Beginning of Bear Market..

Transcript of Beginning of Bear Market..

-

8/15/2019 Beginning of Bear Market..

1/7

Date: 20th

April 2016

Time to Exit Equities&

Move towards Safe Heaven !!!

Uncertainties in the financial markets still prevails wherein US central banklooking forward to reverse their interest rate cycle on the contrary other majorcentral bank like Sweden central bank (Riksbanken), European central bank,Swiss national bank, Bank of Japan and Danmarks National bank continues toopt for negative interest rate.

Federal Reserve took almost 9 years to shift its interest rate cycle, they initiatedto trench their interest rate in the end of 2007 when it was as high as 5.5% andended at 0% in the year of 2008. The rationale to keep their interest rate low wasto infuse liquidity in the economy which in turn increases domestic consumptionand thereby their GDP

Feb began their QE1 process in September 2008 at that stage their balance sheet was at $ 900 Mn and thereafter they continued to expand their balance sheet byQE2, QE3 to reach a level of $4.5 trillion by end of 2014.However the approachdid not proved fruitful for the economy when we compare GDP number of 2008 which was at 1.5% and still hovering at same level in 2015.Viz a viz when we lookon inflation numbers it has shrinked from 4% to 1 % which suggests that liquidityinfused via QE or lowering interest rate, has not helped to revive their economyand instead that money has flown away in other nations in search of betteropportunity.

Fed has decisively failed to achieve its inflation target of 2% because of free fall in

energy prices, global slowdown and low domestic demand. With absoluteimbalance in major economic indicator like GDP, Inflation and Interest rate, I believe it will be very difficult for FED to strengthen their economy on its currentinterest rate policy. In present scenario, if US decide to hike their interest rates when their GDP and inflation numbers are already on lower side, it will have afurther negative impact on their economy. In my view Fed has to keep theirinterest rate lower in the same way as they did in last 8-9 years but notcompletely convinced that will help either when we look retrospective.

Moving to other developed nations, which are already running negative interestrates, are in the same situation in what US is, following table will portray that….

Switzerland Japan Euro ZoneGDP % (YOY) 0.3 0.7 1.6

Inflation % (YOY) -0.8 0.3 -0.2

Interest rate % -0.75 -0.1 0

To conclude in a comprehensive way, recovery in the above mentioned economiesseems to be fragile in near term. Discrepancy in policy stance of the above

-

8/15/2019 Beginning of Bear Market..

2/7

Date: 20th

April 2016

mentioned nation & uneven economic releases are hinting towards a globalfinancial meltdown before outset of a long term recovery. Although it is difficultto predict this slowdown but I am expecting it to happen in upcoming 2-3 months but certainly not beyond 6 months

Now let’s shift our focus towards the emerging countries, where the situation issomewhat same like the developed nations except India. Most of the emergingeconomies like China, Russia, Brazil, and South Africa etc are fighting with theirown fundamental problem if any financial slowdown materializes these nations will have a dual impact and India too won’t be exempted from the same.

If someone asks me after reading this report, what factors are you betting on forsuch a strong bear trend in global equities? I will just smile and reply “Events arealways unknown but be prepared to welcome it”

However below mentioned are some of the reasons which I foresee for a slump inthe financial market.

1. China – Manipulation of data or Yuan depreciation

2. Europe – Any country default and spread its contagion effect on otherEuropean nations

3. Bankruptcy of any major banks/funds from Europe or US

4. British exit from Euro zone

5. Further fall in oil and commodity prices, may create structural imbalance.

Why I foresee such an event happening in next 2-3 months but certainly not beyond 6 months???

I am mainly punting on technical prospective; however there are certainfundamental factors to favor my observation as well

1. The financial slum is broadly expected in the month of May and there is ageneral tendency of “SELL IN MAY GO AWAY”.

2. Irrespective of aggressive efforts, most of the central banks have failed togenerate recovery in their respective economy.

3. When I look back, Last time I saw crude oil prices at $32.40 was inJanuary 2009 and thereafter bounced back sharply towards $100 mark. When black gold was hovering at $32.40 in 2009 all the leading

international broking house forecasted crude oil to drop further below$20, however it recovered sharply towards $100 levels. Two months back black gold has breached its 2009 lows and marked a new life time low of$26.05 a barrel. It has recovered from its low, presently trading at $41.75. With ongoing conflict between the oil producing nations to freeze the oilproduction, slow global growth, I am expecting that the bottom has not been formed yet.

-

8/15/2019 Beginning of Bear Market..

3/7

Date: 20th

April 2016

4. In recent G-20 summit all the nation mutually examines that dollar weakness can be a solution for a global recovery, but nations like Europe &Japan are running negative interest rate & other developing nations stillsuffering from their own fundamentals, with the same situation weaknessis dollar seems unattainable

Apart from the above mentioned observation, following are the technicalexplanation:

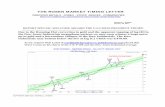

Dow Jones Index (CMP 18053):-

Technical Explanation:-

Dow Jones Index looks like forming the same pattern which it has formed at thetime of Lehman Brothers bankruptcy. The index is only 650 points away from itslife time high of 18351, which it has marked in May 2015. Based on the Ichimokutechnical indicator, a further up move from its immediate resistance zone of18350-18650 looks like difficult.

Dollar Index (CMP 94.11):-

-

8/15/2019 Beginning of Bear Market..

4/7

Date: 20th

April 2016

Technical Explanation:-

Dollar index initiated a fresh rally from low of 78.90 in May 2014 and marked ahigh of 100.51 in Dec 2015. Presently it is hovering in the price band of 92.60 to100.51, thus hinting formation of bullish flag pattern. Based on the mentionedtechnical pattern, the target can be set around 122.12 by adding 21.61 (Difference

b/w 100.51 and 78.90) from break out level of 100.51. The pattern will remainactive as long as Index stays above 92.00 mark.

EURUSD (CMP 1.1365):-

Technical Explanation:-

The pair has formed an exactly opposite technical pattern which it has formed inDollar Index, as euro consist of 57.6% weightage in Dollar index. As per thisreverse flag pattern, target can be set around 0.6923 by subtracting 3535 pips(Difference b/w high of 1.3993 on May 2014 and low of 1.0458 on March 1.0458)from break out level of 1.0458. The above mentioned target level if at all meet, will be a new low as against 0.8230 in October 2000 since the inception of Eurocurrency from 1st Jan 1999. The above pattern will turn vague if the pair crosses1.1710 mark .

-

8/15/2019 Beginning of Bear Market..

5/7

Date: 20th

April 2016

DAX Germany Index (CMP 10350):-

Technical Explanation:-

DAX Index is forming a technical bearish topping pattern as the index unable tosustain above 10000 mark since last few week. As ichimoku Chiko span technicalindicator favors selling in the index, 10112 its recent high as well as 50%retracement of its fall from 11430 to 8699 will act as a resistance for the index. Any close above 10112 on a monthly basis will negate our above mentioned view.

GOLD (CMP $1047):-

-

8/15/2019 Beginning of Bear Market..

6/7

Date: 20th

April 2016

Technical Explanation:-

Technically gold has broken its falling trend line resistance and stochastic favors buying interest. Thus, as long as Gold stays above falling trend line support, biasremains on the higher side.

Nifty Index (CMP 7914):-

Technical Explanation:-

Nifty Index has also forming exactly same pattern as it has formed at the time ofLehman Brothers default. As per this pattern, Nifty is expected to behave in asimilar monthly candlestick pattern for next three months i.e. April, May & June2016 as it has behaved in August, September and October 2008. The pattern issimilar; however repetition of the same might change from April, May and June2016 to any other combination of months in 2016.

After Modi’s government came on board, Nifty has given a breakout of itsprevious high of 6357 and thereafter touched a new high of 9119 in March 2015.Since the election result, we have not seen nifty trading below breakout level.Based on this info and clubbing technical together, I think nifty should fall tillimmediate target of 5650 (50% retracement of the rise from 2252 of October2008 to 9119 in March 2015) and thereafter 4850 (61.8% retracement).

-

8/15/2019 Beginning of Bear Market..

7/7

Date: 20th

April 2016

USDINR (CMP 66.17):-

Technical Explanation:-

USDINR is moving in a rising price band, where currently it is trading near lowertrend line support of 65.80. It is expected to hold this level on a monthly basisand thus upside immediate target can be set at least till 70.30 as I expect fewmore candles to be formed taking support of this rising channel. Considering thefall which I expect in equity and rally in Dollar Index, there is a possibility thatUSDINR can move till 72.50-73.50 level. On the down side a monthly closing below 65.80 will negate our above mentioned view.

Conclusion: -

Considering the present global economic scenario, I am on the opinion that oneshould exit their existing equity portfolio and opt for the safe heave such as UStreasury, Gold or Cash.

Thanks & Best Regards,

Dhaval Shah (+91 9664004455)

The information and analysis contained in this document come from sources believed to be reliable;

however, no representation or warranty, express or Implied, is made as to the fairness, accuracy,

completeness or correctness of this information. Nothing contained in this publication shall constitute an

offer to Sell/purchase or an invitation/ solicitation to do so for any currency, security, and equity.