Chapter 17

-

Upload

tomwinfrey -

Category

Documents

-

view

1.806 -

download

0

description

Transcript of Chapter 17

Chapter 17

Completing the Engagement

McGraw-Hill/Irwin Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved.

TOPICS COVERED Review for contingent liabilities. Commitments. Subsequent events. Final evidential evaluation processes. Communications with the audit

committee and management. Subsequent discovery of facts existing

at the date of the auditor's report.

17-3

Review for Contingent LiabilitiesA contingent liability is defined as an existing condition, situation, or set of circumstances

involving uncertainty as to possible loss to an entity that will ultimately be resolved when some future

event occurs or fails to occur.

A contingent liability is defined as an existing condition, situation, or set of circumstances

involving uncertainty as to possible loss to an entity that will ultimately be resolved when some future

event occurs or fails to occur.

Probable: The future event is likely to occur.

Reasonably Possible: The chances of the future event occurring is more than remote but less than probable.

Remote: The chance of the future event occurring is slight.

Probable: The future event is likely to occur.

Reasonably Possible: The chances of the future event occurring is more than remote but less than probable.

Remote: The chance of the future event occurring is slight.

Examples

• Pending or threatened litigation;

• Actual or possible claims and assessments;

• Income tax disputes;

• Product warranties or defects;

• Guarantees of obligations to others;

• Agreements to repurchase receivables that have been sold.

Examples

• Pending or threatened litigation;

• Actual or possible claims and assessments;

• Income tax disputes;

• Product warranties or defects;

• Guarantees of obligations to others;

• Agreements to repurchase receivables that have been sold.

LO# 1

17-4

Audit Procedures for Identifying Contingent Liabilities

Read minutes of meetings of the board of directors, committees of the board,

and stockholders.

Review contracts, loan agreements, leases, and

correspondence from government agencies.

Confirm or otherwise document guarantees and

letters of credit.

Inspect other documents for possible guarantees.

Review income tax liability, tax returns, and IRS agents’

reports.

LO# 2

17-5

Audit Procedures for Identifying Contingent Liabilities

Inquiry and discussion with management about its policies and

procedures for identifying, evaluating, and accounting for

contingent liabilities.

Examine documents in the entity’s records such as correspondence and invoices from attorneys for pending or threatened lawsuits.

Obtain a legal letter that describes and evaluates any litigation, claims,

or assessments.

Obtain written representation from management that all litigation,

asserted and unasserted claims, and assessments have been

disclosed in accordance with FASB No. 5.

Specific Audit Procedures Conducted Near Completion of Audit

LO# 2

17-6

Legal LettersA letter of audit inquiry (a legal letter) sent to the client’s attorneys is the primary means of obtaining or corroborating information about

litigation, claims, and assessments.

LO# 3

17-7

Example of Legal LetterLO# 3

17-8

Commitments

Long-term commitments are usually identified through inquiry of client personnel during the audit of the revenue and purchasing processes.

In most cases, such commitments are disclosed in a footnote to the financial statements.

Long-term contracts to purchase raw materials or sell their products at a fixed price.

Long-term contracts to purchase raw materials or sell their products at a fixed price.

To obtain a favorable pricing arrangement.

To obtain a favorable pricing arrangement.

To secure the availability of raw

materials.

To secure the availability of raw

materials.

LO# 4

17-9

Review for Subsequent Events for Audit of Financial Statements

Balance Sheet Date

Type I Event

Affects estimates that are part of

financial statements.

Type II Event

Conditions did not exist at the balance sheet

date.

Require adjustment of the financial statements.

Require disclosure and possibly pro forma

financial statements.

LO# 5

17-10

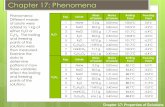

EXAMPLES OF THE FIRST TYPE OF EVENT

A loss of an uncollectible account receivable resulting from continued deterioration of its financial condition leading to bankruptcy after the balance sheet date.

The settlement of a lawsuit after the balance sheet date for an amount different from the amount recorded in the year end financial statements.

17-11

EXAMPLES OF THE SECOND TYPE OF EVENT Purchase or disposal of a business. Sale of a capital stock or bond issue. Loss of a manufacturing facility or assets

resulting from a casualty such as a fire or flood. Losses on receivables arising from conditions

such as a casualty arising subsequent to the balance sheet date.

17-12

Review of Subsequent Events for Audit of Financial Statements

LO# 5

17-13

Dual DatingWhen a subsequent event is recorded or disclosed

in the financial statements after the date on which the auditor has obtained sufficient appropriate audit evidence but before the

issuance of the financial statements, the auditor must consider the following options for dating of

the auditor’s report:

(1) “Dual date” the report (limits liability)

(2) Use the date of the subsequent event.

LO# 6

17-14

Audit Procedures for Subsequent Events

Inquire of Management

Read Interim Financial

StatementsExamine the

Books of Original Entry

Examples of audit procedures

Read Minutes of Meetings

Inquire of Legal Counsel

Obtain Management

Representation Letter

LO# 7

17-15

Review of Subsequent Events for Audit of Internal Control over Financial

Reporting

Auditors of public companies are responsible to report on any changes in internal control that

might affect financial reporting between the end of the reporting period and the date of the

auditor’s report.

LO# 7

17-16

Final Evidential Evaluation Processes

Perform final analytical procedures.

Evaluate entity’s ability to continue as a going

concern.

Obtain a representation letter.

Review working papers.

Final assessment of audit results.

Evaluation of financial statement presentation

and disclosure.

Obtain an independent review of the engagement.

LO# 8

17-17

Estimating Likely MisstatementsLO# 8

17-18

Going-Concern ConsiderationsLO# 9

17-19

Going-Concern ConsiderationsLO# 9

17-20

Going-Concern ConsiderationsLO# 9

17-21

REPRESENTATION LETTER

Auditing standards require that the auditor obtain a representation letter from management

The representation letter is signed by the CEO and CFO.

Management’s refusal to provide a management letter constitutes a scope limitation.

17-22

WORKING PAPER REVIEW

All working paper should be reviewed by an audit team member senior to the person preparing the working papers.

The reviewer must ensure that the audit was properly planned and supervised the evidence supports the audit objectives tested the evidence is sufficient for the type of audit

report issued.

17-23

INDEPENDENT PARTNER REVIEW

Most firm have a policy requiring that a concurring (or Second) partner review the financial statements for publicly traded companies and those financial statements that are expected to be widely distributed.

17-24

EVALUATE FINANCIAL STATEMENT PRESENTATION AND DISCLOSURE

The auditor must ensure that the financial statements comply with GAAP that there is proper presentation of accounts there is inclusion of all disclosures

Most CPA firms use some type of financial statement disclosure checklist.

17-25

Communications with Audit Committee and Management

Auditors are required to communicate to those charged with governance certain matters related to the conduct of the audit.

Auditor’s responsibility under GAAS.

Significant accounting policies.

Management judgments and accounting

estimates.

Significant audit adjustments.

Auditor’s judgments about the quality of the entity’s

accounting principles.

Disagreements with management.

Consultation with other accountants.

Major issues discussed with management before the auditor was retained.

Difficulties encountered during the

audit.

Fraud involving senior management and fraud that causes material misstatement of the financial

statements.

LO# 10

17-26

Archiving and RetentionSarbanes-Oxley Act and PCAOB’s Documentation Standard

• Requires audit firms to archive their public-company audit files for retention within 45 days following the time the auditor grants permission to use the auditor’s report in connection with the issuance of the company’s financial statements.

• Retain audit documentation for 7 years from the date of completion of the engagement, as indicated by the date of the auditor’s report, unless a longer period of time is required by law.

• Retain all documents that “form the basis of the audit or review.”

• Include in the audit file for significant matters any document created, sent, or received, including documents that are inconsistent with a final conclusion. Significant changes in audit plans or conclusions must also be documented.

LO# 8

17-27

Subsequent Discovery of Facts Existing at the Date of the Auditor’s Report

Notify the client that the auditor’s report must no

longer be associated with the financial statements.

Notify the client that the auditor’s report must no

longer be associated with the financial statements.

Notify any regulatory agency having jurisdiction

over the client that the auditor’s report can no longer be relied upon.

Notify any regulatory agency having jurisdiction

over the client that the auditor’s report can no longer be relied upon.

Notify each person known to the auditor to be relying

on the financial statements.

Notify each person known to the auditor to be relying

on the financial statements.

LO# 11

![[PPT]Microbiology Chapter 17 - Austin Community College … ppt/ch 17 ppt.ppt · Web viewMicrobiology Chapter 17 Chapter 17 (Cowan): Diagnosing infections This is wrap up chapter](https://static.fdocuments.in/doc/165x107/5aee76d27f8b9a572b8cc178/pptmicrobiology-chapter-17-austin-community-college-pptch-17-pptpptweb.jpg)