CBRE: Improving Parc Clematis previews Core Collective ... · Botanique at Bartley which obtained...

Transcript of CBRE: Improving Parc Clematis previews Core Collective ... · Botanique at Bartley which obtained...

PROPERTY PERSONALISED

Visit EdgeProp.sg to find properties, research market trends and read the latest news The week of August 19, 2019 | ISSUE 895-117

MCI (P) 047/08/2018 PPS 1519/09/2012 (022805)

CapitaLand’s M&A will give it access to Ascendas-Singbridge’s Changi Business Park

Reinventing Soilbuild GroupLim Han Qin, representing the next generation at the helm

of the company, talks about how the business has diversified

and entered new markets in recent years.

Turn to our Cover Story on Pages 8 & 9.

ALBE

RT C

HUA

/ED

GEP

ROP

SIN

GAP

ORE

Soilbuild Group’s headquarters and Prefab Innovation Hub at Defu South Street 1

Industry InsightsCBRE: Improving

workplace experience platforms ep4

New Launch Parc Clematis previews

at prices from $1,550 psf ep5

Co-Working Core Collective opens

in Dempsey Hill ep6

Market TrendsSingapore retail rents

remain weak in 1H2019 ep15

Lim Han QinDirector of Soilbuild Group Holdings

EP2 • EDGEPROP | AUGUST 19, 2019

PROPERTY BRIEFS

EDITORIALeditor | Cecilia Chowdeputy editor | Amy Tansenior writers | Charlene ChinTimothy Taywriter | Bong Xin Yinghead, copy editing | Pek Tiong Geecopy editor | Rachel Hengphoto editor | Samuel Isaac Chuaphotographer | Albert Chuaeditorial coordinator | Yen Tandesigner | Kim Sy

ADVERTISING + MARKETING ADVERTISING SALES

vice-president, sales & operations | Diana Limaccount director | Ivy Hong deputy account director |Janice Zhuaccount manager |Pang Kai Xinregional business development manager | Cole Tanhead of marketing & branding |Rachel Lim Shuling

CIRCULATION manager | Ashikin Kaderexecutive | Malliga Muthusamy

CORPORATE chief executive officer | Bernard Tong

PUBLISHERThe Edge Property Pte Ltd150 Cecil Street #13-00Singapore 069543Tel: (65) 6232 8688Fax: (65) 6232 8620

PRINTERKHL Printing Co Pte Ltd57 Loyang DriveSingapore 508968Tel: (65) 6543 2222Fax: (65) 6545 3333

PERMISSION AND REPRINTSMaterial in The Edge Property may not be reproduced in any form without the written permission of the publisher

We welcome your commentsand criticism: [email protected]

Pseudonyms are allowed but please state your full name, address and contact number for us to verify.

Good Class Bungalow at White House Park for sale from $75 mil A Good Class Bungalow (GCB) at White House Park, sitting on a land of 35,290 sq ft, is up for sale at an asking price of $75 million to $80 million ($2,125 psf to $2,267 psf).

White House Park, in District 10, Bukit Timah, is one of the 39 gazet-ted GCB areas in Singapore.

The property for sale spans two storeys, and is possibly the highest point in the locality, according to ex-clusive marketing agent JLL. Once it is redeveloped, the owner can enjoy commanding views of lush green-ery, it says.

The regular-shaped plot has a front-age of 54 metres. The land can be sub-divided into two GCB parcels, each with a generous frontage, JLL says.

The tender will close on Sept 20, at 2.30pm.

Kampong Bahru Road shophouses for sale from $39.6 mil A row of six freehold conservation shophouses on Kampong Bahru Road are up for sale from $39.6 million, or $6.6 million per unit.

The property for sale comprises 69, 71, 73, 75, 77 and 79 Kampong Bahru Road. It has a total land area of 7,068 sq ft, and total gross floor area (GFA) of 17,600 sq ft. It is zoned for com-mercial use under URA’s 2014 Master Plan and is within the Blair Plain Con-servation Area.

The property is within walking dis-tance to Outram Park MRT Station and the upcoming Cantonment MRT Sta-tion. The new Kampong Bahru bus ter-

minal is located just across from the property. It is also within a 10-minute drive from the CBD.

The property is marketed by JLL and Tuscany Realty.

The expression of interest exercise closes on Sept 12 at 3pm.

Braddell View estate up for collective sale again at $2.08 bil Braddell View, the largest of the 18 HUDC estates in Singapore, is up for collective sale again at an unchanged reserve price of $2.08 billion.

The estate was first put up for col-lective sale on March 27, but the ten-der closed on May 28 without any bids.

After factoring the 7% bonus bal-cony gross floor area (GFA), the esti-mated differential premium, and the lease top-up to a fresh 99 years, the

price translates to a land rate of ap-proximately $1,159 psf per plot ratio.

Braddell View comprises 918 units of apartments, maisonettes, and pent-houses, as well as two shops. The siz-es of residential units range between 1,453 sq ft and 3,369 sq ft. It sits on a 1.14 million sq ft hilltop site over-looking MacRitchie Reservoir Park.

Under the 2014 Master Plan, the Braddell View site is zoned for resi-dential use with a gross plot ratio of 2.1 and has a proposed total GFA of about 2.4 million sq ft. Colliers esti-mates that up to 2,620 new residential units with an average size of about 915 sq ft could be built on the site, sub-ject to approval for a pre-application feasibility study.

The tender will close on Sept 25 at 3pm. — Compiled by Charlene Chin

CDL sells $1.55 bil residential units in Singapore in 1H2019City Developments (CDL) saw its earn-ings fall 26.4% to $162.4 million for the 2Q2019 ended June, from $220.7 million a year ago.

2Q2019 revenue dropped 37.5% to $850.4 million, from $1.36 billion in the corresponding quarter last year.

This was primarily attributable to lower contribution from the property development segment due to timing of profit recognition for development projects. CDL notes that the segment tends to be lumpy since profits from some projects cannot be recognised pro-gressively but only upon completion.

In 2Q2019, revenue was largely rec-ognised from The Tapestry, Gramercy Park, Hongqiao Royal Lake, Whistler Grand and Suzhou Hong Leong City Center (HLCC).

As at end-June, cash and cash equiv-alents stood at $2.96 billion.

“US-China trade tensions contin-ue to severely dampen market senti-ments globally. Until a deal is struck between the world’s two largest econ-omies, global markets will continue to succumb to trade jitters. Many econo-mies, including Singapore, will be se-riously affected by the escalating dis-pute,” says Kwek Leng Beng, executive chairman of CDL.

Meanwhile, CDL group CEO Sher-

man Kwek says the group is focusing on its strategy of Growth, Enhance-ment and Transformation.

“By creating strong value proposi-tions and timing our launches strategi-cally, we have achieved healthy sales for our residential projects in Singa-pore. At the same time, we have further diversified overseas through transfor-mational initiatives such as our part-nership with Sincere to expand CDL’s presence in China and achieve sustain-able growth there,” he says.

In Singapore, CDL sold 505 residen-tial units (including executive condo-miniums or ECs) with total sales at $1.55 billion in 1H2019.

Of CDL’s developments, Boulevard 88, a luxury 154-unit freehold condo along Orchard Boulevard, has seen 69 units sold to date since its launch in March 2019. This includes all four of its penthouses. The average selling price achieved is over $3,800 psf.

Amber Park, a freehold 592-unit de-velopment in the East Coast, has sold 166 units to date, at an average sell-ing price of over $2,450 psf.

New Futura, a 124-unit freehold development at Leonie Hill Road, is 100% sold, achieving an average sell-ing price of over $3,500 psf.

The 190-unit South Beach Residenc-es, atop the Marriott Hotel Singapore South Beach, is 50% sold to date, at an average selling price of $3,400 psf.

At West Coast Vale, the 716-unit Whistler Grand is now more than 50% sold, at an average selling price of over $1,350 psf.

The Tapestry, a 861-unit condomin-ium at Tampines Avenue 10, has seen 644 units sold at an average selling price of over $1,340 psf.

In China, CDL and its joint-venture associates sold 347 residential units in 1H2019, hitting total sales of RMB1.08 billion ($213 million).

CDL has also invested RMB5.5 billion

($1.1 billion) in Sincere Property Group, a real estate developer in China, in re-turn for 24% of equity stake in the Chi-nese firm, which will be completed by 4Q2019. The move provides CDL access to a landback of 1,356 sq ft gross floor area (GFA) across 70 development pro-jects. It also expands CDL’s asset classes in China to include business parks and serviced apartments, and broadens its geographical presence from three to 20 cities in China.

CDL will also increase its stake in Phase 2 of Shanghai Hongqiao Sin-cere Centre, from 70% to 100%, for RMB1.75 billion. Spread across 11 blocks, this prime commercial proper-ty has a GFA of 384,691 sq ft compris-ing office, serviced apartments and a retail component.

In Japan, CDL is acquiring a 34-unit freehold residential project, named Horie Lux, in Osaka City for JPY2.01 billion ($26 million). The property is in Nishi-ku, central Osaka, and in prox-imity to four train stations. The group is targeting the property at the Osaka rental market, and will provide an en-try net yield of 4.5% per annum.

In Australia, CDL is acquiring a port-folio of three prime freehold mixed de-velopment projects in Brisbane and Mel-bourne for A$25.9 million (S$24 million). The three projects are in various stages of planning and have the potential to yield over 600 residential units and 51,667 sq ft of commercial/retail space.

In 4Q2019, CDL plans to launch the 680-unit Sengkang Grand Residences in Singapore. The mixed-use integrat-ed development will be connected to Buangkok MRT Station and a new bus interchange. Sengkang Grand is a joint venture development with Capitaland.

UOL Group sees 48% jump in 2Q2019 earnings to $195.4 milUOL Group recorded a 48% jump in 2Q2019 earnings to $195.4 million,

compared to $131.9 million in 2Q2018. This brings 1H2019 earnings to $267.7 million, 29% higher than $207.2 mil-lion in 1H2018.

Revenue for 2Q2019 was 20% low-er at $512.3 million from $637.9 mil-lion a year ago, mainly due to low-er progressive recognition of revenue from the development projects, Princi-pal Garden, The Clement Canopy and Botanique at Bartley which obtained TOP in December 2018, March and April respectively.

Hotel operations also recorded a 3% decline mainly from lower occu-pancies and room rates at Marina Man-darin and ParkRoyal Darling Harbour and ongoing refurbishments at Park-Royal on Kitchener Road.

This was partially offset by high-er revenue contribution from proper-ty investments, mainly UIC Building and newly acquired 72 Christie Street in Sydney; higher revenue contribution from the management services and technologies segment; and increase in dividend income from quoted invest-ments in UOB and Haw Par.

As at end-June, cash and cash equiv-alents stood at $609.4 million.

Liam Wee Sin, group CEO of UOL, says, “In the first half of 2019, the take-up for new projects was 6% higher than the preceding year notwithstanding the cooling measures introduced on July 6, 2018. We see resilience in the mar-ket and potentially further upside for selected projects with strong location and product attributes.”

“Riding on the strong sales of Am-ber45 and The Tre Ver, both of which are about 80% sold, we are targeting to launch our Avenue South Residence by the end of this month. The 56-storey project is next to the exciting Greater Southern Waterfront, an extension of our city and a gateway to future live, work and play,” adds Liam.

Avenue South Residence will have

JLL COLLIERS INTERNATIONALJLL

CDL

E

The GCB at White House Park sits on a land of 35,290 sq ft Braddell View comprises 918 units of apartments, maison-ettes, and penthouses, as well as two shops

The six freehold conservation shophouses on Kampong Bahru Road have a total land area of 7,068 sq ft

New Futura, a 124-unit freehold develop-ment at Leonie Hill Road, is 100% sold

EDGEPROP | AUGUST 19, 2019 • EP3

PROPERTY BRIEFS

twin 56-storey towers with a total of 1,074 res-idential units and 13,993 sq ft of commercial space. At this height, the project is regarded as one of the tallest condo projects in Singa-pore. The project will be developed jointly by UOL, United Industrial Corporation (UIC) and Kheng Leong Co in a 50:30:20 split.

On the outlook for the residential property market, UOL expects prices for new private homes to remain relatively stable despite the economic slowdown in Singapore.

Metro’s 1Q earnings down 47.5% to $10.6 mil on higher costs, lower JV contributions Metro Holdings reported 1Q2020 earnings almost halved to $10.6 million, compared to $20.2 million in 1Q2019. The fall in earnings was mainly due to finance costs increasing by about 600% to $4.5 million from $0.7 million a year ago, as well as a 55.3% fall in share of joint ventures’ results to $7.3 million.

The increase in finance costs was mainly due to interest expense of $3.8 million on the notes issued by the company pursuant to its $1 billion multicurrency debt issuance pro-gramme, while the fall in share of joint ven-tures’ results was mainly attributable to loss-es incurred from The Crest, Singapore, and absence of $2.3 million gain from the sale of Acero Works, an office building in Sheffield, the UK, recognised in 1Q2019.

Revenue for the quarter saw an 85.4% jump to $55.9 million from $30.2 million a year ago, as the property division recognised revenue of $27.2 million from the sale of property rights of the residential development properties in Bekasi and Bintaro, Jakarta. The retail divi-sion reported lower sales.

Consequently, cost of revenue increased 74.6% to $51.7 million, which led to a gross profit of $4.2 million in 1Q2020 compared to $0.7 million in 1Q2019.

As at June 30, Metro’s cash and cash equiv-alents stood at $286.2 million.

Looking ahead, Metro says the group’s portfolio of investments, held at fair value through profit or loss, will continue to be subject to fluctuations in their fair value. The group therefore will continue to be sub-jected to significant currency translation ad-justments on foreign operations which will affect the results and other comprehensive in-come and the balance sheet, as a major por-tion of its net assets which mainly represent investment properties and projects situated in China, are denominated in the renminbi

and Hong Kong dollar. Some of the group’s net assets are also denominated in the Brit-ish pound and Indonesian rupiah.

Occupancy at Metro’s recently acquired 50% stake in two Grade-A office towers, 7 and 9 Tampines Grande, remains at 90.6%. Metro expects the property to benefit from an increasing demand in the decentralised office market with its location in Tampines Regional Centre.

The group’s property division is anticipat-ed to continue receiving recurring rental in-come from its GIE Tower in Guangzhou and Metro City and Metro Tower in Shanghai. Leasing activities are also underway for the group’s office buildings in Bay Valley, New Jiangwan City, Yangpu District in Shanghai. Meanwhile, asset enhancement works for Metro’s joint venture in Shanghai Plaza are progressing on schedule.

In Indonesia, construction and sales of the residential projects in Bekasi and Binta-ro in Jakarta which commenced in late 2017 and March 2018, respectively, are ongoing.

In the UK, Manchester residential pric-es are expected to grow by around 3% over the next five years, according to JLL’s North-ern England Residential Forecasts 2019. This supports Metro’s Middlewood Locks develop-ment project. The first phase of construction for the 571 apartment units was completed in October last year, with units being handed over in stages. Construction for phase two is currently ongoing.

“The Metro Group will continuously ex-ercise astute judgement in capital recycling and look for attractive investment opportuni-ties,” says Metro’s chairman Winston Choo.

Meanwhile, the retail division continues to operate amid difficult trading conditions.

Koh Brothers’ 1H2019 net profit up 8% y-o-y to $2.4 mil Construction and property development firm Koh Brothers recorded a net profit of $2.4 mil-lion in 1H2019, which is an 8% growth from $2.2 million in 1H2018.

This was mainly due to a $4.5 million in-crease in shares resulting from its associated companies and joint ventures to $9.7 million in 1H2019, which stemmed from profit from its 45%-owned, maiden mixed-use develop-ment project, Nonhyeon I PARK, located in the prime Gangnam district of South Korea, and a fair value gain from an investment prop-erty in Singapore.

The group also saw a 17% decrease in

administrative expenses as a result of low-er staff costs.

In 1H2019, revenue rose by 6% to $161.3 million from $152.8 million in 1H2018 due to higher revenue from its construction and building materials division. Gross profit fell by 10% to $8.9 million in 1H2019 from $9.9 million in 1H2018 due to lower margins.

Cash and bank balances remained healthy at $52.5 million, while shareholders’ equity stood at $298.8 million as at June 30. The group’s debt servicing ability with liquidity is at a current ratio of 2.1 times and a net gear-ing ratio of 0.98 time as at June 30.

Moving forward, Koh Brothers plans to launch its wholly owned Toho mansion and its 20%-owned joint venture sites, Hollandia and Estoril, for sale. All three sites are free-hold and in Holland Village.

Overseas, Koh Brothers’ Nonhyeon I PARK project in South Korea has sold 97% of its units to date.

“The well-received Nonhyeon I PARK pro-ject in South Korea continues to contribute healthy profit from units sold, while our con-struction arm has continued its momentum to clinch a large-scale project from PUB that has lifted our construction book to almost $1 billion,” said Francis Koh, managing director and group CEO of Koh Brothers.

Last month, Koh Brothers won the $668.2 million PUB contract to construct pumping sta-tions at Tuas Water Reclamation Plant. This has lifted the group’s construction order book to $984.7 million, from $566.4 million, as at June 30, 2019. The project has commenced and is slated to complete in 2025.

Koh Brothers’ other public projects include Circle Line 6-related works (from Prince Ed-ward Station to Marina Bay Station); the de-sign and construction of Phase 2 of the Deep Tunnel Sewerage System; and the Woodlands Health Campus project awarded by the Minis-try of Health, a first in the Woodlands vicinity.

Frasers Property reports 68% rise in 3Q earnings to $334 mil Frasers Property reported 3Q2019 earnings of $333.9 million, up 68.2% from a year ago on higher fair value change and exceptional items.

Gross profit for 3Q2019 fell 27.3% to $298.1 million from a year ago as revenue fell 53.1% to $638.8 million while cost of sales fell a steeper 64.2% to $349.7 million.

Revenue and PBIT from Singapore resi-dential properties fell by $559 million and $70 million to $2 million and $10 million,

respectively. Frasers Property says the de-cline was mainly due to fewer settlements in Parc Life Executive Condo (EC) and the absence of profit contributions from North Park Residences following its TOP last Octo-ber and full revenue recognition in 1Q end-ed December 2018.

Revenue and PBIT from Singapore com-mercial properties increased by $12 million and $58 million to $131 million and $139 mil-lion. Excluding the group’s share of fair value change of joint ventures and associates, PBIT grew by $31 million to $112 million.

These increases were mainly attributed to maiden contributions from the newly ac-quired PGIM Real Estate Asia Retail Fund (PGIM ARF), full quarter’s contributions from Frasers Tower following the start of operations in May 2018 and higher occupancies at the south wing of Northpoint City.

Revenue and PBIT from Australia decreased by 29% and 47% to $204 million and $38 mil-lion. Frasers Logistics and Industrial Trust re-ported higher revenue and PBIT by $8 mil-lion and $11 million to $57 million and $38 million, respectively.

Including other losses of $4.5 million and 16.3% higher administrative expenses of $110.3 million, trading profit came in 42.3% lower at $183.3 million.

Profit before fair value change, taxation and exceptional items fell 42.3% to $166.8 million.

However, share of results of JVs and as-sociates more than doubled to $85.5 million and there was a fair value change on invest-ment properties of $263 million compared to $39.9 million a year ago while exception-al items grew to $16.1 million compared to $0.97 million.

In its outlook, Frasers Property says it will continue to manage and grow its business-es and asset portfolio in a prudent manner across geographies and business segments.

Frasers Property Singapore previewed the 99-year leasehold Rivière on the former Zouk site on Jiak Kim Street in June 2019. Accord-ing to Frasers Property, 32 units were sold during the preview.

Meanwhile, around 90% of the 841-unit Seaside Residences along Siglap Link were sold as at end-June.

On the retail front, Frasers Property says it will “explore opportunities to collaborate and share experiences to enhance its mall of-ferings and better serve its communities”. — The Edge Singapore, with additional report-ing by Charlene Chin

FRASERS PROPERTYUOL

Frasers Property Singapore previewed the 99-year leasehold Rivière in June 2019Avenue South Residence is developed jointly by UOL, United Industrial Corporation (UIC) and Kheng Leong Co

E

EP4 • EDGEPROP | AUGUST 19, 2019

INDUSTRY INSIGHTS

| BY SHOBHIT CHOUBEY |

The conversation around workplace chang-es has become somewhat passé. Across the globe, much has been written about a radical shift in the design and interpre-tation of the workplace. Equally, digital-

ly driven solutions have made office flexibility a bigger reality. The rise of internationally em-braced concepts like co-working, activity-based working and open-plan offices has created what is being referred to in some circles as the work-place’s “Uber moment”. These are all reason-able dicussions, which is not a negative thing, but the time has come to dig a little deeper.

Progress of this nature is clearly a sign of the times – a reflection of shifting demographics; a window into evolving corporate cultures, and the “mainstreaming” of flatter workplace hier-archies and practices. We, as an industry, fully embrace this dialogue.

However, one area that we find needs more discussion and debate is the human element in this new workplace. And this is where we find the development of next-generation employee experience platforms will bridge the gap be-tween humans and technology, workplace and experience, convenience and employee-centric requirements.

The human element of service delivery Providers of digital-tenant platforms have made considerable progress, but have never fully addressed how to connect said platforms with the human experience, within and out-side the bounds of the workplace. True, recent years have seen the development of employ-ee experience platforms in response to grow-ing employee demand for technology-driven, hospitality-infused and inspiring workplaces.

While there now exists a wide range of dig-ital platforms featuring technology capable of enhancing employee experience to some degree, many do not effectively leverage data to identi-fy problem areas or proactively deliver the fea-tures and services end-users require. The com-mon denominator here is the human element of service delivery, which has been neglected.

So wherein lies the answer? In our view, the next-generation workplace experience platforms must combine technology with advanced data strategies as a first step. They must provide best-in-class hospitality services to create a truly transformative and employee-centric workplace experience. And, perhaps most poignantly, op-erate through an understanding that technolo-gy alone cannot create a truly effective and em-ployee-centric workplace experience.

The immediate answer lies in the marriage of data with human experience. Specifically, data analysis and people services are emerg-ing as key differentiators for employee engage-ment platforms. Why is this the case? Simple:

the rise and increasing demand for proactive, rather than reactive, services and more per-sonalised user experiences. Let’s unpack this a little further.

Leveraging dataData and its collection are a divisive topic, and one of the larger cultural conversations at the centre of this new omni-tech age. True, within the workplace sphere, most workplace engage-ment platforms collect vast amounts of data. However, on the flip side, they are not equipped with the requisite expertise or algorithms to analyse it, making them incapable of provid-ing actionable insights into workplace teams.

Change, though, is here. And data is being used far more effectively to improve the expe-rience of the end-user, the employee. In our observations, the most advanced employee en-gagement platforms are now capturing a vari-ety of functional workplace information. Data is identifying how users are utilising the office on a day-to-day basis. It is pinpointing the fea-tures and amenities they prefer and the trans-actions they conduct. More recently, data is leading the charge in terms of how platforms and their users can identify areas for improve-ment and implement employee-centric change.

On a practical level, data from scheduling systems, motion sensors, in-app user behaviour and learned preferences can provide consider-able insight into how employees collaborate or spend their time in the office.

From a convenience and scheduling perspec-tive, it can also enable workplace teams to as-certain whether large spaces are being occupied by individuals; which rooms are rarely occu-pied; and whether there are certain spaces that are chronic service request generators. Pretty simple, but core to improving some measure of employee experience by putting the human at the centre of the outcome.

More recently, the Internet of Things (IoT) system has emerged on tenant experience plat-forms. When viewed through the lens of the workplace, the IoT system has human inter-ests and experiences at its heart.

For example, data collected by IoT sensors and space management software can also pro-vide a wealth of information related to space optimisation and occupancy analytics. After this data is captured, processed and analysed by workplace teams, occupiers can accurately gauge space, seat and room utilisation. It can even calculate and advise on the average size and duration of meetings; and entry and exit statistics.

People servicesThese insights can be used to help occupiers and landlords improve utilisation by chang-ing the role and function of that space or add-ing new features to make it more attractive to users. But once again, it is the end-user that will reap the most benefits. This comes to the changing demands on the way we work and employee expectations of this process.

Across the Asia-Pacific and the globe, em-ployees are increasingly demanding to work in a way that suits them. This is where data works for them. Data can be directed at creating per-sonalised working experiences for individual employees – in other words, people services.

Many platforms overlook the importance of genuine human interaction, particularly regard-ing service delivery. For instance, consumers have come to expect great in-person customer experiences in shops, restaurants and hotels. So why not the workplace?

This shift is occurring. The same consumer and hospitality experiences are increasingly be-

ing demanded by the workplace by the same in-dividuals craving the people-centric experience. In parallel to life outside of the office, employ-ees expect the simplicity and ease of these ex-periences to be accessible to them at any time through technology, even while working.

With this backdrop, CBRE believes that for employee experience technologies to be truly effective, they must be integrated with people services. How is this accomplished? By posi-tioning well-trained and knowledgeable expe-rience professionals on site, who are available to handle enquiries and requests made through the application and to support employees over the course of their working day.

As a result, the experience teams can make informed decisions when curating experiences and events through captured data on user be-haviour, feedback and preferences. Combined with a technology mindset for the human ex-perience, a data-driven and curated experience can significantly increase employee engagement.

On the flip side, technology can be a dou-ble-edged sword when implanted through a workplace experience lens. For example, one of the more common misappropriations that or-ganisations make is buying platforms that focus primarily on technology features and neglect en-hancements to the service delivery capability of workplace managers within the workplace. However, when used correctly, smart technol-ogy tools help workplace managers to enhance moments that matter in the experience journey and proactively resolve pain points to deliver hospitality-focused experience in the workplace.

A configurable platformAs a provider of tenant experience, CBRE takes the role of technology, data and people seri-ously. CBRE’s latest technology-based, hu-man-focused employee experience platform, Host, blends people, training and technology to create an employee-centric workplace expe-rience. Host integrates technology and end-us-er experience features on a single platform.

This enables employees to access their work-place needs from a single app, and organisations to administer building management require-ments from a single and customisable platform. Host, which can be tailored to specific client re-quirements, features a mobile experience that allows users to navigate the workplace, sched-ule meetings with colleagues, reserve work-spaces, use F&B services, and access building and concierge services.

We like to think of it as the extension of a brand – a configurable platform that allows cli-ents to personalise the look and feel of the work-place. The app is also mindful of the unique aspects of space, culture and values of users, ensuring, for example, that through machine learning, space needs are met sustainably and efficiently for building operators.

As the workplace evolves, it will only succeed with the buy-in of the most important currency: the people. Platforms can be technology-sound, innovative and highly analytical, but without a clear connection to the needs, demands and functionality of an evolving employee base, they miss the mark. One must not forget that at the core of any change is behaviour. And that be-haviour is human-led. Next-generation tenant platforms must correlate with that reality to take this important step in the broader work-place evolution.

Shobhit Choubey is the APAC lead, Host, at CBRE.

Why workplace experience platforms need the human element

CBRE’s new office in San Francisco

E

Host is CBRE’s latest technology-based, human-focused employee experience platform

PICTURES: CBRE

EDGEPROP | AUGUST 19, 2019 • EP5

NEW LAUNCH

| BY BONG XIN YING |

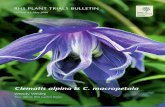

Named after the Clematis aristata, a flower associated with ingenuity and artistry, Parc Clematis by Sin-ghaiyi Group will open for public preview on Aug 17.

Sitting on a 99-year leasehold site spanning 633,639 sq ft, the 1,468-unit development is Singhaiyi’s largest project to date. It is located on the former Park West site at Jalan Lempeng and will be the first mega private residential launch in Clementi in 3½ years. About 30% of the units, or 440 units, will be released for sale at the project’s launch on Aug 31.

“Parc Clematis is an inventive residential project built on the fundamental premise of community living, weaving together residents, homes and well-thought spaces to facilitate a unique, kindred lifestyle community,” says Celine Tang, group managing director of Sin-gHaiyi. The project is marketed by Huttons Asia, OrangeTee & Tie, PropNex Realty and ERA Realty Network.

The development is the third in its “flower series” of new residential projects launched

this year. The first two were The Gazania and The Lilium, located in the How Sun area - which were launched simultaneously in May.

Variety of unitsTo cater to various homebuyers’ needs, Parc Clematis will feature a total of 64 layout con-figurations.

Unit sizes range from 452 sq ft for a one-bed-room unit, to 2,669 sq ft for a five-bedroom penthouse unit. The strata terrace units start from 2,659 sq ft and the bungalow units are 3,832 sq ft each.

Prices start from about $1,550 psf for a one-bedroom unit, $1,540 psf for a two-bed-room unit, and $1,530 psf for a three-bed-room unit.

Community spiritParc Clematis has dedicated over 400,000 sq ft, or 80% of the site, to recreational spaces and communal facilities. To promote commu-nal living and provide an extension of living space for residents, there are themed dining pavilions such as the Chef’s Kitchen, the Wok It Dining Pavilion and the Teppanyaki Pavil-

ion. These are all fitted with communal culi-nary equipment and furnishing.

Other facilities include study/work lounges, clubhouses, multi-purpose entertainment and game rooms, thematic playgrounds including an inclusive playground, as well as a laundry pavilion with large, self-service washing ma-chines and dryers.

Residents can enjoy a free shuttle bus ser-vice to the nearby MRT stations for one year, and at a subsidised rate from the second to fifth year.

“We are confident that Parc Clematis will attract strong interest from both homeowners and investors alike, given its stellar location, extensive list of communal facilities, and en-gaging concept,” says Tang.

Close to amenitiesParc Clematis is within walking distance to The Clementi Mall, where the Clementi Bus Interchange and Clementi MRT Station on the East West Line are situated. The development is also close to major expressways such as Ayer Rajah Expressway, Pan Island Express-way and Bukit Timah Expressway.

The project is a six-minute walk from Nan Hua Primary School, a four-minute drive to NUS High School of Mathematics and Sci-ence, and a 10-minute drive to Anglo-Chi-nese Junior College and the National Univer-sity of Singapore. Business gateways, such as the one-north R&D park, and the Jurong Lake District, are also nearby. West Coast Pla-za, JEM, JCube, and Westgate mall are just a six-minute drive away.

Given these attributes, property consult-ants expect to see keen interest for the pro-ject. “We’ve received good response on the ground since we started doing roadshows [for Parc Clematis] because of its location,” says Ismail Gafoor, CEO of PropNex Realty.

According to him, potential buyers are mainly drawn to the project’s proximity to Clementi MRT Station, schools, and busi-ness parks. As such, he expects owner-oc-cupiers and HDB upgraders to make up the bulk of buyers. “Clementi has also tradition-ally been attractive to investors because of its location,” he adds.

Eugene Lim, key executive officer of ERA, also expects the project to appeal to existing residents in the vicinity. He observes that there has been interest from the children of residents who are living in the private landed estate at Faber Avenue or in the non-landed private homes nearby. This group of buyers is looking to buy a home close to their parents.

Both Gafoor and Lim highlight that the project’s starting price of $1,550 psf for a one-bedroom unit is also a key selling point. “Mass-market condos in the outlying areas command well above $1,400-1,500 psf,” says Gafoor. “Parc Clematis is appealing in that it offers different layouts [catering to] every family and, at this price point, it is really at-tractive in today’s market.”

Lim agrees: “Nearby, recent transactions for an older completed project, The Trilinq, are above $1,600 psf.” Developed by IOI Group, the 99-year leasehold The Trilinq was com-pleted in 2017 and comprises 755 units.

Parc Clematis previews at prices from $1,550 psf

Located on the former Park West site at Jalan Lempeng, the 1,468-unit Parc Clematis will be the first mega private residential launch in Clementi in 3½ years

EThe living and dining area of a four-bedroom show unitTo cater to various homebuyers’ needs, Parc Clematis will feature a total of 64 layout configurations

PICTURES: SAMUEL ISAAC CHUA/EDGEPROP SINGAPORE

EP6 • EDGEPROP | AUGUST 19, 2019

CO-WORKING

| BY BONG XIN YING |

On July 12, Core Collective soft-launched its second location at 27A and 30B/C Loewen Road in Dempsey Hill.

Operating on a concept similar to co-working, Core Collective fo-

cuses on creating spaces for fitness and well-ness professionals to collaborate and deliver their services to clients without committing to long-term leases.

“This location caters to a very different mar-ket from Core Collective Anson,” observes Mi-chelle Yong, founder of Core Collective and direc-

tor of property development firm Aurum Land, a subsidiary of construction giant, Woh Hup.

At Anson Road, Core Collective’s flagship mainly caters to office workers in the CBD area, while at Dempsey, families are its main clients. As such, she does not see its Dempsey outlet as a replica of what the brand has done at Anson.

She shares that her family was her source of inspiration for the Dempsey space. They want-ed to have a Core Collective closer to home so they didn’t need to travel to the CBD, says Yong. This way, they could attend a pilates or aerial yoga class, their children could partici-

pate in the children’s classes and their spous-es could work out at the gym with a personal trainer, she explains.

One-stop lifestyle destinationDrawing from this idea, Core Collective Dempsey was conceived as a one-stop lifestyle and well-ness destination. The site where it is located once housed the Museum of Contemporary Arts. The site was later launched for tender by the Singapore Land Authority (SLA) in May last year. Aurum Land, of which Core Collective is a subsidiary, was awarded the tender after a successful bid rent of $24,800 per month.

“I do keep an eye on the SLA tenders,” says Yong. “SLA flagged the site to us [as] they thought that our concept would be a really good fit.”

While Core Collective Dempsey is situated at a tranquil corner, the space is abuzz with laugh-ter from the children who are having swimming classes at the pool and upbeat music in the main hall that comprises the gym and rest area.

On the same floor, apart from treatment rooms for chiropractors and osteopaths, there is a reformer pilates studio. A highlight of this outlet is a studio fitted with aerial hoops and aerial silks. There, clients can attend yoga class-es with instructors from Yoga Lab or learn aerial

Core Collective opens in Dempsey Hill

The site where Core Collective Dempsey is located once housed the Museum of Contemporary Arts

PICTURES: ALBERT CHUA/EDGEPROP SINGAPORE

Core Collective Dempsey has some 100,000 sq ft of outdoor space that can be used for sports and activities In addition to lifestyle and wellness facilities, Core Collective Dempsey has a Baker & Cook outlet

EDGEPROP | AUGUST 19, 2019 • EP7

CO-WORKING

yoga with Aerial Fitness Studio, Core Collec-tive Dempsey’s latest partner.

Given the studio’s high ceiling, Core Col-lective’s partners are able to offer a range of classes and not just standard yoga. “A lot more tricks and drops [can be done, making it] really exciting,” she says.

On the second floor, there is a studio for barre workouts, in partnership with Barre Lab. A room has also been designed for dedicated play therapy with a focus on children’s well-ness. Yong reveals that talks are currently ongo-ing for three play therapists to collaborate there.

Adjacent to the space are a nursing room and a separate staff lounge for partners to take a break. Yong is considering offering a mani-cure and pedicure service there.

‘Tanjong Beach Club in the city’With all these features, Core Collective Dempsey has attracted a host of new partners including the Institute of Functional Neuroscience with its first clinic location in Singapore; All That Jazz Dance Academy, targeted at children; The Movement Factory which organises outdoor bootcamps for corporates, spartan training for children, and personal training; Bodytree Pi-lates and Centre Stage School of the Arts of-fering drama classes.

Apart from these, Swish Swimming has part-nered Core Collective to offer classes at the pool. Kristen Romain, founder of Swish Swimming, observes that Core Collective Dempsey is “like this breath of fresh air in Singapore”.

Prior to offering classes at Core Collective,

Swish has been conducting classes at another pool at 72 Loewen Road. When Yong approached Swish to hold classes at Core Collective’s pool, Romain thought it was a “no-brainer” as it is close to its existing location.

Romain says that on some evenings, her students get to enjoy a view of the sunset from the pool. “Our clients are really happy to be here,” she adds. According to her, what her clients enjoy the most is the mix of life-style and fitness options at Core Collective Dempsey. Parents would drop their children off for swimming classes while they attend their own fitness classes at Core Collective or have a meal at Baker & Cook.

In conceiving Core Collective Dempsey, Yong made space for a pool there. “I wanted a ‘Tanjong Beach Club in the city’ kind of feel,” she says.

To be sure, Core Collective Dempsey has the opportunity for further development. The land it sits on spans 140,000 sq ft, inclusive of the new Baker & Cook restaurant. Yong es-timates that it has some 100,000 sq ft of ad-ditional outdoor space that can be used for sports and activities.

A permanent obstacle course, a bio pond for children to fish at, and a purpose-built outdoor parkour park are among the ideas Yong has for the unutilised space. “We could do so much more, that’s why it’s so excit-ing,” she says.

Co-working and co-wellnessApart from Core Collective, Yong is co-CEO of co-working operator Found8. The brand is the

result of a merger between local co-working operators, Found and Collision 8. Yong was the founder of Collision 8. Following the merg-er earlier this year, Found8 has five locations in Singapore and is about to open its sixth on Aug 22 in Kuala Lumpur (KL), Malaysia. For its first overseas venture, Found8 is partner-ing Malaysian Resources Corp Bhd, the mas-ter developer of the KL Sentral transport hub and business district.

“They fell in love with Core Collective when they came to visit Found8 [in Singa-pore],” says Yong. “They love the concept, and so they have been asking us to open Core Collective there.”

For now, Yong is in no hurry to expand Core Collective into KL as she wants to fo-cus on getting the Dempsey outlet off on the right foot first. “Most likely in the next year or two, we will have opened one in KL,” she shares.

When it comes to expansion, Yong highlights that it is her intention to bring both Found8 and Core Collective together overseas. “[We could] even have a co-living aspect. A lot of developers are asking us whether we can do all three,” she says.

Found8 has over 1,000 members across its six locations and a network of 22,000 inno-vation-centric individuals. There is a range of membership options starting from $390 per month.

Meanwhile, Core Collective has a curated community of over 70 professionals offering their services, and membership prices start

from $18 per standard class, $100 for a person-al training session, and $65 for a chiropractic consultation. For fitness and wellness profes-sionals, in-class support services and facilities start from $500 per month.

Franchise modelYong’s plan is to open Core Collective in five countries over the next three years, with two locations in each country. Apart from Singa-pore, the markets she has identified include Malaysia, Australia and India.

“Found8 is also interested in those markets [so] it makes sense for both businesses [to be there],” she explains. Found8 is likely to open one branch in India in 2Q2020.

Yong has no further plans to expand in Sin-gapore. “The intention is to grow internation-ally [and] regionally, and not [just] in Singa-pore, because we already have five locations, which we think is strong enough presence and coverage,” she adds.

She is also seeking advice from Enterprise Singapore to develop a franchise model for Core Collective, as she believes this model is “the most optimal way to really scale the business quickly”.

Yong may have big plans for Core Collec-tive, but she still makes time to relax and keep fit at the new Dempsey space, which is within proximity to her current abode at Balmoral. “Core Collective Dempsey is my ‘me-space’, and that’s quite fortunate. I get to have my workouts and see my chiroprac-tor here,” she says.

Yong states that thanks to the studio’s high ceiling, Core Collective’s partners are able to offer a range of classes and not just standard yoga

Kristen Romain of Swish Swimming says what her clients enjoy the most about Core Collective Dempsey is the mix of lifestyle and fitness options it offers. Swish Swimming is one of Core Collective’s partners at its Dempsey branch.

Like co-working operators, Core Collective focuses on creating spaces for fitness and wellness professionals to collaborate and deliver their services to clients without committing to long-term leases

Apart from treatment rooms for chiropractors and osteopaths, there is a reformer pilates studio at Core Collective Dempsey

E

PICTURES: ALBERT CHUA/EDGEPROP SINGAPORE

EP8 • EDGEPROP | AUGUST 19, 2019

COVER STORY

| BY CECILIA CHOW |

Soilbuild Group Holdings’ new headquar-ters at Defu South Street 1 features dou-ble-glazed glass walls to cut off the noise from the nearby Paya Lebar Airbase. Nine fish-tank-style meeting rooms overlook

a central landscaped courtyard. There are also a boardroom and a training room.

The office pantry designed as an open kitch-en with a long countertop and bar stools on ei-ther side has become a popular gathering place for staff to socialise. Other amenities include a well-equipped gym, shower room, steam room and nursing room.

A lot of attention was paid to “doing up the office nicely”, says Lim Han Qin, director of Soilbuild Group Holdings. “These days, young people place a lot of value on a beautiful of-fice.” A staff welfare committee was set up to organise activities, for instance, exercise class-es at the start of the week to beat the Monday blues and quarterly staff buffet dinners.

Unlike Soilbuild’s headquarters and Prefab Innovation Hub, the entire area around it is still very much a construction site. Like all pioneers in a frontier location, being the first had its own logistical challenges. “When we first moved in last year, Grab cars didn’t even come here; you couldn’t find the address on Google Maps; and food options were limited,” says Han Qin. To counter that, Soilbuild provides regular shuttle service for staff to go out for lunch and to the nearest MRT station.

Soilbuild had purchased the 219,708.3 sq ft, 30-year leasehold site at Defu South Street 1 in September 2015 for $23.89 million. The site is designated by Building & Construction Author-ity (BCA) as part of the Integrated Construc-

tion and Prefabricated Hub that caters for the production of prefabricated construction com-ponents, such as precast columns and beams, prefabricated bathroom units (PBUs), modular prefabricated mechanical, electrical and plumb-ing (MEP) systems, and prefabricated prefin-ished volumetric construction (PPVC).

In addition to land cost, Soilbuild spent an-other $50 million on highly automated equip-ment for the precast plant, an administrative office and a dormitory for 1,000 workers. All in, the entire complex is estimated to have cost close to $100 million, according to Han Qin.

EVOLUTIONThe new headquarters signifies the evolution of Soilbuild Group in recent years as it invests in automation and new technology for its con-struction business, ventures further beyond Singapore’s shores and makes forays into new asset classes.

It also heralded the entry of a new genera-tion of Lims at the forefront of Soilbuild Group Holdings: Han Qin, 32, who came on board in 2016; and his elder brother, Han Feng, 33, who joined the firm as a director in 2014.

Their youngest brother Han Ren, 27, is work-ing as an analyst at a private equity firm. “He just graduated over a year ago,” says Han Qin. “We will let him decide whether he wants to join the company. However, every now and then, I will ask him what his plans are.”

They are the sons of Soilbuild Group Hold-ings’ chairman, Lim Chap Huat, who co-found-ed the firm as a construction outfit in 1976. It is not just Lim’s sons; his wife, Leo Jee Lin, is also part of the business. Having joined Soil-build in 1984, she is the head of marketing and leasing division.

“My mum retired for a while as she was looking after my younger brother’s child,” ex-plains Han Qin. “Now that her grandchild is attending school full-time, we asked her if she could return as we would benefit from her vast experience.”

Over the years, Lim, now 65 years old, grew the business and diversified into property de-velopment – from houses and condos to in-dustrial buildings and business space. He has since bought out the shares of the other two co-founders. Lim listed Soilbuild Group Hold-ings on the Singapore Exchange in 2005, but privatised it in 2010.

Lim subsequently listed Soilbuild Construc-tion Group in 2013 where he is both executive chairman and CEO; and spun off Soilbuild

Business Space REIT in 2014. He is still a sub-stantial shareholder of both listed entities: he holds 74.61% of the shares in Soilbuild Con-struction, which had a market capitalisation of $50.5 million at six cents a share; and 9.87% of the shares in Soilbuild Business Space REIT, with a market capitalisation of $623.2 million and share price of 58.5 cents as at Aug 13, ac-cording to Bloomberg.

Both the listed companies – Soilbuild Busi-ness Space REIT and Soilbuild Construction Group – have their own management teams and operate independently, emphasises Han Qin.

GROWING UPRanked among Singapore’s 50 richest by Forbes last year, Lim is reported to have a net worth

PICTURES: ALBERT CHUA/EDGEPROP SINGAPORE

Lim Han Qin, representing the next generation at the helm of the company,talks about how the business has diversified and entered new markets in recent years

Reinventing Soilbuild Group

Han Qin: We want to be diversified – by sector and geography. Hence, you see overseas exposure in both resi-dential and industrial space

The central landscaped courtyard on the top floor of Soilbuild Group’s new headquarters

EDGEPROP | AUGUST 19, 2019 • EP9

COVER STORY

of $895 million. As the third of seven children and the eldest son of a trishaw driver and wash-erwoman, Lim has certainly come a long way.

According to Han Qin, from the time he was in primary school – “about Primary 3” – family outings on weekends had been visits to construction sites and sales galleries, includ-ing other developers’ showflats. “It sparked my interest in property,” he says.

After graduating from the National Univer-sity of Singapore with a law degree, Han Qin spent three years in the corporate mergers & acquisitions department of Allen & Gledhill. “I thought I was going to stay only a year, but I ended up staying on for more than three years because the work was interesting,” he says.

His father allowed them to pursue their own interests. “He didn’t tell us what to study,” says Han Qin. While he read law, his two brothers’ interests were in the financial sector. However, Han Qin felt compelled to “come and help” at Soilbuild as it is, after all, the family business.

In Soilbuild Group, Han Qin focuses on the property development business in Singapore, Myanmar and Vietnam.

In the pipeline for launch is Verticus, a 162-unit, freehold condo development on Jalan Ke-maman, off Balestier Road. The new project sits on the site of the former Kemaman Point which Soilbuild Group purchased en bloc for $143.88 million in June last year. Based on the plot ra-tio of 2.8 and maximum gross floor area (GFA) of about 122,711 sq ft, the land price translates to $1,173 psf per plot ratio.

REVISITING BALESTIERSoilbuild Group is no stranger to Balestier, hav-ing developed five other projects there in the past: the latest was The Mezzo, a mixed strata-titled commercial and residential development, which was launched in 2009 and completed in 2012. The others were The Centrio and Monte-bleu, both launched in 2007, with the former completed in 2009 and the latter in 2010. Pin-nacle 16 was launched in 2003 and completed

in 2006, while Mandale Heights was launched in 2001 and completed in 2004.

“I guess we have an affinity for Balestier,” says Han Qin. “I remember when I was young-er, we used to visit the construction sites in Balestier with my parents as we had five pro-jects there over a short span of time. We like the area because of its city-fringe location, ac-cessibility, rich heritage and vibrancy, with a lot of good food.”

Kemaman Point’s location is also attractive as it is just behind Balestier Plaza and near two other malls, namely Shaw Plaza and Zhongshan Mall at Zhongshan Park, which has a Fairprice supermarket and eateries such as the recent-ly opened New Ubin Seafood restaurant and Starker Bistro. The Balestier area has also be-come a “hipster neighbourhood” with cafes such as Wheeler’s Yard and Brown Sugar Cafe Bistro, says Han Qin.

The purchase of Kemaman Point came one month before the ninth round of property cool-ing measures kicked in on July 6, 2018. “In a way, that attested to our strategy of not putting too many eggs in one basket,” says Han Qin. “Even though we didn’t undertake many resi-dential projects in Singapore over the past dec-ade, we had residential developments in Myan-mar and Vietnam.”

IN MYANMAR AND VIETNAMSoilbuild Group’s maiden residential develop-ment in Myanmar was the 176-unit Rosehill Res-idences, developed in 2015 in a 60:40 joint ven-ture with its local partner in Myanmar.

Soilbuild Construction in Myanmar is under-taking the construction of Rosehill Residences, its maiden construction project there. The con-struction arm entered Myanmar in 2012 and started with 15 people. Today, it has a staff of about 60, adds Han Qin.

In December 2017, Soilbuild Group made its first foray into Vietnam in a joint venture with a local partner, CT Group, to develop a mixed-use residential and commercial retail project in Dis-

trict 9 of Ho Chi Minh City. The project, Metro Star, sits on a 197,385 sq ft site and will have two 30-storey towers containing 1,600 apart-ments. The project is under construction and scheduled for completion in 2Q2021.

District 9 is where the existing Saigon Hi-Tech Park is located, and there are plans underway for a new scientific and technological park mod-elled after Silicon Valley in the US. Metro Star is well situated to benefit from future growth and “property price upside” in the area, says Han Qin. The first phase has already been launched and 25% of the project has been sold to date.

In April 2018, Soilbuild Group signed two more MOUs with CT Group. One is for the de-velopment of I-Town Affordable Housing Town-ship in Ho Chi Minh City with an estimated de-velopment value of US$350 million. The other is for the development and implementation of its prefabrication technology and PPVC sys-tems in Vietnam.

FOCUS ON RESIDENTIAL AND INDUSTRIAL DEVELOPMENTSIn Singapore, Soilbuild Group purchased an old bungalow sitting on a 16,028 sq ft, freehold site on Wilkinson Road for $19.28 million in 2015. The site has been redeveloped into two detached houses sitting on freehold site of 8,021 sq ft each.

Each house has a built-up area of 15,300 sq ft, and comes with six bedrooms, an 11m swim-ming pool and covered parking for up to five cars. Both houses are fully fitted with kitchen cabinetry and appliances, air-conditioning units, bathroom accessories and sanitaryware, as well as home security system with CCTV. They have since been sold.

“Residential development is something that is close to our hearts,” says Han Qin. Howev-er, the group has allocated more capital into industrial developments over the past decade. He adds: “We want to be diversified – by sec-tor and geography. Hence, even overseas, we are in the residential and industrial as well as business space.”

Soilbuild Group has five industrial projects in Singapore currently. Its latest purchase was an industrial land parcel on Gambas Way which it won with a bid of $40.02 million in June this year. Last October, the group also purchased an industrial site on Corporation Road for $44.09 million. Both sites were pur-chased on a 30-year lease from JTC in gov-ernment land tenders.

The group also won two industrial sites in Tuas last year: a site on a 20-year lease at Tuas South Link 3 for $2.63 million in January; and an industrial site on a 30-year lease for $28.85 million. They also purchased a site on New In-dustrial Road in a private treaty.

NEW OVERSEAS MARKETSA new market segment that Soilbuild Group entered recently is purpose-built student ac-commodation in the UK, with the purchase of Innovo House in Liverpool’s Knowledge Quarter in March this year. The site, which broke ground in May, has been approved for a 124-unit student housing scheme, with the development “forward funded” by Soil-build Group.

The plan is to build a sizeable portfolio of student accommodation in the UK, says Han Qin. The business is headed by his elder broth-er Han Feng, who is actively looking for more opportunities in the sector. In addition to that, he is overseeing the family office.

Last September, Soilbuild Business Space REIT made its maiden overseas acquisitions with two properties in Australia: a centrally-lo-cated office building in Canberra for A$55 mil-lion; and a poultry processing plant in Adelaide, South Australia for A$44 million.

As the group is small, it is important to “stay nimble, respond swiftly to market changes and to redeploy capital across various asset classes”, says Han Qin. “I think we have shown that in the last 10 years: From residential, we switched to industrial space and we did very well. And now, we have expanded regionally.”

ALBERT CHUA/EDGEPROP SINGAPORE

SOILBUILD GROUP

KNIGHT FRANK

SOILBUILD GROUP

The precast plant makes reinforcement bars and concrete panels, as well as assembles prefabricated bath- room units

The two detached houses on Wilkinson Road are a redevelopment of a former bungalow sitting on a 16,028 sq ft site purchased by Soilbuild Group in 2015. The two houses have since been sold.

Soilbuild Group will be launching the new 162-unit Verticus on the site of the former Kemaman Point (pictured) that it purchased en bloc for $143.88 million in June last year

Eightrium, an eight-storey business park development in Changi Business Park, was developed by Soilbuild Group and is now part of Soilbuild Business Space REIT’s portfolio

E

EP10 • EDGEPROP | AUGUST 19, 2019

Residential transactions with contracts dated July 30 to Aug 6Singapore — by postal district LOCALITIES DISTRICTS

City & Southwest 1 to 8Orchard/Tanglin/Holland 9 and 10Newton/Bukit Timah/Clementi 11 and 21Balestier/MacPherson/Geylang 12 to 14East Coast 15 and 16Changi/Pasir Ris 17 and 18Serangoon/Thomson 19 and 20West 22 to 24North 25 to 28

PROJECT NAME PROPERTY TYPE TENURE SALE DATE (2019)LAND AREA/

FLOOR AREA(SQ FT)TRANSACTED

PRICE ($)UNIT PRICE

($ PSF)COMPLETION

DATETYPE OF

SALE

PROJECT NAME PROPERTY TYPE TENURE SALE DATE (2019)LAND AREA/

FLOOR AREA(SQ FT)TRANSACTED

PRICE ($)UNIT PRICE

($ PSF)COMPLETION

DATETYPE OF

SALE

District 1 MARINA ONE RESIDENCES Apartment 99 years Jul 31 1,593 3,579,015 2,247 2017 New SaleMARINA ONE RESIDENCES Apartment 99 years Aug 2 1,173 2,543,310 2,168 2017 New SaleDistrict 2 SKY EVERTON Apartment Freehold Jul 30 1,109 2,600,000 2,345 Uncompleted New SaleSKY EVERTON Apartment Freehold Aug 2 678 1,690,000 2,492 Uncompleted New SaleSKY EVERTON Apartment Freehold Aug 4 1,109 2,626,000 2,369 Uncompleted New SaleDistrict 3 ARTRA Apartment 99 years Jul 30 786 1,628,400 2,072 Uncompleted New SaleARTRA Apartment 99 years Jul 31 1,119 2,080,100 1,858 Uncompleted New SaleARTRA Apartment 99 years Jul 31 1,119 2,063,300 1,843 Uncompleted New SaleARTRA Apartment 99 years Aug 1 1,119 2,116,000 1,890 Uncompleted New SaleARTRA Apartment 99 years Aug 2 1,410 2,298,800 1,630 Uncompleted New SaleARTRA Apartment 99 years Aug 2 1,119 2,097,100 1,873 Uncompleted New SaleMARGARET VILLE Apartment 99 years Aug 3 915 1,644,734 1,798 Uncompleted New SaleMARGARET VILLE Apartment 99 years Aug 3 463 925,806 2,000 Uncompleted New SaleONE PEARL BANK Apartment 99 years Jul 30 700 1,777,000 2,540 Uncompleted New SaleONE PEARL BANK Apartment 99 years Jul 30 700 1,756,000 2,510 Uncompleted New SaleONE PEARL BANK Apartment 99 years Jul 30 840 1,849,000 2,202 Uncompleted New SaleONE PEARL BANK Apartment 99 years Jul 30 527 1,259,000 2,387 Uncompleted New SaleONE PEARL BANK Apartment 99 years Jul 31 431 1,071,000 2,487 Uncompleted New SaleONE PEARL BANK Apartment 99 years Aug 1 431 986,000 2,290 Uncompleted New SaleONE PEARL BANK Apartment 99 years Aug 3 431 986,000 2,290 Uncompleted New SaleONE PEARL BANK Apartment 99 years Aug 3 700 1,718,000 2,455 Uncompleted New SaleONE PEARL BANK Apartment 99 years Aug 3 431 994,000 2,309 Uncompleted New SaleONE PEARL BANK Apartment 99 years Aug 4 431 992,000 2,304 Uncompleted New SaleONE PEARL BANK Apartment 99 years Aug 4 560 1,377,000 2,460 Uncompleted New SaleQUEENS PEAK Condominium 99 years Jul 31 1,507 2,479,000 1,645 Uncompleted New SaleRIVER PLACE Condominium 99 years Jul 31 678 1,000,000 1,475 1999 ResaleSTIRLING RESIDENCES Apartment 99 years Jul 30 657 1,164,000 1,773 Uncompleted New SaleSTIRLING RESIDENCES Apartment 99 years Jul 30 786 1,494,000 1,901 Uncompleted New SaleSTIRLING RESIDENCES Apartment 99 years Aug 1 635 1,154,000 1,817 Uncompleted New SaleSTIRLING RESIDENCES Apartment 99 years Aug 3 1,055 1,870,000 1,773 Uncompleted New SaleSTIRLING RESIDENCES Apartment 99 years Aug 3 657 1,184,000 1,803 Uncompleted New SaleSTIRLING RESIDENCES Apartment 99 years Aug 3 657 1,156,000 1,761 Uncompleted New SaleDistrict 4 CARIBBEAN AT KEPPEL BAY Condominium 99 years Aug 1 1,356 2,130,000 1,570 2004 ResaleREFLECTIONS AT KEPPEL BAY Condominium 99 years Aug 1 1,625 3,064,800 1,886 2011 ResaleDistrict 5 HERITAGE VIEW Condominium 99 years Aug 2 1,195 1,370,000 1,147 2000 ResaleKENT RIDGE HILL RESIDENCES Apartment 99 years Jul 31 646 1,126,000 1,743 Uncompleted New SaleKENT RIDGE HILL RESIDENCES Apartment 99 years Jul 31 474 827,000 1,746 Uncompleted New SaleKENT RIDGE HILL RESIDENCES Apartment 99 years Aug 2 474 867,000 1,831 Uncompleted New SaleKENT RIDGE HILL RESIDENCES Apartment 99 years Aug 2 775 1,378,000 1,778 Uncompleted New SaleKENT RIDGE HILL RESIDENCES Apartment 99 years Aug 2 474 862,000 1,820 Uncompleted New SaleKENT RIDGE HILL RESIDENCES Apartment 99 years Aug 3 786 1,346,000 1,713 Uncompleted New SaleKENT RIDGE HILL RESIDENCES Apartment 99 years Aug 3 517 890,000 1,723 Uncompleted New SaleKENT RIDGE HILL RESIDENCES Apartment 99 years Aug 3 474 834,000 1,761 Uncompleted New SaleMURANO Apartment Freehold Aug 2 635 700,000 1,102 2008 ResaleTHE INFINITI Condominium Freehold Aug 6 915 1,120,000 1,224 2008 ResaleVIVA VISTA Apartment Freehold Jul 30 388 625,000 1,613 2014 ResaleWHISTLER GRAND Apartment 99 years Jul 31 764 1,186,650 1,553 Uncompleted New SaleWHISTLER GRAND Apartment 99 years Jul 31 990 1,373,760 1,387 Uncompleted New SaleWHISTLER GRAND Apartment 99 years Aug 4 1,066 1,511,460 1,418 Uncompleted New SaleDistrict 7 SOUTH BEACH RESIDENCES Apartment 99 years Aug 5 2,120 7,288,900 3,437 2016 ResaleTHE PLAZA Apartment 99 years Aug 5 840 960,000 1,143 1979 ResaleDistrict 8 N.A. Apartment Freehold Aug 5 1,023 900,000 880 Unknown ResaleDistrict 9 CAIRNHILL PLAZA Apartment Freehold Aug 1 3,305 5,300,000 1,604 1978 ResaleCAVENAGH COURT Apartment Freehold Aug 1 1,841 2,880,000 1,565 Unknown ResaleELIZABETH TOWER Apartment Freehold Aug 1 3,068 4,500,000 1,467 1980 ResaleHILLTOPS Condominium Freehold Aug 5 1,550 4,500,000 2,903 2011 ResaleMARTIN MODERN Condominium 99 years Aug 3 764 1,986,500 2,599 Uncompleted New SaleMARTIN MODERN Condominium 99 years Aug 3 764 1,979,800 2,591 Uncompleted New SaleMARTIN MODERN Condominium 99 years Aug 4 764 2,129,000 2,786 Uncompleted New SaleMARTIN NO 38 Apartment Freehold Jul 30 1,335 3,460,000 2,592 2011 ResalePARC CENTENNIAL Apartment Freehold Aug 5 1,249 1,850,000 1,482 2011 ResaleRIVERGATE Apartment Freehold Jul 31 1,604 3,250,000 2,026 2009 ResaleRV ALTITUDE Apartment Freehold Jul 30 441 1,360,000 3,082 Uncompleted New SaleSOPHIA RESIDENCE Condominium Freehold Aug 2 1,819 3,050,000 1,677 2014 ResaleTHE LAURELS Condominium Freehold Jul 30 1,302 3,620,000 2,779 2013 ResaleTWENTYONE ANGULLIA PARK Condominium Freehold Jul 30 2,260 9,080,000 4,017 2014 ResaleTWENTYONE ANGULLIA PARK Condominium Freehold Jul 30 2,260 9,280,000 4,105 2014 ResaleTWENTYONE ANGULLIA PARK Condominium Freehold Aug 5 2,260 8,380,000 3,707 2014 ResaleTWENTYONE ANGULLIA PARK Condominium Freehold Aug 6 1,163 3,980,000 3,424 2014 ResaleVIDA Apartment Freehold Aug 1 861 1,600,000 1,858 2009 ResaleVIVACE Apartment 999 years Jul 31 398 798,000 2,004 2012 ResaleDistrict 10 3 CUSCADEN Apartment Freehold Aug 4 474 1,625,845 3,433 Uncompleted New Sale

BOTANIC GARDENS MANSION Apartment Freehold Aug 2 1,755 3,000,000 1,710 Unknown ResaleBOULEVARD 88 Apartment Freehold Jul 30 1,776 6,066,900 3,416 Uncompleted New SaleBOULEVARD 88 Apartment Freehold Aug 1 1,776 6,099,300 3,434 Uncompleted New SaleBOULEVARD 88 Apartment Freehold Aug 2 1,776 6,600,000 3,716 Uncompleted New SaleDUCHESS ROYALE Apartment 999 years Aug 2 764 1,400,000 1,832 2013 ResaleESTRIVILLAS Semi-Detached Freehold Jul 30 5,403 3,408,000 631 2013 ResaleFOURTH AVENUE RESIDENCES Apartment 99 years Aug 4 689 1,589,000 2,307 Uncompleted New SaleGRAMERCY PARK Condominium Freehold Aug 5 2,185 6,880,000 3,149 2016 ResaleKING’S ARCADE Apartment Freehold Jul 30 1,281 1,498,000 1,169 2002 ResaleMING TECK PARK Semi-Detached 999 years Aug 2 3,326 3,900,000 1,173 Unknown ResaleNAMLY AVENUE Semi-Detached Freehold Aug 1 3,767 5,730,000 1,522 1972 ResaleNASSIM JADE Condominium Freehold Aug 1 3,208 5,300,000 1,652 1997 ResaleNOUVEL 18 Condominium Freehold Aug 1 2,820 9,664,000 3,427 2014 ResaleNOUVEL 18 Condominium Freehold Aug 2 3,337 12,905,000 3,867 2014 ResaleONE JERVOIS Condominium Freehold Aug 2 990 1,750,000 1,767 2009 ResaleRIDGEWOOD Condominium 999 years Jul 31 2,002 2,520,000 1,259 1981 ResaleSPRING GROVE Condominium 99 years Aug 5 1,012 1,550,000 1,532 1996 ResaleTANGLIN PARK Condominium Freehold Aug 1 1,604 3,000,000 1,871 1989 ResaleTHE DRAYCOTT Apartment Freehold Jul 31 2,637 4,500,000 1,706 1980 ResaleTHE HYDE Condominium Freehold Jul 30 1,249 3,730,000 2,837 Uncompleted New SaleTHE MARBELLA Condominium Freehold Jul 31 1,076 1,900,000 1,765 2005 ResaleTHE SERENADE @ HOLLAND Condominium 99 years Aug 1 1,152 1,450,000 1,259 2004 ResaleDistrict 11 AMARYLLIS VILLE Condominium 99 years Jul 31 2,594 3,600,000 1,388 2004 ResaleM21 Apartment Freehold Aug 2 1,066 1,560,000 1,464 2010 ResaleTEN @ SUFFOLK Apartment Freehold Jul 31 1,119 1,640,000 1,465 2006 ResaleWATTEN HILL Condominium Freehold Aug 1 1,981 2,550,000 1,288 1979 ResaleDistrict 12 JUI RESIDENCES Apartment Freehold Aug 1 710 1,270,000 1,788 Uncompleted New SaleONE DUSUN RESIDENCES Apartment Freehold Aug 1 657 1,100,000 1,675 2016 ResaleRIVERBAY Apartment 999 years Aug 6 517 720,000 1,394 2014 ResaleTREVISTA Condominium 99 years Aug 2 1,615 1,760,000 1,090 2011 ResaleDistrict 13 BARTLEY RIDGE Condominium 99 years Jul 30 732 988,000 1,350 2016 ResalePARK COLONIAL Condominium 99 years Jul 30 506 935,000 1,848 Uncompleted New SalePARK COLONIAL Condominium 99 years Jul 31 506 947,000 1,872 Uncompleted New SalePARK COLONIAL Condominium 99 years Aug 1 1,410 2,451,000 1,738 Uncompleted New SalePARK COLONIAL Condominium 99 years Aug 2 1,711 2,805,000 1,639 Uncompleted New SalePARK COLONIAL Condominium 99 years Aug 2 1,249 2,125,000 1,702 Uncompleted New SalePARK COLONIAL Condominium 99 years Aug 4 603 1,236,000 2,050 Uncompleted New SalePARK COLONIAL Condominium 99 years Aug 4 1,410 2,457,000 1,742 Uncompleted New SaleTHE TRE VER Condominium 99 years Jul 30 495 833,000 1,682 Uncompleted New SaleTHE TRE VER Condominium 99 years Aug 2 1,098 1,728,000 1,574 Uncompleted New SaleTHE TRE VER Condominium 99 years Aug 4 1,378 2,306,000 1,674 Uncompleted New SaleDistrict 14 ARENA RESIDENCES Apartment Freehold Aug 2 603 1,129,000 1,873 Uncompleted New SaleESCADA VIEW Condominium Freehold Aug 1 775 750,000 968 1997 ResaleWARINGIN WALK Detached Freehold Aug 2 12,034 8,000,000 665 1998 ResalePARC ESTA Apartment 99 years Jul 30 635 1,067,000 1,680 Uncompleted New SalePARC ESTA Apartment 99 years Jul 30 721 1,249,000 1,732 Uncompleted New SalePARC ESTA Apartment 99 years Jul 30 721 1,209,000 1,676 Uncompleted New SalePARC ESTA Apartment 99 years Jul 31 915 1,497,440 1,637 Uncompleted New SalePARC ESTA Apartment 99 years Jul 31 915 1,477,840 1,615 Uncompleted New SalePARC ESTA Apartment 99 years Jul 31 915 1,487,640 1,626 Uncompleted New SalePARC ESTA Apartment 99 years Jul 31 915 1,502,340 1,642 Uncompleted New SalePARC ESTA Apartment 99 years Jul 31 926 1,549,350 1,674 Uncompleted New SalePARC ESTA Apartment 99 years Jul 31 926 1,564,200 1,690 Uncompleted New SalePARC ESTA Apartment 99 years Jul 31 829 1,364,160 1,646 Uncompleted New SalePARC ESTA Apartment 99 years Jul 31 829 1,368,080 1,651 Uncompleted New SalePARC ESTA Apartment 99 years Jul 31 829 1,390,620 1,678 Uncompleted New SalePARC ESTA Apartment 99 years Jul 31 829 1,360,240 1,641 Uncompleted New SalePARC ESTA Apartment 99 years Jul 31 829 1,348,480 1,627 Uncompleted New SalePARC ESTA Apartment 99 years Jul 31 926 1,584,000 1,711 Uncompleted New SalePARC ESTA Apartment 99 years Jul 31 926 1,579,050 1,706 Uncompleted New SalePARC ESTA Apartment 99 years Jul 31 926 1,588,950 1,716 Uncompleted New SalePARC ESTA Apartment 99 years Jul 31 926 1,574,100 1,700 Uncompleted New SalePARC ESTA Apartment 99 years Jul 31 926 1,569,150 1,695 Uncompleted New SalePARC ESTA Apartment 99 years Jul 31 527 953,000 1,807 Uncompleted New SalePARC ESTA Apartment 99 years Aug 1 635 1,067,000 1,680 Uncompleted New SalePARC ESTA Apartment 99 years Aug 1 926 1,585,000 1,712 Uncompleted New SalePARC ESTA Apartment 99 years Aug 3 904 1,467,000 1,622 Uncompleted New SalePARC ESTA Apartment 99 years Aug 4 926 1,540,000 1,664 Uncompleted New SalePARC ESTA Apartment 99 years Aug 4 420 759,000 1,808 Uncompleted New SalePARK PLACE RESIDENCES AT PLQ Apartment 99 years Aug 1 1,076 1,953,000 1,814 Uncompleted New SaleTHE MIDAS Apartment Freehold Jul 31 2,131 1,730,000 812 2008 ResaleVACANZA @ EAST Condominium Freehold Jul 31 840 956,888 1,140 2014 ResaleVIENTO Apartment Freehold Aug 1 452 560,000 1,239 2013 ResaleDistrict 15 AMBER 45 Apartment Freehold Aug 3 1,345 2,800,000 2,081 Uncompleted New SaleAMBER PARK Condominium Freehold Jul 30 700 1,703,430 2,435 Uncompleted New SaleAMBER PARK Condominium Freehold Aug 2 743 1,807,110 2,433 Uncompleted New SaleAMBER PARK Condominium Freehold Aug 3 700 1,800,630 2,574 Uncompleted New SaleAMBER PARK Condominium Freehold Aug 4 2,336 5,730,750 2,453 Uncompleted New SaleCOASTLINE RESIDENCES Apartment Freehold Jul 30 1,130 3,174,000 2,808 Uncompleted New SaleCORALIS Condominium Freehold Aug 1 1,227 2,010,000 1,638 2013 ResaleEIS RESIDENCES Apartment Freehold Jul 31 1,066 878,000 824 2014 ResaleEMERY POINT Apartment Freehold Aug 6 1,302 1,500,000 1,152 2003 ResaleFRANKEL ESTATE Semi-Detached Freehold Jul 31 4,252 4,630,000 1,090 1956 ResaleFRANKEL ESTATE Detached Freehold Aug 2 5,038 7,680,000 1,525 2013 ResaleHAIG COURT Condominium Freehold Aug 1 1,076 1,580,000 1,468 2004 ResaleIDYLLIC RESIDENCES Apartment Freehold Aug 5 1,109 1,370,000 1,236 2009 ResaleLAGOON VIEW Apartment 99 years Aug 1 1,647 1,450,000 880 Unknown ResaleMANDARIN GARDENS Condominium 99 years Aug 5 732 860,000 1,175 1986 ResaleMARINE BLUE Condominium Freehold Aug 1 1,270 1,600,000 1,260 2016 ResaleOLLOI Apartment Freehold Jul 31 947 1,630,530 1,721 Uncompleted New SaleONE MEYER Apartment Freehold Aug 1 1,033 2,626,470 2,542 Uncompleted New SaleONE MEYER Apartment Freehold Aug 1 614 1,684,980 2,746 Uncompleted New SaleONE MEYER Apartment Freehold Aug 4 614 1,594,000 2,598 Uncompleted New SaleSANCTUARY GREEN Condominium 99 years Aug 5 1,711 2,300,000 1,344 2003 ResaleSANDY EIGHT Apartment Freehold Aug 2 732 1,227,000 1,676 2018 New SaleSANDY EIGHT Apartment Freehold Aug 2 721 1,249,000 1,732 2018 New SaleSEASIDE RESIDENCES Apartment 99 years Jul 31 1,302 2,226,150 1,709 Uncompleted New SaleDistrict 16 AQUARIUS BY THE PARK Condominium 99 years Jul 30 1,227 1,120,000 913 2000 ResaleBEDOK RESIDENCES Apartment 99 years Aug 1 538 790,000 1,468 2015 ResaleCOSTA DEL SOL Condominium 99 years Aug 1 1,238 1,700,000 1,373 2003 Resale

DONE DEALS

EDGEPROP | AUGUST 19, 2019 • EP11

Residential transactions with contracts dated July 30 to Aug 6

PROJECT NAME PROPERTY TYPE TENURE SALE DATE (2019)LAND AREA/

FLOOR AREA(SQ FT)TRANSACTED

PRICE ($)UNIT PRICE

($ PSF)COMPLETION

DATETYPE OF

SALEPROJECT NAME PROPERTY TYPE TENURE SALE DATE (2019)LAND AREA/

FLOOR AREA(SQ FT)TRANSACTED

PRICE ($)UNIT PRICE

($ PSF)COMPLETION

DATETYPE OF

SALE

Source: URA Realis. Updated Aug 13, 2019.EC stands for executive condominium

DISCLAIMER:The Edge Property Pte Ltd shall not be responsible for any loss or liability arising directly or indirectly from the use of, or reliance on, the information provided therein.