Slow flexible fast inflexible waste efficient fragile robust.

Budgeting II. What is a Budget? A plan for spending and saving money Most people think budgets are:...

-

Upload

jeffery-lewis -

Category

Documents

-

view

217 -

download

2

Transcript of Budgeting II. What is a Budget? A plan for spending and saving money Most people think budgets are:...

What is a Budget?

• A plan for spending and saving money

• Most people think

budgets are:– Rigid and inflexible

– Painful – who wants to

eat Top Ramen every

night!

– No fun!

A budget takes the fun out of money – Mason Cooley

Why Budgets Make Sense

• Budgets help you:– Set priorities

– Achieve what’s

important to you

• A good budget is:– Realistic– Ongoing– Clear and easy to

use – NOT 12 pages!– Flexible – changes

as needs change

Budget Categories

• Income– Gross– Net

• Savings– Emergencies– Long-Term– Retirement– Short-Term

• Expenses– Fixed– Variable– Discretionary

Income: Money Earned

• Gross income: An individual’s income before taxes.

• Net income: Income after taxes are paid.

• Taxes can range from 15% to 31%.

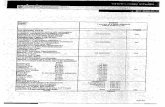

Taxes and Deductions

• First job pays $30,000/year. • Your salary is your gross income. Take off at least 25% for taxes

and other deductions. That’s what’s left for you to spend.• Example:

Gross salary = $30,000Minus 25% taxes and deductions - 7,500Net income $22,500

Why You Should Save

The best reason to save some of your income as you earn it is to provide for future needs, both expected and unexpected.

Can improve your standard of living

No matter how old you are, you will have financial goals

Why You Should Save

What works at 20 won’t necessarily work at 40

20’s – paying off student loans; trying to buy first house

70’s – goal may be trying to make sure your retirement funds last your lifetime

Expenses

• Expense: A cost to meet a need or pay a debt

• Types of expenses– Fixed– Variable– Discretionary

Fixed Expenses

A cost that occurs regularly and doesn’t vary in amount

– Rent

– Mortgage

– Car payment

– Insurance premium

– School loans

– Others?

Variable Expenses

A cost that occurs regularly but may vary in amount:

– Electricity

– Water and Garbage

– Telephone

– Gasoline

– Groceries

– Others?

Ways to Reduce your Grocery Bill•Make a shopping list

•Study grocery ads

•Use coupons

Buy store-brand products

Avoid impulse purchases

Learn the basic prices of your favorite foods.

Discretionary Expenses

A cost determined by personal wants that may be controlled

– Movies, videos, CDs

– Sports

– Eating out

– Grooming and clothes

– Concerts and plays

– Vacations

– Others?

Budget Summary

• Establish a budget:

– Income

– Savings

– Expenses

• Fixed

• Variable

• Discretionary

• End up with a budget

surplus and you’re a

success!

Financial Security

Amount of money you save will vary

according to several factors:

1. Discretionary Income – what you have left over after you have paid your bills

2. Importance you attach to savings

3. Anticipated needs and wants

4. Will power to restrict present spending

Balance Your Budget

3 R’s reality / responsibility / restraint

1) Determine surplus/deficit

2) Evaluate Budget – ways to reduce budget (increase income, coupons, luxuries) – spend less

3) Understand advertising influence – evaluate information