CF-Topic-1

Transcript of CF-Topic-1

-

8/13/2019 CF-Topic-1

1/37

CORPORATE FINANCE

-

8/13/2019 CF-Topic-1

2/37

Topic 1

Nature of Corporate

Finance

-

8/13/2019 CF-Topic-1

3/37

To understand about meaning of Business

finance;

Importance of corporate finance;

Types of corporate firms;

To understand financial assets & financial

system;

Significance and areas of financial decisionmaking (Finance Functions);

To understand role of finance manager;

To study financial goals of an organization.

Objectives:

-

8/13/2019 CF-Topic-1

4/37

Introduction: Finance

Financeis concerned with Valueand also

concerned with how to make best

decisions.

Finance is defined as the provision of

money at the time when it is required

Finance: Management of flows of money

through an organisation. Finance as to

providing of funds needed by a business.

-

8/13/2019 CF-Topic-1

5/37

Business Finance

Business Finance as an activity or a processwhich is concerned with ;

- Acquisition of funds

- Use of funds- Distribution of profit by a

business

Business finance can be classified into;* Sole proprietary finance

* Partnership finance

* Company or Corporate finance

-

8/13/2019 CF-Topic-1

6/37

Business Organization from Start-up

to a Major Corporation

Sole proprietorship

Partnership

Corporation

-

8/13/2019 CF-Topic-1

7/37

Starting as a Proprietorship

Advantages: Ease of formation

Subject to few regulations

No corporate income taxes Disadvantages:

Limited life

Unlimited liability

Difficult to raise capital to support growth

-

8/13/2019 CF-Topic-1

8/37

Starting as or Growing into a

Partnership

A partnership has roughly the sameadvantages and disadvantages as a soleproprietorship.

-

8/13/2019 CF-Topic-1

9/37

Advantages and Disadvantages of a

Corporation

Advantages:

Unlimited life

Easy transfer of ownership

Limited liability

Ease of raising capital

Disadvantages:

Double taxation Cost of set-up and report filing

-

8/13/2019 CF-Topic-1

10/37

Why is corporate finance

important to all managers?

Corporate finance provides the skillsmanagers need to:

Identify and select the corporate

strategies and individual projects that

add value to their firm.

Forecast the funding requirements of

their company, and devise strategies for

acquiring those funds.

-

8/13/2019 CF-Topic-1

11/37

Real & Financial Assets

1) Real Assets:

(i) Tangible real assets

(ii) Intangible real assets

2) Financial Assets

-

8/13/2019 CF-Topic-1

12/37

What are Real Assets & Financial assets?

Real Assets:

Tangible real assets

Intangible real assets

Financial Assets: A financial asset is a contract that entitles the

owner to some type of payoff or they are alsocalled as Securities

Debt Equity

Derivatives

In general, each financial asset involves two

parties, a provider of cash (i.e., capital) and a userof cash.

-

8/13/2019 CF-Topic-1

13/37

Equity and Borrowed Funds

13

Shares represent ownership rights oftheir holders. Shareholders are owners ofthe company. Shares can of two types:

Equity Shares Preference Shares

Loans, Bonds or Debts: representliability of the firm towards outsiders.

Lenders are not owners of the company.These provide interest tax shield.

-

8/13/2019 CF-Topic-1

14/37

Equity and Preference Shares

14

Equity Shares are also known asordinary shares.

Do not have fixed rate of dividend.

There is no legal obligation to pay dividends toequity shareholders.

Preference Shares have preference fordividend payment over ordinary

shareholders. They get fixed rate of dividends.

They also have preference of repayment atthe time of liquidation.

-

8/13/2019 CF-Topic-1

15/37

FINANCIAL MARKETS

Money Market

Capital Market

FINANCIAL INSTITUTIOS

Commercial Banks

Insurance companies

Mutual funds

Provident funds

NBFC

Suppliers of funds

Individual

Business

Government

PrivatePlacements

Demanders offunds

Individuals

Business

Government

Funds

Deposits / Shares

Funds

Securities

Funds

Securities

Securities

Funds

Funds

Loans

FINANCIAL SYSTEM:

-

8/13/2019 CF-Topic-1

16/37

Significance of Corporate Finance

Corporate Finance is broadly concerned with

acquisition and use of funds by a business firm.

It scope may be;

How large should the firm be and how fast

should it grow?

What should be the composition of the firms

assets?

What should be the mix of firmsfinancing?

How should the firm analyse, plan and control its

financial affairs?

-

8/13/2019 CF-Topic-1

17/37

Finance Functions / Objectives;

Long-Term Decision:

a) Investment or Long Term Asset MixDecision

b) Financing or Capital Mix Decision

c) Dividend or Profit Allocation Decision

Short-Term decision:

Liquidity or Short Term Asset MixDecision

-

8/13/2019 CF-Topic-1

18/37

Areas of Financial Decision Making

Capital Budgeting Decision - Investment

- Identification of Investment

Opportunities

- Evaluation of capital projects

- Selection of capital projects

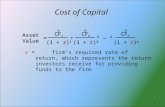

Capital Structure Decision - Finance

- Determining optimal debt-equity mix

- Measurement of cost of capital

- Mobilization of finance

-

8/13/2019 CF-Topic-1

19/37

Dividend Decision

- Determination of Dividend policy

- Deciding interim dividends

- Deciding stock dividends- Tax considerations

Working Capital Management

- Cash Management- Receivables Management

- Inventory Management

- Financing of WC requirement

Areas of Financial Decision Making

-

8/13/2019 CF-Topic-1

20/37

Finance Managers Role

Raising of Funds

Allocation of Funds

Profit Planning

Understanding Capital Markets

-

8/13/2019 CF-Topic-1

21/37

Role of finance manager

12

34(a)

4(b)Firms

FinancialOperation

Finance

Manager

Capital

Markets

1.Tapping financing sources2. Investment 3. CF generated4. (a) Reinvestments (b) Return of capital

St t d D ti f Fi E ti

-

8/13/2019 CF-Topic-1

22/37

Status and Duties of Finance Executives

Board of Directors

Managing Director

Production

Manager

Personnel

Manager

Financial

Manager

Marketing

Manager

Retirement

Benefits

Cost

Control

Performance

Evaluation

Accounting

InventoryManagement

Planning andBudgeting

CreditManagement

Auditing

TRESURER CONTROLLER

S d D i f Fi

-

8/13/2019 CF-Topic-1

23/37

Status and Duties of Finance

Executives

23

The exact organisation structure forfinancial management will differ acrossfirms.

The financial officer may be known as thefinancial manager in some organisations,while in others as the vice-president offinance or the director of finance or the

financial controller.

-

8/13/2019 CF-Topic-1

24/37

-

8/13/2019 CF-Topic-1

25/37

The Goal of Financial Management

Possible Goals:

Survive

Avoid financial distress & bankruptcyBeat the competition

Maximize sales or market share

Minimize costsMaximize profits

Maintain steady earning growth

-

8/13/2019 CF-Topic-1

26/37

Financial Goals

(a) Profit maximization (profit after tax)

(b) Maximizing Earnings per Share

(c) Shareholders Wealth Maximization

-

8/13/2019 CF-Topic-1

27/37

(a) Profit Maximization

Maximizing the Rupee Income of Firm

Resources are efficiently utilized Appropriate measure of firm

performance

Serves interest of society also

-

8/13/2019 CF-Topic-1

28/37

Objections to Profit Maximization

It Ignores the Timing of Returns

It Ignores Risk

Assumes Perfect Competition In new business environment profit

maximization is regarded as

Unrealistic

Difficult

Inappropriate

-

8/13/2019 CF-Topic-1

29/37

I. M. Pandey, Financial Management, 9thed., Vikas.

29

(b) Maximizing EPS

Market value is not a function of EPS. Hence

maximizing EPS will not result in highest price

for company's shares

Maximizing EPS implies that the firm should

make no dividend payment so long as funds

can be invested at positive rate of return

such a policy may not always work

-

8/13/2019 CF-Topic-1

30/37

(c) Shareholders Wealth Maximization

Maximizes the net present value of a course of

action to shareholders.

Accounts for the timing and risk of the expected

benefits. Benefits are measured in terms of cash flows.

Fundamental objectivemaximize the market

value of the firms shares.

Value creation based on;

- Accounting profit vs cash flows

- Timing of cash flows

- Risk of cash flows (situation like pessimistic, optimistic)

-

8/13/2019 CF-Topic-1

31/37

Profit maximization v/s Wealth

Maximization

Ex: Option 1 Option 2 Option 3

Year 1 200 500 333.33

Year 2 300 300 333.33

Year 3 500 200 333.33

Total 1000 1000 1000.00

Option-2 will maximize shareholders wealththoughit offers earlier returns.

-

8/13/2019 CF-Topic-1

32/37

Comparison of Profit & Wealth objectives:

Profit Max. Wealth Max.

Returns Yes Yes

Time factor No Yes

Risk factor No Yes

-

8/13/2019 CF-Topic-1

33/37

Need for a Valuation Approach

33

SWM requires a valuation model.

The financial manager must know,

How much should a particular share be worth?

Upon what factor or factors should its valuedepend?

-

8/13/2019 CF-Topic-1

34/37

Risk-return Trade-off

34

Financial decisions of the firm are guidedby the risk-return trade-off.

The return and risk relationship:

Return = Risk-free rate + Riskpremium

Risk-free rate is a compensation for timeand risk premium for risk.

-

8/13/2019 CF-Topic-1

35/37

Risk Return Trade-off

35

Risk and expected return move in tandem; the greaterthe risk, the greater the expected return.

-

8/13/2019 CF-Topic-1

36/37

What do firms do?

Business firms often persue several goals;

They seek to achieve high rate of growth

Enjoy substantial market share

Attain product and technological leadership

Promote employee welfare

Employees & Customers satisfaction

Support education and research

-

8/13/2019 CF-Topic-1

37/37

Capital BudgetingDecision

Capital StructureDecision

Dividend Decision

Working capital

Decision

RETURN

RISK

Market ValueOf Firm

Finance Objectives