BPO Finals

-

Upload

april-ocampo -

Category

Documents

-

view

244 -

download

0

Transcript of BPO Finals

-

8/8/2019 BPO Finals

1/62

Economics of Business Process

Outsourcing

By: April Ocampo

-

8/8/2019 BPO Finals

2/62

Outsourcing

is a management process in the globalized business context thathas been well understood, tried and tested by successfulorganizations across the world.

The competitive pressures arising from the emergence of aboundary-less global economy, have spurred the faith in theprocess - as a means for providing significant cost savings,flexibility and improved operational performance.

Offshoring is no longer being considered a short-term tool for costsavings - the focus is steadily shifting to long-term competitive

advantage, an integral part of the global corporations strategy.

-

8/8/2019 BPO Finals

3/62

Business process outsourcing(BPO)

is not a new management

strategy, but has received heightened interest in the past several

years because of its potential economic and strategic impact.

Companies look to outsourcers to provide process efficiencies andeconomies of scale, as well as continued investment in the latest

technology, which can be more effectively cost-justified when

spread across multiple organizations.

-

8/8/2019 BPO Finals

4/62

Definition: Business Process Outsourcing

The transfer of management and execution of an entire business process to anexternal service provider, including technology, people, and process. In engagingBPO services, clients are buying access to executed business processes and businessoutcomes from their BPO providers. (IDC)

The delegation of one or more IT-intensive business processes to an externalprovider that owns, administrates and manages the selected processes that are

based on defined and measurable performance metrics. (Gartner)

Nearshore Sourcing: sourcing services from geographies within close proximityto the location in which the services are consumed or contracted.

Offshore Sourcing: sourcing services from geographies at a considerabledistance from the location in which the services ar consumed or contracted.

Global sourcing: a corporate sourcing strategy that identifies and leveragesthose human resources and assets, regardless of geographic location, mostappropriate for meeting the organizations needs, often coming from bothnearshore and offshore locations.

Insourcing: sourcing services internally as opposed to through a third-party BPOprovider. Often provided in a a centralized shared services environment.

-

8/8/2019 BPO Finals

5/62

BPO overview: The BPO market worldwide is expanding with new services getting

added to the list of business processes that are outsourced and newlocations coming up as potential offshore destinations, India being themost preferred destination for offshore BPO.

Cost savings is one of the most important drivers now. Informationsecurity, execution capability and financial stability are important

considerations while selecting a vendor. According to IDC, customer care and logistics are mature segments,

while procurement and training are emerging markets and areexpected to have a growth of more than 10 percent in the next fiveyears.

Gartner has also observed the latest trend of offshore insourcing , inwhich firms establish their own offshore captive centers. These captive

centers are generally shared service centers and allow the firms toretain control over the processes.

-

8/8/2019 BPO Finals

6/62

Evolution of BPO:

-

8/8/2019 BPO Finals

7/62

Off-shoring and outsourcing (IT-BPO) involves ITapplications, business process, and design/engineeringservices

Outsourcing and Off-shoring (O&O) Services: Three main sectors

-

8/8/2019 BPO Finals

8/62

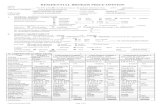

Major BPOs in the Philippines:

BPO IndustryContact Center Non-Contact Center

Inbound and outboundVoice operation services forpurpose of sales, customerservice, technical support, others

Back office

Medical Transcription

Legal Transcription

OtherData Transcription

AnimationSoftware development

Engineering development and digital content

-

8/8/2019 BPO Finals

9/62

Overview :

When most people in the English-speaking world think of contactcenter offshoring, they think of India. After all, in fiscal 2008 India hadcustomer interaction service revenues of $4.7 billion US, making itnumber one. However, the Philippines have seen strong growth in

contact center revenues and now run a close second at $4.0 billionUS.

The Philippine contact center industry has grown rapidly and is now aclose second to India in terms of market share. Provided that thecustomer service quality can be maintained and the costs ofmanaging the outsourcing relationship do not overwhelm the savingsfrom offshoring, contact center outsourcing to the Philippines is agood investment.

9

-

8/8/2019 BPO Finals

10/62

Philippine share of global IT-BPO market rising;Philippines on track to capture 10% of global market share

High-end est. 2008: India 38%, RP 7%100% = US$89 billion in 2008 by Mc kinsey &everest

-

8/8/2019 BPO Finals

11/62

IT-BPO is a large and growing

market

-

8/8/2019 BPO Finals

12/62

Top offshoring rankings

India

Phillipin

es

SouthAfric

a

Romania

Brazil

Mexic

o

Hungary

Canad

a

Chi

na

UK

Top Offshore Destinations

The indisputable leaderIn ITO and BPO

Becoming a hot destinationfor call centres

China,

SouthAfricaserving

bothdomesticAfrican

andWestern

firms

Romania becoming nearshore

destination for European firms

Serving domestic and the USA

market

-

8/8/2019 BPO Finals

13/62

ranking by region

T o p S o u t h A m e ri c a s O f f s h o r e D e s t i n a t io n s

T o p E u r o p e a n O f f s h o r e D e s t i na t i o n s

T o p A s i a O f f s h o r e D e s t i na t i o n s

Top Afr i ca / ME O ffshore Dest i nat i ons

-

8/8/2019 BPO Finals

14/62

T o p A s i a O f fs h o r e D e s t in a t io n s

-

8/8/2019 BPO Finals

15/62

Asia India and China have seen double-digit growth rates have fuelled wage inflation, with average compensation

costs rising between 20-30%, however, cost escalations have been matched by corresponding increases inskill supply and quality indicators.

India maintains a strong-lead in terms of language skills and vendor maturity, together with an enviable trackrecord and strong albeit slow legal system.

China leads on infrastructure development and growth in education, but its legal system lacks transparencyand it suffers from the obvious language skills.

Singapore some 20 years ago a leading outsourcing destination has been overtaken by lower-cost countriesnow competing to establish themselves as service centers.

Philippines is getting exponential business in the case of call centers, largely as firms relocate these fromIndia to the Philippines. It also has language skills unmatchable in the region and a very good culturalalignment with the West. It also offers one of the lowest wage locations and offers low cost telecom.

Malaysia's economic stability, its diverse language skills and the investment the government has made, in theMultimedia Super Corridor and Cyberjaya, to establish the country as a regional IT hub, are driving the regionas a outsourcing destination.

Thailand, Indonesia and Vietnam have also seen significant declines in telecom costs, while slower growthrates have moderated wage inflation. However they lack the language skills, scale and labour arbitrage

afforded by India. Thailand and Indonesia will likely remain challenged by lesser English language capabilitiesand concerns over their economic and political stability. Sri Lanka and Pakistan, although offer many of the same advantages as India, suffer from their relatively

smaller population-base and obvious concerns over internal security. Australia and New Zealand offer attractive destinations in terms of language, cultural alignment, legal systems

and infrastructure, but lack the scale and costs structures that others in the region can provide

-

8/8/2019 BPO Finals

16/62

South Americas Spurred on by Indias success, governments throughout the region have

recognised the potential of the export services sector, particularly in the context ofproviding near-shore support to North America and Iberia.

Brazil has begun to leverage the traditional strengths of its indigenous IT sector,

rapidly expanding university enrollment and quality certifications, together with thescale it can offer.

Chile,Mexico and Argentina have seen significant sector growth and someincreases in graduation rates.

Chile continues to benefit from the best business environment and tax structure inthe region

Mexico leverages its proximity to the US

Argentina offers relatively lower costs. Costa Rica was a traditional leader in the region but has been overtaken by the

heavyweights moving in.

-

8/8/2019 BPO Finals

17/62

Africa and the Middle East Middle Eastern and African countries are increasing their visibility as remote services locations. Egypt, Jordan and the United Arab Emirates are all trying to establish themselves as outsourcing hubs. The former attracting a

number of Asian vendors to the region as they run short of skilled and cost effective labour from the home markets. Egypt has become a prime location for Information Technology (IT) and call center outsourcing. Egypts Smart Village has been the preferred destination for call centers and exported IT services in Egypt. The Village

currently hosts some 12,000 employees working for more than 100 multinational companies most of them in outsourcing who have massive call centers serving English and non-English speaking clients around the world. From providing cell phoneservices and customer support (Vodafone call center) to R&D centers (Orange Business Services) that work autonomously to

provide solutions to the IT and Telecom sectors, Smart Village is well-equipped for anyone seeking to enter Egyptsoutsourcing market. Smart Village expects to host 80,000 employees by 2014, which is more than six times the currentnumber over the coming six years.

Xceed has been Telecom Egypts call center arm since 2003 and is considered to be the biggest call center in the localmarket.

Wipro joins Satyam as the second Indian company to find conditions there suitable for its outsourcing operation. With a 20% growth rate in Egypts IT and call center sector in 2007, outsourcing has already played its part in contributing to

the local economys growth, up by 7% last year. Mauritius a leader in the African region offers good infrastructure, political, economic and business climate, but lacks scale. Morocco and Tunisia reflect growing interest in locations with the ability to serve francophone markets. Ghana maintains its position as a low-cost English language location in Africa, while South Africa is fast becoming the India of the

African world.

-

8/8/2019 BPO Finals

18/62

Europe Czech Republic, Hungary, and Poland the leaders in the region are now losing

ground to emerging locations, such as Bulgaria and Romania. Continuedimprovement in the business environment in the Czech Republic and Hungary cannot offset deterioration in cost competitiveness.

The Baltic States, Estonia, Latvia and Lithuania still lack the infrastructure of itsEuropean neighbours, and suffer from the relatively small size.

Russia the new kid on the clock offers strong technical skills, but lacks theinfrastructure, language skills and cultural alignment that some of the newer EUmembers or prospective members offer.

UK and Ireland score relatively highly and would be leaders were it not for their

high labour costs. Both countries offer stable political and economic environmentswith strong legal systems, excellent infrastructure and access to good resources,albeit smaller in population size than the Asian counterparts

-

8/8/2019 BPO Finals

19/62

Philippines now the third outsourcingdestination in the world, 2nd outsideNorth America

-

8/8/2019 BPO Finals

20/62

IINDUSTRYNDUSTRY AFFAIRSAFFAIRS

-

8/8/2019 BPO Finals

21/62

Philippines IT-BPO industry earned close toUS$5 billion in export revenues in 2007

-

8/8/2019 BPO Finals

22/62

-

8/8/2019 BPO Finals

23/62

Philippine IT-BPO where is it now?

Over $6 billion in revenues, +26%

growth amidst the global crisis

-

8/8/2019 BPO Finals

24/62

Philippine IT-BPO where is itnow?

82% of respondent companies expect their workforce to grow in 2009

50% of BPO HR mgrs say workforce requirements up over 15% in2009

Average increase 11-15%, mostly in complex services such as back-office, IT, infrastructure management, and Web site development

33% of biggest BPOs (5,000 to 10,000) expect to grow the most

Skills requirements from academe and providers: English, industry-

specific, computer, critical thinking, analytics, problem-solving, andsoft skills (incl. leadership, teamwork, initiative, customer service)

-

8/8/2019 BPO Finals

25/62

For BPO alone (excluding IT),the Philippines ranks nextto India and Canada

-

8/8/2019 BPO Finals

26/62

-

8/8/2019 BPO Finals

27/62

Percentage of firms citing offshorelocation of choice

Percentage of location of choice firms citing offshore

-

8/8/2019 BPO Finals

28/62

Philippine IT-BPO services:Excellent prospects for growth

Frontier Strategy Group, September 2007: The Philippines is among seven keymarkets that are above the rest and are the most critical to achieving corporate growthand outperforming the competition in 2008 and beyond

Survey of 100MNC executives in emerging markets: 85% say that the Philippines isamong the top 4 emerging markets in the Asia-Pacific region that they are most interestedin expanding into

National Outsourcing Association (UK), October 2007: Philippines awardedOffshoring Destination for 2007

FBR Research, October 2007: Philippines Poised for Several More Years of HyperGrowth

Nomura Securities, November 2007: We think that the Philippines has grown intothe No. 2 outsourcing base after India in call centerbased BPO fields.

Diamond Consultants, December 2007: The Philippines ranked #3 behind India andthe US in the current location strategy of BPO providers

FBR Capital Markets 2008: We believe that the Philippines has been validated asthe location of choice for B-to-C contact centre work

Philippines: 2007 Offshoring Destination of the Year

-

8/8/2019 BPO Finals

29/62

Industry is supply-driven with no visible demand constraints

leading to a unique opportunity for Philippinesespecially in customer care focused on N. America, Europe, and the Asia-Pacific Region

Philippines inPhilippines ina sweet Spota sweet Spot

to captureto capturemore marketmore market

shareshare

-

8/8/2019 BPO Finals

30/62

Our goal is 10% by 2010

Annual growthAnnual growth

ratratee

Market share

-

8/8/2019 BPO Finals

31/62

The Philippine IT-BPO industry:on track, 2010 revenue target

-

8/8/2019 BPO Finals

32/62

Philippine IT-BPO industry:2010 employment target

-

8/8/2019 BPO Finals

33/62

Philippine talent value proposition: largepool of English speaking talent

Source: Phil. Communication on Higher educ:CIA World Fact book 2007:

-

8/8/2019 BPO Finals

34/62

The Philippine talent value proposition:Quality

* Mexico is the only country where interview results (higher number) were adjusted ex-post since interview basewas thinnerSource: Interviews with HR managers; HR agencies and Heads ofGlobal Resourcing centers; McKinsey Global Institute

-

8/8/2019 BPO Finals

35/62

-

8/8/2019 BPO Finals

36/62

Foundation of Philippine success

-

8/8/2019 BPO Finals

37/62

5 Thematic Programs to draw an additional290 560 thousand employees

-

8/8/2019 BPO Finals

38/62

The 5 thematic programs, if fully successful,will take the industry close to its 2010 aspirations

Growth scenarioSupply

Focus on coreskills, willingness,funding, andGrowth scenarioSupply1,240

Thousand FTEs

Both skill trainingand on-jobexperienceapplicable to anyemployment

-

8/8/2019 BPO Finals

39/62

Makati has absorbed much ofthe available talent in the NCR

-

8/8/2019 BPO Finals

40/62

There is abundant available talentoutside metro cities

-

8/8/2019 BPO Finals

41/62

-

8/8/2019 BPO Finals

42/62

Top Ten Next Wave Cities as ofNovember 2008

Legazpi to work on Intl flight, flight frequency, availability of real estate, PEZA approvals

-

8/8/2019 BPO Finals

43/62

Achieving our aspirations would have amajor impact on the Philippine economy

Preliminary

others

IT_BPO

GS (GS ( GG SS

-

8/8/2019 BPO Finals

44/62

PGS (PGS (PPANGULONGANGULONG GGLORIALORIA SSCHOLARSHIPCHOLARSHIP

PPROGRAMROGRAM))

2008 results: BPAP distributed over 44,000 certificates worth

Php 260 million nationwide as of Dec 31, 2008. As of March 13,

2009, employment yield rates for the BPO sectors are as

follows: 67% for Contact Centers; 82% for Medical

Transcription; 100% for Software and 100% Animation

2009 results: BPAP distributed over Php 50 million worth of

certificates nationwide (representing the first release of the

scholarship)

-

8/8/2019 BPO Finals

45/62

This is amanagement development program BPAPdeveloped with Ateneo De Manila Graduate

School of Business and the De La SalleGraduate School of Business intended toincrease the number of capable managers forthe BPO industrythe Diploma in BPO is composed of 2 parts:Basic Supervisory Course (4 to 5 days)

Leadership andManagement DevelopmentProgram (16 days or 128 hours)May be credited as MBA units (6 units) The BPAP-Ateneo Diploma in BusinessProcess Outsourcing was conferred on its1st batch of graduates (25 students) last

January 21;In 2009, we expect to graduate 150managers

-

8/8/2019 BPO Finals

46/62

BPAP Roadmap 2010 progress

Target: 10% of global IT-BPO market by 2010

Status: on track; at 8-9% in 2007

Target: US$13 billion in revenues by 2010

Status: on track; at US$4.875 billion in 2007, grew by 16% from

January to May 2008, at 3% a month will hit US$6.8 to 6.9 billion

by end 2008

Target: 900,000 to 1 million FTEs by 2010

Status: 338,000 by May 2008; on track to hit at least 416,000 by

end 2008 which is slightly lower than target of 420,000 to

430,000however, employment is expected to accelerate insecond half of 2008; accelerated employment increase needs to

be sustained to hit original 2010 target (conversely, with the

industry seeing higher productivity, i.e., higher revenue earned

per FTE, fewer employees may be needed to hit 10% global

market share than originally thought)

-

8/8/2019 BPO Finals

47/62

Competitive advantage:

Cost advantage

World class English proficiency

Educated workforce

Customer service character

Solid telecommunication infrastructure Government support

Adequate financial stability

-

8/8/2019 BPO Finals

48/62

Cost Advantage

Having some of the lowest hourly labor rates in the world isadvantageous to outsourcing buyers since they can gain significantsavings on operations involving large numbers of full-timecounterparts.

on the average, a call center agent in the Philippines receivesUS$5,800 per year while a US counterpart earns US$ 25,000.Rodolfo (2005) also posits that the overall cost savings are pegged at50% to 60% compared to the standard U.S. rates.

-

8/8/2019 BPO Finals

49/62

World class English proficiency

72% of the population is English proficient.

The Philippines, being home to the 3rd largest English-speakingcountry in the world,

In fact, Gartner (2002) characterizes the Philippines English

proficiency as world class, primarily due to the ability of the Filipinosto adopt accents and nomenclature, as well as understand Americanidiomatic expressions and usage.

verbal skills are clearer and more understandable to the U.S. buyersthan other competitive English-speaking country destinations.

-

8/8/2019 BPO Finals

50/62

Highly educated & skilledworkforce

Of crucial importance to the success of BPO is for a country to have alarge population base to be able to meet the soaring demand foroutsourcing. Yet a large population base must also be complementedwith a strong educational system, which will equip people with the

necessary skills-set and capabilities to perform optimally andefficiently in this field.

The Philippines has a large population base, which is complementedwith a relatively strong educational system. According to theCommission on Higher Education (CHED), the Philippine public and

private university system combined produces 360,000 graduates peryear. Among these graduates, 30,000 - 50,000 are technically-proficient, with degrees in computer science and programming.

Another50% of the total graduates have degrees in businessadministration, mass communication and other courses that arecommonly required in BPO operations.

-

8/8/2019 BPO Finals

51/62

Customer service character

Filipino agents are often praised by foreign managers for theirwarmth, patience, and listening skills, traits that are highly valued inPhilippine culture and important for contact center agents. Managersare also often impressed with their work ethic.

-

8/8/2019 BPO Finals

52/62

Solid telecommunicationinfrastructure

The Philippine telecommunications sector has been deregulated,resulting in a highly competitive industry that delivers lowerinternational transmission costs than India as well as redundant linksto major centers. Fiber-optic backbones provide low-latencytransmission (< 200 ms) that is adequate to support robust VoIPfunctionality, including hosted technology.

The Philippine telecoms market, compared to India, also offers lowerprices (by 30%-50%), shorter procurement times (3 weeks as

opposed to 3 months) and less transmission delay.

-

8/8/2019 BPO Finals

53/62

Government support

support for the outsourcing and offshoring sector is significant andincludes $24 million toward training and education, and, as part of thePhilippine Economic Zone Authority (PEZA) program, a corporateincome tax holiday, exemption from duties, simplified import and

export procedures, and benefits on par with other countries in theregion.

-

8/8/2019 BPO Finals

54/62

Adequate financial stability

After years of running a deficit, the Philippine government beganreporting a surplus in 2006 which has now grown to over 1.5% ofGDP. The government has used this budget surplus to prepay someof its debts, motivatingMoodys Investors Service to upgrade its

sovereign credit rating from stable to positive, although Standard &Poors has maintained its stable rating.

-

8/8/2019 BPO Finals

55/62

Concerns

Security

Corruption

-

8/8/2019 BPO Finals

56/62

Security

is a concern that is worth evaluating for any offshore destinationbecause security disruptions can interrupt service, or worse, putemployees safety at risk.

Mindanao is home to a secessionist movement that has erupted in

occasional violence within that province. However, this violence hasnever extended to the major cities where most contact centers arelocated, such as Manila and Cebu

Additionally, progress has been made towards a peace in talksbrokered by Malaysia. Security risk is difficult to quantify; however,given that the scale of violence in the Philippines has been far belowthat of other developing nations like India, or even Western nationslike the US, the UK, and Spain,

-

8/8/2019 BPO Finals

57/62

Corruption

is another concern that is worth considering. Bribery adds to the cost andcomplexity of doing business Transparency Internationals 2007 corruptionsurvey reported pervasive corruption in most developing nations and thePhilippines are no exception, with 32% of respondents saying they had paid

a bribe to receive a service, compared to 25% in India and 2% in the US.Bribery is a cost of business for many local managers in the Philippines:three out of five managers were asked for a bribe at least once in theprevious year (source: SWS, 2007). However, these are local companies,many of which do business with the government. Although the extent to

which corruption impacts outsourcing clients has not been determined withcertainty, all the contact center managers interviewed for this report said thatcorruption had no impact on their business. Given that most businesses willinteract primarily with their outsourcing partner and not with the governmentor local suppliers directly, corruption is unlikely to be a key factor inoutsourcing to the Philippines.

-

8/8/2019 BPO Finals

58/62

Perception of Political Instability

In particular, some international enterprises are wary of engaging inbusiness in the Philippines because of alleged terrorist networksoperating in the country. To address this misconception, thegovernment must make an effort to explain that most terrorist

activities are concentrated and are limited only to a small islandregion that is 600 miles south of the Metro Manila area, and quite anumber of enterprises conducting business in the Philippines, as wellas clients in the United States, consistently attest that the businessand commercial climate remains unaffected by these issues.

-

8/8/2019 BPO Finals

59/62

The Philippines can excel in all of the e-Services sectors

because of its quality of service that we provide.

English proficiency is the key to success, as it is required

by all sectors of the industry.

Contact Centers have the highest demand, but is also

more advanced in terms of Human Capital Development.

Areas of opportunity for employing large numbers of

workers: Back Office Operations & Medical Transcription.

Niche area for creative talent: Animation. Leveraging on our level of IT and Technical proficiency in

Software Development and Engineering Design.

Phili i BPO t b fit f

-

8/8/2019 BPO Finals

60/62

Philippine BPOs to benefit fromcrisis

The current financial crisis in the U.S. markets is accelerating interest acrossstakeholders to understand adoption trends and opportunity areas inoffshoring. Banks and other financial services firms are under significantcost-reduction pressure, which is why a large number of firms plan to reduceheadcount in Western geographies and move jobs offshore.

PHILIPPINES--The domestic business process outsourcing (BPO) industry isset for a windfall in foreign contracts as the global economy continues itsturbulent path, according to a technology provider of call center services.

Miles Stanton, managing director at Call Design, said the current financialcrisis will spark further growth for the local BPO industry.

"W

e expect more and more foreign firms tapping the Philippines for theircontact center, and other outsourced services, as the need to save on costsbecomes more important,

"This boom is happening now," he added, noting that the local BPO industryis already growing at an impressive 92 percent annual rate, in terms of seats.

-

8/8/2019 BPO Finals

61/62

Conclusion:

Many international enterprises are realizing this, as more and more ofthem are considering outsourcing some of their business processesto the Philippines. They realized that with the Philippines competitiveadvantages, such as vast pool of highly qualified and skilled laborwith unmatched level of American English proficiency and strong

customer service orientation; highly reliable and cost efficienttelecommunications infrastructures; and competitive cost structuresthat make available world class services at significant cost savings,there is no doubt that the country will soon become the global BPOhub. The Philippines, once a cub in business process outsourcing,will eventually grow to become a tiger.

The Philippine contact center industry has grown rapidly and is now aclose second to India in terms of market share. Provided that thecustomer service quality can be maintained and the costs ofmanaging the outsourcing relationship do not overwhelm the savingsfrom offshoring, contact center outsourcing to the Philippines is a

good investment.

-

8/8/2019 BPO Finals

62/62

Thank YOU!!!