Bpo Slides

-

Upload

rodrigo-aguilera -

Category

Business

-

view

3.414 -

download

1

description

Transcript of Bpo Slides

1

VENDOR MARKET ANALYSIS PROCUREMENT OUTSOURCING

SHELL GERMANY, DECEMBER 2009

• Q408 marked an inflection point*•Lower oil & gas prices; weak energy demand

•Prudent approach to economic downturn

•Standardization , cost reduction and process optimization is required

•Outsourcing

INTRODUCTIONOil Market

2*Source: Shell Annual Report Q109

• BPO services increasing in quality, accuracy, efficiency

•Tradicional BPO market increasing CAGR 24%, $450Bn by 2012*

•Vendors are getting better...market is growing

•Vendors Specialization

INTRODUCTIONVendor Market

3*Source: Infosys Market Report, 2009

1. INTRODUCTION

2. OBJECTIVES---METHODOLOGY

3. PROCUREMENT OUTSOURCING (PO)

4. GENERAL COMPANY OVERVIEW-WHY TO IMPROVE?

5. BPO ENGAGEMENT SCOPE-MAIN SCENARIOS

6. PO-VENDOR MARKET INSIGHTS

7. FINAL COMMENTS

AGENDA

4

OBJECTIVES

INTERNAL

• SG&A Ratio•Posible

engagementscenarios

VENDOR

•Top vendors•Characteristics• Locations•Clients

SELECTION

• Selection criteria•Recomendations

IMPLEMENTATION

•Work plan

ADVISORY VENDOR ANALYSIS REPORT

5

• Procurement processes•Direct- Indirect Procuremet•Transactional Processes•Captive vs. BPO solution

PROCUREMENTPO Highlights

6

Activity %SSC

Catalogue Management

80%

Supplier Help Desk 90%

Supplier Credit Check 90%Transactional Purchasing

90%

Small Item Purchasing 90%Ordering 95%

Quantity

Value

Frecuency

Nature

• Shell Germany AG -> lack of corporate information

•Deutsche Shell Holding GmbHAnnett Buchholz (Shell Deutschland Oil GmbHInformation und Presse) ...thanks!

•Manufacturing, transportation and marketing of hydrocarbons

•Revenue 2008: 2,200 mEuro•COGS: 1,800 mEuro•SG&A: 110 mEuro *•Procurement Pers.: 100-120FTE

COMPANY OVERVIEWDeutsch Shell Holding GmbH

Exploration& Production

Gas & PowerOil Sands

7

Cost Savings Oportunities-> Reach Benchmarks

COMPANY OVERVIEWSG&A Ratio

Company SG&A Sales/rev. SG&A ratio Rank

BP 15,412 361,143 4.27% 3EXXON MOBIL

15,873 459,579 3.45% 1

DUTCH SHELL 17,028 458,361 3.71% 2

SHELL GERMANY

110 2,200 5.00% 4

8

Cost Savings Oportunities-> Reach Benchmarks

COMPANY OVERVIEWSG&A Ratio

4.27%3.45% 3.71%

5.00%

0%1%2%3%4%5%6%7%8%9%10%

050,000

100,000150,000200,000250,000300,000350,000400,000450,000500,000

BP EXXON MOBIL DUTCH SHELL SHELL GERMANY

Reve

nue

(mEu

r)

Company

SG&A Sales/revenue SG&A ratio

9

BPO ENGAGEMENT SCOPEProcurement Process Costs (PPC)

*Source: Shell Earnings by Business Segment and Identified Items 2008, Financial reports, shell.com

**Informed by communications department of Deutsche Shell Holdings GmbH

Revenue 2008: 2,200 mEuroCOGS: 1,800 mEuroSG&A: 110 mEuro **Procurement Pers.: 100-120FTE

PPC = 0.0149 x 1,800 = 26.82 mEuro

•Procurement Process Costs (PPC) are 1.49% of COGS (2008)

•Europe segment Income for 2008 corresponds to 8,809 mEuro, which represent the 33.25% of the total Income of the period for Royal Dutch Shell*.

•Shell operation in Germany will be estimated considering**:

10

BPO ENGAGEMENT SCOPEScope

Procurement processes in ScopeActivity Employees and Costs

Catalogue ManagementProcurement Process Costs (yearly basis)

€ 26.82 M

Supplier Help Desk FTE in Scope 120 FTESupplier Credit Check Average Tenure 11.5 yearsTransactional Purchasing Fully Fringed Costs € 56,500.00 Small Item Purchasing Retained FTE 15%***

OrderingProcurement expected savings

+25%*

Countries /Locations

Germany1 location(Hamburg)

*Source: http://logisticstoday.com**Informed by communications department of Deutsche Shell Holdings GmbH

***Similar businesses retained FTE 11

BPO ENGAGEMENT SCOPEScope

Scenario At least 5 years Contract50%Savings

12

-80000

-70000

-60000

-50000

-40000

-30000

-20000

-10000

0

10000

20000

Inve

stm

ent 1 2 3 4 5

VENDOR MARKETMayor Players 2008-2009

2009* Company Name Country1 Genpact India2 Infosys India3 Accenture USA4 ICG Commerce USA5 IBM Global USA6 Ariba USA7 Oracle BPO USA8 Corbus USA9 Capgemini France

10 D & B Supply Chain Solutions

USA

1

7

2 Europe

USA

India

*According Rank Procurement Vendors, Source: The Black book of Outsourcing, Brown-Wilson Group 13

VENDOR MARKETMayor Players 2008-2009

Genpact

*India*It was formerly a GE owned company called GE CapitalInternational Services or GECIS.*37,000 people in various locations,30 languages on a 24/7 basis.

Key Clients:Locations:

Philips, Shell, Allianz, and AkzoUnited States, Mexico, Guatemala, Netherlands, Poland, Hungary,Romania, Spain, Morocco, South Africa, India, China, Philippines

Rank2009

Company Name

Country Employees Revenue (2008) COGS SG&A EBIT

1 Genpact India 37000 1040 619.2 166.4 254.4

14

VENDOR MARKETMayor Players 2008-2009

Infosys*India*Second-largest IT company in India, 106,000 professionals*Offices in 22 countries and development centers in India,China, Australia, UK, Canada and Japan

Key Clients:Locations:

Tesla Australia, Phillips, DHLAsia Pacific, North America, Europe (Belgium,Denmark,Finland, France, Germany, Stuttgart, Milano, Poland, TheNetherlands, Spain, Sweden, Switzerland and UK)

Rank2009

Company Name

Country Employees Revenue (2008) COGS SG&A EBIT

2 Infosys India 106000 4700 2803 645 1252

15

VENDOR MARKETMayor Players 2008-2009

Rank2009

Company Name

Country Employees Revenue (2008) COGS SG&A EBIT

3 Accenture USA 186000 23170 16329 3948 2893

Accenture*USA* It is said to be the largest consulting firm in the world.*186,000 people in 52 countries.*Accenture's clients include 96 of the Fortune Global 100 and more thanthree quarters of the Fortune Global 500.

Key Clients:

Locations:

Microsoft, ING, BC Hydro, Deutsche Bank, Roche, Bayer MaterialScience,Royal Dutch ShellAsia Pacific, North America, South America, Africa, Europe, includingGermany and UK.

16

VENDOR MARKETMayor Players 2009

Rank2009

Company Name

Country Employees Revenue (2008) COGS SG&A EBIT

3 Accenture USA 186000 23170 16329 3948 2893

IBM Global Services*USA*IBM Global Services has the modest goal of making a smarter planet*Operates in about 170 countries.*Global Technology Services (GTS) encompasses IBM's business processoutsourcing, infrastructure support, and product maintenance offerings;Global Business Services (GBS)

Key Clients:Locations:

TBDAsia Pacific, North America, Central America, South America, Africa,Europe, including Germany and UK.

17

VENDOR MARKETMayor Players 2009

Capgemini*France*One of the world's largest information technology,transformation and management consulting, outsourcing andprofessional services companies*91,000 people operating in 36 countries.

Key Clients:Locations:

Syngenta , PrudentialAsia Pacific, North America, Central America, South America,Africa, Europe, including Germany and UK.

Rank2009

Company Name

Country Employees Revenue (2008) COGS SG&A EBIT

9 Capgemini France 91000 12678.3 9429.4 1246.0 2002.9

18

VENDOR MARKETMayor Players 2009

0

20000

40000

60000

80000

100000

120000

140000

160000

180000

200000

0

10000

20000

30000

40000

50000

60000

70000

Genpact Infosys Accenture IBM Global (Services)

Capgemini

Empl

oyee

s

Reve

nue

USD

Vendor

COGS SG&A EBIT Employees

4.5%3.3%

3%

5%

% of Revenue from PO

7.5%

Sources: Annual Reports of each company, financial statements 200819

VENDOR MARKETChilean Player

Rank2009

Company Name

Country Employees Revenue (2008) COGS SG&A EBIT

Sonda Chile 50000 872.0 679.0 87.0 106

Sonda, Chile

Sonda is the leader IT Service center in Chile and one of the most important inSouth America, with operations in Argentina, Brazil, and Mexico betweenothers. Has clear expertise in the IT Outsourcing field in Chile, and in last yearsstarted some small PO services projects in Chile and Argentina.

Key Clients:Locations:

Shell Chile, Esso, Banco Chile, MiscrosoftChile, Argentina, Mexico, Guatemala, Colombia

20

VENDOR MARKETMayor Players 2009

% of Revenue from PO

Sources: Annual Reports of each company, financial statements 2008

0

20000

40000

60000

80000

100000

120000

0

500

1000

1500

2000

2500

3000

3500

4000

4500

5000

Genpact Infosys Sonda

Empl

oyee

s

Reve

nue

Vendor

COGS SG&A EBIT Employees

4.5%1%

7.5%

21

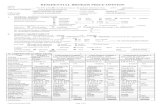

VENDOR SELECTION CRITERIAWeighted selection

Criteria Summary Weight 1=very bad, 3=avg, 5=very goodBPO1 BPO2 BPO3 BPO4 BPO5 BPO6

Experience and reputation

40% 4.525 4.2 4.3 4.3 4.35 2.5

Capabilities and knowledge

15% 4.2 4.2 4.4 4.4 4.5 2.55

Cost and contract 25% 4.3 4.3 3.7 3.7 3.6 2.4Cooperation and trust 20% 4.05 4.05 4.1 4.1 4.55 2.6Sum 100% 17.075 16.75 16.5 16.5 17 10.05

Capabilities and Knowledge Weight 1=very bad, 3=avg, 5=very goodBPO1 BPO2 BPO3 BPO4 BPO5 BPO6

IT and SAP capabilities 30% 5 5 5 5 5 3Consulting Capabilities 10% 4 4 5 5 5 4Industry Expertise 10% 5 5 4 4 4 1.5Process Expertise 30% 4 4 4 4 4 3Language Capabilities 20% 3 3 4 4 4 1Sum 100% 21 21 22 22 22 12.5

22**Expertise, Culture,language, PO capabilities, SAP

VENDOR SELECTION CRITERIAWeighted selection

0

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

BPO1 BPO2 BPO3 BPO4 BPO5 BPO6

Cooperation and trust

Cost and contract

Capabilities and knowledge

Experience and reputation

BPO1 GenpactBPO2 InfosysBPO3 AccentureBPO4 IBM Global (Services)BPO5 CapgeminiBPO6 Sonda

23

VENDOR SELECTION CRITERIAWorkplan proposal

Phase December January February March

Agreement on RFP &Long listSend RFPSelect short list and send notif.Bidders conference/one-one meetingsSubmission final offerNegotiations/due Diligence/site visit

Final decision/contract closing

Based on Offshoring Institute approach24

FINAL RECOMENDATIONSPO- Vendor market analysis

•Analysis usability

•SG&A and economical downturn

•Expertise, cultural and language fit, market participation

•Different engagement options should be evaluated

•+25% costs savings as base

•PO-growing market-control required-Shadow Operations

•CPI (Country and from Vendor provider)->Negotiation structure

25

ENDThanks!

Questions??

26

How can Company objectives regardingBPO project affect the vendor selection?

ENDThanks!

27

ReferencesGlobal Siteshttp://www.shell.com/http://www.wikipedia.comhttp://www.genpact.comhttp://www.capgemini.com/http://www.accenture.comhttp://www.infosys.comhttp://www.theblackbookofoutsourcing.com/https://www.ebundesanzeiger.deNews/News/Blogs siteshttp://www.businesswire.com/portal/site/home/permalink/?ndmViewId=news_view&newsId=20090707005016&newsLang=enhttp://logisticstoday.com/mag/outlog_story_5576/http://www.outsourcing-journal.com/dec2009-chile.htmlhttp://www.everestresearchinstitute.com/Product/10972