Carbon Emissions Booklet - Reed Smith · 2017. 4. 3. · Carbon emissions include CO2, carbon...

Transcript of Carbon Emissions Booklet - Reed Smith · 2017. 4. 3. · Carbon emissions include CO2, carbon...

Short Guide to CarbonEmissions Trading

Contents of guide

A Introduction page 3

B Purpose of the Guide page 4

C Background to Carbon Emissions Trading page 5

D Emissions Trading page 7

E The EU ETS page 9

F How does Carbon Emissions Trading Work? page 14

G Ways to Trade EU ETS Allowances page 16

H Overview of OTC Standard Contract Forms page 17

I Exchange Trading page 18

J Glossary page 20

Appendix I - Further information regarding the CDM and JI mechanisms underthe Kyoto Protocol

Appendix 2 - Brief analysis of the key terms of the ISDA Agreement, the IETA Agreement and the EFET Allowance Agreement

1

2

3

A Introduction

The reduction of greenhouse gases (in particular carbon dioxide emissions –“CO2”) is a “hot” topic from many perspectives - environmental, political, regulatoryand commercial. Its global significance is increasing rapidly.

One of the key mechanisms being used to reduce CO2 production is the allocationand trading of CO2 allowances.

Currently the world’s largest CO2 trading scheme is the European Union EmissionsTrading Scheme (“EU ETS”). However it is predicted that trading will developfurther in the near future with the expansion of available markets for trading CO2and, potentially, a wider range of greenhouse gases.

Whatever the industry sector in which you operate, you should be aware of thedevelopment of this new market and the impact it could have upon your business.

4

B Purpose of this guide

In this guide we:

1 set out the background to the development of CO2 trading;

2 explain how the EU ETS works;

3 provide an overview of exchange trading and of the contracts typically usedin over the counter (“OTC”) trading of EU ETS allowances; and

4 summarise some of the developments predicted to take place in the nearfuture.

We also include contact details for members of our Energy Trade and Commoditiesand Trade Finance Group who can provide further advice in connection with CO2trading.

C Background to Carbon Emissions Trading

WWhhaatt aarree ccaarrbboonn eemmiissssiioonnss??

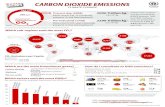

Carbon emissions include CO2, carbon monoxide (“CO”) and hydro-carbons. CO2is one of the greenhouse gases to which global climate change is widely attributed.

Although CO2 is produced naturally it is also created as a result of domestic andindustrial activities, involving the burning of fossil fuels such as coal, oil and naturalgas.

Production of CO2 and other greenhouse gases has increased significantly overrecent years. Scientific evidence suggests that the earth’s natural carbon sinkshave been unable to deal with this increase. As a result, it is thought thatincreased levels of greenhouse gases remain in the atmosphere causing climateand ecological changes.

UUnniitteedd NNaattiioonnss FFrraammeewwoorrkk CCoonnvveennttiioonn oonn CClliimmaattee CChhaannggee ((““UUNNFFCCCCCC””))

The UNFCCC is a treaty (currently ratified by 189 countries) which came into forcein 1994 and which creates a framework for inter-governmental efforts to minimisethe effect of climate change.

The UNFCCC includes a list of the industrial countries (including economies intransition) undertaking a general commitment towards reducing greenhouse gasemissions. These countries are listed in Annex I to the UNFCCC (“Annex I”). Itdoes not, however, include some developing countries that are significant emittersof greenhouse gases such as China and India.

KKyyoottoo PPrroottooccooll ((““KKPP””))

The KP is an addition to the UNFCCC. This contains more powerful legally bindingmeasures for the reduction of CO2 and other greenhouse gases. The KP took effectin February 2005 when it had been ratified by nations accounting for at least 55%of greenhouse gas emissions.

As of the 14 February 2007, 169 states and national economic integrationorganizations had ratified the KP. Each state and national economic integrationorganisation listed in Annex I which has ratified the KP undertakes a specificemissions commitment, that is to say, an individual target as set out in Annex B tothe KP (“Annex B”).

Under Annex B, 35 states and the EEC are required to cut emissions of CO2 andother greenhouse gases by an average of 5% during the first commitment period of2008 - 2012.

The fact that non - Annex I countries, which include large developing countries,such as India, China and Brazil, are not currently required to meet specific targetshas led to some of the world’s major economies not ratifying the KP. In addition the

5

US (thought to be the world’s largest emitter of greenhouse gases) withdrew fromthe KP in 2001.

KKPP MMeecchhaanniissmmss

The KP introduces three mechanisms for lowering the cost of achieving theemissions targets it contains. The first two of these are project based mechanisms;the third is emissions trading:

((ii)) CClleeaann DDeevveellooppmmeenntt MMeecchhaanniissmm ((““CCDDMM””))

This enables Annex I countries to implement projects in non-Annex I countries thatreduce greenhouse gas emissions or absorb CO2 through afforestation and re-forestation activities in return for certified emission reductions (“CER’s”) which can,in turn, be used in meeting KP targets. As explained below CER’s can be tradedunder the EU ETS.

((iiii)) JJooiinntt IImmpplleemmeennttaattiioonn ((““JJII””))

Whereby Annex I countries may implement an emission reducing project or onethat enhances removals by sinks in another Annex I country in return for EmissionReduction Units (“ERU’s”) which can be counted towards meeting KP targets. Asfrom 2008 ERU’s will also be capable of recognition under the EU ETS.

((iiiiii)) EEmmiissssiioonnss TTrraaddiinngg

This enables Annex B parties to acquire units or allowances issued under the KPfrom other Annex B parties which can be used to meet KP targets.

For further information about the above mechanisms please refer to Appendix 1 tothis guide.

EEUU//DDoommeessttiicc AAccttiioonn

In addition to introducing emissions trading between Annex B parties, the KP andthe Marrakech Accords require Annex I parties to implement domestic policies andaction to achieve their goals of reducing greenhouse gas emissions. Such policiesand actions can include emission allowance trading schemes.

The EU ETS is currently the key policy instrument implemented in the EU atMember State level for reducing greenhouse gas emissions.

6

D Emissions Trading

Emissions trading involves the sale or transfer of permits/allowances for theproduction of a particular emission such as CO2.

MMaannddaattoorryy aanndd VVoolluunnttaarryy SScchheemmeess

There are two principal kinds of emission trading schemes currently in existence,namely mandatory and voluntary schemes.

Of the mandatory schemes the EU ETS scheme is the largest in the world. InAustralia, New South Wales established a Greenhouse Gas Abatement Scheme in2003 and it has recently been announced that Australia is planning to establish anational cap and trade system similar to the EU ETS by 2010.

Other planned mandatory schemes in the US currently include the proposedCalifornian Scheme and the Regional Greenhouse Gas Initiative (“RGGI”) a sevenstate emissions trading scheme directed to reducing emissions from power plantsin the North East of the US.

Voluntary schemes involve a participant volunteering to reduce emissions belowcertain targets. Commonly such schemes involve the allocation of allowances toparticipants which can be traded with other participants in the scheme. Thus, if aparticipant within the scheme fails to meet its target it will need to acquire moreallowances than another participant within the scheme. Conversely, if a participantexceeds its target it will have a surplus to sell. Subsidies are sometimes availablefrom governments to those participants in voluntary schemes who meet theirtargets.

There are currently no voluntary schemes in existence in the UK.

CCaapp aanndd TTrraaddee

The most common type of mandatory trading scheme is a “cap and tradescheme”. This is the basis of trading of allowances under the EU ETS.

In broad terms, participants in a cap and trade scheme are allocated allowances toemit a specified quantity of the relevant emission. If the participant emits in excessof its allocated quantity that participant will have to buy extra allowances to coverthe excess quantity and may also be subject to a penalty, as is the case under theEU ETS. If a participant emits less than its allocated quantity, the participant cansell its surplus allowances.

A domestic cap and trade scheme means that governments can regulate theamount of emissions produced in total by setting a national cap on emissions. Inaddition the allocation of tradable allowances to installations covered by thescheme gives installations the flexibility of determining how, when and where

7

the emissions reductions will be achieved. The environmental outcome is notaffected by the flexibility of the scheme because the amount of allowancesallocated is fixed.

8

E The EU ETS

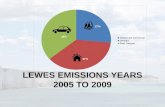

The EU emits almost one fifth of the world’s CO2. The EU ETS is a critical tool inhelping the EU achieve its emissions reduction target of 8% by 2012 under the KP.

OOvveerrvviieeww

The EU ETS commenced on 1 January 2005. The first phase runs from 2005 -2007 (“Phase 1”); the second phase from 2008 - 2012 (“Phase 2”) (i.e. until the endof the first KP Commitment Period). Further five year periods are envisagedthereafter.

The EU ETS covers specified greenhouse gases (currently only CO2) (the othergreenhouse gases that potentially can be included in the EU ETS are listed onpage 10).

Under the EU ETS, EU Member State governments are required to set an emissionscap for all installations covered by the EU ETS by allocating allowances to thoseinstallations to emit a specified quantity for the particular phase (Installationscovered under the EU ETS Directive are defined by reference to specified activitiesand production output. See page 10 below).

Each Member State has to produce a national allocation plan (“NAP”) for approvalby the Commission. This specifies the total number of allowances it intends toissue during the particular phase and how it proposes to distribute thoseallowances to installations that are subject to the EU ETS.

Member States must ensure that each installation covered by the EU ETS holds agreenhouse gas emissions trading permit and their annual emissions must bereported and verified. Each permitted installation will receive an allocation ofallowances based on the NAP.

At the end of each year, installations are required to ensure they have sufficientallowances to account for their installation’s actual emissions. The installationshave flexibility to buy additional allowances or to sell surplus allowances generatedfrom reducing their emissions below their allocation.

Each Member State must set up a national registry for recording allowances andtrading. Any person can hold allowances and buy and sell allowances and thenational registries are open to the public.

In addition the EU has established a central administrator which maintains acommunity independent transaction log of the issue, transfer and cancellation ofEU Allowances.

EEUU DDiirreeccttiivvee aanndd EEUU EETTSS RReegguullaattiioonn

The legal framework for the EU ETS is provided by the EU Emissions TradingDirective 2003/87/EC (“EU ETS Directive”) which Member States were required to

9

implement in national legislation. In the UK the EU ETS Directive was implementedby the Greenhouse Gas Emissions Trading Scheme Regulations 2005 which cameinto force on 21 April 2005.

The EU ETS Directive was amended by Directive 2004/101/EC in October 2004 toprovide for linking to the KP mechanisms and the use of credits from thesemechanisms for compliance under the EU ETS (“Linking Directive”).

GGaasseess ccoovveerreedd uunnddeerr tthhee EEUU EETTSS

The EU ETS Directive1 covers the six greenhouse gases that are included in the KP.Those are namely CO2, methane, nitrous oxide, perfluorocarbons,hydrofluorocarbons and sulphur hexafluoride. However, as indicated above,Phase 1 of the EU ETS covers only CO2 and it has been announced that Phase 2of the EU ETS will also only cover CO2 .

IInnssttaallllaattiioonnss

Installations covered by the EU ETS2 under Phase 1 include those entities carryingout the following activities:

• Energy activities; e.g. boilers, electricity generators, mineral oil refineries andcoke ovens;

• Production and processing of ferrous metals;

• Mineral industries including, depending upon production capacity, productionof cement clinker, lime glass and ceramic products; and

• Pulp and paper industries.

In Phase 2, the installations listed above will be extended to cover installationscarrying out the following activities:

• Manufacturing of glass and glass fibre above a minimum threshold;

• Manufacturing of mineral wool insulation material;

• Manufacturing of gypsum;

• Flaring from offshore oil and gas production;

• Petrochemicals (crackers);

• Integrated Steelworks; and

• Production of Carbon Black;

NNAAPP

As stated above the EU ETS is divided into phases for which Member States mustdevelop a NAP, which requires the approval of the European Commission

10

1 Annex II to the EU ETS Directive2 Annex III to the EU ETS Directive

(“Commission”). The NAPs have to be produced 18 months before the start ofeach phase. The NAPs set out the total quantity of allowances that the MemberStates intend to allocate for the period in question. They also list each installationcovered by the EU ETS and how Member States propose to allocate allowances tothose installations.

The Linking Directive provides that in Phase 2 the Member States must specify inthe NAPs the percentage of the allocation up to which installations will be allowedto use credits from the project based mechanisms.

Annex III of the EU ETS Directive sets out the criteria on which the NAP must bebased. This includes:

• Compatibility with the KP and national climate change programmes;

• Consistency with projected emissions - i.e. no over allocation;

• Consistency with potential activities to reduce emissions;

• Consistency with other EU legislation and policy instruments;

• Information must be included in the NAP as to the manner in which newentrants will be able to participate in the EU ETS;

• No discrimination between installations or sectors in a way to unduly favourcertain undertakings or activities;

• The NAP may accommodate early action;

• Information must be included in the NAP as to the manner in which clean andother technologies are taken into account;

• Provisions must be made for public comments and consideration of the same;

• The NAP must set out the installations covered and quantities of allowancesallocated; and

• The NAP may include information as to the way in which competition fromcountries outside the EU will be taken into account.

FFiinnaall AAllllooccaattiioonn DDeecciissiioonn

Once the NAPs have been approved by the Commission, Member States make afinal allocation decision which sets out the allocation to be issued to eachinstallation in that country. Once a final allocation decision is made, the allowancesgiven to an installation will be registered at the relevant national emissions registry.

NNaattiioonnaall EEmmiissssiioonnss RReeggiissttrriieess

The national registries are secure systems which record allocations allocated toand held in installation accounts; annual verified emissions for installations; thetransfer of allowances between accounts; and the annual compliance status ofinstallations.

11

In the UK, an operator’s holding account on the UK Emissions Registry would havebeen automatically created for installations that have Greenhouse Gas EmissionsPermits subject to providing the registry administrator (the Environment Agency)with the necessary information. Non installations operators who would like to holdor transfer carbon allowances can also do so by opening personal-holdingaccounts.

National registries have public unsecured areas. The public area allows users toapply for an account and see publicly-available reports. The secure area allowsusers to access their registry accounts and to perform various functions, includingtransfers of allowances and units.

The key functions of a national registry are:

• Account management: Allowing operators and registry administrators tocreate, update and close holding accounts as well as record emissions;

• Surrender and retirement: Allowing regulator companies and nationalcompetent authorities to demonstrate compliance with national emissionsproduction targets;

• Internal and external transfers: Allowing account holders within the sameregistry and those in other national registries to transfer units and allowanceswithin their accounts;

• Cancellation and replacement and carry-over of units and allowances inaccordance with the EU ETS rules. This allows the registry to comply withboth the EU and KP regulations; and

• Reconciliation: Reconciling with the Community Independent Transaction Log(“CITL”) and the UNFCCC Independent Transaction Log (“ITL”) on a periodicbasis to ensure registry records are consistent.

In addition to accounts held by individuals and organisations, the registry also hasnational accounts. These accounts are held on behalf of the designated NationalCompetent Authorities, and are meant to show compliance with overall nationalemissions reductions targets.

In the UK, the Designated National Competent Authorities are DEFRA, theEnvironment Agency, the Department of the Environment (Northern Ireland), theScottish Environment Protection Agency, the National Assembly for WalesAgriculture Department and the Department for Trade & Industry.

CCIITTLL

The Commission has established under the EU ETS Directive an independent andsupplementary web-based transaction log operated by a Central Administratorwhich monitors all activities related to the EU ETS to ensure that it is consistent withthe rules of the EU ETS and records the issue, transfer and cancellation ofallowances in the national registries.

12

TThhee LLiinnkkiinngg DDiirreeccttiivvee

The EU ETS Directive initially provided that only EU ETS allowances (known as EUETS Allowance Units) could be recorded as trades on the EU ETS registries.

Subsequently, the Linking Directive changed the position as it allows creditsgenerated from Kyoto flexible mechanisms to be used for EU ETS compliancepurposes. As from 2005, CER’s generated through CDM projects can be used inPhase 1. In Phase 2, operators can also use ERU’s generated through JI projects.

IITTLL

To enable trading of CER’s and ERU’s to take place a CDM Registry has beenestablished by the UNFCCC. The ITL, which will link the CDM Registry operatedby the UNFCCC with national registries and the CITL, has yet to be established bythe UNFCCC. The ITL is currently predicted to become effective in April 2007.

UUKK EEmmiissssiioonnss TTrraaddiinngg RReeggiissttrryy

Emissions trading started in the UK on 24 May 2005 when the UK Registry becameoperational, allowing operators participating in the EU ETS to access theirallowances.

The Environment Agency is the registry administrator for the UK; it manages the UKnational Registry on a daily basis and can monitor and approve all accounts.

Any individual can open an account on the UK Registry provided they are able tosupply the necessary legal documentation and satisfy all security checks. Anadministrative charge has to be paid to the Environment Agency by an applicantfor a new account.

The UK Registry’s software, developed by DEFRA, has been licensed to severalother States, including Denmark, Estonia, Finland, Hungary, Ireland, Italy, Latvia,Lithuania, Slovenia, Sweden, The Netherlands and Norway.

13

F How does Carbon Emissions Trading work?

As mentioned above, installations covered by the EU ETS are allocated anemissions cap and EU ETS allowances up to the limit of the cap.

An EU ETS allowance is defined in the EU ETS Directive as meaning an allowanceto emit one tonne of carbon dioxide equivalent3 during a specified period which isvalid for the purpose of meeting the requirements of the EU ETS Directive andwhich is transferable in accordance with the EU ETS Directive.

In the UK the allocation and surrender of allowances in Phase 1 takes place on anannual basis. Allowances equivalent to the amount of CO2 actually emitted in arelevant year have to be surrendered by each installation by 30 April of thefollowing year.

Installations which emit less than their cap will be able to trade the surplusallowances. Installations that emit more than their cap must buy more allowancesfrom the market.

It is however possible for installations to carry over allowances between years,although not between different phases under the EU ETS.

PPeennaallttiieess

If an installation does not surrender sufficient allowances to cover its reportedemissions for that year, the installation will be liable to a penalty of €40 per tonne ofCO2 equivalent during Phase 1. This penalty increases to €100 in Phase 2. Allpenalties have to be paid to the respective Regulator. Any company that exceedsits allowance will also be required to make up the surrender allowance shortfall inthe following year.

MMaarrkkeett PPaarrttiicciippaannttss

The trading of EU ETS allowances is not confined to installations subject to the EUETS. Third parties can trade provided that they hold an account with a nationalregistry. Some of the biggest participants in the EU ETS market are financialinstitutions.

Trading can also take place between installations and entities located in differentcountries in the EU as EU ETS allowances can be transferred between differentnational registries.

Installations can access the market to buy or sell allowances in several waysincluding:

• Trading directly with other installations covered by the EU ETS;

• Buying or selling directly from intermediaries /financial institutions;

• Using the services of a broker to find other buyers and sellers; or

14

3 One tonne of CO2 equivalent means one mt of CO2 or an amount of any other greenhouse gas listed in Annex II with anequivalent global warming potential, albeit at present only CO2 is covered under the EU ETS

• Joining one of the exchanges that list CO2 allowance products.

Thus trading can be directly with counter parties or through an exchange and, insome cases, OTC transactions can also be cleared through an exchange.

FFoorrmm ooff CCoonnttrraacctt

The type of contract used to buy and sell allowances under the EU ETS willdepend upon whether the transaction is an OTC or exchange trade. We set out inthe section below entitled “Overview of OTC Standard Contract Forms” a briefsummary of the common types of contract forms.

TTrraannssffeerr ooff EEUU EETTSS AAlllloowwaanncceess

Having bought or sold allowances, a trade must be honoured by transferring theappropriate number of allowances on to a national registry, which requires the useof a registry account in the relevant EU country.

As previously mentioned, in the UK an operator holding account on the UKRegistry would have been automatically created for installations that havegreenhouse gas emissions permits. Non installation operators who would like tohold or transfer carbon allowances can also do so by opening personal-holdingaccounts. When affecting a transfer of allowances, account users will input thefollowing information relating to the units being transferred:

• Total units;

• Country of origin;

• Unit type;

• Unit commitment period;

• The acquirer’s account details.

15

G Ways to trade EU ETS Allowances

EExxcchhaannggee aanndd OOTTCC TTrraaddiinngg

The two main ways of trading EU ETS allowances are either through an exchangeor by way of OTC transactions.

The advantages of trading on a futures exchange include transparency,standardization of product, clearing and potentially lower fees. The advantages oftrading OTC include greater flexibility as to product and credit facilities.

TTyyppeess ooff pprroodduucctt

In the case of trading EU ETS allowances, the forward and futures markets havedeveloped faster than the spot market, possibly because of the delay inestablishing national registries and final allocations in many of the EU MemberStates which caused problems for instant delivery under spot contracts.It is clearhowever that new products are now being developed including repo’s, averagingproducts and options.

16

H Overview of OTC Standard Contract Forms

There are three main standard contract forms used for OTC transactions, eachpublished by the International Swaps and Derivatives Association (“ISDA”), theInternational Energy Trading Association (“IETA”) and the European Federation ofEnergy Traders (“EFET”) respectively as follows:

• ISDA has published a Confirmation of OTC Physically Settled EU EmissionsAllowance Option (“Confirmation”) and a Form of Part [6] of the Schedule forEU Emissions Allowance Transactions (“Form”)4 to one of the ISDA MasterAgreements5 (“Master Agreement”); (the Confirmation, Form and the MasterAgreement are referred to below as the “ISDA Agreement”).

• IETA has published an Emissions Trading Master Agreement for the EUScheme6; (“IETA Agreement”) and, for those parties who are likely to tradeinfrequently, an Emissions Allowances Single Trade Agreement for the EUScheme (“IETA Single Trade Agreement”).

• EFET has published an Allowance Appendix7 to the EFET General Agreementrelating to the Delivery and Acceptance of Electricity8 and an AllowanceAppendix, on very similar terms, to the EFET General Agreement relating tothe Delivery and Acceptance of Natural Gas9 (both agreements arehereinafter referred to as the “EFET Agreement” and both appendices as the“EFET Appendix” and are jointly referred to as the “EFET AllowanceAgreement”).

As is evident, the above agreements have been produced by three different bodiesfrom different commercial backgrounds. Initially there was some inconsistencybetween the agreements as to the treatment of some key issues. There hashowever been a concerted effort by all three bodies to achieve harmonizationwhere possible in relation to key issues under the current versions of theagreements.

Appendix 2 to this guide summarises and compares some of the key terms of theabove agreements.

17

4 Current version: version 3 published in September 20065 1992 or 2002 version6 Current version 2.1 published 13 June 20057 Current version 2.0 published 20 July 20058 Current version 2.1 published 20 December 20009 Current version 1.0 published March 2006

I Exchange Trading

There are a number of different exchanges offering EU ETS Allowance productssuch as European Climate Exchange (“ECX”), SENDECO 2, New Values, APXPower Limited, APX B.V., STX Services, Vertis Environmental Finance, Ex AlpenAdria (“EXAA”), Nordic Power Exchange (“Nord Pool”), Powernext SA, EuropeanEnergy Exchange (“EEX”) and Gestore de Mercato Elettrica (“GME”).

Currently, the leading exchange in terms of exchange-traded volume is the ECX.The ECX is part of the same group of companies as the Chicago ClimateExchange. ECX offered the first quoted and cleared product for European CO2.ECX began trading futures on the International Petroleum Exchange (“IPE”) nowknown as ICE in April 200510.

ICE ECX CFI futures contracts (“ICE ECX CFI Futures Contracts”) are one of theleading exchange-traded products in the field. The ICE ECX CFI options contracthas also recently been launched.

IICCEE EECCXX CCFFII FFuuttuurreess CCoonnttrraaccttss

The detailed terms of the ICE ECX CFI Futures Contracts are set out in contractrules and administrative procedures within the regulations of ICE Future (“ICERegulations”). The ICE Regulations cover most of the same issues addressed inthe OTC ISDA, IETA and EFET agreements but are tailored to reflect the specificneeds of exchange traded futures contracts, such as ICE EXC CFI Future’s deliverymechanism.

CCoonnttrraacctt SSppeecciiffiiccaattiioonn aanndd TTeerrmmss

As is usual for exchange traded contracts the contract specifications arestandardised as to the underlying commodity (and units thereof), type ofsettlement, currency, contract months and other details.

The current underlying in ICE ECX CFI Futures Contracts is EU ETS allowances.However there is scope for other allowance types to be recognised by the ECX.

The unit of trading is currently one lot of 1000 “Emission Allowances” being anentitlement to emit one tonne of CO2 equivalent gas. The minimum trading size isone lot and prices are in Euros per metric tonne.

All the contracts are quarterly term contracts listed on a monthly cycle from thecurrent month through to March 2008. Additionally five December contracts will belisted from December 2008 to December 2012.

LCH.Clearnet is the counterpart to all trades and guarantees the financialperformance of the ICE ECX CFI Futures Contracts registered in the name of itsmembers.

18

10 ECX and ICE Futures have a partnership whereby ECX manages the marketing of ECX Carbon Financial Instruments andICE Futures lists and trades the carbon contracts on the electronic trading platform owned and operated by ICE Future’sparent company - Intercontinental Exchange Inc, known as the Interchange or ICE Platform.

In order to guarantee the payments under the ICE ECX CFI Futures Contracts,LCH.Clearnet has a default fund and ensures that it retains sufficient funds to coverthe positions which it takes through margin calls that are taken in two forms: initialmargin that is called up-front and will be passed through the ICE futures clearingmember and a variation margin that will be calculated on a daily basis as positionsare marked-to-market in order to reflect daily price movements.

DDeelliivveerryy aanndd PPaayymmeenntt

The ICE ECX CFR Futures Contracts are physically deliverable by the transfer ofallowances from the holding account of the seller at the holding account ofLCH.Clearnet (if the seller is a clearing member, otherwise the seller will first haveto transfer the allowance to the holding account of a clearing member) and fromthe holding account of LCH at a registry to the holding account of the buyer (if thebuyer is a clearing member, otherwise the transfer will be to the holding account ofa clearing member which will transfer the allowance to the account of the buyer) ata registry.

The buyer has to pay the exchange delivery settlement price specified in the ICEECX CFI Futures Contract by the time stipulated.

In the event of a failure to effect delivery or take delivery of allowances as a resultof seller or buyer default, the ICE Regulations set out the procedures to be followedas regards the reimbursement of costs incurred as a consequence of such default.The ECX also impose fines upon the defaulting party.

In the case of a seller default, LCH.Clearnet will indemnify the buyer in respect ofany reasonable costs incurred as a result of the failed delivery, which may includethe cost of going into the market and buying replacement allowances. These costsare passed onto the defaulting seller.

In the case of a buyer default, the seller will be paid by LCH.Clearnet in any eventand the buyer is obliged to indemnify LCH.Clearnet.

The ECX excludes liability for any failures in the performance of any registry orcommunication link with any registry.

19

20

J Glossary

““AAnnnneexx II””means the Annex I to the UNFCCC;

““AAnnnneexx IIII”” means the Annex II to the UNFCCC;

““AAnnnneexx BB”” means the Annex B to the KP;

““CCCCXX”” means Chicago Climate Exchange;

““CCDDMM”” means Clean Development Mechanism which enables Annex I countries toimplement projects in non-Annex I countries that reduce greenhouse emissions orabsorb CO2 in return for CERs;

““CCEERRss”” means Certified Emission Reductions (see definition of JI below);

““CCIITTLL”” means Community Independent Transaction Log;

““CCoommmmiissssiioonn”” means the European Commission;

““CCoonnffiirrmmaattiioonn”” means the confirmation of an emission allowance transaction underan ISDA Agreement;

““CCOO22”” means carbon dioxide emissions;

““CCOOPP//MMOOPP”” means conference of the parties serving as the meeting of the partiesto the KP;

““DDEEFFRRAA”” means Department for Environment, Food and Rural Affairs;

““EECCXX”” means European Climate Exchange;

““EEFFEETT”” means European Federation of Energy Traders;

““EEFFEETT AAggrreeeemmeenntt”” means EFET General Agreement relating to the Delivery andAcceptance of Electricity (version 2.1 published 20 December 2000) and theGeneral Agreement relating to the Delivery and Acceptance of Natural Gas (version1.0 published March 2006);

““EEFFEETT AAlllloowwaannccee AAggrreeeemmeenntt”” means the EFET Agreement and the EFET Appendix;

““EEFFEETT AAppppeennddiixx”” means EFET Allowance Appendix (version 2.0 published 20 July2005) to the EFET Agreement;

““EERRUU’’ss”” means Emission Reduction Units (see definition of CDM above);

““EEUU”” means European Union;

““EEUU EETTSS”” means European Union Emission Trading Scheme;

““EEUU EETTSS DDiirreeccttiivvee”” means the EU Emission Trading Directive 2003/87/EC amendedby the Linking Directive;

““EExxeeccuuttiivvee BBooaarrdd”” means the executive board elected by the parties to the KP,being comprised of 10 parties to the KP and responsible for supervising of theCDM;

““FFoorrmm”” means the ISDA Form of Part [6] of the Schedule for EU EmissionAllowance Transactions (published in September 2006);

““IICCEE EECCXX CCFFII FFuuttuurreess CCoonnttrraaccttss”” means the ECX CFI futures contracts, whichterms and conditions are regulated in the ICE Future Regulations;

““IICCEE RReegguullaattiioonnss”” means the contract rules and administrative procedures withinthe regulations of ICE Future;

““IIEETTAA”” means International Energy Trade Association;

““IIEETTAA AAggrreeeemmeenntt”” means IETA Emissions Trading Master Agreement for the EUScheme (version 2.1 published 13 June 2005);

““IIEETTAA CCDDMM AAggrreeeemmeenntt”” means the IETA CDM Emission Reductions PurchaseAgreement;

““IIEETTAA CCoonnffiirrmmaattiioonn”” means the confirmation of an emission allowance transactionunder a IETA Agreement;

““IIPPEE”” means International Petroleum Exchange;

““IISSDDAA”” means International Swaps and Derivatives Association;

““IISSDDAA AAggrreeeemmeenntt”” means the Form, the Master Agreements (either 1992 or 2002),the Schedule and the Confirmation;

““IITTLL”” means International Transaction Log;

““JJII”” means the Joint Implementation mechanism whereby Annex I countries mayimplement emission reducing projects or projects that enhance removal by sinks inanother Annex I country in return for CERs;

21

““KKPP”” means the Kyoto Protocol;

““LLFFEE”” means large final emitters;

““LLiinnkkiinngg DDiirreeccttiivvee”” means the Directive 2004/101/EC that amended the EU ETSDirective to provide for linking to the KP mechanisms and the use of credits fromthese mechanism for compliance under the EU ETS;

““MMaasstteerr AAggrreeeemmeenntt”” means one of the ISDA Master Agreements (either 1992 or2002);

““NNAAPP”” means the national allocation plan submitted for the approval of theCommission which specifies the total number of allowances that each MemberState intends to issue during a particular phase and how it proposes to distributethose allowances to the installations subject to the EU ETS;

““OOTTCC”” means over the counter;

““PPhhaassee 11”” means the first phase of the EU ETS that runs from 2005-2007;

““PPhhaassee 22”” means the second phase of the EU ETS that runs from 2008-20012;

““RRGGGGII”” means Regional Greenhouse Gas Initiative;

““SSuuppeerrvviissoorryy CCoommmmiitttteeee”” means the supervisory committee elected by the partiesto the KP, being comprised of 10 parties to the KP and responsible for supervisingthe ERUs generated by means JI projects;

““UUKK”” means the United Kingdom;

““UUNNFFCCCCCC”” means the United Nations Framework Convention on Climate Change;

““UUSS”” means the United States of America;

22

Appendix 1

We set out below further information regarding the CDM and JI mechanisms underthe KP.

CDM

The CDM mechanism enables an Annex I country, which is a party to the KP tocarry out projects to reduce emissions in developing countries.

The conference of the parties serving as the meeting of the parties to the KP(“COP/MOP”) has authority over and provides guidance to the CDM. TheCOP/MOP defines the general rules applicable to the CDM and takes decisions onrecommendations made by the executive board (“Executive Board”), which iscomprised of 10 members from parties to the KP.

The Executive Board supervises the CDM and is, therefore, is responsible for,among others: (i) accreditation and recommendation of the designation ofoperational entities (see below): (ii) making public available relevant information(submitted to it for this purpose) on proposed CDM project activities: (iii) makingtechnical reports commissioned available to the public and providing a period forpublic comments; (iv) developing and maintaining a repository of approved rulesprocedures and methodologies and standards; and (v) developing and maintainingthe CDM registry. In order to perform its functions, the Executive Board canestablish committees, panels or working groups that will assist it in allnecessary matters.

CDM projects are approved by the designated operational entities, which, ingeneral, are responsible for: (i) the validation of the proposed CDM projectactivities; (ii) verification and certification of reduction in anthropogenic emissionsby sources of greenhouse gases; (iii) compliance with applicable laws of theparties to KP hosting the CDM project activities; (iv) submitting annual reports; and(v) making information publicly available.

Once the CDM project activities have been approved by the operational entitiesagainst the applicable requirements, the Executive Board registers the relevantproject activities. Such registration by the Executive Board must occur within eightweeks after the date of receipt by the Executive Board of the request forregistration. If a project is rejected by the Executive Board, it may be submitted forapproval by the operational entity and registration by the Executive Board afterappropriate revisions.

The registration is the prerequisite for the verification, certification and issuance ofCERs. The verification is the periodic independent review and determination by thedesignated operational entity of the monitored reductions in anthropogenicemissions that have occurred as a result of the CDM project activity. This isformalized by (1) a written assurance by the designated operational entity of thereductions of emissions verified during a specific period of time and (2) a request

23

to the Executive Board to issue CERs equal to the verified amount of reduction ofanthropogenic emission of greenhouse gases.

JJII

The JI mechanism enables an Annex I country to carry out projects to reduceemissions in Annex I countries.

The general principles applicable to CDM are, in general, similar to thoseapplicable to the JI mechanism, e.g. the COP/MOP has authority over and providesgeneral guidance to the JI by defining the general rules applicable to the JI andalso taking decisions on recommendations made by a supervisor committee(“Supervisory Committee”) comprised of 10 members from parties to the KP.

The Supervisory Committee must, inter alia, supervise the ERUs generated by theJI projects activities and be responsible for: (i) accreditation of independententities; (ii) review of (a) standards and procedures for the accreditation andmaking, if applicable, recommendations for the COP/MOP; (b) reporting guidelinesand criteria for baselines and monitoring.

Whenever a party to the KP is involved in a JI project, it must inform the secretariat(which assists the Supervisory Committee) of its “designated focal point” forapproving projects under JI and its national guidelines and procedures forapproving such projects.

It is important to note that a country hosting a JI project has to meet the applicablerequirements and must make publicly available information on the project inaccordance with the guidelines established by the COP/MOP.

The project participants must submit to the accredited independent entity theproject design document which must contain the approval of all the countriesinvolved, the expected emissions reductions and the baseline and monitoring plan.

An accredited independent entity must analyse the document submitted by theparties and must determine whether (i) the project has been approved by thecountries involved; (ii) the project would result in a reduction of emissionsanthropogenic emissions by sources or enhancements of anthropogenic removalsby sinks meeting the relevant requirements; (iii) the project has an appropriatebaseline and monitoring plan; and (iv) project participants have submitted to theaccredited independent entity documentation on the analysis of the environmentalimpacts of the project activity.

The determination made by the accredited independent entity must be madepublicly available through the secretariat and will be deemed final 15 days after thedate on which it is made public, unless a party involved in the project or 3 of themembers of the Supervisory Committee request a review.

EEmmiissssiioonn rreedduuccttiioonn ppuurrcchhaassee aaggrreeeemmeennttss uunnddeerr CCDDMM aanndd JJII pprroojjeeccttss

Generally emissions reduction purchase agreements for CDM and JI mechanismsare an individually negotiated terms.

24

However IETA has published a standard agreement in respect of CDM projectsnamely, the CDM Emission Reductions Purchase Agreement11 (“IETA CDMAgreement”).

The IETA CDM Agreement is drafted so as to address certain issues that areparticular to CDM project related transactions, arising from the fact that the buyermay enter into such an agreement at an early stage of the CDM project even(before the CDM project itself is approved by the operational entity and registeredby the Executive Board).

The IETA CDM Agreement has, therefore, specific provisions addressing theposition concerning the validation and register of the CDM project, the granting ofauthorization of the host country to CDM project entity, the financial close of theproject and circumstances in which the agreed amount of CERs are not issued.The IETA CDM Agreement specifies events of default directly related to thecommission date of the project and achievement of financial close, and includesprovisions applicable in case the minimum agreed amount of CERs have not beenissued. In such a case, the buyer may: (i) accept the shortfall where it believes itcan be recovered in the subsequent year; (ii) require the project entity to propose aplan of action to remedy the shortfall; (iii) require the project entity to providereplacement of CERs in the same quantity as the shortfall amount; or (iv) terminatethe agreement if such failure is a results of an event of default.

25

11 Current version: version 2 published 20 August 2004

26

App

endi

x 2

We

set o

ut b

elow

a s

umm

ary

of th

e ke

y te

rms

of th

e IS

DA

Agr

eem

ent,

IETA

Agr

eem

ent a

nd E

FET

Allo

wan

ce A

gree

men

t.

Ther

e ar

e ob

viou

sly

othe

r im

port

ant a

nd r

elev

ant t

erm

s co

ntai

ned

in a

ll of

thes

e ag

reem

ents

whi

ch w

e ar

e un

able

to r

evie

w in

this

guid

e. H

owev

er, f

or fu

rthe

r in

form

atio

n pl

ease

con

tact

us.

IISSDD

AAIIEE

TTAAEEFF

EETT

GGeenn

eerraall

NNoott

eessTh

e IS

DA

Agr

eem

ent i

s de

sign

ed to

allo

w tr

adin

g of

allo

wan

ces

unde

r a

Mas

ter

Agr

eem

ent w

hich

can

oper

ate

as a

sin

gle

prod

uct o

r a

mul

ti-pr

oduc

t ISD

A A

gree

men

t.

The

Mas

ter

Agr

eem

ent12

cont

ains

the

gene

ral t

erm

s de

finin

g th

e le

gal

rela

tions

hip

and

oblig

atio

ns b

etw

een

the

part

ies

and

is s

uppl

emen

ted

byth

e C

onfir

mat

ion

and

the

Form

whi

chin

clud

es th

e sp

ecifi

c te

rms

appl

icab

le to

EU

Em

issi

ons

Allo

wan

ce T

rans

actio

ns.

The

Mas

ter

Agr

eem

ent p

rovi

des

that

the

part

ies

will

be

boun

d by

the

term

s of

the

trans

actio

n fro

m th

em

omen

t the

y ag

ree

to th

e te

rms,

whe

ther

ora

lly o

r ot

herw

ise.

The

IETA

Agr

eem

ent c

ompr

ises

an

agre

emen

t whi

ch s

ets

out t

he m

ain

term

s go

vern

ing

the

rela

tions

hip

betw

een

the

part

ies

and

thre

esc

hedu

les

(Sch

edul

e 1

- D

efin

ition

s,Sc

hedu

le 2

- A

gree

men

t Inf

orm

atio

n(E

lect

ions

) an

d Sc

hedu

le 3

- F

orm

of

Con

firm

atio

n).

It is

an

agre

emen

tsp

ecifi

c to

EU

allo

wan

ce tr

adin

g an

ddo

es n

ot e

nvis

age

the

tradi

ng o

f any

othe

r pr

oduc

ts o

r co

mm

oditi

es.

The

IETA

Agr

eem

ent p

rovi

des

that

the

part

ies

inte

nd th

at th

ey w

ill b

ele

gally

bou

nd b

y w

ay o

f ver

bal

agre

emen

t bet

wee

n th

e pa

rtie

s an

dth

e pa

rtie

s gi

ve th

eir

cons

ent t

ore

cord

any

tele

phon

e co

nver

satio

n to

prov

ide

evid

ence

of s

uch

verb

alag

reem

ents

. It

prov

ides

for

a w

ritte

n“c

onfir

mat

ion”

of a

tran

sact

ion

to b

eis

sued

thre

e bu

sine

ss d

ays

afte

r it

has

been

ent

ered

into

, alth

ough

lack

of a

writ

ten

conf

irmat

ion

will

not

affe

ct th

e va

lidity

of t

he tr

ansa

ctio

n.

The

EFET

Agr

eem

ent c

ompr

ises

the

EFET

Allo

wan

ces

App

endi

x an

d th

eEF

ET G

ener

al A

gree

men

t. T

he E

FET

Gen

eral

Agr

eem

ent c

ompr

ises

bot

han

ele

ctric

ity tr

adin

g ag

reem

ent a

nd a

gas

tradi

ng a

gree

men

t whi

ch c

an b

oth

be a

dapt

ed fo

r tra

ding

allo

wan

ces

byth

e us

e of

the

App

endi

x.

The

EFET

Allo

wan

ce A

gree

men

tw

orks

by

prov

idin

g an

ove

rlyin

g“u

mbr

ella

” ag

reem

ent d

efin

ing

the

lega

l rel

atio

nshi

p an

d ob

ligat

ions

betw

een

the

part

ies,

and

then

allo

win

g fo

r in

divi

dual

tran

sact

ions

of

spec

ified

num

ber

of a

llow

ance

sba

sed

on v

erba

l or

writ

ten

agre

emen

ts w

ithin

the

rule

ses

tabl

ishe

d by

the

umbr

ella

agre

emen

t, ev

iden

ced

by w

ritte

nco

nfirm

atio

n.

It al

low

s fo

r th

e en

try

of in

divi

dual

trans

actio

ns o

f allo

wan

ces

by w

ay o

fve

rbal

agr

eem

ent b

etw

een

the

part

ies

and

the

part

ies

give

con

sent

to r

ecor

d an

y te

leph

one

conv

ersa

tions

to p

rovi

de e

vide

nce

ofsu

ch v

erba

l agr

eem

ents

. It

prov

ides

that

indi

vidu

al tr

ansa

ctio

ns m

ay b

een

tere

d by

any

form

of

12 T

he c

omm

ents

bel

ow a

re o

n th

e ba

sis

that

the

2002

Mas

ter

Agr

eem

ent a

pplie

s

IISSDD

AAIIEE

TTAAEEFF

EETT

com

mun

icat

ion

and

that

tran

sact

ions

are

bind

ing

and

enfo

rcea

ble

as s

oon

as te

rms

are

agre

ed.

Form

alis

ing

trans

actio

ns in

writ

ten

is o

ptio

nal,

but

not n

eces

sary

.

DDeeff

iinniittii

oonn oo

ff AAlllloo

wwaann

cceess

The

Form

con

tain

s a

broa

d de

finiti

onof

the

type

of a

llow

ance

s th

at c

an b

etra

ded

whi

ch in

clud

es E

UA

llow

ance

s, C

ER’s

, ER

U’s

reco

gnis

ed u

nder

the

EU E

TS a

ndan

y ot

her

allo

wan

ce is

sued

und

er a

nem

issi

ons

tradi

ng s

chem

e in

a n

on-

EU c

ount

ry w

hich

has

bee

nre

cogn

ised

by

the

EU u

nder

am

utua

l rec

ogni

tion

agre

emen

ten

visa

ged

unde

r th

e EU

ETS

Dire

ctiv

e.

Allo

wan

ce is

def

ined

as

mea

ning

an

EU A

llian

ce, a

CER

and

an

“Alte

rnat

ive

Allo

wan

ce”.

The

latte

rw

ill in

clud

e an

y al

low

ance

issu

edun

der

an e

mis

sion

s tra

ding

sch

eme

in a

non

-EU

cou

ntry

, whi

ch h

as b

een

reco

gnis

ed b

y th

e EU

.

Allo

wan

ce is

def

ined

as

anal

low

ance

to e

mit

one

tonn

e of

carb

on d

ioxi

de (

C02

) or

equ

ival

ent

durin

g a

spec

ified

per

iod

valid

for

the

purp

oses

of m

eetin

g th

ere

quire

men

ts o

f app

licab

le la

w a

ndth

e re

leva

nt e

mis

sion

s tra

ding

sche

me

appl

icab

le to

the

buye

r an

dth

e de

liver

y po

int o

n th

e de

liver

yda

te.

PPaarrttii

eess’’ OO

bblliigg

aattiioo

nnssG

ener

ally

thes

e ar

e fo

r th

e de

liver

ing

part

y to

tran

sfer

allo

wan

ces

into

the

rece

ivin

g pa

rty’

s no

min

ated

acc

ount

at a

Mem

ber

Stat

e re

gist

ry a

nd fo

rth

e re

ceiv

ing

part

y to

pay

for

the

num

ber

of a

llow

ance

s de

liver

ed.

As

with

the

ISD

A A

gree

men

t the

part

ies

are

oblig

ed to

ens

ure

that

they

hav

e va

lid h

oldi

ng a

ccou

nts

inan

y M

embe

r St

ate

Reg

istr

y an

d th

ege

nera

l obl

igat

ion

is fo

r th

e se

ller

totra

nsfe

r al

low

ance

s in

to th

e bu

yer’s

hold

ing

acco

unt a

nd fo

r th

e bu

yer

topa

y fo

r th

e nu

mbe

r of

allo

wan

ces

deliv

ered

. In

an

IETA

tran

sact

ion

the

part

ies

hold

ing

acco

unts

are

nom

inat

ed in

the

IETA

Con

firm

atio

nor

in S

ched

ule

2 to

the

IETA

Agr

eem

ent.

The

gene

ral o

blig

atio

ns u

nder

the

EFET

Allo

wan

ce A

gree

men

t are

for

the

selle

r to

tran

sfer

allo

wan

ces

into

the

Nom

inat

ed A

ccou

nt a

nd fo

r th

ebu

yer

to p

ay fo

r th

e nu

mbe

r of

allo

wan

ces

deliv

ered

.

DDeell

iivveerr

yyD

eliv

ery

of th

e al

low

ance

s oc

curs

upon

the

depo

sit o

f the

allo

wan

ces

A tr

ansf

er is

con

side

red

to b

eco

mpl

eted

whe

n th

e al

low

ance

s ar

eD

eliv

ery

of th

e al

low

ance

s oc

curs

upon

dep

osit

of th

e al

low

ance

s in

to

27

28

IISSDD

AAIIEE

TTAAEEFF

EETT

into

an

acco

unt a

t a M

embe

r St

ate

Reg

istr

y no

min

ated

by

the

rece

ivin

gpa

rty.

Bot

h re

ceiv

ing

part

y an

dde

liver

ing

part

y th

eref

ore

have

an

oblig

atio

n un

der

the

ISD

AA

gree

men

t to

mai

ntai

n re

gist

ry-

tradi

ng a

ccou

nts

in a

ccor

danc

e w

ithth

e EU

ETS

rul

es.

Und

er th

e IS

DA

Agr

eem

ent,

the

rele

vant

acc

ount

isno

min

ated

in th

e C

onfir

mat

ion.

rece

ived

in th

e bu

yer’s

hol

ding

acco

unts

spe

cifie

d in

Sch

edul

e 2

orin

the

IETA

Con

firm

atio

n. T

itle

to th

eal

low

ance

s an

d ris

k of

loss

rel

ated

the

allo

wan

ces

or a

ny p

art o

f the

mtra

nsfe

r fro

m th

e se

ller

to th

e bu

yer

upon

del

iver

y.

an a

ccou

nt n

omin

ated

by

the

buye

r.U

nder

the

EFET

Allo

wan

ceA

gree

men

t, th

e re

leva

nt a

ccou

nt c

anei

ther

be

nom

inat

ed in

the

conf

irmat

ion

or p

artie

s ca

n ag

ree

topr

ovid

e a

list o

f pos

sibl

e ac

coun

ts in

the

conf

irmat

ion

and

late

r to

desi

gnat

e th

e re

leva

nt a

ccou

nt fo

rde

liver

y am

ong

thos

e lis

ted.

Tran

sfer

of t

itle

to th

e al

low

ance

sta

kes

plac

e up

on d

eliv

ery.

PPaayymm

eenntt

The

rece

ivin

g pa

rty

mus

t pay

for

the

amou

nt o

f allo

wan

ces

actu

ally

deliv

ered

.

Und

er th

e IS

DA

Agr

eem

ent,

paym

ent

occu

rs o

n th

e pa

ymen

t dat

e, w

hich

is n

omin

ated

by

the

part

ies

in th

eC

onfir

mat

ion,

usu

ally

as

eith

er th

e5t

h bu

sine

ss d

ay fo

llow

ing

the

late

rof

the

deliv

ery

date

and

the

date

on

whi

ch th

e re

leva

nt v

alue

add

ed ta

xin

voic

e is

del

iver

ed to

the

rece

ivin

gpa

rty

or th

e 20

th d

ay o

f the

mon

thfo

llow

ing

the

end

of th

e m

onth

inw

hich

the

deliv

ery

date

occ

urs.

Paym

ents

are

req

uire

d to

be

mad

e in

“fre

ely

trans

fera

ble

fund

s” in

the

curr

ency

nom

inat

ed b

y th

e pa

rtie

s.

The

buye

r m

ust p

ay fo

r th

e am

ount

of a

llow

ance

s ac

tual

ly d

eliv

ered

.

Und

er th

e IE

TA A

gree

men

t,pa

ymen

t mus

t be

spec

ified

inSc

hedu

le 2

as

bein

g (i)

the

late

r of

(a)

the

20th

day

of t

he m

onth

follo

win

g th

e m

onth

in w

hich

the

deliv

ery

date

occ

ured

(b)

the

5th

bank

ing

day

afte

r th

e da

te o

n w

hich

the

stat

emen

t is

deliv

ered

to th

ebu

yer

purs

uant

to c

laus

e 8.

213 ;

or (

ii)th

e 5t

h ba

nkin

g da

y af

ter

the

late

r of

(a)

deliv

ery

date

and

(b)

the

date

on

whi

ch th

e st

atem

ent i

s de

liver

ed to

the

buye

r. P

aym

ent m

ust b

e m

ade

in E

uros

or

in a

ny o

ther

cur

renc

y if

agre

ed b

y th

e pa

rtie

s.

The

buye

r m

ust p

ay fo

r th

e am

ount

of a

llow

ance

s ac

tual

ly d

eliv

ered

.

Und

er th

e EF

ET A

llow

ance

Agr

eem

ent,

paym

ent m

ust b

e m

ade

in a

ccor

danc

e to

cyc

le A

or

cycl

e B

,as

spe

cifie

d in

par

t II o

f the

EFE

TA

ppen

dix:

(i)

if cy

cle

A is

spe

cifie

das

app

licab

le, p

aym

ent m

ust o

ccur

on th

e la

ter

of e

ither

(a)

the

20th

day

of th

e ca

lend

ar m

onth

afte

r th

em

onth

in w

hich

the

allo

wan

ces

wer

ede

liver

ed o

r (b

) th

e 5t

h bu

sine

ss d

ayfo

llow

ing

rece

ipt o

f an

invo

ice;

or

(ii)

if cy

cle

B is

spe

cifie

d as

app

licab

le,

paym

ent m

ust o

ccur

on

or b

efor

e th

e5t

h bu

sine

ss d

ay a

fter

the

late

r to

occu

r of

(a)

del

iver

y da

te o

r (b

) th

ere

ceip

t of a

n in

voic

e. P

aym

ent i

s to

be m

ade

in E

uros

.

13 D

etai

ling

mat

ters

suc

h as

the

quan

tity

of a

llow

ance

sde

liver

ed, p

rice

and

any

phys

ical

or

paym

ent n

ettin

g.

29

IISSDD

AAIIEE

TTAAEEFF

EETT

PPaayymm

eenntt nn

eettttiinn

gg aann

dd pphh

yyssiicc

aallnnee

ttttiinngg

ooff dd

eelliivv

eerriiee

ssPa

ymen

t net

ting

appl

ies

to a

mou

nts

paya

ble

in r

espe

ct o

f the

sam

etra

nsac

tion

and

in th

e sa

me

curr

ency

. H

owev

er th

e IS

DA

Agr

eem

ent s

peci

fical

ly p

rovi

des

that

the

part

ies

can

elec

t tha

t a n

etam

ount

will

be

paya

ble

with

res

pect

to a

ll ou

tsta

ndin

g or

spe

cific

gro

ups

of tr

ansa

ctio

ns u

nder

the

ISD

AA

gree

men

t whi

ch a

re d

ue fo

rpa

ymen

t on

the

sam

e da

y an

d in

the

sam

e cu

rren

cy14

.

The

ISD

A A

gree

men

t per

mits

phys

ical

net

tings

of a

llow

ance

trans

actio

ns in

res

pect

of t

wo

orm

ore

EU E

mis

sion

s A

llow

ance

sTr

ansa

ctio

ns b

etw

een

the

part

ies

for

the

sam

e al

low

ance

type

and

spec

ified

com

plia

nce

perio

dbe

twee

n th

e sa

me

pair

of tr

adin

gac

coun

ts o

f the

par

ties.

Net

ting

of p

aym

ents

of d

iffer

ent

allo

wan

ce tr

ansa

ctio

ns is

per

mitt

edan

d, u

nles

s ot

herw

ise

spec

ified

inSc

hedu

le 2

, phy

sica

l net

ting

ofal

low

ance

tran

sact

ions

is a

lso

perm

itted

.

Paym

ent n

ettin

g fo

r al

low

ance

s is

perm

itted

und

er th

e EF

ET A

llow

ance

Agr

eem

ent.

Par

ties

can

agre

e to

cros

s-ne

t aga

inst

ele

ctric

itypa

ymen

ts, b

ut th

e de

faul

t pos

ition

isth

at a

llow

ance

s an

d el

ectri

city

are

nette

d di

scre

tely

. T

he b

uyer

isob

liged

to p

ay fo

r an

y al

low

ance

sw

hich

the

selle

r ha

s ac

tual

lyde

liver

ed in

to th

e no

min

ated

acc

ount

at th

e sc

hedu

led

date

for

deliv

ery

inac

cord

ance

with

the

selle

r’sob

ligat

ions

und

er th

e EF

ETA

llow

ance

Agr

eem

ent.

If sp

ecifi

ed a

s ap

plyi

ng, a

llow

ance

sof

the

sam

e al

low

ance

type

and

com

plia

nce

perio

d w

ill b

eau

tom

atic

ally

sat

isfie

d an

ddi

scha

rged

and

, if a

pplic

able

,re

plac

ed b

y th

e ob

ligat

ion

of th

epa

rty

from

who

m th

e la

rger

aggr

egat

e nu

mbe

r of

allo

wan

ces

wou

ld h

ave

been

tran

sfer

able

tosc

hedu

le a

nd tr

ansf

er to

the

othe

rpa

rty

a nu

mbe

r of

allo

wan

ces

equa

lto

the

exce

ss o

f the

larg

er a

ggre

gate

num

ber

of a

llow

ance

s ov

er th

esm

alle

r ag

greg

ate

num

ber

ofal

low

ance

s.

RReepp

llaaccee

mmeenn

tt CCooss

ttss //

CCoovv

eerr CC

oossttss

Ther

e ar

e sp

ecifi

c pr

ovis

ions

for

calc

ulat

ing

repl

acem

ent c

osts

in th

eev

ent t

hat e

ither

the

rece

ivin

g pa

rty

fails

to ta

ke d

eliv

ery

of th

eA

llow

ance

s or

the

deliv

erin

g pa

rty

SSeellllee

rr’’ss RR

eeppllaa

cceemm

eenntt CC

oossttss

Und

er th

e IE

TA A

gree

men

t, if

the

buye

r fa

ils to

acc

ept d

eliv

ery

of th

eal

low

ance

s an

d if

that

failu

re is

rem

edie

d w

ithin

one

ban

king

day

of

the

date

of t

he n

otic

e gi

ven

by th

e

Prov

isio

n is

mad

e fo

r de

term

inin

gth

e re

plac

emen

t cos

ts fo

r th

e fa

ilure

to d

eliv

er o

r ac

cept

allo

wan

ces.

Und

er th

e EF

ET A

llow

ance

Agr

eem

ent t

hese

are

ref

erre

d to

as

cove

r co

sts

and

not,

as u

nder

the

14 M

ultip

le T

rans

actio

n Pa

ymen

t Net

ting.

30

fails

to m

ake

deliv

ery

of a

llow

ance

sot

her

than

as

a re

sult

of a

set

tlem

ent

disr

uptio

n ev

ent.

DDeell

iivveerr

iinngg

ppaarrttyy

’’ss rr

eeppllaa

cceemm

eenntt cc

oossttss

In th

e ev

ent t

hat t

he r

ecei

ving

par

tyfa

ils to

take

del

iver

y of

the

allo

wan

ces,

the

deliv

erin

g pa

rty’

sre

plac

emen

t cos

ts a

re b

ased

upo

nth

e di

ffere

nce

betw

een

the

cont

ract

ual a

llow

ance

pric

e an

dpr

ice

per

allo

wan

ce th

at th

ede

liver

ing

part

y w

ould

rec

eive

in a

nar

m’s

leng

th tr

ansa

ctio

n on

the

final

com

plia

nce

date

(as

def

ined

in th

eFo

rm s

ectio

n of

the

ISD

AA

gree

men

t) to

geth

er w

ith in

tere

st.

RReecc

eeiivvii

nngg pp

aarrttyy

’’ss rr

eeppllaa

cceemm

eenntt cc

oossttss

The

rece

ivin

g pa

rty

can

choo

se fr

omth

ree

diffe

rent

bas

es fo

r as

sess

ing

the

appl

icab

le r

epla

cem

ent c

osts

inth

e ev

ent t

hat t

he d

eliv

erin

g pa

rty

fails

to m

ake

deliv

ery

of th

eal

low

ance

s an

d m

ake

an e

lect

ion

asto

whi

ch b

asis

is to

app

ly.

Bro

adly

the

repl

acem

ent c

osts

are

bas

edup

on th

e di

ffere

nce

betw

een

the

cont

ract

ual a

llow

ance

pric

e an

d th

epr

ice

that

the

rece

ivin

g pa

rty

wou

ldha

ve to

pay

to p

urch

ase

the

allo

wan

ces

in a

n ar

m’s

leng

thtra

nsac

tion

at th

e tim

es s

peci

fied

defin

ed in

the

ISD

A A

gree

men

t(w

hich

will

dep

end

upon

the

elec

tion

mad

e by

the

Buy

er)

toge

ther

with

inte

rest

. H

owev

er th

e re

ceiv

ing

part

y

selle

r of

the

notic

e re

quiri

ng th

ebu

yer

to r

emed

y th

e fa

ilure

(“t

heFi

nal D

eliv

ery

Dat

e”)

the

buye

r m

ust

pay

to th

e se

ller

inte

rest

of a

nam

ount

equ

al to

the

cont

ract

pric

em

ultip

lied

by th

e nu

mbe

r of

allo

wan

ces

not t

rans

ferr

ed fo

r th

epe

riod

from

the

deliv

ery

date

to th

eac

tual

dat

e of

tran

sfer

. If

the

buye

rdo

es n

ot r

emed

y th

e fa

ilure

totra

nsfe

r by

the

Fina

l Del

iver

y D

ate

the

selle

r m

ay te

rmin

ate

the

trans

actio

n an

d th

e bu

yer

mus

t pay

to th

e se

ller

repl

acem

ent c

osts

for

any

unde

rlive

red

allo

wan

ces

befo

reth

e th

ird b

anki

ng d

ay fo

llow

ing

the

rece

ipt o

f suc

h no

tice

of te

rmin

atio

n.

The

selle

r’s r

epla

cem

ent c

ost i

s th

epo

sitiv

e di

ffere

nce

betw

een

the

cont

ract

pric

e an

d th

e pr

ice

that

ase

ller

wou

ld r

ecei

ve in

an

arm

’sle

ngth

tran

sact

ion

for

the

shor

tfall

quan

tity

plus

inte

rest

, rea

sona

ble

cost

s an

d ex

pens

es in

clud

ing

brok

erfe

es a

nd le

gal f

ees.

BBuuyy

eerr’’ss

RReepp

llaaccee

mmeenn

tt CCooss

ttss

Und

er th

e IE

TA A

gree

men

t, if

the

selle

r fa

ils to

del

iver

the

allo

wan

cean

d (i)

if s

uch

failu

re is

rem

edie

dw

ithin

one

ban

king

day

of t

he d

ate

ofth

e no

tice

give

n by

the

buye

r of

the

notic

e re

quiri

ng th

e se

ller

to r

emed

yth

e fa

ilure

, the

sel

ler

mus

t pay

to th

ebu

yer

inte

rest

on

an a

mou

nt e

qual

toth

e co

ntra

ct p

rice

mul

tiplie

d by

the

ISD