Chappuis Halder - Model validation review

-

Upload

augustin-beyot -

Category

Economy & Finance

-

view

213 -

download

1

description

Transcript of Chappuis Halder - Model validation review

Model validation review

2

Agenda

Our expertise in model validation| Models in the value chain1

3 Introduction to CH&Cie. Focus on Global Risk Reseach & Analytics (GRA)

Our approach to model review | An integrated, iterative and proven2

3

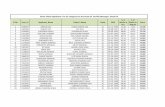

Finance delegates to CIB Finance the supervision of the entire P&L and valuation control process CIB Finance responsibility is carried out through “CIB Financial Control” and the coordination of the

governance structure CIB Financial control is a “global” finance control function which is responsible for supervision of the

entire Valuation and P&L Control framework (which includes 1st and 2nd level controls) across capital market activities, global coordination (prepares and drives the monthly Committees that examine all issues relating to valuation, P&L and system booking)

The responsibility is shared by many players, each of them is responsible for their respective perimeter

Operations

Front Office

Risk

Finance

Middle Office & Product control

Back Office

Global FinanceHeadquarter

Global Finance Control

CIB Local Finance

Global Finance Control

Local

1

2

3

4Based on the charter of responsibilities, which defines the breakdown of responsibilities on the valuation and P&L controls, the organization is placed under the supervision of the Finance function Finance guarantees the

production and the quality of the Group financial statements and Group Management accounts

Finance uses to delegate the production and control of the financial instruments’ fair value, to the various participants

Finance delegates to Risk the authority to control the fair value of the financial instruments booked in the Group accounts (models, parameters)

Our expertise in model validation| Models in the value chainGeneral Overview: Functional organization & delegation principles

4

Ensure correct representation of operations in the official systems

Determine the market parameters to be used and ensure their daily contribution

Contribute to the observability assessment work

Propose modifications to the models and valuation methodologies

Supervise model implementation work

Contribute to the economic P&L validation

Are responsible for the implementation of the FO systems that are secure and that fulfil the control objectives.

Front Office

Finance

Operations

Risk

Define the adequate economic valuation methodologies and establish a reserve policy covering model, parameter and liquidity risks

Approve and review the models used by the Front Office

Draw up and maintain the “models/products” mapping

Contribute to the controls over deal representation in the systems, when no booking rules have been set

Have authority over the observability status of market parameters and products

Are directly responsible for the control of the non-standard market parameters, and are responsible for assisting Operations in the implementation of the standard parameter controls

Determine reserves.

Ensure that the deal representation in the official systems are compliant with a set of pre-defined rules

Ensure that transaction details booked by the FO that impact the economic revaluation are properly reconciled with thecontractual terms

Validate the “standard” market parameters

Contribute to the reserves calculation process (under the responsibility of RCM)

Produce, analyse and validate (substantiate) the official P&L

Contribute to the reconciliation between the accounting P&L and the economic P&L

Contribute to calculation of the Day One P&L adjustments

Ensure the accurate processing of operations (i.e. clearing and settlement, payment and cash management, confirmations)

Perform operational controls (i.e. resolution of unsettled deals, reconciliation of cash and securities movements withclearer/custodian/ broker)

Middle Office & Product Control

Back Office

Ensure the supervision of the entire Valuation and P&L Control framework (first and second level controls) through theconsolidation and analysis of the reports received from all the contributors to the Valuation and P&L Control Chain

Prepare and coordinate the monthly and quarterly meetings.

Coordinate the governance structure, namely monthly P&L and quarterly executive

Headquarter

Local Perform the first level controls that are within the Finance area, notably accounting controls;

Perform the reconciliation between accounting and economic P&Ls,

Assume the entity-specific part of the “CIB Financial Control” supervision mandate

1

2

3

4

Our expertise in model validation| Models in the value chainFocus on mission statements (Key responsibilities)

5

Front Office

BackOffice

Finance

Risk

MISSION STATEMENTPROCESS

TRANSACTION APROVAL

DEAL EXECUTION AND BOOKING

MODELS(Initial development, implementation in

the systems and Model control framework)

RESERVES AND VALUATION ADJUSTMENTS POLICY

MARKET PARAMETERS VALIDATION

P&L PRODUCTION

Transactions are approved by product lines (New Product and Transaction Approval Committees)

Responsible for 1st level controls oncomplex deals booking

Responsible for the model control framework (approval, review and mapping)

Responsible for uncertainty or liquidityreserves valuation

Responsible for controls defined in the flowcharts of official market parameters Responsible for controls on “non standard” parameters

Validate the observability status ofparameters (for the Day One P&Ladjustments)

Model conception & implementation• Formally approve any new valuation model or

modification of valuation methodology followinga specific procedure (supervise back-testing andnumerical tests performed by Research/ITteams)

• Assess the validity of the model’s theoreticalrepresentation and the adequacy of the modelto the product to which it applies

• Review the results of tests on reliability andquality of the IT code, and has authority to askthat further testing is carried out and

• Finally approve the use of this model for officialvaluation (go-live)

2. Model operational use• Is responsible for the setting and the

maintenance of the list of official (authorised)models, that includes the numericalconfigurations, the calibration procedure and/orset, and the official usage rules (scope ofproducts to which a model applies through theproduct/model mapping)

• Is in charge of verifying that the valuation modelused for off-systems deals is adequate (inaccordance to the product/model mapping)

• Performs specific controls on deals which haveno models or specific characteristics (reserves,limits…)

Zoom # 1

Zoom # 2

Our expertise in model validation| Models in the value chainA complex control framework: Zoom on the risk function

6

Model Design Model Validation Analytics Business valuation Expert interventions

1 Expertiseand experience

2 Benchmarkand Best practices

3 Networkand people

Corresponds to the

validation of a model ,

methodology or all or part

of an implementation

model (BT , Stress ... )

Consists in the design

/ construction of a

model or a dominant

quantitative

methodology

Reflects the policy of

development and innovation

in academic subjects

(publications *) or more

operational (applied like CVA

desk research).

Results in quantitative work

but support interventions

trades vocation ( collection

efficiency , performance of

grant impact simulation, ... )

Corresponds to highly specialized

missions, requiring expert

interventions, targeted, quick,

effective and whose ultimate

impact should be detailed

Objectivethe effective resolution of quantitative issueswith environmental / constraints of the bankin mind

ObjectivePosition the bank in a competitiveenvironment, direct the bank to best in classpractices

ObjectiveHaving a network of experts to keep up withthe market and its evolutions, keep up tospeed with market and regulatorydevelopments

5 major types of intervention around quantitative subjects ...

... Based on three pillars*Electronic versions of our white papers are available at http://www.chappuishalder.com/publications/

Our expertise in model validation| Models in the value chain3 pillars for 5 major types of missions

7

Model maintenance and validation techniques

Benchmarking

Find a price based on a benchmark established

1

Methodological review

Detailed review of the methodology used for

pricing ( particularly used for illiquid products)

Independant Back-testing

Find an acceptable price range from a set of external data ( sellers or benchmarks)

4

Re-performance

Find a prize by replicating the same methodology (or similar)

Analytical review

Price quotations obtained from third party sources

2 3

Conformity of the model with regulatory requirements and market practices

Regulatory watch

6

Documentation

Organizational mapping , functional, technological and conditions of validity of the models by asset class and information system

Rationalization et synergies

For convergence and pooling

9 10

Market practice

Identify the model adapted to best practices ( FVA , OIS discounting ...)

Flexibility

This census drivers of change for an adaptable model

Model- Based Pricing vs Market based pricing

7 8

5

CH & Cie has a robust methodology to understand the complexity of models and adapt to regulatory changes andmarket practices (eg calibration , stress testing , back testing ...)

Our expertise in model validation| Models in the value chainEffective and easily replicable methodology

8

Modelisation

Model validation• Model quality

o Ease of use and integration ( speed of calculation and calibration

• Model relevance o Y a-t-il un risque de modèle ?

• Flexibility of the model vis-à -vis the regulatory constraints and market practiceso Can the model easily integrate new

regulatory bias?o Can the model serve the business to

operate as « best in class »

Pricing methodology validation• Model practicality

o From a continuous to a discreteseries

o From a continuous to a discreteprojection

• Calibration and pricing methodologyimplementation

• Calculation of sensitivities and comparison with other models already on instruments calibrated

Model design and conceptual soundness• Validity and robustness of the assumptions and inputs

o For instance, is the model performing in a low rate and volatility market regime• Representativeness of output

o Is the model able to represent the risks in line with expectations

Model documentation and maintenance• Maintenance process review

o E.g. daily margin coverage, back testing• Is documentation up to date with latest

evolutionso E.g. Model in compliance with the

recommendations of the regulator

Model calibration• Under which conditions the model is

(in)effective and (in)valid it ?o Back testing et stress testing

• Quelles sont ses limites?o E.g. Pricing shortcut?

Our expertise in model validation| Models in the value chainCH & Cie controls the entire cycle of model construction and can assess its quality

9

MODEL VALIDATION PROBABLITIES & PARAMETERS REVIEW

An example of audit points on a FX rate model review - on emerging currency with jumps in FX- .

Exposure computation from Market Data : forwhich distribution profile ?Pricing transactions to compute exposure and futureexposure (stressful behavior)

Are models Consistent ?Correlations between the processesShort term risk-free Interest and FX Rates diffusion process

Risk Neutral or Actual Probability ?

How Other parameters are calibrated?Volatilities (implied market or historical volatilities)Correlations

What is the behavior for each market data ?Current and Future market conditions from diffusion processesOne or many factors processes (with a log-normal (Brownianmotions), Jumps (Poisson Processes), …Full pricing or proxies ?

Full pricing using official valuation modelsValuation models are transaction specific Hence may be different from diffusion models

Proxies for performance issues ?Simplified analytic, semi analytic, Monte Carlo, …valuationsConservative measure of the risk

Riskneutral

LGM Diffusion model for IR- Brownian factors

- Mean reverting- Volatility term structure

FX volatility from FX ATM option prices or historical data

Correlation from historical data

Jumps from historical data or economic analysis proposed by Fixed Income Market / Economic Research and Validated by Risk & Permanent Control

1

2

4

5

3

Usually, it is rather theunderlying assumptionsrather than the modelsthemselves that are reviewedand challenged.

Stability, robustness andperformance (especially undera stress / adverseenvironment) are thefundamental criteria ratherthan the exact fair price => Toavoid arbitrage, rogue trading,imperfect hedging strategy orP&L swings

Our expertise in model validation| Models in the value chainBenchmark and best practices within the market risk department

10

Agenda

3

Our approach to model review | An integrated, iterative and proven2

1 Our expertise in model validation | Models in the value chain

3 Introduction to CH&Cie. Focus on Global Risk Reseach & Analytics (GRA)

11

Market Model review

Review of MtModel

consistency & robustness

Review of Model and

pricing system

Mapping &

output analysis

Analytical review

of model results

Gap analysis of

key parameters

Dif ferences

explanation

Data

quality

Inputs /

componentsModel design

Design

benchmark

Calculation

process

Closed FormulaMonte Carlo

simulationsTrees / other …

Scenarios

review

Simulations

convergence

Market Risk

parametersOther Risk

Market direct

access

No access =>

MtModel

Partial access /

Smoothng /

interpolation

LquidityMaret

volatlity /

stress

CVA/DVACross

gamma

effect

Step 2:

Review global

methodology

Step 1:

Preliminary

diagnosis

Step 3: detailed review of a core

component

Arbitrage

…

Correlation

Step 2:Review global Methodology

Step 1:Preliminary Diagnostic

Step 3:Detailed review of the core components

This approach is also designed to address regulatory expectations

Our approach to model review | An integrated, iterative and provenA vertical integration in business

12

Our approach to model review | An integrated, iterative and provenFrom a quantitative tool to a more business oriented instrument with strategic guidance

Qualitative process:

Qualitative review and management oversight

Model operating environment

Systems implementation

Data quality checks

Examination of assumptions

Quantitative process:

Review of input and parameters

Model replication

Benchmarking and hypothetical portfolio testing

Back testing and stress testing• Profit and loss attribution

Model documentation and its review

Review of theoretical soundness

Review of model implementation (including systems and data quality)

Review of model inputs

Review of model assumptions, limitations and usage

Implementation and review of model controls

Environment analysis:

Vacuum of the snapshot

Heterogenity & asynchronicity

To validate a model is not strictly limited to a

quantitative review. The environment and

the internal organisation’s « fit » is

also tested

Reviewing a model should encompass:

The model operating environment includes:

13

Is the model answering all the

bank expectations?

What is the trading strategy? What are the criteria for validating a model?

Risk of mispricing? (new model, strong assumptions, strong hypothesis …)

Very sensitive model? (Greeks and parameter sensitivities are high …)

Risk of P&L swings? Easy to Hedge or not? Very expensive to hedge?

Complex to follow or not? (change in portfolio composition / change in the underlying maturities …)

Risk of arbitrage?

No benchmark? Mark to Model? (no market price, partial quotes …)

Illiquid market? (higher bid-ask spreads…)

Instability of the model under stress conditions?

Regulatory risk? (Arbitrage in ISDA or CSA contracts …)

Capital requirement is too high? (Basel III, cash collateral requirements …)

Avoid gamma holes When volatility is high, gamma is high,

hedging is expensive Large gamma may show imperfect hedge and

possible jumps in PnL (barrier options) When gamma changes sign (spread options),

delta hedge is not possible

Monetize variance risk premia Sell implied, buy realized volatility by creating

a flat dollar gamma portfolio, go long gamma

Volatility term structure arbitrage After the crisis we expect short volatility to

decrease and long volatility to increase Sell short volatility, buy long volatility by delta

hedged straddles

Smile arbitrage Volatilities are extremely volatile, but volatility

smile is always flat Sell straddle, buy butterfly

Monetize liquidity risk premium Borrow on short-term, lend on long-term

…

Our approach to model review | An integrated, iterative and proven Critical choices and model functions needs to be tested

14

Our approach to model review | An integrated, iterative and proven Model review objectives served by CH&Cie powerful tools

The objectives of the review are to:

To ensure your model meets each requirement of the regulation (including technical standards);

To ensure the quality and soundness of the modelling principles on which your framework is based;

To gain comfort on the model calibration, back-testing and stress-testing of the margins;

To identify the model limits and if needed assess the materiality of lump add-ons required to cover the risk; and

To the extent feasible, propose a benchmark analysis and suggest state-of-the-art enhancements.

Model mappingModel validation guide

Sample of tools developped by CH&Cie & Cie for model validation

15

Our approach to model review | An integrated, iterative and proven Model review phased approach

By or across product lines, CH&Cie is reviewing model documentation and testing methodology performed by internal teams with the following phased approach:

Liaise with institution market risk manager to obtain detailed model methodology/policy and validation documentation. This should contain:

• Rationale for the selected model

• Key model assumptions and provisions

• Data sources, parameter definition and model calibration procedures

• Calculation framework and frequency

Identify institution existing VaR testing procedures to review scope, relevance and results under calibrated parameters (market regime, confidence level, look back period…)

• Assess risk factor relevance, return calculation, depth and source

• Define standard parameters and calibrate model accordingly

• Compare VaR and expected shortfall

Prepare test scenarios that can be run independently to verify VaR impact and model performance (back testing, input parameter sensitivity, stress testing) and compare with institution results. For instance, we will “fine-tune” parameters such as:

• Risk measure/number of breaches, confidence level, look-back period, scale vol, correlations, decay factor…

• Description of the tests performed

Sample a representative portfolio and simulate scenarios for additional comparison between institution and CH&Cie model, using back testing at risk factor level.

16

Our approach to model review | An integrated, iterative and proven Model review deliverables

This model review shall include:

An evaluation of the conceptual soundness of the model and framework;

A review of the on-going monitoring procedures such as daily margin coverage and back-testing;

A review of the parameters and assumptions made in the development of its models, their methodologies and the framework including an assessment of the theoretical and empirical properties of the margin model;

A review of the adequacy and appropriateness of the models, their methodologies and framework adopted in respect of the type of contracts they apply to;

A review of add-ons to the base model;

An analysis of the outcomes of testing results against institution performance criteria;

A review of the diversification benefits of the model;

A review of the margin period of risk;

An assessment of pro-cyclical effects and how such affects are mitigated;

An assessment of margin model sensitivity to the material risk factors and correlations to which the institution is exposed;

A review of pricing models; and

A review of model documentation

17

Our approach to model review | An integrated, iterative and proven Our recent work in modeling : one of the richest experiences in the street

Risk management

andmodelling

Accompanying the proposedimplementation of IMM models (EPE ... )

• French Commodity house• Price dissemination and pricing

models

• Validation of the relevance / consistency of technical responses by client• Review and validation of measurement methodology and monitoring of

PD parameter and writing a report ACP

Review of VaR models and CVaR forseveral financial institutions

• Tier 2 financial institutions • VaR MC, historical et parametric+ Stress test + inputs• Documentation

Detailed diagnosis of the modelling ofthe EPE of a large French CIB

• French CIB (under CRD4 constraints

• Price dissemination model review• Comparison standard market practices (benchmark)

Assist in reviewing the ACPRrecommendations for approval of theinternal counterparty risk model

• French CIB (namely inputs and proxies)

• Reviewing the recommendations and proposed responses• Implementation of corrective actions• Documentation to the regulator

Detailed diagnostic work for the establishment of a CVA desk

• French CIB • Study the profile of counterparty risk (maturity, concentration, …)• Design desk mandate• Impact Simulation• Review of CSA

(*) non exhaustive. Other examples available upon request

Mission Perimeter Actions

Building of libraries for pricing vanillaand semi-exotic derivatives for severalsecurities institutions in China

• Securities firms• Chinese market

• Pricing tools(closed formulas mainly)• Adaptation to local market specificities(data, legal …)• Training

Review of models risk provisions(including bid-ask , smile ... ) for severalinstitutions

• French CIB• (incl. Commodities)

• Review provision methodologies• Impact Analysis

Model validation for IM calculation,historical VaR

• Tier 1 institution (largest IRS clearer)

• Review of existing model validation methodologies• Back-testing, stress-testing on Hypothetical portfolios• Review of add-ons: basis risk, problematic currencies

18

Agenda

Our expertise in model validation | Models in the value chain1

3 Introduction to CH&Cie. Focus on Global Risk Reseach & Analytics (GRA)

Our approach to model review | An integrated, iterative and proven2

19

CH&Cie Risk Management offer (1/4)From managing risk processes, to measuring risks and establishing strategic guidance

Strategic

guidance

Measurement &

validation

Processes &

organisation

Risk

Management

1

23

• Helping to making high-level decision (CVAdesk implementation etc…)

• Defining risk appetite in accordance withthe business strategy & development

Strategic guidance

Measurement & Validation• Quantifying risks and measuring

impacts on a business level

• Validating models and developing advanced quantitative techniques

Processes & organization• Reviewing risk management

processes

• Establishing monitoring procedures

• Organizing and defining risk governance and follow-up

20

1. Finance 2. Pricing3. ALM / Liquidity

4. Credit Risk5. Market Risk

6. Operat. Risk

7. Business & Strategy

8. Customer relationship management

1.1 ICAAP / Pillar 2

1.2 Economic capital

1.3 Capital budgeting / RAPM

1.4 P&L and budget forecasting

2.1 Standard & Complex Models

2.2Instrument pricing

2.3 Pricing Parameters control

3.1 Basel III : LCR, NSFR, liquidity

3.2Securitization SPV, collat. manag.

3.3 Gap : CF patterns, survival horiz

3.4 Dynamic modeling

4.1 Basel II: PD, LGD, EAD, CCF, UL, RWA

4.2 Basel III, CVA, CCP, Capital

4.3 Solvency II : capital

4.4 Provision specific, collective

4.5 Stress & back testing

5.1 Classic & stress VaR, CVar

5.2 Risk reserves

5.3Sensitivities Modeling & Calculation

5.4Incrementaland liquidityrisk

6.1 Fraud detection

6.2 AMA models

6.3 Rogue trading

7.1 Strategy guidance and decision

7.2 Brand notoriety, reputation

7.3 Process optimization

8.1 Credit granting models

8.2 Portfolio scoring

8.3Marketing and targeting

8.4 Data mining and desctriptive statistics

CH&Cie Risk Management offer (2/4)A large scope of intervention with expertise, experience and benchmarking at the heart of our strategy

0. Advanced Modeling, experience, expertise, benchmarking

Please, specify the subjects you are interested in, by checking the orange boxes

Legend

Business intent

Regulatory intent

6.4Operations structuringcontrol

21

CH&Cie Risk Management offer(3/4)Modeling as an integrated business tool: a cross-disciplinary skills and decision-making facilitator tool

Modeling as a transversal tool

Risks1

• Market : VaR computing, volatility,liquidity, valuation

• Credit : Basel II parameters,Provisioning, stress, back testing

• Operational : fraud, rogue trading...

Finance2

• Manage Assets and Liabilities

• Manage Economic capital (ICAAP)

• Simulate P&L impacts

• Capital Budgeting : RAROC etc…

Business3

• Optimize operating model

• Adapt marketing (CRM)

• Scoring and targetingcustomers

Strategy4

• Build business strategy

• Monitor reputation

• Arbitrage between risk takingand business developement

Modeling allows to anticipate, prevent, detect, measure, test, develop and decide… It is a powerful tool that requires a specific set of skills and knowledge

22

CH&Cie Risk Management offer(4/4)Modeling techniques and requirements: the work tools

Data analysis1

• To give a quantitativeperspective of aspecific context or forproblem detections(by analysing data)

Main objectives

Simulation2 Solving3 Prediction4 Methods5

• To validate hypotesisand / or find the bestoption of a specificstrategy

• To give a closedformula of a specificproblem

• To give an estimate ora prediction (estimedprobability of an eventto happen undercertain hypothesis)

• To define and design aquantitativemethodoloy forstrategy purposes orbusiness decision

• Data Mining• Statistics

Underlyingtechniques

• Monte Carlo simulation

• Bayesian networks• Fuzzy logic / Expertise

• Mathematics• Statistics

• Probability• Statistics

• Benchmark• Experience/ Best

practices

• Fraud detection• Portfolio analysis• Correlation analysis• Dashboard / reporting• Marketing …

Illustrations • Capital planning• Strategic plan

forecasting• Pricing• Stress testing …

• RWA Calculation• Pricing• Marketing• Valuation (firm

value)…

• Risk parameter estimation (PD, LGD, EAD)

• VaR / Credit VaR …

• CVA desk implement.• « Cost of risk »

hedging policy• Choice among

different approaches…

AAA

AA

A+

A-

BBB

BB+

BB-

B

CCC

DX-

200

400

600

800

1 000

1 200

20

11

20

12

20

13

20

14

20

15

2 0

20

2 0

30

2 0

40

2 0

50

2 0

60

2 0

70

2 0

80

2 0

90

2 1

00

Rating

Number of clients

Maturity

Profile analysis

i

ii

i

yp

yYZP

1

)(

1

1

Markov

Models

Regression models

Vintage analysis

Binomial Tree

Actuarial models (Beta calibration)

Statistical

Models

Loss Calc

Others...

External

Models

Recovery

Assessment models

23

PeopleResearch & analytics

Technical expertiseScope

Business intelligence

We are a team specialized in quantitative expertise. From various background & with varied academic profiles, we yet converge towards Excellence, achieved with high standards and flawless delivery.

From regulatory requirements to optimization and value creation, our experience of the financial services issues enable our teams to capitalize on CH benchmark and enhance our performance on new missions

Our offer & approach are multi-dimensional : we cover all banking activities issues requiring regulatory expertise and modelling skills.

We operate on all modelling issues through the whole life cycle of models, from analysing available data and inputs, to building and designing customized models and validating outputs and performance

Beyond supporting our client offers, we are constantly challenging our knowledge and understanding of the market through• Publications of white papers • Analytical contents• Conferences• GRA Lab

CH&Cie Global Research and Analytics has been recently created in 2012.Our expertise centre covers a wide array of interventions on Risk Management topics, and provide our clients with solutions that are customized to their specific needs and risk profile. In a changing business and regulatory environment, it is crucial to move forward and adapt our capabilities to our clients’ needs.

Furthermore our team can intervene at worldwide level

An holistic vision of Risk Management

Introduction to CH&Cie. Focus on Global Risk Research & Analytics (GRA)CH&Cie & Cie Global Research & Analytics© Dept.: our value added

24

Static modelling

Increasing transactions volumes• Data : poor quality / low storage capacity• Tools : low computing power / increase in banking

transactions volume• Practices : CIB R&D development

Pricing & valuating instruments• MtMarket• MtModel

Dynamic modelling(Average current situation)Regulatory incentives• Data : improved storage capacity• Tools : improved computing power• Practices : homogeneisation of modelling

practices

Business integrated modelling

Need for strategic guidance• Data : centralized with unlimited capacity• Tools : enhanced computing capabilities, algorithms

& modules• Practices : advanced & business oriented modelling

techniques

Understanding transformation of risk management tools

Measuring & capturing market risks• Sensitivities• VaR models

Covering other financial risks • Credit IRB• Operational / AMA

Developing advanced techniques for rare risks & complex instruments• Reputational risk• Complex exotics/Securitization

Optimizing profitability & managing business portfolio • ICAAP / Risk Appetite / RAROC• Scoring / collection• Funding/ Cash management

Defining targets and steering strategy• EVA / Earnings Volatility • Strategic Plan, Risk Reserves

Computing across for every business purpose• Measure impacts on all dimensions (P&L, B/S,

CT1,Treasury, ALM, stress testing)

Solving complex equations for strategic purpose• Competitive positioning• Ideal target product mix

Risk Management functions are shifting from a mere measurement toolto a business-oriented instrument

with strategic guidance

Adapting our offer & expertise to the evolving needs of our clients

Fuelled by the need to limit conflict of interest, to reduce risks and meet regulatory requirements, banks are building longer term relationships focusing on client satisfaction.Since 2007, the erosion of the profitability of the banking sector surged financial institutions towards a better management of their risk environment. We believe managing risks is about understanding all banking activities, as well as the dynamics of their interactions. Risk modelling is therefore cross-disciplinary and transversal across • Financial purposes (Valuation, Credit & Market risks, ALM & Liquidity, Capital) • Business topics (Operational risk, Business & Strategy, Customer Relationship Management)

Introduction to CH&Cie. Focus on Global Risk Reseach & Analytics (GRA)CH&Cie & Cie Global Research & Analytics© Dept.

25

Our first booklet (fromarticles published on our

website)

Les versions électroniques de nos articles sont disponibles sur http://www.chappuishalder.com/publications/

Article on CVA (standardized approach

calculationdemonstartion)

Introduction to CH&Cie. Focus on Global Risk Reseach & Analytics (GRA)CH&Cie & Cie Global Research & Analytics© Dept.

MONTREAL

202 – 1819 Bd Rene

Levesque O.

Montreal, Quebec,

H3H2P5

PARIS

20, rue de la Michodière

75002 Paris, France

NIORT

19 avenue Bujault

79000 Niort, France

NEW YORK

1441, Broadway

Suite 3015, New York

NY 10018, USA

SINGAPORE

Level 25, North Tower,

One Raffles Quay,

Singapore 048583

HONG KONG

905, 9/F,

Kinwick Centre 32

Hollywood Road,

Central, Hong Kong

LONDON

50 Great Portland Street

London W1W 7ND

UK

GENEVA

Rue de Lausanne 80

CH 1202 Genève,

Suisse