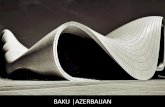

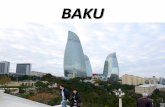

Baku, 2013

description

Transcript of Baku, 2013

Baku, 2013

New Model of Agricultural Insurance in Russia

Korney BizhdovNAAI President

State Support of Agriculture State-Supported Insurance DevelopmentPrior to 1992

Planned governance system. 100% coverage of agricultural lands; Gosstrakh's economically stable system.

1992 – 2000

Аgriculture industry becomes a marketplace. Its support, no longer basicly federal, is divided among federal subjects.

Starting from 1998, the premiums are de jure 50%-subsidized, but financing is not provided.

2001 – 2012

Transition to medium-term planning under state programs. Up to 70% of funds are allocated to support crediting.

Creation of the Development Framework for Agricultural Insurance up to 2020 (2009) and framework law No 260-FZ (2011). Federal subsidy amounts to 5.5 bln rubles ($183 mln).

2012 –…

In August 2012 Russia joins the WTO.

January 1, 2012 — enactment of Federal Law No 260-FZ On State Support of Agricultural Insurance.

2

Now we are at the initial stage of developing a state-supported system of agricultural insurance in Russia.

Agricultural Insurance Development and State Support of Agriculture

FEDERAL BUDGET, in accordance with the Agricultural

Insurance Plan*

BUDGETS OF FEDERAL SUBJECTS

50%

*The Agricultural Insurance Plan is devised each year based on proposals from federal subjects and insurers' association. It lists the insured objects and sets rate limits for

subsidy calculation

INSURER

New System of State-Supported Agricultural Insurance

3

AGRICULTURAL PRODUCER

50%

4

State-Supported Agricultural Insurance since 01.01.2012

MINISTRY OF AGRICULTURE

Regional governing body for agriculture

industry

Report on budget expenses

Agricultural producers

50% of insurance premiums

Insurers

Federal subsidies

National Association of Agricultural Insurers

Compensation Payment FundContributions from

insurance premiums

Application for subsidy and documents reflecting insurance terms

Proposals to the Agricultural Insurance Plan

Independent expertise in case of parties' dispute.Regulated by the Government of the Russian Federation

Federal Law No 260-FZ:insurance is provided against the risk of loss or destruction of

crop and perennial plantings. Crop loss or destruction is the real crop yields falling 30% or more below the planned level.

INSURED EVENT INSURED EVENT

30%

Crops

40%Plantations

5

Risk of loss or damage to crop and perennial plantations, covered by state-supported insurance

1.Atmospheric drought 2.Soil drought 3. Dry hot wind4.Freezing 5.Winter-killing 6.Damping-off7.Hailstorm 8.Dust storm 9.Sleet10.Flooding 11.Waterlogging12.Strong wind 13.Windstorm14.Earthquake 15.Avalanche 16.Mudslide17.Wildfire 18. Epifitoty

6

The list of natural perils to agricultural production has been extended

2013 sees launch of insurance against the risk of loss or damage to livestock of the following types:

7

1.Infectious diseases (as listed by the Ministry of Agriculture) 2.Mass poisoning3.Natural disasters (lightning, earthquake, dust storm, stormwind,

blizzard, snow-storm, flood, downfall, avalanche, mudstorm, landslide)4.Failure of power, heat or water supply caused by natural disasters5.Fire

Insured risks

Type of livestock

1. Cattle 2. Sheep and goats 3. Swine4. Fowl

8

Insurance Premium Structure

80%

Sum insured is no less than 80% of the insurable value

80%Insurance Re-serves + Com-pensation Fund Allocations

20% РВД

Insurance premium structure

1.Possibility of setting unified insurance standards (insurance rules, loss settlement procedure, unified statistics)

2. Reducing farmers' financial burden

3. Cutting budget expenses in cases of accidents (exclusion of direct state compensation for a loss)

4. Compensation payment is guaranteed even if the insurer goes bankrupt

Benefits of Federal Law On State Support of Agricultural Insurance

9

10

State-Supported Insurance Coverage of Croplands: Dynamics

Introduction of the law on state support has halted the degradation of the agricultural insurance system.

2007 2008 2009 2010 2011 2012 2013* (прогноз)

0

5

10

15

20

25

30

0

2

4

6

8

10

12

28.324.8

18.213

20.1 18.5 19

10

8

65 5 5

8Share of insured lands, %

Number of insured farmers, thsd.

Law N260-FZ approved by the State Duma

Источник: использованы данные ФГБУ ФАГПССАП, НСА

11

Agricultural Insurance Market in 2012

Market volume, RUR bln.

Adoption of the new law and the 2010 drought's effects have stimulated growth of agricultural insurance.

2007 2008 2009 2010 2011 201202468

10121416

7.78.8 9.2 8.8

13.7

10.8

1.5

6.1

2.41

2.5 2.6

State-supported insuranceOther agricultural insurance

Sourse: FCSM, Expert RA, Min-istry of Agriculture

$308 mln

$60 mln

$348 mln

$84 mln

Agricultural Insurance Market in 2012: $ 432 mln. 80.4% of the market was represented by state-supported insurance (according to the Federal Financial Markets Service).

12

Development of the Agricultural Insurance Market

348

84Market volume in 2012, $ mln.

State-supported insuranceOther agricultural insurance

1. Client base regrouping as a result of their more exacting requirements for the insurance service.

2. Client base extension by virtue of small and mid-sized farms (mandatory insurance in a number of regions).

3. Decreasing cost of insurance.

13

Current Development Trends in Agricultural Insurance:2012 – 2013

The law provides for two types of deductible: unconditional (deductible proper) and conditional (franchise).

14

Aspect: Deductible

Insured value

Deductible, %

0 5 10 20 30 40

Maximal level of insurance payment, % of insured value

100% 100 95 90 80 70 60

80% 80 76 72 64 56 48

Maximal level of insurance payment for damaged crops depends on unconditional deductible option:

15

Aspect: Popularity of the Deductible

45% of insured agricultural producers opted for crop insurance plans with the deductible clause. The most popular are the minium and the maximum deductible levels.

55%

14%

8%

4% 18%

Client’s Choises for Deductible Levels

0%5%10-20%25-35%40%

National Association of Agricultural Insurers

«The Unified Association of Agriculture Industry Insurers – National Association of Agricultural Insurers» (NAAI) is a professional association of insurers providing state-supported agricultural protection.

The NAAI emerged in 2007 with the active support from the Ministry of Agriculture, Ministry of Finance, Federal Service for Insurance Supervision, and All-Russian Insurance Association.

The NAAI has brought together 27 major Russian federal and regional insurers, with the total authorised capital of 75 bln roubles and many of them top-rated by the national rating agency.

16

The NAAI guarantees to farmers:• Solvency of the system if one of its members goes bankrupt.• Joint efforts in providing timely and adequate insurance payments.• Consulting assistance.

The NAAI offers its member companies:• Coordination of agricultural insurers and protection of their interests.• Implementation of new unified insurance stadards.

NAAI's Chief Functions

Standardization

StatisticsSupervision

NAAI's Chief Functions

Rulemaking

Information

Compensation payments

Organization

17

NAAI's Share in State-Supported Agricultural Insurance Market, 2010-2011 and 2012

In 2012, NAAI members provided state-supported insurance to 8.4 mln ha crop lands, amounting to 62% of the market.

** - by the insured croplands18* - based on data from Federal Agency for State Support to Agricultural Insurance

NAAI's 2012 share growth against 2011 - about 20%.

NAAIOther insurers

2010

2011

2012

19

NAAI development in 1H 2013(as of 01.05.2013, against Jan-May 2012):

number of farms insured:+83%

number of policies: +68%

State-Supported Agricultural Insurance: NAAI Portfolio Dynamics

NAAI: Crops Coverage Dynamics

Farmers insured, thds

Policies issued, thds Lands insured, ha mln

0.01.02.03.04.05.06.07.08.09.0

1.92.8

7.4

3.34.0

8.3

20112012

+78% +43%

+12%

Farms, ths

Policies, ths

Area,mln ha

Sum insured,

$bln

Written premium,

$ mln

Premium received,$ mln.

Losses, $ mln.

Total

Including from

FarmersAgricultura

l authorities

NAAI 3,3 4,0 8,3 3,6 183,9 171 90,3 77,4 35,5Other 3,2 3,6 5,2 2,3 148,4 129 67,7 58,1 16,1 TOTAL 6,5 7,6 13,5 5,9 332,3 300 158,1 135,5 51,6

20

Statistics on State-Supported Agricultural Insurance Policies, 2012

In 2012 NAAI members provided insurance to 3.3 ths farms and concluded 4.0 ths policies, with the total sum insured of $5,9 bln.

21

State-supported insurance: costs for farmers

$ /1 ha05

1015202530 26.8

22.3

20112012

Average price of state-supported crop insurance policy(NAAI members), $/ 1 ha

On the average, a farmer paid $11,6 per ha in 2012 (50% of insurance premium)

22

?

Loss settlement under 2012 policies is not yet completed.

The NAAI expects the ultimate 2012 losses to premiums ratio to reach or exceed 50%.

* - 2009-2011 figures based on data from Federal Agency for State Support to Agricultural Insurance;** - data for the 2012 losses to premiums ratio (as of 01.05.2013).

*

NAAI Members' Loss Settlement under 2012 Policies

2009 2010 2011 20120

20406080

10055

89

27 29

Losses to premiums ratio, %

**

23

Loss Amount,$ mln.

% of the Total Losses Claimed

% of the Total Number of Claims

Settled, as of 01.05.13

37,3 59% 62%

Denied 9,6 15% 12%Under Settlement

16,5 26% 26%

2012:

157 farms 505 losses totaling $65 mln. claimed.

As of 01.05.201374% of losses have been settled.

314129

62

Number of ClaimsPaid

Settlement process

Payment Denied

NAAI Members' Loss Settlement under 2012 Policies

24

29%

33%

34%

4%

Causes for Refused Insurance Payment:NAAI Internal Research

30% crop loss threshold not reached

Case not recognized as the insured event for certain reasons (non-standard agronomic practices, no documentary evidence of the per-ilous condition, etc.)

Event took place prior to the be-ginning of the insurer's liability pe-riod

Loss under the deductible level

NAAI Members' Loss Settlement under 2012 Policies: causes of insurance payment refusals

25

№ Open Issue Suggested Solutions

1The 30% threshold of crop loss in the definition of an insured event (opposed by farmers, banks and some insurers)

Possibly, modified configuration of insurance protection and its correction based on actuarial calculations.

2 No imposed obligation or need to acquire insurance

Insurance policy – a requisite condition for any type of subsidy.

3Agricultural authorities' differing requirements for documentation necessary to apply for subsidies

Irrespective of the region, standard requirements for documentation necessary to apply for subsidies.

State-Supported Agricultural Insurance Practices: Main Problems and Possible Solutions

26

№ Open Issue Suggested Solutions

4 Better definition of experts' status and authority

Requirements for experts should be eased, enabling accreditation at a professional association.

5 No regulatory documents confirming a farm's crop yield

Mandatory annual statistic reports for farmers

6Conformity of subsidy calculation rates and insurance rates with insurance statistics.

Actuarial calculation based on the same statistic data.

State-Supported Agricultural Insurance Practices: Main Problems and Possible Solutions

27

Strategic Guidelines of Agricultural Insurance Development

1. Improvement of the current system of comprehensive agricultural insurance based on conclusions drawn from insurance practice.

2. Design of a variable system of agricultural insurance reflecting the international practice based on weather and crop yield indices.

3. Voluntary insurance of agricultural risks, yet mandatory insurance for other state-subsidized programs.

4. Tougher requirements by state authorities and insurers for compliance with agronomic standards.

5. Transition to a simple and commonly understandable regulatory framework.

28

***Cперва на небе молния во мгле, Потом огонь, потом — земля в золе. И так оно всегда: по воле неба Все беды, все печали на земле.

Мирза Шафи Вазех

***At first, there was a lightning in the sky;Then, the fire in the ashes on the ground has died;For all the times, there should be the HeavenThat for the World its sorrow fate decides.

Mirza Shafi Vazeh