Capital projects in the Russian oil and gas industry - …...Troubled projects Major capital...

Transcript of Capital projects in the Russian oil and gas industry - …...Troubled projects Major capital...

Four steps to greater efficiency

Capital projects in the Russian oil and gas industry

2 Strategy&

Contacts

About the authors

Amsterdam

Douwe TidemanPartner+33-1-44-34-3127douwe.tideman @strategyand.pwc.com

Beirut

Georges ChehadePartner+961-1-985-655georges.chehade @strategyand.pwc.com

Moscow

Ekaterina KozinchenkoPartner+7-495-604-4100ekaterina.kozinchenko @strategyand.pwc.com

Dmitry MordovenkoSenior Executive Advisor+7-495-604-4100dmitry.mordovenko @strategyand.pwc.com

Ekaterina Kozinchenko is a partner with Strategy& based in Moscow. She is the head of the firm’s energy, chemicals, and utilities practice in Russia, with an impressive track record working with large Russian vertically integrated energy companies. She focuses on corporate strategy development, operational excellence, and restructuring programs.

Dmitry Mordovenko is a senior executive advisor with Strategy& based in Moscow. He has more than 10 years’ experience in the oil and gas industry, including management positions in both upstream and downstream companies, and more than five years in consulting. He focuses on strategic planning, project management, and capital expenditures management.

Douwe Tideman is a partner with Strategy& based in Amsterdam. He specializes in the upstream oil and gas sector, with experience working with both large and small operators.

Georges Chehade is a partner with Strategy& based in Beirut. He focuses on corporate strategy and transformation in the downstream oil and gas sector.

Elena Dumnova also contributed to this report.

3Strategy&

Executive summary

Despite the recent decline in the price of oil and the concerns about Russia’s overall economy, the country’s oil and gas companies continue to invest billions of dollars in numerous new exploration and production projects. In the past, such projects — not just in Russia, but around the globe — have been subject to significant delays and cost overruns. But it is particularly important for Russian companies to increase the efficiency of their major capital projects, given both the current economic challenges and the very risky nature of many of the projects.

Typically, projects run into trouble for two reasons. First, governance and performance management problems can be traced to unclear responsibility for strategic and operational decisions, especially when the project involves a joint venture. Second, process problems often result from poor or rushed planning; overoptimistic assessments of required time, money, and technical capabilities; and inefficient procurement and logistics procedures.

The effort to improve project efficiency involves pulling four key management levers: project strategy, management processes, project governance, and personnel. Overall strategy must be determined at the company’s highest management level, and then clearly communicated to all stakeholders in every project. Pre-project planning must be thorough and include a clear stage-gate process and metrics for ensuring that each stage’s goals are met. Each project should be governed by committed project offices, and a corporate-level center of excellence should gather and disseminate best practices for all projects. Finally, proper staffing can be ensured through internal educational programs, often carried out in collaboration with local universities.

Greater project efficiency is a must for all Russian oil and gas companies, and although achieving it can be difficult, the rewards will be considerable.

4 Strategy&

Russian challenges

Russian oil and gas companies, like all the global majors, spend billions of dollars annually on major capital projects. Significant expenditures are required to recover oil and gas from existing fields and to explore for and develop new ones, including particularly expensive offshore and hard-to-reach fields. Companies must also spend money to develop the necessary oil-field facilities and pipeline infrastructure, and to modernize refineries to increase the amount and quality of the oil being refined. That amount increases every year. Russian investments in capital projects have grown at a compounded annual rate of 18 percent since 2009, to an estimated US$47 billion in 2013 (see Exhibit 1, next page), and despite current concerns, the largest players will likely continue to invest huge sums of money (see “Big plans, revised,” page 6).

Yet many capital projects are very risky and prone to significant cost overruns, missed deadlines, and outright failure. Among the most famous examples: Chevron’s Gorgon natural gas project in Australia, which has seen cost overruns of 41 percent1; the development of Caspian oil fields in Kazakhstan, run by cooperative operator NCOC, with overruns of 233 percent; and Shell’s Alaska offshore drilling project in the Arctic Ocean, which cost more than $3.1 billion before it was suspended (see Exhibit 2, page 7).2 Under these circumstances, the potential for savings generated by improving the efficiency of even the best-run projects can be enormous — and the need to gain those efficiencies only increases in importance as these projects grow ever larger.

This is especially true in Russia, where changes in the country’s economic and political conditions over the past several months have already had a significant impact on domestic oil and gas companies’ investment plans. The rapid decline in oil prices has cut the margins of numerous planned projects, and even some existing ones, virtually to zero. Sanctions imposed by the European Union and the U.S. resulting from Russia’s activities in Ukraine have cast into doubt ongoing cooperative agreements between global producers and Russian majors to partner in the exploration and production of offshore and other hard-to-reach oil fields. Moreover, Russian companies are now

The potential for savings generated by improving the efficiency of projects can be enormous.

5Strategy&

Exhibit 1Capital expenditures among the major Russian oil and gas companies have shown an increase over the last several years

Source: Company data; Strategy& analysis

163

138

121

107110

4746423025

20132012201120102009

Russian majors(includes Gazprom, Lukoil,Novatek, Rosneft,Surgutneftegas, and Tatneft)

International majors(includes BP, Chevron,ExxonMobil, Shell, and Total)

US$ billions+10% CAGR for international majors

+18% CAGR for Russian majors

6 Strategy&

Big plans, revised

In 2014, a number of large Russian oil and gas companies announced ambitious plans for large capital projects in the coming years. Recent oil price declines and sanctions have forced some companies to lower capital expenditures for 2015, and uncertainty remains about overall investments through 2030, which will continue to depend on global industry dynamics. Among currently announced plans:

• Rosneft announced plans to invest $400 billion in offshore fields in the Arctic Ocean by 2034, although the partnership with Seadrill and ExxonMobil has recently been put on hold. The company is also planning to develop the Vankor group of oil fields in Western Siberia, and is looking to attract investors from China. Rosneft also continues the modernization of its refinery plants, which will require an additional $14 billion by 2017.

• Gazprom has equally ambitious investment plans, including a $60 billion to $70 billion natural gas pipeline system, called the Power of Siberia, that will bring gas east to Vladivostok. The company also plans to continue the exploration and development of fields on the Yamal Peninsula, on the continental shelf, in Eastern Siberia, and in the Russian Far East.

• Gazprom’s subsidiary Gazprom Neft plans to build a new oil production center in the northern part of the Yamal-Nenets Autonomous District (YNAO) in northwest Siberia and in the Arctic Ocean directly offshore. It also plans to continue the modernization of its refining assets. However, the company recently announced that decisions regarding its ongoing capital expenditures program will depend on future price dynamics.

• Lukoil plans to invest about $100 billion to develop offshore fields in the Caspian Sea, while modernizing its refineries in Nizhny Novgorod, Perm, and Volgograd. However, at the end of 2014, the company announced a 10 to 15 percent decrease in investments in 2015 due to the drop in oil prices.

• Novatek owns a 60 percent stake in Yamal LNG, a $16 billion project that includes development of the South-Tambeyskoye gas field on the Yamal Peninsula and construction of an LNG plant there. The company also plans to invest an annual $1 billion in the development of fields in YNAO, including the launch of the Yarudeyskiy oil field.

7Strategy&

Exhibit 2A number of large oil and gas projects have experienced significant cost overruns in recent years

Source: Company data; Strategy& analysis

37

15

1011

5250

45

20

Sakhalin-2(2003–2005)

+233%

+82%

Browse LNG(2007–2012)

Kashagan Phase 1(2006–2012)

Gorgon LNG(2009–2012)

+41%

+350%

Original estimate Final estimate

US$ billions

8 Strategy&

struggling to gain access to external financing: The Russian government will support only the most strategically important projects, and the sanctions currently prohibit investment from European and U.S. firms. The Asian financial markets, the last hope in the current situation, have so far been reluctant to invest as well.

Worse, no one can predict either how low oil prices might fall or when they will start to recover — let alone when and under what conditions Western sanctions against Russia might be lifted. For the Russian majors, the current high degree of uncertainty makes it very difficult to plan investments in large capital projects, some of which take as long as 20 years to complete. All of which makes it that much more critical for Russian oil and gas majors to focus their efforts on improving the efficiency of their major capital projects.

Doing so requires, first, a clear understanding of the kinds of process and governance problems that typically lead to inefficiencies and cost overruns. With those in mind, companies can then take a disciplined approach to managing large capital projects, from overall project management strategy to governance, processes, and personnel.

9Strategy&

Troubled projects

Major capital projects in the oil and gas industry run into problems for all kinds of reasons. Some problems, such as changes in the local political situation, increases in the price of supplies and equipment, and local prohibitions on the use of certain technologies, are external and beyond the company’s control. Most, however, are internal and involve poor processes and organizational problems. The advantage of internal problems, of course, is that they can be managed (see Exhibit 3, next page).

Governance and performance management problems. Perhaps the most critical problem companies face in managing their capital projects is the lack of clearly delineated responsibility for strategic and operational decision making at each stage of the project. At Russian oil and gas companies, all too often, different departments and even different subsidiaries are involved in making decisions about a project with no clearly defined project center responsible for final approval. Project documentation may go around in circles among the concerned parties for months before it is finally approved — or the CEO intervenes to move the project forward.

This problem is especially acute in joint ventures. Traditionally, one operator plays a leading role, setting the agenda, proposing the course of action, and achieving buy-in from all the partners. However, this model does not adequately address the strategic agendas of the partners, which results in delays in gaining agreement, especially in high-risk environments. The Kashagan project in Kazakhstan is a classic example of such governance problems. Each partner — Shell, Eni, Total, ConocoPhillips, and the Kazakhstan government — had its own internal management committees, audit procedures, and lines of communication, making it very difficult to get agreement on critical plans and procedures.3

Moreover, project management is often forced to make critical decisions without adequate analytical support. Could your company say within an hour how many employees are engaged in the project? What amount of financing has already been spent, for what, and within what period?

The advantage of internal problems is that they can be managed.

10 Strategy&

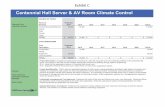

Exhibit 3Problems in capital project management fall into two areas: Governance and processes

Source: Strategy& analysis

What results has the project already achieved? In our experience, few companies know the answers to these questions or can quickly identify the source of problems in the event of deviation from planned key performance indicators.

Finally, many companies struggle to maintain efficient cross-functional interactions. For example, the decision to purchase and use new equipment or materials may be made by a project manager on the basis of their effectiveness in a particular project — without estimating the total cost of ownership of the equipment, including the opportunity to use it in the company’s other projects.

Process problems. Improving the efficiency of planning and implementation processes can lead to savings of millions, even billions, of dollars. Most of the problems that arise can be traced back to the early stages of a project’s planning process. Pressure from shareholders and other stakeholders can force project managers to reduce the time taken to conduct detailed planning and lead to errors in the calculation of business cases and to poor planning. As the head of a Japanese company said about one of the company’s projects in Russia, “The preplanning phase required more than nine months. In addition to drawing up the project plan on paper, when we carried out the actual work on the analysis of the environmental situation

Governance and performancemanagement problems

Planning and implementationprocess problems

– Lack of clear centers of responsibility for strategic and operational decision making, including decisions involving alliances and partnerships

– Lack of analytical supportfor decision making

– Inefficient cross-functional interactions

– Planning and approval processes that are too rapid, resulting in poor project implementation

– Poor project prioritization

– Delayed approval processes, leading to slow strategic and operational decision making

– Inefficient operating processes, especially in logistics and procurement

– Lack of control over day-to-day expenditures

11Strategy&

and regulatory rules in the region, it turned out that the project could only be realized by using very expensive technologies. Thus the preplanning, though it took a long time, has shown the necessity to choose an alternative site, and helped the company to save millions of dollars.”

Further problems can arise when planners develop overoptimistic assessments of time, budget, and technical capabilities in hopes of more easily gaining approval from investment committees. In the absence of detailed verification of business cases by interested parties during the planning stage, this can result in significant losses during the implementation process.

Once a project is in progress, inefficient operational processes, primarily in procurement and logistics, can lead to further disruptions, as can slow and ineffective decision-making processes. For example, an analysis of Chevron’s Gorgon project in Australia for the International Transport Workers’ Federation4 showed that ships carrying essential equipment idled in ports for several days due to a lack of space to unload them, resulting in the loss of as much as $500,000 a day. In another case, a Russian company took 21 days to approve the procurement of equipment; companies with best-practice decision processes typically take just three to five days. Moreover, the company could not provide the proper sequence of equipment orders to its contractors, resulting in delays of several weeks while it waited for delivery.

A final problem arises when the absence of proper controls on the part of headquarters and inadequate employee incentive programs lead to inefficiently allocated budgets, a problem that is particularly acute in dealing with subsidiaries or joint venture partners.

12 Strategy&

Four steps to efficiency

In their efforts to increase the efficiency of major capital projects, Russian oil and gas companies can learn a great deal from global companies that are already using advanced project management techniques. These techniques can be divided into four primary areas: strategy, processes, governance, and personnel (see Exhibit 4, next page).

1. Strategy. All too often, large Russian oil and gas companies develop quite different project management strategies at the corporate level and at the subsidiary level. The divergence often begins with poor project prioritization: Several subsidiaries working in the same industry segments, for example, may apply different risk/return requirements to similar projects, leading to confusion about which to carry out first, and why. Departments and subsidiaries may also differ in project management standards for reporting, the involvement of various functions, how they carry out stage-gate processes, and the like, leading to very different assessments of performance against strategic goals.

Ensuring better strategic alignment requires, first and foremost, that companies decide on the distinct roles of headquarters and subsidiaries in capital project prioritization and management. This process will then help them to design appropriate matrices for all roles and responsibilities and the relevant business processes, and to define the proper set of management tools and control procedures to be used at headquarters, such as policies and standards, key performance indicators, and personnel development.

Typically, headquarters sets the standards and assumptions to be used by subsidiaries to evaluate potential projects. The standards are then incorporated into the subsidiaries’ business plans. Subsidiaries should defend their investment plans in front of investment or strategic committees before receiving the necessary funds.

Depending on the anticipated capital expenditure needed for each project, and its strategic importance, headquarters should determine

Companies should, first and foremost, decide on the roles of headquarters and subsidiaries.

13Strategy&

Exhibit 4Improving capital management processes in oil and gas industry can be broken down into four key areas

Source: Strategy& analysis

1. Strategy

Project managementstrategy

Strategicpartnerships

2. Processes

Front-endloading

Stage-gateprocess

Operatingprocesses

Cross-functionalprocesses

3. Governance

Projectmanagement

office

Centers ofexcellence

4. Personnel

Education

Culture

Development of key capital projects competencies

14 Strategy&

which projects will be controlled at the company’s highest level, and which are small enough to be managed by subsidiaries. Similarly, companies must develop and analyze all possible alternatives for how each project is carried out, including whether strategic partners should be involved. In such cases, however, it is critical to test the performance of potential partners by devising and running pilot projects with them or including them in distinct phases of a project.

2. Processes. Once the overall strategy is decided on, companies must plan how they intend to carry out specific projects. Modern planning processes are key at this stage. Most global companies now employ front-end loading (FEL), which involves planning carefully enough in the early stages of the planning process to ensure that expensive changes will not have to be made during implementation.

At one international oil and gas company, for example, poor FEL efforts led to just one or two departments being involved in the planning process, which didn’t take into account a wide variety of critical cross-functional issues. That resulted in several problems, such as the underutilization of proven project engineering solutions — problems that were not uncovered until the project was under construction. The company has since launched a number of initiatives aimed at improving its FEL processes, including the formation of a common mechanism for data collection from all departments, double-checking the assumptions used to calculate business cases, and even a major effort to change the engineering culture underlying the company’s planning processes.

Second, optimal project management requires a disciplined stage-gate process whereby a project’s progress is analyzed and confirmed at predetermined points during planning, testing, and implementation, using a variety of key metrics. Does the entire team continue to understand clearly the goals of the project? Are the proper management techniques and resources being directed to the project? Is the project management structure still optimal? Are top management and the project sponsors continuing to adequately support the project? Has the estimation of the project’s eventual return on investment changed?

The answer to the last question is particularly important because it allows for the possibility of significant changes, if necessary, including resetting the project’s business goals and the consideration of alternatives such as the sale of assets at upcoming stages. For example, when faced with the necessity to reduce costs in its Kaombo project off the coast of Angola, Total changed its approach to project specifications and equipment usage, deciding to modernize its existing equipment rather than buying and installing new equipment.5 The decision helped the company save $2 billion.

Involving several departments in the planning process can solve a wide variety of critical cross-functional issues.

15Strategy&

A third critical issue in optimizing project management involves the duration and quality of major processes such as procurement and logistics. Because these processes are more operational in nature, they are often ignored by top management, yet their effect on the efficiency — and thus the cost — of projects can be enormous. This is especially important for Russian companies, many of which have worked hard in recent years to make their procurement processes more controllable and transparent in their efforts to reduce costs. Yet in some cases, this has led to new layers of management control as companies created additional positions to manage procurement or involved lots of departments to approve the purchase of services and equipment, and that has slowed the procurement process considerably.

Companies can speed up that process by delegating responsibility for procurement of certain categories of equipment to the project office, which can reduce the time it takes to get approval for acquisition of new equipment and supplies. At the same time, the project office that conducts spot checks of ongoing activities in the field should be left under the control of the parent company, and a workable incentive system should be set up to encourage employees to focus on budgetary savings.

Finally, project teams must ensure that critical operational processes such as the formation and approval of draft technical solutions take place across all relevant functions. Companies should look carefully at how closely functions such as research and development and technical operations units are working together, and where the bottlenecks hindering such cross-functional efforts might be.

As Russian oil and gas companies increasingly partner with international companies, for instance, the importance of standardization of processes and practices has grown. Third-party contractors typically conduct their projects according to their own standards and national practices. Yet many Russian companies continue to use a variety of technical solutions that differ from those used by partners and contractors, and even by their own subsidiaries. The resulting lack of standards makes coordinating technical solutions and consolidating procurement efforts very difficult, increasing costs and project delays significantly.

Moreover, partnering with global companies using new technologies and processes — including innovative exploration technologies such as pulsed neutron logging and new techniques such as polycarboxylate plasticizers in construction — has highlighted their potential for Russian companies. Any decision on the use of new technologies, however, needs to be made in conjunction with the company’s R&D

16 Strategy&

function, which can analyze their cost and speed advantages within the context of the company’s overall project activities.

3. Governance. All large-scale capital projects should be managed by an overarching project office empowered to make the decisions necessary to implement and complete the project successfully. The office should also be responsible for ensuring smooth cross-functional interactions and access to all relevant project information from every department, as well as from the project office itself. The office should also control the pace of implementation through analysis of data at each stage gate, and use that information to make appropriate decisions on budget and resource allocation.

Because accurate and transparent data is so critical an element of efficient project management, the project office should determine what information should be collected, how often, and by whom. For projects involving several different departments, the office should act as the central hub for all analytics. Smaller projects implemented within a single department need not maintain separate centers to oversee data collection and analysis.

If a large capital project involves a joint venture with one or more other companies, the controlling company should choose an appropriate governance model that best suits the project’s needs. The development of the Troll gas field in the North Sea off Norway is an example of how this can be done successfully. The joint venture partners agreed up front that Norske Shell would be the initial operator, with Statoil following up as the lead production operator.6 Moreover, the venture partners would not allow the primary operator to dictate engineering or implementation solutions; instead, all the partners would need to identify and agree on potential conflicts and their solutions early in the planning process. One way a joint venture partner can avoid such conflicts is to choose to take a purely financial stake in the project, making its only concern the rate of return.

Many successful companies have created a company-wide project management center of excellence (COE), typically with five key areas of responsibility:

1. Improve project quality through the standardization of processes and introduction of advanced technologies.

2. Provide expert support to project teams.

3. Identify, study, and introduce new technologies.

4. Manage advanced training for technical personnel.

All large-scale capital projects should be managed by an overarching project office.

17Strategy&

5. Oversee relationships with suppliers of equipment and technology, and in some cases, coordinate research with higher education institutions in Russia and international organizations.

The COE’s areas of responsibilities will vary depending on the nature and size of the company, as well as the geographic extent of its projects. How companies organize their COEs depends largely on the company’s maturity. Younger, smaller companies usually maintain small, centralized “virtual COEs” — typically just two- to three-person teams that bring their project management experience to every project in the company. More mature companies often choose so-called best-practice teams — members of different departments are aligned to the COE and report indirectly to the COE director. They regularly hold common meetings to share best practices but remain within their own project teams or departments. Finally, the most advanced companies have separate, well-established COEs with the resources to delegate experts to different projects on a temporary basis when needed (see Exhibit 5, next page).

No matter which COE and project management governance model a company chooses, it should first check the viability of the model by conducting test runs — preliminary simulations of how successfully the center of excellence and project office will work — before starting a project. Otherwise, the company may run into work disruptions caused by new project managers’ lack of familiarity with their new roles and new project management approaches.

4. Personnel. Every large global oil and gas company suffers from a lack of highly qualified specialists in both production and development. However, this problem is particularly acute in Russia, where qualified specialists and managers are in demand not only at company headquarters but also in the fields, which are often in widely separated parts of Russia, each with its own labor supply challenges.

Many global oil and gas companies solve the problem of lack of staff by establishing cooperative programs with specialized universities and by creating joint educational programs — with the added benefit of being able to work with these schools on research and development activities consistent with the company’s strategic objectives. Others have created their own internal programs; for example, Statoil’s corporate university, called LEAP, offers traditional business courses as well as practical training through the use of simulators for drilling wells. The programs were developed in collaboration with educational institutions based on the needs of the company.

18 Strategy&

Exhibit 5Depending on their size and level of maturity, companies can choose one of three COE organizations

Source: Strategy& analysis

Virtual COE Best-practice team Physical COE

AdvisoryBest-practice identification and sharing Project support

COE

Project 1 Project 2

Project 3 Project 4

Central director

COE director

Project/activity Project/activity

Head local COE Head local COE

Function head

Discipline head

Function head

Discipline head

COE1

COE2

Project 1 Project 2

Project 3 Project 4

InformationResources

– A small COE consisting of one or two members

– Primarily a “keeper of the knowledge”

– Shares knowledge with project teams and captures and centralizes their findings

– Matrix organization in which members from different departments work on projects with functional dotted-line reporting to the COE

– COE holds frequent, regular meetings to update and share best practices

– Expertise-based team

– Team members are provided to projects on a temporary basis

– Staff brings knowledge back to COE

Embryonic COE Evolved COE

19Strategy&

Conclusion

Endnotes

1 “Chevron Says Costs Rise for Gorgon LNG Project in Australia,” San Jose Mercury News, Dec. 7, 2012.

2 “With 2 Ships Damaged, Shell Suspends Arctic Drilling,” New York Times, Feb. 27, 2013; company data; Strategy& analysis.

3 “How a Giant Kazakh Oil Project Went Awry,” Wall Street Journal, Mar. 31, 2014; project data; Strategy& analysis.

4 “What Is Happening on Chevron’s Gorgon Project? A Preliminary Report to the International Transport Workers’ Federation” (PDF), May 2014.

5 “Total Clears Angolan Kaombo Oil Project after Cost Cuts,” Reuters, Apr. 14, 2014; Bloomberg; company data; Strategy& analysis.

6 Bloomberg; company data; Strategy& analysis.

Given their ambitious plans to invest ever-greater amounts in large-scale capital projects — and the challenges they are currently facing — Russian oil and gas companies should reconsider how they approach the management of large capital projects. In doing so, they should also study international experience. Usually, companies improve their project management in four key areas: project strategy, management processes, project governance, and personnel. The major Russian oil and gas companies all have very ambitious investment programs, and improving their project management methods and developing stronger internal competencies will enable them to increase significantly the return they receive on their capital projects.

© 2015 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details. Disclaimer: This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

www.strategyand.pwc.com

Strategy& is a global team of practical strategists committed to helping you seize essential advantage.

We do that by working alongside you to solve your toughest problems and helping you capture your greatest opportunities.

These are complex and high-stakes undertakings — often game-changing transformations. We bring 100 years of strategy consulting experience and the unrivaled industry and functional capabilities of the PwC network to the task. Whether you’re

charting your corporate strategy, transforming a function or business unit, or building critical capabilities, we’ll help you create the value you’re looking for with speed, confidence, and impact.

We are a member of the PwC network of firms in 157 countries with more than 195,000 people committed to delivering quality in assurance, tax, and advisory services. Tell us what matters to you and find out more by visiting us at strategyand.pwc.com.