CHAPTER 14 ECONOMIC INSTABILITY GDP, BUSINESS CYCLE, AND FLUCTUATIONS.

-

Upload

amelia-hawkins -

Category

Documents

-

view

215 -

download

0

Transcript of CHAPTER 14 ECONOMIC INSTABILITY GDP, BUSINESS CYCLE, AND FLUCTUATIONS.

CHAPTER 14

ECONOMIC INSTABILITY

GDP, BUSINESS CYCLE, AND

FLUCTUATIONS

MEASURING THE NATION’S OUTPUT• GROSS DOMESTIC PRODUCT (GDP)

• GDP= the dollar amount of all final goods and services (both private and public) produced within a country’s borders within 1 calendar year.

• Until the 1930s--no measure for calculating the growth and value of the economy.

• Nobel Prize winner Simon Kuznets—GNP (Gross National Product).

• Recently, the GNP has been replaced by the GDP.

• It is based on data collected by the Bureau of Economic Analysis an agency of the Dept. of Commerce.

WORLD RANK (GDP)• 2008 2012 IMF • 1. European Union $18.3 trillion 16.5• 2. USA 14.2 15.7• 3. Japan 4.9 5.9• 4. China 4.4 8.2• 5. Russia 1.2 Germany 3.4

COMPUTING THE GDP• CALCULATING GDP:

• Add the prices of all finished goods and services (including agricultural products) produced in a 12 month period.

• GDP: THE MEASURE OF NATIONAL OUTPUT• Anything built in the US even if it is a foreign owned company

is counted as part of the GDP.• ***Products made in American owned plants in foreign countries are not

counted as part of the US GDP.

• For statistical reasons the data is divided into 3 categories:• 1. Goods—manufactured products, agricultural products• 2. Services– (ex) haircuts, legal advice, medical care, etc.• 3. Structures– (ex) houses, apartments, commercial bldgs.• GDP estimates come out quarterly.• The real value takes up to 3 years to calculate.• Items excluded from the GDP:

– Intermediate products– Second-Hand Sales– Non-market Transactions

Gross national product (GNP)

INTERPRETATION OF THE GDP

• GDP statistics are both good and bad. • The “good”—

– An increased GDP indicates more jobs, higher employment, more income.

• The “bad”—– GDP does not indicate the quality of life.– It does not take into consideration the environmental impact of the

growth.– If GDP does not grow it has political implications. Presidents have

lost re-elections due to a drop in the GDP.• POPULATION GROWTH

• Why population statistics are important to society:• US population:• Decennial Census• Bureau of the Census:

– Trends: family size, regional distribution, age, race

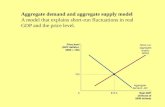

THE BUSINESS CYCLE• Definition:

• Phases of the Business Cycle:

– RECESSION

– TROUGH

– EXPANSION (recovery)

– PEAK

– DEPRESSION

– TREND LINE

• Historic Business Cycles in US:

– PANIC 1819

– PANIC 1837

– PANIC OF 1907

– POSTWAR WW1 RECESSION 1921

– “ROARING 20S”

– GREAT DEPRESSION 1929-1941

– WARTIME BOOM 1941-1945

– POSTWAR PROSPERITY 1950-1970

– “DOT COM” BOOM 1995-2001

– HOUSING MARKET CRASH 2007

PEAKRECESSION

DEPRESSION

TREND LINE

EXPANSION

TROUGH

CAUSES OF BUSINESS CYCLES• THERE IS NO CERTAIN ANSWER FOR THE CAUSES, BUT THERE ARE

MANY THEORIES:• 1. CAPITAL EXPENDITURES

– IF FUTURE SALES LOOK GOOD--INCREASED INVESTMENT IN CAPITAL GOODS (EQUIPMENT AND FACTORIES).

– IF FUTURE SALES LOOK DOWN—INVESTMENT IS PULLED BACK WHICH CAUSES LAY-OFFS IN CAPITAL GOODS MARKET.

• 2. INVENTORY ADJUSTMENTS– CHANGES IN BUSINESS INVENTORY.– SLIGHTEST SIGN OF A WEAKENING ECONOMY COMPANIES CUT

BACK INVENTORY.• 3. INNOVATION AND IMITATION

– NEW INNOVATION STIMULATES AND CHANGES A MARKET.– ONCE THE INNOVATION BECOMES THE NORM, INVESTMENTS

DROP AND AN ECONOMIC SLOWDOWN FOLLOWS• 4. EXTERNAL SHOCKS

– INCREASE IN OIL PRICES (OPEC), WAR, INTERNATIONAL CONFLICT

• 5. MONETARY FACTORS– CHANGE IN INTEREST RATES.– DROP IN INTEREST RATES INCREASE BORROWING AND

INVESTMENT.—Loose Money Policy by the FED.– INCREASE IN INTEREST RATES DECREASE BORROWING AND

INVESTMENT—Tight money policies by the FED

PREDICTING BUSINESS CYCLES• THERE ARE TWO MODELS USED BY ECONOMISTS TO

PREDICT THE BUSINESS CYCLE:• 2012 2nd Qtr. prediction was 2.7 billion increase.• The estimate was $2.2 billion.• 1. Econometric Models—

– A. Macro-economic model.– B. Uses algebraic equations to describe economic

behavior.• GDP= C+I+G+F• C= CONSUMER SPENDING ON GOODS AND SERVICES • (groceries, rent, books, cars, clothes, etc)• I= BUSINESS INVESTMENT (money spent on capital goods)• G= GOVERNMENT SPENDING (defense, social security,

interest payment on the debt, health care, roads, education)

• F= FOREIGN SALES ( exports)– ECONOMISTS THEN COMPARE THEIR MODEL TO THE

REAL WORLD AS THE QUARTER UNFOLDS.

• 2. Index of Leading Indicators– A. These are 9 statistical categories that normally drop

before the GDP drops or rise before the GDP rises.

PREDICTING THE BUSINESS CYCLE cont’d

• (INDEX OF LEADING INDICATORS)• These indicators (taken as a group) are good at predicting

severe downturns.• They have also predicted recessions that never happened

—1966, 1980s, and 1995.• The Index of the 9 Leading Indicators are:• 1.-average workweek• 2.-initial jobless claims• 3.-manufacturers’ new orders for consumer goods.• 4.-vendor performance• 5.-building permits• 6.-level of the S & P Index• 7.-inflation adjusted measure of M2• 8.-interest rate spread between 10 Yr. Treasury Notes and Fed.

Funds rate• 9.-expectations portion of Univ. of Michigan’s Consumer

Sentiment Index