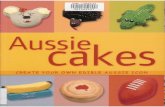

Aussie Pies (A)

description

Transcript of Aussie Pies (A)

AUSSIE PIES (A)

Cost Classifications

Cost Classifications

External reporting Predicting cost behavior Assigning costs to cost objects Decision making

Cost Classifications

External reporting Product vs. period costs

Predicting cost behavior Variable vs. fixed costs

Assigning costs to cost objects Direct vs. indirect costs

Decision making Relevant vs. irrelevant costs

LET’S DEFINE ALL OF THE COSTS MENTIONED IN THE CASE.

WHO CAN GIVE ME ONE COST MENTIONED IN THE CASE?

Aussie Pies’ Costs

Ingredients Utilities for cooking Utilities for lighting the store Pie boxes Rent on store Rent on cooking equipment Rent on fixtures Chefs salaries Sales assistant salary

Let’s start by looking at these costs from an external reporting perspective.

Cracker Barrel

The Cheesecake Factory

The Cheesecake Factory

Cost Classification Summary

Product

Period

Variable

Fixed

Direct

Indirect

Relevant

Irrelevant

IngredientsUtilities for cookingUtilities for lighting in storePie boxesRent on storeRent on cooking equipmentRent on fixturesChefs salariesSales assistant salary

Product vs. Period Costs(external reporting)

Product PeriodIngredientsUtilities for cookingUtilities for lighting in storePie boxesRent on storeRent on cooking equipmentRent on fixturesChefs salariesSales assistant salary

Product vs. Period Costs(external Reporting)

Product PeriodIngredients √Utilities for cooking √Utilities for lighting in store √Pie boxes √Rent on store √Rent on cooking equipment √Rent on fixtures √Chefs salaries √Sales assistant salary √

What are the profit implications of treating a cost such as utilities for

cooking as a period cost rather than a product cost?

Product Costs(excluding raw materials inventory)

Product Costs(excluding raw

materials)

Cost of goods soldEnding work in

process inventory or ending finished goods inventory

Period Costs

Selling & Admin. expense

Income StatementBalance Sheet

Does a restaurant have work in process or finished goods

inventory?

A Matching Perspective

Why not include the rental cost of cooking equipment in COGS?

A Matching Perspective

Why not include the rental cost of cooking equipment in COGS? A manufacturer treats manufacturing

equipment depreciation as a product cost because some units may be produced in the current period but not sold until a later period.

A Matching Perspective

Why not include the rental cost of cooking equipment in COGS? A manufacturer treats manufacturing

equipment depreciation as a product cost because some units may be produced in the current period but not sold until a later period.

A software developer incurs costs to develop products that will be sold in a later period. So in these two instances there is a need to

match costs with revenues.

A Matching Perspective

Why not include the rental cost of cooking equipment in COGS? A manufacturer includes equipment depreciation in

product cost because some units may be produced in the current period but not sold until a later period.

A software developer incurs costs to develop products that will be sold in a later period. So in these two instances there is a need to match

costs with revenues. There is no such matching concern with a

restaurant. Furthermore, cost of goods sold is more useful if not confounded with various non-food costs.

From an external reporting perspective, what would be Aussie Pie’s unit product cost?

Unit Product Cost

Amount

IngredientsPie boxesUnit product cost

Unit Product Cost

Amount

Ingredients $1.20Pie boxes $0.02Unit product cost $1.22

Let’s look at Aussie Pies’ costs from a cost behavior standpoint.

Variable vs. Fixed Costs

(with respect to the number of pies produced)

Variable Fixed

IngredientsUtilities for cookingUtilities for lighting in storePie boxesRent on storeRent on cooking equipmentRent on fixturesChefs salariesSales assistant salary

Variable vs. Fixed Costs

(with respect to the number of pies produced)

Variable Fixed

Ingredients √Utilities for cooking √Utilities for lighting in store √Pie boxes √Rent on store √Rent on cooking equipment √Rent on fixtures √Chefs salaries √Sales assistant salary √

WHAT ARE AUSSIE PIE’S FIXED COST PER MONTH?

Fixed Costs

AmountUtilities for lighting in storeRent on storeRent on cooking equipmentRent on fixturesChefs salariesSales assistant salaryTotal fixed costs

Fixed Costs

AmountUtilities for lighting in store $300Rent on store 11,900Rent on cooking equipment 8,000Rent on fixtures 5,000Chefs salaries 3,600Sales assistant salary 1,200Total fixed costs $30,000

WHAT ARE AUSSIE PIE’S VARIABLE COSTS PER PIE?

Variable Costs

AmountIngredients $1.20Utilities 0.03Packaging 0.02Total variable cost per pie $1.25

Cost Behavior

Total VC VC/Unit Total FC FC/Unit Cost/Unit

5,000 units10,000 units15,000 units20,000 units25,000 units30,000 units

Cost Behavior

Total VC VC/Unit Total FC FC/Unit Cost/Unit

5,000 units

$1.25

10,000 units

$1.25

15,000 units

$1.25

20,000 units

$1.25

25,000 units

$1.25

30,000 units

$1.25

Cost Behavior

Total VC VC/Unit Total FC FC/Unit Cost/Unit

5,000 units

$1.25 $30,000

10,000 units

$1.25 $30,000

15,000 units

$1.25 $30,000

20,000 units

$1.25 $30,000

25,000 units

$1.25 $30,000

30,000 units

$1.25 $30,000

Cost Behavior

Total VC VC/Unit Total FC FC/Unit Cost/Unit

5,000 units

$6,250 $1.25 $30,000

10,000 units

$12,500 $1.25 $30,000

15,000 units

$18,750 $1.25 $30,000

20,000 units

$25,000 $1.25 $30,000

25,000 units

$31,250 $1.25 $30,000

30,000 units

$37,500 $1.25 $30,000

Cost Behavior

Total VC VC/Unit Total FC FC/Unit Cost/Unit

5,000 units

$6,250 $1.25 $30,000 $6.00

10,000 units

$12,500 $1.25 $30,000 $3.00

15,000 units

$18,750 $1.25 $30,000 $2.00

20,000 units

$25,000 $1.25 $30,000 $1.50

25,000 units

$31,250 $1.25 $30,000 $1.20

30,000 units

$37,500 $1.25 $30,000 $1.00

Cost Behavior

Total VC VC/Unit Total FC FC/Unit Cost/Unit

5,000 units

$6,250 $1.25 $30,000 $6.00 $7.25

10,000 units

$12,500 $1.25 $30,000 $3.00 $4.25

15,000 units

$18,750 $1.25 $30,000 $2.00 $3.25

20,000 units

$25,000 $1.25 $30,000 $1.50 $2.75

25,000 units

$31,250 $1.25 $30,000 $1.20 $2.45

30,000 units

$37,500 $1.25 $30,000 $1.00 $2.25

Let’s look at the topic of assigning costs to cost objects.

Direct vs. Indirect Costs

If Aussie Pies eventually opened a second store and hired two additional chefs for that store, then what would be the direct and indirect costs with respect to a specific store?

Direct vs. Indirect CostsDirect Indirect

Ingredients Utilities for cookingUtilities for lighting in storePie boxesRent on storeRent on cooking equipmentRent on fixturesChefs salariesSales assistant salary

Direct vs. Indirect CostsDirect Indirect

Ingredients √Utilities for cooking √Utilities for lighting in store √Pie boxes √Rent on store √Rent on cooking equipment √Rent on fixtures √Chefs salaries √Sales assistant salary √

Let’s look at the topic of cost classifications for decision making.

Relevant vs. Irrelevant Costs Assume the Aussie Pies’ owners

claimed that the cost per Aussie Pie (at a volume of 30,000 units sold) is $2.25 per pie.

Relevant vs. Irrelevant Costs Assume the Aussie Pies’ owners

claimed that the cost per Aussie Pie (at a volume of 30,000 units sold) is $2.25 per pie.

Assume that Aussie Pies turned down a corporate client that wanted to buy 1,000 pies at $2.00 each because the price was below $2.25 per pie.

Comment on the wisdom of this decision.

Relevant vs. Irrelevant Costs Assume the Aussie Pies’ owners claimed

that the cost per Aussie Pie (at a volume of 30,000 units sold) is $2.25 per pie.

Assume that Aussie Pies turned down a corporate client that wanted to buy 1,000 pies at $2.00 each because the price was below $2.25 per pie.

Comment on the wisdom of this decision. Does the concept of “opportunity cost” affect

your answer?

Relevant vs. Irrelevant Costs If Aussie Pies is considering staying

open 2 additional hours everyday, what costs on the next slide would be potentially relevant to this decision?

Relevant vs. Irrelevant Costs

Relevant IrrelevantIngredients Utilities for cookingUtilities for lighting in storePie boxesRent on storeRent on cooking equipmentRent on fixturesChefs salariesSales assistant salary

Relevant vs. Irrelevant Costs

Relevant IrrelevantIngredients √Utilities for cooking √Utilities for lighting in store √Pie boxes √Rent on store √Rent on cooking equipment √Rent on fixtures √Chefs salaries √Sales assistant salary √

Assumes that Chefs would demand an increase in salary to work two extra hours everyday.

Cost Classification Summary

Product

Period

Variable

Fixed

Direct

Indirect

Relevant

Irrelevant

Ingredients √ √ √ √Utilities for cooking √ √ √ √Utilities for lighting in store √ √ √ √Pie boxes √ √ √ √Rent on store √ √ √ √Rent on cooking equipment √ √ √ √Rent on fixtures √ √ √ √Chefs salaries √ √ √ √Sales assistant salary √ √ √ √

Let’s take a closer look at the value of understanding cost behavior.

HOW MANY AUSSIE PIES HAVE TO BE SOLD TO BREAKEVEN?

Equation Method

(P)(Q) ̶ (V)(Q) ̶ F = Profit

Equation Method

($3.25)(Q ) ̶ ($1.25)(Q) ̶ $30,000 = 0

2Q = $30,000

Q = 15,000 pies

What is the breakeven point in sales dollars?

Equation Method

($3.25)(Q ) ̶ ($1.25)(Q) ̶ $30,000 = 0

2Q = $30,000

Q = 15,000 pies

15,000 pies × $3.25 = $48,750

HOW MANY AUSSIE PIES HAVE TO BE SOLD TO EARN A 20% RETURN ON SALES?

Equation Method

($3.25)(Q) ̶ ($1.25)(Q) ̶ $30,000 = ($0.65)Q

1.35Q = $30,000

Q = 22,223 pies

WHAT PROFIT WOULD AUSSIE PIES EARN IF IT RAISED INGREDIENTS COST BY $0.50, INVESTED $5,000 IN A MONTHLY ADVERTISING CAMPAIGN AND WAS ABLE TO SELL 25,000 UNITS AT $3.25 PER UNIT?

Equation Method

($3.25)(25,000) ̶ ($1.75)(25,000) ̶ $35,000 = Profit

Profit = $2,500

AUSSIE BELIEVES IT CAN SELL 20,000 PIES AT A PRICE OF $3.25. HOWEVER, BASED ON MARKET RESEARCH IT BELIEVES FOR EACH $0.25 SHIFT IN PRICE, DEMAND WILL SHIFT BY 1,500 PIES. WHAT IS THE OPTIMAL PRICE?

Optimal Price

Volume PriceVC perUnit

CM per Unit

TotalCM

FixedCosts Profit

20,000 units $3.25

Optimal Price

Volume PriceVC perUnit

CM per Unit

TotalCM

FixedCosts Profit

26,000 units $2.2524,500 units $2.5023,000 units $2.7521,500 units $3.0020,000 units $3.2518,500 units $3.5017,000 units $3.7515,500 units $4.0014,000 units $4.25

Optimal Price

Volume PriceVC perUnit

CM per Unit

TotalCM

FixedCosts Profit

26,000 units $2.25 $1.2524,500 units $2.50 $1.2523,000 units $2.75 $1.2521,500 units $3.00 $1.2520,000 units $3.25 $1.2518,500 units $3.50 $1.2517,000 units $3.75 $1.2515,500 units $4.00 $1.2514,000 units $4.25 $1.25

Optimal Price

Volume PriceVC perUnit

CM per Unit

TotalCM

FixedCosts Profit

26,000 units $2.25 $1.25 $1.0024,500 units $2.50 $1.25 $1.2523,000 units $2.75 $1.25 $1.5021,500 units $3.00 $1.25 $1.7520,000 units $3.25 $1.25 $2.0018,500 units $3.50 $1.25 $2.2517,000 units $3.75 $1.25 $2.5015,500 units $4.00 $1.25 $2.7514,000 units $4.25 $1.25 $3.00

Optimal Price

Volume PriceVC perUnit

CM per Unit

TotalCM

FixedCosts Profit

26,000 units $2.25 $1.25 $1.00 $26,000

24,500 units $2.50 $1.25 $1.25 $30,625

23,000 units $2.75 $1.25 $1.50 $34,500

21,500 units $3.00 $1.25 $1.75 $37,625

20,000 units $3.25 $1.25 $2.00 $40,000

18,500 units $3.50 $1.25 $2.25 $41,625

17,000 units $3.75 $1.25 $2.50 $42,500

15,500 units $4.00 $1.25 $2.75 $42,625

14,000 units $4.25 $1.25 $3.00 $42,000

Optimal Price

Volume PriceVC perUnit

CM per Unit

TotalCM

FixedCosts Profit

26,000 units $2.25 $1.25 $1.00 $26,000

$30,000

24,500 units $2.50 $1.25 $1.25 $30,625

$30,000

23,000 units $2.75 $1.25 $1.50 $34,500

$30,000

21,500 units $3.00 $1.25 $1.75 $37,625

$30,000

20,000 units $3.25 $1.25 $2.00 $40,000

$30,000

18,500 units $3.50 $1.25 $2.25 $41,625

$30,000

17,000 units $3.75 $1.25 $2.50 $42,500

$30,000

15,500 units $4.00 $1.25 $2.75 $42,625

$30,000

14,000 units $4.25 $1.25 $3.00 $42,000

$30,000

Optimal Price

Volume PriceVC perUnit

CM per Unit

TotalCM

FixedCosts Profit

26,000 units $2.25 $1.25 $1.00 $26,000

$30,000

$(4,000)

24,500 units $2.50 $1.25 $1.25 $30,625

$30,000

$625

23,000 units $2.75 $1.25 $1.50 $34,500

$30,000

$4,500

21,500 units $3.00 $1.25 $1.75 $37,625

$30,000

$7,625

20,000 units $3.25 $1.25 $2.00 $40,000

$30,000

$10,000

18,500 units $3.50 $1.25 $2.25 $41,625

$30,000

$11,625

17,000 units $3.75 $1.25 $2.50 $42,500

$30,000

$12,500

15,500 units $4.00

$1.25

$2.75 $42,625

$30,000

$12,625

14,000 units $4.25 $1.25 $3.00 $42,000

$30,000

$12,000

Assume that Aussie Pies decides to pay its sales assistant a

commission of $0.06 per pie sold instead of a salary and each chef is paid a salary of $1,000 plus a

commission of $0.04 per pie sold. If Aussie Pies sells 22,000 units, how would it prepare an income statement for external reporting

purposes?

Traditional Income Statement

AmountSales Cost of goods soldGross marginOperating expenses:Chefs compensationUtilities expenseRent expenseSelling expenseTotal operating expensesNet operating income

Traditional Income Statement

AmountSales (22,000 × $3.25) $71,500Cost of goods sold (22,000 × $1.22) 26,840Gross margin 44,660Operating expenses:Chefs compensation (($2,000 + (22,000 × $0.04 × 2))

$3,760

Utilities expense ($300 + (22,000 × $0.03))

$960

Rent expense ($11,900 + $8,000 + $5,000)

$24,900

Selling expense (22,000 × 0.06) $1,320Total operating expenses $30,940Net operating income $13,720

Given the same assumptions, how would Aussie Pies prepare a contribution format income

statement?

Contribution Margin Income Statement

AmountSales Cost of goods soldChefs commissionCooking utilitiesSelling commissionTotal variable costContribution marginChefs salariesUtilities expenseRent expenseTotal fixed costNet operating income

Contribution Margin Income Statement

AmountSales (22,000 × $3.25) $71,500Cost of goods sold (22,000 × $1.22) 26,840Chefs commission (22,000 × $0.04 × 2) 1,760Cooking utilities (22,000 × $0.03) 660Selling commission (22,000 × $0.06) 1,320Total variable cost 30,580Contribution margin 40,920Chefs salaries 2,000Utilities expense 300Rent expense 24,900Total fixed cost 27,200Net operating income $13,720