Chapters 6 & 7 – MBA5041 Capital Budgeting Net Present Value Rule Payback Period Rule Discounted...

-

Upload

isai-bucey -

Category

Documents

-

view

228 -

download

0

Transcript of Chapters 6 & 7 – MBA5041 Capital Budgeting Net Present Value Rule Payback Period Rule Discounted...

Chapters 6 & 7 – MBA504 1

Capital Budgeting

Net Present Value Rule

Payback Period Rule

Discounted Payback Period Rule

Average Accounting Return

Internal Rate of Return

Profitability Index

Practice of Capital Budgeting

Incremental Cash Flow

Chapters 6 & 7 – MBA504 2

Net Present Value (NPV) Rule• Net Present Value (NPV) =

Total PV of future CF’s + Initial Investment

• Estimating NPV:– 1. Estimate future cash flows: how much? and when?– 2. Estimate discount rate– 3. Estimate initial costs

• Minimum Acceptance Criteria: Accept if NPV > 0• Ranking Criteria: Choose the highest NPV

Chapters 6 & 7 – MBA504 3

Assume you have the following information on Project X:

Initial outlay -$1,100 Required return = 10%

Annual cash revenues and expenses are as follows:

Year Revenues Expenses

1 $1,000 $500

2 2,000 1,000Calculate its NPV.

Example

Chapters 6 & 7 – MBA504 4

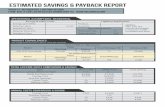

The Payback Period Rule• How long does it take the project to “pay back” its

initial investment?• Payback Period = number of years to recover

initial costs• Minimum Acceptance Criteria:

– set by management• Disadvantages

– Ignores the time value of money– Ignores cash flows after the payback period– Biased against long-term projects

Chapters 6 & 7 – MBA504 5

Initial outlay -$1,000

Year Cash flow

1 $200

2 400 3 600

Accumulated

Year Cash flow

1 2 3

Payback period =

Chapters 6 & 7 – MBA504 6

Discounted Payback Period Rule

• How long does it take the project to “pay back” its initial investment taking the time value of money into account?

• By the time you have discounted the cash flows, you might as well calculate the NPV.

Chapters 6 & 7 – MBA504 7

Initial outlay -$1,000

R = 10%

PV of Year Cash flow Cash flow

1 $ 200 $ 182 2 400 331 3 700 526 4 300 205

Accumulated: Year discounted cash flow

1 $ 182 2 513 3 1,039 4 1,244

Discounted payback period is

Example

Chapters 6 & 7 – MBA504 8

Average Accounting Return Rule

• Another attractive but fatally flawed approach.• Ranking Criteria and Minimum Acceptance Criteria

set by management• Disadvantages:

– Ignores the time value of money– Uses an arbitrary benchmark cutoff rate– Based on book values, not cash flows and market values

• Advantages:– The accounting information is usually available– Easy to calculate

Investent of ValueBook Average

IncomeNet AverageAAR

Chapters 6 & 7 – MBA504 9

Internal Rate of Return (IRR) Rule

• IRR: the discount that sets NPV to zero • Minimum Acceptance Criteria:

– Accept if the IRR exceeds the required return.• Ranking Criteria:

– Select alternative with the highest IRR• Reinvestment assumption:

– All future cash flows assumed reinvested at the IRR.

Chapters 6 & 7 – MBA504 10

ExampleConsider the following project:

0 1 2 3

$50 $100 $150

-$200

The internal rate of return for this project is 19.44%

32 )1(

150$

)1(

100$

)1(

50$0

IRRIRRIRRNPV

Chapters 6 & 7 – MBA504 11

NPV Payoff Profile for The Example

Discount Rate NPV

0% $100.004% $71.048% $47.3212% $27.7916% $11.6520% ($1.74)24% ($12.88)28% ($22.17)32% ($29.93)36% ($36.43)40% ($41.86)

If we graph NPV versus discount rate, we can see the IRR as the x-axis intercept.

IRR = 19.44%

($60.00)

($40.00)

($20.00)

$0.00

$20.00

$40.00

$60.00

$80.00

$100.00

$120.00

-1% 9% 19% 29% 39%

Discount rate

NP

V

Chapters 6 & 7 – MBA504 12

Problems with the IRR Approach• Multiple IRRs.

• The Scale Problem.

• The Timing Problem.

Chapters 6 & 7 – MBA504 13

Multiple IRRsThere are two IRRs for this project:

0 1 2 3

$200 $800

-$200

- $800

($150.00)

($100.00)

($50.00)

$0.00

$50.00

$100.00

-50% 0% 50% 100% 150% 200%

Discount rate

NP

V

100% = IRR2

0% = IRR1

Which one should we use?

Chapters 6 & 7 – MBA504 14

The Scale ProblemWould you rather make 100% or 50% on your

investments?

What if the 100% return is on a $1 investment while the 50% return is on a $1,000 investment?

Chapters 6 & 7 – MBA504 15

The Timing Problem (page 161)

0 1 2 3

$10,000 $1,000$1,000

-$10,000

Project A

0 1 2 3

$1,000 $1,000 $12,000

-$10,000

Project B

The preferred project in this case depends on the discount rate, not the IRR.

Chapters 6 & 7 – MBA504 16

Mutually Exclusive vs. Independent Project

• Mutually Exclusive Projects: only ONE of several potential projects can be chosen, e.g. acquiring an accounting system. – RANK all alternatives and select the best one.

• Independent Projects: accepting or rejecting one project does not affect the decision of the other projects.– Must exceed a MINIMUM acceptance criteria.

Chapters 6 & 7 – MBA504 17

Discount rate

2% 6% 10%

14% 18%

60

40200

– 20– 40

Net present value

– 60

– 80

– 100

22%

IRR A IRR B

0

140

12010080

160

Year

0 1 2 3 4

Project A: – $350 50 100 150 200

Project B: – $250 125 100 75 50

26%

Crossover Point

Which project is good?

Chapters 6 & 7 – MBA504 18

HOW TO FIND CROSS POINT

PROJECT A PROJECT B A - B

-350 -250 -10050 125 -75

100 100 0150 75 75200 50 150

12.91% 17.80% 8.07%IRR(A3: A7) IRR(B3: B7) IRR(C3: C7)

Chapters 6 & 7 – MBA504 19

Decision Rule• If required rate of return < crossover return,

take the project with lower IRR• If required rate of return > crossover return,

take the project with higher IRR• Don’t think a project with higher IRR is

always good• Projects with higher NPV is always good

Chapters 6 & 7 – MBA504 20

Profitability Index (PI) Rule

• Minimum Acceptance Criteria: Accept if PI > 1

• Ranking Criteria: Select alternative with highest PI

• Disadvantages: Problems with mutually exclusive investments

• Advantages:– May be useful when available investment funds are

limited

– Easy to understand and communicate

– Correct decision when evaluating independent projects

Investent Initial

FlowsCash Future of PV TotalPI

Chapters 6 & 7 – MBA504 21

Practice of Capital Budgeting

• Varies by industry:– Some firms use payback, others use accounting

rate of return.

• The most frequently used technique for large corporations is IRR or NPV.

Chapters 6 & 7 – MBA504 22

Example of Investment RulesCompute the IRR, NPV, PI, and payback period for the following two projects. Assume the required return is 10%.

Year Project A Project B0 -$200 -$1501 $200 $502 $800 $1003 -$800 $150

Chapters 6 & 7 – MBA504 23

Incremental Cash Flows

• Cash flows matter—not accounting earnings.• Sunk costs don’t matter.• Incremental cash flows matter.• Opportunity costs matter.• Side effects like cannibalism and erosion matter.• Taxes matter: we want incremental after-tax cash flows. • Inflation matters.

Chapters 6 & 7 – MBA504 24

Cash Flows—Not Accounting Earnings

• Consider depreciation expense.

• You never write a check made out to “depreciation”.

• Much of the work in evaluating a project lies in taking accounting numbers and generating cash flows.

Chapters 6 & 7 – MBA504 25

Incremental Cash Flows• Sunk costs are not relevant

– Just because “we have come this far” does not mean that we should continue to throw good money after bad.

• Opportunity costs do matter. Just because a project has a positive NPV that does not mean that it should also have automatic acceptance. Specifically if another project with a higher NPV would have to be passed up we should not proceed.

Chapters 6 & 7 – MBA504 26

Incremental Cash Flows

• Side effects matter (page 180)– Erosion

– Synergy

Chapters 6 & 7 – MBA504 27

Estimating Cash Flows• Cash Flows from Operations

– Recall that:

Operating Cash Flow = EBIT – Taxes + Depreciation

• Net Capital Spending– Don’t forget salvage value (after tax, of course).

• Changes in Net Working Capital– Recall that when the project winds down, we enjoy a

return of net working capital.

Chapters 6 & 7 – MBA504 28

The Baldwin Company: An Example(page 181)

Costs of test marketing (already spent): $250,000.

Current market value of proposed factory site (which we own): $150,000.

Cost of bowling ball machine: $100,000 (depreciated according to ACRS 5-year life). Salvage value of 30,000.

Increase in net working capital: $10,000. Production (in units) by year during 5-year life of the machine: 5,000, 8,000, 12,000, 10,000, 6,000.

Price during first year is $20; price increases 2% per year thereafter.

Production costs during first year are $10 per unit and increase 10% per year thereafter.

Annual inflation rate: 5%

Tax rate is 34 percent

Working Capital: initially $10,000 changes with sales.

Chapters 6 & 7 – MBA504 29

Key Issues• Dis-regard sunk costs• Consider incremental cash flow – additional cash

flows • Figure out revenue, cost, depreciation, tax, capital

spending, addition to net work capital• Refer to this example when you take advanced

corporate finance to deal with capital budgeting or meet this kind of problem in your work