from a bank run for charities and social enterprises and owned by charitable trusts, foundations and social purpose organisations, would you be interested?

That’s what we’re offering: loans to support your mission, a deep knowledge of what you do and a team of regional managers that is there to be your partner in doing good.

Our approach • We take the time to build relationships with our borrowers.

• Our loans are competitively priced and we seek to fit repayment schedules to your needs.

• Each time a loan is repaid to us we re-lend to support the work of charities and social enterprises.

6

Loans for

good

Step 2 A regional manager works with the charity to make a loan application.

Step 5The loan is repaid in an agreed time scale

suited to the charity’s circumstances.

Step 1A charity or social enterprise calls our lending team and explains what the organisation does and what it needs.

Step 6Each repayment goes straight back into our

funds, to be lent to another charity or social

enterprise, and then another, and so on…

Step 3Our team checks that the organisation has a charitable purpose, the ability to repay the loan and that a loan is in its best interests.

Step 4The loan is approved at

an interest rate and terms that work for the borrower

and Charity Bank.

7

Borrow to support your mission

Who can apply for a loan? • We only lend to charities, social enterprises and organisations with a charitable purpose.

• We lend to both small and large organisations at competitive rates.

• Our regional managers in England, Scotland, Northern Ireland and Wales work with organisations across the UK.

How much can I borrow and what will it cost?• You can apply for loans from £50,000 up to £2.5 million, and up to £3.5 million if you’re a housing association. We also work with other lenders to provide larger loans.

• We tailor the terms of each loan and we fit repayment schedules to meet the needs of our borrowers.

What about sectors and legal structures?• We lend to a range of organisations including community interest companies (CICs) and community benefit societies with charitable purposes, registered charities, companies limited by guarantee and registered social housing providers. What matters to us is that you are committed to a charitable purpose and have the ability to repay a loan.

• Unlike many other funders we don’t target specific sectors but respond to demand from borrowers working in all areas from housing and heritage to sport and community regeneration.

8

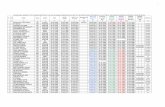

Source: Charity Bank management information as at 31st March 2015.

Sector breakdown

by number of borrowers

Arts 8.8% Community & regeneration 12.4%

Education 8.8%

Environment 3.6%Faith 13.7%

Health & social care 16.6%

Housing 22.5%

Sport 10.7%

Support organisations 2.9%

Regional breakdown

by number of borrowers

East Midlands 4.9%

Eastern 8.8%

London 12.7%

North East 3.3%

North West 9.8%

Northern Ireland 2.0%

Scotland 5.9%

South East 15.0%

South West 14.3%

Wales 4.6%

West Midlands 5.2%

Yorkshire & Humberside 13.7%

9

The nuts and bolts of charitable business: using loan financeInsight, tips and best practiceLoan finance is one tool that is helping our borrowers grow, build, plug funding gaps, innovate and develop long-term revenue strategies.

Their experiences provide crucial insight for anyone interested in making their organisation more effective.

In the next chapters, small community organisations and large charities explain how loans have helped them to solve problems, plan for the future and achieve ambitious goals. Our regional managers pull together useful insights into the nuts and bolts of charitable businesses, from funding decisions and the smart use of loans to income generation and growth strategies.

We’ve featured nine organisations from across the UK, each working in different sectors from the arts to housing, and speaking in their own words.• Get an insight on growth from an education charity that started life as a volunteer group in a church and expanded its activities across the country.

• Gather funding tips from a community organisation working to promote peaceful relations between divided religious communities in Northern Ireland.

• Hear from the entrepreneur who started up the first lettings agency in Scotland to rent homes exclusively to people on low incomes and benefits.

Flick through big picture plans for social change down to the details of finance and business planning.

10

How would you use a loan

to develop a sustainable

income strategy?

What have other charities done to

carry on work during redevelopment

projects?

What are the benefits of

buying your buildings instead

of renting? How could a loan help sustain

charitable activities?

11

© Half Moon© Sherman Cymru

© Sherman Cymru

Art and creative activities are a fundamental part of learning from youth to old age, helping us to empathise with others, to express ourselves and to imagine new possibilities, relationships and worlds.

Through art we can challenge many of our society’s deepest assumptions. A world that lets artistic creation flourish is one full of critical thinking and new ideas. 9% of our borrowers create social value through the arts.

Arts

12

© Half Moon

Towcester MuseumThis community centre for research into local history took out a loan, which allowed it to turn a former Georgian coaching inn into a visitor centre and museum. It’s now an accessible place for the community to actively get involved in educational projects, such as ‘live history days.’

The Framework Knitters MuseumThe Framework Knitters Museum is a small independent working museum, established by the local community, which saved it from the bulldozer and put it under the control of a charitable trust. The site has been restored to show the living and working conditions of the framework knitters who occupied it throughout the nineteenth century. Charity Bank was able to provide a loan to help buy a property which divided the museum’s buildings, enabling it to expand the educational activities it offers.

Point Blank Theatre CompanyFormed in 1997, Point Blank is a creative arts organisation, conceived in a tiny studio in Sheffield. It took out a loan to buy The Riverside Bar and Café – a larger venue where it now offers a range of leisure and recreational activities for the community. This has allowed Point Blank to generate a sustainable income in addition to grants, with profits going back into developing new performance and arts ventures.

Living PaintingsFor 25 years Living Paintings has published Touch to See books that bring the visual world to life for blind and partially sighted people. A loan from Charity Bank enabled the charity to buy its original premises and, when success came and it needed to expand, a second loan helped secure the building next door.

1

2

3

4

1

23

4

Towcester Museum

Point Blank Theatre Company

Living Paintings

The Framework Knitters Museum

Featured

Sherman Cymru: the show must go on!

13

© Sherman Cymru

Sherman Cymru: the show must go on! Margaret Jones, executive director of Sherman Cymru, explains how Cardiff’s leading theatre is taking its work to all corners of society.Sherman Cymru gives a stage to the societal messages of Wales’ emerging artists. We provide first-time theatre experiences for the young, and produce challenging, exciting and memorable work for all audiences. We’ve always worked to make theatre accessible to everyone, reaching out to all areas of our community. But we needed a building that could reflect the work and ambitions of the company.

We gathered funding from the Arts Council of Wales, financial support from individuals, trusts and foundations, and a loan from Charity Bank to undertake a large-scale redevelopment of our building. The new workshop and rehearsal space has helped to produce new work of an exceptionally high standard. We have larger facilities for our youth theatre groups and community projects. We have a larger foyer for a growing audience and our eye-catching exterior ensures that we stand out from the buildings either side.

Tenacity, careful project management and a close relationship with the Charity Bank team helped us create an excellent home for our productions and community activities. It’s a huge opportunity to offer the experience of theatre to people across Cardiff.

We’ve always worked to make theatre accessible...but we needed a building that could reflect the work and ambitions of the company.

Margaret Jones, executive director, Sherman Cymru

14

1. How to mould loan finance to your needs

Complex structural alterations delayed the project and promised funding didn’t materialise. Sherman Cymru kept tight control of the project’s progress, communicated constantly with the development contractors to ensure that there were no unnecessary costs and kept us well informed. This meant we were able to adapt the loan to suit changed circumstances.

2. The show must go on! Sherman Cymru had to plan for

the potential for falls in audience numbers during the closure of the venue and decided to continue to produce new work but present it in other venues. This enabled the company to maintain its reputation and loyal audience and no doubt helped create new awareness of the work of the company and grow its audience base.

3. Using a loan to further an income strategy

Arts organisations need revenue strategies that take funding cuts and the uncertainties of grant funding into account. Loans can be useful in developing new income strategies but are never a replacement for income. Sherman Cymru used a loan wisely to invest in its infrastructure, boosting the income that it will be able to invest back into their future work.

4. Getting commercial trading skills onto your board

One smart step towards sustainable funding is to bring new skills into your organisation. Sherman Cymru is looking to diversify its trustees and bring in people with commercial skills from fundraising to commercial trading and income generation. Commercial know-how alongside experience in the arts and social change will be central to helping Sherman Cymru sustain its income and social impact.

Chris Tweedie, manager, Wales

T: 07766 735118 E: [email protected]

Insight: 4 tips on funding, income strategies and creative thinking

15

Communities have served a vital purpose for centuries, acting as support systems and fostering a sense of camaraderie.

Their place in enabling social interaction and ending isolation is priceless. Investing in community projects, renovating village halls and shared spaces, communities make a big contribution towards promoting social inclusion and active citizenship today and for generations tomorrow.

Community

16

Footprints Family Centre

Community Wise

Crofton Community Centre

North Curry Community

Footprints Family CentreThe family centre was started by the Buttershaw Baptist Church and developed with the help of Spurgeon’s Childcare to help alleviate poverty in the area. It is one of the ways that the Buttershaw Baptist Church is able to provide the community with practical support and services, such as a nursery, counselling service and a shop with discounted food. A loan enabled the charity to buy a building to expand its child care provision for low income families.

Crofton Community CentreCrofton is a former mining village devastated by pit closures in the 1980s. The centre provides community and sporting facilities. A loan contributed to the centre’s refurbishment, helping it to offer more: a health clinic, exercise classes, an after school club, nursery and arts and crafts groups.

North Curry CommunityWith only one shop remaining in the village of North Curry, something had to be done. A loan enabled North Curry Community, a community organisation, to restore a derelict farm stable in order to provide community facilities, including a coffee shop and hairdresser.

Community WiseThis thriving and popular centre offers a range of activities for members of the local community – some 1,500 people use the centre every week – and Wise Buys, a community shop, provides income. A Charity Bank loan enabled the charity to purchase the freehold. Further loans have allowed the charity to improve and extend the centre.

1

2

3

4

3

1

2

4

Featured

Unit3Sixty: a crime - busting skate park

17

Unit3Sixty: a crime-busting skate park Gavin Pardoe, managing director of Unit3Sixty, shares his experience of starting up a skate park with a social mission.I dreamed up the skate park three years ago. Being active in the community as a serving firefighter, I recognised there was an opportunity to create a place for children and young people in Dudley to let off steam, to explore their creativity and be active in a safe, supportive and inspiring environment. When Stourbridge’s only skate park was closed to make way for regeneration in the area, there was a void. Skaters and BMX-ers had nowhere to go and the nearest facility was 25 miles away.

Fast forward to 2015 and Unit3Sixty is a thriving social enterprise with the whole community, including local businesses and organisations, backing the venture. We’re working with the emergency services in getting children and young people off the streets, particularly in the darker months. We’re hoping this will help reduce antisocial behaviour and, crucially, traffic-related accidents and deaths associated with younger people.

Funding came from a number of sources including Sport England, Dudley Council, as well as a number of grants. It didn’t come easy; being a startup not-for-profit venture, we were considered a big risk. Charity Bank saw our potential and provided a loan; an additional boost that made Unit3Sixty what it is today. We’re working to generate a sustainable income and our business model is evolving as we learn about the needs of the young people who come here.

Approximately 1,500 young people are using the skate park each week. Police report that anti-social behaviour has already decreased and local businesses say they have noticed a marked reduction in the number of young people skating near their premises. The future is exciting and we’re already thinking about expansion.

When Stourbridge’s only skate park was closed there was a void. Fast forward to 2015 and Unit3Sixty is a thriving social enterprise.

Gavin Pardoe, managing director, Unit3Sixty

18

1. Believe in the cause for good Unit3Sixty has remained focussed on

the belief that the positive outcomes will outweigh the risks involved in a startup. Its plans to improve sports participation rates and provide a safe environment for children were plus points for funders. With strong business plans Unit3Sixty has been able to persuade its funders of the benefits of such an enterprise.

2. Build partnerships with local businesses and organisations

Gavin has used his credibility in the community to build contacts and get businesses on board. A major national retailer gave them an advertising window for free. Another business provided Unit3Sixty’s kitchen free of charge and the local police force supply bikes and scooters that have been stolen and recovered.

3. A strong but flexible business model goes a long way

Unit3Sixty has a strong business model, but has allowed room for flexibility. The skate park has already evolved to reflect the needs of the people who use it, for example it offers women-only sessions, tuition for under-12s and special sessions for young disabled people. It’s more than a skate park - it’s become an urban recreation centre for an entire community.

4. Research, research, research Unit3Sixty did its homework. Its

business model replicates other sites in the UK, which have a high degree of impact where sport is a tool to support youth engagement and reduce offending. It consulted with children and young people through canvassing at outdoor locations and liaised with local skateboard, scooter and BMX shops. It also organised open events at the proposed site so potential customers could view the venue.

Peter Hughes, regional manager, Midlands and East of England

T: 07919 543237 E: [email protected]

Insight: ‘Catch some air’ as a social enterprise startup

19

© Mary Ward Settlement

Globally, access to education has taken on a deep significance thanks to campaigners like Malala Yousafzai.

But the barriers to education in the UK are less talked about. Bereavement, bullying, or family breakdown are all factors that can steer us away from learning and into trouble. Charities across the UK are working to give everyone the chance to learn, gain qualifications and take themselves where they want to go.

Education

20

House of St. Barnabas

Bridgwater YMCAThis YMCA used a Charity Bank loan to complete a project to build a new sports centre, which has helped raise the profile of the organisation and increase the social impact of its services across Somerset. Over the last three years, YMCA Somerset Coast has enabled 10,000 young people to participate in its activities.

House of St. BarnabasA loan from Charity Bank helped the House of St. Barnabas turn a Grade I listed hostel in Soho into an academy, which trains and supports homeless people, helping them into work and housing. The building is also used to run a not-for-profit members’ club whose activities help support the academy by offering training opportunities. The loan funded essential repairs, refurbishments and provided working capital.

Mid Glamorgan Area Scouts Council Mid Glamorgan Area Scouts makes a huge difference to the lives of local scouts and young people from across England and Wales. It helps engage and support young people in their personal development, enabling them to reach their full potential. A loan helped transform an old railway station into a 36-bed hostel with one acre of camping ground.

YMCA BirminghamYMCA Birmingham used a Charity Bank loan to help build a block of 34 apartments with training rooms and community facilities. Our loan was part of a mix of funding, including a Homes and Communities Agency grant, that helped support the project.

1

2

3

4

4YMCA Birmingham

1Bridgwater YMCA

3Mid Glamorgan Area Scouts Council

2

Featured

TLG, The Education Charity: an astounding journey

21

TLG, The Education Charity: an astounding journeyTim Morfin, chief executive of TLG, The Education Charity, reflects on the charity’s remarkable growth. It all started with a loan.When we started, our organisation was a small community centre in an old church building with one classroom and a community café. There, a group of volunteers taught and trained young people excluded from school. Today we have 11 education centres that give young people a second chance for an education, and 39 early intervention centres across the UK that provide extra support to children at school.

We used seven Charity Bank loans over 13 years to provide accommodation, sport and music facilities to young people. Most recently we used a loan to help build our flagship education centre. A large part of our income now comes from letting office space in this centre to creative arts organisations.

The journey that Charity Bank has walked with TLG is astounding. We saw an opportunity to use loan finance to generate revenue and support our work. We can now use this income stream to help us grow and give more young people the support they need to reach their full potential. With Charity Bank’s support we turned our local youth centre into a national education charity.

We can now use this income stream to help us grow and give more young people the support they need to reach their full potential.

Tim Morfin, chief executive, TLG – The Education Charity

22

1. The power of planning and a good team

High street banks refused to lend to TLG initially. I met with Tim Morfin, TLG’s chief executive, and saw great potential in his plans and his team. We made a loan to TLG to help it buy a warehouse, which became a small scale education and training centre for young people.

2. The decision to buy property TLG has made a point of buying

rather than renting the buildings it uses to deliver its activities. It has used property as an asset to obtain further loans and to help it grow: TLG sold properties to expand and develop a new site. It now uses the property it owns to generate revenue.

3. Developing a sustainable income Being tethered to grant or government

funding doesn’t lend itself to sustainability. When TLG developed its flagship education centre it designated a part of it to be used as office space. It now lets that space to creative arts organisations, which has contributed to its growth and a £1.9m turnover. TLG is generating close to 60% of its funding independently.

4. Managing cash flow TLG has steadily increased its

turnover through renting office space and property. It has been careful not to spend more money than is coming in and has been smart about predicting when it would have access to funding or income to repay loans.

Roger Ong, credit manager

Insight: 4 factors that drove TLG’s growth

23

With greater environmental awareness among the public than ever before, many specialist charities are taking the lead in tackling environmental issues head on.

Yet despite growing public concern for what’s at stake, these organisations often find it hard to access finance from traditional sources to do their bit to protect our planet.

Environment

24

Green Energy Mull

Heron Corn Mill Trust

Green Energy MullGreen Energy Mull (GEM), a community benefit society, is using a loan from Charity Bank to help fund the Isle of Mull’s first community hydroelectricity scheme. Expected to generate more than 1,000MWh of electricity annually, sufficient to power 280 homes, the scheme will reduce the island’s carbon footprint by 450 tonnes.

Reviive CICA joint venture between two charities, Reviive restores and sells unwanted furniture; the proceeds help to support victims of domestic violence and disadvantaged families. It started up, and opened a shop, with a loan from Charity Bank. The loan has helped Reviive divert 200+ tonnes of waste from landfill by upcycling unwanted furniture.

FurnistoreFurnistore sells recycled furniture and household goods at affordable prices to families and individuals in East Surrey, some of whom have experienced homelessness. It aims to reduce the volume of domestic waste in landfills while providing support and work experience for volunteers. A loan enabled Furnistore to buy a warehouse.

Heron Corn Mill TrustHoused in a Grade II listed building, the 18th century watermill is one of the few working mills left in Cumbria. A loan enabled the trust to raise the last remaining funds needed to get a new turbine in place, which now helps generate revenue. The mill has since developed a regular service and event programme for community hydro groups and individuals who want to install hydropower in their own homes.

1

2

3

4

1

2

3

4

Reviive CIC

Furnistore

Featured

Settle Hydro: a fossil free energy boost

25

Settle Hydro: a fossil free energy boostFrom idea to conception, Ann Harding, co-founding director of Settle Hydro, describes the journey of the first community-funded hydroelectric project in Settle.We started with a question: how can we bring more people into Settle and underpin its fragile rural economy?

We wanted to encourage investment into our market town and bolster the local economy. It was also important to empower the community so that residents could take responsibility for their own future. At the time there was a national push for renewable energy and that’s when we came up with the idea of doing something green.

We set up an industrial and provident society for the benefit of the community, with the aim of generating revenue by selling green hydroelectricity to the National Grid. Using the technology of a reverse Archimedean screw at Settle Weir, we’ve been able to achieve this. In addition, our local community’s successful delivery of an energy project has stimulated investment into other local community projects, including the regeneration of a local theatre which is no longer tied to grant funding.

We used three loans from Charity Bank to achieve our vision and today I can proudly say that we are the first community-funded hydroelectric project in the region. The 50kW plant produces enough electricity to power 50 homes. Not only that, it has attracted many tourists and visitors to the town, bolstering business for local B&Bs, pubs and restaurants.

The success of the project has gained us credibility and we’re attracting a lot of interest from others who want to know how they can do the same within their own communities.

Today I can proudly say that we are the first community-funded hydro-electric project in the region.

Ann Harding, co-founding director, Settle Hydro

26

1. Use partnership to lay the foundations

The project arose from a partnership between local environmentalists (Green Settle) and a community group (Settle Area Regeneration Team). Helped along by H2OPE, an organisation that supported the development of community hydro, the coalition formed a volunteer-run industrial and provident society to manage the scheme.

2. Community investors + grants + a loan

The £410,000 up-front cost was raised in stages. September 2008 saw the first community share issue. By December it had raised £140,000 from 166 investors. That success gave the project access to grants from environmental and regeneration bodies, which brought it up to the two-thirds level they needed to accompany the first £125,000 Charity Bank loan.

3. Generating a sustainable income In 2010 the government introduced

a new tariff and pricing structure for renewable energy projects and Settle Hydro applied to be included in this scheme. This will result in a guaranteed income for 20 years, enabling the project to attract further investment.

4. Supporting the community The success of the hydroelectric project has encouraged inward investment from public sector funds into other local community projects. In addition, the hydro has raised the profile of the town, attracting people who want to know how to replicate the project within their own communities. It’s a win-win.

Simon Thorrington, regional director, North of England

T: 07979 644872 E: [email protected]

Insight: How do you start a community energy project?

27

Faith-based organisations and projects are involved in a huge range of activities to strengthen and unite communities.

Many are working tirelessly to support communities, reducing isolation, encouraging self-respect and social responsibility and often providing food and education. Charity Bank is well-placed to understand the positive influence of these groups as this is our fourth biggest sector for lending.

Faith

28

The Greek Orthodox Community of Milton

Keynes

Bethel - London’s Riverside Church

Hindu Pragati SangaThis Hindu temple and community centre in Mile End used a loan to help redevelop an existing building. A larger meeting and prayer hall, a kitchen, a large dining room and facilities for the disabled were all built.

Drolma Buddist CentreRun entirely by volunteers, the centre aims to be a place of peace and refuge in the heart of Peterborough. It had existed for years without a centre for its meetings, but felt that having one would provide a firm foundation for growth. Charity Bank provided a loan which was used to buy a residential meditation centre.

The Greek Orthodox Community of Milton KeynesThe Greek Orthodox Community of Milton Keynes used two Charity bank loans to help it develop facilities including a Greek school for its own community and others: one loan was used to buy a redundant church building and another to buy the community building next door.

Bethel - London’s Riverside ChurchThis church runs a range of activities for the benefit of the community. With a growing congregation and increasing demand for support services, it will use our loan to help it extend and improve its building, including increased auditorium space, counselling rooms, a coffee shop and youth and children’s facilities.

1

2

3

4

2

4

3 Drolma Buddist Centre

Hindu Pragati Sanga1

Featured

City Life Church: a hub for social activity

29

City Life Church: a hub for social activityCity Life Church minister Kevin Clarke explains how loan finance has helped the church bring a community together.We know that people’s health and life chances are strongly linked to social isolation and economic deprivation. These issues are pertinent here in Sunderland, where some individuals don’t have the chance to participate in community activities.

We’ve always aimed to be the heart of the community, a place not only for worship and prayer, but a place where people of any background or faith can come and benefit from

our facilities. We outgrew the existing church building and our size constraints meant that we were unable to accommodate some of our key clubs and groups.

The only way forward was to extend the church building. A Charity Bank loan helped part-fund the building project and the church is now double the size, with meeting rooms and a community hall.

Our congregation size has increased and community involvement in the church has taken off. New mums attend the baby and toddler group and over 30 older people go to the weekly lunch club. We’ve also been able to increase our income by renting space to local business and other community organisations.

New mums attend the baby and toddler group and over 30 older people go to the weekly lunch club.

Kevin Clarke, minister, City Life Church

30

1. Building financial strength The church is financially strong and

has demonstrated the ability to generate a modest, though consistent, surplus sufficient to cover the costs of running the church and the repayments on the new loan, which was used to fund improvements to the fabric of the building.

2. Generating income without grants City Life Church has a strong track

record of income generation. It has a committed community of church-goers who give regularly and provide a steady and stable flow of support. At the same time, it is clever with space, generating income by renting it out to local organisations. This gave it the freedom to take on loan finance and then invest in more space.

3. Growing to support the community By investing in new facilities, the

church saw that it could attract more church-goers and potential donors, acquire more space to rent out, and grow as a support hub for the community. A hardworking and visionary leadership team has helped build an entrepreneurial church that’s active in the community.

4. Social entrepreneurship City Life Church has a strong business

ethic, which helps it to support more people. Taking on a loan represents a significant commitment. The leadership team looked closely at the church’s finances to ensure they could afford the repayments and other running costs. It had good financial controls and was able to produce regular management accounts.

Jeremy Ince, regional manager, Yorkshire & Humberside

T: 07787 575023 E: [email protected]

Insight: Social entrepreneurship, a loan and the growing impact of City Life Church

31

As we live, age and tackle the challenges everyday life throws at us, our health, mental health and care needs change.

Funding remains a stubborn challenge for organisations meeting basic human needs. Nonetheless, people continue, with as much energy as ever, to help others get back to normality after a crisis, deal with an addiction or live independently with a disability.

Health and social care

32

Autism Plus

Rotary Residential and Care Centres

Twinkle House Ltd

London FriendSet up in 1972, London Friend is the UK’s oldest lesbian, gay, bisexual and transgender charity, supporting the health and mental well-being of the LGB&T community in and around London. A loan helped it secure its financial future by enabling it to buy the property it had been renting.

Twinkle House LtdTwinkle House provides free sensory-based personalised support services for children and young people aged 0-19 who have disabilities and additional needs in West Lancashire and the neighbouring areas. A loan enabled Twinkle House to relocate to larger premises and expand its services to meet an increase in demand.

Autism PlusAutism Plus has set about using a loan from Charity Bank to transform a number of derelict farm buildings at Park House Farm, North Yorkshire, into a chocolate factory and horticulture enterprise, which will be run by people with autism and other disabilities. These employees will be trained by skilled chocolatiers and horticulturists to bring quality chocolate and greens to local retailers and to help them develop skills for independence and future employment.

Rotary Residential and Care CentresThis charity provides care for people who have cerebral palsy. Its services are designed to allow residents to have every chance to live as they would at home. An initial loan covered renovation of one of its care homes, and a further loan helped pay for refurbishment of the main residential home.

1

2

3

4

London Friend1

2 3

4

Featured

Cosgarne Hall: beating addiction

33

Cosgarne Hall: beating addictionMalcolm Putko, general manager of Cosgarne Hall, explains how tolerating drugs and alcohol is helping homeless people to take control of their lives.Cosgarne Hall’s 54 rooms are almost always full. Since 2009, ten lives have been saved in overdose cases. Last year 70 people were supported to live independently.

With years of experience we know that homelessness and addiction go hand in hand, and we can offer tailored support to help people turn their lives around. We’re one of the few places in the country to operate an alcohol and substance tolerant policy, so residents at Cosgarne are able to address their issues in a realistic environment. We encourage them to recover at their own pace because their needs are more complex than

addiction alone. We’ve adapted and developed Cosgarne Hall with this in mind.

Two loans from Charity Bank have enabled us to help people move on and live independently. The first loan helped buy an eight-bed property, and a second helped finance a six-bed home for those ready to live more independently and move out of the main complex. We’re lucky to have the support from Charity Bank because we know not every bank would be willing to enter into a partnership with a charity that is alcohol tolerant.

Needs are more complex than addiction alone. We’ve developed Cosgarne Hall with this in mind.

Malcolm Putko, general manager, Cosgarne Hall

34

1. Demand for a unique service There is a waiting list of people needing the services at Cosgarne Hall. Without Cosgarne Hall, Cornwall would have an even bigger problem with homelessness and antisocial behaviour. It was clear from the outset that the organisation had a high social impact and an ambitious management team that we were ready to support.

2. Creating an environment to aid recovery

The quality of the environment is a critical factor in helping residents recover. Cosgarne has invested in making its accommodation of a very high standard. At the same time its trustees and management are looking to grow Cosgarne Hall to provide more accommodation and support more people.

3. A brilliant team The professionalism and passion of

the whole team at Cosgarne Hall, make its dedicated support service a success. Supporting people with addictions can be challenging, which is why the team’s commitment is so important. The residents value it and many are able to turn their lives around as a result of the team’s support and understanding.

4. Community backing Cornwall Council, Devon and

Cornwall Police, the Probation Service, Addaction and the wider community all acknowledge the organisation’s contribution towards the reduction of crime, disorder and re-offending. This level of support has enabled Cosgarne Hall to secure funding from the council, a local church and local families and recruit local volunteers.

Chapman Harrison, regional manager, South West of England

T: 07795 107173 E: [email protected]

Insight: the tools to meet demand

35

Home: a place to love, laugh, cry, grow, learn, a place to feel safe.

Yet there aren’t enough homes: for families who want to give their children the best start in life, for older people on low-incomes who want to keep their independence, and for people with chaotic lifestyles who need support to turn their lives around. The housing sector remains our biggest portfolio of borrowers.

Housing

36

King Edward VI and the Reverend Joseph Prime Almshouse Charity

Target Housing Ltd

Lyvennet Community Land Trust

Broadacres Services Limited

King Edward VI and the Reverend Joseph Prime Almshouse CharityThese almshouses offer a place where people can live independently within a safe and secure environment. Combining a loan from Charity Bank, its own funds and a loan from The Almshouse Association, the charity was able to restore and extend four Grade II listed Victorian almshouses in desperate need of repair.

Broadacres Services LimitedBroadacres Services Limited is an unregistered development subsidiary of Broadacres Housing Association, which provides services to approximately 5,600 homes in North Yorkshire. Charity Bank made a loan to help build homes for outright sale. Sale surpluses will be used by Broadacres Housing Association to help address the lack of affordable homes and support for the vulnerable.

Target Housing LtdTarget Housing provides supported accommodation for ex-offenders. It took out its first Charity Bank loan in 2008 to help buy 11 residential properties and used a further loan three years later to help buy four properties. After winning a contract to provide accommodation to asylum seekers it later took out a further loan to buy three more properties.

Lyvennet Community Land TrustResidents of Crosby Ravensworth formed the trust in August 2009 to acquire a 2.25 acre brownfield site for social housing in response to shortages in the local area. A loan from Charity Bank enabled it to construct ten houses for rent, which were all occupied as soon as they were built, two more houses for sale and eight plots for self-build. It is the first Community Land Trust in the country to become a registered provider of social housing.

1

2

3

4

1

3

2

4

Featured

Homes for Good: an innovative solution

37

Homes for Good: an innovative solutionSusan Aktemel launched Scotland’s first lettings agency for people on benefits. She explains how she’s been able to use social investment to address the housing crisis.The number of people in Scotland waiting for social housing according to government statistics in 2013 was 185,000. As the population grows this will only get worse and more people will face homelessness.

Having a decent home to live in is so much more than a roof over your head. It’s a source of dignity, a space to raise a family and a necessary foundation for a happy, productive life. Some people face a long, hard search for a place to call home. They might be forced to accept homes that are cramped, draughty and even mouldy. They might find nowhere at all. And then there’s also the difficulty of landlords who avoid renting to people on benefits or low incomes.

We want to build affordable good quality homes. We also want to rebuild the trust between private sector landlords and tenants by laying the foundations for successful tenancies. We set up Homes for Good Investments, as a joint venture with social investor Impact Ventures UK (IVUK), to acquire and refurbish run-down properties that will be rented to people on low incomes or benefits.

With the support of a loan from Charity Bank and investment from IVUK we aim to make 120 properties available, which we anticipate will benefit 480 people in Scotland over the next eight years.

We also run Homes for Good CIC (Community Interest Company), a lettings agency that rents homes to people on social housing waiting lists and provides budgeting advice, financial planning and employability assistance to help establish long-lasting tenancies. In many cases this is the first time people have had a place that they can call home, and their smiles and sometimes tears are testament to why everyone should have access to an affordable good quality home.

We aim to make 120 properties available, which we anticipate will benefit 480 people in Scotland over the next 8 years.

Susan Aktemel, director, Homes for Good

38

1. Showing your potential for wider impacts

It’s not essential to a loan application, but the potential of Homes for Good to have a wider systemic impact caught our attention. A lettings agency that works with people on low incomes and benefits and a pipeline of affordable homes created by a sister investment company. That’s a hugely innovative model, which could be adopted by other landlords and property developers.

2. Mission lock Charity Bank will lend to a

limited company if there is a clear commitment to a social purpose. Not only are Susan Aktemel and her team passionate about addressing the housing crisis, Homes for Good Investments also has a ‘mission lock’, which protects its social objectives.

3. Growth and sustainability By setting up a property investment

company to work alongside a community interest company, Homes for Good has created a great opportunity to grow its impact. Any surplus generated by Homes for Good Investments can be re-invested in making more homes available and supporting tenants to take on new responsibilities.

4. What is the right legal structure for your mission?

For Homes for Good Investments, choosing to become a company limited by shares widened access to different forms of finance to help further its mission. Susan Aktemel has successfully attracted equity investment from IVUK and a loan from Charity Bank to launch a company that will drive more affordable homes into the housing market.

John Barnett, manager, Scotland

T: 07771 515484 E: [email protected]

Insight: How social investment can grow your social impact

39

More and more high profile figures are condemning the growth in inequality.

The UK has a regional patchwork of differing opportunities. Some areas are flourishing, others are in decline. On the ground charities are working with people living in areas that aren’t prospering, providing services, helping to create new opportunities and to build a world where people have a better chance to live the lives they want.

Regeneration

40

The Smarterbuys Store

Govan Workspace

Strathfillan Community Development Trust

Lupton Trust

Govan WorkspaceGovan Workspace is an independent office space, industrial and commercial landlord, developing affordable workspace for small businesses, tailoring leases to suit their needs and helping them expand when they’re ready. It took out two loans: one to help finance the £2 million purchase and decontamination of a brownfield industrial site, and another to refurbish a former shipyard building.

Lupton TrustThe Lupton Trust was formed in 2008 to bring Lupton House, a grade II listed house, which stood empty for years, and its gardens back into use for the benefit of the community. A loan helped the Trust buy Lupton House and carry out essential restoration work.

The Smarterbuys StoreThe Smarterbuys Store is a scheme designed to help social housing tenants obtain affordable finance as an alternative to payday loans and doorstep lenders. It enables social housing tenants to buy white goods, furniture and electrical items at a discounted price. A Charity Bank loan has been agreed to help fund its growth.

Strathfillan Community Development TrustA loan helped this community-run organisation turn four British Rail houses into affordable housing for locals. This freed up a former schoolhouse, previously used as accommodation, which now provides much-needed nursery facilities.

1

2

3

4

4

1

3

2

Featured

Seaview Enterprises: peace and

reconciliation in Northern Ireland

41

Seaview Enterprises: peace and reconciliation in Northern Ireland Bernard Thompson, project manager at Seaview Enterprises talks bridging loans and bridging the divide in Northern Ireland.Northern Ireland today is as close to peace as it has been for decades. The peace process has already transformed many aspects of life. But a deep divide remains between Protestant and Catholic communities. When we started Seaview Enterprises, we knew there was a way to use sport as a tool for development, to promote peace and boost employment prospects for young people in North Belfast and Newtownabbey.

We formed a strong alliance through communities and schools between Protestant and Catholics. Our base is Seaview stadium, the shared home ground of Crusaders FC and Newington YC, Protestant and Catholic clubs, respectively. From here, we use football and sports activities to build bridges and reduce conflict between different communities.

Our vision is to develop a sports and education campus that will be a hub for community development, linking schools and youth groups across the religious divide. Already thousands of young people have participated in our programmes helping them address local community issues. Sport is the hook we use to help them strike up long lasting friendships, gain qualifications and training and build a better future for themselves and the community.

We used a Charity Bank loan to help us deliver our ‘Mes Que Un Club’ project, a programme using sport for peace, reconciliation and social change. The loan was essential to our funding, and helped us bridge a gap as we waited for retrospective European grant funding. It helped our cash flow and supported a project with a vital role in bringing two communities together in the most segregated part of Northern Ireland.

It’s hard to describe what you feel when you see young people from divided groups come alive with the buzz of team sport. It gives me endless amounts of drive to work hard and help build a stronger, more vibrant community.

Our vision is to develop a sports and education campus that will be a hub for community development, linking schools and youth groups across the religious divide.

Bernard Thompson, project manager, Seaview Enterprises

42

1. Great people – a strong hook for funders

When it comes to securing loans, the passion and experience of your management team play a big role. The leadership of director Mark Langhammer, a public figure, well-regarded by both Catholic and Protestant communities, is a driving force behind Seaview Enterprises. Seaview’s directors are committed and contribute experience from cross-community work and education to finance and sports marketing.

2. Repaying a loan when grants make up the majority of your income

Seaview was able to repay the loan through retrospective grant payments. It used the loan to manage a shortage of cash as it delivered a project without delving too deeply into its reserves. The reserves were used to cover the interest and once it received the grant payments it was able to repay the loan in full.

3. Balancing grants and other types of finance

Seaview is smart about generating funds from a mix of grants and independent sources. It relies on a good spread of grant applications and generates revenue by hiring out sports and conferencing facilities at Seaview stadium, which it rents from Crusaders FC. This independent income enabled it to build up reserves, and manage a shortfall as it delivered a project.

4. Social impact Social impact is a ‘headache’ term

for many organisations as it often requires time and resources to measure impact. We need to see what benefits a potential borrower is creating but at the same time we don’t enforce methods and strict requirements. In Seaview’s case, we were able to use information already provided to the Special European Union Projects Board.

Patrick Minne, manager, Northern Ireland

T: 07824 340889 E: [email protected]

Insight: Using a loan alongside grants

43

In spite of funding challenges, the sports and leisure sector is as dynamic as ever.

Leisure social enterprises, climbing walls, and community sports organisations are putting sport at the heart of social change. Whether it’s a splash in a community swimming pool or a hat-trick in a youth football competition, they are helping to improve our health and inspire our ambitions.

Sports

44

Development Through Challenge

Farnham Rugby Club

Fusion Lifestyle

Surfleet Play and Recreational

Centre (SPARC)

Fusion LifestyleFusion Lifestyle is a registered charity providing high quality sport, health and well-being services that are inclusive and accessible to communities across the South of England. A Charity Bank loan part-funded the major refurbishment of Holywell Mead Leisure Centre in High Wycombe.

Development Through ChallengeThe charity promotes personal development through challenging physical activity, especially for disadvantaged young people. It took out a loan to redevelop one of its buildings that houses climbing walls, which are used by local schools and for climbing courses.

Surfleet Play and Recreational Centre (SPARC)SPARC provides sporting facilities to a network of small, deprived rural communities in South Lincolnshire where such facilities are scarce. It took out a loan to re-develop its site to provide a greater range of services. SPARC estimates that 15,000 additional people are using the facilities every year as a result of the improvements.

Farnham Rugby ClubIn a little over 30 years, Farnham Rugby Club has grown to become Farnham’s largest charitable community sports club. When it outgrew its existing facilities in Wrecclesham a loan from Charity Bank helped extend the club and build new facilities.

1

2

3

4

3

1

2

4

Featured Folkestone Sports Centre: an unsung sports hero

45

Folkestone Sports Centre: an unsung sports heroTessa Stickler, general manager of Folkestone Sports Centre Trust (FSCT), explains how a social enterprise leisure centre is invigorating the community.When the doors to the centre were officially opened over 40 years ago, I don’t think anyone could have imagined the impact it would have on the community. The main goal was to make sport and leisure activities accessible to people who might otherwise struggle to access them for financial or social reasons. Since then, the centre has been used by several generations of the same families and become an integral part of their lives.

Over time, the centre has evolved to keep up with the changing needs of the community, who we often consult with. Being the only multi-sports facility in the district of Shepway, it’s important for us to be able to adapt to those needs.

When we needed to bring the centre up to date Charity Bank saw our potential and gave its full support. Without it, the first phase of a major regeneration of this tired, 45-year old building would not have gone ahead and it would have most likely ended with closure. As we are a non-profit making organisation, reinvesting any small surplus we make, commercial lenders weren’t prepared to step in.

The Charity Bank loan also enabled us to attract further funding, which meant we could pay for the next phase of the programme. As a result, in addition to increasing our services available for the community - in particular those with learning and physical disabilities - we now host local, national and international sports events.

FSCT recently won an award for its work with disability groups, with many more now using the centre’s facilities including injured soldiers and their families from the local military community. We’re now looking forward to serving the next generation – and beyond!

Over time, the centre has evolved to keep up with the changing needs of the community.

Tessa Stickler, general manager, Folkestone Sports Centre Trust

46

1. Community focus The centre is a lifeline to the

community and to allow it to close would have been a terrible let-down. At the time, commercial banks wouldn’t consider making a loan because the trust was only generating a small surplus. But it had potential for social impact and financial sustainability so I could see how Charity Bank could support the sports centre with a loan.

2. Robust plans for financial sustainability

FSCT put together a good business plan, which enabled it to secure grant funding and a Charity Bank loan. Its ability to generate a surplus helped it to secure our loan and good planning made sure the nuts and bolts were in place as it used the loan to regenerate the centre.

3. Securing trust FSCT used the loan to undertake the

first phase of its renovation work, securing the future of the sports centre. It also used its finance wisely adding new gym facilities, which are helping it to repay the loan. After successfully completing the project, FSCT was in the perfect position to attract new funders who saw it as an organisation that was able to deliver on its promises.

4. Forward thinking Since our first loan to FSCT it has

expanded its range of services and continued to evolve to meet community needs. As a result FSCT has been able to build good relationships with funders. Just as its initial planning was key at the outset, its forward-thinking has been crucial to sustaining and growing its social impact.

Carolyn Sims, head of banking

Insight: Four factors that unlocked funding for community sport activities

47

If you apply for a loan, you will need to show us you are capable of achieving your social mission, explain how a loan would support you and tell us your plans for the future consider:

Your aims. What will you use the loan for?

Your activities. Can you show you’re delivering social good?

Your governance. Who is running the charity, how long has the team been there, and does it have the right skills?

Your income. Do you rely on a single source of funding or do you have diverse income streams? Are you generating surpluses?

Your business plan. How do you aim to sustain and/or grow your organisation over the coming years?

What are the key things to think about before you apply for a loan?

48

TLG, The Education Charity

Call us directly or send a brief email telling us what you do, the amount you’ll need and what you’ll use it for.

Your regional manager will be in touch to learn more about your organisation and the sort of loan that would work best for you. We’ll point you towards alternatives if a loan from us isn’t the best option.

If it’s clear that a loan could support you, you’ll work with a regional manager to submit a loan application. Our credit team will make the final decision.

Once you receive the loan, your regional manager will be on hand for advice as you put it to work.

Taking the next stepLets make it happen:The Charity Bank Limited, Fosse House, 182 High Street, Tonbridge Kent, TN9 1BE

Call, email or visit us

T: +44 (0)1732 441919 E: [email protected] W: charitybank.org

@charitybank

/charitybank

49

Every single one of our shareholders is either a charity or a social purpose organisation. Charity Bank shareholders are social investors, looking to invest in business that is wholeheartedly committed to a social cause. They expect a modest financial return but the central purpose of their investment is to see money do social good.

Our shareholders are:Big Society CapitalIGEN TrustCharities Aid Foundation RBS Social & Community CapitalThe Baring FoundationCommunity Foundation for Northern IrelandThe Frederick Mulder FoundationThe Help for All TrustThe Lankelly Chase FoundationThe Mercers Charitable FoundationThe National Council for Voluntary OrganisationsNorthern Rock FoundationThe Phillips FundEsmée Fairbairn FoundationThe Nuffield FoundationThe Tudor TrustThe Vodafone FoundationWates Foundation

If you are a trust, charity or a foundation interested in investing in Charity Bank, please contact our chief executive Patrick Crawford: [email protected]

Our shareholders: who owns Charity Bank?

50

© Half Moon

© Mary Ward Settlement 51

Thank youCharity Bank is a community of like-minded individuals all working towards one goal.

Our borrowers, savers, shareholders and staff are helping to support charities and social enterprises so that they can always be there when people and communities need them.

51

The Charity Bank LimitedFosse House 182 High Street TonbridgeKent TN9 1BE

T: +44 (0) 1732 441900E: [email protected]: charitybank.org

@charitybank

/charitybank

All photography is of organisations and people in whom we have invested and we acknowledge their kind co-operation.

Registered Office: The Charity Bank Limited, Fosse House, 182 High Street, Tonbridge, Kent TN9 1BE. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority No. 207701. Member of the Financial Services Compensation Scheme (FSCS). Company registered in England and Wales No. 4330018.

We’re a bank for people who don’t just dream of a better world, they’re busy building one.