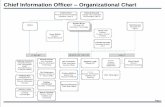

Harry Fleming Chief Financial Officer Kenneth Efird Chief Operations Officer 1.

BP’s Office of the Chief Technology Officer (A)

Transcript of BP’s Office of the Chief Technology Officer (A)

©2015 by the Kellogg School of Management at Northwestern University. This case was prepared by Professor Robert C. Wolcott and Research Fellow Michael J. Lippitz. Cases are developed solely as the basis for class discussion. Cases are not intended to serve as endorsements, sources of primary data, or illustrations of effective or ineffective management. To order copies or request permission to reproduce materials, call 800-545-7685 (or 617-783-7600 outside the United States or Canada) or e-mail [email protected]. No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means—electronic, mechanical, photocopying, recording, or otherwise—without the permission of Kellogg Case Publishing.

REVISED FEBRUARY 4, 2015

ROBERT C. WOLCOTT AND MICHAEL J. LIPPITZ KEL366

BP’s Office of the Chief Technology Officer (A): Driving Open Innovation through an Advocate Team

In early 2006 Phiroz “Daru” Darukhanavala, BP’s VP and chief technology officer (CTO) for Digital and Communications Technology (DCT), could look back with pride on six years of considerable value created for BP. With minimal resources, his office had introduced leading-edge information technologies to a range of BP’s businesses worldwide. Darukhanavala had built his organization from scratch into a lean, flexible team of fifteen professionals. Their efforts had returned hundreds of millions of dollars of value to BP.

Even so, the team had been challenged to do more and become even better. The chief information officer’s (CIO) DCT Advisory Group reviewed the CTO office’s progress at one of its semi-annual meetings. They concluded that it was the best organization of its type they had seen. However, reflecting BP’s strong performance culture where even the best performing groups were continually challenged to do better, they sought to raise the bar. The CTO office had earned credibility through success. Its model was working. But could they find ways to add more value?

How should the CTO’s office respond to the DCT Advisory Group’s challenge? Should it scale up its efforts, hire more people and raise a larger budget? Alternatively, had their innovation advocacy model reached the boundaries beyond which scale might compromise performance? Did the group’s modest size keep it creative and nimble? If remaining small was important, what new methods and approaches might help the team add more value for BP?

As Darukhanavala looked out his office window across the western suburbs of Chicago, east toward BP’s London headquarters, he wondered how his team should best evolve to meet the needs of one of the largest companies in history.

The Global Integrated Oil Industry and its Recent Consolidation

The oil industry is dominated by large, vertically integrated companies. These companies search for oil and natural gas and drill wells to bring it to the surface in quantity (“upstream operations”), and then refine and market a variety of petrochemical products (“downstream operations”). Competitiveness in upstream operations depends on various technologies that increase the productivity of exploration and extraction, as well as concomitant skills in investment risk management (given the high capital costs and uncertainties associated with these

For the exclusive use of U. Business School, .

This document is authorized for use only by UniSA Business School in .

BP’S OFFICE OF THE CHIEF TECHNOLOGY OFFICER (A) KEL366

2 KELLOGG SCHOOL OF MANAGEMENT

activities). Competitiveness in refining depends on industrial efficiency and competitiveness in marketing those products depends on quality and service differentiation (since commodity markets set the prices of the underlying raw materials).

Regardless of operational efficiencies, an oil company’s fortunes depend on the prices of oil and natural gas, which can change dramatically due to political events, regulatory moves, and macroeconomic shocks. The lead time for oil and gas production is typically one to five years; adding refinery capacity takes even longer. Consumer behaviors also change slowly in response to changing oil prices. Taken together, the price of oil experiences significant volatility—from about thirty dollars per barrel in 1990 to less than twelve dollars per barrel in 1998, then back above thirty dollars per barrel in 2002. Volatility and the long payback period make investment decisions quite challenging. The profitability of a given oil well depends on the average price of oil during the period of its operation which often differs substantially from the price when investment decisions are made.

As oil prices dropped in the late 1990s, oil companies faced intense pressure to provide a return on investment comparable to other industries. With prices low and expected to stay low, there was little to be gained in the near term from increasing production, and the possibilities for doing so were limited. (Most of the readily available, easily located and transported reserves were being exploited.) The only apparent paths to significant profit growth were to achieve substantial new efficiencies in overhead costs and reach a larger and more diverse group of end consumers. Hence, the late 1990s saw a consolidation of the integrated oil industry, characterized by mega-mergers and acquisitions intended to provide cost savings, add proven reserves, and increase financial strength and flexibility.1

BP was a leader in this respect, acquiring Amoco in 1998 and Atlantic Richfield Company (ARCO) in 1999. These mergers, among others, brought BP from about $36 billion in annual revenues in 1997 to more than $160 billion in 2000. At the time of acquisition, Amoco was the fifth largest U.S. oil company. The merged company became the third largest publicly traded company worldwide. The Amoco merger was projected to create more than $2 billion in synergies from cutting jobs, higher-value exploration, and business process and procurement rationalization and streamlining. It was anticipated that the combined firm’s revenues, scope, and diversity would enable it to finance more development projects internally, win more reserve auctions, improve its financial risk management, and generally learn and innovate more effectively. The deal closed on December 31, 1998. On April 1, 1999, BP announced that it was acquiring ARCO with intent to generate an additional $1 billion in cost savings. ARCO had revenues of $13 billion in 1999. The combined company would become the world’s largest public oil producer.2 The deal was approved by the Federal Trade Commission on April 13, 2000. Smaller deals followed: Burmah Castrol (a lubricant business) for $5 billion in July 2000 and Veba Oel of Germany in 2002 for $4 billion. BP also made large joint venture investments in several countries, including more than $8 billion in Russia’s Tyumen Oil Company (TNK). (Overall BP revenues by business segment appear in Exhibit 1.)

Other companies followed the same path. On December 1, 1998, Exxon announced a merger with Mobil, forming a company with $232 billion in revenues and generating cost savings of $2.5 billion. Chevron purchased Texaco in October 2001 to form the world’s fourth largest oil

1 Paul Stonham, “BP Amoco: Integrating Competitive and Financial Strategy. Part One: Strategic Planning in the Oil Industry,” European Management Journal 18, no. 4 (August 2000): 413–14. 2 Ibid., 418.

For the exclusive use of U. Business School, .

This document is authorized for use only by UniSA Business School in .

KEL366 BP’S OFFICE OF THE CHIEF TECHNOLOGY OFFICER (A)

KELLOGG SCHOOL OF MANAGEMENT 3

company. Total merged with PetroFina in 1999 and acquired Elf Aquitaine in 2000 to form a company with $108 billion in 2000 revenues. Along with Shell, the end result was a group of five “supermajors.” These firms achieved higher market valuations than their smaller competitors, most likely due to their larger reserves, exploration portfolio, and financial base.3

BP’s Office of the Chief Technology Officer

By 2001 BP consisted of 130 business units with about 100,000 employees in more than 100 countries.4 (Exhibit 2 and Exhibit 3 summarize BP’s global presence and its major business areas.) To encourage flexibility in such a large enterprise, business units enjoyed significant independence. Each business unit leader negotiated an annual performance contract for cash flow, net income, and various other targets. Performance to these contracts greatly impacted an executive’s compensation and career prospects. Managers of related business units would be brought together to critique each other’s performance, with the top quartile of performers made responsible for improving the bottom quartile. Indeed, one of the key expected benefits of BP’s size and scope was the possibility for significant learning across business units, what BP’s CEO, Lord Browne of Madingley, called “intellectual economies of scale.”

To capture synergies from the mergers, Lord Browne turned to his CIO, John Leggate, and Leggate’s right-hand man, Darukhanavala, then VP of IT Integration and known to everyone as “Daru.” Leggate had become CIO in January 1999 just after the Amoco deal. His background was not IT management—his previous position at BP had been president of BP’s Azerbaijan operations and prior to BP he built nuclear power plants—but he had a reputation for understanding and driving technology-based efficiency. Daru had been with BP for many years, serving in a variety of roles in almost every part of the business.

During the mergers, Leggate and Daru were single-minded to cost cutting. For instance, nearly half a billion of the planned $2 billion in expected merger-related savings from the Amoco deal were intended to come from IT integration. Through job and program cuts and extensive outsourcing, they succeeded in that task in less than a year. For instance, BP was using ten thousand software applications in 1999. By 2000, three thousand had been discarded and five thousand outsourced.

While streamlining BP was important, Browne’s vision was broader. He saw IT “not just as a service function but as an activity which could change the nature of the business itself.” His close Silicon Valley connections—he sat on the boards of Stanford University and Intel—left him constantly concerned that work on near-term cost efficiencies not crowd out the long-term need to innovate. Concurrent with cutting half a billion dollars in IT costs during the Amoco merger, BP had invested $250 million to issue laptops to a majority of BP’s employees, configured to be part of a worldwide, networked common operating environment. Daru understood that in most of BP’s businesses, technology cycle times were five to ten years and existing suppliers generated most of the innovations. In IT, cycle times were much shorter, in some cases only a year or so. Moreover, the most important innovations came from outside the petroleum industry. Could BP move fast enough to lead in this environment? Could it behave like a high-tech company?

3 Ibid., 414. 4 Unless otherwise noted, quotes in this section are drawn from Susannah Patton, “In Sync with His CEO,” CIO, April 15, 2004.

For the exclusive use of U. Business School, .

This document is authorized for use only by UniSA Business School in .

BP’S OFFICE OF THE CHIEF TECHNOLOGY OFFICER (A) KEL366

4 KELLOGG SCHOOL OF MANAGEMENT

Formation

Daru was asked to design an organization to exploit digital innovation within BP’s operating businesses, “starting from a clean sheet of paper.”5 He would lead in his newly created role as CTO for Digital and Communications Technology. After considering many models and meeting with IT leaders and top venture capitalists (VCs) to explore alternatives, he concluded that a large internal organization dedicated to developing new IT-based capabilities would be too slow and prone to ossifying around a few selected projects. It would also create the wrong culture. On the other hand, the mainstream IT groups at BP needed to “keep their heads down” and maintain the company’s applications, networks, datacenters, and backbones.6 The innovation group needed to be more flexible and creative.

The VC model intrigued him. These were small organizations, though nevertheless well informed. They could orchestrate small teams and move very nimbly. A team of this type would be consistent with BP’s organization and culture. The model for his CTO office could not be “we know everything” but rather “we know where to go to find solutions.” Over time, Daru concluded the basic principle for the CTO office: a small, technically strong team well-informed about BP business unit needs and highly networked with external companies and experts across the global IT ecosystem. The basic operating motif would be to bring in new digital technology from the outside to improve the company’s operations and performance in areas beyond the traditional IT domains of transaction processing and enterprise resource planning.

In addition to a small team, Daru requested a modest budget—about $10 million out of BP’s $2.5 billion IT budget—and no formal authority. He reasoned that a central group with a large budget would, in BP’s culture, foster resistance and become disconnected from the business units. Having limited resources would require that business units fund most projects, helping to ensure the group’s activities made business sense. Daru negotiated a performance contract for the group that considered not the number of technologies investigated, but only those actually adopted by business units. In such an environment, no one in his team could be sidetracked by research-type activities with little potential business benefit. They had to deliver value and they had to do it through persuading business people with profit and loss responsibilities.

Daru founded the CTO office with six professionals. The team was highly selective in hiring; only one out of every ten or more serious candidates received an offer. It sometimes took the better part of a year to make a hire. He wanted people with a strong background in IT technologies, but not in-depth expertise in any one. These people were not expected to be the sources of new technology. Rather, they would need to be able to interact with the broad IT ecosystem, develop an overview of a given area, and quickly understand tradeoffs among the available options. He also wanted most of his people to have experience in a business area of BP, for example, exploration, oil and gas production, refining, or retail marketing. Ideally, he wanted at least one person from each major BP business area. About a quarter of the team would be outside hires: bright people in an IT field with at least twenty years of significant experience. They would learn the oil business at BP.

By 2002 the team had grown to about a dozen people, and remained approximately that size through the end of 2005. Daru felt this was the right size. Fewer would be insufficient to generate

5 The remainder of this case is based on interviews by the authors with Phiroz P. Darukhanavala and his team members on July 9, 2007, as well as follow-up conversations and documentation provided by BP. 6 Each business segment had its own IT head who reported into the business segment.

For the exclusive use of U. Business School, .

This document is authorized for use only by UniSA Business School in .

KEL366 BP’S OFFICE OF THE CHIEF TECHNOLOGY OFFICER (A)

KELLOGG SCHOOL OF MANAGEMENT 5

and manage a critical mass of projects; more would require too much administration and coordination. The team was flat in structure. People were self-starters or they did not last, though they received significant peer support. No one could know everything in a field this broad, so everyone depended on everyone else and knew what everyone else was doing through informal, person-to-person interactions. Any given project had a single lead, but would typically have a handful of others making contributions. Those with experience in a particular business often acted as “door openers” for a colleague with a relevant idea. Every week, the team had a three-hour conference call during which everyone assessed program status and resolved project challenges. (The team was distributed in Houston, Chicago, and London and gathered in one place only two or three times per year for all-team meetings.)

Daru characterized his team as “orchestra conductors,” coordinating hundreds of companies in the external IT ecosystem toward addressing BP business unit needs through facilitation and communication. Small, entrepreneurial firms and massive global enterprises did not generally interact well. The CTO office mitigated this by acting as matchmakers, coaches, and translators, having already performed due diligence on the small firms’ competence and relevance for BP’s business units. Internally, they teamed with mainstream IT, BP technology groups, and business unit leadership. With digital and communications technology infusing more and more business processes and products—not just in the oil industry but worldwide—the lines between these groups were blurring. The CTO office helped these groups understand where particular emerging technologies might fit among the range of options. In addition, much of the CTO office’s work, in the spirit of Lord Browne’s initial vision of “intellectual economies of scale,” had been to facilitate learning across the company, using knowledge of common issues to connect people who might otherwise not connect.

Building the Networks; Filling the Pipeline: 2000–2001

The early years of the CTO office were characterized by experimentation and learning, as it defined its roles and processes in connecting the external IT ecosystem with internal BP business unit needs. The team initiated relationships with IT suppliers, research firms, consultants, academics, VCs, government agencies, industry groups, and major customers. The office paid special attention to engaging senior BP leadership through a variety of in-house invented programs, such as so-called “Blue Chalk” events, discussed below. (For the first few years, the CTO office engaged in technology “roadmapping” and other planning exercises, as well as consulting projects for business units. These were eventually moved to other groups to focus on network building and project execution.)

INTELLIGENT “PUSH”

Relationship-building with the ecosystem was critical, as the CTO office could not drive IT-based innovation without knowing the IT industry pipeline. The group had to be current so they could feed fresh ideas to business units. By networking with VCs and suppliers, they could identify emerging technology trends industry-wide.

The CTO office discovered that these external players were typically happy to engage with BP, as the company provided a “real world” opportunity for vendors to apply their products and build relationships with BP’s internal experts. The team also acted as translators between external parties and BP’s units.

For the exclusive use of U. Business School, .

This document is authorized for use only by UniSA Business School in .

BP’S OFFICE OF THE CHIEF TECHNOLOGY OFFICER (A) KEL366

6 KELLOGG SCHOOL OF MANAGEMENT

At the same time, the CTO office was committed to doing more than just “pushing” technology solutions to business units. Rather, the CTO office engaged in what might be called “intelligent push”—not just connecting business units with emerging technologies, but also articulating the value proposition for BP and demonstrating what the technology could contribute. Validating a technology in a business application was one of the team’s critical value added services. Focusing from the start on articulating real business value helped build the group’s positive reputation.

Generally, projects would begin by identifying an emerging technology that met a business challenge and discussing it with relevant BP management. The CTO office would then scan its network for relevant offerings, focusing on likely vendors (sometimes, though not always, through a formal request for information process). If a technology looked promising, they would recommend a small trial—perhaps $50,000 including management time—with a narrow scope and well-defined objectives. If the technology generally delivered what the vendors promised, then a larger scale demonstration might be recommended as part of an overall rollout strategy. Responsibility for any rollout would transition to the business unit, with the CTO office providing facilitation where necessary. The expectation was that full implementation of the technology would be supported by the business unit’s budget.

Many of the early projects were opportunistic, based on particular insights of CTO staff or BP executives. Initial conversations with high-level executives at Intel to explore common interests evolved into a “game-changing” program that, among other things, lowered costs and increased performance by using new Intel-based servers running Linux in place of proprietary Unix servers. Regardless of the project, however, the CTO team built a reputation for being willing to iterate and endure where others abandoned ideas as soon as significant problems arose. What mattered was deploying successful projects and that often depended on perseverance.

BLUE CHALKS

In the course of their early networking efforts, Leggate and Daru met with Scott McNealy, CEO of Sun Microsystems. Sitting at the Blue Chalk Café in Palo Alto, California, they discussed how to engage senior management in innovation beyond day-to-day cost reduction. McNealy suggested exposing senior business leadership to emerging technologies in a business-focused manner. At that time, with the dotcom boom at its peak, managers in just about every organization felt they needed to know something about the subject. It was not difficult to obtain participation.

The original Blue Chalk events (named after the café) featured suppliers delivering many of the presentations. These would be either new technologies worth BP’s investigation or existing technologies from which BP could benefit in new ways such as streamlining and modernizing complex systems following mergers. Sometimes, a vendor exhibition space would be set up. As events evolved, external business practitioners and academic experts came to dominate the presentations. They came to emphasize external case studies, as the CTO office found that real life stories more effectively engaged BP’s management.

Each Blue Chalk event focused on a specific theme to generate business unit interest. The CTO office tried to have at least one group vice president level co-sponsor (a very senior title at BP), who then invited key team members. A handful of top IT people were also typically invited to provide the technologist’s perspective. The general pattern was to have a speaker for an hour followed by an hour discussion. The room was set up with eight select people seated at each table, with total participation of fifty to eighty people. The first day presented the landscape

For the exclusive use of U. Business School, .

This document is authorized for use only by UniSA Business School in .

KEL366 BP’S OFFICE OF THE CHIEF TECHNOLOGY OFFICER (A)

KELLOGG SCHOOL OF MANAGEMENT 7

relevant to the theme, followed by case examples and expert perspectives. The second day focused on engaging the participants in the exploration of specific topics and opportunities for BP based on the first day’s discussions.

As Brian Ralphs, organizer of some Blue Chalks noted, “Unlike other BP events which are solution-oriented, Blue Chalks are an inquiry aimed at opening people’s minds, pulling them out of the ‘comfort zone’ to envision what might be possible.” It was a seeding process for new ideas that BP hoped to promulgate with business units. It also provided a forum for seeking management alignment around a particular topic by exposing multiple external viewpoints or approaches. Exhibit 4 lists Blue Chalk topics since 2000. The frequency of Blue Chalk events decreased as the CTO office became established, but remained a core element of the arsenal.

Building the Brand, 2002–2005

By 2002 the CTO office reached the size it would remain through late 2005. As awareness across BP grew, the group’s efforts become more coherent. The team initiated annual “game changer” initiatives: innovative programs with significant transformative potential and at least $50 million to $100 million of expected bottom line impact. Game changers grew to represent a significant portion of the CTO office’s efforts and a collaboration focal point. The CTO office also instituted a formal technology transfer process and facilitated a high-level technical advisory board for the CIO which offered regular top executive awareness and insight.

GAME CHANGERS

Each year, the CTO team worked collectively to select and execute one major program organized around a related group of technologies believed to offer significant business impact, but still one to two years from mainstream application. In 2002 Daru initiated a three-hour weekly conference call to manage that year’s game changer project, as well as socialize ideas for the following year. The weekly call served as the primary coordination mechanism for each year’s focal program.

Often, the game changer topic for a given year becomes obvious as the CTO team contemplated their various projects. Blue Chalk events were frequently the source of game changers. Indeed, the April 2002 event launched the first game changer, Global Outsourcing. At other times, game changers arose from CTO team brainstorming sessions during which they considered which emerging technologies could lead to significant, quantifiable cost savings or revenue enhancements.

The stages for game changers were as follows: (1) ideation and evangelization; (2) pilots and scale up; and (3) transition to business units. Each stage tended to last about one year, generally meaning three game changers ran concurrently. One was just beginning to be socialized with targeted business units, while another was being proven and the most mature was transitioning to full rollout. During the ideation and evangelization stage, the CTO staff undertook a complete market analysis, looking at every entity they could identify involved in the technology. They talked to end users, located executives at other companies willing to discuss the benefits and costs of implementation and visited technology providers and research groups. The office then conducted “proof of concept” tests with the business to ascertain whether the technology could be expected to achieve the value propositions hypothesized for BP. During this period, CTO’s team socialized the idea, offering managers the opportunity to ruminate on the concept for a few months.

For the exclusive use of U. Business School, .

This document is authorized for use only by UniSA Business School in .

BP’S OFFICE OF THE CHIEF TECHNOLOGY OFFICER (A) KEL366

8 KELLOGG SCHOOL OF MANAGEMENT

The CTO game changers from 2002 to 2007 are depicted in Exhibit 5. The 2004 Sensory Network game changer coalesced during the April 2003 Blue Chalk event. Ken Douglas, technology director, described it as focusing on the questions: “What could the combination of radio frequency identification (RFID), low-cost sensors, wireless networks, and mobile devices enable for various business units? Could it work as if each asset had a person standing next to it reporting on its condition in real time?” They were interested in a variety of areas such as machine health monitoring, mobile workforce issues, and asset tracking. Casting its net widely, the team developed a dozen key project opportunities that would test all the major technologies and involve all of the business segments. Despite the avant garde nature of the projects, all were pursued to a successful outcome except one. BP’s leading-edge work was widely lauded in the business and IT press as ahead of the adoption curve.

CTO’s work with “mote technology” illustrates the team’s cutting edge yet pragmatic activity. When small wireless sensors called motes were still mainly in university labs rather than commercial products, CTO recognized their potential to solve a range of machinery monitoring problems typical of refineries and production platforms. They mobilized industry partners and spearheaded development of a new mote-based wireless measurement platform that cut the cost of installing sensors by an order of magnitude. “The new wireless technology enabled us to do things we simply could not do before, either because of cost or physical wiring obstacles,” said CTO technology consultant David Lafferty. “The new system makes possible greater use of instrumentation, increased refinery availability, and reduced costs of unplanned maintenance.”

Another sensory networks project used RFID technology to develop the Location Aware Safety System (LASS), the world’s first wireless system to capture real-time location of people at a dense metal industrial site. Technology director Curt Smith pointed to future benefits as well: “The system can be extended to offer additional capabilities such as tracking the location of assets or warning workers in dangerous areas of protective equipment they need.”

The mobile workforce concept gained traction as the team delivered its sensory networks briefing around BP and through these conversations evolved into a game changer. CTO staff refined the concepts and built business propositions around mobile workforce productivity improvements analogous to in-office automation programs implemented at BP over the prior several years. In the field, many workers still relied on clipboards. Some of the more advanced field workers used handheld devices to capture data, but even then the data would be carried to an office for downloading and processing. The CTO team wondered whether capabilities such as real-time analytics and response could be brought to the mobile environment and, if so, what would be the quantifiable business benefits?

Their turnaround task tracking initiative demonstrated how this game changer could create value. BP refineries periodically underwent major overhauls called turnarounds in which equipment was shut down for testing and maintenance—a process that could involve thousands of interdependent tasks. The CTO team worked with refinery management and technology suppliers to develop a mobile application that automated the paper scheduling and completion process in real time, streamlining the workflow, reducing shutdown time, saving money, increasing revenue, and enhancing safety.

TECHNOLOGY TRANSFER PROCESS

Outside of game changers, the process of finding, filtering, refining, and delivering solutions was also given more structure between 2002 and 2005. They modeled the technology transfer

For the exclusive use of U. Business School, .

This document is authorized for use only by UniSA Business School in .

KEL366 BP’S OFFICE OF THE CHIEF TECHNOLOGY OFFICER (A)

KELLOGG SCHOOL OF MANAGEMENT 9

process on VCs’ approaches to setting priorities among the thousand or so proposals they received each year.

The CTO office would discuss BP’s requirements with its ever-expanding ecosystem of collaborative relationships, mostly within the United States but increasingly worldwide. Relevance to BP was the first filter for transfer. The CTO team found over time that the most efficient process was to first meet with VCs to provide them with information on the most pressing BP business unit challenges. The VCs then selected potentially relevant technologies from their portfolios. The CTO office held these meeting semiannually with eight or more firms. VCs typically returned, collectively, with a hundred or so ideas. They presented their proposals to the CTO team in a manner similar to companies presenting to the VCs for funding: twenty-minute presentations by portfolio companies. Daru and his team made decisions on the spot regarding which warranted further investigation. Of the hundred proposals, about thirty to forty were considered relevant enough to pursue.

The final filters were technical readiness and economic viability within BP. Proposals that passed through these filters were presented to business units, that had to commit to sponsor a pilot for the project to proceed. Any proposal that did not make it all the way to this stage was cancelled. “Only about 10 to 20 percent of our opportunities make it all the way through to a business unit pilot program,” according to technology director Paul Stone, manager of the process. Importantly, the CTO office committed to arriving at this decision within ninety days, responding to the VC firms with constructive feedback. The VC firms and their portfolio companies appreciated the feedback and timely responses, particularly given the contrast to the complex, time-consuming negotiations with many other large, global companies.

BP’s technology transfer process was adoption-oriented. “We don’t want to get bogged down,” explained Daru. “This process is designed to remove the ‘clutter’ . . . [and] identify really significant opportunities.” In its relationships with the business units, “We go where the energy is. We don’t fight battles.”

EVOLVING CREDIBIL ITY

In the early years, the CTO office enjoyed strong senior management support, particularly important to avoiding administrative cost cuts prior to generating a track record. Originally, very few people inside or outside of BP understood its mission or methods. It was, in the words of John Baumgartner, the CTO office’s chief of staff, “a journey of experimentation, innovation, and discovery.” Many BP executives were skeptical about the role and potential impact of such a small group.

As business successes mounted, skepticism gave way to support and the office’s brand and impact grew. Their technological firsts in the area of sensory networks drew attention from the media, and news articles began to appear in IT publications such as Information Week, Computerworld, Wired, and even the Wall Street Journal.

Awards followed. A sensory networks project implemented on petrochemical rail cars was cited in 2004 as one of the top five projects of the year by Infoworld, which also cited a CTO-led shipboard mote system in Infoworld 100. Next, Computerworld selected the sensory networks program as “Best in Class” in their Computerworld Premier 100 recognition program. The same year, CIO magazine recognized the sensory networks program as one of their “CIO Bold 100” for successful risk-taking in service of business objectives. The following year, CTO projects and people went on to receive awards and recognition from Information Age, the American Business

For the exclusive use of U. Business School, .

This document is authorized for use only by UniSA Business School in .

BP’S OFFICE OF THE CHIEF TECHNOLOGY OFFICER (A) KEL366

10 KELLOGG SCHOOL OF MANAGEMENT

Awards, the International Business Awards, Computing magazine, IChemE Awards, and CNet Networks.

Internally, the team won recognition as well. The highest recognition in BP is the Helios Award, presented to the top team in each of six categories across the global enterprise. In 2004 the CTO team’s rail car telematics project was a finalist for the award. In 2005 the CTO-led project developing the world’s first shipboard wireless mote measurement system became the first IT project to win a coveted BP Helios Award, confirming the CTO office’s hard-won credibility firm-wide.

THE CHALLENGE

In 2004 a new advisory group for the CIO was formed called the Digital and Communications Technology Advisory Group (DCTAG). The DCTAG met twice a year to provide the CIO with high level external advice on BP’s capabilities and approach to digital technology, serving as a sounding board for major programs, processes, organization, and governance, and providing a continuing source of ideas and challenges leading to innovation and business value. The DCTAG included six members with expertise in digital technologies drawn from the highest ranks of entrepreneurs, large blue chip firms, and academia.7

In 2006 the advisory group reviewed the CTO’s track record against leading innovation processes in industry and government. The DCTAG found the CTO office’s accomplishments to be at the very top. Nevertheless, the DCTAG cautioned that organizations with good track records could become complacent and suffer from “method bias.” They pushed the team to find even better ways to promote innovation throughout BP. “Don’t rest on your laurels,” they advised. “You need to keep reinventing yourself.”

Where to From Here?

The CTO office had evolved quickly in six years. Beginning with an ad hoc, vendor-based approach to assessing emerging digital technologies, the CTO group developed various “intelligent push” methods: exploring business unit requirements, convening Blue Chalk events, regular meetings with VCs and vendors, and annual large-scale game changer programs. Now the team had been challenged to do more. What were their choices? Consider the following:

Should the CTO office be expanded so that they can take on more projects in different areas in which they may not have technical coverage or business unit knowledge?

Should the CTO office request a larger budget so that they can perform more detailed “due diligence” and experimentation, as opposed to having to abandon a concept if a business unit cannot be found that is willing or able to fund even an initial small-scale pilot project?

7 The six members are the CIO of major financial services company, a professor and faculty director at leading university, the founder of successful telecommunications company, a partner at well established venture capital firm, a founder of prominent IT industry research institution, and chairman emeritus of prominent IT consulting firm.

For the exclusive use of U. Business School, .

This document is authorized for use only by UniSA Business School in .

KEL366 BP’S OFFICE OF THE CHIEF TECHNOLOGY OFFICER (A)

KELLOGG SCHOOL OF MANAGEMENT 11

Considering the changes in the IT world since the dotcom crash in 2000, would the CTO office benefit today from developing new types of capabilities for finding, evaluating, and transitioning technologies?

In what ways might engagement with business units and top BP executives be improved, and to what ends?

What important lessons do you glean from this story regarding execution of an “open innovation” strategy? How might BP improve on its leveraging of outside partners in technology seeking and application experimentation?

For the exclusive use of U. Business School, .

This document is authorized for use only by UniSA Business School in .

BP’S OFFICE OF THE CHIEF TECHNOLOGY OFFICER (A) KEL366

12 KELLOGG SCHOOL OF MANAGEMENT

Exhibit 1: Sales and Other Operating Revenues ($ in millions) By Business 2001 2002 IFRS 2003 IFRS 2004 IFRS 2005

Exploration and production 27,540 25,083 30,621 34,700 47,210

Refining and marketing 114,135 121,908 147,813 176,240 219,995

Gas, power, and renewables 22,906 16,490 22,984 26,220 28,700

Other businesses and corporate 12,005 12,548 515 546 668

Sales by continuing operations 176,586 176,029 201,933 237,706 296,573

Less:

Sales between businesses 28,084 26,355 26,214 29,604 35,318

Sales to Innovene operations — — 6,278 8,226 11,790

Third-party sales of continuing operations 148,502 149,674 169,441 199,876 249,465

Innovene sales — — 13,463 17,448 20,627

Less sales to continuing operations — — 4,501 6,169 8,251

Third-party sales of Innovene operations — — 8,962 11,279 12,376

Total third-party sales 148,502 149,674 178,403 211,155 261,841

By Geographical Area

UKa 41,245 38,958 35,546 60,151 96,134

Rest of Europe 36,701 46,518 42,033 44,858 64,305

USA 71,927 67,206 79,443 87,200 103,185

Rest of World 27,337 28,319 37,782 47,862 59,628

177,210 181,001 194,804 240,071 323,252

Less:

Sales between areas 28,708 31,327 19,085 31,969 61,997

Sales to Innovene operations — — 6,278 8,226 11,790

148,502 149,674 169,441 199,876 249,465

a UK area includes the UK-based international activities of refining and marketing.

For the exclusive use of U. Business School, .

This document is authorized for use only by UniSA Business School in .

KEL366 BP’S OFFICE OF THE CHIEF TECHNOLOGY OFFICER (A)

KELLOGG SCHOOL OF MANAGEMENT 13

Exhibit 2: BP’s Global Presence

Exhibit 3: Major BP Business Areas

For the exclusive use of U. Business School, .

This document is authorized for use only by UniSA Business School in .

BP’S OFFICE OF THE CHIEF TECHNOLOGY OFFICER (A) KEL366

14 KELLOGG SCHOOL OF MANAGEMENT

Exhibit 4: Blue Chalk Topics Since 2000 Blue Chalk Theme Description/Result

Emerging e-Business Technologies Exposed emerging technologies to executives; provided groundwork for IT Colloquium, which produced a BP Digital Agenda.

Business at the Speed of Thought Microsoft executives and others provided IT executives with a vision of the future of the desktop and the Internet.

Office of the Future Sparked BP’s Workplace of the Future program; subsequently a digital summit led to top executive endorsement of an ambitious 90-day plan for moving the BP Digital Agenda forward.

ERP Systems of the Future Focused and shaped key software decisions at BP that had been debated for months.

New Service Models Investigated new service models of key vendors.

Wireless Technology Exploration of the world of M-Commerce led to multiple pilot projects.

Security Explored new sources of security threats to corporate information and the tension between security enhancement and pursuit of growth.

Offshoring: Cost and Quality Benefits from Global Sourcing

Insights into the risks, opportunities, approaches and rewards of modern offshoring and their potential cost and quality benefits for BP.

Sensory Networks-Based Commerce Transformational displacement technologies (wireless, telemetry, radio frequency identification or RFID) offer solutions for supply chain, asset management, and health, safety and environment practices.

ERP Consolidation Exploration of ways to reduce the high licensing, maintenance, and integration costs associated with current ERP implementations.

Safety Enhanced BP’s move from safety as a “priority” to safety as a “value,” part of a five-year plan to create a “value culture” at BP.

Data Solidified view of data as an asset and shaped new approaches to data warehousing.

Collaboration and Social Networking Explored how rapidly emerging social networking tools (blogs, wikis, jams, podcasts, RSS feeds) can improve communication and collaboration among BP stakeholders, internal and external.

Major Dislocation Planning Strengthened BP’s preparedness to respond to potential disasters by learning from the experiences of government agencies, NGOs, and leading transnationals.

Exhibit 5: CTO Game Changers, 2002–2007

For the exclusive use of U. Business School, .

This document is authorized for use only by UniSA Business School in .