Business Advantage Solomon Islands 2012/13

-

Upload

business-advantage-international -

Category

Documents

-

view

232 -

download

4

description

Transcript of Business Advantage Solomon Islands 2012/13

1 businessadvantagesolomonislands.com

Business Advantage

SOLOMON ISLANDS2012/ 2013

B U S I N E S S A N D I N V E S T M E N T G U I D E

Your gateway to the Solomon Islands economy

2

BSP HERITAGE PARKBSP’s Newest flagship has arrived.

Experience State-Of-The-Art Banking in the Solomon Islands.B k th S d

More Bank TellersMore Banking StaffMore ATM MachinesMore ConvenienceMore For You

ONEBANKFORBUSINESSLET’S TALK BUSINESS TODAY. www.bsp.com.sb

For more informationplease call (677) 21874

3

ECONOMIC UPDATE From bust to boom: less than a decade after its economy lay in ruins, the Solomon Islands is in remarkably good shape.

14 WHO’S WHO IN SOLOMON ISLANDS BUSINESS / USEFUL ONLINE RESOURCES

16 INFRASTRUCTURE AND TRANSPORT Several exciting initiatives are underway to address

the country’s infrastructure challenges.

20 PRODUCTIVE SECTORS The Solomons looks to build on its natural

advantages in agriculture and fisheries.

24 TOURISM INVESTMENT Paradise regained: the tourism sector’s enormous

potential remains largely untapped, but major improvements in infrastructure and transport are providing a solid foundation for change.

26 BUSINESS TRAVEL GUIDE TO THE SOLOMONS

A practical guide for the business visitor.

MINING An industry bounces back: exploration is on the increase as the Solomons’ major gold mine re-opens and the investment climate improves.

CONTENTS

INFORMATION & COMMUNICATIONS TECHNOLOGY The Solomon Islands’ telecommunications sector is moving forward at breakneck speed.

5

12

18

Business Advantage International would like to thank the following organisations for their assistance in producing this publication:

H O N I A R A

Foreign Investment Division

4

EDITORIAL

To produce this fourth edition of Business Advantage Solomon Islands, we visited Honiara in November 2011, almost exactly five years after our first visit.

The first thing you notice now is how much busier things are. Crossing the road is challenging: there are still no traffic lights but a lot more cars, the tell-tale signs of an economy growing fast. There are more people on foot, too, many brandishing mobile phones. The mobile penetration rate has soared from a single digit to more than 50% with the advent of competition. The footpaths still need some work, but at least they are now cleaned every day. A poster promotes the first full-length marathon through the same streets, while a little further along a pristine signboard indicates the premises of a new tour operator. The cityscape has changed, too. The gaping hole in the middle of town, the former site of the Governor-General’s residence, has been filled by an international-standard hotel and the imposing building of a major regional bank, symbols of the Solomons’ growing appeal to foreign investors. Two hundred metres up the

road, you pass the gleaming new Hyundai Mall. Its neat, modern outlets have raised the bar in the local retail sector. Coincidentally, there was a change of government during our recent visit, with Prime Minister Danny Philip resigning in the face of a no-confidence vote. Given the civil unrest sparked by elections in early 2006, it was particularly significant that the atmosphere around town remained overwhelmingly calm through the five-day interregnum (in spite of some international reports to the contrary). During his resignation speech, Philip played up the importance of an orderly transition. He did this in a moderate and measured tone that seemed to sum up the mood of his electorate. It is human nature to focus on what needs improving, rather than dwelling on what has already been achieved, but sometimes it is worthwhile to pause, however briefly, and look behind you. For all that still needs doing, if you could have shown anyone walking through Honiara five years ago a glimpse of how things would look today then surely they would have been impressed.

Business Advantage Solomon Islands 2012/13 is published by Business Advantage International Pty Ltd, Level 27, Rialto South Tower, 525 Collins St, Melbourne, Victoria 3000, Australia, tel +61 3 9935 2977, fax +61 3 9935 2750

www.businessadvantageinternational.com

This publication is available free online at www.businessadvantagesolomons.com. Additional printed copies can be purchased for AUD$25 (incl GST and postage) from the above address or by emailing [email protected]

© Copyright 2012 Business Advantage International Pty Ltd

ISSN 1837-2171 (Print)

Project Director: Robert Hamilton-Jones ([email protected]) Publisher: Andrew Wilkins ([email protected]) Editorial: Roz Edmond, Harbant Gill Design: Michael Renga Cover images: Solomon Islands Visitors Bureau, Allied Gold, Our Telekom

Special thanks to: Derick Aihari (Foreign Investment Division, Solomon Islands Department of Commerce, Industries & Employment), Tim Martin (Pacific Islands Trade & Invest), Gus Kraus (Solomon Airlines), Marcos Vaena (International Finance Corporation), and the staff at the Heritage Park Hotel, Honiara.

Produced in partnership with the Foreign Investment Division, Solomon Islands Department of Commerce, Industries & Employment.

Printed in Australia. Both printer and paper manufacturer for this publication are accredited to ISO14001, the internationally recognised standard for environmental management. This publication is printed using vegetable inks and the stock is elemental chlorine free and manufactured using sustainable forestry practices.

DISCLAIMER Business Advantage Solomon Islands is a general guide to some potential business opportunities in the Solomon Islands and is not designed as a comprehensive survey. The opinions expressed herein are not necessarily those of the publisher and the publisher does not endorse any of the business or investment opportunities featured, nor does it accept any liability for any costs or losses related to dealings with entities mentioned in this publication. Readers are strongly advised to pursue their own due diligence and to consult investment advisers before making any investment decisions.

0 100KM

Santa Isabel Is.

Malaita

New Georgia Is.

Honiara

Auki

Buala

Indispensible Strait

The Slot

Kologilo Passage

Poole Reef

Gizo

Bougainville Is.

Kirakira

San Christobal Is.

Central

Choiseul

Guadalcanal

Isabel

Makira-Ulawa

Bellona and RennellTemotu

Western

VANUATU

AUSTRALIA

PNG

Solomon Islands

5

ECONOMIC UPDATE

TERMS & CONDITIONS APPLY

‘Despite the growth we are experiencing, full recognition has not yet been given to the Solomon Islands as an investment destination.’

From bust to boomLess than a decade after its economy lay in ruins, the Solomon Islands is in remarkably good shape.

The Solomon Islands has undergone an economic transformation over the past decade. Its GDP has more than doubled since 2003, with its Central Bank

estimating 2011 GDP growth at 8.2%, up from 7.2% a year earlier. Meanwhile, the country also achieved its first trade surplus in 2011 since 2004—a major milestone indicating the economy has bounced back from the effects of the global financial crisis. This stronger economic performance has been reflected in employment growth. While formal employment in a country heavily reliant on subsistence farming remains very low (around 10%), the Solomon Islands National Provident Fund reporting a 10% increase in membership in 2010/11. Furthermore, the Solomon Islands Government’s fiscal position is solid and strengthening, with its budget in surplus and cash reserves growing. At the same time, a raft of recent business-focused reforms—online business registration, separation of the land registry from the business and movable property registries, and strengthened investor protections under the 2009 Companies Act—has led the World Bank to nominate the Solomons as one of the top dozen performers globally in its 2012 Doing Business survey. (The Melanesian nation rose seven places in the bank’s rankings, which measure ease of doing business, in just one year).

Trigger for mining boomThis economic rebuilding has been underpinned by the presence of the Regional Assistance Mission to the Solomon Islands (RAMSI) that arrived in 2003 to bring stability to the nation after five damaging years of civil unrest, commonly referred to as 'the tensions'. With RAMSI pledging to remain as long as it is needed (see page 8 for an interview with its Special Coordinator) there is every reason to believe current economic progress will be maintained. GDP growth in 2012 is projected at 6.6%. March 2011 saw the highly symbolic re-opening of the country’s only mine, Gold Ridge. Forced to shut during the tensions of 2000, Gold Ridge is not only a major enterprise in its own right but has also become something of a bellwether for the local economy. Many believe its revival could provide the trigger for a full-blown mining boom in a country rich in mineral wealth. Some experts believe that nickel alone could develop into a multi-billion dollar industry over the coming years, with large untapped deposits of gold and copper also currently the subject of energetic prospecting.

Cre

dit:

Sol

omon

Isla

nds

Vis

itors

Bur

eau

/ Bra

d M

alyo

n

6

ECONOMIC UPDATE

Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522.

anz.com/solomonislands

C nnect with a wellconnected bank.

SOLOMON ISLANDS IN BRIEF Structure of incentivesInevitably, the country still faces major challenges, including constraints to private sector development. ‘Government action is needed to improve infrastructure … reform state-owned enterprises, simplify licensing and tax systems and strengthen land reform,’ noted Eugene Zhukov, Regional Director, Asian Development Bank, at the April 2011 launch of its flagship Asian Development Outlook 2011 report. Almost all land outside Honiara is held communally, with no official records of title. For a would-be investor who wishes to develop a piece of land, this makes life very difficult though not impossible as Guadalcanal Plains Palm Oil has demonstrated (see p21). With tangible progress in the area of state-owned enterprise reform (‘we don’t have blackouts every day anymore’, as one executive put it), the overwhelming priority for the business leaders Business Advantage spoke to was for comprehensive tax reform, including a formal structure of incentives for foreign investors rather than the ad hoc system currently in place. Under current legislation, the tariffs on imported products or inputs can be punitive (for example, on hardware in the ICT industry), there is no consistent rate of sales tax and the personal tax rate thresholds are demoralisingly low. There is every reason to hope this will change soon, given that the newly appointed Minister of Finance in the Gordon Darcy Lilo Government that came to office in November 2011 is none other than Rick Houenipwela, the highly respected former Governor of the Central Bank.

Riding in the slipstreamThe Solomons also has some way to go to win back the full confidence of the international business community. Tony Koraua, President of the Solomon Islands Chamber of Commerce, told a business forum in Australia in October 2011:‘Despite the growth we are experiencing, full recognition has not yet been given to the Solomon Islands as an investment destination.’ At least the recent deluge of investment from nearby Papua New Guinea (see p10), the nation most akin to the Solomons, is a positive sign. The Solomons may not be growing quite as fast as its larger neighbour, but it is evidently riding in its slipstream rather than trailing in its wake.

Area 28,900 sq km

Population 550,000 (2011 est.)

Capital city Honiara (c. 50,000)

Official languages Pijin, English

People Melanesian 95%, Polynesian, Micronesian, European & Chinese 5%

GDP US$788 million (IMF est. 2011)

Inflation 8.2% (August 2011)

Exchange rate SBD$1.00 (Solomon Islands dollar) = AU$0.130/US$0.135 (January 2012)

Major export markets China (59.6%), South Korea (3.4%), Thailand (3.4%)

Major import markets Australia (28.7%), Singapore (21.4%), China (7.8%), New Zealand (6%)

Head of State Sir Frank Utu Ofagioro Kabui (Governor-General)

Head of Government The Hon. Gordon Darcy Lilo (Prime Minister)

Distances by air Brisbane (3h 10m)

World Bank Ease of 74 of 183 (2012) Doing Business ranking

The recently-completed Hyundai Mall in Honiara

7

ECONOMIC UPDATE

For more informationT: +677 21164 E: [email protected]

www.telekom.com.sb

MOBILE INTERNET

Mobile Internet, a business telecommunication solution to working on the move.

kabani blong iumi...

The Foreign Investment Division of the Department of Commerce, Industries and Employment is the first port of call for potential investors in the Solomon Islands. Director Derick Aihari explains its function.

What is the role of the Foreign Investment Division?We are the de facto investment promotion agency of the Solomon Islands. Our responsibilities include promoting and facilitating foreign investment. As required under the Foreign Investment Act 2005 and Regulation 2006, we also have a monitoring role to ensure foreign investors abide by their terms of registration.

How straightforward is the foreign investment application process?The 2005 Foreign Investment Act has greatly reduced the amount of time it takes to process an application. The application form is much shorter and the process has been streamlined to improve cooperation from other government agencies. Applicants receive a decision within five working days. However, it is important for investors to be aware of those activities on the Reserved List—that is to say, those reserved for local operators.

What kind of recent reforms should potential investors be aware of?Over the past four years, we have implemented an Insolvency and Receivership Act, as well as a new Secured Transactions Act and a new Companies Act. These measures have undoubtedly improved the investment climate in the Solomon Islands. Further reforms are also planned, including in the area of taxation.

What kind of tax incentives are offered to foreign investors? How can they apply for them?Incentives are granted at the discretion of the Minister of Finance. They include tax holidays and duty exemptions on the import of certain capital goods.

MAKING LIFE EASIER FOR INVESTORS

Derick Aihari

8

ECONOMIC UPDATE

The Regional Assistance Mission to Solomon Islands (RAMSI) is a partnership between the people and Government of Solomon Islands and 15 contributing countries of the Pacific region. Since its arrival in 2003, RAMSI has played an important role in helping the Solomon Islands lay the foundations for long-term stability, security and prosperity. Business Advantage caught up with RAMSI Special Coordinator Nicholas Coppel in November 2011 for an update on its progress.

The role of the RAMSI mission has clearly evolved. What exactly does this ‘transition’, as you refer to it, entail?

When RAMSI arrived in 2003, the focus was on 'doing': managing the economy and the government’s finances, law and order, security and correctional services. Today, the focus is clearly moving to capacity building. There's been an enormous amount of progress in the area of economic reform that has been introduced, and I think it's fair to say that a lot of the strong growth that’s been seen in Solomon Islands today is a result of those reforms that were introduced through the Economic Reform Unit. That process is continuing but in more detailed, less visible areas.

What are the main initiatives you are undertaking?

Sound management of the economy remains very important for investor confidence, so we’re continuing to provide support in that area in terms of bringing together the budget.

For instance, we are trying to link up and connect the public service payroll with the finance system. This means that the Ministry of Finance and Treasury will have a much better understanding of the government’s payroll, which is the major expense of government.

Secondly, there are no proper processes and systems in place for government procurement, so we are working with the Solomon Islands Government to develop those.

We’re also continuing to work with the Internal Revenue Division, and an amendment to the Customs Act has been drafted that just needs to go through Parliament.

Can you confirm that RAMSI will remain for as long as it is needed?

RAMSI is in no rush to leave the Solomons. It is important to maintain confidence in the security environment here, and in turn confidence in the economy and the business environment. In a way, downsizing or transitioning RAMSI should help improve confidence in the Solomon Islands, not take it away. It’s a way of showing that the Solomon Islands is back in business. It is a normal country again and does not need an extraordinary intervention.

That said, there is still more work to be done with the Royal Solomon Islands Police Force. We recognise that and we are working with them to get them up to speed.

Our numbers will be coming down but they will not be going to zero. There will still be a very significant RAMSI police presence in the middle of 2013. In fact, 2013 simply marks the start of the next four-year cycle of funding, not the end of the mission. That hasn’t been well understood by many in the Solomon Islands.

Further information www.ramsi.org

RAMSI REVS UP REFORMS

RAMSI’s Nicholas Coppel plays host to United Nations Secretary General Ban Ki-Moon during his September 2011 visit to the Solomons.

The Solomon Islands’ new chancery in Canberra, Australia.

Cre

dit:

Sol

omon

Isla

nds

Hig

h C

omm

issi

on

The FlySolomons Running Festival, which includes a marathon, is a popular annual event.

Cre

dit:

Sol

omon

Airl

ines

9

10

BSP leads the charge from PNG

ECONOMIC UPDATE

Papua New Guinea firms are playing a key role in the Solomon Islands as investment floods in.

The opening of a landmark new head office building in central Honiara marks the final stage of the takeover by Bank South Pacific (BSP) of the former National Bank of

Solomon Islands (NBSI). It also symbolizes the pivotal role PNG firms are playing in the development of Solomons’ private sector. When PNG-based BSP bought out NBSI as part of its regional expansion in 2007, it may have obtained significant market share but it also inherited outdated systems and infrastructure. It has subsequently set about investing heavily in new technology, with the relocation in late 2011 of its head office to a gleaming new three-storey facility representing the final piece of the jigsaw. The building’s exterior features the striking sight of no less than five ATMs, while the interior includes a spacious, air-conditioned and modern retail banking area and secure transactions facility on the ground floor. Dedicated sections for premium and corporate customers, as well as administration, are housed above. While this flagship branch undoubtedly provides an improved customer experience, it also provides the platform for BSP to use electronic service delivery channels (especially mobile) to improve access to banking services for the Solomons’ large and under-banked rural population. Country Manager Mark Corcoran explains: ‘One of the more

costly parts of the building is our comms room. It is a state-of-the-art facility that contains all our servers and communication links. It has double redundancy to make it as bullet-proof as possible when we are rolling out ATMs, EFTPOS, SMS banking services country-wide.’ BSP may be the most

prominent example of PNG investment in the Solomons, but it is by no means the only one. While the front of the new building faces the main Mendana Avenue, it backs into the Heritage Park compound, home to the PNG-owned Heritage Park Hotel. Since opening in late 2009, the hotel has set a new benchmark for accommodation in the capital. It Is estimated that some 40 PNG-based firms have a physical presence in the Solomons, spanning

a range of sectors. Most are recent arrivals, such as ICT firms Bemobile and Daltron, major agribusiness player Guadalcanal Plains Palm Oil and finance company Credit Corporation, that are fundamentally reshaping the private sector. No other two Pacific Island states are so similar culturally as PNG and the Solomons, and the resulting empathy is at the root

BSP’s new head office in Honiara

The Heritage Park Hotel is a high profile example of Papua New Guinean investment in the Solomons

Mark Corcoran

‘Companies with experience of Papua New Guinea are much more comfortable with this environment because they can understand the risk profile’

of this blooming commercial partnership. One PNG executive working in the Solomons comments happily on how much at home he is in Honiara: ‘it just feels like another province of PNG.’ At the same time, PNG’s economy has enjoyed a decade of economic growth, boosting the coffers of its corporate sector, while its smaller neighbor has rarely looked like such a safe bet. Interestingly, the investors making the short trip east are not necessarily PNG-owned. It is more a case of international companies regarding PNG as a natural springboard to the Solomons, as RAMSI’s Special Coordinator Nicholas Coppel (who has also had a stint as Australia’s Deputy High Commissioner in PNG) explains: ‘Companies with experience of Papua New Guinea are much more comfortable with this environment because they can understand the risk profile, whereas companies from other countries are still a bit wary of locking down their money in a physical investment. It is also true that for many Australian companies, the Solomons is a small market and so it doesn’t get quite the same attention as opportunities in Asia.’ Given the current dynamism in both economies, the flood of investment looks set to continue. The Solomons’ vastly under-developed retail sector is just one that, sooner or later, is likely to tempt investors from across the Solomon Sea.

11

ECONOMIC UPDATE

Morris & Sojnocki Chartered Accountants

Morris & Sojnocki is the leader in Assurance and Business Advisory services. For specialist business advice call Wayne Morris or Greg Sojnocki, the experts in the Solomon Islands.

accounts for more business in the Solomon Islands

Contact - [email protected] or [email protected]

The following information is an abridged version of the ‘Guide to Investment in the Solomon Islands’ included in ANZ Business Investor Guide: Understanding Your Investment Options in the Solomon Islands.

The following steps must be undertaken by investors wishing to establish a business in the Solomon Islands.

Office of Registrar of Companies (ROC)www.investsolomons.gov.sb> Registration of business/company name> Download application form (Form 2 available on website)

Foreign Investment Division (Solomon Islands Government)> Registration must be done via submission of the

completed application form (as above) and a registration fee of SBD$200

> Checklist is available from www.investsolomons.gov.sb

Foreign Investment DivisionThe following steps are normally taken by the Foreign Investment Division in assessing an investment application:> Receipt of application with appropriate fees and required

documents (refer fees and requirements section on www.investsolomons.gov.sb)

> The Registrar shall assess the application to determine whether or not the application specifies all the information required under section 16 of Foreign Investment Act 2005, and whether the information specified is sufficient for determining the nature of each investment activity specified in the application.

> This process usually takes around 7 to 10 days, depending on the provision of all required documents.

Immigration DepartmentThe investor will then need to apply to the immigration department that will:> Check criminal history/connection and character as

required by the Immigration Act> Issue key post residency permits to foreign investors.

Labour DepartmentThe investor will need to apply to the Labour Department,

which will:> Check criminal history/connection and character as

required by the Immigration Act> Issue key post work permits to foreign investors> Work permit checklist is available from

www.investsolomons.gov.sb

Solomon Islands Revenue & Customs Authority> Ensure ROC registration has been obtained before

processing applications> Register the enterprise for Income Tax, PAYE, Goods and

Services Taxes purposes, and issue Tax Identification Numbers (TIN) provided enterprises comply with application requirements

> Apply to Inland Revenue and Customs for investment and tax incentives (for more on incentives refer to www.investsolomons.gov.sb)

City/Town Council Business Licences> Apply to Honiara City Council to obtain a business licence.

Solomon Islands National Provident Fund (www.sinpf.org.sb)> Registration of employee and employer superannuation.

Other Government agencies> May be required, depending on the nature of business.

Banks> Establish a banking relationship in the Solomon Islands.

THE INVESTMENT APPROVAL PROCESS IN THE SOLOMONS

12

The massive expansion of mobile phone coverage is set to transform the dynamics of the nation’s banking sector.

Just five years ago there was no mobile phone coverage outside Honiara, and precious few landlines, whereas by the end of 2011 coverage had expanded to 60% and will grow further in 2012. This new national network is going to do more than merely let subscribers communicate with each other. For those living in urban areas it will also make

banking more convenient, while for many rural residents, formerly isolated by geography, it will give them access to banking services for the first time.

‘Advances in mobile phone technology will give us the opportunity to take the market outside Honiara,' says Westpac’s General Manager Kutila Pinto. ‘While branches still have a role, banking is not restricted to four walls anymore, it can be done anywhere.’

In 2011 Westpac successfully launched its mobile banking offering in nearby Fiji, with the Solomons and other Pacific jurisdictions expected to come on board in 2012. The technology enables registered users the ability to perform simple banking transactions via SMS, such as transferring money from one account to another, checking an account balances, or requesting a cheque book. Meanwhile mobile EFTPOS machines will make life easier for merchants, particularly tourism operators.

Naturally, the country’s other two banks are also keen to capitalise on this revolutionary electronic platform. For Bank South Pacific, which already has a well-established physical network of branches and agencies around the country, it provides a way to improve the efficiency of its rural operations (see page 10).

Meanwhile, ANZ’s Chief Executive Officer in the Solomons, Barry Sowman, reports that the bank is ‘looking to expand the reach of our merchant services network, as well as develop account offerings that minimise fees for those customers who do their banking outside of a branch.’

THE BANKING SECTOR ON THE CUSP OF TRANSFORMATION

INFORMATION & COMMUNICATIONS TECHNOLOGY

Rivals rise to the challengeThe Solomon Islands’ telecommunications sector is moving forward at breakneck speed. Business Advantage assesses recent developments and their implications for the economy.

It is hard to believe that it was not until late 2009 that the Solomon Islands Government awarded a second mobile phone licence, breaking the monopoly of Our Telekom (the

trading name of Solomon Telekom Compnay Limited). Things have changed quickly. New entrant, PNG-based Bemobile, rolled out its own network in a few months, commencing operations in August 2010 (see box opposite). Since then both it and Our Telekom have wooed consumers with a mix of great deals and new services. Prices have dropped, coverage across the dispersed archipelago has increased dramatically and the mobile penetration rate has soared from a single digit to more than 50% of the population. While that growth curve will inevitably flatten out, new services such as mobile broadband

and SMS banking will increase the usage of networks that are already creaking under the weight of high demand. Bernard Hill, the Commissioner of the Telecommunications Commission of the Solomon Islands (TCSI), arrived in the Solomons in 2011 to take up his role. ‘What really impressed me was how clean the legislation was here. It’s world best practice,’ he says. With deregulation now fully complete, new players are also expected to spring up.

Upgrade for core networkThe key to the sector’s dynamism, says Hill, is that genuine competition exists. The regulator’s satisfaction acknowledges the fact that Our Telekom is rising to the challenge. ‘We’re coping

Westpac's Kutila Pinto

13

INFORMATION & COMMUNICATIONS TECHNOLOGY

In December 2009, the Solomon Islands Government made the historic announcement to award the country’s second mobile phone operating licence to PNG-based Bemobile. Originally a wholly owned subsidiary of Telikom PNG, in 2008 50% of Bemobile was acquired by a private consortium of local and international investors. The strong parallels between the telecommunications sectors in PNG and the Solomons serve to enhance the synergies that Bemobile enjoys by operating in both markets.

It took just six months to roll out the first stage of its network before launching on 31 August 2010. By the end of 2011, Bemobile had signed up 118,229 subscribers and was on the point of offering them 3G services.

Alan Barry, Head of Marketing, says it was a major challenge to build its network so quickly in such a harsh environment: ‘Providing power to remote sites was the biggest hurdle we faced. We now have our own engineers based around the country and have even purchased two boats for better access.’

The company’s network now covers more than 50% of the population and this is set to expand in 2012, in part thanks to funding from the Asian Development Bank. It will also open an office in Malaita Province.

Given the low disposable income of the average Solomon

Island consumer, Bemobile set out to keep the cost of handsets very low and thereby remove the main barrier to mobile phone take-up. However, it is also discovering that in a market where gadgets are not ubiquitous many customers want to do more with their phone than just talk.

‘We’ve discovered that people love listening to music , including via a loudspeaker,’ says Barry. ‘They also like using it as a camera, and even as a torch, so there is a need to balance features with price.’

BEMOBILE ON A ROLL

‘What really impressed me was how clean the legislation was here. It’s world best practice.’

The rollout of Bemobile’s network in the Solomons is continuing

Cre

dit:

Bem

obile

with competition,’ says CEO Loyley Ngira, ‘We’re not being complacent.’ Our Telekom launched its 3G network in 2010, enabling data access for its subscribers. It has also introduced a mobile internet service, whereby Internet can be accessed using the 3G network through Internet capable mobile phones or via a laptop (using a modem/dongle). This complements, rather than replaces, its wireless internet service, available in Honiara via a series of hotspots (in hotels etc). Its core mobile network will receive a further upgrade in 2012 with the roll out of another 50 mobile sites across the country.

Undersea cable linkBoth Our Telekom and Bemobile were recently allocated additional spectrum by TCSI to enable them to increase the capacity of their networks. When it comes to international connectivity, however, the solution is less straightforward. ‘Our network upgrade will further increase the pressure on upstream bandwidth,’ says Loyley Ngira. He is referring to the Solomons’ reliance on costly satellite connectivity, to communicate with the wider world (and especially the world wide web), that acts as a bottleneck, slowing internet speeds and pushing up the overheads of local carriers. The ideal solution would be an undersea fibre optic cable link

but this would require a major investment. Encouragingly, serious discussions are underway in this area in collaboration with donor agencies. The Solomons could connect to an existing undersea network via a spur to minimize construction costs or opt for a separate submarine cable. Loyley Ngira says the project would ‘change the whole business environment’.

Government takes the leadTCSI is turning its attention to the more remote parts of the population for whom it is not commercially viable for operators to provide mobile coverage. According to Bernard Hill, a Universal Access project, which should commence in 2012, ‘would rely on sponsorship from donor organisations to grow the network further’. The existing mobile phone operators would be invited to bid on a piecemeal basis. For each parcel of territory, the winning bidder would be subsidized to add it to their network. For larger entities like corporations and government departments, connectivity alone does not necessarily equate to effective communications. Tony Koraua, Country Manager of ICT services provider Daltron, says: ‘Computers are extremely under-utilised in this country. It is one thing to provide someone with a laptop but they will get limited benefit if their organisation has no databases, no integrated systems, no email server.’ To get its own house in order, the Solomon Islands Government issued a tender in late 2011 for a Metropolitan Area Network to connect all 26 SIG departments in Honiara, spread across almost 100 physical locations. The RAMSI-funded project aims to ‘facilitate the provision of basic ICT services to all government offices in a cost and human resource efficient manner’.

14

WHO’S WHO IN SOLOMON ISLANDS BUSINESS

Banking, Finance & InsuranceANZ +677 21111 www.anz.com/solomonislands

BSP (Bank South Pacific) +677 21874 www.bsp.com.sb

Westpac +677 21222 www.westpac.com.sb

AgricultureGuadalcanal Plains Palm Oil +677 21003/21005 www.nbpol.com.pg

MiningGold Ridge Mine Solomon Islands office +677 38351 www.alliedgold.com.au

FisheriesNational Fisheries Developments +677 30991

Soltai (canned tuna) +677 61012

Diplomatic Missions in HoniaraAustralian High Commission +677 21561

British High Commission +677 21705

Japan Embassy +677 22953

New Zealand High Commission +677 21502

Papua New Guinea High Commission +677 21502

Republic of China (Taiwan) +677 38050

ForestryEarth Movers/Pacific Timbers +677 30385

Kolombangara Forest Products Ltd +677 21078

MiscellaneousAsian Development Bank (ADB) Pacific Liaison and Coordination Office (ADB Sydney) +61 2 8270 9444 www.adb.org

Australian Trade Commission (Austrade) c/- Austrade Port Moresby, Papua New Guinea +675 325 9150

Australia-Pacific Business Council + 61 7 3348 5142 www.apngbc.org.au

Central Bank of the Solomon Islands +677 21791 www.cbsi.com.sb

Foreign Investment Division (Ministry of Commerce, Industries & Employment) +677 22851

International Finance Corporation (IFC)/World Bank Regional office +61 2 9235 6519 www.ifc.org www.worldbank.org

Pacific Islands Trade & Invest www.pacifictradeinvest.com Trade and investment promotion arm of the Pacific Islands Forum. Offices in Auckland, Shanghai, Sydney and Tokyo (check website for details).

Regional Assistance Mission to the Solomon Islands (RAMSI) +677 25122 +677 24703 (Public Affairs Unit) www.ramsi.org

Telecommunications Commission of the Solomon Islands (TCSI) +677 23862 www.tcsi.org.sb

TransportPacific Air Cargo +61 7 3268 6633 www.pacificaircargo.com.au

Solomon Islands Ports Authority +677 22646

Tradco Shipping +677 22588

TourismHeritage Park Hotel +677 24007 www.heritageparkhotel.com.sb

Solomon Airlines +677 20031 www.flysolomons.com

Solomon Islands Visitors Bureau +677 22442 www.visitsolomons.com.sb

Business ServicesAustAsia Pacific Health +61 7 55964622www.webbpacific.com.au

Bemobile +677 20776 www.bemobile.com.sb

Looking for a reputable company who provides professional IT Solutions and Services? Wanting to stretch your IT budget further?

Look no further...√ Project Management √ SPAM Management

√ Disaster Recovery Planning √ ISP Services

√ IT Consulting √ Software Development

√ Right Sourcing √ Business Process Consulting

√ Outsourcing your IT systems √ All Consumables and Copy Centre

www.daltron.com.sb email: [email protected]

PORT MORESBYP+ 675 302 2200F+ 675 325 6558

LAEP+ 675 472 8449F+ 675 472 8455

SOLOMON ISLANDSP+ 677 25100F+ 677 25114

SUVAP+ 679 3315091F+ 679 3315093

NADIP+ 679 6724822F+ 679 6724832

VANUATUP+ 678 22537F+ 678 23559

15

Cre

dit:

Sol

omon

Isla

nds

Vis

itors

Bur

eau

Westpac has a long history of financial expertise in the Solomon Islands. Backed by industry experts in commodity, energy, telecommunications and public sector financing your business is in professional hands.

So for all your Institutional, Corporate and Business Banking needs talk to the bank that speaks your language.

Call 677 21222Email [email protected] Mendana Avenue, Honiara or westpac.com.sb

We’re local knowledge.

We’re a bank you can bank on.

2595

00 (0

1/12

)

www.pmc.gov.sb Solomon Islands Department of Prime Minister and Cabinet

www.whitepages.com.sb The Solomons online White Pages

www.solomonchamber.com.sb Solomon Islands Chamber of Commerce and Industry

www.solomonstarnews.com Solomon Star newspaper

www.businessadvantagesolomons.com The online version of this publication plus other useful Pacific business resources.

www.islandsbusiness.com/news/ Islands Business—general news on the Pacific

USEFUL ONLINE RESOURCES FOR THE SOLOMON ISLANDS

WHO’S WHO IN SOLOMON ISLANDS BUSINESS

Daltron +677 25100 www.daltron.com.pg Pacific-wide IT services provider

Hastings Deering +677 30274 www.hastingsdeering.com.au

Morris & Sojnocki (Chartered accountants) +677 21851 [email protected] Assurance and business advisory services

Silentworld Shipping & Logistics +677 20956 www.silentworld.com.au

Sol-Law +677 23886 [email protected]

ConstructionFletcher Kwaimani JV +677 30556 [email protected]

InfrastructureOrigin Energy +677 21833

Our Telekom +677 21576 www.telekom.com.sb

Solomon Islands Electricity Authority (SIEA) +677 30495

Solomon Islands Water Authority (SIWA) +677 23985

Industry AssociationsSolomon Islands Chamber of Commerce & Industry Contact: Calvin Ziru +677 39542 [email protected] www.solomonchamber.com.sb

Association of Solomon Islands Manufacturers +677 38553 [email protected]

Business Council of Solomon Islands +677 30304 [email protected]

Small and Medium Enterprises Council (SMEC) +677 26789/76797

Women in Business +677 26891

Manufacturing/IndustrialSouth Pacific Oil +677 21838 www.spo.com.sb

Solomon Breweries +677 30257

Solomon Tobacco +677 30127 www.bat.com

Sunrice +61 2 9268 2000 www.sunrice.com.au

Szetu Enterprises Limited +677 30304 Producer of soft drinks and purified drinking water

Y Sato (Roviana) & Co +677 21620

16

INFRASTRUCTURE & TRANSPORT

Poised to seize powerInadequate infrastructure is arguably the most powerful brake on the nation’s economic development. Though the task is immense, several exciting initiatives are underway to address the situation.

It is hard to imagine a country anywhere in the world that is more challenging in terms of infrastructure provision than the Solomon Islands. The population of just over 500,000 is

scattered over hundreds of islands that are prone to very high rainfall and even earthquakes. However, donor agencies have identified infrastructure as a priority and progress is being made.

PowerThe Solomons is among the world’s most expensive countries for electricity. Naturally, this puts up the cost of doing business

and limits consumer access, with some estimates suggesting that only 20% of the Solomon Islands population has access to electricity supplied by the Solomon Islands Electricity Authority (SIEA). The capital, Honiara, has been prone to power cuts in recent years, with larger businesses relying on back-up generators. Further afield, major projects such as Guadalcanal Plains Palm Oil and the Gold Ridge Mine generate their own power. At an operational level, root and branch reform of the national electricity utility is a very positive step (see box below), while the

Improvements to state-owned water and power companies are set to make it easier to do business in the Solomons.

When the Asian Development Bank’s report, Finding Balance: Benchmarking the Performance of SOEs in Fiji, Marshall Islands, Samoa, Solomon Islands, and Tonga, stated that the Solomons’ state-owned enterprises were among the region’s most inefficient, no one was surprised. Although the study was based on the 2002-2008 period, the inadequacies of power and water supply in particular remained high on the list of impediments to doing business in the Solomons when the report was actually published in May 2011. And yet programs were underway to turn these key utilities around.

Both the Solomon Islands Electricity Authority (SIEA) and Solomon Islands Water Authority (SIWA) have suffered from similar problems, including poor management, inadequate infrastructure, illegal by-pass and bad debts, that have

combined to create a vicious circle. To compound matters, SIWA is SIEA’s largest client.

In response, the World Bank launched a project in early 2009 to reform SIEA in partnership with the Solomon Islands Government. Edith Bowles, the World Bank’s former Country Manager in the Solomons, reported to Business Advantage in late 2011 that SIEA had clearly turned the corner: ‘Collection of revenue is up, new systems are in place and training is being done. Overall, the picture is looking better in terms of SIEA keeping the lights on and fulfilling its basic function.’

A similar program has subsequently been launched by AusAID to rehabilitate SIWA. New management is in place and consumers are being cut off for not paying bills. This activity is being complemented by investment from Japan’s donor agency (JICA) in core infrastructure such as pumps and pipes.

Although progress in infrastructure is always slow, it seems like the vicious circle is at last changing into a virtuous one.

REVAMP TO LURE BUSINESS

A cruise liner tied up on Honiara’s Point Cruz Wharf.

17

‘Some estimates suggest that only 20% of the Solomon Islands population has access to electricity.’

INFRASTRUCTURE & TRANSPORT

The Solomons’ first major hydropower project would reduce fuel imports.

Like many Pacific countries, the Solomon Islands is dependent on imported fossil fuels for power generation.

This reliance, which places a S$420 million annual burden on the Solomon Islands Electricity Authority, is a serious impediment to widespread electrification and, consequently, economic development.

The September 2011 Pacific Infrastructure Performance Indicators study ranked the Solomons last among 12 Pacific territories for power generation per capita. In this context, the planned Tina River Hydropower Development Project is likely to be a major transformative project.

The project, still subject at the time of writing to Government approvals, would see the building of a 145 metre dam across the Tina River south west of Honiara and the construction of a 14 megawatt hydropower facility that could provide up to 50% of Guadalcanal’s power needs.

Since we first reported on the project in the last edition of Business Advantage Solomon Islands (February 2010), a two-stage European Investment Bank-funded feasibility study has been completed by Entura (the consulting arm of Hydro Tasmania in Australia).

Expressions of interest have also been sought for the completion of an environmental and social impact assessment.

Funding such a major project represents a challenge. Under the 2005 Honiara Club Agreement, the Solomon Islands Government voluntarily placed limits on its ability to borrow, meaning major projects such as Tina River must be funded

using a public-private partnership (PPP) model.

‘This is a hugely important project for the Solomon Islands,’ notes Marcos Vaena, Country Coordinator for the International Finance Corporation, which is advising the Solomons Government on structuring the PPP component of the project.

Vaena told Business Advantage he has been encouraged by early interest from potential developers. At the time of writing, a request for proposal was expected in the second quarter of 2012, with final bids for building the project due in early 2013.

If all goes according to plan, the Tina River hydropower facility could be operational as early as 2016, providing not only increased baseload power to the island of Guadalcanal but also a blueprint for hydropower projects elsewhere in the Solomons.

THE SOLOMONS' HYDROPOWER FUTURE

Tina River Hydropower Development Project could enable power to be generated onshore as opposed to importing expensive diesel (see box above). Other renewable forms of energy could potentially be used to provide electricity to the country’s rural population.

WaterThe situation in the area of water supply and sanitation is especially poor, with estimates suggesting 50% of water in Honiara is lost to leakage and another 20% to illegal tapping. This is the area where the Solomons fares worst in relation to the United Nations’ Millennium Development Goals. However, a program of reform and donor-funded infrastructure investment is underway in this area (see box 1).

Shipping & portsInternational shipping services, operated mainly by Swire Shipping, stop fairly regularly in the Solomons. The problem,

though, is with inter-island shipping, which is vital for social and economic development. This area has been deregulated but many domestic routes are not commercially viable. The advent in 2007 of domestic shipping services by Australian firm Silentworld Shipping and Logistics, which also operates a fast ferry between the two main urban centres of Honiara and Auki among its services, has improved the situation somewhat. The principal ports are in Honiara and Noro (Western Province), but existing infrastructure is considered inadequate to meet rising demand.

RoadsAlthough the Solomon Islands has a road network of almost 2000 km spread over 30 islands, only about one-fifth of the national population has access to land transport, mostly in Guadalcanal and Malaita Provinces. The Solomon Islands Road Improvement Project, led by the ADB and in partnership with the Solomon Islands Government, AusAID and the European Union, funds the construction, upgrading and rehabilitation of roads and bridges.> For aviation and airports see page 24 (tourism)> See also the feature on ICT on page 12

The feasibility study for the Tina River hydro project has involved extensive geological drilling.

Cre

dit:

Wor

ld B

ank

18

MINING

An industry bounces back

Mining in the Solomon Islands reached its nadir in May 2000, when its only gold mine, Gold Ridge on Guadalcanal, was closed due to civil unrest. The mine,

40 km south-west of the capital Honiara, was reportedly making up to 30% of the country’s GDP at the time. Following the return of social and economic stability to the islands from 2003, plans were made to re-open the mine. Its 2009 acquisition by London, Toronto and ASX-listed Allied Gold (which also operates the Simberi gold mine in neighbouring Papua New Guinea) and the recommencement of gold production in March 2011 are the clearest indications that the country’s minerals sector is well and truly back on its feet.

Gold Ridge opening dividendThe re-opening has had an immediate financial impact. The World Bank estimates Gold Ridge increased the Solomons’ GDP by 2% in 2011. Following its acquisition of Gold Ridge, Allied Gold announced an investment program worth US$155 million to expand the mine to a capacity of 110,000 ounces per annum, with current reserves which will see the open pit mine operate for at least 10 years. The $150 million construction and refurbishment was completed in March 2011 and all four mining pits will be fully operational during 2012. Exploration near the mine will pick up in 2012 and 2013.

Attractions for minersAt a business forum in Brisbane, Australia, in October 2011, an Allied Gold spokesperson noted the attractions of investing in a resources project in the Solomons: its proximity and ties to Australia and New Zealand, the social stability enabled by the Regional Assistance Mission to Solomon Islands (RAMSI), clear rules for miners, the support of international aid organisations, pre-existing mining experience and a supportive and welcoming Government and population.

Field grows widerAllied Gold is not the only company actively prospecting for gold in the Solomons. London-listed Solomon Gold is prospecting in five tenements on Guadalcanal close to Gold Ridge as part of a joint venture with the world’s largest gold producer, Newmont Mining. Testing and drilling are continuing after discoveries of gold, copper and silver. There are encouraging results from exploration activity on Fauro Island in the far north of the Solomons. Meanwhile, South Africa’s AngloGold Ashanti is exploring for gold and copper on New Georgia Island and Vangunu Island in partnership with Canadian exploration company XDM Resources. XDM is also prospecting on Vella Lavella and New Georgia under its own steam. Nickel is found in large quantities across Melanesia, and both Japan’s Sumitomo Metal Mining and Australia’s Axiom are currently looking at nickel projects in the Solomons.

While Solomon Islands lies in the mineral-rich Pacific Ring of Fire, its mining sector has yet to mirror the success of Papua New Guinea, the region’s minerals powerhouse. But the obstacles are being removed gradually.

Cre

dit:

Allie

d G

old

Gold is not the only mineral found in the Solomons: copper, nickel and silver are prevalent too

19

MINING

Sumitomo’s activities include exploration on Isabel Island and the smaller Choiseul Island. Sumitomo will invest an additional US$26 million in its nickel projects in 2012. Should they eventually go into production, they would involve not only nickel mining but also the construction of a 30,000 tonne per annum nickel ore processing facility. This would mean not only revenue for the Government and landowners, but also badly needed local jobs. Meanwhile, Axiom is examining what it describes as ‘world class’ nickel laterite deposits in two tenements on Isabel. The seas surrounding the Solomons also offer long-term potential for mineral extraction. Canada-based Nautilus Minerals, currently pioneering undersea mining in the Bismarck Sea in neighbouring Papua New Guinea, has 25 exploration tenements in the Solomon Sea, part of a portfolio that stretches across the Pacific.

An industry maturesGiven the increasing number of mining companies operating in the Solomons, focus has shifted to the enabling environment for mining. The Mining Act is set to be reviewed during 2012, with the World Bank supporting improved governance in the mining sector through review of policy and legislation.

Steps are also well advanced towards establishing a Solomon Islands Chamber of Mineral Development. ‘It’s a good time for the industry to establish itself,’ notes Marcos Vaena, Country Coordinator of the International Finance Corporation, which is facilitating the establishment of the Chamber. ‘The Government is supportive and it represents the maturity of an industry now looking at the Solomons in a serious way.’

Local skills and servicesWith several companies, such as Allied Gold, Nautilus and Newmont, having existing operations in neighbouring Papua New Guinea, it is no surprise to see the PNG Chamber of Mines and Petroleum advising on the Solomons Chamber. The Solomons mineral sector is already benefitting from the pool of experienced mining and mine services companies on its doorstep, both in Australia and PNG. The next step will be to encourage local skills and services. Marcos Vaena reports the IFC is in discussions with ExxonMobil to see if something like its PNG Enterprise Centre, which supports indigenous companies looking to provide services to its liquefied natural gas project, might be replicated in the Solomons. No matter how quickly it develops from here, it’s clear mining has come a long way since those dark days of May 2000 and is showing significant promise for the future.

The re-opening of Allied Gold’s Gold Ridge Mine in March 2011 was a major milestone for the Solomons

Cre

dit:

Allie

d G

old

Cre

dit:

Allie

d G

old

‘The country’s minerals sector is well and truly back on its feet.’

20

PRODUCTIVE SECTORS

The tropical advantage

‘A warm, tropical climate, good soils and reliable rainfall make the Solomon Islands an ideal place to produce a range of agricultural commodities.’

Agriculture and fishing provide the mainstay of the Solomon Islands economy, employing up to 75% of the workforce. Most of them work in subsistence agriculture.

A warm, tropical climate, good soils and reliable rainfall make the Solomon Islands an ideal place to produce a range of agricultural commodities. The major cash crops are palm oil, copra and cocoa. A small amount of coffee is produced, while studies are investigating the feasibility of cultivating rice on a large scale. While exports of cocoa and copra are on a fairly small scale, they have enjoyed strong growth in recent times partly because of higher international prices. The outlook for cocoa is positive thanks to an AusAID scheme to expand production, while a Taiwanese-backed scheme is trialling rice cultivation. Before the tensions, the engine room of the Solomons’ agricultural sector had been the Russell Islands Plantation Estates Limited (RIPEL), a 10,000-hectare plantation in Central Province. RIPEL’s production collapsed during the civil unrest and it remains out of action due to land and labour disputes, though reports suggest that the government is close to brokering a deal to restart operations. As things stand, the star of the local farm sector is undoubtedly palm oil (see box).

Onshore processing & manufacturingPalm oil aside, there is little onshore processing in the Solomons. Copra is generally exported as it stands rather than transformed into higher-value products such as coconut oil. Local manufacturers concentrate on import substitution, with companies such as Solomon Breweries, Szetu Enterprises (bottled drinks) and Solomon Islands Tobacco Limited (see box) producing for the local market.

The Solomons is looking to build on its natural advantages in agriculture and fisheries, principally its warm tropical climate, fertile soils and rich fishing grounds.

Solomon Breweries, which produces the SB and Solbrew brands, was acquired by Singapore-based Asia Pacific Breweries (for US$17.8 million) in 2011, after it completed a major expansion of its factory in 2008. Its new owners, who are responsible for brands such as Heineken and Tiger, intend to exploit regional synergies provided by their existing interests in PNG and New Caledonia: 'Solomon Breweries is a strategic fit to the APB Group as it expands our presence in the South Pacific sector of our regional network,' commented Chief Executive Officer Roland Pirmez at the time.

ForestryA steep decline in revenue from the Solomon Islands’ main export earner, timber, has been predicted for some time. Logging has been carried out at unsustainable levels for many years, and the resource is rapidly becoming depleted. While round log exports peaked at approximately 1.5 million cubic metres in 2008, the global financial crisis caused orders from key markets such as China, South Korea and Japan to dry up the following year as wholesalers slashed their inventories.By 2011, export volumes had bounced back but this recovery is expected to be short-lived.

21

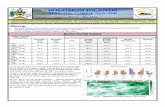

The star of Solomons agribusiness shines more brightly each year.

Guadalcanal Plains Palm Oil Limited (GPPOL) continues to expand at a healthy rate. The 6500-hectare plantation at Tetere, a 30-minute drive east of Honiara, was neglected during the tensions but revived in 2004 by the new owners, PNG-based New Britain Palm Oil Limited. Processed palm oil is shipped to the European Union, where it is primarily used by food and cosmetics producers.

Country Manager Roger Benzie told Business Advantage in late 2011 that the company was close to completing an upgrade of its mill, paving the way for expansion in the form of another 500 hectares in the Tetere area.

Looking further ahead, the company has also identified up to 5000 hectares east of Honiara that would potentially be conducive to palm oil planting. Though provisional discussions with landowners have been undertaken, the problem of road access to the area would need to be solved.

The company produced more than 28,000 tonnes of crude palm oil in 2010 as well as 3200 tonnes of premium palm kernel oil (see chart). The latter is used in soaps and confectionery. Its workforce is now around 1700, of whom 43% are women.

In March 2011, GPPOL emulated its parent company by achieving Roundtable on Sustainable Palm Oil (RSPO) certification, meaning all the palm oil it produces is accredited as high-quality, sustainable and traceable ‘from palm to plate’. In the context of environmental concerns about how palm oil is produced, this certification will add significant value to GPPOL’s production.

PRODUCTIVE SECTORS

NEW FLOW FOR PALM OIL

Cre

dit:

GPP

OL

Year Crude Palm Oil Palm kernel Oil

2006 5429 0

2007 17152 674

2008 21981 2744

2009 25123 3099

2010 28619 3206

2011 31592 3537

GPPOL Estate and Smallholder Annual Production by Year (Tonnes)

Business Advantage talks to one of the country’s largest manufacturers about business conditions in the sector.

Solomon Islands Tobacco (SITCO) is one of the largest and longest-established manufacturing companies in the Solomon Islands. A subsidiary of British American Tobacco, it operated in the Solomons for a decade before independence came in 1978.

According to General Manager George Panao, while upbeat economic conditions are good for business, they are leading to an increasingly severe skills shortage:

‘There is a lack of readily available talent in the Solomons, particularly in the technical area, meaning we’ve had some positions on the production floor that have been vacant for 12 months.’

As a result, the company is operating at close to capacity and carrying minimal buffer stock. Panao adds that SITCO

assists the Solomons Government to provide scholarships to disadvantaged students, but the Solomons lacks a fully fledged institute of higher education. Many students therefore attend the University of the South Pacific in Fiji.

The company is also upgrading staff facilities at its Honiara premises to help improve retention of existing employees.

To ensure a level playing field for local manufacturing, Panao urges the Solomon Islands Government to ensure adequate notice is given before making major changes in the regulatory framework:

‘Companies need time to comply with new regulations, otherwise they risk having to reduce or halt production altogether.’

He also highlights the difficulties of distributing consumer goods to one of the world’s most dispersed populations: ‘It is a major challenge to maintain consistent supply to the outer island provinces of the Solomons. We are working with various partners to improve our reach, as well as sending our own staff out regularly.’

MAKING IT IN THE SOLOMONS

SITCO’s General Manager, George Panao

22

Solomons acts to extract more value from lucrative fishing grounds.

With an exclusive economic zone that stretches over 1.5 million square kilometres, the Solomons’ fisheries sector should be capable of not only feeding the nation’s modest population but also generating substantial employment and much-needed foreign exchange. At times it has provided a mixed blessing, with the government required to prop up state-owned tuna processor Soltai (formerly Solomon Taiyo).

The outlook for the sector in 2012 is much healthier. In 2010, National Fisheries Developments (NFD), a subsidiary of major Singapore-based tuna wholesaler Tri Marine Group, acquired majority control of Soltai. Tri Marine’s Solomon Islands fishing fleet was already the main supplier to Soltai’s processing plant at Noro (Western Province) so the deal was an obvious fit.

The Noro plant turns out frozen loins, which are exported to the EU (via preferential trade access) for canning, and cans its own products for the local market.

The challenge for the Solomons is to try to maximise the value it extracts for its resource in a sustainable way, especially by adding as much value as possible on-shore. It is therefore encouraging to hear that South Korean firm Dong Won is in advanced stages of negotiation with the Solomons Government to build a cannery at Douma, on the main Guadalcanal Island. With Korean Government assistance, the plant would have a capacity of 300 tonnes per day, double that of Soltai. According to reports in the local media, NFD is considering building a loining plant at Malaita in the country’s east.

The Solomons fisheries sector cannot be regarded in isolation. The country is one of the Parties to the Nauru

Agreement (PNA), a grouping of eight Pacific island nations set up to control and manage their collective fishing grounds in Pacific waters that account for 30% of the world’s tuna stocks. Reducing the total volume of fish caught (particularly by so-called ‘distant fleets’ from outside the region that pay a licence fee to fish in Pacific waters) not only improves sustainability, but reduces global supply and pushes up the price.

The global price of tuna has plummeted in real terms over the past 20 years since the inception of the super-efficient (though not very environmentally friendly) purse seine fleets. One consequence of the advent of the purse seine in the Solomons was to undermine the commercial viability of the traditional ‘pole and line’ method of catching tuna. Happily, this is now being revived in the form of a scheme to sell certified ‘pole and line caught’ tuna, albeit at a premium, to ethically conscious consumers in the UK

HAULING IN TREASURE FROM THE SEA

PRODUCTIVE SECTORS

The fisheries sector is worth around SBD$100 million per annum.C

redi

t: Br

ad M

alyo

n

Opportunities to export to the Solomons

> Education and Training> Business services > Construction (private sector and donor related)> Food and Beverage> Industrial parts/maintenance> Infrastructure development, including ICT> Inputs for agribusiness, forestry, fisheries.

Austin Holmes, President of the Solomon Forest Association, expects ‘a sharp tail-off, possibly commencing as early as late 2012’, but adds that ‘ it is exaggerating to say that the sector’s output will ever drop to zero’. International buyers are increasingly demanding timber from sustainbale resources. The obvious long-term solution involves sustainably managed plantations, but these will take time to develop. There are two well-established plantations already in

commercial operation—Kolombangara Forest Products Limited (KFPL), on Kolombangara and Eagon in central New Georgia. Three smaller government-run plantations are also operating, on a smallholder model.

23

So Different !So Solomons,

Explore the hidden paradise of the South Pacifi c, an archipelagocomprising a vast group of 992 breathtaking tropical islands. Feel the spirit of adventure and enjoy your own special piece of paradise - dive, fi sh, surf, hike, kayak or simply relax and discover a culture with a welcoming smile.

FOR MORE INFORMATION CONTACT: Solomon Islands Visitors BureauPO Box 321, Mendana Avenue, Honiara, Solomon Islandscall (677) 22442 or email [email protected]

www.visitsolomons.com.sb

24

TOURISM

Paradise regained

The country’s tourism potential is unquestionable. The Solomons offers an unspoilt tropical setting as well as tourism assets such as WWII diving wrecks, rare endemic

flora and fauna and World Heritage-listed wilderness areas that make it a unique destination. It is considered one of the world’s best diving destinations despite receiving only 20,000 visitors a year (about half of whom come from Australia). However, if you ask a developer of major resorts what will make them consider entering a market, they’ll typically start to talk about infrastructure. Do potential sites have reliable electricity, water supply and telecommunications? How easy will it be for guests to get there and how easy to source essential supplies? This is surely why the Solomons does not have the major international resort it needs to establish itself as a mainstream destination. Away from the capital Honiara, infrastructure and transport services have tended to be unreliable where they exist at all. Thankfully, this situation is starting to improve.

Pacific Arts FestivalHoniara’s tourism sector is developing quite rapidly. The country’s first international standard hotel, the Heritage Park, opened in late 2009 and is enjoying high occupancy rates. Other Honiara hotels have made significant new investment, with the Kitano Mendana and Honiara hotels adding new wings to offer a higher standard of accommodation. New service providers are springing up as well, such as Extreme Adventures (see box on opposite page), and the capital is attracting an increasing number of regional meetings and conferences. In July 2012, Honiara will play host to the Pacific Arts Festival. This will be the largest regional event hosted in the Solomon Islands, with about 2500 performers, artists and cultural practitioners from 27 countries and territories in the Pacific region, plus thousands of visitors.

The tourism sector’s enormous potential remains largely untapped. Major improvements in national infrastructure and transport are providing a solid foundation for that to change.

But it is what lies outside the capital that draws superlatives from those few visitors who have the chance to discover it. One who is well-placed to assess its potential is General Manager of Westpac in the Solomons, Kutila Pinto: ‘The Solomons is gifted when it comes to the natural environment and yet the tourism sector is so under-developed. I believe it could potentially offer the best opportunity in the Pacific for the right operator to come in. A consolidated approach is required to promote the destination, though, from small operators through to the government. No single person or entity can do this alone.’

Phone towers expand tourismLeading the way is the Solomon Islands Visitors Bureau (SIVB), whose General Manager Michael Tokuru reports a recent spate of smaller eco-resorts sprouting around the country. Interestingly, he believes that the massive recent expansion in mobile phone coverage (see page 17) is at least partially responsible: ‘Once the telco firms install towers in a particular area, they open it up [to tourism],’ says Tokuru. This is a good example of major developments in the broader Solomons economy providing an enabling environment for tourism operators. Aviation provides another. National carrier Solomon Airlines was heavily in debt just five years ago and its services, both domestic and international, were expensive and unreliable. Under new management and, vitally, an independent board, the state-owned enterprise has quietly set about putting its house in order. Prices have come down and service has improved. A Dash 8 was leased to improve domestic services (to six domestic destinations and expanding) and its entire domestic fleet has just been refurbished.

Upgrade for airports On the international side, Solomon Airlines recently acquired an

Cre

dit:

Sol

omon

Isla

nds

Vis

itors

Bur

eau

25

TOURISM

Extreme Adventures is just the kind of foreign investment the tourism sector needs. Hopefully its success will encourage others to follow suit.

The company was established by Fiji-born Fred Douglas in 2010 to provide ‘fun things to do in the Solomon Islands’, namely game fishing, boat charters, scuba diving and snorkelling. It operates two modern, well-maintained vessels, and its conspicuous professionalism reflects Douglas’s many years of international experience in the industry.

With departures from the centre of Honiara, it is not just leisure visitors who jump on board. Most of the clients are longer-term expat residents or business visitors eager to leave the capital to cruise through the stunning Florida Islands, trek to the summit of a volcano or simply laze around on a tropical beach.

Although still a relatively small operation, the emergence of such a business is a positive sign for the industry. For all its natural beauty and tourism potential, the Solomons clearly needs more international standard product to substantially grow the industry, be it accommodation or activities. According to Douglas, this growth should play to

the country’s natural strengths and it should not try to imitate its neighbours:

‘The Solomon Islands is about adventure: wreck diving, snorkelling, swimming with dolphins and watching crocs slide down the bank.’

Douglas is already expanding his business, constructing a small marina at his base next to Heritage Park Hotel in Honiara and some accommodation units on an island in Central Province, a mere 40 minutes by boat.

Further information www.solomonadventures.com

NEW PLAYER DIVES INTO NATURAL PLAYGROUND

Airbus A320 to increase capacity. It currently operates four services per week on the core Honiara to Brisbane route on which it competes with Pacific Blue (two services a week), as part of an international network that also encompasses Fiji, Vanuatu and PNG. From March 2012, it expects to operate one service a week direct to Port Moresby in PNG and Nadi in Fiji. A government tender was recently issued to upgrade the main airport of Western Province at Munda, as well as the road from there to Noro, the shipping port. Home to the resort town of Gizo, Western Province is an obvious hub for future tourism development and it is hoped that Munda Airport will eventually be able to handle international flights. Meanwhile, the international terminal at Honiarahas been refurbished, financed by Japanese donor funds. More work is required to ensure the facility meets International standards. There have also been developments in sea access. In 2009, Australian-owned Silentworld Shipping (www.silentworld.com.au) launched a much-needed fast ferry service to Auki in Malaita Province, stopping at Tulagi Resort on the way. This operates daily and provides a comfortable and reliable service at a reasonable price. With the Pacific Islands experiencing major growth in cruise ships arrivals, the SIVB is also seeking to attract more vessels to the Solomons.

Cre

dit:

Sol

omon

Isla

nds

Vis

itors

Bur

eau

• Luxurious rooms and apartments

• All rooms overlooking the Ocean

• Conference facilities

• Bar & Restaurant

• Coffee Shop

• Night Club

• Gymnasium

H O N I A R A

Telephone: (677) 24007 Facsimilie: (677) 21001

WHEN ONLY THEBEST WILL DO

Email: [email protected]: www.heritageparkhotel.com.sb

P.O. Box 1598, Mendana Avenue, Honiara, Solomon Islands

Cre

dit:

Extr

eme

Adv

entu

res

26

BUSINESS TRAVEL GUIDE TO THE SOLOMON ISLANDS

VisasOne-month entry visas are granted on arrival to most nationalities. If you are unsure, check at the nearest Solomon Islands diplomatic mission. Your passport must be valid for at least six months later than your date of entry, and a return ticket is required.

International/ domestic flightsThe key Honiara-Brisbane route is well serviced by Solomon Airlines (www.flysolomons.com) and Pacific Blue (www.pacificblue.com.au). Between them they fly six days a week. Air Niugini (airniugini.com.pg) operates three weekly services between Papua New Guinea and the Solomons. Solomon Airlines also provides connections to Fiji and Vanuatu, while from March 2012 it is scheduled to fly once a week to Port Moresby. Domestically, it flies to about 20 locations around the dispersed archipelago. Honiara’s domestic terminal is located close to the international one.

Getting around HoniaraThe CBD, where corporate and government institutions are generally located, is known as Town. Fifteen minutes up the road, towards Henderson Airport, is the industrial area of Ranadi (pronounced Ran-andi). Chinatown is roughly halfway between the two. In Town, taxis are ubiquitous and cheap (although generally shabby) and can be hired by the hour for travel within Honiara. For other trips, including outside of Honiara, you should negotiate your fare before you leave. The trip to or from Henderson Airport (about 10 km from the centre of Honiara) costs S$100 (US$14). Your hotel can undertake your transfer for a similar fee, and will often be able to supply a superior vehicle.

Car hireEconomy Car rental (+677 27100) and Budget (+677 39082) are two options.

ClimateThe Solomon Islands has a warm and humid climate with coastal day temperatures averaging 28°C (82°F). The

period from May to November tends to be drier.

Time zoneThe Solomon Islands is 11 hours ahead of GMT.

Business etiquette‘Pacific time’ takes on a particular form in the Solomon Islands, where setting up business meetings is an informal affair. This can work both ways. The person you arrange to meet may not show up (so it is always best to re-confirm appointments). On the other hand, you can schedule meetings at short notice, and sometimes even just turn up without an appointment! Business attire is also informal—no need for jackets and ties.

CurrencyThe local currency is the Solomon Islands dollar, currency code SBD. (One US dollar was equivalent to SBD$7.12 in January 2012). There is an ATM and a bureau de change in the departures hall (into which you emerge upon clearing customs). There are several conspicuous ATMs around Honiara.

Business hoursBanking hours are 8.30am or 9am to 3pm, Monday to Friday. Commercial hours tend to be from 7.30am to noon and 1pm to 4pm, Monday to Friday, and also Saturday mornings. Government offices open from 8am to noon and from 1pm to 4.30pm, Monday to Friday.

ElectricityThe current in the Solomon Islands is 240V AC 50Hz using Australian-style plugs.

SafetyDespite the social unrest in its recent past, the Solomon Islands is relatively safe by most standards. It is safe to walk around Town during the day but the usual caution should be exercised after dark.

HealthMalaria is a problem, even in Honiara. Although many expat residents do not take anti-malarial medication, it is advisable. You should consult your doctor about two weeks before you travel. In any event, bring strong insect repellent and use liberally if outdoors at night. You should also ensure your immunisations against tetanus,

polio and hepatitis A and B are up to date. Comprehensive health cover is essential. Australian-based AustAsia Health (www.webbpacific.com.au) is a specialist provider of corporate healthcare services in the South Pacific.

CommunicationsIn Honiara at least, things have improved dramatically over the past five years.Mobile Phones: Roaming is now offered to customers of several major international carriers (best to check with your provider before departure). Alternatively you can easily buy a local SIM card on arrival. Internet: Our Telekom provides a wireless internet service at Honiara’s major hotels and other key sites (including the international airport terminal). Access via pre-paid cards is available from hotels/Our Telekom sales offices. Another option is via Our Telekom’s 3G network. A dongle to connect to your laptop can be obtained for around S$690, or you can access via a 3G phone (beware roaming charges if using a phone registered outside the Solomons).Media: The Solomon Star (www.solomonstarnews.com) and island Sun are the local daily newspapers. The Solomon Times Online (www.solomontimes.com) is the other main local news source.

AccommodationThe accommodation situation in Honiara has improved immensely with the opening of the Heritage Park Hotel (www.heritageparkhotel.com.sb) in 2009. Not only does it provide a genuinely international standard hotel (and long-stay apartments) but it has also raised the bar in terms of the local hotel market. Two other centrally located hotels are the Kitano Mendana ([email protected]—try to stay in the new wing while the older rooms are being renovated), and the Honiara Hotel. Other options a few minutes from Town are the Pacific Casino (the suites are good value) and the King Solomon (www.kingsolomonhotel.info).

Nonetheless, be aware that there is a shortage of both hotel rooms and long-term accommodation so book well in advance if possible.