bcg matrix of coc-cola, india

Transcript of bcg matrix of coc-cola, india

TERM PAPER

OF

STRATEGIC MANAGEMENT

ON

“BCG MATRIX OF COCO-COLA”

SUBMITTED TO, SUBMITTED BY,

MS. ANUMEHA JHA KARAN WADHERA

RT1803A16

10808494 (REG. NO.)

CONTENTS

I. COCO-COLA, INDIA MISSION STATEMENT

VISSION STATEMENT

VALES

BELIEFS & DIVERSITY

II. CULTURE OF COCO-COLAIII. PRODUCT STRATEGYIV. PRODUCTLINE OF COCO-COLA , INDIAV. SWOT ANALYSIS OF COCO-COLA

VI. BCG- MATRIX BENEFITS LIMITATIONS BCG-MATRIX COMPONENTS

VII. BCG-MATRIX OF PRODUCTLINE OF COCO-COLA ,INDIAVIII. BCG- PRODUCT LIFE CYCLE

IX. REVIEW OF LITERATUREX. CONCLUSION

COCO-COLA , INDIA

Coca-cola Company, nourishing the global community with the world’s largest selling soft drink since 1886, returned to India in 1993 after a gap of 16 years.HCCB serves in India some of the most recalled brands across the world including names such as coca-cola, sprite, fanta, thums up, limca, maaza and kinley (packaged drinking water), minute maid pulpy orange.

The business system of the company in India directly employs approximately 6,000 people, and indirectly creates employment for many more. Coca-Cola India has increased its market share from 57 percent in the carbonated soft drink (CDs) category in 2005 to 61 percent at the end of December 2006.

Coca Cola was the first in the country to launch cans, plastic cap leak proof bottles and full length delivery crates.

• Ranking: We own 4 of the world’s top 5 nonalcoholic sparkling beverage brands: Coca-Cola, Diet Coke, Sprite and Fanta.

• Company Associates: 90,500 worldwide (as of December 31, 2007)

• Operational Reach: 200+ countries

• Consumer Servings (per day): 1.5 billion.

MISSION STATEMENT

“TO HAVE A STRONG DOMINANT AND PROFITABLE BUSINESS IN INDIA”.

SHARED VALUES

We value and respect our employees We communicate openly We have integrity We are committed to winning

VISION

“TO CREATE VALUE FOR OUR SHARE HOLDERS.”

Building Preference & Market Leadership For Our Brands

Achieve Quality Excellence And Serve Our Customers With Quality Products

Maximizing Profits

Developing People Optimum Utilization Of Assets

VALUES

Respect And Trust As The Framework Of All Our Relationships

Flexibility For Our Clients, Partners And Staff

Innovation In The Products, Processes, And Services We Offer

Focus On Results, Without Neglecting The Quality Of The Process

Doing the Right Thing

BELIEFS AND DIVERSITY

Vibrant Network of People in 200 Countries.

Putting Citizenship into Action.

Our Actions as Local Citizens.

Every Day to Refresh the Marketplace.

Enrich The Workplace.

Protect The Environment.

Strengthen Our Communities.

CULTURE OF COCA-COLA COMPANY

Our employees are our asset

Motivating employees

Bonuses for employees

Special discount for employees

Work in shifts 8 p.m. to 4 p.m. (all departments’ other then technical departments), 4 p.m. to 12 p.m. (technical department).

New employees are placed with old ones to learn work and the values prevalent in the company

The company working environment is really a good blend of asian and western values

Coca-cola is providing smart wages to its employees.

Medical facilities are of prime importance in any organization

PRODUCT STRATEGY

Product: Anything that can be offered to a market for attention, acquisition, use or consumption that might satisfy a want or need.

Levels of coke as a productCore product:

Core benefit is that it fulfills the thirst.

Actual product:

Design: Pet bottles, returnable glass bottles, economy packs.

Quality: Quality differs with respect to country for example. Coca-Cola Can quality that is available in Middle East is certainly different as compared to Coke Can available in India.

Product Classifications:

Coke is categorized as a convenience product, because the purchasing rate is very high and this is the product that is bought very frequently.

Individual product decisions

BRANDING:

a) Brand Equity:

As far as coke is concerned brand equity for the customers is very high. People are highly brand loyal.

b) Brand Strategy:

The following is the brand strategy of Coke

Line Extension:

Line extension occurs when a company introduces additional items in a given product category under the same brand name. For example if Coke introduces new flavors and package size, it will be considered as line extension.

Brand Extension:

Brand

Product

Existing New

Existing Line extension Brand extension

New Multi-Branding New brands

Brand extension means using a successful brand name lets say Coca-Cola and then launching new product for example cherry coke. This was an example of brand extension.

Multi-Branding:

It means introducing additional brands in the same category. For example Coca-Cola not only introduced coke as a brand but also sprite and Fanta.

Diversification:

It means introducing new product with the new brand name. It means diversification but this is something Coca-Cola has not adopted for as yet.

Product Line Decisions:

Product Line Length:

It means the number of products that company is offering. For example Coke, Diet Coke, Fanta , Sprite.

PRODUCT LINE OF COCO-COLA IN INDIA

PRODUCT THAT SELL MORE IN MARKET ACCORDING TO DISTRIBUTORS

2

5

6

1

3

8

0

1

2

3

4

5

6

7

8

9

THUMS-UP

SPRITE COKE MAAZA FANTA LIMCA

PRODUCTS

SELL

IN M

ARKE

T

Swot Analysis of Coca-Cola.

Strength

Strong leading brands with high levelof consumer acceptance – this allow the company to extend it product to attract new customers.

Large scale of operations – Coca-Cola product already sold in 200 countries. In addition it recorded revenue of $31million making the largest manufacturer in the industry.

Leading market position – the brand large market about 5% ahead of its main competitor PepsiCo.

Strong cash flows from operations- the brand is able to create over $ 50million a day.

Weakness

Financial market volatility impacting pension assets and in turn the liquidity position of the company.

Big slow decision making can give competitive advantage to the competitor such as PepsiCo by being the first to introduce a product for example.

Opportunities

Global growth in non-alcoholic ready-to-drink beverage industry- this trend is set to generate retail sale in the industry to more than $1trillion by 2020.

Growing global bottle water market Intense competition

Booming global functional drinks market e.g. energy drink.

Target the ageing customers and the young and more environmental concern people

Threat

Economic climate - countries from all over the world have felt the impacts of the current recession. This may be a problem for Coke, which derives approximately 75% of its sales from outside North America.

Health and wellness has created concern for carbonated product especially in the USA and Europe.

Overdependence on bottling partners

Intense competition – either local or global market.

THE BCG MATRIX

INTRODUCTION

BOSTON CONSULTING GROUP (BCG) MATRIX IS DEVELOPED BY BRUCE HENDERSON OF THE BOSTON CONSULTING GROUP IN THE EARLY 1970’S.

According to this technique, businesses or products are classified as low or high performers depending upon their market growth rate and relative market share.

MARKET SHARE

Is the percentage of the total market that is being serviced by your company, measured either in revenue terms or unit volume terms? The higher your market share, the higher proportion of the market you control.

MARKET GROWTH RATE

Market growth is used as a measure of a market’s attractiveness. Markets experiencing high growth are ones where the total market share available is expanding, and there’s plenty of opportunity for everyone to make money.

It is a portfolio planning model which is based on the observation that a company’s business units can be classified in to four categories:

STARS

QUESTION MARKS

CASH COWS

DOGS

It is based on the combination of market growth and market share relative to the next best competitor.

BENEFITS OF BCG-MATRIX

BCG MATRIX is simple and easy to understand.

It helps you to quickly and simply screen the opportunities open to you, and helps you think about how you can make the most of them.

It is used to identify how corporate cash resources can best be used to maximize a company’s future growth and profitability.

LIMITATIONS

BCG MATRIX uses only two dimensions, Relative market share and market growth rate.

Problems of getting data on market share and market growth.

High market share does not mean profits all the time.

Business with low market share can be profitable too.

THE BCG MATRIX COMPONENTS

STARS :-

High growth business competing in market where they are relatively strong compared with the competition. they have a high point shares and are the ideal businesses.

$ CASH COW: -

The low-growth business with a relatively high point market shares. These businesses were stars but now have lost their attractiveness.

Ɂ QUESTION MARK: -

Businesses with low point share but which may have a high growth rate. This suggests that they have potential but may require huge ever, a competing force extraordinary effort in order to grow point share.

DOGS :-

Businesses that have low relative share and low expected growth rate. Dogs may generate enough points to sustain but they are rarely, if ever, a competing force.

BCG- MATRIX

STARS HIGH GROWTH, HIGH MARKET SHARE

Stars are leaders in business. They also require heavy investment, to maintain its large market share. It leads to large amount of cash consumption and cash generation. Attempts should be made to hold the market share otherwise the star will

become a cash cow.

$ CASH COWS

LOW GROWTH, HIGH MARKET SHARE

$ They are foundation of the company and often the stars of yesterday. $ They generate more cash than required.$ They extract the profits by investing as little cash as possible$ They are located in an industry that is mature, not growing or declining.

DOGS LOW GROWTH, LOW MARKET SHARE

Dogs are the cash traps. Dogs do not have potential to bring in much cash. Number of dogs in the company should be minimized. Business is situated at a declining stage.

Ɂ QUESTIONMARKS HIGH GROWTH , LOW MARKET SHARE

Ɂ Most businesses start of as question marks.Ɂ They will absorb great amounts of cash if the market share remains

unchanged, (low)Ɂ Question marks have potential to become star and eventually cash cow but

can also become a dog.Ɂ Investments should be high for question marks.

BCG-MATRIX

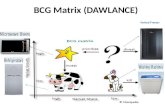

BCG-MATRIX FOR THE PRODUCT LINE OF COCO-COLA

STARS HIGH GROWTH, HIGH MARKET SHARE

$ CASH COWS

LOW GROWTH, HIGH MARKET SHARE

DOGS LOW GROWTH, LOW MARKET SHARE

Ɂ QUESTIONMARKS

HIGH GROWTH , LOW MARKET SHARE

BCG PRODUCT LIFE CYCLE

From here we can say that:-

Ɂ INTRODUCTION STAGE:- FANTA & SPRITE are at the introduction stage , as both are much new in the market as compared to thums up and limca.

GROWTH STAGE:_ THUMS UP, KINLEY & MAZZA are at the growth stage having high growth and low market share.

$ MATURITY STAGE:

LIMCA, COCO-COLA are at the maturity stage having low growth but high market share.

DECLINE STAGE:-

DIET COKE, MINUTE MADE PULPY ORANGE & KINLEY SODA are at decline stage, proving to be non profitable product for coco-cola having low growth and low market share.

REVIEW OF LITERATURE

George Stalk Jr.

The underlying idea of the BCG matrix is that the best strategy is to dominate

market share when the market is mature. The thinking goes like this:

Profitability is greatest when the market matures.

A dominating market share gives the highest accumulated production

volume.

According to the experience curve, high volume leads to lower production

costs.

Low production costs can either be used to lower prices and take market

share, or to increase profit margins.

The BCG matrix proved a great success and most of the big American companies

used it to review their business units.

Richard Hamermesh .

Portfolio planning on the basis of early methods was very useful when decisions

had to be made concerning which business units were to be sold off, but was much

less useful in connection with growth and business development. Richard

Hammermesh gives good advice in this respect:

Do not confuse resource allocation with strategy. Planning is not a

substitute for visionary leadership.

Pay careful attention to the strategy of each business unit and not only the

strategy for the whole portfolio, which is of course the aim of portfolio

planning.

Involve line managers in the planning process. Line managers and not

personnel managers should plan strategy.

Do not confuse strategic planning with strategic thinking. The discipline

involved in strategic planning helps in the development of strategic

thinking, but they are in no way identical.

Dagmar Recklies.

This product portfolio matrix classifies product lines into four categories. The

BCG model suggests that organizations should have a healthy balance of products

within their range.

In the result, the profitability of a product depends on its market share, the growth

rate of its market and on its position in product lifecycle.

Carl W. Stern.

Typical Question Marks are new products in markets with a high growth rate.

They enter the market with a small market share in relation to the market leader. In

order to improve their position, it takes investments, especially in marketing.

Normally, such products do not generate profits.

R.Sharma

The BCG Matrix is useful for a company to achieve balance between the four

categories of products a company produces. As a particular industry matures and

its growth slows, all business units become either cash cows or dogs. The overall

goal of this ranking is to help corporate analysts decide which of their business

units to fund, and how much; and which units to sell. Managers are supposed to

gain perspective from this analysis that allowed them to plan with confidence to

use money generated by the cash cows to fund the stars and, possibly , the question

marks .

CONCLUSION

TO CONCLUDE WE CAN SAY THAT:-

Dog Strategy: Either invest to earn market share or consider disinvesting. For the products like diet coke ,pulpy orange and kinlely soda it better to stop manufacturing these products and to should try to come up with some new innovative and better beverages.

Star Strategy: Invest profits for future growth and for earning more of market share and profits , thums up and mazza will be a lot profitable for Coco-Cola India

Question Mark Strategy: Either invest heavily in order to push the products to star status, or divest in order to avoid it becoming a Dog.

Cash Cow Strategy: Use profits to finance new products and growth elsewhere. LIFE CYCLE:

To be able to market its product properly, a firm must be aware of the product life cycle of its product. The standard product life cycle tends to have five phases: Development, Introduction, Growth, Maturity and Decline. Coca-Cola is currently in the maturity stage, which is evidenced primarily by the fact that they have a large, loyal group of stable customers.

Furthermore, cost management, product differentiation and marketing have become more important as growth slows and market share becomes the key determinant of profitability.

In foreign markets the product life cycle is in more of a growth trend Coke's advantage in this area is mainly due to its establishment strong branding and it is now able to use this area of stable profitability to subsidize the domestic "Cola Wars".