Br impact of_waiting_time1

-

Upload

abdelhamid-ragab -

Category

Economy & Finance

-

view

45 -

download

0

Transcript of Br impact of_waiting_time1

Page 2

IntroductionIntroduction

As a result of the privatization and the emergence of private banks, investment and the intensity of competition between the Banks. Was the public banks and state-owned banks be cautious of leakage customers to foreign banks or investment performed well

The loss of many investment opportunities or the profits of many of these banks not satisfying the customers and solving this problems. It is also the result of the social responsibility of these banks and acting as some of the activities of the government, such as pension and payment of salaries

In this study we have the main problem is increasing of waiting for the customers of banks Egyptian public.

We are trying to explore through the presence of a practical customer service NBE What are the reasons that lead to a strong increase in the bank waiting for customers

Page 3

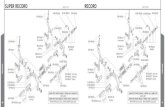

Conceptual FrameworkConceptual Framework

The high rate of customer waiting

E BANKING SERVICES

SPREAD ATM SERVICES

Service process design

Financial illiteracy

Social responsibility

Page 4

Financial literacyFinancial literacy

Financial literacy is defined

set of financial skills that informs decisions, affects behavior and ultimately leads to financial security over the life course.

The need for financial literacy.

Having low level financial skills and knowledge causes making wrong decisions that harm both individuals and societies.

introduce knowledge as the key factor in any organization that leads to a sustainable competitive advantage for Success.

Page 5

Service process designService process design

Service Process design definition.

Activity of planning and organizing people, infrastructure, communication and material components of a service in order to improve its quality and the interaction between service provider and customers.

Does negative perception of waiting environment effect waiting time?

Answer is yes.

Perception of the waiting time it’s moderating variable.

Page 6

Service process designService process design

1- Perception of the waiting time.

2- waiting environments.

A major concern for service managers is to counter act negative effects of waiting.

By the following:

Two elements of the waiting environment were distinguished:

1-The attractiveness of the waiting room

2-The presence of television (TV) as an explicit distracter.

Page 7

Social responsibilitySocial responsibility

Question?:

Is social responsibility has un effect on the waiting time of the customers in the bank?

Definition of social responsibility of business:

The obligation of an organization's management towards the welfare and interests of the society in which it operates.

Page 8

Social responsibilitySocial responsibility

Literature review.

Out come: Social responsibilities with the literal meaning of the term have no effect on the waiting time itself.

Discovering two variables from the literature review:1-Operational decision2- Segmentations, Targeting, positioning

• Exploring the new variables

Page 9

E-BankingE-Banking

Definition

Internet banking is where a customer can access his or her bank account via the Internet using personal computer (PC) or mobile phone and web-browser

E-BankingE-Banking

Page 10

E-BankingE-Banking

B. Bank customers can perform transactional banking tasks through online banking, including:

Funds transfers between the customer's linked accounts

Bill payments and wire transfers

Loan application and repayments

Buying investment products

Management of multiple users having varying levels of authority

Transaction approval process

Page 11

E-BankingE-Banking

Advantage of internet Banking

A. Convenience

B. No Lines& reduce waiting time

C. Availability

D. Innovation

E. Cost saving

Disadvantages of Internet banking

A.Banking relationship

B.Security matters

C.Education Level an internet access limited

Page 12

ATMATM

is an electronic telecommunications device that enables the clients of a financial institution to perform financial transactions without the need for a cashier, human clerk or bank teller.Know as “ATM , cash machine.

• Type of cards can be used at an ATM - ATM cards/debit & credit cards. - Prepaid cards.

• Growth of ATMs in the global market.

Page 13

ATMs services/facilities

Account information Cash Deposit.

Regular bills payment.

Purchase of Re-load Vouchers for Mobiles.

Mini/Short Statement.

Loan account enquiry.

Pension for retirees.

Salaries & bones for employee.

Page 15

Questions

Is social responsibility has an effect on the waiting time of customers in bank?

Does financial literacy affect on the increase of rate of waiting in Egyptian public banks?

To what extent does electronic banking affecting on waiting in customer services?

To what extent does spread ATM and valid it services affect in waiting in customer services?

Page 16

Data collection

Sampling

The sampling procedure that was adopted in this study for data collection was a convenience sampling method through questionnaire survey with a pre-planned sample size of 100 respondents. The target sample in this study was experienced Internet banking users. The questionnaire survey was distributed in NBE , which is the most populous,

. Overall, from the total of 100 questionnaires distributed during a one month data collection period, there were only 82 valid questionnaires received that could be used for further analysis

.

Page 17

Data collection

Preliminary Data

We will use the survey work for Customers

this survey about customer perception about waiting time and how to solve this problems.

100 customers were interviewed about their opinion to the high rate of customer waiting lounge Bank

And found the following:

70 of them aged 41-65 want to deal within the bank and do not prefer to use the automated teller machine and do not have any knowledge of how to use it.

The literacy rate of 50% qualified and 20% average uneducated and 30% qualified high

Page 18

Data collection

30 of them Age 18-40 70% the proportion of education qualification and 30% on average qualified

They want to deal via the internet and through automated teller machine and do not prefer to deal within the bank.

t also was their opinion of how to solve this problemMost clients believe that the work procedures and the lack of specialization and stop the system and the limited number of staff and the lack of proliferation of automated teller machines in cities and centers leads to the existence of a large number of customers waiting hall and thus affect the high rate of wait.

Page 19

Data collection

Interviews for employees

He has also been the work of a personal interview to 100 employees to find out what are the reasons that lead to the increased rate of bank customers waiting

80 of them said that the main reason first:

Work procedures and rules

Second, the lack of a culture of bank customers'

Third, the lack of electronic banking services

20 of them agreed that as a result of the social role played by the bank is the main reason for this problem