chap1

-

Upload

sankalpakash -

Category

Documents

-

view

3 -

download

0

description

Transcript of chap1

-

Chapter 1

INTRODUCTION TOMANAGEMENT SCIENCE

1.1 WHAT IS MANAGEMENT SCIENCE?

In management science (sometimes called operations research), managers use mathematicsand computers to make rational decisions to solve complex problems. Some problems are simpleenough that a manager can apply personal experience to solve the problem. In todays complexworld, however, many problems cannot be solved this way because evaluating each alternative istoo dicult or time consuming due to the amount and complexity of the information that must beprocessed, or because the number of alternative solutions is so vast that a manager simply cannotevaluate them all to select an appropriate one.

For example, consider the problem faced by Mark, an MBA graduate who has recently taken ajob as a financial analyst with a firm on Wall Street. One of the fringe benefits is a retirement planwhere the employee invests 5% of his/her monthly income which is then matched by the company.Monies in this plan are then invested in two funds: a stock fund and a bond fund. The BenefitsDepartment has asked Mark to specify what fraction of these retirement monies to invest in eachfund. Mark has analyzed the historical performance of these funds and has ascertained that thestock fund grows at an average annual rate of 10% while the more-conservative bond fund averagesa 6% annual return. To diversify his porfolio and to control the risk, he has identified the followingguidelines:

1. Neither of the two funds should have more than 75% of the total investment.

2. The amount invested in the stock fund should not exceed twice that invested in the bondfund.

In this problem, there are many dierent combinations of investment strategies that can beconsidered. For example,

1. Invest 50% in each fund. Since each dollar invested this way returns $0.05 from the stockfund and $0.03 from the bond fund, this strategy earns a total annual return of 8%.

2. Invest 60% in the stock fund and 40% in the bond fund. This strategy earns $0.084 for eachdollar invested, that is, a return of 8.4%.

1

-

2 Chapter 1

3. Invest 70% in the stock fund and 30% in the bond fund. This strategy earns a larger amountof $0.088 for each dollar invested, but, unfortunately, these percentages violate guideline (2)above. This is because the amount of 70% invested in the stock fund exceeds twice theamount invested in the bond fund.

In this problem, Mark cannot try each and every combination of investment in an attempt to findthe best strategy, as there are simply too many of them (in Chapter 4, you will learn that there arean infinite number of possible combinations). Managers increasingly turn to the use of quantitativemethods and computers to arrive at the optimal solution to problems involving a large number ofalternatives. The study of these various methods and how managers use them in the decision processis the essence of management science.Management science techniques apply to the following two basic categories of problems:

1. Deterministic problems in which all necessary information for obtaining a solution isknown with certainty. For instance, in Marks problem, the expected returns for each of thetwo funds are known.

2. Stochastic problems in which some of the pertinent information is not known with cer-tainty, but rather, behaves in a known probabilistic manner. For example, Marks problembecomes stochastic if his objective is to maximize the probability of earning at least 8%.This is because the objective now depends on the probabilistic behavior of the returns ofthe two funds.

Solving a deterministic problem is similar to deciding which airline ticket to buy for flying from NewYork to Los Angeles today because you can obtain the exact fares from all the airlines. In contrast,consider making the same trip one month from now. Deciding whether to buy the best availableticket today or to risk waiting for a better fare is a stochastic problem because you do not know thefuture airfares. Obtaining solutions to these two groups of decision problems deterministic andstochastic often require very dierent management science techniques. The first eleven chaptersof this book focus on deterministic problems and their solution procedures. Stochastic problems aredealt with in the remaining four chapters.

1.2 THE HISTORY OF MANAGEMENT SCIENCE

The field of management science arose during World War II when there was a critical need to managescarce resources. The British Air Force formed the first group to develop quantitative methods forsolving these operational problems, and hence they adopted the name of Operational Research.Subsequently the American Armed Forces formed a similar group consisting of physical scientistsand engineers, five of whom later became Nobel Laureates. The eorts of these groups, especiallyin the area of radar detection, is considered a critical factor in winning the air battle of Britain.After World War II, managers in industry recognized the value of applying similar techniques to

their complex decision problems. Early eorts were devoted to developing appropriate models andcorresponding procedures for solving problems arising in such areas as the scheduling of petroleumrefineries, distribution of products, production planning, market research, investment planning, pa-per cutting, and others. These solution procedures were made possible by the advent of high-speedcomputers since solving the typical operations research problem requires too many computations tobe performed practically by hand. The use of management science techniques has grown with theadvances in computing to the point where, today, these techniques are used routinely to solve manydecision problems on a desktop computer.In the remainder of this chapter, the general steps used in applying management science tech-

niques are discussed. The rest of the book describes the dierent techniques available for solving

-

Chapter 1 3

PROBLEM

DEFINITION

?DEVELOP

MATHEMATICAL MODEL

AND COLLECT DATA

-SOLVE

MATHEMATICAL

MODEL

- SOLUTION

?

@@@@

@@

@@

IS

SOLUTION

VALID

?

NO

?

YES

IMPLEMENT

MODIFY

MODEL

6

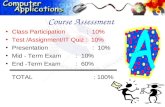

Figure 1.1: The Methodology of Management Science

deterministic and stochastic problems in more detail, including how and when to use them, how tointerpret the solutions obtained from the computer, and additional issues a manager should considerregarding each method.

1.3 THE METHODOLOGY OF MANAGEMENTSCIENCE

Using quantitative methods to solve problems generally involves many individuals throughout theorganization. The individuals in this project team provide information from their respective ar-eas pertaining to the various aspects of the problem. The actual process of applying quantitativemethods requires the systematic sequence of steps illustrated in Figure 1.1. Each of these steps isdescribed in detail in this section.

1.3.1 PROBLEM DEFINITION

The first step is to identify, understand, and describe, in precise terms, the problem the organizationfaces. In some cases, the problem is well defined and clear. For example, the problem faced by Markin Section 1.1 is quite well defined in that the overall objective is known as well as the limitations

-

4 Chapter 1

(in terms of the investment guidelines) that must be considered in reaching the decision. Mark hasalso determined the necessary returns for the two funds so that he can solve this problem.In other situations, the problem may not be so well defined and may require much discussion and

concensus among the members of the project team. For instance, there may be several objectivesthat conflict with each other. For example, you may want to maximize customer satisfaction yetalso minimize total costs. Corporate decisions as to an overall objective will have to be made.Sometimes, quantifying the objective itself is dicult. For example, how do you measure customersatisfaction? All of these issues must be resolved and made clear by concensus of the project teamduring the problem-definition phase.

1.3.2 DEVELOPING A MATHEMATICAL MODEL ANDCOLLECTING DATA

After the problem is clearly defined and understood, the next step is to express the problem in amathematical form, that is, to formulate a mathematical model. The reason for doing so isthat, once in such a form, there are many mathematical techniques available for obtaining the bestsolution, in spite of the vast number of alternatives and/or the complexity involved in evaluatingeach one. To illustrate this formulation process for Marks deterministic problem, observe that hewants to determine the fraction of his retirement monies to invest in each of the stock and bondfunds. To state the problem mathematically, begin by defining two decision variables, often simplycalled variables, (whose values are not yet known) as follows:

S = the fraction to invest in the stock fund,B = the fraction to invest in the bond fund.

These decision variables are also called controlable variables because you have some control overtheir values. For this problem, you want to choose values for these variables that

1. Maximize the expected annual return, and

2. Satisfy all the investment guidelines.

For specific values of the variables S and B, you can express the expected annual return in amathematical formula. Recalling that each dollar invested in the stock fund is expected to return$0.10 and each dollar invested in the bond fund is expected to return $0.06, a fraction S of a dollarinvested in the stock fund is expected to return 0.10 S and a fraction B of a dollar invested inthe bond fund is expected to return 0.06 B. Thus, the objective function that is, the overallobjective expressed in a mathematical form of this problem is to choose values for S and B to:

Maximize 0.10S + 0.06B.

Due to the investment guidelines, you cannot choose arbitrary values for these variables. Eachof these guidelines gives rise to a constraint that you can describe by a mathematical formula.For example, the first guideline requires that the fractions S and B each be less than or equal to0.75. Thus the upper limits on these two fractions are expressed mathematically as the followingtwo constraints:

S 0.75, (upper limit on stock fund)

B 0.75 (upper limit on bond fund).

-

Chapter 1 5

Another constraint is also needed for the second investment guideline. That is, the fraction Sinvested in the stock fund should not exceed twice the fraction B invested in the bond fund. Thecorresponding mathematical constraint is:

S 2B, or

S 2B 0 (portfolio-mix constraint).

Finally, each fraction must be nonnegative. This implicit constraint is made explicit in themathematical model by writing:

S, B 0.

Putting together all the pieces, the mathematical model developed so far for this problem is tochoose values for the variables S and B so as to:

Maximize 0.10S + 0.06BSubject to S 0.75 (upper limit on stock fund)

B 0.75 (upper limit on bond fund)S 2B 0 (portfolio-mix constraint)S , B 0.

Observe that the objective function and constraints are expressed in terms of the decision variablesand other known information. These other known information are called the data. In this case,the data consist of the known annual returns for the two funds and the upper and lower limits on theamounts to invest in each fund. In contrast to the decision variables whose values you can control,those of the data you cannot. For this reason, the data are often called uncontrolable parameters.While here, all the data were provided when the problem was stated, in most real-world problems:

1. Some data are identified during the problem definition. The need for additional data mayonly be discovered as the formulation progresses.

2. Once the data items are identified, you must determine their specific values. In some cases,you may need to use estimates because the exact values are not readily available. Further-more, obtaining these values can sometimes be more time consuming than developing themodel. Keep in mind that the quality of the solution you eventually obtain is only as goodas the accuracy of the data.

In this section you have seen an example of developing a mathematical model. While doing so ismore of an art than a science, in Chapter 2 you will learn many systematic techniques and guidelinesfor formulating a problem mathematically.

1.3.3 SOLVING THE MATHEMATICAL MODEL

Once a mathematical model of the problem has been formulated, the next step is to solve the model,that is, to obtain a numerical solution. For the example above, this means obtaining the best valuesfor the variables S and B. How these solutions are obtained depends on the specific form of themathematical model. That is, once you identify what type of model you have, you will be ableto choose an appropriate management science technique for solving that particular model. Thesetechniques fall into the following two categories:

1. Optimal methods that indeed obtain the best values for the decision variables. That is,those values that simultaneously satisfy all of the constraints and provide the best value forthe objective function.

-

6 Chapter 1

2. Heuristic methods that obtain feasible values for the variables that satisfy all the con-straints. While not necessarily optimal, these values provide an acceptable value of theobjective function.

In contrast to the optimal methods, the heuristic ones are computationally more ecient and aretherefore used when obtaining optimal solutions is either too time consuming or impossible becausethe model is too complex.One objective of this book is to show you many dierent mathematical models and their asso-

ciated solution procedures. Most of the time, these procedures will be available on a computer andyou will learn how to obtain and interpret the solutions to the model. In fact, using the procedureof Chapter 4, the solution to Marks investment model in Section 1.2.2 is:

S = 0.75,B = 0.75,

leading to an expected annual return of 0.10S + 0.06B = (0.10 0.75) + (0.06 0.75) = 0.12. Thatis, each dollar invested is expected to return $0.12. However, you can see that this solution does notmake sense because it is impossible to to invest 75% in both of these funds. The source of this erroris identified and corrected in Section 1.3.4.

1.3.4 VALIDATING, IMPLEMENTING, ANDMONITORING THE SOLUTION

After solving the mathematical model, it is extremely important to validate the solution, that is,review the solution carefully to see that the values make sense and that the resulting decisions canbe implemented. The reasons for doing so include the fact that:

1. The mathematical model may not have captured all of the limitations of the real problem.

2. Certain aspects of the problem were overlooked, deliberately omitted, or simplified.

3. The data were incorrectly estimated or recorded, perhaps when entered into the computer.

For example, in validating the solution of S = 0.75 and B = 0.75 for Marks invesment model, youcan see that these values do not make sense because it is not possible to invest 75% in both funds.In this case, the error is caused by the omission of a constraint to insure that the fractions S and Badd up to 1, that is:

S +B = 1.0.

In general, if the solution cannot be implemented, either modify the model to reflect more accuratelythe limitations of the real problem (and obtain a new solution), or use your experience and judgementto modify the solution provided by the model, as shown in Figure 1.1.It is also important to realize that, even though the model and solution are valid, you might still

be unable to implement the decision. This is because doing so has behavioral or political implicationsthat cannot be included in the model. For example, the result of a model may indicate that it ismost cost-eective to transfer some workers from the day to the night shift. However, such a changemay face resistance from employees (or managers) for personal, political, or other reasons. One wayto avoid these types of diculties is to include representatives of all potentially-aected groups as apart of the project team.The results and subsequent implementation must be monitored carefully, not only to ensure that

the solution works as planned, but also because the problem and/or data may change over time. Forexample, the expected returns of the two funds in Marks investment problem may change at somefuture point, thus necessitating a change in the model and its solution.

-

Chapter 1 7

1.3.5 MODIFYING THE MODEL

During the validation step, if the solution cannot be implemented, you may identify constraintsthat were omitted during the original problem formulation, or you will find that some of the originalconstraints were incorrect and need to be modified. In these cases, you should return to the problem-formulation step and carefully make the appropriate modifications to reflect more accurately thereal problem. For example, adding the constraint that the fractions sum to 1 to Marks originalinvestment model results in the following revised model:

Maximize 0.10S + 0.06BSubject to S 0.75 (upper limit on stock fund)

B 0.75 (upper limit on bond fund)S 2B 0 (portfolio-mix constraint)S + B = 1 (fraction-sum constraint)S , B 0.

The solution to this new model obtained by the procedure in Chapter 4 is:

S = 0.6667,B = 0.3333,

leading to an expected return of 0.10S + 0.06B = (0.10 0.6667) + (0.06 0.3333) = 0.08667. Thatis, each dollar invested is expected to return $0.08667.This process of modifying a model, obtaining the new solution, and validating it may have to be

repeated several times before an acceptable and implementable solution is found (see Figure 1.1).

1.4 USES AND ADVANTAGES OFMANAGEMENT SCIENCE MODELS

In Section 1.2, you saw one way in which a mathematical model is used, namely, to help make adecision. In general, such models help managers make the following types of decisions:

1. One-time strategic decisions, for example:

(a) Whether or not to open a new production facility.

(b) To compare an existing system with a newly-proposed one, for example, for determiningthe impact of converting one of three toll booths to an express lane for cars with twoor more passengers.

(c) To compare dierent policies such as reodering inventories at regular time intervals asopposed to when the level drops below some specified amount.

Since these models are generally used to make one long-term decision, you should not beoverly concerned with how much computational eort is needed to obtain the solution.Rather, since the decision will, most likely, have a major impact on the organization, youshould devote most of your eorts to insuring that the model is valid and includes allimportant aspects of the problem, and that the data are as accurate as possible.

2. On-going operational decisions, for example:

(a) Scheduling a weekly workforce.

-

8 Chapter 1

(b) Determining an optimal monthly production plan.

(c) Determining the weekly shipping plan for distributing products from plants to retailoutlets.

In contrast to models for strategic planning, those for operational decisions are used repeat-edly. It is therefore worthwhile spending extra time and eort in identifying or developingthe most ecient solution procedures as doing so can result in significant savings in compu-tational costs over time.

Regardless of whether a strategic or operational decision is needed, mathematical models providethe following benefits to managers:

1. Determining the best way to accomplish an objective, such as allocating scarce resources.

2. Evaluating the impact of a proposed change or a new system without having to go throughthe expense and time of implementing it first.

3. Experimenting with a proposed solutaion before implementation by asking sensitivity ques-tions of the form What happens if .... For example, by how much can the expected returnfrom the stock fund in Marks investment problem decrease before the optimal investmentplan changes?

4. Achieving an objective that benefits the overall organization rather than one division byincorporating aspects from all aected areas.

1.5 SUMMARY

The general steps involved in applying management science techniques to solve deterministic andstochastic decision problems are:

1. Problem definition by identifying and understanding the problem so you can define itprecisely.

2. Develop a mathematical model often by identifying decision variables, an overall mathe-matical objective, and constraints.

3. Solve the model by using an appropriate management science technique.

4. Validate the solution by using intuition and experience to determine if the solution obtainedfrom the model makes sense and can realistically be implemented.

5. Modify the model by determining that further refinements or changes in the data areneeded.

6. Implement and monitor the solution, making appropriate changes and then resolving themodel, as necessary.

Now that you know the basic ideas behind the methodology of management science, Chapter2 provides you with systematic techniques for formulating mathematical models of deterministicproblems.