Bell Ringer This helps to understand the US debt: U.S. tax revenue: $2,170,000,000,000 Fed budget:...

-

Upload

angel-marlene-knight -

Category

Documents

-

view

213 -

download

0

Transcript of Bell Ringer This helps to understand the US debt: U.S. tax revenue: $2,170,000,000,000 Fed budget:...

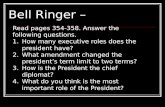

Bell Ringer• This helps to understand the US debt:

• U.S. tax revenue: $2,170,000,000,000• Fed budget: $3,820,000,000,000• Deficit: $ 1,650,000,000,000• National debt: $14,271,000,000,000• Recent budget cut: $38,500,000,000

• Let’s remove 8 zeros and pretend it’s a household budget:• Annual family income: $21,700• Money the family spent: $38,200• New debt on the credit card: $16,500• Outstanding balance on the credit card: $142,710• Total budget cuts: $385

• In your opinion, why are American politicians still avoiding tackling the U.S. debt? Think about how spending cuts (welfare for those in poverty & the elderly, roads/infrastructure, education, research, etc.) and tax hikes would affect our everyday lives.

• http://www.usdebtclock.org/

Please put your Budget Simulations

HW in the bin!

Today we will …

Objectives Agenda

• Review executive orders, impeachment & succession.

• Describe the steps in creating the US national budget.

• Explain the role of The Federal Reserve in monetary policymaking.

• Compare/contrast fiscal & monetary policy.

1. Presidential Odds & Ends2. Fiscal Policy - Creating US

National Budget slides/notes

3. Monetary Policy – The Fed video & questions

4. Closure - Fiscal & Monetary Policy FRQ

HW: • Foreign Policy RQs (1/30)• Topic Statement (’d 1/30)

Executive Orders• A rule or regulation issued

by the President that has the force of law.

• Congress acts in response to or in anticipation of executive orders (preempts and compromises)

Impeachment• The House can “impeach”

the President.• The Senate conducts a

trial & votes on impeachment.

• The Supreme Court Justice presides over the trial.

• Presidents:1. Andrew Johnson -

acquitted2. Bill Clinton - acquitted▫ Nixon resigned before

impeachment

Check for understanding

•Specifically explain how a president can be removed from office. Provide at least one historical example of this process being used.

Economic Policy

Fiscal Policy Monetary Policy

Goal: put more $ in people’s pocket Manage the economy by

controlling taxing & spending.

How can the Pres. influence?

How can the Congress influence?

Goal: regulate money supply to increase or decrease the nations level of business We want a productive

growing economy but it can’t grow too fast

Inflation!

Overall goal is to regulate & ensure the stability of the economy.

Inflation• When the value of money goes down. This means that it

costs more money to buy products. • The more money there is out there being spent, the less

the money is worth. The supply is high, thus the value is comparatively lower.

• What this also means is that people are spending, and this is good.

• Proper balance between a healthy amount of spending and money in circulation & an acceptable level of inflation.

• Economists have placed "healthy" inflation at 2 - 3%. This shows spending growth and expansion, any more and we begin to worry.

Fiscal Policy Actions▫Raising & lowering taxes▫Spending

1. Mandatory Spending – obligated by previously enacted laws

Entitlements (ex: Social Security, Medicare) Interest on the debt

2. Discretionary Spending – controlled thru regular budget process• Defense budget• Education• Environmental Protection Agency• Department of Veterans Affairs

Monetary PolicyFederal Reserve Video – 14 min.

https://www.youtube.com/watch?v=KN3kD4T3ltY&feature=related