Basics of Budgeting Exhaustive

-

Upload

arun-pandey -

Category

Documents

-

view

217 -

download

0

Transcript of Basics of Budgeting Exhaustive

The Winning Edge

Basics of Budgeting

The Winning Edge

BUDGETING

Definition : A budget is a quantified expression of the intentions of the management and operates in a fashion that enables attainment of orgainsational goals.

Elements of a Budget

1. It is a comprehensive and co-ordinated plan.

2. It is expressed in financial and physical terms.

3. It is a plan for the company’s operations and resources.

4. It is a future plan for a specified period.

The Winning Edge

MAJOR OBJECTIVES OF BUDGETING

1. To state the company’s goals.

2. To communicate expectations to all concerned.

3. To provide detailed plan of action for reducing uncertainty.

4. To co-ordinate activities and efforts in such a way so as to maximise resources.

5. Measure for controlling performance.

The Winning Edge

TYPES OF BUDGETS

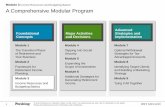

Comprehensive Budgeting involves the preparation of a Master

Budget. The three important components of Master Budget are:

i) Operational / Functional Budgets

ii) Financial Budgets

iii) Capital Budgets

The Winning Edge

ESSENTIALS OF BUDGETING

1. Senior management support

2. Clear and realistic goals

3. Assignment of authority and responsibility

4. Creation of responsibility centres

5. Adaptation of accounting system

6. Full participation

7. Effective communication

8. Budget education

9. Flexibility

The Winning Edge

Budgeting As a Tool of Management Planning and Control• Communication• Coordination• Performance Evaluation• Motivation

Fundamental Concepts & Techniques Used for Budgetary Control

• Cost benefit analysis including the social cost benefit analysis.

• Contingency approach

• Responsibility accounting based on the technique of variance analysis

• Value analysis for services, systems, cost incurrence etc.

• Application of mathematical models such as PERT, CPM,Transportation & Assignment models, L.P. & Simplex Models, Scrutiny Analysis etc.

The Winning Edge

bBudgeting Process – A Structured Approach

Formation of Multipurpose Budget Team Definition of Vision/Mission/Objectives Exhaustive analysis of :

- Competitive Environment- Economic Environment- Political Environment- Business SWOT- New Product Strategies- Corporate Strategic Initiatives e.g.., New/ Restructured

Alliances at Industry and Company level

Continued …

The Winning Edge

• Agree on Volumes and Price Realisations

• Work on related linkages (at various companies, various business etc. viz., Manufacturing, Logistics, etc.)

• First pass preparation of Income/Capital Employed Statements

• Budget Package Finalisation

Continued …

Continued …

The Winning Edge

Volumes and Price Realisation determination

• Territywise/Productwise Volume and NRV determination (Net Realisable Value).

• Inputs on Brand Pricing,Product Positioning , Past Product Performance Analysis, Proposed Product Lines from Marketing and Technology Teams.

• Deliberations on the above done by the Budget Team to determine Volumes and Prices Regionwise

Continued …

Continued …

The Winning Edge

• Zero base build up, other than Fixed Commitments

• Projected Business Growth

• Determination of Sales Regions/ Territories

• Manpower Requirement

• New Product Launches

• Proposed Brand Plans

Continued …

The Winning Edge

Manufacturing Budget Preparation

CapacityVolumes

Inventory

Production PlanImport Plan

Operations Cost

Variable

Fixed

Labour

Utilities

Standard Cost of Goods Sold

Fixation of RM/PM Costs

Continued …

The Winning Edge

Logistics Cost Plan

Determined by the Production Plan, Import Plan and Despatch Plan

Continued …

The Winning Edge

FUNCTIONAL / OPERATIONAL BUDGETS

1. Sales budget

2. Production / Operations

3. Material Consumption

4. Purchase

5. Labour

6. Overheads

7. Marketing and Selling

8. Administration and Finance

The Winning Edge

14

Sales Budgets : sales being primary source of cash practically all the enterprise planning regarding capital additions needed, the production level, manpower requirements, inventories required, material purchases etc. depend upon the sales volumes.

Thus the usefulness of almost all the rest of the budgets depend upon the accuracy & reliability of the sales estimates, much of the expertise for the forecasting of it is with Marketing Staff of the firm .

Operating Budgets : Provide the profit Budget for the Co. as a whole as well as its segments by consolidation of the several budgets comprising the operational budgets. Sales Budget is one of the operating Budgets.

The Winning Edge

Following factors affect the sales budget figuresGeneral Industry & economic conditions

a) Product Mixb) Territories & /or other segments of businessc) Pricing decisions (in turn depends upon the demand, cost recovery &

profit margins)d) New Products/Existing Productse) Seasonal saleabilityf) Sensitivity to technological advancementg) Competitor’s Strategies h) Types of consumers (classes /masses) i) Govt. Policies. j) The quantity and value of past salesk) Market research and salesmen’s estimates

The Winning Edge

16

STEPSa) Sales forecast by productb) Product mix : taking into consideration the

manufacturing capacity and profitability of product lines.

c) By product type; area and mix which management believes it could sell to achieve company objectives.

d) Customer profile Products TotalSales Budget A BBudgeted Sales Units (i) Budgeted Sales Price Rs./unitBudgeted Sales Revenue Rs.

70,00055

38,50,000

80,00040

32,00,000

1,50,000

70,50,000Above illustration shows that the budget targets of both types physical & financial are required.

The Winning Edge

AN OVERVIEW OF BUDGETING PROCESSA PLAN OF OPERATIONS Management’s Goals and Objectives for the year

Formalised in

THE ANNUAL PROFIT PLAN

Wherein Mgmt. Specifies

THE OVERALL INCOME OBJECTIVEDetailed in

SALES BUDGETin Qty/Territory/ Product and Time

Period

OTHER INCOME BUDGETInterest Income / Royalty etc.

Less

THE OVERALL COST & EXPENSE OBJECTIVE detailed in

DISTRIBUTION EXP. BUDGET

By Territory

ADMIN. EXP. BUDGET

By Department

OTHER EXP. BUDGET

Interest Exp. Etc.

PRODUCTION BUDGET

Unites to be produced

All the below are prepared for pre decided time period involved

[PURCHASE BUDGET][DIRECT LABOUR BUDGET]

[FACTORY O/H BUDGET]

The Entire PLAN OF OPERTIONS is finally reflected in

THE FINANCIAL BUDGET Composed of

THE BUDGETED B/SASSETS/ LIABILITIES

OWNER’S EQUITY

SUPPORTING SUB-BUDGETS, CASH BUDGET,

INVENTORY BUDGET, CAPITAL EXP. BUDGET,

OTHERS

The Winning Edge

TABLE SHOWING VAROUS FACETS OF A BUDGET PROGRAM Name of Budget

What it shows

Prepared by

Based upon Classification by

1) Sales Budget

2) Production Budget

3) Production Cost Budget

4) Materials & Stores

5) Labour Budget

6) Production Over Heads

Estimated sales of products

Estimated Quantity of Production

Cost of Production

Quantity & Value of Materials needed for (2)

Labour Hours and Cost needed for (2)

Estimated Over Heads expenses for (2)

Sales Manager

Production Manager

Production Manager

Production Manager & Costing Department

Production Manager & Costing Department Production Manager & Costing Department

Historical Analysis Business Conditions Salesman's Report Market Analysis, Special ConditionsSales Budget, Production Capacity, Stock Requirements

Production Budget

Production Budget and Stocks on hand

Production Budget

Production Budget and fixed expenses

Product Territory Customers,Salesmen, Period

Product, Department, Period

Product /Department, Period & Elements of Costs

Item wise (Major)

Category/Skill wise

Expense Wise Department Wise

The Winning Edge

FLOW CHART OF BUDGETARY CONTROL

Specification of organisational objectives and identification of key factors

Sales Budget

Operations Budget

Budget for Prime Cost & Overhead

Budget for Sell. & Dist. Cost

Cap. Expend.Budget

Cash Budget

AdministrativeCash Budget

Master Budget

Acc. & Resp., Var. analysis Managerial Action

The Winning Edge

Summary of Steps in Budgetary Control

1) SWOT analysis for deciding objectives2) Preparing a budget statement3) Recording the actual performance4) Periodic comparisons between the budgeted and actual performance,

& finding out the favourable and unfavourable variances5) Finding out the causes grouping these variances 6) Basis the cause grouping these variances as “controllable” and

“uncontrollable”7) Deciding the quantum of reward or penalty for the individual or the

teams for the variances8) Revising the standards to suit the cyclic – environmental and

uncontrollable changes in conditions.9) Go through the steps 2 to 7 again10) Thus the process of budgetary control has to be continuous, flexible

and unbiased

The Winning Edge

ADVANTAGES OF BUDGETING1. Forced planning.

2. Co-ordinated operations.

3. Performance evaluation & control.

4. Effective communication.

5. Optimum resource utilisation.

6. Productivity improvement.

7. Profit mindedness.

8. Efficiency.

9. Cost control.

The Winning Edge

LIMITATION IN USING THE BUDGETING SYSTEM

1. Management judgement.

2. Continuous adaptation.

3. Implementation.

4. Management complacency.

5. Unnecessary detailing.

6. Goal conflict.

7. Evaluation system.

8. Unrealistic targets.

The Winning Edge

PROFIT PLANNING AND CONTROL Consider the following data:

EXHIBIT I

Sales Rs.SalesVariables Cost Contribution MarginFixed CostOperating ProfitFinancing Costs (@10%)NPBTI.T. @ 50%NPATOwners FundsBorrowed fundsCapital Employed

10,00,0006,00,0004,00,0001,00,0003,00,00050,0002,50,0001,25,0001,25,0005,00,0005,00,00010,00,000

The Winning Edge

EXHIBIT II

[A] OPERATING MANAGEMENT PERFORMANCE: (A) =(a) x (b) x(c) = 75% x 40% x 100% = 30%

= 40%(a) P/V Ratio = Contribution MarginSales

= 75%(b) Margin of Safety Ratio =Contribution Margin

Operating Profit

(c) Turnover Ratio = = 100%Capital Employed

Sales

The Winning Edge

B] FINANCIAL MANAGEMENT PERFORMANCE:

(B) = (d) x (e) = 41% x 200% = 82%

(d) NPAT .

OPERATING PROFIT = 41%

(e) Capital Employed Owner’s Funds

= 200%

The Winning Edge

[C] OVERALL MANAGEMENT PERFORMANCE:

(A) =(B) = 30% x 82% = Approx 25%EXHIBIT III

BREAK EVEN ANALYSIS

A 75% Margin of safety indicates if sales fell by 75%, losses will start (as shown hereunder)

Sales (reduced by 75%) 2,50,000

Variable Costs @60% 1,50,000

Contribution Margin 1,00,000

Fixed Costs 1,00,000

PROFIT ZERO .

Thus the sales level of Rs. 2,50,000 is the “NO PROFIT – NO LOSS” point or the BEP which is also defined as:

The Winning Edge

It is defined in units as under:

BEP = Fixed Costs x Sales Unit Contribution Margin

BEP = Fixed Costs x Sales Sales – Variable Costs

=Fixed Cost

P V Ratio

BEP =1,00,000 X 10,00,000

4,00,000= 2,50,000

The Winning Edge

EXHIBIT IV

SENSITIVITY ANALYSIS FOR PROFIT PLANNING BASIS BEP

In the existing situation Operating Profit is planed @30% on capital employed.

With the help of BEP Analysis we can now check its sensitivity to various factors as under:

The Winning Edge

1. What should be the sales level to increase the OP to 40% level?

BEP = Fixed Costs + Desired Profit PV Ratio

1,00,000 + 4,00,00040%

= 12,50,000=

Computation of operating profit at new sales level:

Sales 12,50,000

Variable Costs (60% of Sales) 7,50,000

Contribution Margin (40% of Sales) 5,00,000

Fixed Costs 1,00,000

Operating Profit 4,00,000

The Winning Edge

BEP = Fixed Costs + Desired Profit PV Ratio

1,00,000 + 4,00,000

PV Ratio=10,00,000=

5,00,00010,00,000

=PV Ratio= 50%=Contribution Margin

Sales=

2. What should be the variable costs level to increase the OP to 40% level?

The Winning Edge

Computation of Operating Profit at new variable costs level:-

Sales 10,00,000

Variable Costs 5,00,000

Contribution Margin@ 50% 5,00,000

Fixed Costs 1,00,000

Operating Profit 4,00,000

The Winning Edge

BEP = Fixed Costs + Desired Profit

PV Ratio

Fixed Cost + 4,00,000

40%=10,00,000=

4,00,000 = Fixed Costs + 4,00,000

Fixed Costs = Zero

3. What should be the fixed costs level to increase the OP to 40% level?

The Winning Edge

Computation of Operating Profit at New Fixed Costs Level:

Sales 10,00,000

Variable Costs 6,00,000

Contribution Margin 4,00,000

Fixed Costs Zero .

Operating Profit 4,00,000

The Winning Edge

VARIOUS STYLES OF BUDGETING

1. Flexible Budgeting

2. Zero Base Budgeting

3. Activity Based Costing

4. Balanced Score Card

The Winning Edge

Flexible Budgeting It is a budget which by recognizing the difference between fixed, semi fixed and variable costs, is designed to change in relation to the level of activity attained. It is a budget prepared for a range and is also known as variable budget or a sliding scale budget

Steps in flexible budgeting:1. Deciding the range of activity2. Determine cost behaviour patterns3. Selecting the activity levels to prepare budgets at those levels4. Prepare budget at each activity level

The Winning Edge

Zero Base Budgeting

ZBB is a method of budgeting whereby all activities are

revalued each time a budget is formulated and every item of

expenditure in the budget is fully justified. That is, ZBB

involves starting from scratch or zero

The Winning Edge

Implementation of ZBB involves the following :

1. Each activity of the organisation is identified and called a decision package

2. Each decision package must be justified

3. If justified the minimum cost to sustain each decision package is determined

4. Alternatives for decision packages are evaluated

5. Managers rank their decision package in order of priority for resource allocation

6. Resources are allocated to the package

The Winning Edge

ADVANTAGES OF ZBB

1. Allocation of resources by need and benefit

2. Identifies and eliminates wastages and obsolete operations

3. Best possible methods of performing jobs is ensured

4. Increased staff involvement which may lead to improved motivation and greater interest in job

5. It increases communication and co-ordination within the organisation

6. Managers become more aware of cost inputs which help in identifying priorities

The Winning Edge

DISADVANTAGES OF ZBB

1. Substantial Cost & time involved in preparing a large number of decision packages

2. Managers could develop fear and feel threatened by ZBB

3. Ranking of packages could result in departmental conflict

The Winning Edge

Measurement-Performance-SuccessMeasurement-Performance-Success

The Winning Edge

Activity Based Costing•In Activity based costing (ABC) costs are first traced to activities and then to products •It is a system which focuses on activities performed to produce products •Activities become the focal point of cost accumulation

ABC involves two primary stages:

- Tracing costs to activities

- Tracing activities to products

The Winning Edge

TRADITIONAL COSTING

OverheadCost

P1

P2

P3

PRODUCT

Stage 1 : Overheads assigned Stage 2 : Overheads assigned to to cost centres/ pools. products using cost

driver rate.

Process / Job 1

Process / Job 2

Process / Job 3

The Winning Edge

ACTIVITY BASED COSTING

OverheadCost

PRODUCT

Stage 1 : Overheads assigned Stage 2 : Overheads assigned to cost centres / pools. to products using

cost driver rate.

Activity 1

Activity 2

Activity 3

Activity 4

Activity 5

P1

P2

P3

P4

P5

The Winning Edge

COST DRIVERS IN ABC

1. Number of receiving orders 2. Number of purchase orders 3. Number of dispatch orders 4. Number of units 5. Amount of labour cost involved 6. Number of material handling man hours 7. Number of direct labour hours 8. Number of vendors/ suppliers 9. Number of set up hours10. Number of employees11. Number of labour transactions

The Winning Edge

45

ACTIVITY BASED MGMT [ABM]Meaning :• It is the use of activity based costing

information to manage costs, by improving operations and eliminating non-value-added costs

• ABC allows an understanding what activities cause costs

• ABM involves managing these activities to reduce costs

• It focuses on ‘Work’ and not ‘Worker’• It is a management information tool

The Winning Edge

46

ABM TECHNIQUES

• Activity Analysis

• Analysis of value-added & non-value added costs

• Activity based budgeting & variance analysis

The Winning Edge

47

ANALYSIS OF VALUE-ADDED & NON VALUE-ADDED COSTS

The objective is to eliminate non value Added activities

Engineering study of processes and benchmarking are important tools in identifying non value-added costs

The Winning Edge

48

ANALYSIS OF VALUE-ADDED COSTS

Value-added activities are necessary activities that cannot be eliminated without deterioration of

product quality performance or perceived value Value-added activities contribute to customer

value & satisfaction or satisfy an organization need

The Winning Edge

49

Traditional Amt. ABC Amt.

Salaries 100.00 Clean door 40.00Equipment 80.00 Paint door 75.00Supplies 20.00 Inspect door 75.00Overhead 45.00 Send door to assembly 55.00 Total 245.00 Total 245.00

ABC vs. Traditional CostingExample in a Car Mfg. Org.

The Winning Edge

50

CUSTOMER PROFITABILITY ANALYSIS

Customer profitability analysis uses activity-based costing to determine the

activitiescostsprofit associated with serving particular

customers

The Winning Edge

LIMITATION OF FINANCIAL MEASUREMENT

OF A BUSINESS PERFORMANCE

Less supportive of long term investments with no short term returns

•Leads to under-investment in intangible assets – product and process innovation, employee skills, customer satisfaction – where short term returns are difficult to measure

•Over investment in assets that can be easily valued, such as through mergers and acquisitions

•Allows companies with very strong asset bases (such as in natural resources, strong consumer brands) to operate inefficiently as long as short term results are satisfactory

52

Why Is It So Difficult to Execute Strategy ?Why Is It So Difficult to Execute Strategy ?

Value is Shifting from Tangible to Intangible Assets Value is Shifting from Tangible to Intangible Assets Percentage of market value related to ...Percentage of market value related to ...

Intangible Assets

Tangible Assets

38%

62%

62%

38%

62%

38%

1982 1992 1998

53

Is Strategy very Important to Investors?Is Strategy very Important to Investors?

““Strategy has never been more importantStrategy has never been more important””Business WeekBusiness Week

““Less than 10% of strategies Less than 10% of strategies effectively formulated are effectively formulated are effectively executedeffectively executed””

Fortune MagazineFortune Magazine

““In the majority of failures - we In the majority of failures - we estimate 70% - the real problem estimate 70% - the real problem Is nIs n’’t (bad strategy) ….. Itt (bad strategy) ….. It’’s bad s bad

executionexecution””

Fortune MagazineFortune Magazine

54

60% of organizations don’t link strategy & budgets

85% of management teams spend less than one hour per month on strategy issues

STRATEGY

Strategic Learning Loop

BALANCED SCORECARD

Translate Strategy to Operational terms

The Winning Edge

SUCCESS FACTORS OF INDUSTRIAL AGE & INFORMATION AGE

INDUSTRIAL AGEINDUSTRIAL AGE

• Economies of ScaleEconomies of Scale• Economies of ScopeEconomies of Scope• Technology Technology

The Winning Edge

SUCCESS FACTORS OF SUCCESS FACTORS OF INDUSTRIAL AGE & INDUSTRIAL AGE & INFORMATION AGEINFORMATION AGE

INFORMATION AGEINFORMATION AGE

Customer loyalty through customer Customer loyalty through customer relationshipsrelationships

Innovative products and servicesInnovative products and services High quality customized products and High quality customized products and

services at low cost and with short lead services at low cost and with short lead timetime

The Winning Edge

SUCCESS FACTORS OF SUCCESS FACTORS OF INDUSTRIAL AGE & INDUSTRIAL AGE & INFORMATION AGEINFORMATION AGEINFORMATION AGEINFORMATION AGE

Employee skills, motivation and Employee skills, motivation and capabilitiescapabilities

Adaptation of Information Adaptation of Information TechnologyTechnology

EVOLUTIONEVOLUTIONTHE PROBLEM-

The Winning Edge

The Winning Edge

Balance Score Card

The Winning Edge

Origin

• Developed by Robert Kaplan and David Norton

• Communicate Companies’ Objectives, link them to strategy

• Translates mission and strategy into four perspectives

ROCEROCE

Customer Customer LoyaltyLoyalty

On-time On-time deliverydelivery

Process Process Cycle TimeCycle Time

Process Process QualityQuality

Employee Employee CompetencyCompetency

Cause and Effect RelationshipCause and Effect Relationship

Balance Score CardBalance Score Card

Knowledge, Skills, Systems, and ToolsKnowledge, Skills, Systems, and Tools

Financial Financial ResultsResults

To Build the Strategic Capabilities..To Build the Strategic Capabilities..

Needed to Deliver UniqueNeeded to Deliver UniqueSets of Benefits to Customers...Sets of Benefits to Customers...

To Drive Financial To Drive Financial Success...Success...

And Realize

the Vision

Equip our People...Equip our People...

Internal Internal CapabilitiesCapabilities

Customer Benefits

The Winning Edge

The Balance Scorecard Perspectives

• Financial

• Customer

• Internal business processes

• Learning and growth

Vision &Vision &StrategyStrategy

Learning & Learning & growthgrowth

Internal Internal Business Business processprocess

Financial Financial perspectiveperspective

Customer’sCustomer’s

PerspectivePerspective

Balanced Scorecard FrameworkBalanced Scorecard Framework

BALANCED SCORECARD BALANCED SCORECARD GOALS & MEASURESGOALS & MEASURES

Goals MeasuresGoals Measures Goals MeasuresGoals Measures

Goals MeasuresGoals Measures

Goals MeasuresGoals Measures

Financial PerspectivesFinancial Perspectives

Learning & Growth PerspectivesLearning & Growth Perspectives

Customer Customer PerspectivesPerspectives

Internal Process Internal Process PerspectivesPerspectives

Balanced Balanced ScorecardScorecard

The Winning Edge

The Balance Scorecard Perspectives

• Financial

• Customer

• Internal business processes

• Learning and growth

The Winning Edge

BALANCED SCORECARD BALANCED SCORECARD GOALS & MEASURESGOALS & MEASURES

FINANCIAL PERSPECTIVEFINANCIAL PERSPECTIVEGOALSGOALS MEASURESMEASURES

SurviveSurvive • Cash FlowCash Flow

SucceedSucceed • Sales GrowthSales Growth• Growth in Operational IncomeGrowth in Operational Income

ProsperProsper • ROIROI• EVAEVA

The Winning Edge

BALANCED SCORECARD BALANCED SCORECARD GOALS & MEASURESGOALS & MEASURES

CUSTOMER PERSPECTIVECUSTOMER PERSPECTIVEGOALSGOALS MEASURESMEASURES

ResponsiveResponsive SupplySupply

On time deliveryOn time delivery

Preferred Preferred supplier Statussupplier Status

Share of key customers’ purchasesShare of key customers’ purchases

New Product New Product LaunchLaunch Percentage sale from new Percentage sale from new

productsproductsCustomer Customer RelationshipRelationship Customer partnership venturesCustomer partnership ventures

The Winning Edge

BALANCED SCORECARD BALANCED SCORECARD GOALS & MEASURESGOALS & MEASURES

INTERNAL PROCESS PERSPECTIVEINTERNAL PROCESS PERSPECTIVE

GOALSGOALS MEASURESMEASURES

Technology Technology UpgradationUpgradation

Technological investmentsTechnological investments

New Product New Product DevelopmentDevelopment

R & D expenditureR & D expenditure

Manufacturing Manufacturing ExcellenceExcellence • Cycle-time reductionCycle-time reduction

Commercialization of R & DCommercialization of R & D

• Improvement in throughputImprovement in throughput

The Winning Edge

BALANCED SCORECARD BALANCED SCORECARD GOALS & MEASURESGOALS & MEASURES

INNOVATION & LEARNING PERSPECTIVEINNOVATION & LEARNING PERSPECTIVEGOALSGOALS MEASURESMEASURES

Technological Technological LeadershipLeadership • Internal technology developmentInternal technology development

Manufacturing Manufacturing ImprovementImprovement

• Waste reductionWaste reduction

Time to Time to MarketMarket

Process improvementProcess improvement

Constraint removalConstraint removal

BALANCED SCORECARD STRATEGIC BALANCED SCORECARD STRATEGIC THEMETHEMEELEMENT ELEMENT STRATEGYSTRATEGY TARGETARGE

TTMEASURESMEASURES INITIATIVES INITIATIVES

FINANCIAL FINANCIAL PERSPECTIVEPERSPECTIVE

REVENUE REVENUE GROWTHGROWTH

CUSTOMER CUSTOMER PERSPECTIVEPERSPECTIVE

INNOVATIVE INNOVATIVE PRODUCTSPRODUCTS

INTERNAL INTERNAL PERSPECTIVEPERSPECTIVE

WORLD CLASS WORLD CLASS PRODUCT PRODUCT DEVELOPMENTDEVELOPMENT

INNOVATION INNOVATION & LEARNING & LEARNING PERSPECTIVEPERSPECTIVE

COMPETENCY COMPETENCY BUILDINGBUILDING

The Winning Edge

Four perspectives: Are they sufficient?Four perspectives: Are they sufficient?

•Community perspective - Social responsibilityCommunity perspective - Social responsibility

•Suppliers perspectiveSuppliers perspective

Question : Is it vital for success of business unit’s Question : Is it vital for success of business unit’s strategy?strategy?

The Winning Edge

Conclusions

• The Balance Score Card is basic tool

• Can be modified & customized according to an Organization's needs

• An important weapon in every manager’s arsenal

The Winning Edge

Learning Curves and Non Linear Costs

The learning curve phenomena is based on the concept that costs tend to be non linear.

It is found that the cost of doing most tasks of a repetitive nature decrease as experience at doing these tasks accumulate.

Most experience curves, estimated on actual process, indicate that costs decline 20 to 30 percent each time accumulated experience doubles.

The Winning Edge

Factors that lead to this long-run decline in costs include:

1. Labour efficiency.

2. New process and improved methods.

3. Product stadardisation.

4. Scale effect.

The Winning Edge

REVENUE MANAGEMENT - TOPLINE Rule I Price then costs

Intuition In high demand times, increase productive capacity. In periods of low demand, reduce capacity and lower headcount

Entropic Event:

Demand fluctuations growing in frequency and intensity

R.M.P. I Address short term fluctuations with price, then capacity planning in long run

The Winning Edge

Rule II Value management and marketing value based pricing dominates cost based pricing

When customers dominate – value dominates and they do not care about your costs; you care if cost based price exceeds customer’s valueFind market acceptable price point

Move from cost-based pricing to price-based costingIntuition Set prices to cover costs and provide an acceptable

margin (Cost Based Price: CBP)Entropic Event:

Non-conformist customers determine the price: Marketing provides the choices

R.M.P. II Move from CBP to PBC Monitor market for both Revenue Management (RM)& Cost Management (CM) for Profit Management (PM)

The Winning Edge

Rule III Sell to segmented micro-markets and not mass markets

Seek and seize revenue advantage rather than worry about cost disadvantage

Faster-Better-Cheaper mantra

What is this customer willing to pay for this product at this point in time

There is no average consumer, thus there can not be an average price

Intuition Price is set to sell the greatest number of units at the highest possible price in the mass markets

Entropic Event:

Consumer individualism and amoeba market shatters the myth of mass market

R.M.P. III

Different segments demand different prices. To maximise revenue with competition, prices must vary to meet the price sensitivity of each market segment

The Winning Edge

Rule IV Save your product for your most valuable customers

“First Come, First Served” do not ensure RM or PMMakes relevance only when there is shortageCustomers who are paying less are those who come FirstFavor the most valuable customers

Intuition Sell products and services on a “First Come, First Served” basis

Entropic Event:

Traditional business practices do not satisfy investor demand for revenue growth

R.M.P. IV

Forecast and understand demand at micro-market levels and save products for the most valuable customers through prioritization

The Winning Edge

Rule V Decisions should be based on knowledge and not supposition

Data Information Knowledge Profit Adopt a RM program of appropriate size and scopeUnderstand window of opportunity and volatilityUnderstand intentional/unintentional biases and availability of information bias while forecasting

Intuition Assumptions are and can be made about future consumer behaviour based on intuition and personal observation

Entropic Event:

Non-conformist consumers are continuously fragmenting the market and changing buying behaviour

R.M.P. V

Forecast demand at the micro-market level, gain knowledge of subtle changes in consumer behaviour patterns and then optimize on Product/Consumer/ Supply or Demand

The Winning Edge

Rule VI Exploit and leverage each product’s value cycle.Maximise value of product in micro-markets over timeAdopt a RM program of appropriate size and scopeGet as much money as possible as soon as possibleEntertainment – Movie business example

Intuition Decisions on product availability and pricing are made based on experience, gut feel, tradition or rule of thumb.

Entropic Event:

Rapidly changing market conditions defy conventional approaches

R.M.P. VI Maximise revenue by understanding the value cycle and optimally timing the availability and price of the product to each micro-market segment.The sales force in the trench should be armed with decision support tools built upon appropriate databases so they can make dynamic decisions at the micro-market level.

The Winning Edge

PRICE is VALUE ADD + COSTSPRICE is VALUE ADD + COSTS Philip Kotler has defined Customer Delivered Value as the difference Philip Kotler has defined Customer Delivered Value as the difference

between the Total Customer Value and Total Customer Cost, as between the Total Customer Value and Total Customer Cost, as illustrated here below.illustrated here below.

Customer CostCustomer Cost

Monetary CostMonetary Cost

+ Time Cost+ Time Cost

+ Energy Cost+ Energy Cost

+ Psychic Cost+ Psychic Cost

Total Customer ValueTotal Customer Value

Generic Value Generic Value

+ Service Value+ Service Value

+ Personnel Value+ Personnel Value

+ Image Value + Image Value

minusminus

Price = Customer Delivered ValuePrice = Customer Delivered Value

The Winning Edge

Facts Data

Analysis Information

Forecasts Knowledge

Profit Optimization Wisdom

Turn Facts into Profit!

THE CRUX OF BUDGETING