Calgary Real Estate Forum · 6 Tech & Energy Markets Leading the Recovery State of U.S. Economy,...

Transcript of Calgary Real Estate Forum · 6 Tech & Energy Markets Leading the Recovery State of U.S. Economy,...

20

State of the U.S. Economy, Capital Markets, and Commercial Real Estate

Calgary Real Estate Forum October 24, 2012

Douglas Poutasse Head of Strategy and Research Bentall Kennedy Group

1

-4

-3

-2

-1

0

1

2

3

4

5 ANATOMY OF A DELEVERAGING CYCLE

Year 1 Year 2/3 Year 4/5 Year 6+ or more?

This is where we are!

Price Discovery

Contingent Liability

Realization

Deleveraging Concludes

Repair & Recognition

Crisis Hits

Real GDP Growth

This Was Not Your Father’s Recession

State of U.S. Economy, Capital Markets, and Commercial Real Estate

2

The New Globalization

State of U.S. Economy, Capital Markets, and Commercial Real Estate

3

U.S. Fiscal Policy: Spend What You Want, Tax What You Can

14.0%

16.0%

18.0%

20.0%

22.0%

24.0%

26.0%

77 79 81 83 85 87 89 91 93 95 97 99 01 03 05 07 09 11

Outla

ys & Ta

xes %

of G

DPOutlays Tax Receipts

Solving U.S. fiscal problems will require a dual approach

State of U.S. Economy, Capital Markets, and Commercial Real Estate

4

Labor Market Recovery Remains Sluggish

Sources: Moody’s Analytics, Bureau of Labor Statistics

-‐1,000

-‐800

-‐600

-‐400

-‐200

0

200

400

600

2008 2009 2010 2011 2012

Mon

thly Change (jo

bs, 000

s)

Goods-‐Producing Service-‐Producing (Ex-‐Government) Government Total

State of U.S. Economy, Capital Markets, and Commercial Real Estate

5

Capacity Tightening, Corporations Have Cash to Spend: But Under What Rules?

State of U.S. Economy, Capital Markets, and Commercial Real Estate

65

67

69

71

73

75

77

79

81

83

600

800

1,000

1,200

1,400

1,600

1,800

2005 2006 2007 2008 2009 2010 2011 2012

Capacity Utiliza

tion (%, SA)

Corporate Profits ($

, bil., SAA

R)

Corporate Profits Capacity Utilization

Sources: Federal Reserve, BEA

6

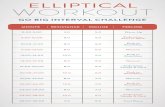

Tech & Energy Markets Leading the Recovery

State of U.S. Economy, Capital Markets, and Commercial Real Estate

-‐15.0%

-‐10.0%

-‐5.0%

0.0%

5.0%

10.0%

Houston

New

York

Washington, D.C.

Dallas

Denver

Boston

San Francisco

San Jose

Baltimore

Seattle

Minne

apolis

United States

Portland

Philade

lphia

San Diego

Atlanta

St. Lou

is

Miami

Chicago

Orla

ndo

Los A

ngeles

Northern New

Jersey

Oakland

Orange Co

unty

Phoe

nix

Fort Laude

rdale

Riverside

West P

alm

Las V

egas

Employmen

t Change (% of p

eak)

Peak to Trough Trough to July 2012 Trough to July 2011 Peak to July 2012

Sources: Moody’s Analytics, Bureau of Labor Statistics

7

Have to Add Value Somewhere

State of U.S. Economy, Capital Markets, and Commercial Real Estate

8

High Educational Attainment Positions Metros for Stronger Growth

State of U.S. Economy, Capital Markets, and Commercial Real Estate

0

5

10

15

20

25

30

35

40

45

50

Houston

New

York

Washington, D.C.

Dallas

Denver

Boston

San Francisco

San Jose

Baltimore

Seattle

Minne

apolis

United States

Portland

Philade

lphia

San Diego

Atlanta

St. Lou

is

Miami

Chicago

Orla

ndo

Los A

ngeles

Northern New

Jersey

Oakland

Orange Co

unty

Phoe

nix

Fort Laude

rdale

Riverside

West P

alm

Las V

egas

% of P

opulation with

a Bache

lor's Degree or Highe

r

Avg. of Metros: 33.7

Sources: Moody’s Analytics, U.S. Census Bureau

9

Tech Markets Experiencing Fastest Office Demand Growth

State of U.S. Economy, Capital Markets, and Commercial Real Estate

*Bubble Size Denotes Market Size

AtlantaBoston

Chicago

Dallas

Denver

Edison

Houston

Los Angeles

New York

Newark

PhiladelphiaPhoenix

San Francisco

Seattle

Washington, DC

San Jose

CharlotteMiami

-‐4.0%

-‐2.0%

0.0%

2.0%

4.0%

6.0%

0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0%

Demand Grow

th 201

1Q2 to 201

2Q2

Vacancy 2012Q2

Sources: CBRE-EA

10

Retail Sales Rising Again but Gas and Internet Sales grabbing a Larger Share

State of U.S. Economy, Capital Markets, and Commercial Real Estate

4%

6%

8%

10%

12%

14%

16%

$100

$150

$200

$250

$300

$350

1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012

Share of Sales

Retail Sales (billion

s)

Store-‐based Gas Stations

Nonstore Gas (Share)

Nonstore (Share)

Source: U.S. Census Bureau

11

American Consumers have far more options for spreading out our shopping dollars

State of U.S. Economy, Capital Markets, and Commercial Real Estate

24

14.5

$400

$600

$0

$100

$200

$300

$400

$500

$600

$700

0

5

10

15

20

25

30

US Canada

SHOPPING CENTRE SALES AND SUPPLY

Sq. ft. per capita Sales per sq. ft.

sq. ft. per capita $ per sq. ft

Source: ICSC

12

Perhaps you are following our path to profligacy…

Sources: Statistics Canada, Federal Reserve, BEA, Bentall Kennedy

80

90

100

110

120

130

140

150

160

170

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012

Debt to

Personal Incom

e Ratio

(%)

U.S.

Canada

State of U.S. Economy, Capital Markets, and Commercial Real Estate

13

The Reality of the American Housing Bust Continues to Play Out

State of U.S. Economy, Capital Markets, and Commercial Real Estate

14

Home Prices Stabilizing (Hopefully) as Sales Volume Improves

State of U.S. Economy, Capital Markets, and Commercial Real Estate

-‐40%

-‐30%

-‐20%

-‐10%

0%

10%

20%

30%

2005 2006 2007 2008 2009 2010 2011 2012

Year-‐over-‐Year Change

Case-‐Shiller US Home Prices Existing Home Sales

Sources: S&P/Case-Shiller, National Association of Realtors

15

Renter Households Set for Continued Strong Growth

State of U.S. Economy, Capital Markets, and Commercial Real Estate

60%

62%

64%

66%

68%

70%

72%

-‐1.5

-‐1.0

-‐0.5

0.0

0.5

1.0

1.5

80-‐84 85-‐89 90-‐94 95-‐99 00-‐04 05-‐09 10-‐11 12-‐16 12-‐16 12-‐16 12-‐16

U.S. H

omeo

wne

rship Ra

te

Renter Hou

seho

lds (M)

Avg. Annual Change in Renter Households

U.S. Homeownership Rate

U.S. Homeownership Rate (Scenarios)

Forecast Scenarios (12-‐16)ApartmentRecovery

Moody'sBasecase

HO Falls2PP

HO Rises2PP

HO RateFlat

Downward Arrow Indicates Falling Homeownership Rate

Sources: Moody’s Analytics, U.S. Census Bureau, Bentall Kennedy Research

16

Apartment Market Experiencing Strong Rent Growth

State of U.S. Economy, Capital Markets, and Commercial Real Estate

17131557

1068

1424

119

121613

12

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0%

Demand Grow

th 201

1Q2 to 201

2Q2

Vacancy 2012Q2 Y/Y Rent Growth >4.5% Y/Y Rent Growth 3.5%-‐4.5%Y/Y Rent Growth 2%-‐3.4% Y/Y Rent Growth <2%

Houston

DallasPhoenix

Atlanta

Los Angeles

BostonMinneapolis

San Francisco

New York

Distict of Columbia

Denver

DetroitSeattle

Orange County

Philadelphia

ChicagoNorthern New Jersey

Source: REIS

17

Apartment Market is only one similar to Canadian Markets

Sources: CBRE-EA, REIS, CMHC

U.S. Apartment

U.S. OfficeU.S. Retail*

U.S. Industrial*

Canada Office

Canada Industrial*

Canada Retail

Canada Apartment

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0%

Demand Grow

th 201

1Q2 to 201

2Q2

Vacancy 2012Q2 (*Availability Rate)

State of U.S. Economy, Capital Markets, and Commercial Real Estate

18

Real Estate Offering Attractive Yields Versus Treasuries

State of U.S. Economy, Capital Markets, and Commercial Real Estate

-‐200

-‐100

0

100

200

300

400

500

600

700

800

900

1,000

-‐2

-‐1

0

1

2

3

4

5

6

7

8

9

10

Spread (b

ps)

Cap Rate/Treasury Rate (%

)

Cap Rate Spread 10-‐Year Treasury Cap Rate 4 Qtr Moving Avg. 25-‐Yr Average Spread

Sources: Federal Reserve, Moody’s Analytics, NCREIF (transaction-based cap rates)

19

“Valuation Effect” has played a Significant Role in the Rebound of CRE Performance

State of U.S. Economy, Capital Markets, and Commercial Real Estate

Sources: NCREIF, Bentall Kennedy Research

-‐30%

-‐25%

-‐20%

-‐15%

-‐10%

-‐5%

0%

5%

10%

15%

20%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

NCR

EIF Re

turn

Income Return NOI Growth Valuation Effect Total Return