Chapter 23 Performance Evaluation Using Variances from … · 2009-11-05 · 1034 Chapter 23...

Transcript of Chapter 23 Performance Evaluation Using Variances from … · 2009-11-05 · 1034 Chapter 23...

1033Chapter 23 Performance Evaluation Using Variances from Standard Costs

Standards represent performance benchmarksthat can be compared to actual results inevaluating performance. Standards are estab-lished so that they are neither too high nortoo low, but are attainable.

• Define ideal and normal stan-dards and explain how theyare used in setting standards.

• Describe some of the criti-cisms of the use of standards.

1. Describe the types of standards and how they are established for businesses.

Example PracticeKey Points Key Learning Outcomes Exercises Exercises

At a Glance

Budgets are prepared by multiplying thestandard cost per unit by the planned pro-duction. To measure performance, the stan-dard cost per unit is multiplied by the actualnumber of units produced, and the actual results are compared with the standard costat actual volumes (cost variance).

• Compute the standard costper unit of production formaterials, labor, and factoryoverhead.

• Compute the direct labor, direct materials, and factoryoverhead cost variances.

• Prepare a budget performancereport.

2. Explain and illustrate how standards are used in budgeting.

Example PracticeKey Points Key Learning Outcomes Exercises Exercises

The direct materials cost variance can be separated into direct materials price andquantity variances.

The direct labor cost variance can be sepa-rated into direct labor rate and time variances.

• Compute and interpret directmaterials price and quantityvariances.

• Compute and interpret directlabor rate and time variances.

• Describe and illustrate howtime standards are used innonmanufacturing settings.

23-1

23-2

23-1A, 23-1B

23-2A, 23-2B

3. Compute and interpret direct materials and direct labor variances.

Example PracticeKey Points Key Learning Outcomes Exercises Exercises

The factory overhead cost variance can beseparated into a variable factory overheadcontrollable variance and a fixed factoryoverhead volume variance.

• Prepare a factory overheadflexible budget.

• Compute and interpret thevariable factory overheadcontrollable variance.

• Compute and interpret thefixed factory overhead vol-ume variance.

• Prepare a factory overheadcost variance report.

• Evaluate factory overheadvariances using a T account.

23-3

23-4

23-3A, 23-3B

23-4A, 23-4B

4. Compute and interpret factory overhead controllable and volume variances.

Example PracticeKey Points Key Learning Outcomes Exercises Exercises

(continued)

CH23_Warren22e.qxd 7/24/06 5:04 PM Page 1033

FINAL

1034 Chapter 23 Performance Evaluation Using Variances from Standard Costs

Standard costs and variances can be recordedin the accounts at the same time the manu-facturing costs are recorded in the accounts.Work in Process is debited at standard. Undera standard cost system, the cost of goodssold will be reported at standard cost.Manufacturing variances can be disclosed onthe income statement to adjust the grossprofit at standard to the actual gross profit.

• Journalize the entries torecord the purchase and useof direct materials at stan-dard, recording favorable orunfavorable variances.

• Prepare an income statement,disclosing favorable and un-favorable direct materials, direct labor, and factory over-head variances.

23-5

23-6

23-5A, 23-5B

23-6A, 23-6B

5. Journalize the entries for recording standards in the accounts and prepare an income statement that includes variances from standard.

Example PracticeKey Points Key Learning Outcomes Exercises Exercises

Many companies use a combination of finan-cial and nonfinancial measures in order formultiple perspectives to be incorporated inevaluating performance. Nonfinancial mea-sures are often used in conjunction with theinputs or outputs of a process or an activity.

• Define, provide the rationalefor, and provide examples ofnonfinancial performancemeasures.

• Identify nonfinancial inputsand outputs to an activity.

23-7 23-7A, 23-7B

6. Explain and provide examples of nonfinancial performance measures.

Example PracticeKey Points Key Learning Outcomes Exercises Exercises

Key Terms

budget performance report (1017)controllable variance (1024)cost variance (1014)currently attainable standards

(1015)direct labor rate variance (1021)direct labor time variance (1021)

direct materials price variance(1019)

direct materials quantity variance(1020)

ideal standards (1015)nonfinancial performance measure

(1031)

process (1031)standard cost (1014)standard cost systems (1014)volume variance (1025)

Illustrative Problem

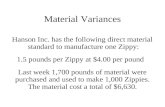

Hawley Inc. manufactures woven baskets for national distribution. The standard costsfor the manufacture of Folk Art style baskets were as follows:

Standard Costs Actual Costs

Direct materials 1,500 pounds at $35 1,600 pounds at $32Direct labor 4,800 hours at $11 4,500 hours at $11.80Factory overhead Rates per labor hour,

based on 100% ofnormal capacity of5,500 labor hours:

Variable cost, $2.40 $12,300 variable costFixed cost, $3.50 $19,250 fixed cost

CH23_Warren22e.qxd 7/24/06 5:04 PM Page 1034

FINAL