Chapter 44 | HTS

Transcript of Chapter 44 | HTS

SECTION IX

WOOD AND ARTICLES OF WOOD; WOOD CHARCOAL; CORK AND ARTICLES OF CORK; MANUFACTURES OFSTRAW, OF ESPARTO OR OF OTHER PLAITING MATERIALS; BASKETWARE AND WICKERWORK

IX-1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX-2

CHAPTER 44

WOOD AND ARTICLES OF WOOD; WOOD CHARCOALIX

44-1Notes

1. This chapter does not cover:

(a) Wood, in chips, in shavings, crushed, ground or powdered, of a kind used primarily in perfumery, in pharmacy, or forinsecticidal, fungicidal or similar purposes (heading 1211);

(b) Bamboo or other materials of a woody nature of a kind used primarily for plaiting, in the rough, whether or not split, sawnlengthwise or cut to length (heading 1401);

(c) Wood, in chips, in shavings, ground or powdered, of a kind used primarily in dyeing or in tanning (heading 1404);

(d) Activated charcoal (heading 3802);

(e) Articles of heading 4202;

(f) Goods of chapter 46;

(g) Footwear or parts thereof of chapter 64;

(h) Goods of chapter 66 (for example, umbrellas and walking-sticks and parts thereof);

(ij) Goods of heading 6808;

(k) Imitation jewelry of heading 7117;

(l) Goods of section XVI or section XVII (for example, machine parts, cases, covers, cabinets for machines and apparatus andwheelwrights' wares);

(m) Goods of section XVIII (for example, clock cases and musical instruments and parts thereof);

(n) Parts of firearms (heading 9305);

(o) Articles of chapter 94 (for example, furniture, lamps and lighting fittings, prefabricated buildings);

(p) Articles of chapter 95 (for example, toys, games, sports equipment);

(q) Articles of chapter 96 (for example, smoking pipes and parts thereof, buttons, pencils, and monopods, bipods, tripods andsimilar articles) excluding bodies and handles, of wood, for articles of heading 9603; or

(r) Articles of chapter 97 (for example, works of art).

2. In this chapter, the expression "densified wood" means wood which has been subjected to chemical or physical treatment (being,in the case of layers bonded together, treatment in excess of that needed to insure a good bond), and which has thereby acquiredincreased density or hardness together with improved mechanical strength or resistance to chemical or electrical agencies.

3. Headings 4414 to 4421 apply to articles of the respective descriptions of particle board or similar board, fiberboard, laminatedwood or densified wood as they apply to such articles of wood.

4. Products of heading 4410, 4411 or 4412 may be worked to form the shapes provided for in respect of the articles of heading4409, curved, corrugated, perforated, cut or formed to shapes other than square or rectangular or submitted to any other operationprovided it does not give them the character of articles of other headings.

5. Heading 4417 does not apply to tools in which the blade, working edge, working surface or other working part is formed by anyof the materials specified in note 1 to chapter 82.

6. Subject to note 1 above and except where the context otherwise requires, any reference to "wood" in a heading of this chapterapplies also to bamboo and other materials of a woody nature.

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

Subheading Note

1. For the purposes of subheading 4401.31, the expression "wood pellets" means by-products such as cutter shavings, sawdustor chips, of the mechanical wood processing industry, furniture-making industry or other wood transformation activities, whichhave been agglomerated either directly by compression or by the addition of a binder in a proportion not exceeding 3 percentby weight. Such pellets are cylindrical, with a diameter not exceeding 25 mm and a length not exceeding 100 mm.

Additional U.S. Notes

1. In this chapter:

(a) The term "wood waste" means residual material other than firewood resulting from the processing of wood, including scraps,shavings, sawdust, veneer clippings, chipper rejects and similar small wood residues, as well as larger or coarser solid typesof residual wood such as slabs, edgings, cull pieces and veneer log cores;

(b) The term "standard wood moldings" means wood moldings worked to a pattern and having the same profile in cross sectionthroughout their length; and

(c) The term "surface covered," as applied to the articles of headings 4411 and 4412, means that one or more exterior surfacesof a product have been treated with creosote or other wood preservatives, or with fillers, sealers, waxes, oils, stains, varnishes,paints or enamels, or have been overlaid with paper, fabric, plastics, base metal, or other material.

2. The effectiveness of the proviso to section 304(a)(3)(J) of the Tariff Act of 1930 (19 U.S.C. 1304(a)(3)(J)), to the extent permittedby that section and as provided for in schedule XX to the General Agreement on Tariffs and Trade, is suspended, with the resultthat sawed lumber and sawed timbers however provided for, telephone, trolley, electric light and telegraph poles of wood andbundles of shingles, other than red cedar shingles, shall not be required to be marked to indicate the country of origin.

3. Subheadings 4407.19.05 and 4407.19.06 cover combinations of the named species whose proportions are not readily identifiable.

4. Heading 4409 includes articles having a repeating design worked along any edge or face.

5. Heading 4418 includes--

(a) drilled or notched lumber studs; and

(b) multi-layer assembled flooring panels having a face ply 4 mm or more in thickness.

Statistical Note

1. For the purposes of heading 4407, the term "rough" includes wood that has been edged, resawn, crosscut or trimmed to smallersizes but it does not include wood that has been dressed or surfaced by planing on one or more edges or faces or has beenedge-glued or end-glued.

Compiler's Note

The provisions of subchapter II of chapter 99 (Miscellaneous Tariff Bills or MTBs), the provisions of the Generalized System ofPreferences (GSP) found in General Note 4 and most product exclusions from the additional tariffs on products of China in subchapterIII of chapter 99 expired on December 31, 2020. However, no endnotes or footnotes relating to these provisions have been deletedas of the issue date of this edition.

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-2

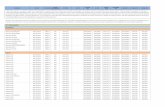

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Fuel wood, in logs, in billets, in twigs, in faggots or in similarforms; wood in chips or particles; sawdust and wood wasteand scrap, whether or not agglomerated in logs, briquettes,pellets or similar forms:

4401

Fuel wood, in logs, in billets, in twigs, in faggots or in similarforms:

Coniferous........................................................................004401.11.00 20%Free1/kg..............

Nonconiferous..................................................................004401.12.00 20%Free1/kg..............Wood in chips or particles:

Coniferous........................................................................004401.21.00 FreeFree1/t dwb.........

Nonconiferous..................................................................004401.22.00 FreeFree1/t dwb.........Sawdust andwoodwaste and scrap, agglomerated in logs,briquettes, pellets or similar forms:

Wood pellets....................................................................004401.31.00 FreeFree1/kg..............

Other:4401.39Artificial fire logs composed of wax and sawdust,with or without added materials .............................

004401.39.2020%Free1/kg..............

Other..........................................................................4401.39.41 FreeFree1/..................Sawdust..............................................................10 kgShavings.............................................................20 kgOther...................................................................90 kg

Sawdust and wood waste and scrap, not agglomerated...4401.40.00 FreeFree1/..................Sawdust............................................................................10 kgShavings...........................................................................20 kgOther.................................................................................90 kg

Wood charcoal (including shell or nut charcoal), whether ornot agglomerated:

4402

Of bamboo2/............................................................................004402.10.00 FreeFree1/t .................

Other........................................................................................004402.90.00 FreeFree1/t .................

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-3

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Wood in the rough, whether or not stripped of bark or sap-wood, or roughly squared:

4403

Treated with paint, stain, creosote or other preservatives:Coniferous........................................................................4403.11.00 FreeFree1/..................

Poles, piles and posts:Telephone, telegraph and electrical powerpoles....................................................................

20m

Fence posts........................................................40 mOther...................................................................50 m

Other..........................................................................60 m3

Nonconiferous..................................................................4403.12.00 FreeFree1/..................Poles, piles and posts:

Telephone, telegraph and electrical powerpoles....................................................................

20m

Fence posts........................................................40 mOther...................................................................50 m

Other..........................................................................60 m3

Other, coniferous:Of pine (Pinus spp.), of which any cross-sectionaldimension is 15 cm or more...........................................

4403.21.00FreeFree1/..................

Poles, piles and posts:Telephone, telegraph and electrical powerpoles....................................................................

12m

Fence posts........................................................15 mOther...................................................................16 m

Logs and timber:Southern yellow pine (Loblolly pine (Pinustaeda)), long leaf pine (Pinus palustris), pitchpine (Pinus rigida), short leaf pine (Pinusechinata), slash pine (Pinus elliottii) andVirginia pine (Pinus virginiana)........................

20

m3

Ponderosa pine (Pinus ponderosa).................25 m3

Other...................................................................30 m3

Other..........................................................................65 m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-4

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Wood in the rough, whether or not stripped of bark or sap-wood, or roughly squared: (con.)

4403 (con.)

Other, coniferous: (con.)Of pine (Pinus spp.), other.............................................4403.22.00 FreeFree1/..................

Pulpwood...................................................................08 m3

Poles, piles and posts:Telephone, telegraph and electrical powerpoles....................................................................

12m

Fence posts........................................................15 mOther...................................................................16 m

Logs and timber:Southern yellow pine (Loblolly pine (Pinustaeda)), long leaf pine (Pinus palustris), pitchpine (Pinus rigida), short leaf pine (Pinusechinata), slash pine (Pinus elliottii) andVirginia pine (Pinus virginiana)........................

20

m3

Ponderosa pine (Pinus ponderosa).................25 m3

Other...................................................................30 m3

Other..........................................................................65 m3

Of fir (Abies spp.) and spruce (Picea spp.), of whichany cross-sectional dimension is 15 cm or more.........

4403.23.00FreeFree1/..................

Poles, piles and posts:Telephone, telegraph and electrical powerpoles....................................................................

12m

Fence posts........................................................15 mOther...................................................................16 m

Logs and timber:Spruce (Picea spp.)...........................................35 m3

Other fir; balsam................................................42 m3

Other..........................................................................65 m3

Of fir (Abies spp.) and spruce (Picea spp.), other.......4403.24.00 FreeFree1/..................Pulpwood...................................................................04 m3

Poles, piles and posts:Telephone, telegraph and electrical powerpoles....................................................................

12m

Fence posts........................................................15 mOther...................................................................16 m

Logs and timber:Spruce (Picea spp.)...........................................35 m3

Other fir; balsam................................................42 m3

Other..........................................................................65 m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-5

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Wood in the rough, whether or not stripped of bark or sap-wood, or roughly squared: (con.)

4403 (con.)

Other, coniferous: (con.)Other, of which any cross-sectional dimension is 15cm or more.......................................................................

4403.25.00FreeFree1/..................

Poles, piles and posts:Telephone, telegraph and electrical powerpoles....................................................................

12m

Fence posts........................................................15 mOther...................................................................16 m

Logs and timber:Douglas-fir (Pseudotsuga menziesii)...............40 m3

Western hemlock (Tsuga heterophylla)..........50 m3

Other hemlock....................................................52 m3

Western red cedar (Thuja plicata)...................55 m3

Other cedar........................................................57 m3

Other...................................................................64 m3

Other..........................................................................65 m3

Other.................................................................................4403.26.00 FreeFree1/..................Pulpwood...................................................................08 m3

Poles, piles and posts:Telephone, telegraph and electrical powerpoles....................................................................

12m

Fence posts........................................................15 mOther...................................................................16 m

Logs and timber:Douglas-fir (Pseudotsuga menziesii)...............40 m3

Western hemlock (Tsuga heterophylla)..........50 m3

Other hemlock....................................................52 m3

Western red cedar (Thuja plicata)...................55 m3

Other cedar........................................................57 m3

Other...................................................................64 m3

Other..........................................................................65 m3

Other, of tropical wood:Dark Red Meranti, Light Red Meranti and MerantiBakau................................................................................

004403.41.00FreeFree1/m3..............

Other.................................................................................004403.49.01 FreeFree1/m3..............

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-6

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Wood in the rough, whether or not stripped of bark or sap-wood, or roughly squared: (con.)

4403 (con.)

Other:Of oak (Quercus spp.)....................................................4403.91.00 FreeFree1/..................

Of red oak..................................................................20 m3

Other..........................................................................40 m3

Of beech (Fagus spp.), of which any cross-sectionaldimension is 15 cm or more...........................................

004403.93.00FreeFree1/m3..............

Of beech (Fagus spp.), other.........................................004403.94.00 FreeFree1/m3..............Of birch (Betula spp.), of which any cross-sectionaldimension is 15 cm or more...........................................

4403.95.00FreeFree1/..................

Poles, piles and posts..............................................27 m3

Other..........................................................................30 m3

Of birch (Betula spp.), other...........................................4403.96.00 FreeFree1/..................Pulpwood...................................................................23 m3

Poles, piles and posts..............................................27 m3

Other..........................................................................30 m3

Of poplar and aspen (Populus spp.).............................4403.97.00 FreeFree1/..................Pulpwood...................................................................22 m3

Poles, piles and posts..............................................26 m3

Other:Of yellow poplar (Liriodendron tulipifera)........65 m3

Of other poplar; of aspen or cottonwood.........67 m3

Of eucalyptus (Eucalyptus spp.)....................................4403.98.00 FreeFree1/..................Pulpwood...................................................................23 m3

Poles, piles and posts..............................................28 m3

Other..........................................................................95 m3

Other.................................................................................4403.99.01 FreeFree1/..................Pulpwood...................................................................23 m3

Poles, piles and posts..............................................28 m3

Other:Of ash (Fraxinus spp.).......................................40 m3

Of western red alder (Alnus rubra)..................50 m3

Of cherry (Prunus spp.).....................................55 m3

Of maple (Acer spp.).........................................60 m3

Of walnut (Juglans spp.)...................................70 m3

Of paulownia (Paulownia spp.)........................75 m3

Other...................................................................95 m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-7

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Hoopwood; split poles; piles, pickets and stakes of wood,pointed but not sawn lengthwise; wooden sticks, roughlytrimmed but not turned, bent or otherwise worked, suitable forthe manufacture of walking-sticks, umbrellas, tool handles orthe like; chipwood and the like:

4404

Coniferous...............................................................................4404.10.00 FreeFree1/..................Fence pickets, palings and rails....................................40 kgPoles, piles and posts.....................................................80 kgOther.................................................................................90 kg

Nonconiferous........................................................................4404.20.00 FreeFree1/..................Fence pickets, palings and rails....................................40 kgPoles, piles and posts.....................................................80 kgOther.................................................................................90 kg

Wood wool (excelsior); wood flour..............................................004405.00.00 33 1/3%Free (A+, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

3.2%1/kg..............

Railway or tramway sleepers (cross-ties) of wood:4406Not impregnated:

Coniferous........................................................................004406.11.00 FreeFree1/m3..............No.

Nonconiferous..................................................................004406.12.00 FreeFree1/m3..............No.

Other:Coniferous........................................................................004406.91.00 FreeFree1/m3..............

No.Nonconiferous..................................................................004406.92.00 FreeFree1/m3..............

No.

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-8

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Wood sawn or chipped lengthwise, sliced or peeled, whetheror not planed, sanded or end-jointed, of a thickness exceeding6 mm:

4407

Coniferous:Of pine (Pinus spp.)........................................................4407.11.00 $1.70/m3Free1/..................

Finger-jointed............................................................01 m3

Other:Treated with paint, stain, creosote or otherpreservative........................................................

02m3

Not treated:Eastern white pine (Pinus strobus) and redpine (Pinus resinosa):

Rough....................................................42 m3

Other......................................................43 m3

Lodgepole pine (Pinus contorta):Rough....................................................44 m3

Other......................................................45 m3

Southern yellow pine (Loblolly pine (Pinustaeda)), long leaf pine (Pinus palustris),pitch pine (Pinus rigida), short leaf pine(Pinus echinata), slash pine (Pinus elliottii)and Virginia pine (Pinus virginiana):

Rough....................................................46 m3

Other......................................................47 m3

Ponderosa pine (Pinus ponderosa):Rough....................................................48 m3

Other......................................................49 m3

Other pine:Rough....................................................52 m3

Other......................................................53 m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-9

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Wood sawn or chipped lengthwise, sliced or peeled, whetheror not planed, sanded or end-jointed, of a thickness exceeding6 mm: (con.)

4407 (con.)

Coniferous: (con.)Of fir (Abies spp.) and spruce (Picea spp.)..................4407.12.00 $1.70/m3Free1/..................

Finger-jointed............................................................01 m3

Other:Treated with paint, stain, creosote or otherpreservative........................................................

02m3

Not treated:Sitka spruce (Picea sitchensis):

Rough....................................................17 m3

Other......................................................18 m3

Other spruce:Rough....................................................19 m3

Other......................................................20 m3

Fir (Abies spp.):Rough....................................................58 m3

Other......................................................59 m3

Other:4407.19Mixtures of spruce, pine and fir ("S-P-F"), nottreated with paint, stain, creosote or otherpreservative...............................................................

004407.19.05

$1.70/m3Free1/m3..............Mixtures of western hemlock and amabilis fir("hem-fir"), not treated with paint, stain, creosoteor other preservative................................................

004407.19.06

$1.70/m3Free1/m3..............

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-10

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Wood sawn or chipped lengthwise, sliced or peeled, whetheror not planed, sanded or end-jointed, of a thickness exceeding6 mm: (con.)

4407 (con.)

Coniferous: (con.)Other: (con.)4407.19

(con.)Other..........................................................................4407.19.10 $1.70/m3Free1/m3..............

Finger-jointed.....................................................01 m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-11

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Wood sawn or chipped lengthwise, sliced or peeled, whetheror not planed, sanded or end-jointed, of a thickness exceeding6 mm: (con.)

4407 (con.)

Coniferous: (con.)Other: (con.)4407.19

(con.)Other (con.)4407.19.10

(con.)Other:

Treated with paint, stain, creosote or otherpreservative.................................................

02m3

Not treated:Douglas-fir (Pseudotsuga menziesii):

Rough:Having a minimum dimensionless than 5.1 cm......................

54m3

Having a minimum dimension5.1 cm or more but less than12.7 cm....................................

55

m3

Having a minimum dimension12.7 cm or more......................

56m3

Other...............................................57 m3

Hemlock (Tsuga spp.):Rough.............................................64 m3

Other...............................................65 m3

Larch (Larix spp.):Rough.............................................66 m3

Other...............................................67 m3

Western red cedar:Rough.............................................68 m3

Other...............................................69 m3

Yellow cedar (Chamaecyparisnootkatensis):

Rough.............................................74 m3

Other...............................................75 m3

Other cedar (Thuja spp., Juniperusspp., Chamaecyparis spp., Cupressusspp. and Libocedrus spp.):

Rough.............................................76 m3

Other...............................................77 m3

Redwood (Sequoia sempervirens):Rough.............................................82 m3

Other...............................................83 m3

Other:Rough.............................................92 m3

Other...............................................93 m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-12

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Wood sawn or chipped lengthwise, sliced or peeled, whetheror not planed, sanded or end-jointed, of a thickness exceeding6 mm: (con.)

4407 (con.)

Of tropical wood:Mahogany (Swietenia spp.)...........................................004407.21.00 $1.27/m3Free1/m3..............Virola, Imbuia and Balsa.................................................4407.22.00 $1.27/m3Free1/..................

Balsa (Ochroma lagopus)........................................06 m3

Other..........................................................................91 m3

Dark Red Meranti, Light Red Meranti and MerantiBakau................................................................................

004407.25.00$1.27/m3Free1/m3..............

White Lauan, White Meranti, White Seraya, YellowMeranti and Alan.............................................................

004407.26.00$1.27/m3Free1/m3..............

Sapelli...............................................................................004407.27.00 $1.27/m3Free1/m3..............Iroko..................................................................................004407.28.00 $1.27/m3Free1/m3..............Other.................................................................................4407.29.01 $1.27/m3Free1/..................

Acajou d'Afrique (Khaya spp.), also known asAfrican mahogany.....................................................

06m3

Aningre (Aningeria spp.), also known as Aniegreor Anegre...................................................................

11m3

Keruing (Dipterocarpus spp.)..................................16 m3

Ipé (Tabebuia spp. or Handroanthus spp.)...........20 m3

Teak (Tectona grandis)...........................................31 m3

Andiroba (Carapa guianensis and C. procera),Padauk (Pterocarpus spp.), also known asPadouk.......................................................................

40

m3

Cedro (Cedrela spp.), also known as SpanishCedar.........................................................................

60m3

Jatoba (Hymenaea spp.), also known as BrazilianCherry........................................................................

85m3

Other..........................................................................95 m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-13

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Wood sawn or chipped lengthwise, sliced or peeled, whetheror not planed, sanded or end-jointed, of a thickness exceeding6 mm: (con.)

4407 (con.)

Other:Of oak (Quercus spp.)....................................................4407.91.00 $1.27/m3Free1/..................

Red oak.....................................................................22 m3

Other..........................................................................63 m3

Of beech (Fagus spp.)....................................................004407.92.00 $1.27/m3Free1/m3..............Of maple (Acer spp.).......................................................4407.93.00 $1.27/m3Free1/..................

Hard maple................................................................10 m3

Other..........................................................................20 m3

Of cherry (Prunus spp.)..................................................004407.94.00 $1.27/m3Free1/m3..............Of ash (Fraxinus spp.)....................................................004407.95.00 $1.27/m3Free1/m3..............Of birch (Betula spp.)......................................................4407.96.00 $1.27/m3Free1/..................

North American (Betula alleghaniensis, Betulapapyrifera, Betula lenta, Betula nigra)....................

11m3

European (Betula pendula, Betula pubescens),also known as Baltic, Russian or Chinese birch....

13m3

Other..........................................................................19 m3

Of poplar and aspen (Populus spp.).............................4407.97.00 $1.27/m3Free1/..................Yellow poplar (Liriodendron tulipifera)...................72 m3

Other poplar; aspen; cottonwood...........................79 m3

Other.................................................................................4407.99.02 $1.27/m3Free1/..................Hickory (Carya spp.) and pecan (Carya illinoensis,Carya pecan).............................................................

42m3

Walnut (Juglans spp)...............................................61 m3

Western red alder (Alnus rubra).............................63 m3

Other nonconiferous.................................................95 m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-14

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Sheets for veneering (including those obtained by slicinglaminated wood), for plywood or for similar laminated woodand other wood, sawn lengthwise, sliced or peeled, whetheror not planed, sanded, spliced or end-jointed, of a thicknessnot exceeding 6 mm:

4408

Coniferous...............................................................................4408.10.01 20%Free1/..................Douglas fir........................................................................25 m2

Other.................................................................................45 m2

Of tropical wood:Dark Red Meranti, Light Red Meranti and MerantiBakau................................................................................

004408.31.0120%Free1/m2..............

Other.................................................................................4408.39.02 20%Free1/..................Spliced or end-jointed..............................................10 m2

Other..........................................................................90 m2

Other........................................................................................4408.90.01 20%Free1/..................Spliced or end-jointed:

Ash (Fraxinus spp.)..................................................05 m2

Birch (Betula spp.)....................................................10 m2

Cherry (Prunus spp.)................................................15 m2

Maple (Acer spp.).....................................................21 m2

Oak (Quercus spp.):Red......................................................................31 m2

Other...................................................................37 m2

Walnut (Juglans spp.)..............................................45 m2

Other..........................................................................51 m2

Other:Ash (Fraxinus spp.)..................................................56 m2

Birch (Betula spp.)....................................................61 m2

Cherry (Prunus spp.)................................................66 m2

Maple (Acer spp.).....................................................71 m2

Oak (Quercus spp.):Red......................................................................76 m2

Other...................................................................81 m2

Walnut (Juglans spp.)..............................................87 m2

Other..........................................................................97 m2

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-15

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Wood (including strips and friezes for parquet flooring, notassembled) continuously shaped (tongued, grooved, rebated,chamfered, V-jointed, beaded, molded, rounded or the like)along any of its edges, ends or faces, whether or not planed,sanded or end-jointed:

4409

Coniferous:4409.10Wood continuously shaped along any of its ends,whether or not also continuously shaped along any ofits edges or faces, all the foregoing whether or notplaned, sanded or end-jointed.......................................

004409.10.05

33 1/3%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

3.2%1/m3..............

Other:Wood siding..............................................................4409.10.10 2.2¢/m2Free1/..................

Resawn bevel siding:Western red cedar......................................20 m2

m3

Other.............................................................40 m2

m3

Other:Western red cedar......................................60 m2

m3

Other.............................................................80 m2

m3

Wood flooring............................................................004409.10.20 33 1/3%Free1/m2..............m3

Wood moldings:Standard wood molding:

Pine (Pinus spp.).........................................4409.10.40 5%Free1/..................End-jointed............................................10 mOther......................................................90 m

Other.............................................................004409.10.45 5%Free1/m ...............Other...................................................................004409.10.50 40%Free1/m ...............

Wood dowel rods:Plain.....................................................................004409.10.60 5%Free1/m ...............

m3

Sanded, grooved, or otherwise advanced incondition..............................................................

004409.10.6533 1/3%Free (A+, AU, BH,

CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

4.9%1/m ...............m3

Other..........................................................................4409.10.90 $1.70/m3Free1/..................Western red cedar.............................................20 m2

m3

Other...................................................................40 m2

m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-16

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Wood (including strips and friezes for parquet flooring, notassembled) continuously shaped (tongued, grooved, rebated,chamfered, V-jointed, beaded, molded, rounded or the like)along any of its edges, ends or faces, whether or not planed,sanded or end-jointed: (con.)

4409 (con.)

Nonconiferous:Of bamboo:4409.21

Wood continuously shaped along any of its ends,whether or not also continuously shaped along anyof its edges or faces, all the foregoing whether ornot planed, sanded or end-jointed..........................

004409.21.05

33 1/3%Free (A, AU, BH, CL,CO, D, E, IL, JO,KR, MA, OM, P,PA, PE, S, SG)

3.2%1/m3..............

Other..........................................................................004409.21.90 $1.70/m3Free1/m3..............

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-17

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Wood (including strips and friezes for parquet flooring, notassembled) continuously shaped (tongued, grooved, rebated,chamfered, V-jointed, beaded, molded, rounded or the like)along any of its edges, ends or faces, whether or not planed,sanded or end-jointed: (con.)

4409 (con.)

Nonconiferous: (con.)Of tropical wood:4409.22

Wood continuously shaped along any of its ends,whether or not also continuously shaped along anyof its edges or faces, all the foregoing whether ornot planed, sanded or end-jointed..........................

4409.22.05

33 1/3%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

3.2%1/..................

Wood flooring (end-matched):Jatoba (Hymenaea spp.), also known asBrazilian Cherry...........................................

15m2

m3

Ipé (Tabebuia spp. or Handroanthus spp.),also known as Tahibo, LaPacho, Brazilianwalnut, and Patagonian walnut.................

20

m2

m3

Santos'mahogany (Myroxylon balsamum),also known as Cabreuva............................

35m2

m3

Cumaru (Dipteryx spp.), also known asBrazilian teak...............................................

45m2

m3

Other.............................................................60 m2

m3

Other...................................................................90 m2

m3

Other:Wood siding........................................................004409.22.10 4.3¢/m2Free1/m2..............Wood flooring.....................................................004409.22.25 8%Free1/m2..............

m3

Wood moldings:Standard wood moldings...........................004409.22.40 5%Free1/m ...............

Other.............................................................004409.22.50 40%Free1/m ...............Wood dowel rods:

Plain..............................................................004409.22.60 5%Free1/m ...............

Sanded, grooved or otherwise advancedin condition...................................................

004409.22.6533 1/3%Free (A+, AU, BH,

CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

4.9%1/m ...............

Other...................................................................004409.22.90 $1.70/m3Free1/m3..............

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-18

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Wood (including strips and friezes for parquet flooring, notassembled) continuously shaped (tongued, grooved, rebated,chamfered, V-jointed, beaded, molded, rounded or the like)along any of its edges, ends or faces, whether or not planed,sanded or end-jointed: (con.)

4409 (con.)

Nonconiferous: (con.)Other:4409.29

Wood continuously shaped along any of its ends,whether or not also continuously shaped along anyof its edges or faces, all the foregoing whether ornot planed, sanded or end-jointed..........................

4409.29.06

33 1/3%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

3.2%1/..................

Wood flooring (end-matched)...........................55 m2

m3

Other...................................................................65 m2

m3

Other:Wood siding........................................................004409.29.11 4.3¢/m2Free1/m2..............Wood flooring.....................................................4409.29.26 8%Free1/..................

Maple (Acer spp.).......................................30 m2

m3

Birch (Betula spp.) and beech (Fagusspp.)..............................................................

50m2

m3

Other.............................................................60 m2

m3

Wood moldings:Standard wood moldings3/.........................004409.29.41 5%Free1/m ...............

Other.............................................................004409.29.51 40%Free1/m ...............Wood dowel rods:

Plain..............................................................004409.29.61 5%Free1/m ...............

Sanded, grooved or otherwise advancedin condition...................................................

004409.29.6633 1/3%Free (A+, AU, BH,

CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

4.9%1/m ...............

Other...................................................................004409.29.91 $1.70/m3Free1/m3..............

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-19

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Particle board, oriented strand board (OSB) and similar board(for example, waferboard) of wood or other ligneousmaterials,whether or not agglomerated with resins or other organicbinding substances:

4410

Of wood:Particle board...................................................................4410.11.00 40%Free1/..................

Unworked or not further worked than sanded.......10 m3

kgSurface-covered with melamine-impregnatedpaper..........................................................................

20m3

kgSurface-covered with decorative laminates ofplastic.........................................................................

30m3

kgOther..........................................................................60 m3

kgOriented strand board (OSB)........................................4410.12.00 40%Free1/..................

Unworked or not further worked than sanded.......10 m3

kgOther..........................................................................20 m3

kgOther.................................................................................4410.19.00 40%Free1/..................

Unworked or not further worked than sanded.......10 m3

kgSurface-covered with melamine-impregnatedpaper..........................................................................

20m3

kgSurface-covered with decorative laminates ofplastic.........................................................................

30m3

kgOther..........................................................................60 m3

kgOther........................................................................................004410.90.00 20%Free1/m3..............

kg

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-20

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Fiberboard of wood or other ligneousmaterials, whether or notbonded with resins or other organic substances:

4411

Medium density fiberboard (MDF):Of a thickness not exceeding 5 mm:4411.12

Not mechanically worked or surface covered.......004411.12.10 30%Free1/m3..............Other:

Tongued, grooved or rabbetted continuouslyalong any of its edges and dedicated for usein the construction of walls, ceilings or otherparts of buildings:

Laminated boards bonded in whole or inpart, or impregnated, with syntheticresins............................................................

004411.12.20

33¢/kg + 25%Free (A, AU, BH, CL,CO, D, E, IL, JO,KR, MA, OM, P,PA, PE, S, SG)

1.9¢/kg + 1.5%1/kg..............m3

Other.............................................................004411.12.30 20%Free1/m3..............Other:

Not surface covered (except for oiltreatment).....................................................

004411.12.6030%Free1/m3..............

Other.............................................................4411.12.90 45%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

3.9%1/..................

Standard wood molding.......................10 m3

Other......................................................90 m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-21

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Fiberboard of wood or other ligneousmaterials, whether or notbonded with resins or other organic substances: (con.)

4411 (con.)

Medium density fiberboard (MDF): (con.)Of a thickness exceeding 5 mm but not exceeding 9mm:

4411.13

Not mechanically worked or surface covered.......004411.13.10 30%Free1/m3..............Other:

Tongued, grooved or rabbetted continuouslyalong any of its edges and dedicated for usein the construction of walls, ceilings or otherparts of buildings:

Laminated boards bonded in whole or inpart, or impregnated, with syntheticresins4/..........................................................

004411.13.20

33¢/kg + 25%Free (A, AU, BH, CL,CO, D, E, IL, JO,KR, MA, OM, P,PA, PE, S, SG)

1.9¢/kg + 1.5%1/kg..............m3

Other.............................................................004411.13.30 20%Free1/m3..............Other:

Not surface covered (except for oiltreatment).....................................................

004411.13.6030%Free1/m3..............

Other.............................................................4411.13.90 45%Free (A, AU, BH, CL,CO, D, E, IL, JO,KR, MA, OM, P,PA, PE, S, SG)

3.9%1/..................

Standard wood molding.......................10 m3

Other......................................................90 m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-22

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Fiberboard of wood or other ligneousmaterials, whether or notbonded with resins or other organic substances: (con.)

4411 (con.)

Medium density fiberboard (MDF): (con.)Of a thickness exceeding 9 mm:4411.14

Not mechanically worked or surface covered.......004411.14.10 30%Free1/m3..............Other:

Tongued, grooved or rabbetted continuouslyalong any of its edges and dedicated for usein the construction of walls, ceilings or otherparts of buildings:

Laminated boards bonded in whole or inpart, or impregnated, with syntheticresins............................................................

004411.14.20

33¢/kg + 25%Free (A, AU, BH, CL,CO, D, E, IL, JO,KR, MA, OM, P,PA, PE, S, SG)

1.9¢/kg + 1.5%1/kg..............m3

Other.............................................................004411.14.30 20%Free1/m3..............Other:

Not surface covered (except for oiltreatment).....................................................

004411.14.6030%Free1/m3..............

Other.............................................................4411.14.90 45%Free (A, AU, BH, CL,CO, D, E, IL, JO,KR, MA, OM, P,PA, PE, S, SG)

3.9%1/..................

Standard wood molding.......................10 m3

Other......................................................90 m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-23

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Fiberboard of wood or other ligneousmaterials, whether or notbonded with resins or other organic substances: (con.)

4411 (con.)

Other:Of a density exceeding 0.8 g/cm3 :4411.92

Not mechanically worked or surface covered.......004411.92.10 30%Free1/m3..............Other:

Not surface covered (except for oiltreatment)...........................................................

004411.92.2030%Free1/m3..............

Other:Tileboard which has been continuouslyworked along any of its edges and isdedicated for use in the construction ofwalls, ceilings or other parts ofbuildings.......................................................

004411.92.30

20%Free1/m3..............Other.............................................................004411.92.40 45%Free (A, AU, BH, CL,

CO, D, E, IL, JO,KR, MA, OM, P,PA, PE, S, SG)

6%1/m3..............

Of a density exceeding 0.5 g/cm3 but not exceeding0.8 g/cm3 :

4411.93

Not mechanically worked or surface covered.......004411.93.10 30%Free1/m3..............Other:

Tongued, grooved or rabbetted continuouslyalong any of its edges and dedicated for usein the construction of walls, ceilings or otherparts of buildings:

Laminated boards bonded in whole or inpart, or impregnated, with syntheticresins............................................................

004411.93.20

33¢/kg + 25%Free (A, AU, BH, CL,CO, D, E, IL, JO,KR, MA, OM, P,PA, PE, S, SG)

1.9¢/kg + 1.5%1/kg..............m3

Other.............................................................004411.93.30 20%Free1/m3..............Other:

Not surface covered (except for oiltreatment).....................................................

004411.93.6030%Free1/m3..............

Other.............................................................4411.93.90 45%Free (A, AU, BH, CL,CO, D, E, IL, JO,KR, MA, OM, P,PA, PE, S, SG)

3.9%1/..................

Standard wood molding.......................10 m3

Other5/....................................................90 m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-24

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Fiberboard of wood or other ligneousmaterials, whether or notbonded with resins or other organic substances: (con.)

4411 (con.)

Other: (con.)Of a density not exceeding 0.5 g/cm3...........................4411.94.00 20%Free1/..................

Of a density exceeding 0.35 g/cm3 but notexceeding 0.5 g/cm3:

Not mechanically worked or surface covered:Impregnated with bitumen.........................10 m3

Other.............................................................20 m3

Other:Impregnated with bitumen.........................30 m3

Other.............................................................40 m3

Other:Not mechanically worked or surface covered:

Impregnated with bitumen.........................50 m3

Other.............................................................60 m3

Other:Impregnated with bitumen.........................70 m3

Other.............................................................80 m3

Plywood, veneered panels and similar laminated wood:4412Of bamboo:4412.10

Plywood6/..........................................................................004412.10.05 40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/m3..............

Other6/...............................................................................004412.10.90 40%Free1/m3..............

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-25

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Plywood, veneered panels and similar laminated wood: (con.)4412 (con.)Other plywood consisting solely of sheets of wood (otherthan bamboo), each ply not exceeding 6 mm in thickness:

With at least one outer ply of tropical wood:4412.31Not surface covered, or surface covered with aclear or transparent material which does notobscure the grain, texture or markings of the faceply:

With a face ply of birch (Betula spp.)...............4412.31.06 50%Free1/..................Panels not exceeding in any dimension 3.6mm in thickness, 1.2 m in width and 2.2 min length........................................................

20

m3

Other:Not surface covered.............................40 m3

Other......................................................60 m3

With a face ply of Spanish cedar (Cedrelaspp.) or walnut (Juglans spp)...........................

4412.31.2640%Free (A*, AU, BH,

CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/..................

With a face ply of Spanish cedar (Cedrelaspp.)..............................................................

10m3

With a face ply of walnut (Juglans spp.)....20 m3

Other:With at least one outer ply of the followingtropical woods: Dark Red Meranti, LightRed Meranti, White Lauan, Sipo, Limba,Okoumé, Obeche, Acajou d'Afrique,Sapelli, Virola, Mahogany, Palissandre dePara, Palissandre de Rio or Palissandrede Rose:

With a face ply of mahogany(Swietenia spp. or Khaya spp.)...........

004412.31.4240%Free (A*, AU, BH,

CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/m3..............

Panels not exceeding 3.6 mm inthickness and exceeding 1.2 m inwidth and 2.2 m in length.....................

004412.31.45

40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/m3..............

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-26

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Plywood, veneered panels and similar laminated wood: (con.)4412 (con.)Other plywood consisting solely of sheets of wood (otherthan bamboo), each ply not exceeding 6 mm in thickness:(con.)

With at least one outer ply of tropical wood: (con.)4412.31(con.)

Not surface covered, or surface covered with aclear or transparent material which does notobscure the grain, texture or markings of the faceply: (con.)

Other: (con.)With at least one outer ply of the followingtropical woods: Dark Red Meranti, LightRed Meranti, White Lauan, Sipo, Limba,Okoumé, Obeche, Acajou d'Afrique,Sapelli, Virola, Mahogany, Palissandre dePara, Palissandre de Rio or Palissandrede Rose: (con.)

Other......................................................4412.31.48 40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/..................

Panels not exceeding 3.6 mm inthickness and not exceeding 1.2m in width and 2.2 m in length......

50

m3

Other:Not surface covered...............65 m3

Other:Wood flooring...................75 m3

Other.................................80 m3

Other.............................................................4412.31.52 40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/..................

Wood flooring........................................25 m3

Other:With a face ply of sen (Kalopanaxspp.)................................................

35m3

Other:Panels not exceeding in anydimension 3.6 mm inthickness, 1.2 m in width and2.2 m in length.........................

55

m3

Other:Not surface covered........65 m3

Other.................................75 m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-27

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Plywood, veneered panels and similar laminated wood: (con.)4412 (con.)Other plywood consisting solely of sheets of wood (otherthan bamboo), each ply not exceeding 6 mm in thickness:(con.)

With at least one outer ply of tropical wood: (con.)4412.31(con.)

Other:With at least one outer ply of the followingtropical woods: Dark Red Meranti, Light RedMeranti, White Lauan, Sipo, Limba, Okoumé,Obeche, Acajou d'Afrique, Sapelli, Virola,Mahogany, Palissandre de Para, Palissandrede Rio or Palissandre de Rose.........................

004412.31.61

40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/m3..............

Other...................................................................004412.31.92 40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/m3..............

Other, with at least one outer ply of nonconiferouswood of the species alder (Alnus spp.), ash (Fraxinusspp.), beech (Fagus spp.), birch (Betula spp.), cherry(Prunus spp.), chestnut (Castanea spp.), elm (Ulmusspp.), eucalyptus (Eucalyptus spp.), hickory (Caryaspp.), horse chestnut (Aesculus spp.), lime (Tilia spp.),maple (Acer spp.), oak (Quercus spp.), plane tree(Platanus spp.), poplar and aspen (Populus spp.),robinia (Robinia spp.), tulipwood (Liriodendron spp.)or walnut (Juglans spp.):

4412.33

Not surface covered, or surface covered with aclear or transparent material which does notobscure the grain, texture or markings of the faceply:

With a face ply of birch (Betula spp.)...............4412.33.06 50%Free1/..................Panels not exceeding in any dimension 3.6mm in thickness, 1.2 m in width and 2.2 min length........................................................

20

m3

Other:Not surface covered.............................40 m3

Other:Wood flooring.................................65 m3

Other...............................................70 m3

With a face ply of walnut (Juglans spp.).........4412.33.26 40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

5.1%1/..................

Wood flooring..............................................25 m3

Other.............................................................30 m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-28

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Plywood, veneered panels and similar laminated wood: (con.)4412 (con.)Other plywood consisting solely of sheets of wood (otherthan bamboo), each ply not exceeding 6 mm in thickness:(con.)

Other, with at least one outer ply of nonconiferouswood of the species alder (Alnus spp.), ash (Fraxinusspp.), beech (Fagus spp.), birch (Betula spp.), cherry(Prunus spp.), chestnut (Castanea spp.), elm (Ulmusspp.), eucalyptus (Eucalyptus spp.), hickory (Caryaspp.), horse chestnut (Aesculus spp.), lime (Tilia spp.),maple (Acer spp.), oak (Quercus spp.), plane tree(Platanus spp.), poplar and aspen (Populus spp.),robinia (Robinia spp.), tulipwood (Liriodendron spp.)or walnut (Juglans spp.): (con.)

4412.33(con.)

Not surface covered, or surface covered with aclear or transparent material which does notobscure the grain, texture or markings of the faceply: (con.)

Other...................................................................4412.33.32 40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/..................

Wood flooring..............................................25 m3

Other:With a face ply of sen (Kalopanaxspp.).......................................................

35m3

With a face ply of mahogany(Swietenia spp. or Khaya spp.)...........

55m3

Other:Panels not exceeding in anydimension 3.6 mm in thickness,1.2 m in width and 2.2 m inlength..............................................

65

m3

Other:Not surface covered...............75 m3

Other........................................85 m3

Other..........................................................................004412.33.57 40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/m3..............

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-29

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Plywood, veneered panels and similar laminated wood: (con.)4412 (con.)Other plywood consisting solely of sheets of wood (otherthan bamboo), each ply not exceeding 6 mm in thickness:(con.)

Other, with at least one outer ply of nonconiferouswood not specified under subheading 4412.33:

4412.34

Not surface covered, or surface covered with aclear or transparent material which does notobscure the grain, texture or markings of the faceply:

With a face ply of Spanish cedar (Cedrelaspp.)....................................................................

004412.34.2640%Free (A*, AU, BH,

CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

5.1%1/m3..............

Other...................................................................4412.34.32 40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/..................

Wood flooring..............................................25 m3

Other:With a face ply of sen (Kalopanaxspp.).......................................................

35m3

With a face ply of mahogany(Swietenia spp. or Khaya spp.)...........

55m3

Other:Panels not exceeding in anydimension 3.6 mm in thickness,1.2 m in width and 2.2 m inlength..............................................

65

m3

Other:Not surface covered...............75 m3

Other........................................85 m3

Other..........................................................................004412.34.57 40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/m3..............

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-30

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Plywood, veneered panels and similar laminated wood: (con.)4412 (con.)Other plywood consisting solely of sheets of wood (otherthan bamboo), each ply not exceeding 6 mm in thickness:(con.)

Other, with both outer plies of coniferous wood:4412.39Not surface covered, or surface covered with aclear or transparent material which does notobscure the grain, texture or markings of the faceply:

With a face ply of Parana pine (Araucariaangustifolia)........................................................

004412.39.1040%Free1/m3..............

With a face ply of European red pine (Pinussilvestris) ............................................................

004412.39.3040%Free (A*, AU, BH,

CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

3.4%1/m3..............

Other...................................................................4412.39.40 40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/..................

With at least one outer ply of Douglas fir(Pseudotsuga menziesii):

Rough, or touch sanded for sizingpurposes, but not furtherprocessed..............................................

11

m3

Fully sanded on at least one face, butnot further processed...........................

12m3

Other......................................................19 m3

With at least one outer ply of long leaf pine(Pinus palustris), short leaf pine (Pinusechinata), southern yellow pine (loblollypine)(Pinus taeda), slash pine (Pinuselliotti), pitch pine (Pinus rigida) or Virginiapine (Pinus virginiana):

Rough, or touch sanded for sizingpurposes, but not furtherprocessed..............................................

31

m3

Fully sanded on at least one face, butnot further processed...........................

32m3

Other......................................................39 m3

With at least one outer ply of Agathis spp.:Rough, or touch sanded for sizingpurposes, but not furtherprocessed..............................................

51

m3

Fully sanded on at least one face, butnot further processed...........................

52m3

Other......................................................59 m3

Other:Rough, or touch sanded for sizingpurposes, but not furtherprocessed..............................................

61

m3

Fully sanded on at least one face, butnot further processed...........................

62m3

Other......................................................69 m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-31

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Plywood, veneered panels and similar laminated wood: (con.)4412 (con.)Other plywood consisting solely of sheets of wood (otherthan bamboo), each ply not exceeding 6 mm in thickness:(con.)

Other, with both outer plies of coniferous wood: (con.)4412.39(con.)

Other..........................................................................4412.39.50 40%Free (A+, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

5.1%1/..................

With at least one outer ply of Douglas fir(Pseudotsuga menziesii) .................................

10m3

With at least one outer ply of long leaf pine(Pinus palustris), short leaf pine (Pinusechinata), southern yellow pine (loblolly pine)(Pinus taeda), slash pine (Pinus elliotti), pitchpine (Pinus rigida) or Virginia pine (Pinusvirginiana) ..........................................................

30

m3

Other...................................................................50 m3

Other:Blockboard, laminboard and battenboard:4412.94

With at least one outer ply of nonconiferous wood:Plywood:

Not surface covered, or surface coveredwith a clear or transparent material whichdoes not obscure the grain, texture ormarkings of the face ply:

With a face ply of birch (Betulaspp.).......................................................

4412.94.1050%Free1/..................

Not surface covered......................30 m3

Other...............................................50 m3

Other......................................................4412.94.31 40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/..................

Wood flooring.................................05 m2

m3

Other:With a face ply of Spanishcedar (Cedrela spp.) .............

11m2

m3

With a face ply of walnut(Juglans spp.) ........................

21m2

m3

With a face ply of mahogany(Swietenia spp. or Khayaspp.).........................................

41

m2

m3

Other:Not surface covered........61 m2

m3

Other.................................75 m2

m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-32

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Plywood, veneered panels and similar laminated wood: (con.)4412 (con.)Other: (con.)

Blockboard, laminboard and battenboard: (con.)4412.94(con.)

With at least one outer ply of nonconiferous wood:(con.)

Plywood: (con.)Other.............................................................004412.94.41 40%Free (A*, AU, BH,

CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/m3..............

Other...................................................................004412.94.51 40%Free1/m3..............Other:

Plywood:Not surface covered, or surface coveredwith a clear or transparent material whichdoes not obscure the grain, texture ormarkings of the face ply:

With a face ply of Parana pine(Araucaria angustifolia).......................

004412.94.6040%Free1/m3..............

With a face ply of European red pine(Pinus silvestris) ..................................

004412.94.7040%Free (A, AU, BH, CL,

CO, D, E, IL, JO,KR, MA, OM, P,PA, PE, S, SG)

3.4%1/m3..............

Other......................................................004412.94.80 40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/m3..............

Other.............................................................004412.94.90 40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

5.1%1/m3..............

Other...................................................................004412.94.95 40%Free1/m3..............

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-33

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Plywood, veneered panels and similar laminated wood: (con.)4412 (con.)Other: (con.)

Other:4412.99With at least one outer ply of nonconiferous wood:

Containing at least one layer of particleboard...................................................................

004412.99.0640%Free1/m3..............

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-34

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Plywood, veneered panels and similar laminated wood: (con.)4412 (con.)Other: (con.)

Other: (con.)4412.99(con.)

With at least one outer ply of nonconiferous wood:(con.)

Other:Plywood:

Not surface covered, or surfacecovered with a clear or transparentmaterial which does not obscure thegrain, texture or markings of the faceply:

With a face ply of birch (Betulaspp.)................................................

4412.99.1050%Free1/..................

Panels not exceeding in anydimension 3.6 mm inthickness, 1.2 m in width and2.2 m in length.........................

20

m3

Other:Not surface covered........30 m3

Other.................................40 m3

Other...............................................4412.99.31 40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/..................

With a face ply of Spanishcedar (Cedrela spp.) .............

10m3

With a face ply of walnut(Juglans spp.) ........................

20m3

With a face ply of sen(Kalopanax spp.) ....................

30m3

With a face ply of mahogany(Swietenia spp. or Khayaspp.).........................................

40

m3

Other:Panels not exceeding inany dimension 3.6 mm inthickness, 1.2 m in width,and 2.2 m in length..........

50

m3

Other, not surfacecovered.............................

60m3

Other.................................70 m3

Other......................................................004412.99.41 40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/m3..............

Other.............................................................4412.99.51 40%Free1/..................Wood flooring7/......................................05 m3

Other......................................................15 m3

Rates of Duty1

Harmonized Tariff Schedule of the United States Basic Revision 8 (2021)Annotated for Statistical Reporting Purposes

IX44-35

Rates of DutyUnitof

QuantityArticle Description

Stat.Suf-fix

Heading/Subheading 21

SpecialGeneral

Plywood, veneered panels and similar laminated wood: (con.)4412 (con.)Other: (con.)

Other: (con.)4412.99(con.)

Other:Containing at least one layer of particleboard...................................................................

014412.99.5740%Free1/m3..............

Other:Plywood:

Not surface covered, or surfacecovered with a clear or transparentmaterial which does not obscure thegrain, texture or markings of the faceply:

With a face ply of Parana pine(Araucaria angustifolia).................

004412.99.6040%Free1/m3..............

With a face ply of European redpine (Pinus silvestris) ...................

004412.99.7040%Free (A*, AU, BH,

CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

3.4%1/m3..............

Other...............................................004412.99.80 40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

8%1/m3..............

Other......................................................004412.99.90 40%Free (A*, AU, BH,CL, CO, D, E, IL,JO, KR, MA, OM,P, PA, PE, S, SG)

5.1%1/m3..............

Other.............................................................004412.99.95 40%Free1/m3..............Densified wood, in blocks, plates, strips or profile shapes......004413.00.00 50%Free (A, AU, BH, CL,

CO, D, E, IL, JO,KR, MA, OM, P,PA, PE, S, SG)

3.7%1/kg..............