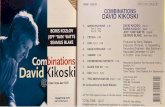

Boris J Steffen Fair Value In Corporate Shareholder Litigation Presentation (2)

Transcript of Boris J Steffen Fair Value In Corporate Shareholder Litigation Presentation (2)

Page 1

Fair Value v Fair Market& Other Value Standards:Considerations in Corporate and Shareholder Litigation

Boris J. Steffen, CPA, ASA, ABV, CDBVPrincipal & Director

Overview

» What is fair value?

» Fair value, fair market value and other valuation standards

» Methods to establish fair value

» Treatment of valuation discounts and premiums

» The IMD controversy

Page 2

» The IMD controversy

» Summary

» Appendix

» Expert profile

Fair value is a legal standard of value defined by state statutes governing dissenting shareholder actions and corporate dissolutions

» The legal notion of fair value generally arises in statutory appraisal cases, in cases where a stockholder’s equity has been eliminated without consent, and in cases of self-dealing under the entire fairness test

» Within these contexts, a majority of states follow the definition of fair value provided in the Model Business Corporation Act (“MBCA”), and in its revision (“RMBCA”)

» In 1984, the MBCA defined fair value as

› “The value of the shares immediately before the effectuation of the corporate action to which the shareholder objects,

Page 4

shareholder objects,

› excluding any appreciation or depreciation in anticipation of the corporate action unless exclusion would be inequitable.”

» Starting in 1999, the RMBCA definition of fair value was changed to

› “The value of the shares immediately before the effectuation of the corporate action to which the shareholder objects

› using customary and current valuation concepts and techniques generally employed for similar businesses in the context of the transaction requiring appraisal,

› and without discounting for lack of marketability or minority status except,

› if appropriate, for amendments to the certificate of incorporation pursuant to section 13.02(a)(5).

The framework for determining fair value in Delaware is provided by statute and decisions by the Court of Chancery and Supreme Court

» Despite revisions to the MBCA, currently there is no clear consensus regarding the definition of fair value

› Most states use the 1984 definition,

› A few use the 1999 revision or a hybrid of the 1984 and 1999 revision,

› While a minority use the 1984 definition with the phrase

‒ “unless exclusion would be inequitable” deleted, or with

‒ “unless exclusion would be inequitable” deleted, while adding that all relevant factors be considered

» Many states look to Delaware case law for guidance in dissenting shareholder litigation,

Page 5

» Many states look to Delaware case law for guidance in dissenting shareholder litigation, adopting all or some of the opinions of the Delaware Court of Chancery or Delaware Supreme Court

› Delaware’s dissenting shareholder statute is modeled after the 1984 MBCA, though it omits the “unless exclusion would be inequitable” phrase, and requires that all relevant factors be considered

» By comparison, Delaware does not have a minority oppression statute› Rather, wrongful conduct by the majority is addressed under the entire fairness test, which

considers the

‒ Fairness of consideration ─ Absolute and relative

‒ Procedural fairness ─ Independence, competence and thoroughness

The legal definition of fair value in Delaware is given in Title 8, § 262(h) of the Delaware General Corporation Law

» As provided in the appraisal statute of the Delaware General Corporation Law,

› “……the Court shall determine the fair value of the shares exclusive of any element of value arising from the accomplishment or expectation of the merger or consolidation,

› …..In determining such fair value, the Court shall take into account all relevant factors.”

» The details by which fair value is determined, however, are left to the parties and the Courts, with case law precedent providing guidance

» As described by the Delaware Supreme Court, fair value is “that which has been taken from [the shareholder], viz. his proportionate interest in a going concern.”

Page 6

from [the shareholder], viz. his proportionate interest in a going concern.”

› And in the appraisal process, the corporation is to be valued as an entity, not as a collection of assets or by the sum of the market price of each share of stock outstanding, and

› as a going concern, taking into account its market position and future prospects

» Similarly, the corporation is to be valued….by means of traditional value factors, weighted as necessary, ignoring post-merger events or other potential business combinations.

› The proportionate interest of the dissenting shareholder is determined only after the firm as an enterprise has been valued

» In sum, fair value is the value of the shares on a pro rata enterprise basis

Fair value as defined for appraisal rights and minority oppression purposes and fair market value are not equivalent

» While sometimes used interchangeably in other contexts, “The concept of fair value under Delaware law is not equivalent to the economic concept of fair market value.”

» Under Delaware law, fair market value is “the price which would be agreed upon

› by a willing seller and a willing buyer

› under usual and ordinary circumstances,

Page 8

› under usual and ordinary circumstances,

› after consideration of all available uses and purposes,

› without any compulsion upon the seller to sell or upon the buy to buy.”

» Examples of fair market value may include the price

› at which a stock trades in an active and liquid public market

› or determined in an active and competitive bidding process for privately held shares

» Given these differences with the definition of fair value, the fair value of petitioners’ shares in an appraisal action can be adjudicated as higher or lower than that of their fair market value

Fair value for appraisal rights and minority oppression cases also differs

from fair value in financial reporting, intrinsic value and investment value

Fair value (appraisal rights)

the value of the shares immediately before the effectuation of the corporate action to which the dissenter objects, excluding any appreciation or depreciation in anticipation of the corporate action

Fair value (financial reporting)

the price (exit) that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date

Page 9

Intrinsic value

the “true” value of an investment based on a fundamental analysis of its inherent attributes, that will become the market value when other investors have the same insight and knowledge as the analyst

Investment value

the value to a specific owner based on that owner’s unique situation, abilities, knowledge, motivation and expectations, considering factors including available synergies, risk tolerance, required return and tax status

Fair value in appraisal rights may also differ from fair value in financial reporting, fair market, intrinsic and investment values based on premise

Value in exchange

Value of a business or interest in a real or hypothetical sale

Value to the holder

Value of a business or interest maintained in its current form by its present owner

Going concern

Value of a business in continued use as an assemblage of income producing assets

Liquidation

Orderly – value of assets sold piecemeal with normal market exposure

Valuation Premise Operational Premise

Page 10

Considers discounts for lack of control and marketability and premiums for control

Typically applies to fair market value

present owner

Discounts and premiums are not considered

Typically applies to fair value and investment value

producing assets

Accounts for value added relationships between tangible and intangible assets

Assembled, in place and operational plant, work force, licenses, systems and procedures

exposure

Forced – value of assets sold piecemeal with less than normal market exposure

Assemblage of assets- value of assets sold in place but not in current use in the production of income or as a going concern

Fair value in appraisal rights may also differ from fair value in financial reporting, fair market, intrinsic and investment values based on level

» The level of value of an interest is a function of the degree of control and marketability of the underlying shares

» Control refers to the ability to direct the management and policies of a business

› The ability to appoint management, set operational and strategic policy, acquire and divest assets and declare and pay dividends, etc., etc.

» Marketability refers to the ability to convert a property to cash quickly, with a

Page 11

» Marketability refers to the ability to convert a property to cash quickly, with a minimum of transaction costs and a high level of certainty

› By comparison, some analysts think of marketability as relating to the ability to make a sale, and liquidity as related to the timing and certainty of receiving the cash proceeds

› The IRS defines lack of marketability as “the absence of a ready or existing market for the sale or purchase of the securities being valued.”

» In practice, discounts for lack of control are taken before discounts for lack of marketability

Strategic, investment or acquisition value

Financial control value

ControlMinority interest

StrategicPremium Synergies

The greater the degree of control and liquidity of the shares, the higherthe level of value

Non-marketable, minority interest

Marketable, minority interest

Discount for lackof marketability

ControlPremium

Minority interestdiscount

PrivatelyHeld

Public,Restricted

PubliclyTraded

Agency Costs

The determination of fair value in Delaware is guided by the statutory principle that the Court “shall take into account all relevant factors.”

» Fair value may be determined by any technique or methodology generally considered acceptable in the financial community and admissible in court

» Implicit to this interpretation is that no one particular method fits all facts and circumstances

» Regardless of method, however, all relevant factors must be considered

Page 14

» Regardless of method, however, all relevant factors must be considered

› Asset value, dividend record, earnings prospects, and any other factor affecting the firm’s financial stability or growth

» Within this framework, the Court is free to adopt, adjust and or correct the opinions, frameworks and methods of the parties’ experts in reaching its own

» The Court may not accept one party’s valuation in its entirety simply because it is more reasonable, however, as in a valuation proceeding it falls to the Court to determine the value of the

Delaware courts typically use one or both of the income and market approaches to determine fair value

Valuation ApproachesValuation

Approaches

IncomeIncome MarketMarket AssetAsset

•Present value of future

economic benefits

— Discounted cash flow

— Capitalized cash flow

•Comparable firms and transactions

— Guideline public company

— Guideline mergers and

acquisitions

•Value of individual assets net of liabilities

— Net asset value

— Excess earnings

The income approach is used to derive an indication of fair value based on the projected future income of the firm being valued

» While no one method is preferable per se, Delaware courts appear to favor the discounted cash flow (“DCF”) method in appraisal proceedings

› First the appraiser calculates the cash flows for each period of the specific projection provided by the subject firm’s management

‒ Delaware law prefers valuations based on projections prepared by management given management’s first-hand knowledge of a firm’s operations

› The value of the subject firm attributable to its cash flows in the post-projection period is then estimated to derive a terminal value

Page 16

period is then estimated to derive a terminal value

‒ Delaware courts have used both the perpetual growth rate model and the exit multiples model to estimate terminal value, expressing a preference for the former if it can be reliably used given the circumstances of the specific valuation

› In turn, the cash flows over the specific projection period and the terminal value are discounted to the valuation date to calculate fair value

» Notwithstanding, the Court of Chancery has noted that a DCF analysis is only as good as the model inputs, which are necessarily speculative

› There are cases where the DCF method has been used exclusively, and others in which it has been rejected totally

Comparison of the DCF valuation method using Gordon Growth model and exit multiple model terminal value calculations

Gordon Growth Model

FCF1 + FCF2 + FCF3 + ….. FCFn +

( 1 + k) 1

( 1 + k) 2

( 1 + k) 3

( 1 + k) n

Present Value of

Terminal Value FCFPresent Value of FCF Over Explicit Forecast Period

FCFn x (1 + g)

(k - g)

( 1 + k) n

Page 17

( 1 + k) 1

( 1 + k) 2

( 1 + k) 3

( 1 + k) n

( 1 + k) n

Exit Multiple Model

FCF1 + FCF2 + FCF3 + ….. FCFn + FCFn x FCF multiple

( 1 + k) 1

( 1 + k) 2

( 1 + k) 3

( 1 + k) n

( 1 + k) n

Present Value of

Present Value of FCF Over Explicit Forecast Period Terminal Value FCF

The market approach is used to derive an indication of fair value based on market multiples of publicly traded comparable firms

» The market approach, also referred to in Delaware law as the “comparable,” “comparative” or “guideline” company approach, is thought of in the financial community as a valuation method

› The first step is to identify publicly traded firms comparable to the subject firm, i.e.,

‒ Size, product and geographic markets, growth, profitability, capital structure, maturity, ownership

› Appropriate market-based pricing multiples are then calculated from the guideline public company trading prices and earnings measures, adjusting for differences with

Page 18

public company trading prices and earnings measures, adjusting for differences with the subject firm

‒ No single multiple has been recognized as the most reliable, with the courts using multiples of EBIT, EBITDA, book value, net income and gross revenue

› The market-based pricing multiples from the guideline public companies are then applied to the earnings measures of the subject firm to calculate fair value

» Given the subjectivity inherent to the selection of comparable firms and appropriate multiples, reliance by the Delaware courts has been based on demonstrating that the

› Comparable firms are in fact comparable to the subject firm

› Earnings measures are relevant to the industry

The market approach is used to derive an indication of fair value based on market multiples of publicly traded comparable firms (continued)

» In applying the market approach, the Delaware courts have considered it alternately as either

› just one element among others in an integrated valuation analysis, or

› as a check on the reliability of some other approach

» And as with the income approach, the Delaware courts have also

› relied on the market approach exclusively in certain cases,

› while rejecting it as even one factor where material differences existed between the

Page 19

› while rejecting it as even one factor where material differences existed between the

subject firm and the comparable companies

» The Delaware courts have also found that the market approach results in an indication of value that includes an implicit minority discount that must be backed-out in determining fair value, in contrast to what is generally done in the financial community

» In practice, the market approach relies on a one-year forward projection of future income

Vt = 0 = FCFt = 1 x FCF market multiple

Relationship between the capitalization rate, market multiple and discount rate

k = disount rate, whether cost of equity or weighted average cost of capital

g = long-term sustainable growth rate in measure of income from subject asset

re = cost of common equity

W = proportion of common equity in capital structure

Market Multiple = 1 / cCapitalization Rate = c = k - g

WACC = (re x WE) + (rp x WP) + (rd [1 - Tc] WD)Cost of Equity = re = rf + β (rm - rf)

rf = rate of return on a risk-free security

β = beta, a measure of systematic risk

Page 20

rp = cost of preferrrd equity

rd = cost of debt capital

Tc = marginal income tax rate

(rm - rf) = the market risk premium; difference

between the return on the market and risk-free

security

WE = proportion of common equity in capital structure

at market value

WP = proportion of preferred equity in capital structure

at market value

WD = proportion of debt in capital structure at market

value

β = beta, a measure of systematic risk

reflecting the correlation of the returns of a

stock and the market

The transaction approach is used to derive an indication of fair value based on market multiples of comparable mergers and acquisitions

The transaction approach, also referred to in Delaware law as the “comparable transaction” or “comparable acquisition” approach, is thought of in the financial community as a valuation method

As compared to the market approach, which uses prices from the trading of marketable minority interests in the stock market, the transaction approach use prices

Page 21

marketable minority interests in the stock market, the transaction approach use prices from the sale of controlling interests in the merger market, which can include the entire capital structure, and reflect publicly traded as well as privately held firms

•The first step is to identify comparable guideline mergers and acquisitions i.e.,

•Size, industry, date, type, approach, consideration, completion

•Appropriate market-based pricing multiples are then calculated from the guideline merger and acquisition transaction prices and earnings measures, adjusting for differences with the subject firm, and for economic and industry conditions between the date of the transaction and valuation i.e.,

•Multiples of EBIT, EBITDA, book value, net income and gross revenue

•The market-based pricing multiples from the guideline mergers and acquisitions are then applied to the earnings measures of the subject firm to calculate fair value

The transaction approach is used to derive an indication of fair value based on market multiples of comparable mergers and acquisitions (continued)

» Judicial decisions concerning the appropriate use of the transaction approach indicate that the results of the approach must be adjusted, with Delaware courts finding that

› Fair value is not equal to the pro rata value of the highest price available in a sale to a third party

› A control premium derived from merger and acquisition data includes post-merger value arising from potential synergies or better management that cannot be included in fair value

Page 22

in fair value

› The results of the transaction approach must be adjusted to eliminate any portion of shared synergies implicit to the comparable transactions

» As with the income and market approaches, the use of the transaction approach by the Delaware courts has varied

› Certain courts have treated the approach as one indication among others in an integrated valuation, or as a check on the reasonableness of another approach

› Others have relied on it totally, or excluded it completely due to reliability and transaction comparability concerns

Liquidation value is an indication of the value shareholders would be entitled to if the firm ceased operations and its assets were sold piecemeal

Neither a valuation approach nor method in the financial community, liquidation value assumes a firm’s assets will be sold in a mass assemblage, or in an orderly or forced liquidation

•As liquidation value is not reflective of a going concern, it is not interchangeable with, or a substitute for, fair value

•Notwithstanding, liquidation value is regarded as an acceptable measure and relevant factor to consider with others in the adjudication of fair value, particularly for a firm whose value derives from its underlying assets

Page 23

others in the adjudication of fair value, particularly for a firm whose value derives from its underlying assets

Also referred to as net asset value, liquidation value is equal to the market value of a firm’s assets, including cash, minus its outstanding liabilities, debentures and preferred stock

•The first step in the net asset value method under the asset approach is to obtain a GAAP-based balance sheet dated as close as possible to the valuation date

•Next, actual or contingent off-balance sheet assets and liabilities are identified

•Each asset and liability is then analyzed and revalued or valued as necessary, recognizing a deferred tax liability for the built-in gain on appreciated assets

•A market-value based balance sheet is then constructed using the restated values, with the net of the assets and liabilities equal to the market value of the equity

The level of value resulting from a valuation method may differ based on assumptions implicit to the method or imputed to the cash flows

Method Assumption Level of Value

Discounted Cash Flow Control cash flows Controla

Minority cash flows Marketable, minority

Relationship between Valuation Methodology Affects the Resulting Value

Page 24

Guideline Merger & Acquisition Control transaction Controla

Guideline Company Control cash flows Controla

Minority cash flows Marketable, minority

Net Asset Value Control over assets Control

Excess Earnings Control over assets Control

a If synergies involved, could be investment value

While not permitted at the shareholder level, valuation discounts and premiums must be considered at the corporate level

» The objective of a Delaware appraisal is to determine the fair value of 100 percent of the company, and to give the dissenting shareholder his or her proportionate share of that amount

› A shareholder of a large block of stock is therefore not entitled to a premium, while a dissenting minority shareholder may not be penalized by a discount

» Applying a discount to a minority interest is also contrary to the requirement that the firm be valued as a going concern rather than in a sale

›

Page 26

that the firm be valued as a going concern rather than in a sale

› The appraisal process assumes that the shareholder would have held his or her interest regardless of size but for the merger

› Discounting a minority shareholder’s proportionate interest also imposes a penalty for lack of control, potentially enriching the majority unfairly

» In contrast to the treatment of shareholders, discounts and premiums must be considered at the corporate level

› A discount may be required to derive a going concern value, but once determined, it should not be discounted based on the minority interest of the shareholder

› The fair value of a holding company includes a premium to reflect the value of control over its majority- or wholly-owned subsidiaries

While not permitted at the shareholder level, valuation discounts and premiums must be considered at the corporate level (continued)

Not permitted at the shareholder level in either a statutory appraisal or entire fairness proceeding, though allowed to value securities held by a firm that was itself being valued

Minority Discount

Not permitted at the shareholder level in a statutory

Marketability Discount

Not permitted at the shareholder level in a statutory appraisal proceeding, despite approval of the small stock

premium in the discount rate of the DCF method given that small firms have higher rates of return than large firms

Private Company or Liquidity Discount

Not permitted at the corporate level given perception that a private company or liquidity discount is in substance a

marketability discount applied to all shares

While not permitted at the shareholder level, valuation discounts and premiums must be considered at the corporate level (continued)

» Appraisers sometimes add a risk premium to the discount rate used in a DCF valuation in an effort to reflect company-specific risk they believe is not reflected by the company’s beta

» The Court may consider a transaction price in determining fair value

» At the shareholder level, however, the value of the control and or synergy premiums must be eliminated

Company-Specific Risk Premium Control and Synergy Premiums

not reflected by the company’s beta and small size premium

» The Court of Chancery, however, will not adopt a company-specific risk premium unless supported by fact-based evidence

premiums must be eliminated

» In contrast, the fair value of a holding company includes a premium for control

» Factors affecting the size of the control premium include the character of non-operating assets, discretionary costs, existing management, available but unexploited opportunities and the ability to integrate the acquired firm

Page 28

The Delaware courts adjust values derived from the guideline company method by applying a control premium to eliminate what is known as the “implicit minority discount”

“The comparable companies analysis …..includes an inherent minority trading discount, because the method

Concurrently, and inconsistently, the

Page 30

trading discount, because the method depends on comparisons to market multiples derived from…..minority blocks of the comparable companies…..the court must correct this minority trading discount by adding back a premium…”

Concurrently, and inconsistently, the Delaware courts continue to accept and adopt DCF valuations that incorporate terminal values calculated using exit multiples derived from market multiples of comparable companies

The “implicit minority discount” was first adopted in Delaware not by adversarial or judicial process, but by default

The implicit minority discount (“IMD”) first appeared in Delaware in the matter of In re Radiology Associates (1991)

•Plaintiff’s expert submitted valuations based on DCF and comparable company analyses (“CCA”), the latter of which was rejected

•The expert’s opinion that it was necessary to add a 30 % premium to the value derived from the DCF analysis as it included an IMD due to the use of returns from minority interests to derive a discount rate was also rejected

Page 31

Following in 1992, the Court rejected a 15 % premium added to a CCA to correct for an IMD argued in Salomon Brothers Inc. v. Interstate Bakeries Corp.

That same year, the vice chancellor that rejected the IMD in Salomon approved it in Hodas v. Spectrum Technology, Inc., and not because of further analysis

•The defendant’s expert in Hodas was the plaintiff’s expert in Radiology

•As in Radiology, the expert, this time advocating a lower valuation, opined that it was necessary to add a 30 % premium to adjust for the IMD , albeit in the CCA

•This adjustment met no opposition from the respondent, who stood to benefit from it, and the IMD ended up being adopted by the vice chancellor absent any comment or evaluation

Though now required by Delaware law, finance theory is not generally supportive of the IMD

» Consistent with the DCF method, finance theory holds that the value of a firm as a going concern equals the net present value of its expected free cash flows, discounted at a risk-adjusted cost of capital

» No adjustments are taken in a DCF analysis for premiums or discounts

› The premium paid by a third-party acquirer reflects the value of synergies, the benefits of control or both

› Agency costs arising from the separation of ownership and control are embedded in

Page 32

› Agency costs arising from the separation of ownership and control are embedded in the free cash flows

» For an all-equity financed firm, the result of a DCF analysis is the value of its equity

› The pro rata value of the enterprise as a going concern is derived simply by dividing by the number of shares

» Given that a CCA is in essence a short-form DCF analysis with expected future cash flows the same in each year, but with growth and discount rates estimated using rates implicit to the market multiples of comparable firms, adjusting a CCA valuation for the IMD is theoretically and procedurally inconsistent

Though now required by Delaware law, market evidence is not generally supportive of the IMD (continued)

Strong: security prices reflect all information; historical, public and private

No matter how liquid or efficient, the IMD assumes implicitly that publicly traded shares trade at a discount to their proportionate share of the value of the firm

Page 33

Semi-strong: security prices reflect all historical and public information

Weak: security prices reflect all historical information

Though now required by Delaware law, market evidence is not generally supportive of the IMD (continued)

» Firms are acquired at a premium to their going concern value as opportunities not available to or pursued by the firms independently make them more valuable to bidders

» In an arms-length transaction with a third-party, the premium reflects the value of expected synergies and or benefits of control; not an IMD

» In a going-private transaction, the premium represents the benefits of control, whether the ability to reduce agency costs and or improve management; not

Page 34

whether the ability to reduce agency costs and or improve management; not an IMD

› In an efficient market, agency costs are factored into the prices at which shares trade and are purchased by minority shareholders

› The opportunity to improve management and reduce agency costs would not be available but-for a change in control

» That the majority of publicly-owned and traded firms are not acquired also indicates that their stock does not trade at an IMD

That control shares trade at a premium to non-control shares does not mean that non-control shares trade at an IMD

» The value of a share of stock to a shareholder depends on the specific attributes of the ownership interest

» With respect to control rights, the most valuable is at the level of strategic control, followed by financial control, marketable minority (stock price equivalent) and nonmarketable minority levels

» While identical in dollar-value, the difference between a financial control interest and marketable minority interest is viewed as a

Page 35

interest and marketable minority interest is viewed as a

› control premium from the marketable minority interest perspective

› minority discount from the financial control interest perspective

» The difference between the value of a financial control interest and marketable minority interest then equals the difference between a valuation that assumes control, and one that assumes the firm continues as is as a going concern

» It follows that the effect of the minority discount is to eliminate the value of control, and that there is no need to adjust a marketable minority value for an IMD as it represents the value of the firm as a going concern

Comparison of discounted cash flow, comparable company and transaction approach valuations excluding IMD

XYZ, Inc. Valuation Summary

Valuation as of September X, 2009

Low High Mid-point

Value of XYZ Class A Shares1 $55.06 $73.78 $64.42

Page 36

Note: [1] Value of XYZ Class A Shares is calculated by weighting equally the Value of XYZ Class A Shares from Discounted Cash Flow Analysis, the Value of XYZ Class A Shares from Comparable Public Companies Analysis and the Value of XYZ Class A Shares from Precedent Transaction Analysis.[2] Exclusive of control premium of 30%.

Value of XYZ Class A Shares from Discounted Cash Flow Analysis $59.85 $77.93 $68.89

Value of XYZ Class A Shares from Comparable Public Companies Analysis2 $47.52 $67.36 $57.44

Value of XYZ Class A Shares from Precedent Transaction Analysis $57.83 $76.04 $66.93

Comparison of discounted cash flow, comparable company and transaction approach valuations including IMD

XYZ, Inc. Valuation Summary

Valuation as of September X, 2009

Low High Mid-point

Value of XYZ Class A Shares1 $56.64 $76.01 $66.33

Page 37

Note: [1] Value of XYZ Class A Shares is calculated by weighting equally the Value of XYZ Class A Shares from Discounted Cash Flow Analysis, the Value of XYZ Class A Shares from Comparable Public Companies Analysis and the Value of XYZ Class A Shares from Precedent Transaction Analysis.[2] Inclusive of control premium of 30%.

Value of XYZ Class A Shares from Discounted Cash Flow Analysis $59.85 $77.93 $68.89

Value of XYZ Class A Shares from Comparable Public Companies Analysis2 $61.77 $87.57 $74.67

Value of XYZ Class A Shares from Precedent Transaction Analysis $57.83 $76.04 $66.93

Summary

» Fair value is a legal standard of value governing appraisal and fairness actions, the framework for which is provided by state statutes and case law

» Under Delaware law, fair value is equal to the value of a holder’s shares in a firm, valued on a pro rata, going concern, enterprise basis, considering all relevant factors, but excluding any element of value attributable to the merger

» The legal standard of fair value differs from the standards of fair value for financial reporting, fair market value, intrinsic and investment value

Page 39

financial reporting, fair market value, intrinsic and investment value

» Fair value may also differ from other standards based on premise, whether in exchange, to a holder, as a going concern or in liquidation, and based on level, strategic, financial, marketable minority or non-marketable minority

» Delaware courts typically use one or both of the income and market approaches to determine fair value

» The income approach relies on the projected future income of the firm being valued to derive an indication of value, while the market approach uses market multiples derived from publicly traded comparable firms or comparable mergers and acquisitions

Summary (continued)

» While not permitted at the shareholder level due to the principle that the firm is to be valued as a going concern, valuation discounts and premiums must be considered at the corporate level

» A company-specific risk premium to account for risk not reflected by firm’s equity beta and small size premium may not be added to the cost of capital unless factually supported

» At the shareholder level, the value of synergies and control must be

Page 40

» At the shareholder level, the value of synergies and control must be eliminated, while the fair value of a holding company includes a premium for control

» Delaware courts apply a control premium to values derived from comparable company analyses to eliminate the “implicit minority discount” thought to arise from the use of market multiples based on minority interests

» The IMD is generally at odds with finance theory, market evidence and practice in the financial community. That control shares are more valuable than minority shares reflects the value of control and not an IMD to the value of the enterprise as a going concern.

Comparison of invested capital and equity cash flows

Revenue Revenue

─ Cost of Sales ─ Cost of Sales

─ Operating Expenses ─ Operating Expenses

= Operating Income (EBIT) = Operating Income (EBIT)

─ Interest Expense

Equity Cash FlowInvested Capital Cash Flow

Page 42

─ Interest Expense

= Pretax Income

─ Taxes on EBIT ─ Income Taxes

= Net Operating Profit After Tax = Net Income

+ Depreciation & Amortization + Depreciation & Amortization

= Gross Cash Flow = Gross Cash Flow

─ Change in Working Capital ─ Change in Working Capital

─ Capital Expenditures ─ Capital Expenditures

+/- Change in Debt Principal

= Invested Capital Cash Flow = Equity Cash Flow

Relationship between enterprise value and market value of equity

Calculation of Enterprise Value

= Market value of common equity

+ Market value of interest bearing debt

+ Preferred stock

Page 43

+ Preferred stock

+ Minority interest

─ Cash and cash equivalents

= Enterprise value

─ Market value of interest bearing debt

= Market value of equity

Boris J. Steffen, CPA, ASA, ABV, CDBV(202) 538 – [email protected]

» Boris Steffen is an expert in financial and managerial accounting, corporate finance and valuation with significant multi-industry, multi-company and cross-border experience in operations, finance, strategy and litigation. As an advisor in financing, investment and restructuring transactions and claims, matters in which he has consulted or testified include antitrust and competition policy, bankruptcy, restructuring and solvency, contracts, intellectual property, international trade and arbitration, mergers and acquisitions, business valuation, pricing, costs and profitability, securities and taxes.

» As a corporate development executive and consultant, Mr. Steffen has advised in transactions and claims valued in excess of $100 billion. Sectors in which he has consulted include the aerospace,

Page 45

claims valued in excess of $100 billion. Sectors in which he has consulted include the aerospace, automotive, beef processing, biotechnology, business services, cable network, chemical, consumer product, defense, document management, electronic imaging, financial services & banking, food & beverage, healthcare, independent power, information technology, insurance, internet, newspaper, magazine, pharmaceutical, oil & gas, printing, pumps & controls, retail, semiconductor, software, steel, telecom, tobacco and electric utility industries.

» Mr. Steffen has held positions in finance, public policy, corporate development and consulting with Inland Steel Industries, the FTC, Bureau of Competition, U.S. Generating, and LECG. He holds a Master of Management degree with specializations in accounting and finance from the Kellogg School of Management of Northwestern University, and a Bachelor of Science degree in Finance and Bachelor of Music degree in Applied Music from DePaul University. He is an Accredited Senior Appraiser, Certified Public Accountant, Accredited in Business Valuation, Certified Distressed Business Valuation Analyst, and member of the AICPA, ABA, ABI, Insol International, AIRA, ASA and American Finance Association.