BY LARRY STALCUP MI o YOUR BASIS - Lockwood Farmers...

Transcript of BY LARRY STALCUP MI o YOUR BASIS - Lockwood Farmers...

f

MARKETING BY LARRY STALCUP

MI o YOUR BASISIT CAN YIELD AN EXTRA40-80¢/BU. OR MORE.

Be comfortable hedging corn atan $8/bu. future price. "But

don't leave 80¢ on the table by ig-noring your basis."That's Jon Scheve's philosophy,

who pulls the marketing trigger ona corn/soybean farm he runs withhis father Rich, in Beatrice, Neb.Jon lives in Minneapolis and mar-kets feed ingredients. The seniorScheve lives on the farm and is alsoa seed rep.Rich says, "Jon started farm-

ing with me and took note of howgrain merchandisers were market-ing crops. He decided, 'this is whatthey're doing, why don't we do it?'".Their strategy .shifted to follow-

ing basis - the difference betweenthe cash price and futures. Jon's un-derstanding of how and why basismoves (gained by working for a full

By monitoring basis movement, JonScheve builds on futures price posi-tions to add 40¢/bu. or more.to hissales. "I find out what people areusing on the other end," he says.

"If an Alabama poultry companyis short on feed and narrows its ba-sis, then the 'river' basis may backup. Then the local ethanol plant orelevator basis backs up. It's usuallya three or four-day delay. You canalso see when basis trends the oth-er way. The end user increases thebasis, followed by the river, fol-lowed by the local plants," he says.

36 CORNANDSOYBEANDIGEST.COM APRIL 2013 •

dealing with end-users of commodi-ties) now generates greater returns.For example, futures sales of 2012

corn made more than a year ago fordelivery this spring are 40-S0¢/bu.higher than if straight cash saleshad been made - thanks to basis."I sold futures in July 2011 for

corn we harvested in 2012," Jon says.''Additional sales using futures weremade in December 2011, and againin April, June and July 2012 tospread the risk and market volatility."The average of the futures prices

was about $6.67 on 85% of my 2012. crop so far and were based mostlyon the May 2013 futures contractfor May 2013 delivery. Had I soldcash at each of those actual times,the basis level was 75¢ under onsales made in 2011 and 40¢ underon sales made in 2012."But by locking i~ my basis this

February at about 40¢ over (aftertight supplies had caused an in-crease in basis), the increased profitwas between 80¢ and $1.15/bu. com-pared to farmers who sold cash atthose times."

BASIS GIVES SIGNALSChris Hurt, Purdue University Ex-tension economist, teaches thatbasis reflects local supply and de-mand. "If basis is stronger thannormal, deinand is stronger thannormal relative to supply. The ba-sis price' gives a good indication ofwhen to price corn or beans."Jon charts all sales and why they

were made that day. ''Last Augustwe sold 2013 December corn futuresat $6.50," he says. "That was for onlyabout 5% of our normal production.

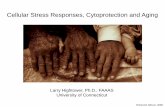

Jon Scheve (top) takes data he obtains from. corn and soybean end users and applies itto his farm's marketing plan. Through betterbasis management, corn delivered this springis 40¢-80¢/bu. higher than if straight cashsales were made last harvest. Marketingmoves weren't as successful as Rich Scheve(bottom) wanted. So the Beatrice,Neb.,

.grower let his partner/son Jon apply someof the same futures/basis strategies used byelevators and other buyers to manage priceson the farm's account.

We also used an options spread witha $6 put and sold a $7 call. Thoseprices are locked in. But we have along timeto set the basis."He's now about 25% priced on

2013 corn with an average futuresprice of $6. "I would like to be nearly50% priced by mid-April," he says."Also,when new crop beans were at$13.15/bu. (in late February), I soldthe first 60% of my 2013 beans usingfutures and I bought a $14 call backin case there is drought."Jon also sold 15% of his 2014 corn .

crop at $5.50 and even 5% of 2015corn crop at $5.50 using futures. He .says no one can predict the futuresmarket. "But when it comes to basis,there is a lot more opportunity with.a lot fewer risks." III