CHAPTER 14: MEASURING AND ASSIGNING COSTS FOR INCOME STATEMENTS Cost Management, Canadian Edition ©...

-

Upload

samuel-walker -

Category

Documents

-

view

224 -

download

0

Transcript of CHAPTER 14: MEASURING AND ASSIGNING COSTS FOR INCOME STATEMENTS Cost Management, Canadian Edition ©...

CHAPTER 14: MEASURING AND ASSIGNING COSTS FOR INCOME STATEMENTS

Cost Management, Canadian Edition

© John Wiley & Sons, 2009Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et al Slide # 1

Learning Objectives

© John Wiley & Sons, 2009

Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et alSlide # 2

• Q1: How are absorption costing income statements constructed?

• Q2: How are variable costing income statements constructed?

• Q3: What factors affect the choice of production volume measures for allocating fixed overhead?• Q4: How are throughput costing income statements constructed?

• Q5: What are the uses and limitations of absorption, variable, and throughput costing income statements?

© John Wiley & Sons, 2009Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et al Slide 3

Q1: How are absorption costing income

statements constructed?

Absorption Costing Income Statements

© John Wiley & Sons, 2009

Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et alSlide # 4

• Under absorption costing, fixed manufacturing overhead is an inventoriable cost.

• GAAP requires the use of absorption costing.

• Absorption costing income statements are prepared using the traditional format.– Expenses are grouped by function.– Manufacturing costs deducted above the

gross margin subtotal.– Nonmanufacturing costs deducted below the

gross margin subtotal.

Absorption Costing Income

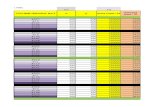

Statement ExampleRussell Corporation produces a product that sells for $10. In 2009, there were 10,000 units in beginning finished goods inventory that had a per unit cost of $4.45. The company expected to produce, and actually did produce, 80,000 units, and 62,000 units were sold. The costs incurred in 2009 are shown below. Given the cost information below, compute the inventoriable costs per unit under absorption costing.

2009Direct materials $60,000 Direct labour 128,000Variable factory overhead 68,000Variable non-mfg costs 55,800Fixed mfg overhead 100,000Fixed non-mfg costs 70,000

© John Wiley & Sons, 2009Chapter 14: Measuring and Assigning Costs for Income

StatementsCost Management, Cdn Ed, by Eldenburg et al

Slide # 5

Direct materials $0.75 Direct labour 1.60Variable mfg overhead 0.85Fixed mfg overhead 1.25

$4.45

Absorption Costing Income

Statement ExampleSuppose that the Russell Corporation uses the FIFO inventory method. Prepare an absorption costing income statement for 2009.

© John Wiley & Sons, 2009

Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et alSlide # 6

Note that cost of goods sold is based on the 2009 per-unit manufacturing costs because:

(1) Cost per unit was the same in 2008 and 2009. If cost had been different in 2008, 10,000 of the 62,000 units sold would be recorded at the per unit cost in 2008

Sales (# units sold @ $10) $620,000 Cost of goods sold (# units sold @ $4.45) 275,900Gross margin 344,100Nonmfg costs ($70,000 + $55,800) 125,800Operating income $218,300

Sales (# units sold @ $10) $620,000 Cost of goods sold (# units sold @ $4.45) 275,900Gross margin 344,100Nonmfg costs ($70,000 + $55,800) 125,800Operating income $218,300

© John Wiley & Sons, 2009Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et al Slide 7

Q2: How are variable costing income

statements constructed?

Variable Costing Income Statements

© John Wiley & Sons, 2009

Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et alSlide # 8

• Under variable costing, fixed manufacturing overhead is a period cost.

• Variable costing income statements are used internally only.

• Variable costing income statements are prepared using the contribution format.– Expenses are grouped by cost behaviour.– Variable costs deducted above the

contribution margin subtotal.– Fixed costs deducted below the contribution

margin subtotal.

Variable Costing Income Statement Example

Russell Corporation produces a product that sells for $10. In 2009, there were 10,000 units in beginning finished goods inventory, with a per unit variable cost of $3.20. The company expected to produce, and actually did produce, 80,000 units, and 62,000 units were sold. The costs incurred in 2009 are shown below. Compute the inventoriable costs per unit under variable costing.

2009Direct materials $60,000 Direct labour 128,000Variable factory overhead 68,000Variable non-mfg costs 55,800Fixed mfg overhead 100,000Fixed non-mfg costs 70,000

© John Wiley & Sons, 2009Chapter 14: Measuring and Assigning Costs for Income

StatementsCost Management, Cdn Ed, by Eldenburg et al

Slide # 9

Direct materials $0.75 Direct labour 1.60Variable mfg overhead 0.85

$3.20

Variable Costing Income Statement Example

Suppose that the Russell Corporation uses the FIFO inventory method. Prepare a variable costing income statement for 2009.

© John Wiley & Sons, 2009

Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et alSlide # 10

Note that per unit cost was the same in 2008 and 2009 which is why COGS did not factor in separate costs for the 10,000

2008 units and the 52,000 2005 units.

Sales (# units sold @ $8) $620,000 Variable costs:Cost of goods sold (# units sold @ $3.20) 198,400Nonmfg variable costs 55,800Contribution margin 365,800Fixed costs:Fixed mfg overhead 100,000Fixed nonmfg costs 70,000Operating income $195,800

Sales (# units sold @ $8) $620,000 Variable costs:Cost of goods sold (# units sold @ $3.20) 198,400Nonmfg variable costs 55,800Contribution margin 365,800Fixed costs:Fixed mfg overhead 100,000Fixed nonmfg costs 70,000Operating income $195,800

Variable Costing Income Statement Example

Suppose that the Russell Corporation uses the FIFO inventory method. Reconcile the income under variable costing you determined on the prior slide with the $218,300 income under absorption costing computed on slide #4.

© John Wiley & Sons, 2009

Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et alSlide # 11

Variable costing income $195,800

Add: fixed overhead attached to the increase in inventory

(18,000 units x $1.25/unit) 22,500

Absorption costing income $218, 300

© John Wiley & Sons, 2009Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et al Slide 12

Q3: What factors affect the choice of production

volume measures for allocating fixed overhead?

Actual versus Estimated Denominator Levels

© John Wiley & Sons, 2009

Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et alSlide # 13

• Normal costing (chapter 5) uses an estimated, rather than an actual, denominator level for the overhead cost allocation base.• If an actual denominator level is used, information is not timely.

• Using an estimated denominator level provides a smoothing effect, for two reasons:– Numerator reason– Denominator reason

Various Measures of Production Volume

© John Wiley & Sons, 2009

Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et alSlide # 14

• Supply-based measures of capacity:– The maximum possible capacity, with no

allowance for downtime, is known as theoretical capacity.

– Theoretical capacity, reduced by an allowance for normal downtime, is known as practical capacity.

• Demand-based measures of capacity:– The average use of capacity of several

years is known as normal capacity.– The anticipated use of capacity for the

upcoming year is known as budgeted capacity or expected capacity.

Effect of Denominator Volume

on the Income Statement

© John Wiley & Sons, 2009

Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et alSlide # 15

• When denominator volume is different than actual volume, there is a fixed overhead volume variance.

• The volume variance is the difference between budgeted fixed overhead and applied fixed overhead.

• If material, the volume variance is closed to work in process, finished goods, and cost of goods sold at year-end.

Absorption Costing Income Statement & Volume

Variance ExampleRussell Corporation produces a product that sells for $10. In 2009, there were 10,000 units in beginning finished goods inventory. The company expected to produce 100,000 units in 2009. However, it actually produced 80,000 units and sold 62,000 units. The costs incurred in 2009 are shown below. Compute the inventoriable costs per unit under absorption costing.

2009Direct materials $60,000 Direct labour 128,000Variable factory overhead 68,000Variable non-mfg costs 55,800Fixed mfg overhead 100,000Fixed non-mfg costs 70,000

© John Wiley & Sons, 2009Chapter 14: Measuring and Assigning Costs for Income

StatementsCost Management, Cdn Ed, by Eldenburg et al

Slide # 16

Direct materials $0.75 Direct labour $1.60 Variable mfg overhead $0.85 Fixed mfg overhead $1.00

$4.20

Note that choice of denominator level affects only the fixed overhead cost per unit.

Absorption Costing Income Statement & Volume

Variance ExampleSuppose that the Russell Corporation uses the FIFO inventory method and that the volume variance is considered material. Assume that the balances in WIP, FG, and CGS, before any adjustment for the volume variance, were at a ratio of 1:2:7 at 12/31/09. There was no fixed overhead spending variance in 2009. Compute the volume variance and prepare the year-end entry to close the fixed overhead control account.

© John Wiley & Sons, 2009

Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et alSlide # 17

Note that the unfavourable volume variance equals the underapplied fixed overhead because there was no spending

variance for fixed overhead.

Budgeted fixed overhead $100,000Fixed overhead applied (80,000 units x $1/unit) 80,000Unfavourable fixed overhead volume variance $20,000

Fixed overhead control 20,000Work in process [(1/10) x 20,000] 2,000Finished goods [(2/10) x 20,000] 4,000Cost of good sold [(7/10) x 20,000] 14,000

Absorption Costing Income Statement

& Volume Variance ExampleUsing the cost information on slide #8 and the volume variance you calculated on the prior slide, prepare an absorption costing income statement for 2009.

© John Wiley & Sons, 2009

Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et alSlide # 18

Sales (# units sold @ $10) $620,000 Cost of goods sold: (# units sold @ $4.20) $260,400 Adjustment for volume variance 14,000 274,400Gross margin 345,600Nonmfg costs ($70,000 + $55,800) 125,800Operating income $219,800

Sales (# units sold @ $10) $620,000 Cost of goods sold: (# units sold @ $4.20) $260,400 Adjustment for volume variance 14,000 274,400Gross margin 345,600Nonmfg costs ($70,000 + $55,800) 125,800Operating income $219,800

© John Wiley & Sons, 2009Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et al Slide 19

Q4: How are throughput costing income

statements constructed?

Throughput Costing Income Statements

© John Wiley & Sons, 2009

Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et alSlide # 20

• Under throughput costing, all manufacturing costs except direct materials are period costs.

• Throughput costing income statements are used internally only; useful when most manufacturing costs are not variable in the short run.

• Throughput costing income statements are prepared using a new format.– Sales – cost of goods sold (direct materials

only) = throughput margin

Throughput Costing Income Statement Example

Russell Corporation produces a product that sells for $10. In 2009, there were 10,000 units in beginning finished goods inventory with per unit costs that were the same as those experienced in 2009. The company expected to produce, and actually did produce, 80,000 units, and 62,000 units were sold. The costs incurred in 2009 are shown below. Suppose that the Russell Corporation uses the FIFO inventory method. Prepare a throughput costing income statement for 2009.

2009Direct materials $60,000 Direct labour 128,000Variable factory overhead 68,000Variable non-mfg costs 55,800Fixed mfg overhead 100,000Fixed non-mfg costs 70,000

© John Wiley & Sons, 2009Chapter 14: Measuring and Assigning Costs for Income

StatementsCost Management, Cdn Ed, by Eldenburg et al

Slide # 21

Sales (# units sold @ $8) $620,000 Cost of goods sold (# units sold @ $0.75) 46,500Throughput margin 573,500All other costs:Direct labour 128,000Variable mfg overhead 68,000Fixed mfg overhead 100,000Variable nonmfg overhead costs 55,800Fixed nonmfg costs 70,000Operating income $151,700

Note that DL and VO costs expensed

based on units produced, not units

sold

Sales (# units sold @ $8) $620,000 Cost of goods sold (# units sold @ $0.75) 46,500Throughput margin 573,500All other costs:Direct labour 128,000Variable mfg overhead 68,000Fixed mfg overhead 100,000Variable nonmfg overhead costs 55,800Fixed nonmfg costs 70,000Operating income $151,700

Throughput Costing Income Statement Example

continuedReconcile the income under throughput costing you computed on the prior slide to the income under variable costing computed on slide #8 and to the income under absorption costing computed on slide #5.

© John Wiley & Sons, 2009Chapter 14: Measuring and Assigning Costs for Income

StatementsCost Management, Cdn Ed, by Eldenburg et al

Slide # 22

Throughput costing income $151,700

Add: Costs attached to the increase in inventory:

Direct labor (18,000 units x $1.60/unit) 28,800

Variable overhead (18,000 units x $0.85/unit) 15,300

Variable costing income $195,800

Add: fixed overhead attached to the increase in inventory

(18,000 units x $1.25/unit) 22,500

Absorption costing income $218, 300

Throughput costing income $151,700

Add: Costs attached to the increase in inventory:

Direct labour (18,000 units x $1.60/unit) 28,800

Variable overhead (18,000 units x $0.85/unit) 15,300

Variable costing income $195,800

Add: fixed overhead attached to the increase in inventory

(18,000 units x $1.25/unit) 22,500

Absorption costing income $218, 300

© John Wiley & Sons, 2009Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et al Slide 23

Q5: What are the uses and limitations of absorption, variable, and throughput

costing income statements?

Uses and Limitations of the Three Income

Statement Methods

© John Wiley & Sons, 2009

Chapter 14: Measuring and Assigning Costs for Income Statements

Cost Management, Cdn Ed, by Eldenburg et alSlide # 24

• Absorption costing is used for external reporting but may not be best for performance evaluation purposes.• Variable and throughput costing avoid incentives to build up inventory levels.

• Throughput costing may be useful for some short-term decision making.

• Under absorption costing, if practical capacity is used as the denominator level,– the fixed overhead rate is a useful measure of

the cost of capacity, and– the volume variance helps measure the use of

capacity.

Copyright

Copyright © 2009 John Wiley & Sons Canada, Ltd. All rights reserved. Reproduction or translation of this work beyond that permitted by Access Copyright (The Canadian Copyright Licensing Agency) is unlawful. Requests for further information should be addressed to the Permissions Department, John Wiley & Sons Canada, Ltd. The purchaser may make back-up copies for his or her own use only and not for distribution or resale. The author and the publisher assume no responsibility for errors, omissions, or damages caused by the use of these programs or from the use of the information contained herein.

© John Wiley & Sons, 2009

Slide 25Chapter 14: Measuring and Assigning Costs for Income

StatementsCost Management, Cdn Ed, by Eldenburg et al