Capitalizing on a Massive Opportunity: Ownership of …...$2.2 Billion June 2019 $286 Million...

Transcript of Capitalizing on a Massive Opportunity: Ownership of …...$2.2 Billion June 2019 $286 Million...

Capitalizing on a Massive Opportunity:

Ownership of an Entire District in Brazil

TSX-V: VOOTCQX: KVLQF

FRANKFURT: KEQ0www.valoremetals.com

Pedra Branca PGE+Au Project, Northeastern Brazil

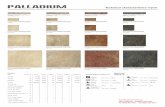

PdPalladium

46

106.42

PtPlatinum

78

195.08

RhRhodium

45

102.95

AuGold

79

196.97

MAY 2020 | 2TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

Forward Looking Statements

This presentation contains "forward-looking statements". These forward-looking statements are made as of the date of this

presentation and ValOre Metals Corp. does not intend, and does not assume any obligation, to update these forward-looking

statements. Forward-looking statements include, but are not limited to, statements with respect to the timing and amount of

estimated future exploration, success of exploration activities, expenditures, permitting, and requirements for additional capital

and access to data.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual

results, performance or achievements of the Company to be materially different from any future results, performance or

achievements expressed or implied by the forward-looking statements. Such factors include, among others, risks related to

actual results of current exploration activities; changes in project parameters as plans continue to be refined; the ability to

enter into joint ventures or to acquire or dispose of property interests; future prices of mineral resources; accidents, labor

disputes and other risks of the mining industry; ability to obtain financing; and delays in obtaining governmental approvals or

financing.

This presentation does not constitute an offer to sell or solicitation of an offer to buy any securities of ValOre Metals Corp.

Susan Lomas, P.Geo., of LGGC is the Qualified Person, as defined in NI 43-101, responsible for the mineral resource

estimates as reported herein.

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set

out in NI 43-101 and reviewed and approved by Colin Smith, P.Geo., who oversees New Project Review for ValOre.

MAY 2020 | 3TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

The Opportunity – Ownership of Entire PGE District in Brazil

Industry consolidation occurring, but very

few junior explorers/developers with high

quality projects

PGE mine production supply faces

jurisdictional risk (Russia 40%, South

Africa 39%, North Am 14%, Other 7%)

Palladium ~US$2,000/oz, up >70% since

Jan 1/19 and Platinum >$700/oz

VALORE’S PEDRA BRANCA PROJECT OFFERS INVESTORS OWNERSHIP AND CONTROL OF

AN ENTIRE PLATINUM GROUP ELEMENTS (PGE) DISTRICT IN CEARÁ STATE, NORTH

EASTERN BRAZIL

▪ VEHICLE AND TEAM• TSX-V company; high insider ownership; strong experienced and successful team

▪ SUBSTANTIAL PRIOR INVESTMENT• Excellent access and infrastructure; US$35M spent on exploration by prior groups

▪ HIGH VALUE, LARGE SCALE MINERALIZATION• 38,000 hectares with property wide exploration targets• >1M oz NI 43-101 with significant expansion potential• High grade and near surface targets

▪ INNOVATION AND PROCESS IMPROVEMENT• Employing new technologies and techniques combined with boots on ground exploration have yielded a new perspective and significant upside for shareholders

▪ DISCOVERY PIPELINE IS FULL

46

106.42

PdPalladium

78

195.08

PtPlatinum

79

196.97

AuGold

45

102.95

RhRhodium

MAY 2020 | 4TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

2020 Drill Program

▪ Two Fully Permitted Phases

▪ Phase 1 Fully Funded and expected to begin

in June

▪ Three Classes of Targets

▪ Resource Expansion

▪ New Discovery

▪ Target Advancement

▪ Significant Resource Expansion and

Discovery potential

MAY 2020 | 5TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

12%34%40%

-2%

189%

-100%

0%

100%

200%

300%

400%

500%

VO-V vs PGE+Au

VO-V Au Pd Pt Rh

Robust PGE Market

▪ Palladium prices near

$2,000 per ounce

▪ Platinum prices are near

$1,000 per ounce

▪ PGE mine production

from risky jurisdictions

▪ Industry consolidation

occurring

Tech Report1

Pd: $1,000

Pt: $860

Au: $1,250

1. Metal price assumptions used in the Pedra Branca NI 43-101 Technical Report filed on SEDAR with effective date of May 28, 2019

May 28 Today Change

VO-V: $0.25 $0.28 +12%

Pd: $1,337 $1,870 +34%

Pt: $780 $780 -2%

Rh: $2,840 $8,200 +189%

Au: $1,279 $1,680 +40%

May 28, 2019:ValOre Metals acquires Pedra Branca PGE project

MAY 2020 | 6TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

Robust PGE Market – Supply

Russia40%

South Africa39%

North America

14%

Zimbabwe5%

Other2%

(1) F

*Excludes supply from recycling.

Significant Jurisdictional Risk:

Palladium Supply by Region*

Palladium Market Balance:

8-Year Supply Deficit

Platinum Market Balance:

Strong Investment Demand

MAY 2020 | 7TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

Robust PGE Market – Demand

Autocatalyst83%

Electrical7%

Chemical4%Dental

3%

Other2%

Jewelry1%

*Excludes demand from investments, which has been a negative since 2014.

Palladium Demand (by Category) *▪ Demand Inelastic with Low Substitution Risk

• Primarily used for catalytic converters in gasoline & gas-

hybrid automobiles (~85% of palladium demand)

o ~3-7 grams of palladium per automobile

o Converts harmful pollutants to inert gas

• Strong demand growth with tighter emission requirements

(higher loading of palladium)

• Substitution risk minimal with palladium catalytic converter

efficiency

▪ Strong Demand Outlook From China

• Stricter Chinese emissions legislation expected to trigger a

step-change in demand from Chinese automakers

o China currently ~30% of global auto-catalyst demand

(up from ~20% in 2014)

▪ Long-term Demand Outlook Positive

• Hybrid vehicles

• Fuel cells

MAY 2020 | 8TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

May 2017

$2.2 Billion

June 2019

$286 Million

December 2019

$750 Million

Platinum + Palladium – Few Players

Top 5 Producers

▪ ~85% of Global Pt+Pd Production

▪ Collective Market Cap: ~US$70B

Developers & Explorers

▪ Collective Market Cap: <US$200M

Recent Transactions

MAY 2020 | 9TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

Capital Structure – The Right Vehicle

Exchange: Symbols: Share Price: 52 Week High: 52 Week Low: Shares Outstanding: Market Capitalization: Capital:

TSX-V VO $0.28 $0.405 $0.135 89.0 (basic) $25.0M $1.3 M

OTCQX KVLQF US$0.19 US$0.30 US$0.06 103.2 (diluted)

Frankfurt KEQ0 €0.21 €0.256 €0.0913

JANGADA

MINES

INSIDERS, ADVISORS

CLOSE

ASSOCIATES

RESOURCE,MINING…

RETAIL,

OTHER

Insider ownership >20% TSX-V: VO – 1 Year Price History

MAY 2020 | 10TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

Strong Team

Directors Management & Advisors

Jim Paterson

Chairman & CEO

Rob Scott

Chief Financial Officer

Dale Wallster

Director

Colin Smith

New Project Review

Jim Malone

Director

Glayton Dias

Project Geologist

Garth Kirkham

Director

Jeff Dare

Corporate Secretary

Luis Azevedo

Director

Rob Carpenter

Corporate and Technical

Advisor

Brian McMaster

Director

Rob Brozdowski

Technical Advisor

John Robins

Special Advisor to the Board

Alex Heath

Strategic AdvisorAcquired for $650M by

Rio Tinto

Northern Empire acquired

for $117M by Coeur Mining

2008 IPO; 2010 Transaction Created a USA

Met Coal Producer valued $250M

Acquired for $520M by

Goldcorp

▪ Proven track record of

mineral discovery

▪ Project management and

development

▪ Physical commodity

transactions

▪ Legal, permitting, and

project financing

▪ Capital markets and

M&A success

▪ Strong relationships and

key connections within

Brazil

Recent Transactions

MAY 2020 | 11TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

Discovery Group

PEDRA BRANCA

Focus: AuStage: ExplorationO/S: 43.9M Share Price: $0.22Market Cap: $7.1M

Focus: AuStage: Advanced ExplorationO/S: 45.6M Share Price: $7.45Market Cap: $285M

Focus: CuStage: Advanced ExplorationO/S: 36.7M Share Price: $0.22Market Cap: $8.1M

Focus: AuStage: DevelopmentO/S: 81.8M Share Price: $1.70Market Cap: $140M

Focus: AuStage: ExplorationO/S: 63.3M Share Price: $0.12Market Cap: $7.5M

Focus: Zn, Pb, AgStage: Resource ExpansionO/S: 37.8M Share Price: $0.37Market Cap: $14.0M

Focus: AuStage: Resource ExpansionO/S: 41.7M Share Price: $0.25Market Cap: $10.4M

Focus: PGE+Au, UStage: Resource ExpansionO/S: 89.0M Share Price: $0.26Market Cap: $23.1M

MAY 2020 | 12TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

Right Connections Established

Ceará State Government

Established connections with key contacts at a local, state, and federal level

MAY 2020 | 13TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

Excellent Access and Infrastructure

BRAZIL

BR122

BR020

Fortalezapop.~3M + port

MAY 2020 | 14TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

Pedra Branca

MAY 2020 | 15TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

Treasure Trove of Data – US$35M Spent by Previous Operators

▪ 1960s: First explored (gov’t geos for chromite potential)

▪ 1980s: Unamgem (1986-87), Gencor & RTZ (from 1987)

▪ 1990s-2000s: Rockwell (1997 on), Altoro/Solitario (1999 on)

▪ 2003-2014: Anglo American Platinum

▪ 2014-2019: Jangada Mines PLC

▪ 2019-present: ValOre Metals Corp.

▪ Diamond drilling:

• 385 DDHs; >30,000m; 83% of DDHs at 5 PGE deposit areas

▪ Geophysics:

• 2013 aeromagnetic gradiometry and radiometric (>80,000 ha)

• Extensive ground mag, ground IP

▪ Geological Mapping:

• Regional gov’t mapping, revised in 2016

• Extensive deposit-scale, district-wide mapping

▪ Spectral Mapping:

• ASTER regional mineral mapping (2006)

• Spectral serpentinization picks from 2013 airborne

• WorldView (2019, incoming)

▪ Geochemistry:

• ~17,000 soil samples

• ~3,500 stream sed samples

• ~900 grab samples

• Extensive trenching (PGE deposits, select exploration targets)

MAY 2020 | 16TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

District-Scale Potential

43-101 PGE Deposit (expansion upside)

Tier 1 Target

Tier 2 Target

Tier 3 Target

Fertile geology (Troia Unit)

Geophys (Mag) Anomaly

Geochem Anomaly

Ultramafic Rocks

Drilled PGEs (follow-up req.)

Target Tiers

Claims (38,000 ha)

50km

▪ 38,000 hectares with property-wide exploration targets

▪ Mineralization and prospective geology identified in >45km of fertile strike

25km

35km

Trapia

EsbarroCedro

Curiu

MAY 2020 | 17TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

Resource Zones Near Surface Mineralization

1.06 Moz @ 1.22 g/t

0.394 Moz @ 1.23 g/t

0.100 Moz @ 1.93 g/t

0.151 Moz @ 1.10 g/t

0.219 Moz @ 1.11 g/t

0.203 Moz @ 1.19 g/t

0.0

0.2

0.4

0.6

0.8

1.0

1.2

TOTAL Esbarro Curiu Cedro Trapia SantoAmaro

Mo

z2P

GE

+A

u

CONTAINED METAL

Pd (oz) Pt (oz) Au (oz) 2PGE+Au (oz)

679,000 367,000 21,000 1,067,000

AUG. 12, 2019 NI 43-101 INFERRED RESOURCE ESTIMATE

Tonnes Pd (g/t) Pt (g/t) Au (g/t) 2PGE+Au (g/t)

27,200,000 0.77 0.42 0.02 1.22

Inferred Mineral Resource reported at 0.65 gpt PGE+Au cut-off; Commodity prices used: Pd=US$1000/oz, Pt=US$860/oz, Au=US$1250/oz

91 resource DDHs

*9.9 Mt @ 1.23 g/t 2PGE+Au

*394 Koz 2PGE+Au

Curiu 37 resource DDHs

*1.6 Mt @ 1.93 g/t 2PGE+Au

*100 Koz 2PGE+Au

High grade mineralization to 55m

High grade mineralization to 70m

MAY 2020 | 18TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

A’surface

2PGE+Au (g/t)1.2-3.0 3.0-5.0 5.0-10 >10

2PGE+Au (g/t)

2PGE+Au (g/t)2PGE+Au (g/t)

2PGE+Au (g/t)2PGE+Au (g/t)

2PGE+Au (g/t)

A

Esbarro Cross Section A-A’

High-grade

mineralization

within 60m of

surface

High-Grade and Near Surface Mineralization

Drilling intercepts up to 44.2 g/t 2PGE+Au

MAY 2020 | 19TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

Significant Resource Expansion and Discovery Potential

Blue area: Existing NI 43-101 resource

Black lines: drill holes

Yellow: isosurface 0.1 – 0.3

Pink: isosurface 0.3 – 0.8

Red: isosurface 0.8 – 1.2

Santo Amaro: 203K oz (2PGE+Au) 1.19 g/t

MAY 2020 | 20TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

▪ Property-wide high-grade mineralization

▪ Rock samples up to 44.0 g/t 2PGE+Au

▪ Soils and stream sediments up to 5.9 g/t 2PGE+Au

High-Grade and Near Surface Mineralization

Esbarro Deposit

9.9 Mt @ 1.23 g/t 2PGE+Au

394 Koz 2PGE+Au

Curiu Deposit

1.6 Mt @ 1.93 g/t 2PGE+Au

100 Koz 2PGE+Au

Cedro Deposit

4.2 Mt @ 1.1 g/t 2PGE+Au

151 Koz 2PGE+Au

50km

Trapia Deposit

6.2 Mt @ 1.1 g/t 2PGE+Au

219 Koz 2PGE+Au

Santo Amaro Deposit

5.3 Mt @ 1.19 g/t 2PGE+Au

203 Koz 2PGE+Au

High-Grade Mineralization

Throughout District

2019 NI 43-101

2PGE+Au

Deposits

Rocks Samples

>5 g/t

LEGEND

Image source: D. Hladky

Chromitite Sample

MAY 2020 | 21TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

Proven Targeting Methodology – C04

C04 Chromitite Discovery

Nov. 2019

Assays:(g/t 2PGE+Au)

7.945

2.390

2.319

3.036

C04 Target: ▪ Undrilled▪ Geophysical analogue: striking similarities

Curiu Deposit: ▪ 37 resource holes (DDH)▪ 100Koz @ 1.93 g/t 2PGE+Au

E

MAY 2020 | 22TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

Proven Targeting Methodology – Mendes North

▪ Three newly identified large-scale PGE

targets, all >1 km in strike length

▪ Excellent access – within 200 meters of, a

main road

▪ 3D magnetic inversion modelling of historical

ground geophysical data has defined multiple

compelling near-surface PGE targets

▪ All magnetic anomalies situated in broad area

of radiometric low, indicative of prospective

regional mafic to ultramafic Troia Unit

▪ WorldView spectral data indicates all 4

ultramafic and chromitite spectral classes

coincide with the mag high anomalies

▪ Low-cost soil sampling and prospecting

campaign to further refine the specific targets

prior to drill testing

▪ Video: https://youtu.be/QglFj2wTU_o

MAY 2020 | 23TSX: VO | OTCQX: KVLQF | FRANKFURT: KEQ0 | www.valoremetals.com

Key Investment Highlights

▪ OWNERSHIP OF ENTIRE PGE DISTRICT IN BRAZIL

▪ 2020 DRILL PROGRAM LAUNCHED

▪ ROBUST PGE MARKET

▪ VALORE VEHICLE AND TEAM

▪ SUBSTANTIAL PRIOR INVESTMENT

▪ HIGH VALUE, LARGE SCALE MINERALIZATION

▪ INNOVATION AND PROCESS IMPROVEMENT

46

106.42

PdPalladium

78

195.08

PtPlatinum

79

196.97

AuGold

45

102.95

RhRhodium

Jim Paterson

Chairman & CEOEmail: [email protected]

Phone: +1 (604) 646 4527

Address: Suite 1020 – 800 West Pender St.

Vancouver, BC

Website: www.valoremetals.com

TS

X-V

: V

O