Backtest Portfolio Returns Rev11a

Transcript of Backtest Portfolio Returns Rev11a

This is a spreadsheet to backtest portfolio returns from 1972-2011 [1985-2011 if you want to include Sector/Tax-Exempt funds]

sample portfolios like Coffeehouse and draws charts to compare the growth.The worksheet Returns_72_11 calculates portfolio returns (total/cagr/sharpe ratio/correlation etc) for funds from 1972-2011The worksheet Returns_85_11 calculates portfolio returns (total/cagr/sharpe ratio/correlation etc) for funds[includes sector funds] from 1985-2011The worksheet Data_72_11 includes the returns of various funds from 1972-2011The worksheet Data_85_11 includes the returns of various funds from 1985-2011 (to include many of the funds that were started in 1984)

The worksheet Compare_Portfolios allows you to compare upto 5 different portfolios for 1972-2011 and 1985-2011 with the abilty to change the starting and ending yearsThe Spreadsheet also includes the total/cagr etc for a portfolio that's rebalanced annually (default) and one that is not rebalanced (un-rebalanced) and thecharts reflect both the returns.

It's now easier to compare different portfolios for the user defined time periods

You can change the time period for comparing the lazy portfolios in cells E4 and E5 in the Lazy_Portfolios_85 worksheet

pale blue1 - %allocation of funds in worksheet Portfolio2 - You can change the Starting Year in Cell B57/K57 in worksheet Portfolio3 - You can change the Ending Year in Cell B58/K58 in worksheet Portfolio4 - Initial investment for your portfolio5 - MAR (Minimum Acceptable Return) returns [Used in calculating Sortino Ratios]6 - Expense ratio for the funds using Index Returns/Synthetic returns in Data_72_11 and Data_85_11 worksheets

For example to calculate the returns from 1981-1990change cell B57 (for Starting Year) to 1981 in worksheet Portfoliochange cell B58 (for Ending Year) to 1990 in worksheet PortfolioThe spreadsheet would return the porfolio return over the period 1981-1990.

To calculate returns for a portfolio that includes sector funds (Health/P. Metals/Energy) or Windsor II funds from 1991-2000Change your allocation to include the sector fundschange cell K57 to 1991 in worksheet Portfoliochange cell K58 to 2000 in worksheet PortfolioThe spreadsheet would return the porfolio return over the period 1991-2000.

Adding returns for additional FundsLets say you want to enter returns for a Fund in the worksheet Data_85_10

The worksheet Portfolio is a simple way to change the allocations of various funds. It provides the CAGR/total/Sharpe Ratio etc. It also compares your portfolio to

The worksheet Data_Sources lists the sources of the various fund returns

You can also change the percentage allocations of any fund. If the total doesn't add up to 100% then you would see an

The worksheet Lazy_Portfolios_85 compares 25 lazy portfolios and shows a chart with the risk/return for all the 25 lazy portfolios.

Things you can change: (Cells that can be changed have

1. Enter Fund Name in cell AQ1 in Data_85_102. Enter Fund Symbol in cell AQ2 3. Enter ER (Expense Ratio) in cell AQ3 4. Enter starting year for the Fund in cell AQ4 5. Add the fund returns in cell cell AQ56 6. If you have returns for the Fund from inception then there is no ER deduction but if you are using synthetic returns then the ER is deducted from the returns. If you want no ER to be deducted, then enter an ER of 0 in cell AQ3

DISCLAIMERPlease use this spreadsheet only for learning purposes and as a need for diversification. Don't change your Asset Allocation purely based on historical returns.Past returns are not indicative of future returns.

For comments/Feedback/updates visit

Regards,Simba

Revision History

Rev11a1. Added the returns for 20112. Fixed sharpe ratio in Data_72_11 and Data_85_113. Updated conditional formating for Portfolio returns4. Updated the formulas in Data_72_11 and Data_85_11 so it doesn't reflect 0.00 for the future years/undefined funds/columns5. Updated the conditioning formating for Max drawdown

Rev10c1. Corrected the symbol for VG International Small from VFWIX to VFSVX2. Corrected the returns for VUSXX (Admiral Treasury Money Market / Tbills)3. Corrected the chart data for Rolling Returns (Nominal and Real) for 1985-2010 charts.

Rev10b1. Added a Chart for 3, 5, 10 and 15 year Rolling Returns for both Nominal and Real Returns2. Rolling Returns Chart has the checkbox option to display either 3,5,10, 15 or all the Rolling Returns 3. Updated the portfolio composition for Fund Advice Ultimate Buy & Hold in Lazy_Portfolios_85 worksheet

Rev10a1. Added the returns for 20102. Replaced VINEX with VFWIX from 2010 onwards3. Fixed Correlations table in Data_72_10 and Data_85_104. Fixed Sharpe Ratio in Returns_85_10

Rev9b1. Fixed a typo and modified 2008 to 2010 in worksheet Lazy_Portfolios_852. Added the returns for PCRIX, PGLIX and BRSIX3. Corrected the 2009 returns for VBMFX4. Added returns for International Small5. Fixed the data point for Portfolio 2 in the CAGR vs Std Dev chart in Lazy_Portfolios_85 worksheet

Rev9a

http://www.bogleheads.org/forum/viewtopic.php?t=2520

Visit the Bogleheads Forum - http://www.bogleheads.orgVersion # rev11a

1. Added the returns for 20102. Added Return vs. Risk charts at bottom of Portfolio worksheet (Thanks to Paul Douglas Boyer)3. Moved the data from SP_72_10 and SP_85_10 to the Returns_72_10 and Returns_85_10 worksheets. 4. Moved the Portfolio comparison section from Portfolio worksheet to Compare_Portfolios worksheet5. Updated the source/returns for Gold

Rev8i1. Corrected the returns for BRSIX,VMGIX for 20082. Corrected the formula to deduct the ER's. Earlier I was using (ActualReturns-Inflation). The new formula uses (ActualReturn-Inflation)/(1+Inflation%)3. Corrected the Std deviation for Unrebalanced_Returns in Returns_72_10 tab

Rev8h1. Corrected the Formula to calculate the total real value for rebalanced portfolio in the Compare Portfolio section2. Corrected the Formula to calculate the un-rebalanced returns in Returns_72_10 and Returns_85_10 for 2008 and higher years3. Fixed a typo for Down SD in the Compare Portfolio section for 1985-20084. Fixed the formula for Sortino Ratio in SP_72_10 and SP_85_10 worksheets

Rev8g1. Corrected the Sortino Formula in Returns_72_10 and Returns_85_10

Rev8f1. Fixed CAGR formula for Comparing 72-08 portfolios2. Updated the Compare Portfolio section to now have the ability to select different time periods instead of the fixed 1972-2008 or 1985-20083. Fixed Correlation for CHP and SBFS in SP_72_10 and SP_85_104. Charts in Excel spreadsheet now have dynamic titles that reflect the time period being tested5. The unrebalanced calculations now include the time period being tested instead of the entire 1972-2008 or 1985-2008 time periods6. User can now change the time period for comparing the Lazy Portfolios7. The correlations in the Lazy Portfolio are now time period dependent instead of being fixed for the entire period8. Updated the formula for Sortino Ratio9. Updated the formula for Sharpe Ratio to calculate Tbill average only for the time period being tested instead of the entire period

Rev8e1. Sharpe Ratio uses the average of Tbill for the selected Time period instead of using the average for the entire 1972-2008 or 1985-2008 periods.2. Fixed the formula used for 2008 and onwards returns in Returns_85_10 worksheet3. Fixed the formula used for 2010 and onwards returns in Returns_72_10 worksheet

This is a spreadsheet to backtest portfolio returns from 1972-2011 [1985-2011 if you want to include Sector/Tax-Exempt funds]

sample portfolios like Coffeehouse and draws charts to compare the growth.The worksheet Returns_72_11 calculates portfolio returns (total/cagr/sharpe ratio/correlation etc) for funds from 1972-2011The worksheet Returns_85_11 calculates portfolio returns (total/cagr/sharpe ratio/correlation etc) for funds[includes sector funds] from 1985-2011The worksheet Data_72_11 includes the returns of various funds from 1972-2011The worksheet Data_85_11 includes the returns of various funds from 1985-2011 (to include many of the funds that were started in 1984)

The worksheet Compare_Portfolios allows you to compare upto 5 different portfolios for 1972-2011 and 1985-2011 with the abilty to change the starting and ending yearsThe Spreadsheet also includes the total/cagr etc for a portfolio that's rebalanced annually (default) and one that is not rebalanced (un-rebalanced) and the

It's now easier to compare different portfolios for the user defined time periods

You can change the time period for comparing the lazy portfolios in cells E4 and E5 in the Lazy_Portfolios_85 worksheet

background)1 - %allocation of funds in worksheet Portfolio2 - You can change the Starting Year in Cell B57/K57 in worksheet Portfolio3 - You can change the Ending Year in Cell B58/K58 in worksheet Portfolio4 - Initial investment for your portfolio5 - MAR (Minimum Acceptable Return) returns [Used in calculating Sortino Ratios]6 - Expense ratio for the funds using Index Returns/Synthetic returns in Data_72_11 and Data_85_11 worksheets

For example to calculate the returns from 1981-1990change cell B57 (for Starting Year) to 1981 in worksheet Portfoliochange cell B58 (for Ending Year) to 1990 in worksheet PortfolioThe spreadsheet would return the porfolio return over the period 1981-1990.

To calculate returns for a portfolio that includes sector funds (Health/P. Metals/Energy) or Windsor II funds from 1991-2000Change your allocation to include the sector fundschange cell K57 to 1991 in worksheet Portfoliochange cell K58 to 2000 in worksheet PortfolioThe spreadsheet would return the porfolio return over the period 1991-2000.

is a simple way to change the allocations of various funds. It provides the CAGR/total/Sharpe Ratio etc. It also compares your portfolio to

You can also change the percentage allocations of any fund. If the total doesn't add up to 100% then you would see an ERROR.

compares 25 lazy portfolios and shows a chart with the risk/return for all the 25 lazy portfolios.

6. If you have returns for the Fund from inception then there is no ER deduction but if you are using synthetic returns then the ER is deducted from the returns. If you

Please use this spreadsheet only for learning purposes and as a need for diversification. Don't change your Asset Allocation purely based on historical returns.Past returns are not indicative of future returns.

Regards,

Revision History

Rev11a1. Added the returns for 20112. Fixed sharpe ratio in Data_72_11 and Data_85_113. Updated conditional formating for Portfolio returns4. Updated the formulas in Data_72_11 and Data_85_11 so it doesn't reflect 0.00 for the future years/undefined funds/columns5. Updated the conditioning formating for Max drawdown

Rev10c1. Corrected the symbol for VG International Small from VFWIX to VFSVX2. Corrected the returns for VUSXX (Admiral Treasury Money Market / Tbills)3. Corrected the chart data for Rolling Returns (Nominal and Real) for 1985-2010 charts.

Rev10b1. Added a Chart for 3, 5, 10 and 15 year Rolling Returns for both Nominal and Real Returns2. Rolling Returns Chart has the checkbox option to display either 3,5,10, 15 or all the Rolling Returns 3. Updated the portfolio composition for Fund Advice Ultimate Buy & Hold in Lazy_Portfolios_85 worksheet

Rev10a1. Added the returns for 20102. Replaced VINEX with VFWIX from 2010 onwards3. Fixed Correlations table in Data_72_10 and Data_85_104. Fixed Sharpe Ratio in Returns_85_10

Rev9b1. Fixed a typo and modified 2008 to 2010 in worksheet Lazy_Portfolios_852. Added the returns for PCRIX, PGLIX and BRSIX3. Corrected the 2009 returns for VBMFX4. Added returns for International Small5. Fixed the data point for Portfolio 2 in the CAGR vs Std Dev chart in Lazy_Portfolios_85 worksheet

Rev9a

1. Added the returns for 20102. Added Return vs. Risk charts at bottom of Portfolio worksheet (Thanks to Paul Douglas Boyer)3. Moved the data from SP_72_10 and SP_85_10 to the Returns_72_10 and Returns_85_10 worksheets. 4. Moved the Portfolio comparison section from Portfolio worksheet to Compare_Portfolios worksheet5. Updated the source/returns for Gold

Rev8i1. Corrected the returns for BRSIX,VMGIX for 20082. Corrected the formula to deduct the ER's. Earlier I was using (ActualReturns-Inflation). The new formula uses (ActualReturn-Inflation)/(1+Inflation%)3. Corrected the Std deviation for Unrebalanced_Returns in Returns_72_10 tab

Rev8h1. Corrected the Formula to calculate the total real value for rebalanced portfolio in the Compare Portfolio section2. Corrected the Formula to calculate the un-rebalanced returns in Returns_72_10 and Returns_85_10 for 2008 and higher years3. Fixed a typo for Down SD in the Compare Portfolio section for 1985-20084. Fixed the formula for Sortino Ratio in SP_72_10 and SP_85_10 worksheets

Rev8g1. Corrected the Sortino Formula in Returns_72_10 and Returns_85_10

Rev8f1. Fixed CAGR formula for Comparing 72-08 portfolios2. Updated the Compare Portfolio section to now have the ability to select different time periods instead of the fixed 1972-2008 or 1985-20083. Fixed Correlation for CHP and SBFS in SP_72_10 and SP_85_104. Charts in Excel spreadsheet now have dynamic titles that reflect the time period being tested5. The unrebalanced calculations now include the time period being tested instead of the entire 1972-2008 or 1985-2008 time periods6. User can now change the time period for comparing the Lazy Portfolios7. The correlations in the Lazy Portfolio are now time period dependent instead of being fixed for the entire period8. Updated the formula for Sortino Ratio9. Updated the formula for Sharpe Ratio to calculate Tbill average only for the time period being tested instead of the entire period

Rev8e1. Sharpe Ratio uses the average of Tbill for the selected Time period instead of using the average for the entire 1972-2008 or 1985-2008 periods.2. Fixed the formula used for 2008 and onwards returns in Returns_85_10 worksheet3. Fixed the formula used for 2010 and onwards returns in Returns_72_10 worksheet

To calculate portfolio returns from 1972-2011, Enter fund allocations here

Starting Allocation

Total US Market - TSM VTSMX 66.00% 45.31%Large Cap Value - LCV VIVAXLarge Cap Blend - LCB VFINXLarge Cap Growth - LCG VIGRXMid-Cap Blend - MCB VIMSXSmall Cap Value - SCV VISVXSmall Cap Blend - SCB NAESXSmall Cap Growth - SCG VISGXMicro Cap BRSIXREIT VGSIXIntl Developed - EAFE VDMIXEmerging Mkt - EM VEIEXTotal_Intl - EAFE85/EM15 VGTSXIntl Pacific VPACXIntl Europe VEURXIntl.Value VTRIXCommodities PCRIXLong Term Govt Bond - LTGB VUSTX 66.00% 23.32%5 Yr T-Bills VFITXTotal Bond VBMFXTbills/Treasury Money Mkt VUSXXSynthetic TIPS VIPSXWellington - Balanced VWELXWellesley - Balanced VWINXWindsor VWNDX2 Year ST Treasury VFISXGOLD GLD 66.00% 31.37%VG Intl Small VFSVX

198% ERROR 100%

Ending Allocation if not rebalanced

# of Years for backtest 40Starting Year for backtest 1972Ending Year for backtest 2011Initial Investment 4000MAR Nominal 5% Avg TBill Return (Nominal) = 5.41%MAR Real 2% Avg TBill Return (Real) = 0.97%

Total CAGR Std.Dev C-US

Portfolio Growth - Nominal ERROR #VALUE! 20.58 0.78 3.00 0.40Portfolio Growth - Real $1,028,971 14.88 18.65 0.82 2.45 0.44Coffee House - Nominal $529,519 10.43 11.27 0.50 1.03 0.91Coffee House - Real $38,575 5.83 11.32 0.48 0.68 0.89

ERROR #VALUE! 17.66 0.28 0.66 0.25

ERROR #VALUE! 15.34 0.30 0.43 0.30

Sharpe Ratio

Sortino Ratio

Portfolio Growth without Rebalancing (Nominal)

Portfolio Growth without Rebalancing (Real)

$0

$2

$4

$6

$8

$10

$12

Portfolio Growth (Nominal) 1972 - 2011

Portfolio Rebalanced CHP Portfolio UnBalanced

Portfolio Nominal (Rebalanced) = ERROR

CHP Nominal (Rebalanced) = 529519.03

Portfolio Nominal (Unbalanced) = ERROR

$0

$2

$4

$6

$8

$10

$12

Portfolio Growth (Nominal) 1972 - 2011

Portfolio Rebalanced CHP Portfolio UnBalanced

Portfolio Nominal (Rebalanced) = ERROR

CHP Nominal (Rebalanced) = 529519.03

Portfolio Nominal (Unbalanced) = ERROR

0

2

4

6

8

10

12

Avg. Drawdown Rebalanced = 1.0% Avg. Drawdown Unbalanced = 4.6%

Max. Drawdown Rebalanced = 23.2%

Max. Drawdown Unbalanced = 27.8%

$0

$2

$4

$6

$8

$10

$12

Portfolio Growth (Real) 1972 - 2011Portfolio Rebalanced CHP Portfolio Unbalanced

Portfolio Real (Rebalanced) = 1028971.45

CHP Real (Rebalanced) = 38574.76

Portfolio Real (Unbalanced) = ERROR

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

1200.00%

3-Year Rolling Returns 5-Year Rolling Returns

10-Year Rolling Returns 15-Year Rolling Returns

Rolling Returns (Nominal) 1972 - 2011

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

1200.00%

3-Year Rolling Returns 5-Year Rolling Returns

10-Year Rolling Returns 15-Year Rolling Returns

Rolling Returns (Nominal) 1972 - 2011

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

1200.00%3-Year Rolling Returns [Real]

5-Year Rolling Returns[Real]

10-Year Rolling Returns [Real]

15-Year Rolling Returns [Real]

Rolling Returns (Real) 1972 - 2011

3-Year Rolling Returns 5-Year Rolling Returns 10-Year Rolling Returns 15-Year Rolling Returns

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

1200.00%3-Year Rolling Returns [Real]

5-Year Rolling Returns[Real]

10-Year Rolling Returns [Real]

15-Year Rolling Returns [Real]

Rolling Returns (Real) 1972 - 2011

3-Year Rolling Returns 5-Year Rolling Returns 10-Year Rolling Returns 15-Year Rolling Returns

To calculate portfolio returns from 1985-2011, Enter the fund allocations here

Total US Market - TSM VTSMX 50.00% 52.16%Large Cap Value - LCV VIVAXLarge Cap Blend - LCB VFINXLarge Cap Growth - LCG VIGRXMid-Cap Blend - MCB VIMSXSmall Cap Value - SCV VISVXSmall Cap Blend - SCB NAESXSmall Cap Growth - SCG VISGXMicro Cap BRSIXREIT VGSIXIntl Developed - EAFE VDMIXEmerging Mkt - EM VEIEXTotal_Intl - EAFE85/EM15 VGTSX 30.00% 36.71%Intl Pacific VPACXIntl Europe VEURXIntl.Value VTRIXCommodities PCRIXLong Term Govt Bond - LTGB VUSTX5 Yr T-Bills VFITX 20.00% 11.14%Total Bond VBMFXTbills/Treasury Money Mkt VUSXXSynthetic TIPS VIPSXWellington - Balanced VWELXWellesley - Balanced VWINXEnergy Fund VGENXHealth Care Fund VGHCXPrecious Metals Fund VGPMXWindsor VWNDXWindsor II VWNFXShort term Tax Exempt VWSTXInter Tem Tax Exempt VWITXLong Term Tax Exempt VWLTXHigh Yield Corp VWEHX2 Year ST Treasury VFISXMid-Cap Growth Index VMGIXMid-Cap Value Index VMVIXVG Extended Market VEXMXGlobal Bond Fund PIGLXST Investment Grade VFSTXGOLD GLDVG Intl Small VFSVX

Starting Allocation

Ending Allocation if not rebalanced

100% 100%

# of Years for backtest 27Starting Year for backtest 1985Ending Year for backtest 2011Initial Investment 10000MAR Nominal 5% Avg TBill Return (Nominal) = MAR Real 2% Avg TBill Return (Real) =

C-Intl Total CAGR Std. Dev Sharpe Ratio

0.32 Portfolio Growth - Nominal $141,056 10.30 15.30 0.47 0.730.36 Portfolio Growth - Real $65,817 7.23 14.88 0.47 0.760.68 Coffee House - Nominal $49,247 9.74 10.97 0.56 0.910.67 Coffee House - Real $57,447 10.37 10.70 0.56 0.94

0.18 $123,712 9.76 17.08 0.41 0.59

0.23 $57,724 6.71 16.62 0.41 0.60

Sortino Ratio

Portfolio Growth without Rebalancing (Nominal)

Portfolio Growth without Rebalancing (Real)

$0

$2

$4

$6

$8

$10

$12

Portfolio Growth (Nominal) 1972 - 2011

Portfolio Rebalanced CHP Portfolio UnBalanced

Portfolio Nominal (Rebalanced) = ERROR

CHP Nominal (Rebalanced) = 529519.03

Portfolio Nominal (Unbalanced) = ERROR

$0

$2

$4

$6

$8

$10

$12

Portfolio Growth (Nominal) 1985 - 2011

CHP Portfolio Rebalanced Portfolio Unbalanced

Portfolio Nominal (Rebalanced) = 141055.71

CHP Nominal (Rebalanced) = 49247.03

Portfolio Nominal (Unbalanced) = 123711.93

$0

$2

$4

$6

$8

$10

$12

Portfolio Growth (Nominal) 1972 - 2011

Portfolio Rebalanced CHP Portfolio UnBalanced

Portfolio Nominal (Rebalanced) = ERROR

CHP Nominal (Rebalanced) = 529519.03

Portfolio Nominal (Unbalanced) = ERROR

$0

$2

$4

$6

$8

$10

$12

Portfolio Growth (Nominal) 1985 - 2011

CHP Portfolio Rebalanced Portfolio Unbalanced

Portfolio Nominal (Rebalanced) = 141055.71

CHP Nominal (Rebalanced) = 49247.03

Portfolio Nominal (Unbalanced) = 123711.93

0

2

4

6

8

10

12

Avg. Drawdown Rebalanced = 1.0% Avg. Drawdown Unbalanced = 4.6%

Max. Drawdown Rebalanced = 23.2%

Max. Drawdown Unbalanced = 27.8%

0

2

4

6

8

10

12

Avg. Drawdown Rebalanced = 4.0%

Avg. Drawdown Unbalanced = 5.9%

Max. Drawdown Rebalanced = 29.1%

Max. Drawdown Unbalanced = 35.5%

$0

$2

$4

$6

$8

$10

$12

Portfolio Growth (Real) 1972 - 2011Portfolio Rebalanced CHP Portfolio Unbalanced

Portfolio Real (Rebalanced) = 1028971.45

CHP Real (Rebalanced) = 38574.76

Portfolio Real (Unbalanced) = ERROR

$0

$2

$4

$6

$8

$10

$12Portfolio Growth (Real) 1985 - 2011

CHP Portfolio Rebalanced Portfolio Unbalanced

Portfolio Real (Rebalanced) = 65817.12

CHP Real (Rebalanced) = 57447.12

Portfolio Real (Unbalanced) = 57724.45

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

1200.00%

3-Year Rolling Returns 5-Year Rolling Returns

10-Year Rolling Returns 15-Year Rolling Returns

Rolling Returns (Nominal) 1972 - 2011

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

1200.00%

3-Year Rolling Returns 5-Year Rolling Returns

10-Year Rolling Returns 15-Year Rolling Returns

Rolling Returns (Nominal) 1985 - 2011

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

1200.00%

3-Year Rolling Returns 5-Year Rolling Returns

10-Year Rolling Returns 15-Year Rolling Returns

Rolling Returns (Nominal) 1972 - 2011

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

1200.00%3-Year Rolling Returns [Real]

5-Year Rolling Returns[Real]

10-Year Rolling Returns [Real]

15-Year Rolling Returns [Real]

Rolling Returns (Real) 1972 - 2011

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

1200.00%

3-Year Rolling Returns 5-Year Rolling Returns

10-Year Rolling Returns 15-Year Rolling Returns

Rolling Returns (Nominal) 1985 - 2011

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

1200.00%3-Year Rolling Returns [Real]

5-Year Rolling Returns[Real]

10-Year Rolling Returns [Real]

15-Year Rolling Returns [Real]

Rolling Returns (Real) 1985 - 2011

15-Year Rolling Returns 3-Year Rolling Returns 5-Year Rolling Returns 10-Year Rolling Returns 15-Year Rolling Returns

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

1200.00%3-Year Rolling Returns [Real]

5-Year Rolling Returns[Real]

10-Year Rolling Returns [Real]

15-Year Rolling Returns [Real]

Rolling Returns (Real) 1972 - 2011

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

1200.00%3-Year Rolling Returns [Real]

5-Year Rolling Returns[Real]

10-Year Rolling Returns [Real]

15-Year Rolling Returns [Real]

Rolling Returns (Real) 1985 - 2011

15-Year Rolling Returns 3-Year Rolling Returns 5-Year Rolling Returns 10-Year Rolling Returns 15-Year Rolling Returns

4.16%1.25%

C-US C-Intl

0.93 0.900.93 0.890.90 0.740.89 0.73

0.91 0.92

0.91 0.92

Portfolio Growth (Nominal) 1972 - 2011 Portfolio Growth (Nominal) 1985 - 2011Portfolio Growth (Real) 1972 - 2011 Portfolio Growth (Real) 1985 - 2011

$0

$2

$4

$6

$8

$10

$12

Portfolio Growth (Nominal) 1985 - 2011

CHP Portfolio Rebalanced Portfolio Unbalanced

Portfolio Nominal (Rebalanced) = 141055.71

CHP Nominal (Rebalanced) = 49247.03

Portfolio Nominal (Unbalanced) = 123711.93

Rolling Returns (Nominal) 1972 - 2011 Rolling Returns (Nominal) 1985 - 2011

$0

$2

$4

$6

$8

$10

$12

Portfolio Growth (Nominal) 1985 - 2011

CHP Portfolio Rebalanced Portfolio Unbalanced

Portfolio Nominal (Rebalanced) = 141055.71

CHP Nominal (Rebalanced) = 49247.03

Portfolio Nominal (Unbalanced) = 123711.93

0

2

4

6

8

10

12

Avg. Drawdown Rebalanced = 4.0%

Avg. Drawdown Unbalanced = 5.9%

Max. Drawdown Rebalanced = 29.1%

Max. Drawdown Unbalanced = 35.5%

$0

$2

$4

$6

$8

$10

$12Portfolio Growth (Real) 1985 - 2011

CHP Portfolio Rebalanced Portfolio Unbalanced

Portfolio Real (Rebalanced) = 65817.12

CHP Real (Rebalanced) = 57447.12

Portfolio Real (Unbalanced) = 57724.45

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

1200.00%

3-Year Rolling Returns 5-Year Rolling Returns

10-Year Rolling Returns 15-Year Rolling Returns

Rolling Returns (Nominal) 1985 - 2011

Rolling Returns (Real) 1972 - 2011 Rolling Returns (Real) 1985 - 2011

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

1200.00%

3-Year Rolling Returns 5-Year Rolling Returns

10-Year Rolling Returns 15-Year Rolling Returns

Rolling Returns (Nominal) 1985 - 2011

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

1200.00%3-Year Rolling Returns [Real]

5-Year Rolling Returns[Real]

10-Year Rolling Returns [Real]

15-Year Rolling Returns [Real]

Rolling Returns (Real) 1985 - 2011

15-Year Rolling Returns

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

1200.00%3-Year Rolling Returns [Real]

5-Year Rolling Returns[Real]

10-Year Rolling Returns [Real]

15-Year Rolling Returns [Real]

Rolling Returns (Real) 1985 - 2011

15-Year Rolling Returns

Portfolio Growth (Nominal) 1985 - 2011Portfolio Growth (Real) 1985 - 2011

Rolling Returns (Nominal) 1985 - 2011

Rolling Returns (Real) 1985 - 2011

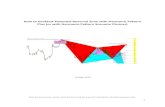

To compare portfolios from 1972-2011, Enter fund allocations here

Compare 5 portfoliosP1 P2 P3 P4 P5

Total US Market - TSM VTSMXLarge Cap Value - LCV VIVAXLarge Cap Blend - LCB VFINXLarge Cap Growth - LCG VIGRXMid-Cap Blend - MCB VIMSXSmall Cap Value - SCV VISVX 65.00% 25.00% 50.00% 80.00% 100.00%Small Cap Blend - SCB NAESXSmall Cap Growth - SCG VISGXMicro Cap BRSIXREIT VGSIXIntl Developed - EAFE VDMIXEmerging Mkt - EM VEIEXTotal_Intl - EAFE85/EM15 VGTSXIntl Pacific VPACXIntl Europe VEURXIntl.Value VTRIXCommodities PCRIXLong Term Govt Bond - LTGB VUSTX 65.00% 25.00% 50.00% 20.00%5 Yr T-Bills VFITXTotal Bond VBMFXTbills/Treasury Money Mkt VMPXXSynthetic TIPS VIPSXWellington - Balanced VWELXWellesley - Balanced VWINXWindsor VWNDX2 Year ST Treasury VFISX 25.00%GOLD GLD 65.00% 25.00%VG Intl Small VFSVX

195% 100% 100% 100% 100%

Compare 5 Portfolios

Initial Investment for comparing portfolios 10000 10000 10000 10000 10000Starting Year for backtest 1972 1972 1972 1972 1972Ending Year for backtest 2011 2011 2011 2011 2011# of Years backtesting 40 40 40 40 40Offset 0 0 0 0 0MAR Nominal 5% Avg TBill Return (Nominal) = 5.41%MAR Real 2% Avg TBill Return (Real) = 0.97%

P1 P2 P3 P4 P5Average 23.42% 10.81% 11.97% 13.66% 14.79%

Std. Dev. 20.61% 8.16% 12.17% 16.94% 20.86%

Down SD 4.63% 2.25% 5.13% 8.23% 10.68%

Up SD 17.31% 6.90% 8.55% 10.06% 12.11%

CAGR 21.85% 10.53% 11.32% 12.36% 12.79%

Sharpe 0.87 0.66 0.54 0.49 0.45

Sortino 3.97 2.59 1.36 1.05 0.92

US Mkt. Corr. 0.31 0.32 0.68 0.75 0.76

Intl. Corr. 0.24 0.22 0.35 0.45 0.47

Total - Rebalanced (N) 27140422 548452 728080 1059162 1231297

Total-Unbalanced (N) 1170070 489028 748530 1038190 1231297

Total - Rebalanced (Real) 4942859 99885 132599 192896 224246

6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% 22.00%

0.00%

1.20%

2.40%

3.60%

4.80%

6.00%

7.20%

8.40%

9.60%

10.80%

12.00%

13.20%

14.40%

15.60%

16.80%

18.00%

19.20%

20.40%

21.60%

Portfolios Return vs. Risk

P1 P2

P3 P4

P5

Annualized Standard Deviation

An

nu

ali

ze

d R

etu

rn

1972 39.55% 16.12% 6.09% 6.49% 6.75%

1973 28.41% 12.38% -13.76% -21.21% -26.17%

1974 37.54% 16.64% -7.13% -13.88% -18.39%

1975 23.04% 10.77% 31.53% 45.10% 54.15%

1976 42.42% 18.47% 34.87% 45.90% 53.25%

1977 27.76% 11.54% 10.28% 17.02% 21.52%

1978 36.74% 15.44% 10.03% 16.93% 21.52%

1979 103.53% 42.35% 16.82% 27.78% 35.09%

1980 23.13% 12.35% 10.43% 19.24% 25.11%

1981 -10.79% 0.50% 8.14% 12.04% 14.64%

1982 53.77% 25.48% 34.12% 30.57% 28.21%

1983 14.35% 7.60% 19.36% 30.71% 38.28%

1984 -1.46% 2.56% 8.63% 4.69% 2.07%

1985 43.30% 19.88% 30.68% 30.69% 30.70%

1986 33.90% 15.94% 15.67% 10.56% 7.15%

1987 7.30% 4.24% -5.25% -6.49% -7.31%

1988 14.79% 7.10% 19.18% 25.19% 29.20%

1989 17.45% 8.82% 15.04% 13.30% 12.14%

1990 -11.74% -2.36% -8.10% -16.43% -21.98%

1991 31.44% 14.70% 29.40% 36.59% 41.37%

1992 19.55% 9.14% 18.10% 24.52% 28.80%

1993 37.38% 15.98% 20.15% 22.17% 23.52%

1994 -7.36% -2.97% -4.38% -2.79% -1.73%

1995 36.53% 17.08% 27.81% 26.43% 25.51%

1996 9.69% 4.82% 9.94% 16.65% 21.12%

1997 15.39% 7.52% 22.70% 27.98% 31.50%

1998 3.32% 3.12% 3.17% -2.76% -6.71%

1999 -3.31% -0.81% -2.77% 0.76% 3.11%

2000 23.26% 11.15% 20.80% 21.45% 21.88%

2001 11.99% 6.56% 9.00% 11.82% 13.70%

2002 17.83% 8.86% 1.24% -8.03% -14.20%

2003 38.35% 15.34% 19.94% 30.29% 37.19%

2004 22.85% 9.05% 15.34% 20.26% 23.55%

2005 19.79% 8.05% 6.34% 6.18% 6.07%

2006 27.90% 11.67% 10.49% 15.74% 19.24%

2007 21.28% 10.16% 1.09% -3.81% -7.07%

2008 -2.97% 0.53% -4.76% -21.14% -32.05%

2009 27.48% 10.93% 9.15% 21.86% 30.34%

2010 40.96% 16.42% 16.88% 21.64% 24.82%

2011 22.55% 9.24% 12.56% 2.53% -4.16%

2012201320142015

6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% 22.00%

0.00%

1.20%

2.40%

3.60%

4.80%

6.00%

7.20%

8.40%

9.60%

10.80%

12.00%

13.20%

14.40%

15.60%

16.80%

18.00%

19.20%

20.40%

21.60%

Portfolios Return vs. Risk

P1 P2

P3 P4

P5

Annualized Standard DeviationA

nn

ua

liz

ed

Re

turn

To compare portfolios from 1985-2011, Enter fund allocations here

Compare 5 portfoliosP1 P2 P3 P4

Total US Market - TSM VTSMX 25.00% 15.00% 7.50%Large Cap Value - LCV VIVAX 15.00% 7.50%Large Cap Blend - LCB VFINXLarge Cap Growth - LCG VIGRXMid-Cap Blend - MCB VIMSX 5.00%Small Cap Value - SCV VISVX 66.00% 5.00% 5.00%Small Cap Blend - SCB NAESX 5.00% 5.00%Small Cap Growth - SCG VISGXMicro Cap BRSIX 5.00%REIT VGSIX 25.00% 10.00% 5.00%Intl Developed - EAFE VDMIXEmerging Mkt - EM VEIEX 7.50% 7.50%Total_Intl - EAFE85/EM15 VGTSX 25.00%Intl Pacific VPACX 7.50% 7.50%Intl Europe VEURX 7.50% 7.50%Intl.Value VTRIX 7.50% 7.50%Commodities PCRIXLong Term Govt Bond - LTGB VUSTX 66.00%5 Yr T-Bills VFITXTotal Bond VBMFX 20.00% 15.00%Tbills/Treasury Money Mkt VMPXXSynthetic TIPS VIPSX 25.00% 15.00%Wellington - Balanced VWELXWellesley - Balanced VWINXEnergy Fund VGENXHealth Care Fund VGHCXPrecious Metals Fund VGPMXWindsor VWNDXWindsor II VWNFXShort term Tax Exempt VWSTXInter Tem Tax Exempt VWITXLong Term Tax Exempt VWLTXHigh Yield Corp VWEHX2 Year ST Treasury VFISXMid-Cap Growth Index VMGIXMid-Cap Value Index VMVIXVG Extended Market VEXMXGlobal Bond Fund PIGLXST Investment Grade VFSTX

GOLD GLD 66.00%VG Intl Small VFSVX

198% 100% 100% 100%

ERROR

Initial Investment for comparing portfolios 10000 10000 10000 10000Starting Year for backtest 1985 1985 1985 1985Ending Year for backtest 2011 2011 2011 2011# of Years backtesting 27 27 27 27Offset 0 0 0 0MAR Nominal 5% Avg TBill Return (Nominal) = MAR Real 2% Avg TBill Return (Real) =

P1 P2 P3 P4Average 19.51% 11.28% 11.89% 11.70%

Std. Dev. 15.22% 13.62% 14.89% 13.87%

Down SD 4.63% 7.74% 8.24% 7.41%

Up SD 10.61% 7.78% 8.64% 8.47%

CAGR 18.54% 10.39% 10.84% 10.80%

Sharpe 1.01 0.52 0.52 0.54

Sortino 3.14 0.81 0.84 0.90

US Mkt. Corr. 0.48 0.85 0.89 0.86

Intl. Corr. 0.53 0.89 0.90 0.91

Total - Rebalanced 986906 144255 160910 159378

Total - Unbalanced 217166 124637 160529 158913

Total - Rebalanced (Real) 460494 67310 75081 74366

6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% 22.00%

0.00%

1.20%

2.40%

3.60%

4.80%

6.00%

7.20%

8.40%

9.60%

10.80%

12.00%

13.20%

14.40%

15.60%

16.80%

18.00%

19.20%

20.40%

21.60%

Portfolios Return vs. Risk

P1 P2

P3 P4

P5

Annualized Standard Deviation

An

nu

ali

ze

d R

etu

rn

4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

20.00%

Portfolios Return vs. Risk

P1 P2

P3 P4

P5

Annualized Standard Deviation

An

nu

aliz

ed r

etu

rn

1985 43.97% 29.09% 35.46% 33.02%

1986 34.42% 31.28% 30.25% 30.16%

1987 7.41% 8.08% 7.87% 8.33%

1988 15.02% 19.92% 21.25% 21.94%

1989 17.72% 15.42% 21.51% 18.80%

1990 -11.92% -9.33% -9.41% -9.26%

1991 31.93% 26.20% 26.66% 26.50%

1992 19.85% 5.66% 7.07% 7.80%

1993 37.96% 21.03% 23.70% 24.35%

1994 -7.47% 2.82% 0.92% 1.12%

1995 37.09% 15.27% 21.53% 17.67%

1996 9.84% 16.84% 15.49% 12.67%

1997 15.63% 14.06% 13.95% 11.63%

1998 3.37% 6.28% 7.75% 6.05%

1999 -3.36% 14.34% 17.99% 18.94%

2000 23.61% 1.19% 0.03% 0.10%

2001 12.17% -2.84% -4.43% -1.47%

2002 18.10% -3.92% -9.57% -5.02%

2003 38.94% 28.84% 31.29% 31.42%

2004 23.20% 18.10% 16.69% 16.11%

2005 20.09% 9.01% 10.44% 10.03%

2006 28.33% 19.41% 19.42% 15.94%

2007 21.60% 4.04% 5.54% 7.37%

2008 -3.02% -30.26% -30.08% -27.49%

2009 27.90% 26.45% 26.92% 26.45%

2010 41.59% 15.67% 14.96% 14.31%

2011 22.90% 2.03% -2.15% -1.61%

2012201320142015

6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% 22.00%

0.00%

1.20%

2.40%

3.60%

4.80%

6.00%

7.20%

8.40%

9.60%

10.80%

12.00%

13.20%

14.40%

15.60%

16.80%

18.00%

19.20%

20.40%

21.60%

Portfolios Return vs. Risk

P1 P2

P3 P4

P5

Annualized Standard Deviation

An

nu

ali

ze

d R

etu

rn

4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

20.00%

Portfolios Return vs. Risk

P1 P2

P3 P4

P5

Annualized Standard Deviation

An

nu

aliz

ed r

etu

rn

P520.00%

5.00%

25.00%

12.50%

12.50%

25.00%

100%

1000019852011

270

4.16%1.25%

P58.55%

6.18%

2.36%

4.64%

8.38%

0.71

1.51

0.63

0.75

87914

86600

41021

4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

20.00%

Portfolios Return vs. Risk

P1 P2

P3 P4

P5

Annualized Standard Deviation

An

nu

aliz

ed r

etu

rn

20.75%

20.04%

7.74%

5.04%

12.50%

0.74%

11.62%

3.06%

13.68%

-1.75%

17.51%

4.20%

5.63%

9.93%

5.01%

2.41%

-0.54%

6.65%

14.14%

6.70%

8.63%

11.40%

13.39%

-1.66%

10.81%

13.86%

9.46%

4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

20.00%

Portfolios Return vs. Risk

P1 P2

P3 P4

P5

Annualized Standard Deviation

An

nu

aliz

ed r

etu

rn

To compare the Lazy Portfolios for different time periods (between 1985-2010), Change the starting and ending year in cells E4 and E5

Initial Investment 10000

Starting Year (>=1985) 1985

Ending Year (<= 2010) 2011

MAR Nominal 5%

Offset 0

# of Years of Backtesting 27

Average Std. Dev. Down SD Up SD CAGR

Wellington P1 11.47% 11.85% 6.05% 7.27% 10.55%

Wellesley P2 10.44% 9.56% 4.06% 6.63% 10.02%

P3 P3 19.09% 15.27% 4.59% 10.45% 18.27%

Taylor Larimore 3 Fund P4 11.82% 15.66% 9.09% 7.90% 10.13%

Taylor Larimore 4 Fund P5 11.86% 15.72% 9.18% 7.78% 10.18%

Rick Ferri Core Four P6 11.72% 14.86% 8.57% 8.04% 10.21%

Bill Berstein No Brainer Cowards P7 10.72% 11.79% 6.67% 6.19% 9.62%

Bill Berstein No Brainer P8 11.34% 14.34% 8.05% 8.04% 9.86%

Bill Bernstein Smart Money P9 10.72% 11.79% 6.67% 6.19% 9.62%

Dilbert's Portfolio P10 10.77% 13.40% 7.31% 7.36% 9.67%

Ted Aronson Family Taxable P11 12.26% 14.90% 7.82% 9.02% 10.81%

Bill Schultheis Coffee House P12 10.62% 11.06% 5.85% 6.28% 9.74%

P13 12.01% 12.09% 6.02% 7.89% 10.82%

David Swenson Lazy Portfolio P14 11.29% 12.61% 7.04% 6.88% 10.18%

David Swenson Yale Endowment P15 11.83% 12.66% 6.58% 7.89% 10.87%

2nd Grader P16 12.32% 17.29% 10.34% 8.22% 10.32%

Frank Armstrong Ideal Idx P17 10.99% 13.03% 7.40% 7.82% 9.66%

Scott Burns Couch Portfolio P18 10.05% 10.06% 5.52% 5.16% 9.48%

Scott Burns Margaritaville P19 11.41% 14.24% 8.01% 7.67% 10.04%

Scott Burns Four Square P20 10.30% 11.25% 6.19% 5.82% 9.41%

Scott Burns Five Fold P21 10.70% 11.50% 6.35% 7.04% 9.82%

P22 11.59% 11.93% 6.83% 6.37% 10.57%

Harry Browne Permanent P23 8.19% 5.82% 2.30% 4.06% 8.11%

Larry Swedroe Simple Portfolio P24 11.39% 11.94% 6.35% 7.00% 10.37%

P25 10.48% 8.44% 3.66% 6.09% 9.84%

FundAdvice Ultimate Buy & Hold Portfolio

Scott Burns Six Ways from Sunday

Larry Swedroe Minimize FatTails Portfolio

P1 P2 P3 P4 P5

Wellington Wellesley P3

Total US Market - TSM VTSMX 50.0% 50.0%

Large Cap Value - LCV VIVAX

Large Cap Blend - LCB VFINX

Large Cap Growth - LCG VIGRX

Mid-Cap Blend - MCB VIMSX

Small Cap Value - SCV VISVX 65.0%

Small Cap Blend - SCB NAESX

Small Cap Growth - SCG VISGX

Micro Cap BRSIX

REIT VGSIX

Intl Developed - EAFE VDMIX

Emerging Mkt - EM VEIEX

Total_Intl - EAFE85/EM15 VGTSX 30.0% 30.0%

Intl Pacific VPACX

Intl Europe VEURX

Intl.Value VTRIX

Commodities PCRIX

Long Term Govt Bond - LTGB VUSTX 65.0%

5 Yr T-Bills VFITX

Total Bond VBMFX 20.0% 10.0%

Tbills/Treasury Money Mkt VMPXX

Synthetic TIPS VIPSX 10.0%

Wellington - Balanced VWELX 100.0%

Wellesley - Balanced VWINX 100.0%

Energy Fund VGENX

Health Care Fund VGHCX

Precious Metals Fund VGPMX

Windsor VWNDX

Windsor II VWNFX

Short term Tax Exempt VWSTX

Inter Tem Tax Exempt VWITX

Long Term Tax Exempt VWLTX

High Yield Corp VWEHX

2 Year ST Treasury VFISX

Mid-Cap Growth Index VMGIX

Mid-Cap Value Index VMVIX

VG Extended Market VEXMX

Global Bond Fund PIGLX

ST Investment Grade VFSTX

GOLD GOLD 65.0%

VG Intl Small VFSVX

0 0

0 0

0 0

0 0

0 0

0 0

TaylorLarimore3 Fund

TaylorLarimore4 Fund

0 0

0 0

0 0

100.0% 100.0% 195.0% 100.0% 100.0%

P1 P2 P3 P4 P5

Wellington Wellesley P3Average 11.47% 10.44% 19.09% 11.82% 11.86%

Std. Dev. 11.85% 9.56% 15.27% 15.66% 15.72%

Down SD 6.05% 4.06% 4.59% 9.09% 9.18%

Up SD 7.27% 6.63% 10.45% 7.90% 7.78%

CAGR 10.55% 10.02% 18.27% 10.13% 10.18%

Sharpe 0.62 0.66 0.98 0.49 0.49

Sortino 1.07 1.34 3.07 0.75 0.75

US Mkt. Corr. 0.91 0.68 0.48 0.94 0.93

Intl. Corr. 0.65 0.42 0.53 0.90 0.91

Total - Rebalanced (N) 150020 131786 928407 135453 136998

Total - Unbalanced (N) 150020 131786 213875 121942 122961

Total - Rebalanced (Real) 70000 61492 433198 63203 63924

$1 Portfolio = 15.00 13.18 92.84 13.55 13.70

1985 28.53% 27.41% 43.30% 36.59% 35.68%

1986 18.40% 18.34% 33.90% 31.01% 31.92%

1987 2.28% -1.92% 7.30% 8.88% 9.60%

1988 16.11% 13.61% 14.79% 19.36% 20.49%

1989 21.60% 20.93% 17.45% 22.63% 21.86%

1990 -2.81% 3.76% -11.74% -7.82% -8.09%

1991 23.65% 21.57% 31.44% 26.05% 26.09%

1992 7.93% 8.67% 19.55% 3.65% 3.66%

1993 13.52% 14.65% 37.38% 18.77% 19.35%

1994 -0.49% -4.44% -7.36% 1.03% 1.59%

1995 32.92% 28.91% 36.53% 24.42% 22.66%

1996 16.19% 9.42% 9.69% 13.45% 13.48%

1997 23.23% 20.19% 15.39% 17.07% 16.90%

1998 12.06% 11.84% 3.32% 18.03% 17.43%

1999 4.41% -4.14% -3.31% 20.73% 21.57%

2000 10.40% 16.17% 23.26% -7.69% -8.37%

2001 4.19% 7.39% 11.99% -9.84% -9.95%

2002 -6.90% 4.64% 17.83% -13.35% -12.52%

2003 20.75% 9.66% 38.35% 28.57% 28.97%

2004 11.17% 7.57% 22.85% 13.36% 13.76%

2005 6.82% 3.48% 19.79% 8.14% 8.16%

2006 14.97% 11.28% 27.90% 16.60% 16.22%

2007 8.34% 5.61% 21.27% 8.79% 9.25%

2008 -22.30% -9.84% -2.97% -30.74% -31.53%

TaylorLarimore3 Fund

TaylorLarimore4 Fund

2009 22.20% 16.02% 27.48% 26.56% 27.04%

2010 10.94% 10.65% 40.96% 13.17% 13.14%

2011 3.85% 9.63% 22.55% -2.38% -1.81%

2012201320142015

To compare the Lazy Portfolios for different time periods (between 1985-2010), Change the starting and ending year in cells E4 and E5

Intl. Corr. 1$ Portfolio

0.62 1.07 0.91 0.65 150019.50 150019.50 69999.66 15.00

0.66 1.34 0.68 0.42 131786.15 131786.15 61491.91 13.18

0.98 3.07 0.48 0.53 928406.88 213875.16 433198.13 92.84

0.49 0.75 0.94 0.90 135453.44 121941.94 63203.08 13.55

0.49 0.75 0.93 0.91 136997.89 122960.95 63923.73 13.70

0.51 0.78 0.95 0.87 137936.24 123083.18 64361.57 13.79

0.56 0.86 0.92 0.82 119290.44 128354.69 55661.37 11.93

0.50 0.79 0.96 0.80 126762.92 121323.07 59148.05 12.68

0.56 0.86 0.92 0.82 119290.44 128354.69 55661.37 11.93

0.49 0.79 0.99 0.67 120810.57 115678.82 56370.66 12.08

0.54 0.93 0.86 0.93 159852.43 163400.40 74587.74 15.99

0.58 0.96 0.90 0.74 123117.57 111821.44 57447.12 12.31

0.65 1.16 0.82 0.93 160132.80 153371.35 74718.57 16.01

0.57 0.89 0.89 0.87 137129.77 136505.55 63985.26 13.71

0.61 1.04 0.89 0.86 162313.33 148495.67 75736.01 16.23

0.47 0.71 0.94 0.89 141922.05 129523.57 66221.36 14.19

0.52 0.81 0.86 0.92 120498.30 109841.72 56224.96 12.05

0.59 0.92 0.96 0.76 115421.18 107648.64 53855.96 11.54

0.51 0.80 0.86 0.95 132520.83 116743.32 61834.72 13.25

0.55 0.86 0.86 0.92 113511.27 102183.27 52964.78 11.35

0.57 0.90 0.86 0.87 125505.84 111523.30 58561.50 12.55

0.62 0.96 0.83 0.83 150769.93 141314.42 70349.81 15.08

0.69 1.39 0.69 0.70 82105.54 84427.64 38310.75 8.21

0.61 1.01 0.84 0.85 143644.85 138763.30 67025.23 14.36

0.75 1.50 0.67 0.81 126092.32 165106.74 58835.15 12.61

Sharpe Ratio

Sortino Ratio

Mkt. Corr.

Total - Rebalanced

(Nominal)

Total - Unbalanced

(Nominal)

Total - Rebalanced

(Real)

P6 P7 P8 P9 P10 P11 P12 P13

48.00% 15.00% 15.00% 70.00% 5.00%

10.00% 10.00% 10.00% 6.00%

25.00% 15.00% 10.00% 6.00%

10.00% 10.00% 5.00% 10.00% 6.00%

5.00% 25.00% 5.00% 10.00%

5.00%

6.00%

8.00% 5.00% 5.00% 10.00% 6.00%

6.00%

5.00% 5.00% 10.00% 6.00%

24.00% 10.00%

5.00% 5.00% 15.00%

5.00% 25.00% 5.00% 5.00%

6.00%

10.00%

20.00%

20.00% 30.00% 40.00%

15.00% 8.00%

5.00%

25.00% 12.00%

10.00%

40.00% 40.00%

12.00%

Rick Ferri Core Four

BillBersteinNo BrainerCowards

BillBersteinNo Brainer

Bill BernsteinSmartMoney

Dilbert's Portfolio

Ted Aronson FamilyTaxable

BillSchultheisCoffee House

FundAdviceUltimateBuy & Hold

100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

P6 P7 P8 P9 P10 P11 P12 P13

11.72% 10.72% 11.34% 10.72% 10.77% 12.26% 10.62% 12.01%

14.86% 11.79% 14.34% 11.79% 13.40% 14.90% 11.06% 12.09%

8.57% 6.67% 8.05% 6.67% 7.31% 7.82% 5.85% 6.02%

8.04% 6.19% 8.04% 6.19% 7.36% 9.02% 6.28% 7.89%

10.21% 9.62% 9.86% 9.62% 9.67% 10.81% 9.74% 10.82%

0.51 0.56 0.50 0.56 0.49 0.54 0.58 0.65

0.78 0.86 0.79 0.86 0.79 0.93 0.96 1.16

0.95 0.92 0.96 0.92 0.99 0.86 0.90 0.82

0.87 0.82 0.80 0.82 0.67 0.93 0.74 0.93

137936 119290 126763 119290 120811 159852 123118 160133

123083 128355 121323 128355 115679 163400 111821 153371

64362 55661 59148 55661 56371 74588 57447 74719

13.79 11.93 12.68 11.93 12.08 15.99 12.31 16.01

34.05% 28.36% 38.56% 28.36% 27.69% 33.78% 27.07% 32.71%

28.11% 20.82% 19.81% 20.82% 14.98% 34.22% 18.92% 28.74%

6.95% 4.69% 1.31% 4.69% 1.34% 10.34% 1.51% 11.14%

18.26% 17.09% 15.64% 17.09% 14.65% 22.13% 16.56% 18.83%

21.63% 18.58% 21.12% 18.58% 24.15% 21.15% 16.61% 18.15%

-7.65% -4.48% -4.51% -4.48% -1.73% -9.46% -5.58% -7.04%

27.04% 25.11% 24.62% 25.11% 28.69% 28.68% 25.74% 21.76%

5.12% 9.64% 7.13% 9.64% 8.86% 5.40% 10.20% 5.44%

17.80% 17.39% 16.03% 17.39% 10.19% 24.38% 16.72% 22.89%

0.94% 0.18% 0.49% 0.18% -0.92% 0.72% -0.40% 1.72%

24.33% 20.16% 25.15% 20.16% 30.51% 19.20% 22.60% 15.89%

15.38% 13.48% 16.66% 13.48% 15.75% 10.26% 14.08% 10.57%

17.99% 14.80% 22.10% 14.80% 24.53% 10.24% 17.43% 8.28%

15.32% 6.62% 15.56% 6.62% 18.86% 7.97% 6.75% 8.68%

18.13% 14.18% 15.67% 14.18% 16.44% 25.06% 8.27% 21.39%

-4.43% 2.59% -2.77% 2.59% -3.98% -6.68% 7.25% 3.71%

-7.43% 0.09% -5.36% 0.09% -5.15% -6.19% 1.88% -0.45%

-11.73% -7.12% -13.02% -7.12% -12.19% -6.45% -5.56% -1.65%

28.38% 24.13% 28.80% 24.13% 23.14% 29.98% 23.54% 29.35%

14.32% 12.43% 13.13% 12.43% 10.04% 14.95% 13.80% 15.27%

8.04% 7.25% 5.79% 7.25% 4.91% 11.02% 6.24% 9.18%

17.50% 14.74% 17.12% 14.74% 12.14% 13.17% 15.15% 15.95%

6.43% 4.58% 7.06% 4.58% 5.92% 9.71% 2.63% 6.83%

-30.32% -24.51% -27.79% -24.51% -24.41% -26.79% -20.21% -21.42%

Rick Ferri Core Four

BillBersteinNo BrainerCowards

BillBersteinNo Brainer

Bill BernsteinSmartMoney

Dilbert's Portfolio

Ted Aronson FamilyTaxable

BillSchultheisCoffee House

FundAdviceUltimateBuy & Hold

26.14% 24.65% 23.99% 24.65% 21.87% 26.55% 20.26% 22.54%

14.42% 13.34% 12.55% 13.34% 13.89% 15.54% 14.68% 13.79%

-0.84% -1.36% -2.54% -1.36% 2.94% 0.36% 2.02% -1.96%

4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

20.00%

Portfolios Return vs. Risk

P1 P2

P3 P4

P5 P6

P7 P8

P9 P10

P11 P12

P13 P14

P15 P16

P17 P18

P19 P20

P21 P22

P23 P24

P25Annualized Standard Deviation

An

nu

aliz

ed R

etu

rn

P14 P15 P16 P17 P18 P19 P20 P21

2nd Grader

30.00% 30.00% 60.00% 50.00% 34.00% 25.00% 20.00%

9.25%

6.25%

9.25%

6.25%

20.00% 20.00% 8.00% 20.00%

15.00% 15.00%

5.00% 5.00%

30.00% 31.00% 33.00% 25.00% 20.00%

15.00%

15.00% 15.00% 10.00% 50.00% 33.00% 25.00% 20.00%

15.00% 30.00%

25.00% 20.00%

DavidSwenson Lazy Portfolio

David Swenson Yale Endowment

FrankArmstrongIdeal Idx

Scott Burns Couch Portfolio

Scott Burns Margaritaville

Scott Burns Four Square

Scott Burns Five Fold

100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

P14 P15 P16 P17 P18 P19 P20 P21

11.29% 11.83% 12.32% 10.99% 10.05% 11.41% 10.30% 10.70%

12.61% 12.66% 17.29% 13.03% 10.06% 14.24% 11.25% 11.50%

7.04% 6.58% 10.34% 7.40% 5.52% 8.01% 6.19% 6.35%

6.88% 7.89% 8.22% 7.82% 5.16% 7.67% 5.82% 7.04%

10.18% 10.87% 10.32% 9.66% 9.48% 10.04% 9.41% 9.82%

0.57 0.61 0.47 0.52 0.59 0.51 0.55 0.57

0.89 1.04 0.71 0.81 0.92 0.80 0.86 0.90

0.89 0.89 0.94 0.86 0.96 0.86 0.86 0.86

0.87 0.86 0.89 0.92 0.76 0.95 0.92 0.87

137130 162313 141922 120498 115421 132521 113511 125506

136506 148496 129524 109842 107649 116743 102183 111523

63985 75736 66221 56225 53856 61835 52965 58561

13.71 16.23 14.19 12.05 11.54 13.25 11.35 12.55

28.05% 30.71% 37.10% 32.61% 20.32% 32.50% 24.79% 23.60%

27.11% 28.99% 32.22% 30.01% 18.92% 35.19% 26.95% 25.35%

7.32% 5.98% 9.66% 8.59% 4.85% 11.94% 9.45% 6.80%

17.86% 18.39% 21.53% 19.14% 18.22% 22.10% 18.17% 17.19%

17.25% 18.67% 23.36% 15.61% 17.27% 17.82% 16.64% 15.03%

-6.84% -7.26% -9.57% -9.45% -0.10% -7.23% -3.42% -5.85%

26.12% 27.17% 28.01% 23.07% 25.06% 23.24% 21.08% 23.95%

6.55% 6.69% 3.91% 5.28% 8.44% 2.83% 3.08% 5.34%

18.88% 20.44% 19.43% 20.79% 12.94% 21.44% 19.10% 19.17%

1.69% 0.73% 1.84% 1.45% 1.41% 2.74% 2.26% 2.41%

17.36% 20.06% 24.42% 17.86% 18.19% 15.54% 16.19% 15.96%

16.24% 15.40% 15.22% 12.54% 12.43% 10.89% 9.05% 14.24%

14.56% 15.69% 19.05% 11.60% 19.39% 12.76% 9.20% 11.07%

7.30% 8.15% 18.90% 8.32% 12.93% 13.91% 13.49% 7.53%

14.89% 13.31% 24.03% 13.49% 15.75% 20.50% 14.28% 10.62%

0.60% 2.23% -10.57% 2.04% -2.99% -7.23% -5.29% 1.04%

-2.02% -2.55% -11.89% -3.55% -1.79% -7.94% -5.31% -1.78%

-4.57% -3.27% -15.44% -7.56% -2.18% -6.62% 0.47% 1.13%

26.77% 26.81% 31.71% 26.96% 19.68% 26.61% 24.07% 26.39%

15.65% 16.56% 14.59% 14.50% 10.40% 13.86% 13.30% 16.79%

8.43% 9.16% 8.52% 8.36% 4.29% 8.03% 4.45% 5.93%

17.69% 17.39% 17.34% 17.75% 7.97% 14.21% 12.11% 16.70%

4.87% 5.07% 9.11% 6.15% 8.54% 10.81% 10.47% 5.08%

-26.83% -24.46% -35.74% -25.74% -19.95% -28.09% -21.67% -24.74%

DavidSwenson Lazy Portfolio

David Swenson Yale Endowment

2nd Grader

FrankArmstrongIdeal Idx

Scott Burns Couch Portfolio

Scott Burns Margaritaville

Scott Burns Four Square

Scott Burns Five Fold

24.39% 22.36% 29.32% 23.07% 19.75% 25.44% 23.35% 24.60%

14.33% 15.28% 14.21% 12.97% 11.63% 11.52% 11.41% 14.78%

1.47% 5.52% -2.47% -3.43% 7.10% -0.11% 2.21% 3.46%

4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

20.00%

Portfolios Return vs. Risk

P1 P2

P3 P4

P5 P6

P7 P8

P9 P10

P11 P12

P13 P14

P15 P16

P17 P18

P19 P20

P21 P22

P23 P24

P25Annualized Standard Deviation

An

nu

aliz

ed R

etu

rn

P22 P23 P24 P25

16.67% 25.00%

15.00%

15.00% 15.00%

13.00%

16.66%

4.00% 15.00%

16.66%

13.00%

25.00%

25.00%

16.66% 40.00% 35.00%

16.66%

35.00%

16.66%

25.00%

Scott Burns Six Ways from Sunday

Harry BrownePermanent

LarrySwedroeSimple Portfolio

LarrySwedroeMinimize FatTails Portfolio

100.0% 100.0% 100.0% 100.0%

P22 P23 P24 P25

11.59% 8.19% 11.39% 10.48%

11.93% 5.82% 11.94% 8.44%

6.83% 2.30% 6.35% 3.66%

6.37% 4.06% 7.00% 6.09%

10.57% 8.11% 10.37% 9.84%

0.62 0.69 0.61 0.75

0.96 1.39 1.01 1.50

0.83 0.69 0.84 0.67

0.83 0.70 0.85 0.81

150770 82106 143645 126092

141314 84428 138763 165107

70350 38311 67025 58835

15.08 8.21 14.36 12.61

22.02% 18.81% 26.25% 21.20%

23.24% 16.72% 24.41% 22.12%

6.68% 6.54% 7.01% 9.34%

17.88% 4.63% 25.01% 18.85%

19.76% 13.06% 14.85% 16.48%

-5.10% 1.42% -8.00% 0.17%

20.00% 11.79% 25.78% 24.22%

5.47% 3.60% 10.63% 10.78%

20.39% 11.82% 23.08% 22.30%

1.73% -1.49% 1.94% -0.57%

17.52% 17.99% 14.87% 8.30%

17.53% 4.96% 12.19% 8.44%

11.70% 7.07% 14.23% 7.16%

2.85% 10.02% 3.69% -0.24%

12.34% 5.04% 13.73% 13.04%

6.93% 2.28% 3.61% 3.85%

-1.91% -0.56% 1.70% 6.94%

0.84% 5.54% -3.26% 5.38%

27.61% 13.49% 27.30% 17.86%

20.09% 6.28% 15.34% 10.71%

12.37% 8.28% 7.58% 7.24%

17.19% 10.94% 13.15% 8.76%

10.40% 12.49% 6.94% 11.59%

-27.76% -1.90% -23.57% -11.39%

Scott Burns Six Ways from Sunday

Harry BrownePermanent

LarrySwedroeSimple Portfolio

LarrySwedroeMinimize FatTails Portfolio

26.88% 10.29% 23.93% 20.23%

14.55% 13.83% 13.64% 9.64%

2.59% 9.96% 1.80% 1.92%

Data_Sources

Page 49

Credit to Trevh/Cb/Alec from Vanguard Diehards / Bogleheads forum for compiling this data from various sources.A special thanks to Gummy (gummy-stuff.org) for all the Math & Excel help.

For comments/Feedback/updates visit

Annual Return Data Sources:http://www.tamasset.com/other/AC2705.xlshttp://www.fpanet.org/journal/articles/2006_Issues/jfp0206-art7.cfmhttps://flagship.vanguard.com/VGApp/hnw/FundsByTypehttp://www.mscibarra.com/products/indices/us/annualReturns.jspCPI-U data was collected from http://www.bls.gov/cpi and the actual data was obtained from ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.txt

Credit to Cb/Gnobility/Jeff for calculating the synthetic returns of CCF data Credit to Stratton for the Global Bond Funds DataCredit to CraigR for the Gold returns - http://crawlingroad.com/blog/2008/12/22/permanent-portfolio-historical-returns/#more-299

Folowing is the list of the Abbreviations and a summary of the data sources by year range.

MKT = US Cap Weighted Market: EAFE============================= ================================CRSP Market Decile 1-10 1972-1992 MSCI EAFE Index 1972-2000 (Developed Only)Vanguards Total Stock Market Index Fund 1993-2011 Vanguard Developed Mkts Idx (VDMIX) 2001-2011

LCB = US Large Blend: EM===================== ================================S&P 500: Standard & Poors 1972-1976 IFA website (added back expenses):1972-1987 Vanguards 500 Index Fund 1977-2011 (http://www.ifa.com/library/support/data/IFAindexdata.asp)

Allocated 50% IFA Intl Value Index and 50% IFA Intl SmallLCV = US Large Value: MSCI Emerging Mkts Index 1988-1994===================== Vanguard Emerging Mkts Idx - 1995-2011Fama and French 1972-1978 Russell 1000 Value Index 1979-1992Vanguards Value Index Fund 1993-2011 EAFE/EM

INTLT - Total International:LCG = US Large Growth: ================================================== MSCI EAFE Index 1972-1987 (Developed Only)Fama and French 1972-1978 85% EAFE IndexRussell 1000 Growth Index 1979-1992 Vanguards Total International Index Fund 1997-2011Vanguards Growth Index Fund 1993-2011

PacificMCB = US Mid Blend: =============================================== MSCI Data 1972-1990CRSP Decile 3-5 1972-1978 Vanguard Pacific Stock Index (VPACX) 1991-2011Russell Mid Cap Index 1979-1998Vanguards Mid Cap Index Fund 1999-2011

EuropeMCG = US Mid Growth: =============================================== MSCI Data 1972-1984Russell Mid Cap Growth Index 1986-1995 Vanguard Europe Stock Index (VEURX) 1991-2011

http://www.bogleheads.org

http://www.bogleheads.org/forum/viewtopic.php?t=2520

http://gnobility.com/Syn_Comm/CCF_1972-2007_san.xls

Data_Sources

Page 50

MSCI Mid Cap Growth Index 1996-2011 International ValueMCG = US Mid Value: =============================================== IFA Intl Value (ifa.com) 1972-1974Russell Mid Cap Value Index 1986-1995 MSCI EAFE Value 1975-1996MSCI Mid Cap Value Index 1996-2011 Vanguard Intl Value (VTRIX) 1997-2011 SCB = US Small Blend: Windsor===================== ==================================Ibbotson 1972-1978 Vanguard Windsor (VWNDX) - 1972-2011Russell 2000 Index 1979-1991Vanguards Small Cap Index Fund 1992-2011 Windsor II

==================================SCV = US Small Value: Vanguard Windsor II (VWNFX) 1985-2011=====================Ibbotson 1972-1978 EnergyRussell 2000 Value Index 1979-1998 ============================Vanguards Small Cap Value Index Fund 1999-2011 Vanguard Energy (VGENX) - 1985-2011

SCG = US Small Growth: Health Care====================== ============================Ibbotson 1972–1978 Vanguard Health (VGHCX) - 1985-2011Russell 2000 Growth Index 1979-1998Vanguards Small Cap Growth Index Fund (VISGX) 1999-2011 Precious Metals

============================MICRO = US MicroCap Blend: Vanguard Precious Metals (VGPMX) - 1985-2011==========================CRSP Decile 10 1972-1997 Short Term Treasuries BRSIX Bridgeway Ultra Small Market 1998-2011 ===============================

ST Treasury (2F) IFA website: 1972-1991

Extended market Index Vanguard Short Term Treasury (VFISX) 1992-2011=============================55% Mid-Cap(VIMSX)+45% Small Cap(NAESX) - 1985-1987 5YT - InterTerm Treasury Bonds:VG Extended Mkt - 1988-2011 ===============================

Tamasset Spreadsheet 1972-1991REIT = Real Estate: Vanguards InterTerm Treasury Fund (VFITX) 1992-2011===================Nat. Assn. of Real Estate Inv Trusts 1972-1996 Tbill - Risk Free Benchmark for Sharpe:Vanguards REIT Index Fund - 1997-2011 ===============================

T-Bills 1972-1983Vanguard Treasury Money Market Fund (VMPXX) 1984-2011VG Treasury (VMPXX) merged with Admiral Treasury (VUSXX) in Aug 2009

Data_Sources

Page 51

Credit to Trevh/Cb/Alec from Vanguard Diehards / Bogleheads forum for compiling this data from various sources.

CPI-U data was collected from http://www.bls.gov/cpi and the actual data was obtained from ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.txt

Credit to CraigR for the Gold returns - http://crawlingroad.com/blog/2008/12/22/permanent-portfolio-historical-returns/#more-299

ITB = Intermediate Term Bonds:================================ ==============================MSCI EAFE Index 1972-2000 (Developed Only) Ibbotson 1972Vanguard Developed Mkts Idx (VDMIX) 2001-2011 Lehman Brothers 1973-1986

Vanguards Total Bond Index Fund 1987-2011

================================ TIPSIFA website (added back expenses):1972-1987 ===============================(http://www.ifa.com/library/support/data/IFAindexdata.asp) Synthetic TIPS data provided by Cb (Data from Kothari's paper)Allocated 50% IFA Intl Value Index and 50% IFA Intl Small http://www.diehards.org/forum/viewtopic.php?t=281MSCI Emerging Mkts Index 1988-1994 Vanguard Inflation-Protected Security Fund (VIPSX) 2001-2011Vanguard Emerging Mkts Idx - 1995-2011

LTGB = Long Term Government Bonds:==================================Tamasset Spreadsheet 1972-1986Vanguards Long Term Treasury(VUSTX) 1987-2011

============================MSCI EAFE Index 1972-1987 (Developed Only) High Yield Corporate

==================================Vanguards Total International Index Fund 1997-2011 Vanguard High Yield Corporate (VWHEX) 1985-2011

CPI-U (Inflation)============================ ==================================

Consumer Price Index - Urban - 1972-2011Vanguard Pacific Stock Index (VPACX) 1991-2011 Compiled by Bureau of Labor and Statistics

Commodities============================

============================ COMM - Commodities/Natural ResourcesCollaterallized Chase Index 1972-1990

Vanguard Europe Stock Index (VEURX) 1991-2011 DJ-AIJ plus T-Bills 1991-1996

http://www.bogleheads.org/forum/viewtopic.php?t=2520

http://gnobility.com/Syn_Comm/CCF_1972-2007_san.xls

Data_Sources

Page 52

DJ-AIG plus Yahoo's IPS 'category' returns 1997-2001 (prior to VIPSX)DJ-AIJ plus VIPSX - 2001-2002

============================ Pimco PCRIX 2003-2011IFA Intl Value (ifa.com) 1972-1974MSCI EAFE Value 1975-1996 Global Bonds (Unhedged)Vanguard Intl Value (VTRIX) 1997-2011 ============================

JP Morgan Global Gov Bond - 1987-1996Pimco Global Bond PIGLX Instl - 1997-2011

==================================Vanguard Windsor (VWNDX) - 1972-2011 Short Term Investment Grade

==================================Vanguard ST Investment Grade (VFSTX) 1985-2011

==================================Vanguard Windsor II (VWNFX) 1985-2011 Gold

==================================

============================Vanguard Energy (VGENX) - 1985-2011 http://www.kitco.com/charts/historicalgold.html

Kitco returns - 1972 - 2004GLD ETF - 2004 - 2011

============================Vanguard Health (VGHCX) - 1985-2011 International Small

============================Intl Small IFA website (added back expenses):1972-1974

============================ Intl Small 1975-1996Vanguard Precious Metals (VGPMX) - 1985-2011 VG Intl Explorer - 1997 - 2009

FTSE All-World ex-US Small Cap Idx (VFSVX) 2010-2011

===============================ST Treasury (2F) IFA website: 1972-1991

Vanguard Short Term Treasury (VFISX) 1992-2011

5YT - InterTerm Treasury Bonds:===============================Tamasset Spreadsheet 1972-1991Vanguards InterTerm Treasury Fund (VFITX) 1992-2011

Tbill - Risk Free Benchmark for Sharpe:===============================

Vanguard Treasury Money Market Fund (VMPXX) 1984-2011VG Treasury (VMPXX) merged with Admiral Treasury (VUSXX) in Aug 2009

http://www.finfacts.ie/Private/curency/goldmarketprice.htm

http://www.onlygold.com/TutorialPages/prices200yrsfs.htm - 1972-2011

Data_Sources

Page 53

Synthetic TIPS data provided by Cb (Data from Kothari's paper)

Vanguard Inflation-Protected Security Fund (VIPSX) 2001-2011

Data_Sources

Page 54

DJ-AIG plus Yahoo's IPS 'category' returns 1997-2001 (prior to VIPSX)

FTSE All-World ex-US Small Cap Idx (VFSVX) 2010-2011

http://www.onlygold.com/TutorialPages/prices200yrsfs.htm - 1972-2011

Year US Mkt LCV LCG MCB SCV SCB SCG

VTSMX VIVAX VFINX VIGRX VIMSX VISVX NAESX VISGX

Allocation 66%

Amount 2640

1972 11.01

1973 -12.05

1974 -18.04

1975 25.37

1976 17.46

1977 -2.89

1978 4.82

1979 15.03

1980 21.42

1981 -2.56

1982 13.58

1983 14.37

1984 2.84

1985 21.09

1986 10.48

1987 0.99

1988 11.73

1989 18.91

1990 -4.08

1991 22.73

1992 6.33

1993 6.87

1994 -0.11

1995 23.62

1996 13.83

1997 20.45

1998 15.35

1999 15.71

2000 -6.98

2001 -7.24

2002 -13.83

2003 20.69

2004 8.26

2005 3.95

2006 10.24

2007 3.62

2008 -24.45

2009 18.94

2010 11.28

2011 0.63

2012

LCB-500 Idx

2013

2014

2015

Portfolio Total CAGR Std.Dev C-US C-Intl

Nominal ERROR #VALUE! 20.58 0.78 3.00 0.40 0.32Real 1028971.45 14.88 18.65 0.82 2.45 0.44 0.36

0 39 40 Portfolio Nominal (Rebalanced) = ERRORCorrelation of your portfolio with different assets

Portfolio US Mkt LCV LCG MCB SCV SCB SCG

Correlation VTSMX VIVAX VFINX VIGRX VIMSX VISVX NAESX VISGX

0.40 0.34 0.39 0.42 0.35 0.23 0.36 0.42

Returns without Rebalancing

Year US Mkt LCV LCG MCB SCV SCB SCG

VTSMX VIVAX VFINX VIGRX VIMSX VISVX NAESX VISGX

Allocation 66% 0% 0% 0% 0% 0% 0% 0%

Amount 2640

1972 3080.31

1973 2517.99

1974 1829.62

1975 2532.87

1976 3203.06

1977 3062.71

1978 3286.17

1979 4034.32

1980 5343.40

1981 5135.93

1982 6192.44

1983 7540.45

1984 7864.83

1985 10377.59

1986 12025.53

1987 12206.77

1988 14376.67

1989 18496.39

1990 17353.63

1991 23331.01

1992 25568.87

1993 28230.65

1994 28182.66

1995 38269.23

1996 46290.46

Sharpe Ratio

Sortino Ratio

LCB-500 Idx

LCB-500 Idx

1997 60635.87

1998 74739.78

1999 92535.32

2000 82754.34

2001 73676.18

2002 58233.66

2003 76489.91

2004 86066.44

2005 91213.22

2006 105360.39

2007 111144.67

2008 69976.69

2009 90059.99

2010 105451.25

2011 106463.58

2012

2013

2014

2015

%Allocation 45.31%

Portfolio CAGR Std.Dev C-US C-Intl

Nominal ERROR #VALUE! 17.66 0.28 0.66 0.25 0.18

Real ERROR #VALUE! 15.34 0.30 0.43 0.30 0.23

Portfolio Nominal (Unbalanced) = ERROR

CoffeeHouse Portfolio

Year LCB LCV SCV SCB EAFE / EM REIT ITB

0 VFINX VIVAX VISVX NAESX VGTSX VGSIX VBMFX Nominal Allocation 10% 10% 10% 10% 10% 10% 40%

1972 1.88 1.88 0.68 0.42 3.80 0.78 2.20 11.62

1973 -1.49 -0.38 -2.62 -3.11 -1.50 -1.57 1.28 -9.38

1974 -2.66 -2.33 -1.84 -2.01 -2.37 -2.16 2.71 -10.65

1975 3.70 5.69 5.41 5.24 3.63 1.90 3.23 28.81

1976 2.37 4.37 5.32 5.70 0.29 4.73 4.59 27.38

1977 -0.80 0.12 2.15 2.51 2.26 2.21 1.12 9.58

1978 0.59 0.31 2.15 2.32 3.54 1.01 0.80 10.71

1979 1.80 2.02 3.51 4.28 0.42 3.56 2.55 18.14

1980 3.19 2.41 2.51 3.83 2.29 2.41 2.55 19.20

1981 -0.52 0.11 1.46 0.18 -0.05 0.58 4.23 5.99

1982 2.09 1.97 2.82 2.46 -0.12 2.13 10.06 21.42

1983 2.13 2.80 3.83 2.88 2.54 3.03 3.19 20.41

1984 0.62 0.99 0.21 -0.75 0.79 2.06 5.63 9.55

Sharpe Ratio

Sortino Ratio

Portfolio Returns

1985 3.12 3.12 3.07 3.08 5.69 1.89 7.11 27.07

1986 1.81 1.97 0.72 0.55 6.83 1.90 5.15 18.92

1987 0.47 0.03 -0.73 -0.90 2.65 -0.38 0.38 1.51

1988 1.62 2.29 2.92 2.46 3.00 1.33 2.94 16.56

1989 3.14 2.49 1.21 1.59 1.86 0.86 5.46 16.61

1990 -0.33 -0.83 -2.20 -1.97 -2.15 -1.56 3.46 -5.58

1991 3.02 2.43 4.14 4.58 1.93 3.54 6.10 25.74

1992 0.74 1.36 2.88 1.79 -0.86 1.44 2.86 10.20

1993 0.99 1.81 2.35 1.87 3.88 1.94 3.87 16.72

1994 0.12 -0.07 -0.17 -0.05 0.55 0.30 -1.06 -0.40

1995 3.75 3.69 2.55 2.87 0.96 1.51 7.27 22.60

1996 2.29 2.19 2.11 1.81 0.75 3.50 1.43 14.08

1997 3.32 2.98 3.15 2.46 -0.11 1.85 3.78 17.43

1998 2.86 1.46 -0.67 -0.26 1.56 -1.63 3.43 6.75

1999 2.11 1.26 0.31 2.31 2.99 -0.40 -0.30 8.27

2000 -0.91 0.61 2.19 -0.27 -1.56 2.64 4.56 7.25

2001 -1.20 -1.19 1.37 0.31 -2.02 1.24 3.37 1.88

2002 -2.22 -2.09 -1.42 -2.00 -1.51 0.38 3.30 -5.56

2003 2.85 3.23 3.72 4.56 4.03 3.57 1.59 23.54

2004 1.07 1.53 2.36 1.99 2.08 3.08 1.70 13.80

2005 0.48 0.71 0.61 0.74 1.56 1.19 0.96 6.24

2006 1.56 2.22 1.92 1.56 2.66 3.51 1.71 15.15

2007 0.54 0.01 -0.71 0.12 1.55 -1.65 2.77 2.63

2008 -3.70 -3.60 -3.21 -3.61 -4.41 -3.71 2.02 -20.21

2009 2.65 1.96 3.03 3.61 3.67 2.96 2.37 20.26

2010 1.49 1.43 2.48 2.77 1.11 2.83 2.57 14.68

2011 0.20 0.10 -0.42 -0.28 -1.46 0.85 3.02 2.02

2012

2013

2014

2015

Portfolio Total CAGR Std.Dev C-US C-Intl

Nominal 529519.03 10.433 11.27 0.50 1.03 0.91 0.68

Real 38574.7607 5.829 11.32 0.48 0.68 0.89 0.670 39 40

Correlation of your portfolio with different assetsPortfolio LCB LCV SCV SCB REIT EAFE/ EM ITB TIPS

Correlation VFINX VIVAX VISVX NAESX VGSIX VGTSX VBMFX VIPSX

0.88 0.88 0.91 0.92 0.81 0.68 0.42 0.27

CHP Nominal (Rebalanced) = 529519.03CHP Real (Rebalanced) = 38574.76

Sharpe Ratio

Sortino Ratio

D10 REIT EAFE EM Total Intl Pacific Europe Int.Val COMM LTGB

BRSIX VGSIX VDMIX VEIEX VGTSX VPACX VEURX VTRIX PCRIX VUSTX

66%

2640

3.58

-0.90

2.73

5.89

10.89

-0.63

-0.96

-0.96

-2.80

1.08

26.42

0.29

10.03

20.24

15.96

-2.10

6.04

11.83

3.81

11.50

4.88

11.08

-4.64

19.87

-0.83

9.17

8.61

-5.72

13.02

2.84

11.00

1.77

4.70

4.36

1.15

6.10

14.86

-7.95

5.89

19.32

Portfolio Nominal (Rebalanced) = ERROR Portfolio Real (Rebalanced) = 1028971.45

D10 REIT EAFE EM Pacific Europe Int.Val COMM LTGB

BRSIX VGSIX VDMIX VEIEX VGTSX VPACX VEURX VTRIX PCRIX VUSTX

0.25 0.26 0.32 0.23 0.32 0.26 0.38 0.25 0.40 0.20

D10 REIT EAFE EM Pacific Europe Int.Val COMM LTGB

BRSIX VGSIX VDMIX VEIEX VGTSX VPACX VEURX VTRIX PCRIX VUSTX

0% 0% 0% 0% 0% 0% 0% 0% 0% 66%

2640

2783.24

2745.49

2858.86

3113.78

3627.46

3592.73

3540.41

3488.85

3340.61

3395.26

4754.58

4775.45

5501.34

7188.06

8925.93

8641.93

9432.67

11123.94

11766.91

13817.88

14840.40

17332.11

16113.66

20965.48

20703.42

EAFE85 / EM15

EAFE85 / EM15

23581.19

26658.54

24349.91

29151.71

30408.15

35477.18

36427.97

39021.64

41600.97

42324.83

46235.65

56647.91

49821.84

54270.93

70161.46

23.32%

Portfolio Nominal (Unbalanced) = ERROR Portfolio Real (Unbalanced) = ERROR

Total Total

Nominal Real Real

10000 400011161.63 7.94 4317.58

10115.00 -16.63 3599.36

9037.53 -20.46 2862.76

11641.48 20.46 3448.39

14828.68 21.47 4188.72

16249.15 2.70 4301.71

17989.88 1.55 4368.59

21253.93 4.28 4555.60

25334.52 5.94 4826.18

26852.87 -2.69 4696.40

32604.54 16.94 5491.99

39259.53 16.01 6371.44

43009.22 5.39 6714.83

Portfolio Returns

54653.21 22.42 8220.48

64993.28 17.63 9669.59

65973.22 -2.80 9398.61

76900.37 11.63 10491.64

89672.61 11.43 11690.86

84669.46 -11.01 10403.33

106461.28 22.00 12691.98

117325.28 7.10 13592.87

136936.92 13.59 15440.62

136394.54 -2.99 14978.80

167225.58 19.57 17910.02

190773.94 10.41 19775.05

224019.97 15.46 22832.54

239149.26 5.06 23987.88

258932.36 5.44 25293.21

277712.73 3.74 26239.06

282939.28 0.33 26324.40

267216.35 -7.75 24284.34

330129.76 21.26 29448.36

375700.88 10.22 32456.77

399125.83 2.73 33341.61

459577.42 12.29 37440.30

471668.90 -1.39 36918.61

376363.49 -20.28 29431.93

452599.67 17.07 34456.45

519054.88 12.99 38931.71

529519.03 -0.92 38574.76

5 Yr T ITB TBILL STIPS Bal Bal Windsor GOLD VG Intl Smal

VFITX VBMFX VUSXX VIPSX VWELX VWINX VWNDX VFISX GLD VFSVX

66%

2640

32.12

47.02

47.53

-18.23

-2.96

14.62

24.07

82.93

9.72

-21.69

9.56

-10.98

-12.88

3.47

13.74

14.34

-10.29

-2.13

-1.23

-6.88

-4.04

11.36

-1.69

0.38

-3.28

-14.34

-0.81

0.30

-3.84

0.29

16.47

12.62

2.96

11.72

14.49

20.18

3.27

15.83

19.32

6.32

ST Treasury

Portfolio Real (Rebalanced) = 1028971.45

5 Yr T ITB TBILL TIPS Bal Bal Windsor GOLD VG Intl Smal 0

VFITX VBMFX VMPXX VIPSX VWELX VWINX VWNDX VFISX PIGLX VFSVX 0

0.18 0.25 0.01 -0.07 0.35 0.26 0.21 0.11 0.73 0.20

5 Yr T ITB TBILL STIPS Bal Bal Windsor GOLD VG Intl Smal

VFITX VBMFX VUSXX VIPSX VWELX VWINX VWNDX VFISX GLD VFSVX

0% 0% 0% 0% 0% 0% 0% 0% 66% 0% 0%

2640

3924.60

6720.41

11560.38

8367.27

7992.26

9762.61

13322.58

30061.87

34488.98

23153.45

26507.34

22096.79

17784.27

18719.47

22617.67

27530.33

23237.60

22487.76

22069.45

19767.98

18557.59

21751.19

21194.47

21316.58

20257.85

ST Treasury

ST Treasury

15857.57

15663.77

15734.18

14818.40

14883.05

18597.32

22153.72

23146.81

27257.68

33240.74

43402.44

45555.20

56483.89

73016.73

80004.43

31.37%

Portfolio Real (Unbalanced) = ERROR

Total

ERROR

4000

46.70 5868.15

34.07 7867.63

32.21 10402.16

13.02 11756.89

25.39 14742.37

11.10 16378.13

27.92 20951.15

96.99 41271.96

28.33 52964.79

-23.18 40690.09

49.56 60856.46

3.68 63093.07

-0.01 63087.16

44.79 91345.78

40.18 128050.02

13.23 144991.40

7.48 155836.90

28.62 200432.38

-1.49 197444.77

27.35 251454.85

7.17 269492.76

29.31 348481.57

-6.44 326034.90

43.87 469080.34

9.73 514724.58

15.29 593432.62

23.16 730859.72

10.30 806106.57

2.20 823821.57

-4.11 789981.90

13.64 897733.85

35.08 1212668.64

15.92 1405737.64

20.03 1687320.95

25.87 2123864.63

29.90 2758857.68

-6.31 2584784.79

26.82 3278086.11

36.49 4474305.62

26.27 5649911.53

Portfolio Returns

0 0 0 0 0 0 0 0

0 0 0 0 0 0 0 0

Total

0% 0% 0% 0% 0% 0% 0% 0% ERROR7920

23.59 9788.15

22.43 11983.89

35.59 16248.85

-13.75 14013.92

5.77 14822.78

10.76 16418.05

22.73 20149.16

86.53 37585.05

14.87 43172.99

-26.61 31684.64

18.21 37454.36

-8.12 34412.68

-9.48 31150.43

16.48 36285.11

20.07 43569.13

11.04 48379.03

-2.75 47046.94

10.76 52108.09

-1.76 51189.99

11.19 56916.87

3.60 58966.87

14.16 67313.95

-2.71 65490.79

23.00 80551.30

8.32 87251.73

Portfolio Returns

14.70 100074.63

16.97 117062.08

13.29 132619.40

-4.45 126724.44

-6.12 118967.38

-5.60 112308.16

20.27 135071.60

9.75 148234.90

7.99 160071.87

13.03 180925.96

10.98 200782.76

-14.25 172179.80

14.05 196365.73

18.52 232738.90

10.26 256629.46

Growth of 4000 TBILL Inflation0.4 1.0% VMPXX CPI-U

Max. Drawdown Rebalanced = 23.2% 0.244000 Avg. Drawdown Rebalanced = 1.0% 1984

5.41% 4.39%0.97%

41.87 5674.85 0.40 0.40 0.0% 3.55 3.41 0.1423.34 6999.12 0.54 0.54 0.0% 6.64 8.71 -1.9017.69 8237.55 0.71 0.71 0.0% 7.74 12.34 -4.095.69 8706.45 0.80 0.80 0.0% 5.55 6.94 -1.30

19.58 10410.85 1.00 1.00 0.0% 4.85 4.86 -0.024.12 10839.63 1.12 1.12 0.0% 4.85 6.70 -1.74

17.34 12719.24 1.43 1.43 0.0% 6.94 9.02 -1.9073.88 22115.74 2.81 2.81 0.0% 10.14 13.29 -2.7914.06 25224.25 3.61 3.61 0.0% 11.03 12.52 -1.32

-29.47 17791.09 2.77 3.61 23.2% 14.43 8.92 5.0544.04 25627.05 4.15 4.15 0.0% 10.24 3.83 6.17-0.11 25598.47 4.30 4.30 0.0% 8.54 3.79 4.58-3.81 24623.76 4.30 4.30 0.0% 9.54 3.95 5.3839.49 34348.69 6.23 6.23 0.0% 7.37 3.80 3.4438.66 47627.66 8.73 8.73 0.0% 6 1.10 4.858.42 51639.05 9.88 9.88 0.0% 6.12 4.43 1.612.93 53152.67 10.62 10.62 0.0% 7.18 4.42 2.64

22.90 65327.29 13.66 13.66 0.0% 8.87 4.65 4.04-7.16 60650.07 13.46 13.66 1.5% 7.94 6.11 1.7323.57 74944.12 17.14 17.14 0.0% 5.73 3.06 2.594.15 78056.04 18.37 18.37 0.0% 3.53 2.90 0.61

25.85 98234.52 23.75 23.75 0.0% 2.86 2.75 0.11-8.88 89512.59 22.22 23.75 6.4% 3.81 2.67 1.1140.31 125597.41 31.97 31.97 0.0% 5.49 2.54 2.886.20 133387.01 35.09 35.09 0.0% 5.09 3.32 1.71

13.36 151209.43 40.45 40.45 0.0% 5.12 1.70 3.3621.20 183272.33 49.82 49.82 0.0% 5 1.61 3.337.41 196856.68 54.95 54.95 0.0% 4.55 2.68 1.82

-1.15 194592.34 56.16 56.16 0.0% 5.8 3.39 2.33-5.57 183747.91 53.85 56.16 4.1% 3.99 1.55 2.4011.00 203962.75 61.19 61.19 0.0% 1.51 2.38 -0.8532.59 270432.34 82.66 82.66 0.0% 0.82 1.88 -1.0412.27 303603.87 95.82 95.82 0.0% 1 3.26 -2.1816.07 352382.58 115.02 115.02 0.0% 2.77 3.42 -0.6222.75 432561.13 144.77 144.77 0.0% 4.55 2.54 1.9624.80 539855.31 188.06 188.06 0.0% 4.65 4.08 0.55-6.40 505330.66 176.19 188.06 6.3% 1.97 0.09 1.8823.46 623902.33 223.45 223.45 0.0% 0.53 2.72 -2.1334.47 838988.21 304.99 304.99 0.0% 0.01 1.50 -1.4722.64 1028971.45 385.12 385.12 0.0% 0.02 2.96 -2.86

Portfolio Returns Real

Total in 1972 dollars

Previous Max Growth

TBill72Real

Growth of 4000

0.4 4.6% Max. Drawdown Unbalanced = 27.8%

10000 Avg. Drawdown Unbalanced = 4.6%19.52 4780.67 0.40 0.40 0.0%12.63 5384.34 0.49 0.49 0.0%20.70 6498.78 0.66 0.66 0.0%

-19.35 5241.35 0.57 0.66 13.8%0.86 5286.68 0.61 0.66 8.8%3.81 5487.90 0.67 0.67 0.0%