Bg Air Transport in 2012

-

Upload

arijit-bose -

Category

Documents

-

view

8 -

download

1

description

Transcript of Bg Air Transport in 2012

Global Aviation & Transport Services

Structural changes in the airline industrywill be crucial to the future success of theindustry. The insatiable growth of lowcost carriers will continue to open newmarkets and the long-haul aircraft willprovide new supply to far flungdestinations. Research projections showan expected transition from the extremelyvolatile swings in demand of the last fouryears to a period of stable growth whichwill be led by routes within Asia Pacific,largely due to the strength of economicexpansion and the liberalisation ofmarkets in China and India. Routes inCentral and Eastern Europe are expectedto grow at a faster pace than in WesternEurope. However, whilst the aboveindicators paint a picture of stablegrowth, the industry continues to behaunted by the twin spectres of globalpandemic and economic slowdown.

Air Transport in 2010

We have selected five key issues and triedto explain what the airline industry mightlook like in the future. Although thereality may turn out to be different, it isworth examining each aspect along withits impact on the industry and economyworldwide.

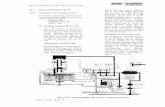

From North to SouthThe future of air travel is rosy, withskyrocketing numbers of passengers flyingin 2010. Over 1.6 billion passengersworldwide use the world's airlines forbusiness and leisure travel. Researchindicates that by 2010, this number couldexceed 2.3 billion. Our analysis shows thatRevenue Passenger Kilometres (RPKs) areexpected to reach 5,000 billion by 2010. Abreakdown of RPKs by major region isshown in the chart below.

Air transport will continue to be an essential influence on thetourism industry. Airlines and airports will become part of everydaylife for the millions who until a few years ago had never flown before.

January 2006

“Over 1.6 billion passengersworldwide use the world'sairlines for business and leisuretravel. Research indicates thatby 2010, this number couldexceed 2.3 billion.”

World RPK growth 2004-2010

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

2004 2010

Asia - Oceania

North America

Europe - CIS

Central & SouthAmerica

Africa

RPK (billion)

Source: Deloitte estimates on Boeing, IATA and Airbus data

.

In 2005, more than 50% of totalpassenger traffic was generated withinNorth America and Europe, an additional4% of passengers flew within or to andfrom Japan. Research estimates that morethan 70% of the USD 400 billion of airlinerevenues is generated in North America,Europe and Japan.

This will change dramatically in the nextfew years. The insurgence of China andIndia as new economic superpowers willcapture around 15% of the expectedglobal growth of passengers. This will bedriven mainly by economic activities, butnew inbound and outbound tourism flowswill account for a significant slice of thetraffic. What is most important is thatthere will be a whole new market andmost of this growth will come from peoplewho have never flown before.

What has so far been mainly an industryfor the western industrialised mass marketwill increasingly become a truly globalbusiness. Other than economic growth,factors that are likely to accelerate or slowdown this process are liberalisation ofdomestic and international traffic, fuelprices and political stability. Whatever thepace, the process is bound to see a shift intraffic from North to South and from Westto East.

Business vs. Leisure trafficThere is no doubt that people will continueto fly for both business and leisure reasons.The real question is: does the differencematter? What we have seen in the lastfew years, both in America and in Europe,is that the distinction in product offering isblurring. Some airlines have abolished theirbusiness class on short and medium-haulflights (e.g. Aer Lingus), while low costcarriers (LCCs) have introduced features toattract business clients, such as inflightentertainment and departures from firsttier and business friendly airports.

This trend has been triggered by the fiercecompetition between LCCs and traditionalcarriers and the need for airlines andcorporate travel managers alike to cutcosts. But as the airline industry stabilisesand the corporate market recovers, therewill be new room for differentiation ofservices, including business and luxuryservices. There are clear signs of this onintercontinental traffic, where some airlinesare now offering all business flights (e.g.Air France, British Airways, KLM, Lufthansaand Virgin) and all the major networkcarriers are investing considerably toimprove their products. Some of the

recognisable trends showing clear upwardmarket segmentation are:

• Increased on-board comfort levels withpossible shower facilities, gym andmassages.

•Seamless and pervasive technology, withbroadband as the "bare minimum" andpossibly video conferencing.

•Mood lighting to aid jetlag and assistsleep.

•On-board entertainment to move into"home from home", including theoption to play games with fellowpassengers and online gaming.

•Amenities which will focus much moreon the personalised needs of travellers(based on enhanced CRM), includingfavourite reading materials, menu items,wines, etc.

•Segmentation of the physical space toallow interaction or solitude.

•Door-to-door rather than gate-to-gateservice.

In a certain way, we can argue that airtravel, with all its amenities and luxuryfacilities, will become, at least for certainsegments, part of the tourism attractionitself.Consequently, in spite of its very nature ofbeing a commodity product, air travel willstill be differentiated between valueconscious and luxury seeking passengers.

LCCs: growth or decline?The continuous expansion of LCCs in theUS, where the model was first invented inthe 1970s, proves that the very nature ofthis business model is sound and respondsto the needs of a significant chunk of themarket. We can expect some majoroverhaul in the LCC segment amongst itsplayers, especially in Europe and in Asia,where the phenomenon is more recent(eight and three years respectively) andwhere LCCs are experiencingunprecedented challenges. With newmarket creation that is reaching saturation(at least in Northern Europe) and strongreaction from network carriers (which inEurope and Asia are in much better shapethan in the US) and charter airlines alike,what can be expected is a wave ofconsolidation among the LCCs, eitherthrough acquisition or the market exit ofmany start-ups.

LCCs survivors will continue to be amongthe most profitable airlines in the world. Aworld where less than 50% of theirrevenues will be generated by ticket sales;with most of the revenues and all of the

profit coming from related activities suchas on-board sales, car and hotel rentals,ground transportation tickets fees, etc.,can be easily envisaged. In the Middle East,where the LCC revolution has just started,the same kind of “LCC mania” over thenext three to five years that we haveobserved in South-East Asia and Europe inthe past decade can be expected. But inthe long run a shake-up of the LCCsegment such as the one now looming inEurope and Asia is inevitable.

Hub & Spoke vs. Point to PointWill the transformation of the LCC modelimply an end to the ‘Point to Point’ networkpromoted by budget airlines? Although thePoint to Point model is overall lesseconomically efficient, it better serves theneeds of passengers moving from A to B.Other things being equal (especially theprice!), it will always be preferred over anynetwork link that requires a connection.Furthermore, in the last few years theeconomic benefits of the Hub & Spokemodel (essentially asset allocation and slotsutilisation) have been more than balancedby the cost of complexity built in by airlinesto run huge network operations. There isevidence that major network carriers havealready reduced the “thickness” of their huboperations, either reducing the number ofwaves or withdrawing from certain airportswhich they had established as “secondaryhubs”.

In any case, there are noticeable exceptionsto this trend. Emirates, an airline with nodomestic market, is building its success andwhole bold strategy based on its Dubai hub.By 2010 Emirates intends to be the biggestlong-haul carrier in the world. But the airlinehas built its strategy on market liberalisationof air traffic which could be the reasonbehind the definitive success of the Point toPoint model. The UAE has “open skies”agreements with all the major countries,making it possible for Emirates to linksecondary airports in Europe, Asia, Africaand the Pacific Region and leverage on itsnatural hub position. Should the recentlyagreed open skies agreement between theEU and the US be ratified, it will pave theway for a wave of similar agreementsaround the world. It will then be possible tofly from any city to any other city of thecountry or region that adopts theagreement, making connection stops atsuper-hubs (such as London Heathrow),redundant.

Obviously this will only be possible if theairport infrastructure is ready toaccommodate long-haul aircraft and the

Deloitte refers to one or more of Deloitte Touche Tohmatsu, a Swiss Verein, its member firms, and their respectivesubsidiaries and affiliates. Deloitte Touche Tohmatsu is an organization of member firms around the world devoted toexcellence in providing professional services and advice, focused on client service through a global strategy executedlocally in nearly 150 countries. With access to the deep intellectual capital of 120,000 people worldwide, Deloittedelivers services in four professional areas—audit, tax, consulting, and financial advisory services—and serves more thanone-half of the world’s largest companies, as well as large national enterprises, public institutions, locally importantclients, and successful, fast-growing global growth companies. Services are not provided by the Deloitte ToucheTohmatsu Verein, and, for regulatory and other reasons, certain member firms do not provide services in all fourprofessional areas.

As a Swiss Verein (association), neither Deloitte Touche Tohmatsu nor any of its member firms has any liability for eachother’s acts or omissions. Each of the member firms is a separate and independent legal entity operating under thenames “Deloitte,” “Deloitte & Touche,” “Deloitte Touche Tohmatsu,” or other related names.

Member of Deloitte Touche Tohmatsu

increasing number of passengers at anygiven time that intercontinental trafficentails. Again the future of air transport willdepend on product innovation andcustomer preferences as much as on publicpolicies and local community support forhuge infrastructure investments (not onlyrunway capacity, but also groundtransportation, logistics platforms, retail andcommercial activities, etc.).

Super Jumbos vs. Sub JumbosDiffering views on what business models willprevail in the future is what lies behind theinvestment decisions that airlines are nowtaking. Those who believe that the Hub &Spoke model will eventually prove itspotential economic superiority are orderingthe so called “Super Jumbo”, such as thedouble deck Airbus A380 (with 550-800seats), but also its Boeing archrival stretchedB747-800 or smaller B777 or A340. Thosewho believe that passenger preference is forPoint to Point travel are ordering the new“Sub Jumbos”, i.e. the 250 seats aircraft likeBoeing 787 and the renewed Airbus 350.

Several elements will influence what thepreferred long-haul aircraft will be for thefirst half of the 21st century, including:

•Oil prices

•Environmental concern and relativeregulation

•Cost of capital/access to financialresources

• Investment decisions of airports toaccommodate super jumbos

•Final customer preferences

•Traffic congestion and Air Traffic Control(ATC) regulation

Industry specialists believe that there isenough aircraft demand for both types ofairplanes. The recent boom in aircraft ordershas been stretching Boeing and Airbusproduction plants to the limit. Boeing wasbooming with about 1348 orders under itsbelt towards the end of 2005 while Airbusdisplayed its order book with 1373 aircrafton order till Nov 2005 (source: ATI). It mightbe worth noting that the numbers in 2005were about a quarter higher than thenumber of total orders set in 1989!

ConclusionAir transport will continue to be an essentialinfluence on the tourism industry. Airlinesand airports will become part of everydaylife for the millions who until a few yearsago had never flown before.

Technology (both IT and avionics) will enableeasier market segmentation and channeldisintermediation alike. Airlines (especiallycharters who now offer up to 35% of their

Contacts

Libero MiloneGlobal Leader, Aviation & TransportServicesTel: +39 02 8332 2111Email: [email protected]

Paul O’NeillGlobal Aviation & Transport ServicesTel: +44 20 7303 7110Email: [email protected]

Alessandro CassinisGlobal Aviation & Transport ServicesTel: +39 348 015 304 238Email: [email protected]

seats directly on line) and airports willbecome competitors of tour operators,competing on the overall customer spendingpotential (the more you spend at the airportand on-board, the less you will spend at thedestination).

Government policies, international co-operation and public opinion concerns willdictate the pace of the transformationlooming ahead.