Chap1- Time Value of Money (Ridha)[1]

-

Upload

siwar-hakim -

Category

Documents

-

view

222 -

download

0

Transcript of Chap1- Time Value of Money (Ridha)[1]

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

1/60

2-1

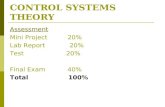

CHAPTER 1

Time Value of Money Simple interest

Compound interest Present and Future value

Annuities

Effective rate Loan Amortization

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

2/60

2-2

The concept of Time Value

of Money If you are offered the choice between

having $100 today and having $100 one

year from now, what will you Prefer?

Why?

you will usually prefer to have $100

now.

because you can simply put the moneyin the bank and earn interest on it.

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

3/60

2-3

$100 received today is worth morethan $100 received after one year

If the annual interest rate i=10%,

after 1 year you will earn :interest: 10% x $100 =$10

+ the original amount ($100)

= $110

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

4/60

2-4

the fundamental principle behind the

concept of time value of money is that, asum of money received today, is worthmorethan if the same is received after acertain period of time.

Why?

The main reason why the value of moneyincreases with time is because of theinterest rate, which represents the returnobtainable by investing the money or thecost of borrowing it.

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

5/60

2-5

Time lines

Show the timing of cash flows.

Tick marks occur at the end of periods, soTime 0 is today; Time 1 is the end of thefirst period (year, month, etc.) or thebeginning of the second period.

CF0 CF1 CF3CF2

0 1 2 3

I%

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

6/60

2-6

Drawing time lines

100 100100

0 1 2 3I%3 year $100 (ordinary annuity)

100

0 1 2I%

$100 lump sum due in 2 years

70 10

0 1 2 3I%

50

Uneven cash flow stream (Mixed stream) : A series ofunequal cash flows reflecting no particular pattern.

60

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

7/60

2-7

Present Value and Future Value

- Present value: is the value today of a sum of money to bereceived at a future point of time.

- Future value: represents the value of a given sum of moneytoday measured at a specific date

- Compouding: The process of going from todaysvalue (presentvalue) to future value.

- Discounting: The process we use to calculate the present value

of a future cash flow.

FV

0 1 2 ni%

PV

Compouding

Discounting

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

8/60

2-8

The Interest Rate:

Simple interest:Interest on only the

original amount, or principal

Compound interest:Interest on the

principal as well as on any previousinterest earned

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

9/60

2-9

A- The Simple interest In the simple of interest only the

principal earns interest in every period

over the life of the amount. The interestearned at the end of the period on theprincipal will not earn interest in any of

the subsequent periods

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

10/60

2-10

Future Value of an amount

Example 1:Assume that you deposit $100in anaccount earning 10% simple interest for 2 years. Whatis the accumulated amount at the end of the 2nd year?

1-At the end of period 1, you will have:

Interest earned = 0.10 x $100 = $ 10

+ Principal $100

Total amount FV1= $100 + $10 = $110

100 FV1=? FV2=?

0 1 2

i=10%

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

11/60

2-11

Under the simple rate of interest in the successiveperiod only the principal ($100) will earn the

interest.

The interest earned ($10) in period 1 will not earn interestin any of the subsequent periods.

2-Therefore, the total amount in the account at the end ofthe period 2will be FV2=$120, computed as follows:

Interest earned in period 1 = 0.10 x $100 = $ 10

+ Interest earned in period 2 = 0.10 x $100 = $ 10

+ Principal $100 Total amount FV2= $100 + $10 + $10 = $120

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

12/60

2-12

Simple interest FormulaFuture Value = P+ SI

SI = P(i.n)

FV =P(1+ i.n)

SI: Simple Interest

P: Deposit today (t=0)

i: Interest Rate per Period

n: Number of Time Periods

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

13/60

2-13

What if the interest rate does not

stay the same over time? If the simple interest rate is i1, for the

first n1years, i2

for the next n2years, i3 for

the next n3years, etc.

The principal P will accrue interest Pi1n1

for the first n1years, Pi2n2

for the next n2

years, and Pi3n3for the next n3years, etc.

FV = P(1 + i1n1+ i2n2

+ i3n3+ ....)

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

14/60

2-14

Example 2:Suppose you deposit $1.000 in anaccount pays simple interest. What will be thefuture value of the account if the annual simpleinterest rate is 7% for the first 5 years, 10% for

the next 10 years, and 12% for the last 5 years?

P = $1.000, i1= 7%, n1= 5

i2= 10%, n2= 10

i3= 12%, n3= 5

FV = $1,000(1 + 0,075 + 0,1010 + 0,125)

= $1.000 (2,95) = $2.950

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

15/60

2-15

Present Value of an amount

...1332211

ininin

FPV

If there are more than one simple interest rate over

time, (i1, for the first n

1

years, i2

for the next n2

years,i3 for the next n3

years, etc )

The PV shows the value of cash flows in terms

of todays purchasing power.The present value (PV) of an amount F received at the

end of n years with a simple rate of interest i, is given by

in

FPV.1

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

16/60

2-16

The present and future value ofseries of payments (Annuity)

In the above time line, the same amount A is made atthe end of each year for n years.

A AA

0 1 2 3i%

We define a sequence of deposits as an annuityif it satisfies the following two conditions:

1. The deposits are of the same amount

2. The deposits must be made at equidistantintervals.

Considering the following timeline:

A A

n-1 n

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

17/60

2-17

The difference between an ordinaryannuity and an annuity due

Ordinary Annuity

A AA

0 1 2 3

i%

A A

0 1 2 3i%

A

Annuity Due

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

18/60

2-18

Future Value of an Ordinary annuityThe same amount A is made at the end of each year for n years

FV of first A = A [1+(n-1)i]

FV of 2nd A = A [1+(n-2)i]

FV of 3rd A = A [1+(n-3)i]

FV of (n-2)thA = A (1+2i)

FV of (n-1)thA = A (1+i)

FV of nth A = A

Thus the future value of this ordinary annuity (of the end)

FVAord

= A [1+(n-1)i] + A [1+(n-2)i] + + A (1+2i) + A (1+i) + A= A + A + + A + Ai [(n-1)+(n-2)++2+1]

A A

0 1 2 n-2i%

A AA

nn-1

2

)1(. nn

AinA

2

)1(1.

innAFVA

ord

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

19/60

2-19

Future Value of an annuity DueIf the same amount A is made at the beginning of each

year for n years

FV of first A = A [1+n.i]

FV of 2nd A = A [1+(n-1)i]

FV of 3rd A = A [1+(n-2)i]

FV of (n-2)thA = A (1+3i)

FV of (n-1)thA = A (1+2i)

FV of nth A = A (1+i)

Thus the future value of this annuity Due (of the beginning):

FVAdue

= A [1+ni] + A [1+(n-1)i] + A [1+(n-2)i] + + A (1+2i) + A (1+i)= A + A + + A + Ai [n+(n-1)+(n-2)++2+1]

2

)1(. nn

AinA

2

)1(1.

innAFVA

due

AA

0 1 2 n-2i% n-1 n

AA A

..

..

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

20/60

2-20

Example 3 :

Suppose an account earns a 15 percent simple rate of interest annually.What will the future value be of an annual deposit of:

(a) $20 at the end of each year for four years?

(b) $20 at the beginning of each year for four years? (Anuity due)

(a) FVAord = 20(1+0.15x3) + 20(1+ 0.15x2) + 20(1+0.15) + 20 = $98

or = 4x20[1+(3x0.15)/2] = $98

(b) FVAdue = 20(1+0.15x4)+20(1+0.15x3)+20(1+0.15x2)+20(1+0.15)

or = 4x20[1+(5x0.15)/2] = $110

2

)1(1.

innAFVA

ord

2

)1(1.

innAFVA

due

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

21/60

2-21

Present Value:If the same amount A is made at the end of each year

for n years.PV of first A = A / (1+i)PV of 2nd A = A / (1+2i)PV of 3rd A = A / (1+3i)

PV of (n-1)thA = A / [1+(n-1)i]PV of nth A = A / (1+ni)

PVAord= A/(1+i) + A/(1+2i)++ A/(1+ni)

If the deposits are made at the beginning of each year

PVAdue= A + A/(1+i) + A/(1+2i)++ A/[1+(n-1)i]

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

22/60

2-22

Example 4:

The deposit of $8 is made in an account for 20 years.If the rate of interest is 6%, obtain the present value

of this annuity as well as annuity due:

PVAord = 8/(1+0.06) + 8/[1+(2x0.06)] +

+ 8/[1+20x0.06)]

PVAdue = 8 + 8/(1+0.06) + 8/ [1+(2x0.06)] +

+ 8/[1+(19x0.06)]

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

23/60

2-23

B- Compound interest

In compound rate of interest, theinterest earned on the principal during

the specified period also earns interestin the subsequent periods.

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

24/60

2-24

Example 5:

Assume that you deposit $100in an account earning10% compound interest for 2 years. What is theaccumulated amount at the end of the 2nd year?

1-At the end of period 1, you will have:Interest earned = 0.10 x $100 = $ 10

+ Principal $100

Total amount FV1= $100 + $10 = $110

100 FV1

=? FV2

=?

0 1 2

i=10%

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

25/60

2-25

at the end of period 1, the account will have $110 under

both approaches (simple interest and compound interest). 2-But at the end of period 2, the total amount will be

FV2= $121 under the compound interest approach ratherthan $120 as we obtained in the simple interest approach.

Break down is as follows: Principal $100

Interest earned in period 1 = 10% x $100 = $ 10

Interest earned in period 2 = 10% x $100 + 10% x $10

= $ 11

Total amount FV2= $100 + $10 + $11 = $121

The difference of $1 between compound interest and simpleinterest approach is due to interest of $1 earned in period 2

on $10 interest that was earned in period 1.

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

26/60

2-26

Compound interest Formula

Future Value of a Lump sum:

FV =PV

(1+ i)n

PV : Deposit today (t=0)

I : Interest Rate per Period

n : Number of Time Periods

FV = PV.(1+i)n= PV.(FVIF, i , n)The values of FVIF (Future Value Interest Factor) are given inthe table (A.1)

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

27/60

2-27

What is the future value (FV) of an initial $100after 3 years, if the interest rate is 10%?

Finding the FV of a cash flow or series of cash flowsis called compounding.

The time line:

After 3 years: FV3= PV (1 + I)

3 = $100 (1.10)3 =$133.10 FV3= PV (FVIF,10%,3) = 100x1.3310 =$133.10

FV = ?

0 1 2 3

10%

100

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

28/60

2-28

Present Value of an Amount

Finding the PV of a cash flow or series of cash flowsis called discounting (the reverse of compounding).

PV= FVn/ (1 + i)n

PV = FV.(1+i)-n= FV.(PVIF, i , n)

The values of PVIF (Present Value Interest Factor)

are given in the table (A.3)

PV = ?

0 1 2 n

i%

FV

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

29/60

2-29

Solving for PV:The formula method

What is the present value (PV) of $100 duein 3 years, if interest rate is 10%?

PV = FV3/(1 + i)3= $100/(1.10)3= $75.13

PV = FV3(PVIF,10%,3) = $100x0.7513=$75.13

FV= 100

0 1 2 3

10%

PV?

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

30/60

2-30

Future Value of an Ordinary AnnuityFV of first A = A [1+i]n-1

FV of 2nd A = A [1+i]n-2

FV of 3rd A = A [1+i]n-3

FV of (n-2)thA = A (1+i)2

FV of (n-1)thA = A (1+i)1

FV of nth A = A

Thus the future value of this ordinary annuity (of the end) will be:

FVAord= A [1+i]n-1+A [1+i]n-2++A (1+i)1+A

= A [1+(1+i)+(1+i)2++(1+i)n-1]

A sum of the nthfirst term of a geometric progression with first term U1=A and

random ratio q=(1+i), equal U1(1-qn)/1-q

Future Value Interest Factor

Annuity values given in

table (A.2)),,.(

1)1(. niFVIFAA

i

iAFVA

n

ord

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

31/60

2-31

Future Value of an Annuity Due

FV of first A = A [1+i]n

FV of 2nd A = A [1+i]n-1

FV of 3rd A = A [1+i]n-2

FV of (n-1)thA = A (1+i)2

FV of nth A = A (1+i)

Thus the future value of this ordinary annuity (of the beginning) will be:

FVAdue= A [1+i]n+A [1+i]n-1++A (1+i)2+A(1+i)

= A(1+i).[1+(1+i)+(1+i)2++(1+i)n-1]

A sum of the nthfirst term of a geometric progression with first term U1=A(1+i)

and random ratio q=(1+i), equal U1=(1-qn)/1-q

)1.()1(1)1(

. iFVAii

iAFVA

ord

n

due

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

32/60

2-32

Exemple 6: Future Value

Compute the FV of $100 payments occurring at theend of each period for 3 years, interest rate i=10%.

FVAord

= 100[(1+10%)3-1]/10%=$331

=100(FVIFA,10%,3) = 100x3.31 = $331

Compute the FV of $100 payments occurring at the

beginning of each period for 3 years, interest ratei=10%.

FVAdue= 100x(1+10%)[(1+10%)3-1]/10%=$364.10

= FVAord(1+i) = $331(1.10) = $364.10

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

33/60

2-33

Present Value of an Ordinary Annuity

PV of first A = A [1+i]-1

PV of 2nd A = A [1+i]-2

PV of 3rd A = A [1+i]-3

PV of (n-1)thA = A (1+i)-(n-1)

PV of nth A = A (1+i)-n

Thus the Present value of this ordinary annuity (of the end) will be:

PVAord= A [1+i]-1+A [1+i]-2++A (1+i)-(n-1)+A(1+i)-n

= A(1+i)-n[1+(1+i)+(1+i)2++(1+i)n-1]

A sum of the nthfirst term of a geometric progression with first term

U1=A(1+i)-n

and random ratio q=(1+i), equal U1(1-qn)/1-q

Present Value Interest Factor

Annuity values given in

table (A.4)

),,.()1(1

. niPVIFAAi

iAPVA

n

ord

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

34/60

2-34

Present Value of an Annuity Due

PV of first A = A

PV of 2nd A = A [1+i]-1

PV of 3rd A = A [1+i]-2

PV of (n-1)thA = A (1+i)-(n-2)

PV of nth A = A (1+i)-(n-1)

Thus the Present value of this ordinary annuity (of the end) will be:

PVAdue= A +A [1+i]-1++A (1+i)-(n-2)+A(1+i)-(n-1)

= A(1+i)-(n-1)[1+(1+i)+(1+i)2++(1+i)n-1]

A sum of the nthfirst term of a geometric progression with first term

U1=A(1+i)-(n-1)

and random ratio q=(1+i), equal U1(1-qn)/1-q

)1.()1()1(1

. iPVAii

iAPVA

ord

n

due

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

35/60

2-35

Exemple 7: Present Value

Compute the PV of $100 payments occurring at theend of each period for 3 years, interest rate i=10%.

FVAord

= 100[1-(1+10%)-3]/10%=$248.69

=100(PVIFA,10%,3) = 100x2.4869 = $248.69

Compute the PV of $100 payments occurring at the

beginning of each period for 3 years, interest ratei=10%.

PVAdue= 100x(1+10%)[1-(1+10%)-3-1]/10%= $273.55

= PVAord(1+i) = $248.69(1.10) = $273.55

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

36/60

2-36

Example 8: What is the Present Value at 10% ofa 10-year ordinary annuity? A 25-year ordinary

annuity? A perpetuity?

10-year ord annuity PV = 100[1-(1.1)-10]/0.1=$614.46

25-year ord annuity PV = 100[1-(1.1)-25]/0.1=$907.70

Perpetuity PV = PMT / i = $100/0.1 = $1,000

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

37/60

2-37

Will the FV of a lump sum be larger orsmaller if compounded more often,

holding the stated interest i% constant? LARGER, as the more frequently compounding

occurs, interest is earned on interest more often.

Annually: FV3= $100(1.10)3= $133.10

0 1 2 3

10%

100 133.10

Semiannually: FV6= $100(1.05)6= $134.01

0 1 2 35%

4 5 6

134.01

1 2 30

100

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

38/60

2-38

Nominal Annual interest rateand Periodic rate

Nominal rate (INOM): also called the quoted or staterate. An annual rate that ignores compoundingeffects.

INOMis stated in contracts. Periods must also begiven, e.g. 8% compounded Quarterly or 8%compounded Daily.

Periodic rate (IPER): amount of interest charged each

period, e.g. monthly or quarterly. IPER= INOM/ M, where M is the number of

compounding periods per year. M = 4 for quarterly,M= 12 for monthly and M = 365 for daily

compounding.

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

39/60

2-39

Nominal Annual interest rateand Periodic rate

Nominal rate (INOM)

Periodic rate (IPER):

IPER= INOM/ Mwhere M is the number of compounding periods peryear. M = 4 for quarterly, M= 12 for monthly andM = 365 for monthly compounding.

iSEMIANNUALY= INOM/2

iQUARTERLY= INOM/4

iMONTHLY= INOM/12

iDAILY

= INOM

/365

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

40/60

2-40

Effective interest rate

Effective (or equivalent) annual rate (Ieff=Ieq) is the annual rate of interest actuallybeing earned, that reflects the impact ofmultiple compounding during the year.

Ieff= ( 1 + INOM/ M )M1

Ieff is the annual effective rate

INOM is the annual nominal rate

M is the number of compounding periods per year

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

41/60

2-41

Example 9: What is the Annual Effective Rateequivalent to a nominal rate INOM=10%compounded semiannually?

100 FV1= 100(1.1) =110

0 1i=10%

100 FV1=100(1.05) FV2=100(1.05)2=110.25

1 20 i/2=5% i/2=5%

10% compoundedannually

10% compoundedsemi-annually

The annual rate equivalent to nominal rate of 10% compounded semi-

annually is ieffsolving:100(1.05)2=100(1+ieff)

ieff = (1+05)2 -1 = 10.25%

We should be indifferent between receiving 10.25% annual interestand receiving 10% interest, compounded semiannually.

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

42/60

2-42

INOM iSEMIANNUALY= INOM/2 ieff= (1+ INOM/2)2 -1

iQUARTERLY= INOM/4 ieff= (1+ INOM/4)4 -1

iMONTHLY= INOM/12 ieff= (1+ INOM/12)12 -1

iDAILY= INOM/365 ieff= (1+ INOM/365)365 -1

The Equivalence relation:

(1+ieff)= (1+ INOM/2)2 =(1+ INOM/4)

4

=(1+ INOM/12)12= (1+ INOM/365)365

The Equivalence Relation

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

43/60

2-43

Compute the effective rate equivalent to anominal rate of 10% compounded semiannualy,quaterly, monthly, daily.

INOM= 10%

EFFSEMIANNUALY = (1+10%/2)2

-1 =10.25%EFFQUARTERLY = (1+10%/4)4 -1 = 10.38%

EFFMONTHLY = (1+10%/12)12-1= 10.47%

EFFDAILY (365) = (1+10%/365)365-1=10.52%

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

44/60

2-44

Investments with different compoundingintervals provide different effective returns.

To compare investments with differentcompounding intervals, you must look at theireffective returns (IEff%).

See how the effective return varies between

investments with the same nominal rate, butdifferent compounding intervals.

Why is it important to considereffective rates of return?

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

45/60

2-45

When is each rate used?

INOM written into contracts, quoted bybanks and brokers. Not used incalculations or shown on time lines.

IPER Used in calculations and shown ontime lines. If M = 1, INOM= IPER=EAR.

EAR Used to compare returns oninvestments with different paymentsper year. Used in calculations whenannuity payments dont matchcompounding periods.

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

46/60

2-46

Example 11: What is the FV of $100 after 3years under 10% semiannual compounding?

Quarterly compounding?

$134.490.1/4)(1$100FV

$134.01(1.05)$100FV

)2

0.101($100FV

)M

I1(PVFV

34

3Q

63S

32

3S

NMNOMn

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

47/60

2-47

Can the effective rate ever beequal to the nominal rate?

Ieff= ( 1 + INOM/ M )M1

Yes, but only if annual compoundingis used, i.e., if M = 1.

If M > 1, Ieffwill always be greaterthan the nominal rate.

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

48/60

2-48

Example 12: Whats the FV of a 3-year $100annuity, if the quoted interest rate is 10%,

compounded semiannually?

Payments occur annually, but compounding

occurs every 6 months. Cannot use normal annuity valuation

techniques.

0 1

100

2 3

5%

4 5

100 100

6

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

49/60

2-49

Method 1:Compound each cash flow

110.25121.55331.80

FV3= $100(1.05)4+ $100(1.05)2+ $100

FV3= $331.80

0 1

100

2 3

5%

4 5

100

6

100

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

50/60

2-50

Method 2:Find the Ieffand treat as an annuity

Ieff= (1 + 10%/2 )21 = 10.25%.

FV3= 100 [(1+10.25%)3-1]/10.25%

= $331.80

100FV3= ?

0 1 2 3

10.25%

100100

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

51/60

2-51

Loan amortization

Amortizationrefers to the process of paying off adebt (often from a loan or mortgage) over time

through regular payments.

A portion of each payment is for interest whilethe remaining amount is applied towards theprincipal balance

http://en.wikipedia.org/wiki/Amortizationhttp://en.wikipedia.org/wiki/Amortization -

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

52/60

2-52

Loan and required annualpayments

PMTn

0 1 2 ni%

PMT2PMT

1Loan

int1 int2 intn

Principal1 Principal

2 Principal

n

A portion of each payment is for interestwhile theremaining amount is applied towards the principalbalance

Loan Amortization Schedule

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

53/60

2-53

oa o t at o Sc edu e(General case)

An amortization scheduleis a table detailing each

periodic payment on an amortizing loan

Ln-1= Pn PMTn= Pn (1+i) L0= P1+ P2

+.. + Pn

Period Debt in beginningof period

Interest Principal Loan payment(Annuity)

Debt remainingin the end of

Period

1

2...

n-1n

L0 (or D0)

L1= L0 - P1...

Ln-2=Ln-3 - Pn-2Ln-1=Ln-2 - Pn-1

I1=i.L0

I2=i.L1...

In-1=i.Ln-2In=i.Ln-1

P1

P2...

Pn-1Pn

PMT1=P1+ i.L0

PMT2=P2+ i.L1...

PMTn-1=Pn-1+ i.Ln-2PMTn= Pn+ i.Ln-1

L1= L0 - P1

L2=L1 - P2...

Ln-1=Ln-2 - Pn-1Ln=Ln-1Pn=0

loan amortization rules

http://en.wikipedia.org/wiki/Amortizing_loanhttp://en.wikipedia.org/wiki/Amortizing_loan -

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

54/60

2-54

loan amortization rules

case of reimbursement through constant

annuity Link between Principal portions amounts: Pk= Pj(1+i)

k-j

Link between the capital Borrowed (L0) and the annual Payment (PMT)

Link between the capital Borrowed (L0) and the First Principal portion (P1)

Link between the amount of the loan (L0) and the amount of the loan not yetreimbursed(Lk)

Lkis the debt not yet reimbursed at the end of period k.

i

i

PMTL

n)1(1

.0

i

iPL

n 1)1(.10

i

iPLL

k

k

1)1(.10

L A i i i h l

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

55/60

2-55

Loan Amortization with equalPayements

EXAMPLE 13: Construct anamortization schedule for a $1,000,

10% annual rate loan with 3 equalpayments.

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

56/60

2-56

Step 1:Find the required annual payment

i

iPMTLoan

n)1(1.

ni

i

LoanPMT )1(1.

11.402$%)101(1

%10000,1

3

PMT

PMT

0 1 2 310%

PMTPMTPMTLoan

=$1,000

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

57/60

2-57

Step 2:Find the interest paid in Year 1

The borrower will owe interest upon theinitial balance at the end of the first

year.Interest to be paid in the first year canbe found by multiplying the beginningbalance by the interest rate.

INTt= Beg balt(I)

INT1= $1,000 (0.10) = $100

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

58/60

2-58

Step 3:

Find the principal repaid in Year 1 If a payment of $402.11 was made at

the end of the first year and $100 was

paid toward interest, the remainingvalue must represent the amount ofprincipal repaid.

PRIN1= PMTINT1

= $402.11 - $100 = $302.11

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

59/60

2-59

Step 4:Find the ending balance after Year 1

To find the balance at the end of theperiod, subtract the amount paid

toward principal from the beginningbalance.

END BAL = BEG BALPRIN

= $1,000 - $302.11

= $697.89

-

8/13/2019 Chap1- Time Value of Money (Ridha)[1]

60/60

Constructing an amortization table:Repeat steps 14 until end of loan

Interest paid declines with each payment asthe balance declines.

Year

BEG

BAL PMT INT PRIN

END

BAL

1 $1,000 $402 $100 $302 $6982 698 402 70 332 366

3 366 402 37 366 0

TOTAL 1,206.34 206.34 $1,000

![download Chap1- Time Value of Money (Ridha)[1]](https://fdocuments.in/public/t1/desktop/images/details/download-thumbnail.png)