Business Conditions: December 1969

Transcript of Business Conditions: December 1969

A review by the Federal Reserve Bank of Chicago

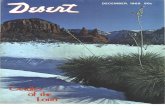

BusinessConditions

1969 December

Contents

Trends in the Midwest Is Megalopolis coming to the Midwest? 2

Midwest—A leader in productionand export growth 7

Agency securities and the federal budget 12

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis

Federal Reserve Bank of Chicago

Trends in the Midwest—Is Megalopolis coming to the Midwest?

A new period of urban history has opened for the United States. On the East Coast, in the Midwest, and along the Pacific large metropolises are crowding together as towns and villages once did. Out of this mass of overlapping metropolises, a new kind of urban structure is being formed—megalopolis.

Interest in the concept of megalopolis is growing. Thus, a look at the characteristics attributed to a megalopolis may help answer some questions about the emergence of this new level of urban concentration.

Perhaps the United States’ first megalopolis is the 500-mile strip of northeastern shoreline containing six of the nation’s 13 largest metropolitan areas and more than two dozen lesser ones. It houses nearly one-fifth of the U. S. population. Even rural areas within this urban web have acquired many characteristics of metropolitan life.

A study of recent patterns of county population growth in the Seventh District1 reveals that major metropolitan communities, such as Chicago and Detroit, have become focal points for further rapid expansion. This development could signal the emergence of a megalopolis in the Great Lakes region.

The Pacific coast, although less populous than either the Northeast or the Great Lakes region, has been growing at a pacesetting rate and holds the promise of a third megalopolis.

A megalopolis is a large number of metropolitan areas that have an enormous combined population and close proximity so that

'See Business Conditions, October, 1969.

trading among member metropolitan centers is convenient and economical. Its large population provides a market which permits sellers to operate on a large, efficient scale of production, and the proximity of metropolitan centers allows firms in even small member metropolitan centers to participate in the market more easily than those in centers outside the area.

Each megalopolis needs at least one national metropolitan area to serve as a core. A national metropolitan area is one with national, as opposed to strictly regional, influence. This implies that national centers participate in nearly every national market. In this way, they act as a bridge for transmitting national economic changes to other member metropolitan centers. Only they are populous enough and dense enough to provide a market for nearly all kinds of goods and services.

Along the Northeast seaboard, national metropolises are New York-Newark, Phila- dephia, Boston, Washington, and Baltimore. These form the skeleton of a megalopolis.

In the Great Lakes region, Chicago, Milwaukee, Detroit, Cleveland, Pittsburgh, and Buffalo are major centers which form the skeleton of another megalopolis. Pittsburgh is included because of its strong trading ties to Cleveland, although it is not situated on one of the Great Lakes. Buffalo is included because it lies on the eastern edge of the Great Lakes, although its trading ties with the Northeast approximately equal its ties with other Great Lakes SMSAs.2

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis

Business Conditions, December 1969

Another important region where national metropolitan areas are surrounded by clusters of lesser metropolitan areas is on the Pacific coast of California, where the skeleton of a megalopolis is formed by Los Angeles and San Francisco. Although widely separated compared to the urban centers of the Northeast and Great Lakes, Los Angeles and San Francisco are close relative to other centers of the Far West.

Large sparsely-populated spaces separating metropolitan areas are often pointed to as evidence that a megalopolis does not exist for the region. For instance, there is much farmland between Chicago and Detroit, and considerable open space between Los Angeles and San Francisco. But this probably has relatively little impact upon trading relationships between Chicago and Detroit, and between Los Angeles and San Francisco, because of their relative proximity to each other when compared to their proximity to other major urban centers.

These three regions—the Northeast, Great Lakes, and Pacific—are currently the only American candidates for the title of mega-

Trade important to megalopolis

V a lu e added by

N orth east

G re a tLakes C a lifo rn ia

m a n u fa ctu re 1

(b illio n d o lla rs )

G oods sh ipped beyond

city or tow n o f fa b r ic a t io n 1

(p ro po rtion )

30 .4 31 .0 10.1

W ith in ow n m egalopo lis 0 .4 0.3 0 .5

To another m egalopo lis 0 .2 0 .2 0.1

E lsew here 0 .4 0 .5 0 .4

S p e c i f ic a l ly exc lu d es : tobacco p roducts, textile and m ill p roducts, lum ber and w ood p roducts, p rinting and p ub lish ing , lea the r p roducts, and ordnance .

SO U R C E : Bureau o f the Census.

lopolis. Eighteen metropolitan areas not included in the three regions had more than one million persons in 1966, but none have many smaller metropolitan areas for neighbors. Thus, the population for the entire region is too small to be considered a megalopolis. In time, however, other megalopolises may develop.

For purposes of this study, any metropolitan area contiguous to one of the skeleton areas, or to any other metropolitan area in a megalopolis, belongs to the same megalopolis.Also, counties with cities that are nearly large enough to become cores of metropolitan areas are included in a megalopolis. Contiguous nonurban counties are included if they are areas of rapid growth, indicating suburban potential. For simplicity, state boundaries are followed wherever possible and a few otherwise ineligible counties are included to maintain geographic continuity, although this is not strictly necessary. In the case of the West Coast region, the entire state of California may be considered as a potential megalopolis without serious analytical consequences.

Over one-third of all metropolitan areas in the United States are in the Northeast, Great Lakes, and Pacific regions defined above.Each region is large; even the smallest one— California—contains nearly 20 million persons and 17 separate metropolitan areas. The Northeast and Great Lakes regions are nearly equal in the number of metropolitan areas they include, but the Northeast has 40 million inhabitants compared to 30 million in the Great Lakes area.

Ex p o rts im p o rtan t to M eg alo p o lis . . .

The capacity of each megalopolis to fabricate goods is enormous: the Great Lakes and Northeast areas annually produce more goods than any European nation. Each megalopolis plays a significant role within the national 3

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis

Federal Reserve Bank of Chicago

economy as a producer and consumer of goods and services of all kinds.

The Census of Transportation, taken for the first time in 1963, provides the most comprehensive data on the intermetropolitan flows of commodities by all modes of transport. Although the data have some shortcomings, they provide a valuable picture of major trading patterns.

In each megalopolis at least half of all goods leaving the city or town of fabrication also leave the megalopolis. In California the proportion is 50 percent; in the Great Lakes area it rises to 70 percent; and the Northeast seaboard lies halfway between, at 60 percent. These are large proportions when compared with the proportions of total production exported across national boundaries by nations throughout the world. The highest proportion for any European nation is substantially lower.

Considering only goods which leave the city or town of fabrication admittedly inflates the proportion exported from a megalopolis. Even if a more accurate measure could be computed, we would expect a high proportion of exports2 from each megalopolis because each one sells its goods and services in the world’s most important free trade area—the domestic United States market—and because an extensive transportation network reduces the physical problem of reaching the market.

California’s relatively low level of exports as a proportion of production may be explained by its isolation from other large population centers and by relatively high per capita income, creating a high demand for consumption goods.

Special problems are also connected with the analysis of California’s trade data. For

2“Exports” specifically refer to goods shipped from the megalopolis to other domestic markets.

4 Exports to foreign markets are not considered.

Almost half of U. S. population lives in three megalopolises

N ortheast

G re a tLakes C a lifo rn ia

Num ber o f counties 117 123 57

Num ber o f SM SAs 38 34 14

Po pu lation , 1966(m illions) 41.8 29 .6 18.7

A nnua l a ve rag e g ro w th ,

1960-66 1.7 1.1 3.1

(percent)

SO U RC E : Bureau o f the Census.

instance, the data do not cover raw agricultural produce, which is undoubtedly more important for California than for either the Great Lakes or Northeast regions. Also, military aircraft may be improperly counted as not exported if they are received by the Air Force at California air bases.

. . . but so a re im ports

Each megalopolis is thus a massive exporter but is each a net exporter? Data for trade flows between a megalopolis and the rest of the United States are not comprehensive, but it is possible in some cases to infer whether or not each megalopolis is a net exporter on its trade account to the rest of the United States. The inference is based upon the basic balance-of-payments accounting identity arising from the fact that a flow of goods and services must be matched by a flow of cash or credit. Thus, a region which is a net exporter of goods and services must be increasing its financial claims on other regions, or importing money, or both, unless it is an importer of investment capital.

A recent study of capital movements in the United States revealed that the states from New England to Maryland along the Atlantic coast and westward across the Great

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis

Business Conditions, December 1969

Lakes region are net creditor states—that is, net exporters of capital.

The data were collected for regions which are not identical with the Northeast and Great Lakes megalopolises but contain the largest portion of each. Each megalopolis dominates its respective region. Thus, both of these megalopolises are probably creditor regions. California, however, has been a heavy exporter of claims for some time—a debtor region.

For the period 1960-66, demand deposits3 (net of interbank deposits), a proxy for money, in all three megalopolises expanded at a rate below that of the national average, implying a net export of money.

Since New York, the center of the North-

3Data are not available on regional flows of currency and coin, but these are much less important than demand deposits for which such information is available. The data are adjusted for migration, assuming that each migrant transferred an account of average size, about $600, to his new location.

Population growth rapid in Megalopolis'

— metropolitan boundaries • metropolitan centers

NEW H AM PSH IRE M ASSACH U SETTS

ISLAND CONNECTICUT

*The n a tio n a l popu lation g ro w th fo r 1960-66 w a s 9 .3 percent. A re a s represented in so lid co lor g re w a t a ra te in excess o f tw ice the n atio n a l av e ra g e .

fG re a t Lakes and N ortheast m egalopolises b oundary . 5

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis

Federal Reserve Bank of Chicago

east megalopolis, is the nation’s major financial center, it is likely that the export of capital from the Northeast is massive, leading to a net export of money in and of itself. To what extent this money deficit is eased (or intensified) by the positive (or negative) trade balance of the region, cannot be deduced from existing data. This same ambiguity exists in the Great Lakes data.

California, however, is an exporter of both claims (importer of capital) and money. This implies that the state is a net importer of goods and services.

Thus, in spite of large agricultural and aircraft sector exports, California probably is a net importer on its trade account. This can be explained largely on the ground that population growth has occurred so rapidly there that local production has been unable to keep pace with demand.

Enough data are available, however, to determine trade balances between megalopolises. California is a net importer with respect to the Northeast and Great Lakes megalopolises. The effect that isolation has on California’s trade is demonstrated also by those industries that sell the highest proportion of their output to consumers—food, apparel, furniture. The value of such goods produced and distributed locally plus imports from the other megalopolises, both expressed

Trade among megalopolises specialized

Ratio o f expo rts to im ports 1.1 1.2 0 .6

Consum er nondurab les and

sem idurab les 2 .8 0 .4 0 .8

Producers goods an d consum er

durab les 0 .8 1.8 0 .3

SO U RC E: Bureau o f the Census.

in per capita terms, is the same for the Northeastern and Great Lakes areas, but 20 percent lower for California. Since per capita consumption should be approximately proportional to per capita income, the lower figure for California is probably due to imports received from other western areas.

With respect to each other, the Northeast and Great Lakes megalopolises maintain a nearly neutral balance of trade, neither exporting nor importing on balance. The Northeast and Great Lakes tend to be highly specialized in their trade with each other. The Northeast region ships consumer nondurables and semidurables to the Great Lakes region and receives consumer durables and producers’ goods.

The future of M egalopolis

The Great Lakes region already has three- quarters of the population of the Northeast and an equal proportion of its manufactured output. But the Northeast has been expanding in population at a rate half again larger than the Great Lakes region. Furthermore, California is rapidly approaching the Great Lakes area in population size.

If trends since 1960 continue to the year 2000, the Northeast will remain the most populous region with about 65 million persons, 25 million more than at present. Both California and the Great Lakes basin will have approximately 40 million persons; however, California will probably not be able to maintain its past rapid growth rate. Over half of the increase in the United States’ population will be in these three areas alone.

The dominance of the Great Lakes area in durables manufacturing probably accounts for its relatively low population growth. While demand for durables will probably remain strong, increased productivity can satisfy the needs of an expanding economy for these6

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis

Business Conditions, December 1969

kinds of goods. Increased productivity in services is much harder to obtain. Thus, relatively more human resources must be shifted into service industries in coming years, and those areas that specialize in services probably will have faster population growth. Unless the Great Lakes area shifts away from durable goods and into services, it probably will continue to have a relatively low rate of population growth.

In time other megalopolises may develop —perhaps along the Gulf coast, or in the Piedmont region of the South. The entire Pacific coast may become a Pacific megalopolis, and the Northeast may join the Great Lakes megalopolis across an urban bridge already developing in upper New York State (they already touch in the Appalachains of Pittsburgh), but these developments will have to wait for the year 2000.

Midwest —A leader in production and export growth

JE a r ly in 1969 the President’s Committee on Export Expansion proposed a U. S. export goal of $50 billion by 1973. An increase of more than $3 billion per year will be needed if exports are to be raised to that level from the $34 billion of 1968.

Short of a major upheaval in world trade, any substantial increase in exports will likely come from areas of the nation that are currently major producers of those kinds of materials, foodstuffs, and manufactured goods that already are exported in sizable volume.

The United States exports only about 4 percent of its gross national product (GNP) and, unlike most other important exporting countries, does not specialize in export- oriented production. While some U. S. firms rely heavily on the export market, most produce primarily for the domestic market. Thus, areas with the largest production also tend to be the largest exporters. These areas probably will be the main source of export growth.

Agricultural production is widely distributed throughout the nation, but the production of export-oriented products is concentrated in relatively few states. The leading ten states in agricultural production supply 56 percent of the nation’s exported agricultural products. Seven of these states—Illinois,Iowa, Kansas, Indiana, Minnesota, Nebraska, and Ohio—are in the North Central Region and provide 35 percent of the nation’s agricultural exports. The other three states— Texas, California, and North Carolina—provide an additional 21 percent.

As with agricultural production, manufacturing exists throughout the nation, but manufacturing and related exports are concentrated in a few well-defined areas. Six states—New York, California, Ohio, Illinois, Pennsylvania, and Michigan—account for nearly half of the value added by manufacturing and an equal proportion of manufactured exports. Essentially the same relative concentrations 7

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis

Federal Reserve Bank of Chicago

in value added and export origin occurred in both 1960 and 1966, indicating considerable stability in this relationship.

Those states in the Middle Atlantic Region and those bordering the Great Lakes, specifically the East North Central Region, are the most prominent manufacturing and export originating areas in the nation (see map). They contribute 30 percent and 22 percent respectively of U. S. value added bymanufacturing, and 30 percent and 20 percent of exports. These two areas contain seven of the largest manufacturing and exporting states.

States can be classified into two groups with respect to their importance in industrial production and exports of manufactured goods. Ten major states—the six noted above plus New Jersey, Indiana, Texas, and Massachusetts—account for approximately two- thirds of total U. S. value added by manufacture and exports. These states are characterized not only by physical proximity but also by industrial diversification which broadens their foreign market potential. They have unusually well-developed nationally- and internationally-oriented transportation systems. They have large population centers that provide the labor supply required for production, and a demand base to draw forth domestically-oriented production facilities that also support exports.

The remaining and second group of states,

Major industrial states are major source of exports, 1966

State

Value added by manufacturing

Percent of U. S.

total RankValue of exports

Percent of U. S.

total Rank*

N ew Yo rk

(billion dollars)

$ 24.6 10% 1

(billion dollars)

$ 1.8 9% 2

C a lifo rn ia 21.3 9 2 1.8 8 3O hio 20.1 8 3 1.6 8 4

Illino is 19.9 8 4 1.9 9 1

Pen n sy lvan ia 17.8 7 5 1.5 7 6

M ich igan 17.6 7 6 1.6 7 5

N ew Je rsey 12.2 5 7 1.0 5 8

In d ian a 10.1 4 8 0 .6 3 11Te xas 9 .7 4 9 1.2 5 7M assachusetts 8.4 3 10 0 .6 3 12

Total 161.7 66 13.6 64

*The 9th and 10th ranked expo rt sta tes, W isconsin and W ash in g to n , ran k 11th and 22nd respective ly in va lu e added by m anu factu ring .

SO U RC E : U. S . Departm ent of Com m erce.

40 in number, individually are relatively unimportant when compared to U. S. totals. The average value added and value of exports for each state are less than 1 percent of the respective U. S. totals. In general, these states do not have the industrial diversification of the top ranking states, their transportation systems are not as well developed, and they have fewer large population centers.

Although these minor industrial export states individually contribute little to total national exports, there are nine states within this group whose individual economies rest heavily on manufactured exports.1 The value of their exports as a percentage of value added by manufacturing ranges from 10 to 32 percent—considerably higher than the 6 to 9 percent range of most other industrial-export states. While their manufacturing activity is not large in relation to the major states and

Alaska, Arizona, Arkansas, Iowa, Louisiana, New Mexico, Virginia, West Virginia, and Washington.

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis

Business Conditions, December 1969

is not highly diversified, the activity that does exist has a relatively strong export orientation, especially in such industries as food processing, nonelectrical machinery, chemicals, and transportation equipment.

Composition va rie s among states . . .

The most important industries in the major industrial states are nonelectrical and electrical equipment, transportation equipment, processed food, printing and publishing, and chemical products. Exports tend to fall into

the same categories, but the pattern across states varies considerably.

While the exports that are relatively important to a state also tend to be relatively important items of production for that state, the important production categories are not always the important exports for the state. For example, in Indiana and Michigan the manufacturing of primary metals comprises 18 percent of their total production, while exports of primary metals are 5 percent or less of their total exports.

Proportion of total value added and of exports by region

Percent of total U. S. value added to manufacturing contributed by geographic region (1966).

Percent of total U. S. manufactured exports originating from geographic regions (1966). Totals may not add due to rounding.

SO U RC E : U. S . D epartm ent o f Com m erce. 9

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis

Federal Reserve Bank of Chicago

Comparisons of production and exports for individual states can only be made on a very rough basis. Data on production in individual states are for the value added by manufacture while data on exports are for the total value of the end products. Consequently, the data exaggerate the importance of exports for states with production concentrated at the end of the production chain.Nevertheless, exports as a percentage ofvalue added by category of production do provide a rough indication of the relative importance of exports to production in the various states.

Exports of nonelectrical machinery and, to

Machinery and food products areleading industries

________________ Distribution of value added by manufacture, 1966Exportcategory Illinois Indiana Iowa Michigan Wisconsin Ohio

NewYork Californ ia

Food 12% 7% 25% 5% 13% 6% 9% 13%

N onelectrica lm ach inery 17 10 24 16 23 15 8 8

E lectrica l

m ach inery 13 16 12 3 11 10 14 12

Transp ortatio n

equipm ent 5 14 1 38 8 15 5 15

P rim ary m etals 9 18 3 18 7 14 5 4

Fabricated

m etals 9 6 5 9 7 9 7 6

Instrum ents 3 1 1 1 2 1 8 2

O ther 32 28 29 10 29 30 44 40

Total

va lu e added 100 100 100 100 100 100 100 100

SO U RC E : U. S . D epartm ent o f Com m erce.

a lesser extent, transportation equipment and instruments are a substantial portion of value added in major industrial states—New York, California, and Illinois—plus some lesser industrial states such as Iowa and Wisconsin.

Future exp o rt

Exports are an important part of production grow th . . .

for nonelectrical machineryExports as a percent of value added, 1966

If U. S. exports are to meet a goal of $50

Exportcategory Illinois Indiana Iowa Michigan Wisconsin Ohio

NewYork Californ ia

billion by 1973, they

Food 8% 11% 8% 6% 5% 4% 6% 8%must increase at least 8

N onelectrical

m ach inery 28 13 25 11 21 16 17 17percent per year. This would be greater than

Electricalm ach inery 6 4 14 7 7 8 7 9

the increase of 6 to 7 percent per year typi-

Transportatio n

equipm ent 13 12 7 12 13 14 6 16cal during most of the 1960s, but it may be

Prim ary m etals 3 2 6 2 3 3 8 7 achieveable. ExportsFabricated

m etals 5 6 7 5 6 6 4 6grew at a 9 percent rate during 1968, but

Instrum ents 9 13 13 30 14 18 13 15 fo r the f i r s t ninemonths of 1969 were10 SO U RC E; U. S. D epartm ent o f Com m erce.

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis

Business Conditions, December 1969

Nonelectrical machinery, an important part of exports

Distribution of 1966 exportsExportcategory Illinois Indiana Iowa Michigan Wisconsin Ohio

NewYork Californ ia

Food 11% 14% 18% 3% 6% 3% 6% 13%

N onelectrical

m ach inery 49 21 51 19 52 30 26 13

Electrica l

m ach inery 8 11 15 3 9 11 10 11

Transportatio n

equipm ent 7 29 1 51 12 27 7 27

P rim ary m etals 2 5 2 3 2 5 5 2

Fabricated

m etals 5 5 3 5 5 6 2 4

Instrum ents 3 2 1 3 3 2 14 3

O ther 15 13 9 13 11 16 30 27

Total

expo rts 100 100 100 100 100 100 100 100

SO U RC E: U . S . D epartm ent o f Com m erce.

only 7 percent over 1968 on an annual rate basis—partly because of the dock strike early in the year.

Agricultural exports will continue to be dominated by mid- western states. There is some question, however, as to whether agricultural exports will contribute significantly to the increase required to achieve the 1973 goal . Af t e r reaching a record level in 1966, the value of agricultural exports declined in 1967, again in 1968, and apparently will decline still further in 1969. Increasing world supplies of food and feed grains in particular, as well as more severe restrictions on agricultural imports in many areas, do not augur well for a substantial increase in agricultural exports over the next five years.

If present trends continue, much of the increase in manufactured exports will originate in the Midwest and Middle Atlantic regions. From 1960-1966, the ten major manufacturing states accounted for 61 percent of the increase in U. S. value added. These states accounted for 62 percent of the increase in U. S. exports during the same period.

But the rate of growth, both in value added and in exports, has varied considerably among the states. Increases in value added for the major manufacturing states ranged from 37 percent in New York to 67 percent in Texas. The range was even greater in export growth with New Jersey and Wisconsin increasing exports by 25 percent and 153 per

cent respectively. In only four of these manu- acturing states—Illinois, Michigan, Texas, and Indiana—did manufacturing grow faster than the 53 percent average rate for the nation. Similarly, in only four of the ten largest exporting states—Illinois, Michigan, New York, and Wisconsin—did exports increase faster than the 45 percent average rise for the nation. Thus, over this period there has been rapid growth outside the major production and exporting areas. Nonetheless, the sheer size of the major states, as well as the rapid growth of a number of them, bodes well to maintain them in a dominant position for the foreseeable future.

Midwestern states—in particular Illinois and Michigan, and to a lesser extent Indiana and Wisconsin—have been important in both the production and export of manufactured goods during the 1960s. If the United States is to reach its export goal of $50 billion by 1973, the Midwest will clearly have a major role in that achievement. 11

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis

Federal Reserve Bank of Chicago

Agency securities and thefederal budget

I n measuring the impact of the federal sector on the nation’s credit markets, it is necessary to examine both the public debt operations of the U. S. Treasury and the borrowing activities of certain other government agencies. These agencies (e.g., Federal National Mortgage Association, Federal Land Banks, Export-Import Bank, Tennessee Valley Authority, the Federal Home Loan Banks, etc.) are authorized to issue their own securities directly to the public. Proceeds finance the issuing agencies’ individual programs—primarily lending. Each credit agency, in effect, operates as a middleman, entering the securities market to obtain funds that it rechannels to the economic sector it serves.

Government agencies are playing an increasingly important role in the securities market. The dollar volume of agency debt outstanding at the end of fiscal 1969 was almost four times its 1960 level. Although agency debt has increased substantially in recent years, federal budget totals do not fully reflect this development. This is a result of a change in the budgetary treatment of agency financing combined with the recent shift in ownership of certain major agencies from public to private hands. The activities—both borrowing and lending—of five of the largest agencies were eliminated from the budget during fiscal 1969. Such reclassification has had major ramifications for federal finance as it is presented in the government’s annual budget statement. In light of the importance accorded the federal government’s budget

12 totals, the growth of agency debt and its

relationship to government finance deserve continuing review.

Impact of ag ency borrow ing

The combined debt of the U. S. government agencies has been growing at a much faster pace than the public debt (securities issued by the Treasury). Between fiscal 1965 and 1969, public debt rose slightly more than 10 percent; however, agency debt outstanding more than doubled.

Furthermore, the agencies are becoming much more prominent in the new issues market. During calendar 1968, new borrowings by federal agencies totaled $7.7 billion, up from $1.2 billion only four years earlier. These agency issues rose from 3.2 to 11.6 percent of all new issues between 1964 and 1968. During the same period, Treasury borrowing eased to 27.5 percent from 28.7 percent of all new issues. The federal agencies have become a significant competitor for the public’s investment dollar.

In some recent years, the agencies’ borrowings from the public have exceeded the U. S. Treasury’s. The public’s holding of Treasury debt alone can be a rather misleading index of the government sector’s needs for credit to finance federal programs. In four of the last six years, Treasury debt held by the public declined, but these declines were more than offset by increase agency debt.

A gency issues and issuers

Of the $38.3 billion total of agency debt outstanding at the end of fiscal 1969, $27.3

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis

Business Conditions, December 1969

billion of securities were solely the obligation of the agencies themselves. They were not guaranteed by the U. S. Treasury. Payments on principal and interest are met solely from the issuing agencies’ own resources.

Of the remaining agency debt, $10.4 billion were participation certificates (PCs)— securities that represent interests in pools of agency loans (federally-underwritten home mortgages, loans to small businesses, college dormitory loans, etc.) with a single agency acting as trustee. The Government National Mortgage Association (GNMA) administers $8.6 billion of these certificates and the Export-Import Bank nas issued $1.8 billion of PCs based upon loans supporting transactions in foreign trade. The Federal Housing Authority is the other major issuer of guaranteed agency debt with $577 million of government-backed securities outstanding at the end of fiscal 1969. The budget treats guaranteed agency debt, including participation certificates, as part of the federal debt.

Almost 90 percent of the total nonguaran- teed agency debt, (and over 60 percent of all agency debt) or $24 billion, represents obli-

Agency finance is animportant part of federal borrowing from the private sector

FiscalC h an g e in

p riva te sector hold ings

y e a r T reasu ry debt A gency debt

(b illio n d o lla rs )

Total

1961 + 1.1 — 0 .3 + 0 .8

1962 + 5 .8 + 2.3 + 8.1

1963 + 3.8 + 1.3 + 5.1

1964 - 0 .3 + 2.3 + 2 .0

1965 — 1.0 + 2 .0 + 1.01966 — 4 .0 + 6.1 + 2.1

1967 — 5.2 + 1-4 — 3.8

1968 + 12.3 + 5 .8 + 18.1

1969 — 3.2 + 4 .5 + 1.3

Agency debt has been growing more rapidly than public debt

billion dollars

gations of the five privately-owned, government-sponsored credit agencies—the Federal Land Banks, the Federal Intermediate Credit Banks, the Banks for Cooperatives, the Federal Home Loan Banks, and the Federal National Mortgage Association (Fanny May).

A gency borrow ing in the budget

Starting with the fiscal year 1969, the federal government adopted a new unified budget format to present its fiscal program. Among other changes, privately-owned credit agencies were eliminated from the budget.Prior to fiscal 1969, the government had presented its budget in three different formats. Federal credit agencies had been included in the consolidated cash budget totals but excluded from the administrative budget figures as well as the federal sector of the national 13

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis

Federal Reserve Bank of Chicago

income accounts.The immediate effect of this change was

the exclusion from the federal budget presented for fiscal 1969 of the Federal Land Banks, which had been privately-owned since 1947, and the Federal Home Loan Banks, privately-owned since 1951. During fiscal 1969, the Federal Intermediate Credit Banks, the Banks for Cooperatives, and Fanny May retired the capital stock held by the U. S. Treasury. To reflect the shift of these three agencies out of the public sector, about $10 billion of their outstanding debt was subtracted from the 1969 budget figures for total agency net borrowing from the public.

For fiscal 1969, the Treasury reported an $11-billion reduction in federal debt—largely the shifted agency debt. During the fiscal year, the five agencies increased their debt by $4 billion. If the five agencies had been included, the 1969 federal budget would have shown a $3-billion growth in the combined agency and Treasury debt.

Some observers question the propriety of this treatment. They regard it as a means of showing deceptively conservative indebtedness totals. Though the agencies are now privately-owned, many features of their operations support the contention that they remain part of the federal government.

All five agencies were established by Congress, and their operations can be modified or suspended by that body at any time. Federal charters specify the scope and scale of their activities. Each is an instrumentality of the federal government, concerned with specific national objectives. Each is supervised by an agency or department in the executive branch of the government. (Fanny May is subordinate to the Secretary of Housing and Urban Development. The Federal Home Loan Banks are supervised by the Federal Home

14 Loan Bank Board. The three agricultural

The debt of each agency has increased sharply . . .

^billion dollars7 -

. . . to support a greater volume of loans

billion dollars

year-end figures

credit agencies are all supervised by the Farm Credit Administration.) Although their securities are not guaranteed by the government, the agencies may, in certain circumstances, borrow from the Treasury or sell their securities to the government. In many ways, agency financing is a close substitute for Treasury borrowing. Investors regard agency obligations as nearly equal in quality to Treasury debt.

The President’s Commission on Budget Concepts, which developed and recommended the unified budget format, dealt at some

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis

Business Conditions, December 1969

length with the question of budget coverage: To work well the governmental bud

get process should encompass the full scope of programs and transactions that are within the Federal sector and not subject to the economic disciplines of the marketplace. This, however, poses practical questions as to precisely what outlays and receipts should be in the budget of the Federal Government. The answer to this question is not always as obvious as it may seem: the boundaries of the Federal establishment are sometimes difficult to draw. . . . What about privately owned agencies which were established by the Federal Government in pursuit of public policy objectives but from which all government capital has now been withdrawn, such as the Federal home loan banks or Federal land banks? It is difficult to draw a boundary line in some of these cases without having programs included in the budget that do not seem greatly different from other excluded items.The Commission sought to develop a bud

get format that would be meaningful and

consistent as well as comprehensive. While recognizing that the ownership principle was somewhat arbitrary, the Commission concluded that it was the most definitive criterion that could be applied. Although it is obvious that the agencies are not entirely private, they are at the same time only quasi-governmental. They are not subject to Congressional appropriation or budget review. A major motivation behind their conversion to private ownership was to enhance the independence of their operations. Their security issues may be considered a substitute for private rather than public borrowing in that the agencies’ sole function is to pool the credit needs of their borrowers and enter the market in their stead —and, perhaps, more efficiently.

Finally, the Commission made it clear that it specifically recommends that the total volume of loans outstanding and borrowing of these enterprises at the end of each year be included at a prominent place in the budget document as a memorandum item. Exclusion from the budget proper was not intended as a way to evade scrutiny.

The five private agencies

The first three agencies in this listing are concerned with agriculture and the latter two with housing. The Federal National Mortgage Association operates from a single location, the other agencies have regional banks around the nation. In lending, each bank acts alone, but in floating debt, all banks in an agency act as a group.

The 12 Federal Land Banks extend longterm mortgage credit to farmers through the Federal Land Bank associations, which are cooperative institutions organized by bor

rowers. The associations, in turn, hold the stock of the Federal Land Banks. The Federal Land Banks’ obligations range in maturity from 2 to 15 years.

The Federal Intermediate Credit Banks (FICB) serve the seasonal and other short- and intermediate-term credit requirements of farmers. This agency functions as a bank of discount for agricultural paper from the production credit associations and other financial institutions making agricultural loans. The Federal Intermediate Credit Banks enter the 15

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis

Federal Reserve Bank of Chicago

money market monthly, issuing nine-month consolidated debentures.

The Banks for Cooperatives (COOP) engage in two types of lending to farmers’ cooperative associations. Short-term funds are advanced for seasonal needs. Term loans of various maturities and payable in instalments are made to cooperatives for construction and equipment purchases. To finance these operations, the Banks for Cooperatives issue six- month consolidated debentures.

The Federal Home Loan Bank System (FHLB) was established in 1932 to provide credit to its member savings and loan associations for mortgage financing. The banks are authorized to make various types of loans— both secured and unsecured, long- and shortterm. They issue both consolidated notes that mature within a year and consolidated bonds with maturities up to five years.

The Federal National Mortgage Association (FNMA) provides increased liquidity to the mortgage market through its secondary market operations. It is authorized to purchase or sell government insured or guaranteed home mortgages or to make short-term loans secured by such mortgages. To finance its operations, FNMA issues short-term discount notes, which mature in 30 to 270 days at the option of the investor, and debentures with a maturity range of 1 to 15 years.

Of the five government-sponsored agencies, Fanny May is the largest borrower. At the end of 1968, its debentures and notes outstanding totaled nearly $6.4 billion, or about 30 percent of the combined debt of the five agencies. All five agencies, however, have expanded operations during this decade, with the loans and securities of each now equal to between two and four times their 1960 level.

BUSINESS CONDITIONS is published monthly by the Federal Reserve Bank of Chicago.H. Woods Bowman is p rim arily responsible fo r the article "Trends in M idwest—Is Megalopolis coming to the M idw est?," Jack L. Hervey for "M idwest—A leader in production and export growth," and Nancy M. Goodman for "Agency securities and the federal budget."

Subscriptions to Business Conditions are ava ilab le to the public without charge. For inform ation concerning bulk m ailings, address inquiries to the Federal Reserve Bank of Chicago, Box 834, Chicago, Illinois 60690.

16 Articles m ay be reprinted provided source is credited.

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis

Business Conditions

a review by theFederal Reserve Bank of Chicago

Index for the year 1969

Month Pages

Agriculture and farm finance

Banks and PC As—a comparison................................ February 5-11Developments in the cattle industry

Continued growth indicated.................................... October 12-16Farm outlook............................................................... January 11-16Larger farms—a continuing trend............................. May 7-13Rise in farmland values slows in Midwest................. September 5-9

Banking, cred it, and m onetary policy

Agency securities and the federal budget................... December 12-16Bank float: by-product of collecting checks............... September 12-16Changing styles in business finance............................. November 6-16Consumer instalment loans

A profile from Detroit............................................ September 9-12Customers view a bank merger—before

and after surveys.................................................... July 5-8Measures of money and credit.................................... July 11-16Ownership of demand deposits at large

Chicago banks......................................................... March 10-16Pension funds and capital markets............................. August 7-16Regulation Z—truth-in-lending.................................. April 11-15Strong rise in currency circulation............................. August 2-6Trends in banking and finance.................................... July 2-5

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis

Economic conditions, genera l

Autos and trucks—output, sales, and credit............... March 2-9Consumption

Patterns shift with rise in income........................... February 2-4Personal saving and inflation...................................... May 13-16The trend of business.................................................. January 2-11The trend of business

New surge in capital expenditures......................... April 2-10The trend of business.................................................. June 2-9The trend of business.................................................. September 2-5The trend of business

Another 1966 for homebuilding?........................... November 2-5What’s happening to take home pay......................... May 2-6

In ternational tra d e , finance, and paym ents

Eurodollars—an important source offunds for American banks...................................... June 9-20

Important stake in free trade...................................... July 8-11International payments

Further improvements needed in the system........ February 11-16Midwest

A leader in production and export growth............. December 7-11Special drawing rights................................................ October 6-11U. S. foreign trade surplus declines............................. April 16-20

Trends in the M idwest

Is Megalopolis coming to the Midwest?..................... December 2-7Population growth concentrated in

suburban counties.................................................. October 2-6

Month Pages

Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis