Chapter III World trade and economic growth, 2020-21

Transcript of Chapter III World trade and economic growth, 2020-21

10

Trade and GDP in 2020 and early 2021 22

Merchandise trade volume 23

Commodity prices 26

Exchange rates 27

Merchandise and services trade values 28

Leading indicators of trade 31

Economic recovery from COVID-19 34

World trade and economic growth, 2020-21

20

Chapter I I I

11

World merchandise trade volume and real

GDP fell sharply in the first half of 2020 as

a result of the COVID-19 pandemic before

rebounding in the second half. Consequently,

trade and output declined less than initially

expected for the year. The volume of

merchandise trade dropped by 5.3 per cent in

2020 while real GDP at market exchange rates

declined by 3.6 per cent.

The decline in merchandise trade in 2020 was

less severe than forecasters predicted for a

number of reasons. These included proactive

fiscal and monetary policies that boosted

incomes and consumption, an increase in

demand for technological innovation to facilitate

remote work, and trade policy restraint that kept

supply chains functioning.

The post-pandemic trade recovery is already

showing signs of divergence across countries

and regions. Merchandise export and import

volumes in the first quarter of 2021 rose to new

heights in Asia and reverted to pre-pandemic

levels in Europe and North America but lagged

behind in poorer, less industrialized regions,

such as Africa and the Middle East.

Merchandise trade and commercial services

trade in current US dollar terms plunged in the

early stages of the pandemic. Merchandise trade

rebounded strongly in the second half of 2020

but services continued to be weighed down by

travel restrictions. The value of merchandise

exports fell by 8 per cent in 2020 to US$ 17.58

trillion while commercial services exports

dropped by 20 per cent to US$ 4.91 trillion.

21

Ann

ual p

erce

ntag

e ch

ange

-6

-4

-2

0

2

4

6

2020201920182017201620152014

Average trade growth 2010-19Trade GDP Average GDP growth 2010-19

2.63.0

2.2

3.1

1.4

4.9

3.2 3.2 3.1

0.2

-5.3

-3.6

2.42.7

Trade and GDP in 2020 and early 2021

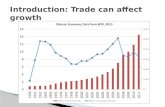

The volume of world merchandise trade declined significantly in 2020, with only the financial crisis of 2008-09 having seen a steeper decline. However, it could have been even greater in view of the contraction in GDP.

Chart 3.1 World merchandise trade volume and real GDP growth, 2014-20 (Annual percentage change)

Sources: WTO Secretariat for trade, consensus estimates for GDP.Note: GDP growth is calculated with market exchange rate weights.

• The volume of world merchandise trade declined by 5.3 per cent in 2020 as the COVID-19 pandemic severely jolted the global economy. This followed a sharp decline in trade the previous year, with volume growth of just 0.2 per cent as trade tensions between leading nations remained high.

• The decline in merchandise trade in 2020 was even larger when measured in nominal US dollar terms, with the value of exports falling by nearly 8 per cent to US$ 17.58 trillion. The dollar value of commercial services exports declined even more, dropping by 20 per cent to US$ 4.91 trillion.

• The large decline in services trade is mostly due to travel restrictions and lockdowns, which prevented the delivery of services requiring physical proximity. Some income not spent on services may have been diverted to goods, supporting merchandise imports.

• The 5.3 per cent decline in merchandise trade volume in 2020 was accompanied by a 3.6 per cent contraction in world real GDP at market exchange rates. The trade decline was therefore 1.5 times larger than the decline in output. This is smaller than in 2009 following the global financial crisis, when trade volumes fell 12.6 per cent, six times more than the 2.0 per cent slump in GDP.

World Trade Statistical Review 2021

22

-20

-15

-10

-5

0

5

10

90

95

100

105

110

115

120

Year

-on-

year

per

cent

age

chan

ge

Volu

me

inde

x 20

15=

100

4.0

2.51.9 2.8

-2.0

1.9 1.8 1.8

4.55.4 5.4 5.5

4.63.7 3.6

1.5 1.3

0.4 -0.2 -0.7

-3.3

-5.4

0.0

4.3

-15.5

111.0

93.7

111.7

2019

Q1

2018

Q4

2018

Q3

2018

Q2

2018

Q1

2017

Q4

2019

Q3

2019

Q4

2020

Q1

2020

Q2

2020

Q3

2020

Q4

2017

Q3

2017

Q2

2017

Q1

2016

Q4

2016

Q3

2016

Q2

2019

Q2

2016

Q1

2015

Q4

2015

Q3

2015

Q2

2021

Q1

2015

Q1

Index, 2015Q1 = 100 (left axis)Year-on-year % change (right axis)

Merchandise trade volume

The 2020 contraction in the volume of merchandise trade started in the first quarter and accelerated in the second. The subsequent rebound in the third and fourth quarters was strong enough to return merchandise trade to its pre-pandemic level by the end of the year.

Chart 3.2 World merchandise trade volume, 2015Q1-2021Q1 (Volume index 2015=100 and year-on-year percentage change)

Sources: WTO Secretariat and UNCTAD.

• World merchandise trade volume fell by 2.0 per cent in thefirst quarter of 2020 compared with the previous quarterand a further 12.5 per cent in the second quarter. By theend of the second quarter, merchandise trade was down15.5 per cent compared to the same period in 2019.

• Merchandise trade jumped 11.4 per cent in the thirdquarter of 2020 compared with the previous quarter andanother 4.4 per cent in the final quarter, bringing thevolume of trade back to its level in the fourth quarter of

2019. By comparison, merchandise trade took more than two years to recover to its pre-crisis level after the financial crisis.

• Trade growth slowed to 2.1 per cent in the first quarterof 2021 compared with the previous quarter while year- on-year growth picked up to 4.3 per cent. Year-on-yeargrowth is expected to be very strong in the secondquarter of 2021, mostly due to the downturn in the secondquarter of 2020.

Chapter III: World trade and economic growth, 2020-21

23

Africa Middle East AsiaCIS2EuropeSouth America1North America

2018

Q3

2019

Q4

2019

Q4

2019

Q4

2019

Q4

2020

Q1

2021

Q1

2020

Q2

2020

Q3

2020

Q4

2019

Q3

2019

Q2

2019

Q1

2018

Q4

2018

Q2

2018

Q1

2017

Q4

2017

Q3

2017

Q2

2017

Q1

2016

Q4

2016

Q3

2016

Q2

2016

Q1

2015

Q4

2015

Q3

2015

Q2

2015

Q1

2018

Q3

2019

Q4

2019

Q4

2019

Q4

2019

Q4

2020

Q1

2021

Q1

2020

Q2

2020

Q3

2020

Q4

2019

Q3

2019

Q2

2019

Q1

2018

Q4

2018

Q2

2018

Q1

2017

Q4

2017

Q3

2017

Q2

2017

Q1

2016

Q4

2016

Q3

2016

Q2

2016

Q1

2015

Q4

2015

Q3

2015

Q2

2015

Q1

Volu

me

indi

ces

2015

Q1

=10

0Vo

lum

e in

dice

s 20

15Q

1=

100

70

80

90

100

110

120

130

140

Africa Middle East AsiaCIS2EuropeSouth America1North America

70

80

90

100

110

120

130

140

The recovery of merchandise trade since the third quarter of 2020 has been strong but uneven, with exports and imports growing faster in some regions than in others.

Chart 3.3 Merchandise exports by region, 2015Q1-2021Q1 (Volume indices 2015Q1=100)

1 Refers to South and Central America and the Caribbean.2 Refers to Commonwealth of Independent States, including certain associate and former member States.Sources: WTO and UNCTAD.

Exports

• All regions recorded year-on-year declines in merchandisetrade volumes in the second quarter of 2020 exceptthe Commonwealth of Independent States (includingcertain former and associate members), which saw a2.8 per cent rise in its exports. North American exportsdeclined the most (-25.5 per cent), followed by Africa(-21.7 per cent), Europe (-20.4 per cent) and the MiddleEast (-19.7 per cent). Smaller declines were seen inSouth and Central America (-9.0 per cent) and Asia(-7.1 per cent).

• All regions have seen merchandise exports and importsrecover to varying degrees since trade bottomed out inthe second quarter of 2020. In the first quarter of 2021,merchandise export volumes were up in Asia (21.0 per centyear-on-year) and Europe (1.9 per cent). They were downslightly in South and Central America (-0.1 per cent) andNorth America (-2.2 per cent). They were also down moresubstantially in Africa (-4.6 per cent), the Middle East(-8.4 per cent) and the Commonwealth of IndependentStates (-13.9 per cent).

World Trade Statistical Review 2021

24

Africa Middle East AsiaCIS2EuropeSouth America1North America

2018

Q3

2019

Q4

2019

Q4

2019

Q4

2019

Q4

2020

Q1

2021

Q1

2020

Q2

2020

Q3

2020

Q4

2019

Q3

2019

Q2

2019

Q1

2018

Q4

2018

Q2

2018

Q1

2017

Q4

2017

Q3

2017

Q2

2017

Q1

2016

Q4

2016

Q3

2016

Q2

2016

Q1

2015

Q4

2015

Q3

2015

Q2

2015

Q1

2018

Q3

2019

Q4

2019

Q4

2019

Q4

2019

Q4

2020

Q1

2021

Q1

2020

Q2

2020

Q3

2020

Q4

2019

Q3

2019

Q2

2019

Q1

2018

Q4

2018

Q2

2018

Q1

2017

Q4

2017

Q3

2017

Q2

2017

Q1

2016

Q4

2016

Q3

2016

Q2

2016

Q1

2015

Q4

2015

Q3

2015

Q2

2015

Q1

Volu

me

indi

ces

2015

Q1

=10

0Vo

lum

e in

dice

s 20

15Q

1=

100

70

80

90

100

110

120

130

140

Africa Middle East AsiaCIS2EuropeSouth America1North America

70

80

90

100

110

120

130

140

Chart 3.4 Merchandise imports by region, 2015Q1-2021Q1 (Volume indices 2015Q1=100)

1 Refers to South and Central America and the Caribbean.2 Refers to Commonwealth of Independent States, including certain associate and former member States.Sources: WTO and UNCTAD.

Imports

• All regions had large year-on-year import contractions for merchandise trade volumes in the second quarter of 2020, including the Middle East (-20.1 per cent), Europe (-19.0 per cent), South and Central America (-18.6 per cent), North America (17.8 per cent), Africa (-16.0 per cent), the Commonwealth of Independent States (-11.1 per cent), and Asia (-7.0 per cent).

• Merchandise import volumes were up year-on-year in all regions in the first quarter of 2021 except in Africa (-0.9 per cent) and the Middle East (-2.7 per cent). Overall, it appears that the trade recovery has been strongest in Asia and weakest in regions that rely on exports of natural resources.

Chapter III: World trade and economic growth, 2020-21

25

20

40

60

80

100

120

140

160

FuelsMetalsAgricultural raw materialsFood

2021

M0

4

2020

M01

2020

M0

4

2020

M07

2020

M10

2021

M01

2019

M10

2019

M07

2019

M0

4

2019

M01

2018

M10

2018

M07

2018

M0

4

2018

M01

2017

M10

2017

M07

2017

M0

4

2017

M01

2016

M10

2016

M07

2016

M0

4

2016

M01

2015

M10

2015

M07

2015

M0

4

2015

M01

2014

M10

2014

M07

2014

M0

4

2014

M01

US

$ p

rice

indi

ces,

Jan

uary

201

4=

100

Prices of energy commodities fell sharply during the first wave of the pandemic but have risen steadily since then.

Chart 3.5 Prices of primary commodities, January 2014 - May 2021 (US$ price indices, January 2014=100)

Source: IMF primary commodity prices.

• Fuel prices fell by 60.1 per cent between January and April 2020 as the pandemic resulted in a decline in domestic and international travel. Smaller declines over the same period were recorded for other commodities, such as food (-10 per cent), agricultural raw materials (-8 per cent) and metals (1 per cent).

• Fuel prices rose steadily after April 2020 as economic growth picked up and travel restrictions were eased in

the summer. Successive waves of COVID-19 do not appear to have had as strong an impact on fuel prices. Other commodity prices have also risen since April 2020, raising concerns about a build-up in inflationary pressures.

• In May 2021, fuel prices were up 194 per cent year-on-year. Prices were also up 54 per cent for metals, 45 per cent for food and 26 per cent for agricultural raw materials.

Commodity prices

World Trade Statistical Review 2021

26

United States

04

-202

1

01-2

020

04

-202

0

07-2

020

10-2

020

01-2

021

10-2

019

07-2

019

04

-201

9

01-2

019

10-2

018

07-2

018

04

-201

8

01-2

018

10-2

017

07-2

017

04

-201

7

01-2

017

10-2

016

07-2

016

04

-201

6

01-2

016

10-2

015

07-2

015

04

-201

5

01-2

015

10-2

014

07-2

014

04

-201

4

01-2

014

Japan China Euro area United Kingdom

80

90

100

110

120

130

140

Inde

x, J

anua

ry 2

014

=10

0

Exchange rates

The US dollar appreciated sharply early in the pandemic but has fallen in value against other currencies since its peak in April 2020.

Chart 3.6 Exchange rate indices for selected economies, January 2014 – May 2021 a (Index, January 2014=100)

a) Nominal effective exchange rate indices against a broad basket of currencies.Source: Bank for International Settlements (BIS).

• The US dollar appreciated 7 per cent on average against currencies of trading partners between January and April 2020, reflecting the traditional safe-haven status of the currency.

• The appreciation of the dollar probably contributed to the fall in fuel prices denominated in dollars over the same period since these variables tend to move in opposite directions. However, the appreciation would only account for a small fraction of the 60 per cent drop in fuel prices over the same period.

• The dollar fell in value by 9 per cent between April and December 2020 as global economic growth picked up and expansionary monetary and fiscal policy put downward pressure on the currency. The nominal effective exchange rate of the US dollar was relatively stable between January and May 2021.

• Exchange rates of other major currencies fluctuated less than the dollar exchange rate during the pandemic.

Chapter III: World trade and economic growth, 2020-21

27

-50

-40

-30

-20

-10

0

10

20

ManufacturesFuels and mining productsAgricultural productsTotal merchandise

-5

-21

-6

2

14

0

-5

2

6

119

-6

-18

-3

6

16

-7

-43

-26

-19

2020Q1 2020Q2 2020Q3 2020Q4 2021Q1

Year

-on-

year

% c

hang

e in

US

$ v

alue

s

The sharp decline and subsequent recovery of merchandise trade in 2020 was mostly due to trade in manufactured goods.

Merchandise and services trade values

Chart 3.7 Growth in world merchandise trade by sector, 2020Q1-2021Q1 (Year-on-year percentage change in US$ values)

Sources: WTO estimates and UNCTAD.

• The US dollar value of world trade in manufactured goods was down 18 per cent year-on-year in the second quarter of 2020 but by the first quarter of 2021 trade had risen by 16 per cent above its level from the same period the previous year.

• The growth rates are similar to those for total merchandise trade since manufactured goods account for the vast majority of this trade (73 per cent in 2020).

• Trade in agricultural products declined less than trade in manufactured goods during the second quarter of 2020 (-5 per cent) and by the first quarter of 2021 it was

up substantially (+11 per cent). The lower decline for agricultural products trade in the second quarter is mostly due to the ongoing need for vital food supplies.

• The sharp 43 per cent decline in fuels and mining products trade in the second quarter of 2020 and the partial recovery since then reflect both falling prices and the availability of reduced quantities.

• Most types of manufactured goods saw significant gains in the second half of 2020, notably textiles, pharmaceuticals, computers and telecommunications equipment.

World Trade Statistical Review 2021

28

-40

-30

-20

-10

0

10

20

30

Other regions2AsiaEuropeSouth America1North AmericaWorld

-7

-21

-4

3

16

-2

-32

-11

-3

-7

-19

-9

-3

13

-5

-23

-3

5

13

-7

-10

2

9

28

-16

-39

-21

-16

8

4

2020Q1 2020Q2 2020Q3 2020Q4 2021Q1

Year

-on-

year

% c

hang

e in

US

$ v

alue

s

Export revenues fell most in oil-exporting regions during the pandemic but by the start of 2021 all regions were recording year-on-year growth.

Chart 3.8 Growth of merchandise trade by region, 2020Q1 - 2021Q1 (Year-on-year percentage change in US$ values)

1 Refers to South and Central America and the Caribbean.2 “Other regions” comprise Africa, Middle East and the Commonwealth of Independent States, including certain associate and former member states.Sources: WTO and UNCTAD.

• Merchandise exports of Asia in current US dollar terms declined by 10 per cent year-on-year in the second quarter of 2020 but by the first quarter of 2021 they were up 28 per cent. In contrast, Europe recorded a larger decline in the second quarter of 2020 (23 per cent) and a smaller increase in the first quarter of 2021 (13 per cent).

• North America’s merchandise exports were down heavily in the second quarter of 2020 (32 per cent) and were only up slightly (+4 per cent) in the first quarter of 2021. In South

and Central America, exports were down 19 per cent in the second quarter of 2020 but up strongly (+13 per cent) in the first quarter of 2021.

• Merchandise exports of other regions, including Africa, the Middle East and the Commonwealth of Independent States, were collectively down 39 per cent in the second quarter of 2020, reflecting a persistent reduction in fuel consumption and a fall in prices during the pandemic but by the first quarter of 2021 exports were up 8 per cent.

Chapter III: World trade and economic growth, 2020-21

29

-90

-80

-70

-60

-50

-40

-30

-20

-10

0

10

Goods-related servicesOther commercial servicesTravelTransportCommercial services

-6

-30

-25

-17

-9

-6

0

-29

-23 -23

-81

-68 -68

-62

1

-6

-2

2

6

-6

-14

-20

-9

-3

-14

Year

on

year

% c

hang

e

2020Q1 2020Q2 2020Q3 2020Q4 2021Q1

Services trade recovered only partially in the second half of 2020, weighed down by COVID-19-related travel restrictions.

Chart 3.9 Growth in the value of world commercial services trade by category, 2020Q1-2021Q1 (Year-on-year percentage change)

Sources: WTO-UNCTAD-ITC estimates.Note: Trade as average of exports and imports

• Services trade remained depressed in the first quarter of 2021 although the category of “other commercial services” - including financial services, business services and charges for the use of intellectual property - increased by 6 per cent.

• The biggest source of the decline was travel, which fell by 81 per cent in the second quarter. It was still down 62 per cent in Q1 2021, weighed down by pandemic related restrictions for cross-border movement of people.

• Transport also experienced a severe decline (-29 per cent in Q2 2020) due mostly to the reduction in international

passenger flights, which were curtailed early in the pandemic. However, maritime transport held up relatively well, with a year-on-year decline in container throughput of around 7 per cent in Q2 of 2020. The sector recovered its year-on-year level in Q1 2021.

• Other commercial services, which includes financial and other business services, avoided large declines during the pandemic (down just 6 per cent in Q2 of 2020) due to the widespread adoption of technologies allowing remote work. These services sectors were the only ones having year-on-year positive growth since Q4 2020.

World Trade Statistical Review 2021

30

Jan

2020

Jul 2

021

Jan

2021

Jul 2

020

Jul 2

019

Jan

2019

Jul 2

018

Jan

2018

Jul 2

017

Jan

2017

Jul 2

016

Jan

2016

Jul 2

015

Jan

2015

Jul 2

014

Jan

2014

Jul 2

013

Jan

2013

Jul 2

012

Jan

2012

Jul 2

011

Jan

2011

Jul 2

010

Jan

2010

Jul 2

00

9

Jan

200

9

Jul 2

00

8

Jan

200

8

Inde

x, b

ase

=50

20

30

40

50

60

ServicesManufacturing

Leading indicators of trade

Leading indicators of trade provide clues about the strength of the global economy in the aftermath of the COVID-19 pandemic. These data continue to point to a strong but uneven recovery.

Chart 3.10 Global PMI new export orders indices, January 2010 - May 2021 (Index, base=50)

Source: IHS Markit.Note: Values greater than 50 indicate expansion while values less than 50 denote contraction. No available data for services before September 2014.

• Purchasing managers’ indices (PMIs) showed new export orders of manufacturers and services providers falling sharply early in the pandemic but rebounding strongly afterwards.

• New export orders of services fell to 21.8 in April 2020 while new export orders of manufacturing bottomed out at 27.1.

• Services export orders surpassed the baseline value of 50 for the index in April 2021 compared with September 2020

for manufacturing export orders, reflecting the weaker state of global services trade.

• As of May 2021, the manufacturing index continued to indicate a strong recovery in goods trade, with a value of 54.9. The services index suggested weaker growth in services trade, with a value of 51.0.

Chapter III: World trade and economic growth, 2020-21

31

TrendSeasonally adjusted index

Jan-

20

Jul-2

1

Jan-

21

Jul-2

0

Jul-1

9

Jan-

19

Jul-1

8

Jan-

18

Jul-1

7

Jan-

17

Jul-1

6

Jan-

16

Jul-1

5

Jan-

15

Jul-1

4

Jan-

14

Jul-1

3

Jan-

13

Jul-1

2

Jan-

12

Jul-1

1

Jan-

11

Jul-1

0

Jan-

10

Jul-0

9

Jan-

09

Jul-0

8

Jan-

08

Jul-0

7

Jan-

07

Sea

sona

lly a

djus

ted

inde

x, 2

015

=10

0

60

70

80

90

100

110

120

130

Container shipping fell in 2020 as the pandemic disrupted the global economy but throughput quickly returned to and surpassed pre-pandemic levels.

Chart 3.11 Global container throughput, January 2007 - April 2021 (seasonally-adjusted index, 2015=100)

Source: Institute for Shipping Economics and Logistics.

• Container throughput of major ports dropped by 7 per cent between January and May 2020 as the pandemic hit international trade flows, according to the Institute for Shipping Economics and Logistics. However, by July the index had already risen above its level at the start of the year.

• For the whole of 2020, throughput was only down 1.3 per cent, reflecting the relative strength of goods trade and

continued shipments of goods from Asia to the rest of the world.

• Throughput continued to increase in the first months of 2021. Average monthly growth between January and April was 0.7 per cent, which is equivalent to an annualized rate of 8.8 per cent.

World Trade Statistical Review 2021

32

Number of flights7-day moving average

19-M

ay-2

1

04

-Nov

-20

18-N

ov-2

0

02-D

ec-2

0

16-D

ec-2

0

30

-Dec

-20

13-J

an-2

1

27-J

an-2

1

10-F

en-2

1

24-F

en-2

1

10-M

ar-2

1

24-M

ar-2

1

07-A

pr-2

1

21-A

pr-2

1

05

-May

-21

21-O

ct-2

0

07-O

ct-2

0

23-S

ep-2

0

09

-Sep

-20

26-A

ug-2

0

12-A

ug-2

0

29-J

ul-2

0

15-J

ul-2

0

01-J

ul-2

0

17-J

un-2

0

03

-Jun

-20

20-M

ay-2

0

06

-May

-20

22-A

pr-2

0

08

-Apr

-20

25-M

ar-2

0

11-M

ar-2

0

26-F

eb-2

0

12-F

eb-2

0

29-J

an-2

0

15-J

an-2

0

01-J

an-2

0

Num

ber o

f flig

hts

0

10,000

20,000

30,000

40,000

50,000

60,000

International commercial flights slumped in 2020 as travel restrictions were imposed to slow the spread of COVID-19. In August 2020 the number of flights returned to just over half their level before the pandemic, but more widespread vaccination is required to increase passenger numbers and to achieve full recovery.

Chart 3.12 International commercial flights per day, 1 January 2020 - 30 May 2021 (Number of flights)

Source: Martin Strohmeier, et.al, “Crowdsourced air traffic data from the OpenSky Network 2019–2020”, Earth System Science Data 13(2), 2021.

• International commercial flights per day fell to less than 10,000 in mid-April 2020, a decline of around 80 per cent from the start of the year. Many flights were devoted to cargo only as passenger flights were suspended.

• From mid-April 2020 until the end of the year, flights per day averaged 27,000, around 55 per cent of the level in January 2020.

• As of 30 May 2021, the number of daily flights remained below 30,000. Increased international travel will depend to a large extent on the success of vaccination programmes.

Chapter III: World trade and economic growth, 2020-21

33

Since the second half of 2020, WTO economists have predicted a strong rebound in world trade, with outcomes heavily dependent on GDP growth and the evolution of the pandemic. Growth in 2021 could exceed expectations if universal access to vaccines is achieved or fall short if vaccination efforts falter.

Economic recovery from COVID-19

Chart 3.13 Real GDP growth of selected economies, 2020Q1 – 2021Q1 (Quarter-on-quarter percentage change)

Source: OECD National Accounts.

• GDP growth slowed in major economies in the first quarter of 2021 and is likely to remain slow in the second and third quarters as new waves of infection prompted new lockdowns and travel restrictions.

• GDP growth in the United States rose to 1.6 per cent in the first quarter of 2021 compared with the previous quarter. This is equivalent to around 6.5 per cent on an annualized basis. Meanwhile, EU GDP contracted by 0.1 per cent in the first quarter as the virus resurged in the region.

• China’s economy grew by 0.6 per cent in the first quarter of 2021. This is equivalent to 2.4 per cent on an annualized basis. Excluding the sharp contraction in the first quarter of 2020 that coincided with the emergence of COVID-19, this is the weakest quarterly result for China since the country started reporting quarter-on-quarter GDP growth in 2011.

-30

-25

-20

-15

-10

-5

0

5

10

15

20

25

South Africa

ChinaIndiaRussian Federation

BrazilJapanEuropean Union

United States

2021Q12020Q42020Q32020Q22020Q1

-1.3

-9.0

7.5

1.1 1.6

-3.4

-11.1

11.7

-0.4

-0.1

-0.5

-8.1

5.3

2.8

-1.0-2.2

-9.2

7.8

3.2

1.2

0.6

-2.6

0.6

-0.2

0.8

-25.9

23.1

9.3

2.1

-9.7

11.6

3.0 2.6

0.6

-0.4

-16.6

13.7

1.4 1.1

Qua

rter

-on-

quar

ter %

cha

nge

World Trade Statistical Review 2021

34

-30

-25

-20

-15

-10

-5

0

5

10

15

20

25

30

35

40

Iran

Mau

ritiu

sN

amib

iaIs

rael

Kaz

akhs

tan

Rus

sian

Fed

erat

ion

Col

ombi

aM

oroc

coIc

elan

dU

nite

d K

ingd

omS

ri La

nka

Uni

ted

Sta

tes

Mex

ico

New

Zea

land

Uru

guay

Phi

lippi

nes

Tuni

sia

Japa

nB

eliz

eN

orw

ayTh

aila

ndIn

dia

Can

ada

Bel

arus

Ecu

ador

Kor

ea, R

ep. o

fE

urop

ean

Uni

onA

rgen

tina

El S

alva

dor

Ken

yaU

krai

neS

inga

pore

Turk

eyC

hile

Mon

tene

gro

Bra

zil

Bos

nia

and

Her

zego

vina

Nor

th M

aced

onia

Per

uB

oliv

ia, P

lurin

atio

nal s

tate

of

Alb

ania

Hon

g K

ong,

Chi

naG

uate

mal

aP

arag

uay

Egy

ptA

ustr

alia

Mal

aysi

aS

witz

erla

ndE

thio

pia

Indo

nesi

aC

ote

d'Iv

oire

Cos

ta R

ica

Chi

naC

hine

se T

aipe

iV

iet N

amG

hana

Zam

bia

3833 32 31 31 29

2624 23 23

21 21 19 19 19 18 18 18 18 17 17 16 16 15 15 1412 12 11 10 10 9 9 9 8 8

6 6 6 6 5 4 43 3

1-3 -3

-6 -6 -8 -8-1

0-1

5-1

7-2

2-2

6

% c

hang

e co

mpa

red

to J

anua

ry-A

pril

2019

Despite the strong recovery in merchandise trade in value terms in the first quarter of 2021, exports of many economies remained below their pre-pandemic peaks.

Chart 3.14 Cumulative merchandise exports of selected economies, January-April 2021 (Percentage change compared to January-April 2019)

Sources: WTO and UNCTAD.Note: Colombia, Egypt, Tunisia and Ukraine refer to January - March 2021

• Merchandise exports of the United States increased by only 1 per cent between January and April 2021 compared with the same period in 2019 while those of the European Union rose by 10 per cent.

• Russia’s merchandise exports remained below their level of two years ago (-8 per cent) while those of China were up sharply (+31 per cent).

• Some African countries, such as Zambia (+38 per cent), benefitted from improved terms of trade in January-April 2021 as metals prices rose nearly 50 per cent whereas others, such as Namibia (-17 per cent), did not.

Chapter III: World trade and economic growth, 2020-21

35

% change in volume

-20 -15 -10 -5 0 5 10 15 20

Asia

World

Europe

North America

South America1

Africa

CIS2

Middle East

EXPORTS

15.4

1.7

-2.4

-3.3

-7.7

-11.2

-14.2

-19.9

% change in volume

IMPORTS

-20 -15 -10 -5 0 5 10 15 20

Asia

CIS2

South America1

North America

World

Africa

Europe

Middle East

10

10

4.8

2.6

1.7

-3.5

-5.1

-8.2

Regional growth in merchandise trade volume has varied much more than it did before the pandemic, with Asia exceeding growth in other regions for both exports and imports.

Chart 3.15 Change in merchandise trade volume by region, 2021Q1 (Percentage change compared to 2019Q1)

• Asian merchandise export volumes were up 15 per cent in the first quarter of 2021 compared to the same period in 2019 while exports of all other regions were down compared to two years ago.

• Merchandise exports of oil-producing regions were down the most in 2021 due to reduced demand for fuels as a result of COVID-19-related travel restrictions.

• Asia also led other regions in merchandise imports, which were up 10 per cent for the year-to-date in 2021 compared to 2019.

• The weakness of Europe’s year-on-year growth in merchandise imports was partly due to the resurgence of COVID-19 in the first quarter of 2021.

Exports Imports

1 Refers to South and Central America and the Caribbean.2 Refers to the Commonwealth of Independent States, including certain former and associate member states.Source: WTO.

World Trade Statistical Review 2021

36

-30

-20

-10

0

10

20

30

9%

-16%

-10%

2% 3%5%

7%

19%

World Middle East CIS1 North America Africa South America2 Europe Asia

% c

hang

e in

US

dol

lar v

alue

s

-30

-20

-10

0

10

20

30

8%

-2%

2%

5% 5% 6%

12%14%

-10%

World Middle East CIS1 North America Africa South America2 Europe Asia

% c

hang

e in

US

dol

lar v

alue

s

Regional disparities in nominal dollar-denominated merchandise growth in 2021 were similar to those in volume terms.

Chart 3.16 Change in merchandise trade values by region, 2021Q1 (Percentage change in US dollar values compared to 2019Q1)

1 Refers to South and Central America and the Caribbean.2 Refers to Commonwealth of Independent States, including certain former and associate member States.Sources: WTO-UNCTAD.

• The US dollar value of world merchandise trade was up 9 per cent for exports and 8 per cent for imports in the first quarter of 2021 compared to the first quarter of 2019.

• Asia’s merchandise export and import values grew more than for all other regions over the last two years.

• Africa’s merchandise export growth in value terms was stronger than in volume terms because of improved terms of trade. Metals prices were up nearly 50 per cent in the first quarter of 2021 compared to the first quarter of 2019.

Exports

Imports

Chapter III: World trade and economic growth, 2020-21

37

-40

-30

-20

-10

0

10

20

30

40

Aus

tral

ia

Por

tuga

l

Hun

gary

Uga

nda

Mor

occo

Italy

Turk

ey

Tanz

ania

Phi

lippi

nes

Japa

n

Uni

ted

Sta

tes

Rus

sian

Fed

erat

ion

Finl

and

Latv

ia

Slo

vak

Rep

ublic

Bul

garia

Gre

ece

Uni

ted

Kin

gdom

Slo

veni

a

Cze

ch R

epub

lic

Bra

zil

Can

ada

Fran

ce

Ger

man

y

Den

mar

k

Mon

golia

Sw

eden

Ukr

aine

Rom

ania

Mal

ta

Indi

a

Kor

ea, R

epub

lic o

f

Bel

gium

Pak

ista

n

Est

onia

Pol

and

Net

herla

nds

Luxe

mbo

urg

Lith

uani

a

Ser

bia

Chi

na25

18

15

12

10 9 8 6 6

4

3 2 2

0

-1 -2 -3

-5

-7 -8 -8 -9 -9 -9 -11

-14

-14

-15

-16

-16

-19

-22

-22

-23

-24

-25

-27

-29

-32

-35

-36

% c

hang

e co

mpa

red

to J

anua

ry-A

pril

2019

Services exports remained depressed in many economies in the first four months of 2021. China was the major exception, with exports up strongly compared to the previous year.

Chart 3.17 Cumulative commercial services exports of selected economies, January-April 2021 (Percentage change compared to January-April 2019)

• China’s cumulative exports of commercial services between January and April 2021 were up 25 per cent compared with the same period in 2019, more than any other major economy.

• India’s exports were also up 3 per cent over the same period, while those of Germany, France and the United Kingdom were down 5 per cent, 7 per cent, and 9 per cent, respectively.

• Other major economies suffered double-digit declines, including the United States (-19 per cent), Italy (-25 per cent) and Australia (-36 per cent).

Source: WTO estimates.Note: Mongolia, Philippines, Portugal and Tanzania refer to January-March.

World Trade Statistical Review 2021

38

-40

-30

-20

-10

0

10

-19%

-37%

-35%

-27%

-23%-21% -20%

-15%

World Middle EastCIS2 North AmericaAfrica South America1 EuropeAsia

% c

hang

e

-40

-30

-20

-10

0

10

-18%

-33%-31%

-24%-22% -22%

-19%

-13%

World Middle EastCIS2 North America AfricaSouth America1 EuropeAsia

% c

hang

e

Europe’s exports and imports of commercial services were down less than other regions in the first quarter of 2021 but growth for all regions remained deeply depressed compared to the pre-pandemic period.

Chart 3.18 Change in commercial services trade values by region, 2021Q1 (Percentage change in US dollar values compared to 2019Q1)

• World commercial services trade was down 19 per cent for exports and 18 per cent for imports in the first quarter of 2021 compared to the same period in 2019.

• Europe’s exports and imports of commercial services were down less than the world average in the first quarter of 2021, 15 per cent and 13 per cent respectively, while all other regions were down by more than the world average.

• Africa and South America and Central America, including the Caribbean, recorded the biggest declines in exports of commercial services due to continuing COVID-19 restrictions hampering travel exports.

Exports

Imports

1 Refers to South and Central America and the Caribbean.2 Refers to Commonwealth of Independent States, including certain former and associate member States.Sources: WTO-UNCTAD-ITC estimates.

Chapter III: World trade and economic growth, 2020-21

39