Chapter 17

description

Transcript of Chapter 17

11

Rittenberg/Schwieger/JohnstoneRittenberg/Schwieger/JohnstoneAuditing: A Business Risk ApproachAuditing: A Business Risk Approach

Sixth EditionSixth Edition

Chapter 17Chapter 17

Communicating Audit Communicating Audit and Attestation and Attestation

ResultsResultsCopyright © 2008 Thomson South-Western, a part of the Thomson Corporation. Thomson, the Star logo, and South-Western are trademarks used herein under license.

22

Audit Reports Audit Reports

Designed to promote clear communication between Designed to promote clear communication between auditor and financial statement reader by clearly auditor and financial statement reader by clearly statingstating What was audited and the division of responsibility: What was audited and the division of responsibility:

management for the financial statements and the auditor management for the financial statements and the auditor for expressing an opinion (introductory paragraph)for expressing an opinion (introductory paragraph)

The nature of the audit process (scope paragraph)The nature of the audit process (scope paragraph) Auditor's opinion on the fair presentation of the financial Auditor's opinion on the fair presentation of the financial

statements (opinion paragraph)statements (opinion paragraph) If an unqualified opinion cannot be expressed, reasons If an unqualified opinion cannot be expressed, reasons

why (explanatory paragraph)why (explanatory paragraph)

The fourth reporting standard requires auditors to The fourth reporting standard requires auditors to either express an opinion or state why an opinion either express an opinion or state why an opinion cannot be expressed cannot be expressed

33

What are the types of audit What are the types of audit reports? reports?

Standard unqualifiedStandard unqualified

Unqualified opinion with Unqualified opinion with modified wordingmodified wording

QualifiedQualified

AdverseAdverse

Disclaimer Disclaimer

44

The Standard Unqualified Report The Standard Unqualified Report

Statements present fairlyStatements present fairlyNo material departures from GAAPNo material departures from GAAPDisclosures are adequateDisclosures are adequateAll necessary audit procedures All necessary audit procedures

performed (no scope limitation)performed (no scope limitation)No change in GAAP with material No change in GAAP with material

impactimpactAuditor is independentAuditor is independentNo going concern problemsNo going concern problems

55

The Unqualified Report with The Unqualified Report with Modified Wording Modified Wording

Statements present fairly, but auditor wishes Statements present fairly, but auditor wishes to disclose additional informationto disclose additional information Substantial doubt about client being a going Substantial doubt about client being a going

concernconcern Change in accounting principlesChange in accounting principles Justified departure from GAAPJustified departure from GAAP Auditor wishes to emphasize particular event, Auditor wishes to emphasize particular event,

transaction, or subsequent occurrencetransaction, or subsequent occurrence Reference to other auditorsReference to other auditors Changes in comparative statements, such as Changes in comparative statements, such as

differences in the level of audit report or a differences in the level of audit report or a change in auditors where the predecessor's change in auditors where the predecessor's opinion will not be reissuedopinion will not be reissued

66

The Qualified ReportThe Qualified Report

Statements present fairly except Statements present fairly except for....for....Material unjustified departure from Material unjustified departure from

GAAPGAAP

Inadequate disclosureInadequate disclosure

Scope limitationScope limitation

77

The Adverse ReportThe Adverse Report

Statements, as a whole, do NOT Statements, as a whole, do NOT present fairlypresent fairly

Pervasive and material Pervasive and material unjustified departure from GAAPunjustified departure from GAAP

Lack of important disclosureLack of important disclosure

88

The Disclaimer of OpinionThe Disclaimer of Opinion

Auditor lacks independenceAuditor lacks independence

Scope limitationScope limitation

Substantial going concern Substantial going concern problemproblem

99

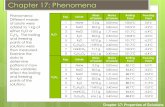

Modifications AffectingModifications Affectingthe Opinion the Opinion

Departure from GAAPDeparture from GAAP - whether the departure is - whether the departure is justified or unjustified, amount and pervasiveness of justified or unjustified, amount and pervasiveness of the misstatement, and potential impact of the misstatement, and potential impact of misstatements on statement users determines misstatements on statement users determines whether an unqualified, qualified, or adverse opinion whether an unqualified, qualified, or adverse opinion is issued.is issued.

Scope limitationScope limitation - imposed by client or circumstance, - imposed by client or circumstance, materiality of the amounts involved, auditor's ability materiality of the amounts involved, auditor's ability to form an opinion on the statements without the to form an opinion on the statements without the evidence determines whether qualified or disclaimer is evidence determines whether qualified or disclaimer is issuedissued

Going concernGoing concern - depending on auditor's assessment of - depending on auditor's assessment of client's ability to remain a going concern, auditor may client's ability to remain a going concern, auditor may issue unqualified opinion with modified wording, issue unqualified opinion with modified wording, qualified opinion, or disclaimqualified opinion, or disclaim

1010

Financial Statement ReviewsFinancial Statement Reviews

Sometimes a client does not need an audit. Sometimes a client does not need an audit. Practitioners can perform fewer procedures Practitioners can perform fewer procedures and report a lower, or no, level of assurance and report a lower, or no, level of assurance on the financial statements. The most on the financial statements. The most common of these financial statement common of these financial statement services are compilations and reviews.services are compilations and reviews.

The standards for compilations and reviews The standards for compilations and reviews of financial statements of non-public entities of financial statements of non-public entities are called Statements on Standards for are called Statements on Standards for Accounting and Review Services (SSARS)Accounting and Review Services (SSARS)

1111

Financial Statement Reviews Financial Statement Reviews (continued)(continued)

Inquiry and analytical procedures are Inquiry and analytical procedures are

performed for each significant performed for each significant

account balanceaccount balanceAccountant does NOT assess internal Accountant does NOT assess internal

control or perform substantive testscontrol or perform substantive tests

Provides limited assurance that Provides limited assurance that

accountant is not aware of any reporting accountant is not aware of any reporting

problemsproblems

Accountant must be independentAccountant must be independent

1212

CompilationCompilation Presents management information in financial Presents management information in financial

statement form without any form of assurancestatement form without any form of assurance The accountant must have general knowledge The accountant must have general knowledge

of client accounting records, accounting of client accounting records, accounting methods, and form and content of statementsmethods, and form and content of statements

The accountant is not required to perform The accountant is not required to perform procedures to verify, corroborate, or review procedures to verify, corroborate, or review client informationclient information

The accountant must read the statements to The accountant must read the statements to make sure they are free from obvious material make sure they are free from obvious material misstatementmisstatement

1313

If the accountant believes the statements are If the accountant believes the statements are incorrect, incomplete, or misleading, s/he must incorrect, incomplete, or misleading, s/he must obtain any additional information necessary to obtain any additional information necessary to prepare accurate statementsprepare accurate statements

Compiled statements may omit disclosures if Compiled statements may omit disclosures if the accountant believes the omission is not the accountant believes the omission is not done to mislead, and it is noted in the done to mislead, and it is noted in the compilation reportcompilation report

If the accountant is not independent of client, If the accountant is not independent of client, a separate paragraph is added to the a separate paragraph is added to the compilation report stating lack of compilation report stating lack of independenceindependence

Compiled statements may only be prepared Compiled statements may only be prepared for nonpublic entities.for nonpublic entities.

Compilation Compilation (continued)(continued)

1414

Reports on Other Financial Reports on Other Financial Information: Special ReportsInformation: Special Reports

Statements prepared on a comprehensive Statements prepared on a comprehensive basis other than GAAP (OCBOA)basis other than GAAP (OCBOA)

Reporting on specified elements, accounts, Reporting on specified elements, accounts, or items of financial statementsor items of financial statements

Reporting on compliance with aspects of Reporting on compliance with aspects of contractual agreements or regulatory contractual agreements or regulatory requirements related to audited financial requirements related to audited financial statementsstatements

Reporting on special-purpose financial Reporting on special-purpose financial presentations to comply with contractual presentations to comply with contractual agreements or regulatory provisionsagreements or regulatory provisions

Reporting on financial information Reporting on financial information presented in prescribed forms or schedulespresented in prescribed forms or schedules

1515

Interim Financial InformationInterim Financial Information

The SEC requires publicly traded The SEC requires publicly traded companies to have their quarterly companies to have their quarterly financial information reviewed by their financial information reviewed by their independent auditorsindependent auditorsReview procedures much the same as Review procedures much the same as

required by SSARSrequired by SSARSReporting on interim statements Reporting on interim statements

presented separatelypresented separatelyReporting on interim information Reporting on interim information

accompanying audited annual financial accompanying audited annual financial statementsstatements

1616

Reports on Other Financial and Reports on Other Financial and Non-Financial InformationNon-Financial Information

Prospective Financial StatementsProspective Financial Statements Forecasts and projectionsForecasts and projections May compile (no assurance) or examine May compile (no assurance) or examine

(positive assurance)(positive assurance)

Pro forma financial informationPro forma financial information Historical information adjusted for proposed or Historical information adjusted for proposed or

actual transactionsactual transactions

Compliance with laws and regulationsCompliance with laws and regulations Compliance with requirements of specified Compliance with requirements of specified

laws, regulations, rules, contracts, or grantslaws, regulations, rules, contracts, or grants Effectiveness of entity's internal control over Effectiveness of entity's internal control over

compliance with specified requirements compliance with specified requirements

1717

Evolving Assurance ServicesEvolving Assurance Services

In 1994, the AICPA established the In 1994, the AICPA established the Special Committee on Assurance Special Committee on Assurance Services to identify new assurance Services to identify new assurance services. The SCAS identified six services. The SCAS identified six services:services:Electronic Commerce Electronic Commerce Business Performance ManagementBusiness Performance ManagementHealth Care Performance Management Health Care Performance Management Risk AssessmentRisk AssessmentInformation Systems ReliabilityInformation Systems ReliabilityElder Care AssuranceElder Care Assurance

![[PPT]Microbiology Chapter 17 - Austin Community College … ppt/ch 17 ppt.ppt · Web viewMicrobiology Chapter 17 Chapter 17 (Cowan): Diagnosing infections This is wrap up chapter](https://static.fdocuments.in/doc/165x107/5aee76d27f8b9a572b8cc178/pptmicrobiology-chapter-17-austin-community-college-pptch-17-pptpptweb.jpg)