Audit Voted on in Jan - Draft

-

Upload

donna-j-forgas -

Category

Documents

-

view

218 -

download

0

Transcript of Audit Voted on in Jan - Draft

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 1/157

“DRAFT”COMPREHENSIVE

ANNUAL

FINANCIAL REPORT

For the Year Ended August 31, 2011

Beaumont Independent School DistrictBeaumont, Texas

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 2/157

Beaumont Independent

School DistrictBeaumont, Texas

Comprehensive Annual

Financial Report

For the Year Ended August 31, 2011

Prepared by theBusiness Office

Robert Zingelmann Devin McCraney Chief Business Officer Director of Finance

Sharika Allison Laura KlockComptroller Property and Employee

Benefits ManagerBelinda KlockBudget Supervisor

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 3/157

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 4/157

BEAUMONT INDEPENDENT SCHOOL DISTRICTCOMPREHENSIVE ANNUAL FINANCIAL REPORTTABLE OF CONTENTS

EXHIBIT PAGE

INTRODUCTORY SECTION

Transmittal Letter 3

GFOA Certificate of Achievement for Excellence in Financial Reporting 9

Board of Trustees 10

Certificate of Board 11

District Organization Chart 12

FINANCIAL SECTION

Independent Auditor's Report 13

Management's Discussion and Analysis 15

Basic Financial StatementsGovernment-wide Financial Statements:

Statement of Net Assets A-1 26Statement of Activities A-2 27

Fund Financial Statements:Balance Sheet - Governmental Funds B-1 28Reconciliation of the Governmental Funds Balance Sheet to the

Statement of Net Assets B-1R 29Statement of Revenues, Expenditures and Changes in Fund Balances -

Governmental Funds B-2 30Reconciliation of the Governmental Funds Statement of Revenues,

Expenditures and Changes in Fund Balance to theStatement of Activities B-2R 31

Statement of Net Assets - Proprietary Funds C-1 32Statement of Revenues, Expenses and Changes in Fund Net Assets -

Proprietary Funds C-2 33Statement of Cash Flows - Proprietary Funds C-3 34Statement of Fiduciary Net Assets - Fiduciary Funds D-1 36Statement of Changes in Fiduciary Net Assets - Fiduciary Funds D-2 37

Notes to the Financial Statements 38

Required Supplementary InformationBudgetary Comparison Schedules:Schedule of Revenues, Expenditures and Changes in Fund Balances-

Budget and Actual - General Fund E-1 59

Notes to Required Supplementary Information 60

Combining and Individual Fund Information and Other Supplementary Information:Combining Balance Sheet - Non-major Governmental Funds F-1 68Combining Statement of Revenues, Expenses and

Changes in Net Assets - Non-major Governmental Funds F-2 82Combining Balance Sheet - Internal Service Funds F-3 96Combining Statement of Revenues, Expenses and

Changes in Net Assets - Internal Service Funds F-4 97Combining Balance Sheet - Fiduciary Funds F-5 98Combining Statement of Revenues, Expenses and

Changes in Fund Balances - Agency Funds F-6 99Combining Statement of Net Assets - Private Purpose Trust Funds F-7 100Combining Statement of Revenues, Expenses and

Changes in Net Assets - Private Purpose Trust Funds F-8 101iii

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 5/157

BEAUMONT INDEPENDENT SCHOOL DISTRICTCOMPREHENSIVE ANNUAL FINANCIAL REPORTTABLE OF CONTENTS

EXHIBIT PAGE

Budgetary Comparison Schedules:Schedule of Revenues, Expenditures and Changes in Fund Balances-

Budget and Actual - National School Breakfast and Lunch Program F-9 102Budget and Actual - Debt Service Fund F-10 103

Capital Assets Used in the Operation of Governmental Funds:Schedule of Function and Activity G-1 104Schedule of Changes by Function and Activity G-2 105Schedule by Location G-3 106

STATISTICAL SECTION - UNAUDITED TABLE PAGE

Statistical Section Contents 109

Governmental Activities Net Assets 1 111

Changes in Net Assets 2 112

Fund Balances of Governmental Funds 3 115

Changes in Fund Balances of Governmental Funds 4 116

Assessed Value - Real and Personal Property 5 118

Property Tax Rates - Direct and Overlapping Governments 6 119

Principal Property Taxpayers 7 120

Property Tax Levies and Collections 8 121

Ratios of Outstanding Debt by Type 9 122

Ratios of Net General Obligation Bonded Debt Outstanding 10 123

Computation of Direct and Overlapping Debt 11 124

Legal Debt Margin Information 12 125

Demographic and Economic Statistics 13 126

Total Enrollment and Average Daily Attendance 14 127

Principal Employers 15 128

Full Time Equivalent Employees by Position 16 129

Operating Statistics 17 130

Teacher Salary Data 18 131

School Building Information 19 132

Fund Balance and Cash Flow Calculation Worksheet 20 138

District Map 21 139

COMPLIANCE SECTION

Schedule of Delinquent Taxes Receivable H-1 142Schedule of Expenditures of Federal Awards H-2 144Notes on Accounting Policies for Federal Awards 147Long Term Debt Schedule H-3 148Schedule of Expenditures for Computation of Indirect Cost for 2010-2011 H-4 150

iv

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 6/157

INTRODUCTORY SECTION

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 7/157

3

January 19, 2012

Board of TrusteesBeaumont Independent School District3395 Harrison StreetBeaumont, Texas 77706-5009

Dear Board Members:

The Texas Education Code requires that all school districts file a complete set of financial statements withthe Texas Education Agency (TEA) within 150 days of the close of each fiscal year. The financialstatements must be presented in conformity with generally accepted accounting principles (GAAP) andaudited by a firm of licensed certified public accountants in accordance with generally accepted auditingstandards. Pursuant to that requirement, we hereby issue the Comprehensive Annual Financial Report ofthe Beaumont Independent School District (the District) for the year ended August 31, 2011.

This report consists of management’s representations concerning the finances of the District.Consequently, management assumes full responsibility for the completeness and reliability of all of theinformation presented in this report. In order to provide a reasonable basis for making theserepresentations, management of the District has established a comprehensive internal control frameworkthat is designed to protect the District’s assets from loss, theft or misuse. Additionally, the internal controlframework is designed to compile sufficient reliable information for the preparation of the District’s financialstatements in conformity with GAAP. Because the cost of internal controls should not outweigh theirbenefits, the District’s comprehensive framework of internal controls has been designed to providereasonable assurance rather than absolute assurance that the financial statements will be free frommaterial misstatement. To the best of our knowledge and belief, this financial report is complete andreliable in all material respects.

The financial statements of the District have been audited by Gayle W. Botley & Associates, a firm oflicensed certified public accountants. The goal of the independent audit is to provide reasonableassurance that the financial statements of the District for the year ended August 31, 2009, are free ofmaterial misstatement. The independent audit involves examining, on a test basis, evidence supportingthe amounts and disclosures in the financial statements; assessing the accounting principles used andsignificant estimates made by management; and evaluating the overall financial statement presentation.The independent auditors concluded, based upon the audit, that there was a reasonable basis forrendering an unqualified opinion that the District’s financial statements for the year ended August 31,2009, are fairly presented in conformity with GAAP. The independent auditors’ report is presented as the

first component of the financial section of this report.The independent audit of the financial statement is part of a broader, federally mandated “Single Audit”designed to meet the special need of federal grantor agencies. The standards governing Single Auditengagements require the independent auditor to report not only on the fair presentation of the financialstatements, but also on the audited government’s internal controls and compliance with legalrequirements, with special emphasis on internal controls and legal requirements involving theadministration of federal awards. These reports are available in the District’s separately issued SingleAudit Report.

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 8/157

Board of TrusteesBeaumont Independent School DistrictJanuary 19, 2012

4

GAAP require that management provide a narrative introduction, overview, and analysis toaccompany the basic financial statements in the form of Management’s Discussion and Analysis(MD&A). This letter of transmittal is designed to complement MD&A and should be read in

conjunction with it. The District’s MD&A can be found immediately following the report of theindependent auditors.

Profile of the District

The original Beaumont Independent School District was established in 1913 and reached itscurrent configuration through a consolidation of the former Beaumont Independent School Districtand South Park Independent School District on September 1, 1984. Located within the City ofBeaumont and totally in Jefferson County, Texas, it encompasses 153.34 square miles and has apopulation of approximately 113,866 . Residents of the district elect a seven-member Board ofTrustees (the Board), each of whom serves for three years. Monthly meetings of the Board areposted and advertised as prescribed under state law so that the Board may fulfill its charge to thestudents, parents, staff, and taxpayers of the District. Special meetings or work sessions arescheduled as needed. The board has final control over all school matters except as limited by

state law.The Beaumont Independent School District Public Facility Corporation (Corporation) wasorganized as a non-profit corporation under the Public Facility Corporation Act, Article 717s, ofVernon’s Texas Civil Statutes. Articles of Incorporation were adopted on October 21, 1999 withthe Board of Trustees of the District serving as Directors of the Corporation. The Corporation wasformed for the construction of improvements and purchase of necessary land to be leased by theDistrict for use in its operations. Detailed information regarding the Corporation is found in thenotes to the financial statements.

The financial statements of the reporting entity include those of the District, the primarygovernment, and the Corporation, its component unit. All funds of the District are included in thisreport.

The District employs 2,891 persons, with 1,180 classified as professional employees and 1,711classified as support personnel. These employees adequately provide educational services forthe approximately 20,000 students enrolled in the District’s seventeen elementary schools (pre-kindergarten through fifth grade), seven middle schools (sixth through eighth grade), three highschools (ninth through twelfth grade), one career center, and one recovery learning center as adropout recovery campus. All District schools are fully accredited by the Texas EducationAgency.

The District provides a full range of educational services appropriate to the grade levels pre-kindergarten through twelfth grade. In addition to the basic instructional programs, the Districtprovides gifted and talented, bilingual/ESL, special education for handicapped students, remedial,college preparatory, and career and technology programs. These programs are supplemented bya wide variety of offerings in the fine arts, athletics, and other extracurricular programs.

The mission of the District is to guarantee that its graduates possess the necessary skills, valuesand knowledge to compete successfully as productive citizens in a diverse global society throughan educational system characterized by:

• Expectation of success for each person;• Optimum application of technology;• An appreciation of various cultures;• Full involvement of parents, teachers and the community; and• Respect and care for each other.

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 9/157

Board of TrusteesBeaumont Independent School DistrictJanuary 19, 2012

5

Factors Affecting Financial Conditions

Local Economy. The Beaumont Independent School District is located in the City of Beaumont, Texas.Beaumont is the major city in a region with nearly 400,000 residents. Economic development is a majorthrust of the Beaumont Chamber of Commerce as evidenced by expansions of commercial sites, hospitalsand the Port of Beaumont. Interstate highways, rails, a deep-water port and regional airport benefit areabusinesses. Having one of the fastest-growing technical colleges in the State of Texas and an outstandinguniversity adds to the strengths of our region.

Abundant raw materials and a great variety of man-made materials are also available in the Beaumontarea. Along the Texas Gulf Coast, a maze of pipelines delivers feedstock for the manufacture of anunlimited number of products, most of which are hydrocarbons derived from Texas' abundant oil andnatural gas. A healthy agricultural economy includes rice, soybeans, blueberries, crawfish, wheat, corn,grain, sorghum and livestock.

Growth History. The Beaumont Independent School District has maintained a steady enrollment onlyexperiencing slight fluctuations over the last 10 years and is projected to trend upward slightly in the futuredue to new industry relocating to the Beaumont area.

Future Planning. The current method of funding public education in Texas has caused Beaumont ISD tomake key budget adjustments for the 2011-2012 school year. The District’s approach to coping with thechallenges of a restricted funding environment with increasing academic standards has been to ensurethat the budget process is instructionally driven and guided by the Goals of the District. The major budgetpriorities are to provide adequate staff for any fluctuations in student growth and increased accountability;to ensure that quality staff is retained and competitive hiring practices continue by providing competitivesalaries and benefit packages including fully funding employee health insurance coverage; to provideongoing professional development resources; and to provide additional funding for utilities andmaintenance supplies associated with the ongoing implementation of the bond program. The Board andAdministration review the Goals of the District every year, focusing on aligning the allocation of resources,both personnel and financial, with the accomplishment of the goals and objectives. This facilitatesidentification of target areas for both operating cost reductions and increases.

Financial Information. The Beaumont Independent School District’s accounting records reflect generallyaccepted accounting principles as promulgated by the Governmental Accounting Standards Board. This isalso required under state regulations by the Texas Education Agency.

The District’s accounting system is organized and operated on the basis of funds, each of which is aseparate accounting entity with a self-balancing set of accounts.

In developing and evaluating the District’s accounting system, consideration is given to the adequacy of itsinternal control structure. An internal control structure is designed to provide reasonable, but not absolute,

assurance regarding: (1) the safeguarding of assets against loss from unauthorized use or disposition; and(2) the reliability of financial records used for preparing financial statements and accounting for assets.The concept of reasonable assurance recognizes that the cost of an internal control structure should notexceed the benefits to be derived and that these evaluations occur within this framework. Themanagement of the District is convinced that the internal control structure adequately safeguards assetsand provides reasonable assurance of proper recording of financial transactions.

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 10/157

Board of TrusteesBeaumont Independent School DistrictJanuary 19, 2012

6

An encumbrance system maintains budgetary control. As purchase orders are issued, correspondingamounts of appropriations are reserved by the use of encumbrances for later payment so thatappropriations may not be overspent. No substantial amounts that exceed the budget are expended prior

to the Board of Trustees amending the budget.The annual budget serves as the foundation for the District’s financial planning and control. Thebudgeting process for Beaumont Independent School District allows for input from teachers,community leaders, principals, administrators and ancillary personnel. Budget workshops are heldwith the Board of Trustees regularly during the budget process. The budget for 2010-2011 wasformally prepared for adoption for all governmental fund types by August 18, 2010. The Board ofTrustees formally adopted the budget at a duly advertised public meeting prior to the expenditure offunds. The budget was properly amended as required throughout the year.

The District’s administration reviews the budget throughout the year and recommends amendmentsto the Board as necessary. The Board approves amendments to the budget that are required whena change is made to any one of the functional expenditure categories or revenue object accountsdefined by the Texas Education Agency (“TEA”). Expenditures may not legally exceedappropriations, as amended, at the function level, by fund.

Debt Administration. The ratio of net bonded debt to assessed value for the BeaumontIndependent School District is .44 percent. The legal restriction of the State of Texas on netbonded debt is 10% of the assessed value and the District is below that level. All principal andinterest payments are due February 15 and August 15 of each year. On February 1 of each year,outstanding taxes become delinquent, which permits the collection of a large majority of taxeslevied before the long-term debt payments are due.

Cash Management. Using competitive bidding, depository bank services are awarded for a two-year contract period with an option to extend for an additional two years as allowed by TEA. Toachieve an active cash management policy, the following procedures are followed:

1. Investment Strategy:• Demand accounts receive interest based on monthly average balances.• Tax collections are deposited directly to a local government investment pool• District balances in selected accounts are “swept” into overnight investments.

2. Disbursement Strategy:• Vendor payments are scheduled to maximize any discount rates afforded to the

District.• A controlled disbursement account is utilized to pay district payables.• Payroll and benefits accounts are maintained as “zero based” and are funded as

checks are presented for payment.

3. Bank Relationships:• A checking account analysis is prepared and analyzed on a monthly basis to

determine monthly bank charges.• Immediate access to bank balances is available through internet banking.

4. Management Strategy:• Cash forecasting is performed annually based on new revenue projections.• Cash flow is monitored on a daily basis to assure maximum utilization.

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 11/157

Board of TrusteesBeaumont Independent School DistrictJanuary 19, 2012

7

Cash available in excess of cash requirements was invested in the Texas Local GovernmentInvestment Pool, and Lone Star Investment Pool. The District’s investment policy minimizes risk

while maintaining a competitive yield on its portfolio. District deposits were entirely covered byFederal Deposit Insurance Corporation (FDIC) insurance or pledged collateral for the year endedAugust 31, 2011.

Risk Management. The District has an active risk management policy in place. Workers’compensation claims are investigated and appropriate action is taken. The workers’compensation plan is self funded and administered through a third party. The District routinelyreviews all District insurance programs to assess risk exposure and the appropriate level ofcoverage. Various risk control techniques, including employee training are ongoing to reducepotential accident scenarios.

The District's property and casualty insurance is provided by national commercial carriers on a fullyinsured basis.

Major Initiatives and Accomplishments

The 2010-11 structure of the Beaumont Independent School District provided support to accomplish thefollowing results:

• The District issued its final installment of bonds totaling $31.5 million from the $388.6 million bondissue authorized by voters on November 6, 2007.

• The District moved numerous temporary buildings and others added to school operations to allowfor construction work at several sites slated to receive new schools. The district also purchasedland, hired architects and design team, construction managers at risk (CMARs) andsubcontractors. Demolition work was started and various other construction projects were also

jump started in an effort to begin its fourth year of a four year building program.

• The District completed the construction of Blanchette, Charlton-Pollard, Mae Jones Clark, Martin,Price-Fehl, and Regnia-Howell Elementary Schools.

• The District completed additions and renovations at numerous locations throughout the Distrct.

• The District completed construction and opened a third transportation center.

Awards and Acknowledgements

• The Beaumont Independent School District participates in the Certificate of Achievement forExcellence in Financial Reporting Award program sponsored by the Government Finance OfficersAssociation (GFOA). Receiving this prestigious award is the result of achieving the higheststandards in governmental accounting and financial reporting. Fiscal year ended August 31, 2010marked the Fifteenth consecutive year the District received this annual award. We believe that ourfiscal year ended August 31, 2011. CAFR continues to meet the program requirements and aresubmitting it to GFOA for consideration.

• Of Beaumont ISD’s twenty-eight ratable schools the Texas Education Agency rated seven schoolsas exemplary, ten as recognized, and ten as academically acceptable.

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 12/157

Board of TrusteesBeaumont Independent School DistrictJanuary 19, 2012

8

• Business Review USA Magazine named Beaumont ISD to its national list of “Top 10 SchoolDistricts.”

• Beaumont ISD is home to three Blue Ribbon Schools as well as three ACT model schools andone Texas Business Education Coalition Honor Roll School.

• The Houston Chronicle named Beaumont ISD as #23 on the 2011 list of “Top 100 Workplaces.”

• The National League of Cities’ National Black Caucus of Local Elected Officials commendedBeaumont ISD as a national model school district.

The preparation of this report on a timely basis could not have been accomplished without theefficient and dedicated efforts of the entire staff of the Business Office and the Print Shop. We

would like to express our sincere appreciation to the members of these departments who assistedand contributed to the preparation of this report. The Superintendent and Business Office staff ofthe Beaumont Independent School District wishes to express its appreciation to the Board ofTrustees for their concern in providing fiscal accountability to the patrons of the District andthereby its support in the financial management of the District. Finally, we would like to thank theresidents of the district for their support of and belief in our public schools and the principals andteachers who provide the quality of education for which the District is known.

Respectfully submitted,

_____________________________ Dr. Carrol A. Thomas Jr.Superintendent of Schools

_____________________________ Robert ZinglemannChief Business Officer

_____________________________ Devin McCraneyDirector of Finance

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 13/157

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 14/157

10

BEAUMONT INDEPENDENT SCHOOL DISTRICTBeaumont, Texas

Board of Trustees

Woodrow Reece, President

Janice Brassard, Vice President

Terry D. Williams, Secretary

Zenobia Bush, Member

Gwen Ambres, Member

Mike Neil, Member

Tom B. Nield Sr., Member

Dr. Carrol A. ThomasSuperintendent of Schools

Dr. David Harris

Assistant Superintendent for Secondary Schools

Dr. Shirley BontonDeputy Superintendent for Elementary Schools

Phillip BrooksAssistant Superintendent for Administration

Dr. Timothy ChargoisAssistant Superintendent for Research, Evaluation & Planning

Robert ZingelmannChief Business Officer

Sybil ComeauxExecutive Director of Personnel

Jessie HaynesSpecial Assistant to Superintendent/Communications

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 15/157

CERTIFICATE OF BOARD

Beaumont Independent School District JeffersonName of School District County

We, the undersigned, certify that the attached annual financial reports of the above named

school district was reviewed and _____ approved _____ disapproved for the year ended

August 31, 2011 at a meeting of the board of school trustees of such school district on the

__19_ day of January, 2012.

Terry D. Williams, Secretary Woodrow Reece, President

11

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 16/157

Board of Trustees Auditor

Beaumont Independent School District Organization Chart

Attorney

DEICDistrict Educationalprovement Committee

Safety & EnergyMgt. Coordinator

Director of Food Services

SecondarySchools & Alternative

School Principals Principal of Head Start

ElementaryPrincipals

Director of Career Technology

Director of AthleticsP.E. & Health Ed.

Coordinator of Drivers Ed.

Director of Adult &Community Ed.

Director - InformationServices & Technology

Director Performance Mgt.

CurriculumSupervisors

Director of Title I

Updated 8-12-11

SuperintendentDr. Carrol A. Thomas

In Quest of Excellence

Coordinator of Guidance &

Drug-Free Schools

LibrarianCoordinator

Chief BusinessOf cer

Assistant Superintendentfor Administration

Chief of Police

Director of Health Services

Director of Transportation

Special Assistant for Communications

Deputy Superintendentfor Curriculum, Instruction &Elementary Administration

ExecutiveDirector - Personnel

Asst. SuperintendentResearch & Evaluation

Executive Director Special Education

Reprographic Systems/Printing Operations

Special Ed.Supervisors

Diagnosticians

Media Center

Graphic Arts/Desktop Publishing

CommunicationsSpecialist

Volunteer Program/Education Partnerships

PersonnelInventory

Certi cations

Comptroller

Assistant Director for Finance & Purchasing

Payroll Supervisor

Cabinet Members

Systems Manager -Business & Personnel

Supervising Manager of Business Support Services

Budget Supervisor

Director of Staff Development

Director of Student Services

Asst. SuperintendentSecondary Schools

Organizational Chart

Director of Finance

Asst. Director of Facilities

Asst. Director of AthleticsP.E. & Health Ed.

Director of Facilities

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 17/157

FINANCIAL SECTION

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 18/157

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 19/157

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 20/157

BEAUMONT INDEPENDENT SCHOOL DISTRICTMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2011

15

In this section of the Comprehensive Annual Financial Report, we, the managers of the BeaumontIndependent School District (the District), discuss and analyze the District’s financial performance for the fiscalyear ended August 31, 2011. We encourage readers to consider the information presented here inconjunction with our transmittal letter on page 3, the independent auditors' report on page 13, and theDistrict's Basic Financial Statements that begin on page 26.

FINANCIAL HIGHLIGHTS

• The District’s assets exceeded its liabilities at the close of the most recent period by $215,888,496(net assets). Of this amount, $30,491,143 (unrestricted net assets) may be used to meet theDistrict’s ongoing obligations.

• The District’s total net assets increased by $76,284,745. See table II on page 19.

• At August 31, 2011, the District’s governmental funds reported combined ending fund balances of$153,490,133 a decrease of $122,125,056 or 55.69% from the prior year restated balance.

• At August 31, 2011, $40,566,216 or 23.6% of total General Fund expenditures is available for

spending at the government’s discretion ( unreserved, undesignated fund balance) .

OVERVIEW OF THE FINANCIAL STATEMENTS

This discussion and analysis are intended to serve as an introduction to the District’s basic financialstatements. The District’s basic financial statements include of three components: (1) government-widefinancial statements, (2) fund financial statements, and (3) notes to the financial statements.

This report also contains certain required supplementary information, which includes this management’sdiscussion and analysis.

Government-wide Financial Statements . The government-wide financial statements are designed to

provide readers with a broad overview of the District’s finances, in a manner similar to a private-sectorbusiness. They include the Statement of Net Assets and the Statement of Activities that provideinformation about the activities of the District as a whole and present a longer-term view of the District'sproperty and debt obligations and other financial matters. They reflect the flow of total economic resourcesin a manner similar to the financial reports of a business enterprise.

The S tatement of Net Assets presents information on all of the District’s assets and liabilities, with thedifference between the two reported as net assets. Over time, increases or decreases in net assets mayserve as a useful indicator of whether the financial position of the District is improving or deteriorating.

The Statement of Activities presents information showing how the government’s net assets changed duringthe current fiscal year. All changes in net assets are reported for all of the current year’s revenues andexpenses regardless of when cash is received or paid. Thus, revenue and expenses are reported in thisstatement for some items that will only result in cash flows in future fiscal periods.

Both of the District’s government-wide financial statements distinguish the functions of the District as beingprincipally supported by taxes and intergovernmental revenues (governmental activities) as opposed tobusiness-type activities that are intended to recover all or a significant portion of their costs through user feesand charges. The District has no business-type activities but includes one blended component unit for whichit is financially accountable. The government-wide financial statements can be found on pages 26 -27 of thisreport.

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 21/157

BEAUMONT INDEPENDENT SCHOOL DISTRICTMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2011

16

Fund Financial Statements . A fund is a grouping of related accounts that is used to maintain control overresources that have been segregated for specific activities or objects. The District, like other state and localgovernments, uses fund accounting to ensure and demonstrate compliance with finance-relatedrequirements. The fund financial statements provide detailed information about the District’s most significantfunds, not the District as a whole.

All of the funds of the district can be divided into three categories: governmental funds, proprietary funds, andfiduciary funds.

• Governmental Funds . Governmental funds are used to account for essentially the samefunctions reported as governmental activities in the government-wide financial statements.However, unlike the government-wide financial statements, governmental fund financialstatements focus on near-term inflows and outflows of spendable resources, as well as onbalances available at end of each fiscal year.

Because the focus of governmental funds is narrower than that of the government-wide financialstatements, it is useful to compare the information presented for governmental funds with similarinformation presented for governmental activities in the government-wide financial statements. By

doing so, readers may better understand the long-term effort of the government’s near-term effortof the government’s near-term financing decisions. Both the governmental funds balance sheetand the governmental funds statement of revenues, expenditures, and changes in fund balancesprovide a reconciliation to facilitate this comparison between governmental funds andgovernmental activities.

The District maintains several individual governmental funds organized according to their type(special revenue, debt service, and capital projects). Information is presented separately in thegovernmental funds balance sheet and in the governmental funds statement of revenues,expenditures and changes in fund balances for the District’s most significant funds. The District’smajor governmental funds are the General Fund and Local Capital Projects Fund. Data for theremaining governmental funds are combined into a single, aggregated presentation. Individualfund data for each of the non-major governmental funds is provided in the form of combiningstatements elsewhere in this report.

The District adopts an annual appropriated budget for its General Fund. A budgetary comparisonstatement has been provided for the General Fund to demonstrate compliance with this budget.The Texas Education Agency also requires the District to present a budgetary comparisonstatement for one of its special revenue funds (food service) and the debt service fund.

• Proprietary Funds. Proprietary funds reported by the District are generally used to account forservices for which the District charges its employees or internal units. The District maintainsInternal Service funds to accumulate and allocate costs internally among the District’s variousfunctions. The District used internal service funds to account for its self-insurance program forworkers’ compensation, and the District’s program for providing employee health insurancebenefits. The activities and balances of these funds have been included with governmentalactivities in the government-wide financial statements.

• Fiduciary Funds. The District is the trustee, or fiduciary, for money raised by student activities andalumnae scholarship programs. All of the District's fiduciary activities are reported in separateStatements of Fiduciary Net Assets and Changes in Fiduciary Net Assets on pages 36 - 37. Weexclude these resources from the District's other financial statements because the District cannotuse these assets to finance its operations. The District is only responsible for ensuring that theassets reported in these funds are used for their intended purposes.

Notes to the Financial Statements. The notes provide additional information that is essential to a completeunderstanding of the data provided in the government-wide and fund financial statements. The notes to thefinancial statements can be found on pages 38 - 57 of this report.

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 22/157

BEAUMONT INDEPENDENT SCHOOL DISTRICTMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2011

17

Required Supplementary Information. In addition to the basic financial statements and accompanyingnotes, this report also presents certain required supplementary information that further explains andsupports the information in the financial statements. Required supplementary information can be found onpages 59 - 60 of this report.

Combining Statements. The combining statements for non-major governmental funds containinformation about the District’s individual funds. Combining and individual fund statements and schedulesare presented on pages 68 - 95 of this report.

GOVERNMENT-WIDE FINANCIAL ANALYSIS

Our analysis focuses on the Net Assets (Table I) and Changes in Net Assets (Table II) of the District’sgovernmental activities.

As noted earlier, net assets may serve as a useful indicator of a government’s financial position. Table I isa condensed version of the District’s Statement of Net Assets and reports that assets exceeded liabilitiesby approximately $151.3 million at the close of the fiscal year ended August 31, 2011, which was aincrease of $74.0 million. The largest portion of the District’s net assets (35% or $75.36 million) representsresources that are subject to external constraints (example: constraints imposed by creditors, grantors orby law.) An additional portion of the District’s net assets (51% or $110.0 million) reflects its investment incapital assets (primarily school facilities and related furniture and fixtures and equipment), net ofoutstanding debt used to acquire or construct capital assets. Unrestricted net assets (14% or $30.4 million)can be used to meet the District’s ongoing obligations to creditors and to provide programs to its students.

Net assets of the District’s governmental activities for the current year increased $74,076,434. This is anindication that the government’s overall financial position has increased. Beginning net assets were$139.6 million. Ending net assets for the year were $151.3 million. Exhibit B-2R details the reasons for theincrease in net assets.

August 31,2011 August 31,2010

Current and Other Assets 177,278,428$ 303,846,129$Capital Assets 419,225,211 261,960,730Total Assets 596,503,639 565,806,859

Long-term debtPrincipal 423,223,005 399,588,519Accreted Interest 1,728,623 1,629,639

Other Liabilities 20,202,514 24,984,950Total Liabilities 445,154,142 426,203,108

Net Assets:Invested in Capital Assets, Netof Related Debt 47,704,300 34,181,927Assigned 75,362,365 76,964,232Unassigned 28,282,832 28,457,592Total Net Assets 151,349,497$ 139,603,751$

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 23/157

BEAUMONT INDEPENDENT SCHOOL DISTRICTMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2011

18

Governmental Activities.

Governmental activities increased the District’s net assets by $74,076,434 for the current year.

• Property tax revenue increased by approximately $4.8 million during the year due to an increase

in property tax values.• Revenues from Operating Grants and Contributions decreased approximately $2.4 million due to a

decrease in grant funding.

• Miscellaneous Local and Intermediate saw the most significant increase of approximately$115,365.631 due to an increase in value of the Foreign Trade Zone, along with the proceedsfrom the settlement of a law suit related to hurricane losses.

• The total cost of all governmental activities this year was $365,584,670 significantly more than theprior year by $40,932,641.

• Instruction and Instructional support expenses increased by $1,769,409 between the 2010-2011

fiscal year and 2009-2010 fiscal year which represents an 1.5 percent increase.• Plant maintenance and operations increased $37,823,603 as a result of numerous construction

and capital outlay projects taking place around the district.

• Student Pupil Transportation increased $1,813,169 due to the increase of fuel cost for additionaltransportation for the after school tutorial program ACE, along with the expansion of other afterschool tutorial and enrichment programs through the district which allows for the transport ofparticipates from their home school campus to the tutorial program site and from the site to theirindividual homes each day

.

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 24/157

BEAUMONT INDEPENDENT SCHOOL DISTRICTMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2011

19

Key elements of the governmental activities of the District are reflected in the following table.

August 31,2011 August 31,2010Revenues:

Program Revenues:Charges for Services 13,172,542$ 5,964,291$Operating Grants and Contributions 52,003,974 54,479,701

General Revenues:Maintenance and Operations Taxes 91,237,253 90,837,563 Debt Service Taxes 23,847,140 19,400,000 State Aid - Formula Grants

Grants and Contributions - Not Restricted toSpecific Functions 40,579,973 46,537,431

Investment Earnings 463,188 903,170 Miscellaneous 218,357,034 102,991,403

Total Revenue 439,661,104 321,113,559

Expenses:

Instruction 112,860,852 111,752,028 Instructional Resources and Media Services 2,798,831 2,138,246 Curriculum/Instructional Development 2,212,411 1,908,921 Instructional Leadership 5,635,824 5,120,505 School Leadership 10,784,759 10,198,627 Guidance and Counseling Services 5,135,076 4,552,286 Social Work Services 916,205 773,993 Health Services 2,008,140 1,919,799 Student (Pupil) Transportation 11,301,735 9,488,566

Food Services 11,302,793 10,759,322 Cocurricular/Extracurricular Activities 4,488,196 4,289,662 General Administration 12,200,086 6,683,933 Plant Maintenance and Operations 170,790,004 132,966,401 Security and Monitoring Services 2,553,114 2,321,161 Data Processing Services 1,595,652 1,313,045 Community Services 1,524,411 1,502,498 Debt Services - Interest on Long Term Debt 6,730,000 16,193,121 Debt Services - Bond Issuance Cost & Fees 405,557 459,134 Facilities Acquisition and Construction - - Shared Service Arrangement/Deaf Program 157,274 127,031 Juvenile Justice Alternative Education 183,750 183,750

Total Expenses 365,584,670 324,652,029

Decrease in Net Assets 11,745,746 (3,538,470) Net Assets - September 1 (Beginning) 139,603,751 139,977,031 Prior Period Adjustment - 3,165,190 Net Assets - September 1 (Restated) 139,603,751 143,142,221 Net Assets - August 31 (Ending) 151,349,497$ 139,603,751$

Table IIBeaumont Independent School DistrictChanges in Net Assets

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 25/157

BEAUMONT INDEPENDENT SCHOOL DISTRICTMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2011

20

Key elements of the District’s governmental activities are further illustrated in the following charts:

Other support services include security and monitoring services and data processing services. Otherincludes community services, debt service interest and fees, shared service arrangements, juvenile justicealternative education and depreciation expense.

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

Thousands

Comparison of Expenditures - Current to Prior Year

2009-2010 2010-2011

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 26/157

BEAUMONT INDEPENDENT SCHOOL DISTRICTMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2011

21

FINANCIAL ANALYSIS OF THE DISTRICT’S FUNDS

As noted earlier, the District uses fund accounting to ensure and demonstrate compliance with finance-related requirements.

Governmental Funds. The focus of the District’s governmental funds is to provide information on nearterm inflows, outflows, and balances of dependable resources. Such information is useful in assessing theDistrict’s financing requirements. In particular, unreserved fund balance may serve as a useful measure ofthe District’s net resources available for spending at the end of the fiscal year.

As the District completed the year, its governmental funds (as presented in the balance sheet on page 28reported a combined fund balance of $151,275,148 a decrease of $124,351,538 from the prior year. Ofthis total $40,565,239 represents unassigned resources available for spending at the District’s discretionand $10,286,970 for capital projects. Resources designated for other purposes total $1,750,000. Theremainder of the fund balances are assigned to indicate that they are not available for new spendingbecause they have already been committed (1) to liquidate contracts and purchase orders of the priorperiod ($3,740,086), (2) to liquidate the related expenditures that will be recognized when inventories areeventually consumed, ($513,745), (3) to make debt service payments, ($2,189,790), (4) for food service,($1,145,873) (5) for prepaid items, ($2,619,411). Please reference Exhibit B-1.

The General Fund is the primary operating fund of the District. At the end of the current fiscal year, theunassigned fund balance of the General Fund was $40,565,239, while the total fund balance of theGeneral Fund was $45,759,664. As a measure of the General Fund’s liquidity, it may be useful tocompare the unreserved fund balance to total General Fund expenditures. Unassigned fund balancerepresents 24% of total General Fund expenditures of $171,462,554. Total fund balance represents 27%of that same amount.

0

50,000

100,000

150,000

200,000

250,000

Thousands

Comparison of Revenues by Source ‐ Current to Prior Year

2010 ‐2011 2009 ‐2010

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 27/157

BEAUMONT INDEPENDENT SCHOOL DISTRICTMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2011

22

The Debt Service fund has a total fund balance of $2,186,610 all of which is reserved for the payment ofdebt service. The net decrease in the debt service fund balance during the current year of $815,233 wasprimarily attributable to decreased earnings along with increased Debt Service cost .

The capital projects fund has a total fund balance of $101,989,736 all of which is reserved for authorized

constructions projects because of resources made available in the Capital Project Fund along with bondproceeds. This fund decreased by approximately $125,061,372 due to the construction of 6 new schoolsand several new parking lots, classroom additions and various other construction projects throughout thedistrict.

Proprietary Funds. As of August 31, 2011, the unrestricted net assets for the internal service funds,which are used to account for certain governmental activities were $620,809. The net change in assets ofthe fund is eliminated and allocated to governmental expenses in the government-wide financialstatements.

Fiduciary Funds. The District reports fiduciary fund activity for Private Purpose Trust Funds(scholarships) and Agency Funds (student activity). Changes to these funds were immaterial for the fiscalyear.

GENERAL FUND BUDGETARY HIGHLIGHTS

Over the course of the year, the District recommended and the Board approved several revisions tobudgeted revenue and expenditures. These amendments fall into the following categories:

• Amendments approved shortly after the beginning of the new fiscal year for amounts reserved anddesignated in the prior year

• Amendments in early and late spring to revise estimates for local and state revenue based on thelatest information on student attendance numbers and tax collections

• Amendments throughout the year for transfers to and from other funds and federal indirect costcalculations

• Amendments during the year for unexpected occurrences

Significant differences between the original budget and the final amended budget of the General Fund canbe briefly summarized as follows:

Budgeted revenue:

• $12,380,782 increase in local revenues due to insurance proceeds from Hurricane Ike, along withan increase in the Foreign Trade Zone Value

• 4,505,250 in state revenue due to increase in enrollment

Budgeted expenditures:

• $2,389,657 decrease in instruction cost due to the closing/combining of several schools.

• $4,556,950 increase in student (pupil) transportation cost due the refurbishing of several buses,increase in fuel cost, an increase in student enrollment, along with the addition of the after schooltutorial program ACE and the expansion of other after school programs.

• $5,469,179 increase in plant maintenance and operations due to the acquisition of land along withnumerous capital improvements throughout the district.

Reallocations within budgets to reflect campus plan updates and changes in needs .

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 28/157

BEAUMONT INDEPENDENT SCHOOL DISTRICTMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2011

23

CAPITAL ASSET AND LONG-TERM DEBT ACTIVITY

Capital Assets . At August 31, 2011, the District had $419.2 million (net of depreciation) invested in abroad range of capital assets, including land, buildings, furniture and equipment used for instruction,transportation, athletics, administration, and maintenance.

August 31, 2011 August 31, 2010Land 13,317,689 13,196,524 Construction in Progress 60,226,129 82,596,079 Building and Improvements 388,085,522 219,554,979 Furniture and Equipment 30,761,201 27,715,426 Totals at Historical Costs 492,390,541 343,063,008

Less Accumulated Depreciation:Buildings and Improvements (62,309,685) (71,030,800) Furniture and Equipment (10,855,645) (10,071,478) Total Accumulated Depreciation (73,165,330) (81,102,278)

Net Capital Assets 419,225,211 261,960,730

Beaumont Independent School DistrictCapital Assets

Governmental Activities

Major capital assets events during the current fiscal year include the following:

• The District completed the construction of Blanchette, Charlton-Pollard, Mae Jones Clark, Martin,Price-Fehl, and Regina-Howell Elementary Schools.

• The District completed additions and renovations at numerous locations throughout the District.

• The District completed construction and opened a third transportation center.

For government-wide financial statement presentation, all depreciable capital assets were depreciatedfrom acquisition date to August 31, 2011. Fund financial statements record capital asset purchases asexpenditures. See Notes 1 and 4 in the Notes to the Financial Statements for further informationregarding capital assets.

Long-Term Debt. At year-end, the District had $414,725,000 in bonds and tax notes outstanding. Of thisamount, $410,115,000 is general obligation bonds backed by the full faith of the State of Texas PermanentSchool fund, and $4,610,000 in lease revenue bonds backed by the general revenue of the District.

The District's general obligation bond rating is very favorable with a Standard & Poor’s rating of “AAA” anda Moody’s Investor Services rating of “Aaa”.

The District has no authorized, unissued bonds.

More detailed information about the District's long-term liabilities is presented in Note 7 to the financialstatements.

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 29/157

BEAUMONT INDEPENDENT SCHOOL DISTRICTMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2011

24

August 31, 2011 August 31, 2010Governmental activities:

Bonds Payable:

General obligations bonds 410,115,000$ 384,745,000$

Accumulated accretion 1,728,623 1,629,639 Less deferred amounts:

On refunding (1,099,624) (1,099,624) Lease Revenue Bonds 4,610,000 5,610,000

Total bonds payable 415,353,999 390,885,015 Compensated absences 7,615,000 8,703,504

Total 422,968,999$ 399,588,519$

Beaumont Independent School DistrictOutstanding Debt

ECONOMIC FACTORS AND NEW YEAR’S BUDGETS AND RATES

The District's elected officials considered many factors when adopting the fiscal year 2011 budgets andtax rates. Of primary concern was their desire to adopt a balanced budget for the General Fund. Generaland specific factors affecting the Board’s budgeting decisions included:

• Unemployment in the area is 8.5%, which compares un-favorably to the State’s averageunemployment rate of 8.1 %.

• The District’s enrollment is expected to remain stable.• The District’s student attendance rate is expected to remain stable at 95.10%.• The taxable assessed value increased by $188.9 million or 2% from the prior year.• The District has estimated revenues and other sources of $162,303,438 and appropriated

expenditures and other uses of $162,303,438 representing a balanced budget.

CONTACTING THE DISTRICT'S FINANCIAL MANAGEMENT

This financial report is designed to provide our citizens, taxpayers, customers, investors and creditors witha general overview of the District’s finances as well as demonstrate accountability for funds the Districtreceives. Questions concerning any of the information provided in this report or requests for additionalinformation should be addressed to the Office of the Chief Business Officer, Beaumont I.S.D., 3395Harrison, Beaumont, Texas 77706-5009.

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 30/157

BASIC FINANCIAL STATEMENTS

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 31/157

BEAUMONT INDEPENDENT SCHOOL DISTRICT EXHIBIT A-1STATEMENT OF NET ASSETSAUGUST 31, 2011

Data Primary GovernmentControl GovernmentalCodes Activities

Assets

1110 Cash and Cash Equivalents 142,083,822$1220 Property Taxes Receivable (Delinquent) 10,264,895 1230 Allowance for Uncollectible Taxes (4,205,621) 1240 Due from Other Governments 10,333,912 1290 Other Receivables, Net 15,308,363 1310 Inventories - Supplies and Materials 513,745 1420 Capital Bond and Other Debt Issuance Costs 155,025 1490 Other Current Assets 2,824,287

Capital Assets (Net of AccumulatedDepreciation):

1510 Land 13,317,689 1520 Buildings and Improvements 325,775,837 1530 Furniture and Equipment 19,905,557 1580 Construction In Progress 60,226,128

1000 Total Assets 596,503,639

Liabilities

2110 Accounts Payable and Accrued Expenses 7,336,759 , ,

2150 Payroll Deductions and Withholdings Payable 2,353,453 2160 Accrued Wages Payable 9,546,664 2170 Due to Other Funds 136,189

2180 Due to Other Governments 544,712 2200 Accrued Expenses 27,670 2300 Unearned Revenues 257,067

Long Term Liabilities: - 2501 Due Within One Year 7,615,000 2502 Due in More Than One Year 415,608,005

2000 Total Liabilities 445,154,142

Net Assets

3800 Invested in Capital Assets, Net of Related Debt 47,704,300 3850 Restricted for Debt Service 2,189,790 3860 Restricted for Capital Projects 73,172,575 3900 Unrestricted Net Assets 28,282,832

3000 Total Net Assets 151,349,497$

The notes to the financial statements are an integral part of this statement.

26

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 32/157

BEAUMONT INDEPENDENT SCHOOL DISTRICT EXHIBIT A-2STATEMENT OF ACTIVITIESFOR THE FISCAL YEAR ENDED AUGUST 31, 2011

Net (Expense)Revenue andChanges inNet Assets

Data Charges OperatingControl for Grants and GovernmentalCodes Expenses Services Contributions Activities

Governmental Activities0011 Instruction 112,860,852$ 790,353$ 29,632,312$ (82,438,187)$0012 Instructional Resources & Media Services 2,798,831 - 649,292 (2,149,539) 0013 Curriculum/Instructional Development 2,212,411 - 1,385,171 (827,240) 0021 Instructional Leadership 5,635,824 - 3,412,422 (2,223,402) 0023 School Leadership 10,784,759 - 902,298 (9,882,461) 0031 Guidance and Counseling Services 5,135,076 - 1,200,261 (3,934,815) 0032 Social Work Services 916,205 - 325,904 (590,301) 0033 Health Services 2,008,140 - 271,070 (1,737,070) 0034 Student (Pupil) Transportation 11,301,735 - 308,887 (10,992,848)

0035 Food Services 11,302,793 2,371,058 11,039,348 2,107,613 0036 Cocurricular/Extracurricular Activities 4,488,196 395,176 214,880 (3,878,140) 0041 General Administration 12,200,086 - 233,955 (11,966,131) 0051 Plant Maintenance and Operations 170,790,004 7,640,074 780,193 (162,369,737) 0052 Security and Monitoring Services 2,553,114 - 148,121 (2,404,993) 0053 Data Processing Services 1,595,652 - 128,732 (1,466,920) 0061 Community Services 1,524,411 1,975,881 1,371,128 1,822,598 0072 Debt Service - Interest on Long Term Debt 6,730,000 - - (6,730,000) 0073 Debt Service - Bond Issuance Cost & Fees 405,557 - (405,557) 0093 Shared Service Arran ements/Local Deaf 157 274 - - 157 274

Program Revenues

, , 0095 Juvenile Justice Alternative Education 183,750 - - (183,750)

TP Total Primary Government: 365,584,670$ 13,172,542$ 52,003,974$ (300,408,154)$

Data

Control General Revenues:

Codes Taxes:

MT Property Taxes, levied for general purposes 91,237,253

DT Property Taxes, levied for debt service 23,847,140

GC Grants and Contributions not restricted 40,579,973

IE Investment Earnings 463,188

MI Miscellaneous Local and Intermediate 156,026,346

TR Total General Revenues 312,153,900

CN Change in Net Assets 11,745,746

NB Net Assets - September 1 (Beginning) 139,603,751 PA Prior Period Adjustment -

NB Net Assets - September 1 (Restated) 139,603,751

NE Net Assets - August 31 (Ending) 151,349,497$

The notes to the financial statements are an integral part of this statement.

27

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 33/157

BEAUMONT INDEPENDENT SCHOOL DISTRICT EXHIBIT B-1BALANCE SHEET GOVERNMENTAL FUNDSAUGUST 31, 2011

10 60 60 TotalData General Major Local Major Capital Other Governmental

Control Fund Capital Projects Project Bond Funds FundsCodes Assets 1110 Cash and Temporary Investments (market) 28,236,483$ 6,829,280$ 97,062,395$ 3,743,159$ 135,871,316$1220 Property Taxes - Delinquent 8,149,300 - 2,115,595 10,264,895 1230 Allowance for Uncollectible Taxes (credit) (4,022,381) - - (183,240) (4,205,621) 1240 Due from Other Governments 1,997,872 - - 8,336,040 10,333,912 1260 Due from Other Funds 6,359,475 - - 136,189 6,495,664 1290 Other Receivables 15,295,425 - - 12,938 15,308,363 1310 Inventories, at Cost 331,976 - - 181,769 513,745 1490 Other Current Assets 2,362,586 - - - 2,362,586

1000 Total Assets 58,710,735$ 6,829,280$ 97,062,395$ 14,342,450$ 176,944,860$

Liabilities

2110 Accounts Payable 777,050$ 490,415$ 1,403,524$ 836,921$ 3,507,911$2150 Payroll Deduction and Withholdings Payable 2,353,051 - - 402 2,353,453 2160 Accrued Wages Payable 7,907,038 - - 1,639,626 9,546,664

2170 Due to Other Funds 136,189 - - 6,359,474 6,495,663 2180 Due to State 164,418 - - 380,294 544,712 2190 Due to Student Groups 10,212 - - - 10,212 2200 Accrued Expenditures 27,670 - - - 27,670 2300 Deferred Revenues 1,583,443 - - 1,608,301 3,191,744

2000 Total Liabilities 12,959,072$ 490,415$ 1,403,524$ 10,825,018$ 25,678,029$

Fund Balance Nonspendable:

3410 Investments in Inventory 331,976$ -$ -$ 181,769$ 513,745$Restricted for:

3420 Retirement of Long-Term Debt - - - 2,189,789 2,189,789 3430 Prepaid Items 2,619,411 - - - 2,619,411 3440 Outstanding Encumbrances 493,038 3,247,047 - 3,740,086

3450 Food Service - - - 1,145,873 1,145,873 Committed to:3590 General Fund Designated for Other Purposes 1,750,000 - 88,455,718 - 90,205,718

Unassigned to:3600 General Fund 40,565,239 - - 318 40,565,557 3620 Reported in Capital Projects Fund - 3,091,818 7,203,152 - 10,294,970

3000 Total Fund Balance 45,759,664$ 6,338,865$ 95,658,871$ 3,517,749$ 151,275,148$

4000 Total Liabilities and Fund Balance 58,718,735$ 6,829,280$ 97,062,395$ 14,342,767$ 176,953,177$

The notes to the financial statements are an integral part of this statement.

28

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 34/157

BEAUMONT INDEPENDENT SCHOOL DISTRICT EXHIBIT B-1RRECONCILIATION OF THE GOVERNMENTAL FUNDS BALANCE SHEET TO THESTATEMENT OF NET ASSETSFOR THE FISCAL YEAR ENDED AUGUST 31, 2011

Total Fund Balances - Governmental Funds 151,263,651$

620,809

137,630,789

Current year capital outlays of $160,440,247 net of retirement and long-term debt principal payments incapital assets and increases in capital assets and reductions in long-term debt in the government-widefinancial statements. The District dold new debt in the amount of $31,500,000. Long term liabilitiesrelated to vaction and sick leave were adjusted to reflect the net change accrued during the year.Amoritization of bond premium of $136,172 increased net assets. Decreases in net assets occurred dueto amortization of capitalized bond and debt issuance costs of ($179,158) Additionally, net assetsdecreased due to the disposal of assets and related accumulated depreciation for a net total of($104,274,301) issued and changes in other long term liabilities is to (decrease) net assets.

87,622,960

The 2011 depreciation expense increases accumulated depreciation.The net effect of the current year'sdepreciation is to decrease net assets.

(8,620,317)

Various other reclassificationsand eliminationsare necessary to convert from the modified accrual basisof accountin to accrual basis of accounting. These include recognizing deferred revenue of $1,205,653as revenue, eliminating interfund transactions, recognizing the liabilities associated with maturing long-term debt and interest of $34,741,070. The net effect of these reclassifications and recognitions is todecrease net assets

(217,168,395)

Net Assets of Governmental Activities 151,349,497$

The notes to the financial statements are an integral part of this statement.

The District uses internal service funds to charge the costs of certain activities, such as self-insurance,toappropriate function in other funds. The assets and liabilities of the internal service funds are included ingovernmental activities in the statement of net assets. The net effect of this consolidation is to increasenet assets

Capital assets used in governmental activities are not financial resources and therefore are not reportedin governmental funds. The net effect of capital assets net of (accumulated depreciation) which includesthe cost of the beginning of the year assets, the cost of these assets was $343,063,008 and theaccumulated depreciation was ($81,102,278). In addition, long-term liablities, including bonds payable,are not due and payable in the current period, and, therefore are not reported as liablities in the funds.The total debt outstanding as of the beginning of the year was $399,588,519. The net effect of includingthe beginning balances for capital assets (net of depreciation) and long-term debt in the governmentalactivities is to increase net assets.

29

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 35/157

BEAUMONT INDEPENDENT SCHOOL DISTRICT EXHIBIT B-STATEMENT OF REVENUES, EXPENDITURES, AND CHANGES IN FUND BALANCEGOVERNMENTAL FUNDSFOR THE FISCAL YEAR ENDED AUGUST 31, 2011

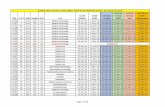

Data 10 60 60 TotalControl General Major Local Major Capital Other GovernmentalCodes Fund Capital Projects Project Bond Funds Funds

Revenues 5700 Local Sources 108,556,583$ -$ 384,707$ 26,983,749$ 135,925,04$

5800 State Program Revenues 67,466,886 - - 5,391,015 72,857,90 5900 Federal Program Revenues 1,957,917 - - 37,397,809 39,355,72 5020 Total Revenues 177,981,386 - 384,707 69,772,573 248,138,66

Expenditures

0011 Instruction 87,712,955 - - 25,596,600 113,309,55 0012 Instructional Resources and Media Services 2,256,020 - - 543,159 2,799,17 0013 Curriculum and Instructional Development 802,978 - - 1,409,433 2,212,41 0021 Instructional Leadership 2,307,630 - - 3,337,542 5,645,17 0023 School Leadership 10,434,958 - - 377,845 10,812,80 0031 Guidance and Counseling Services 4,163,252 - - 981,172 5,144,42 0032 Social Work Services 603,676 - - 312,529 916,20 0033 Health Services 1,839,060 - - 178,428 2,017,48 0034 Student (Pupil) Transportation 11,413,911 - - - 11,413,91

0035 Food Services 48,904 - - 11,253,889 11,302,79 0036 Cocurricular/Extracurricular Activities 4,437,573 - - 134,755 4,572,32 0041 General Administration 12,168,271 - - 41,163 12,209,43 0051 Plant Maintenance and Operations 28,143,308 - 1,832,888 187,470 30,163,66 0052 Security and Monitoring Services 2,519,579 - - 52,231 2,571,81 0053 Data Processing Services 1,532,877 - - 72,123 1,605,00 0061 Community Services 167,010 - - 1,366,749 1,533,75

Debt Service0071 Debt Service - Principal on long-term debt - - - 6,730,000 6,730,00 0072 Debt Service - Interest on long-term debt - - - 19,636,298 19,636,29 0073 Debt Service - Bond Issuance Cost and Fees - - - (202,771) (202,77

Capital Outlay0081 Facilities Acquisition and Construction 569,568 7,643,022 152,227,657 - 160,440,24

Intergovernmental0093 Shared Service Arrangement/Deaf Program 157,274 - - - 157,27 0095 Juvenile Justice Alternative Education 183,750 - - - 183,75

6030 Total Expenditures 171,462,554 7,643,022 154,060,545 72,008,615 405,174,73 1100 Excess (Deficiency) of Revenues Over (Under)

Expenditures 6,518,832 (7,643,022) (153,675,838) (2,236,042) (157,036,07

Other Financing Sources (Uses):7911 Sale of Bonds - - 31,500,000 - 31,500,00 7915 Transfers In - 3,765,675 - 1,348,580 5,114,25 7916 Premium or Discount on Bonds - - 1,080,000 - 1,080,00 7917 Prepaid Interest - - - 98,984 98,98 7949 Other Resources - Insurance Proceeds 17,045 - - - 17,04 8911 Transfers Out (5,034,067) (80,188) - - (5,114,25 8949 Other Uses - Payment to Refunded Bond - - - - -

7080 Total Other Financing Sources (Uses) (5,017,022) 3,685,487 32,580,000 1,447,564 32,696,02

1200 Net Change in Fund Balances 1,501,810 (3,957,535) (121,095,838) (788,478) (124,340,04

0100 Fund Balance - September 1 (Beginning) 44,257,854 10,296,399 216,754,709 4,306,227 275,615,18

3000 Fund Balance - August 31 (Ending) 45,759,664$ 6,338,864$ 95,658,871$ 3,517,749$ 151,275,14$

The notes to the financial statements are an integral part of this statement.

30

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 36/157

BEAUMONT INDEPENDENT SCHOOL DISTRICT EXHIBIT B-2RRECONCILIATION OF THE GOVERNMENTAL FUNDS STATEMENT OF REVENUES,EXPENDITURES, AND CHANGES IN FUND BALANCES TO THE STATEMENT OF ACTIVITIESFOR THE FISCAL YEAR ENDED AUGUST 31, 2011

Total Net Change in Fund Balances - Governmental Funds (122,044,870)$

(934,798)

87,622,960

(8,620,317)

Various other reclassifications and eliminations are necessary to convert from the modifiedaccrual basis of accounting to accrual basis of accounting. These include decreasing currentyear revenueby ($42,552,207) eliminatinginterfundtransactions,and recognizing the liabilitiesassociated with interest accrued on long-term debt ($780,037). The net effect of thesereclassifications and recognitions is to increase net assets 120,261,770

Change in Net Assets of Governmental Activities 76,284,745$

The notes to the financial statements are an integral part of this statement.

The District uses internal service funds to charge the costs of certain activities, such as selfinsuranceand printing, to appropriate functions in other funds. The net income (loss) of internalservice funds is reported with governmental activities. The net effect of this consolidation is todecrease net assets.

Depreciation is not recognized as an expense in governmental funds since it does not requirethe use of current financial resources. The net effect of the current year's depreciation is todecrease net assets

Current year captial outlays of $160,440,247 net of retirement and long-term debt principalpayments of $19,636,298 are expedituresin the fund financial statements, but they should beshown as increases in capital assets and reductions in long-term debt in the government-widefinancial statements. The District sold new debt in the amount of $31,500,000. Long termliablities related to vacation and sick leave were adjusted to reflect the net change accured

during the year. Amoritization of bond premium of $136,172 increased net assets. Decreasesin net assets occurred due to amoritization of capitalized bond and debt issuance costs of($179,158) Additionally, net assets decreased due to the disposal of assets and relatedaccumulated deprecitation for a net total of ($104,274,301). The net effect of including the2010 capital outlays and debt principal payments along with new debt issued and changes inother long term liablities is to (decrease) net assets.

31

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 37/157

BEAUMONT INDEPENDENT SCHOOL DISTRICT EXHIBIT C-1STATEMENT OF NET ASSETSINTERNAL SERVICE FUNDSAUGUST 31, 2011

Data InternalControl ServiceCodes Funds

AssetsCurrent Assets:

1110 Cash and Cash Equivalents 4,009,362$1490 Other Assets 461,701

Total Current Assets 4,471,063

Total Assets 4,471,063

Liabilities

Current Liabilities:

2110 Accounts Payable 3,844,848 2150 Payroll Liabilities Payable 5,445 2171 Due to General Fund -

Total Current Liabilities 3,850,293

Total Liabilities 3,850,293

Net Assets

3900 Unrestricted Net Assets 620,770

Total Net Assets 620,770$

The notes to the financial statements are an integral part of this statement.

32

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 38/157

BEAUMONT INDEPENDENT SCHOOL DISTRICT EXHIBIT C-2STATEMENT OF REVENUES, EXPENSES, AND CHANGES IN FUND NET ASSETSINTERNAL SERVICE FUNDSFOR THE YEAR FISCAL ENDED AUGUST 31, 2011

InternalServiceFunds

Operating Revenues Local and Intermediate Sources 1,300,831$

Total Operating Revenues 1,300,831

Operating ExpensesInsurance Claims and Expenses 2,243,663

Total Operating Expenses 2,243,663

Operating Income (942,832)

Nonoperating Revenues (Expenses)Interest Earnings 8,034

Total Nonoperating Revenue (Expense) 8,034

Transfers Out -

Change in Net Assets (934,798)

Total Net Assets - September 1 (Beginning) 1,555,607

Total Net Assets - August 31 (Ending) 620,809$

The notes to the financial statements are an integral part of this statement.

33

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 39/157

BEAUMONT INDEPENDENT SCHOOL DISTRICT EXHIBIT C-3STATEMENT OF CASH FLOWSINTERNAL SERVICE FUNDS FOR THE FISCAL YEAR ENDED AUGUST 31, 2011

InternalServiceFunds

Cash Flows from Operating Activities:Cash Received from Other Funds 1,300,831 Cash Payments For Insurance Claims (2,219,231) Cash Payments For Prepaid Insurance (24,433)

Net Cash Provided by (Used for) Operating Activities (942,832)

Cash Flows from Non-Capital Financing Activities:

Increase in Short Term LoanTransfer Out -

Net Cash Provided by (Used for) Non-Capital Financing Activities -

Cash Flows from Investing Activities:

Interest and Dividends on Investments 8,034

Net Increase (Decrease) in Cash and Cash Equivalents (934,798)

Cash and Cash Equivalents at Beginning of the Year: 5,405,900

Cash and Cash Equivalents at End of the Year: 4,471,102$

Reconciliation of Operating Income (Loss) to Net CashProvided By (Used For) Operating Activities:

Operating Income (Loss): (942,832)

Effect of Increases and Decreases in CurrentAssets and Liabilities:

Decrease (increase) in Prepaid Expenses - Increase (decrease) in Accounts Payable -

Net Cash Provided by (Used for) Operating Activities (942,832)$

The notes to the financial statements are an integral part of this statement.34

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 40/157

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 41/157

BEAUMONT INDEPENDENT SCHOOL DISTRICT EXHIBIT D-1STATEMENT OF FIDUCIARY NET ASSETSFIDUCIARY FUNDSAUGUST 31, 2011

Private Purpose AgencyTrust Funds Fund

Assets

Cash and Cash Equivalents 46,807$ 834,665$Due From Other Funds - 10,212

Total Assets 46,807 844,877

Liabilities

Accounts Payable 3,500$ -$Due to Student Groups - 834,665

Total Liabilities 3,500 834,665$

Net Assets

Unrestricted Net Assets 43,307

Total Liabilities and Net Assets 46,807$

The notes to the financial statements are an integral part of this statement.

36

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 42/157

BEAUMONT INDEPENDENT SCHOOL DISTRICT EXHIBIT D-2STATEMENT OF CHANGES IN FIDUCIARY NET ASSETSFIDUCIARY FUNDSFOR THE FISCAL YEAR ENDED AUGUST 31, 2011

Private PurposeTrust Funds

Additions Local and Intermediate Sources 5,570$

Total Revenues 5,570

DeductionsOther Operating Costs 6,750

Total Deductions 6,750

Change in Net Assets (1,180)

Total Net Assets - September 1 (Beginning) 44,487

Total Net Assets - August 31 (Ending) 43,307$

The notes to the financial statements are an integral part of this statement.

37

8/2/2019 Audit Voted on in Jan - Draft

http://slidepdf.com/reader/full/audit-voted-on-in-jan-draft 43/157

BEAUMONT INDEPENDENT SCHOOL DISTRICTNOTES TO FINANCIAL STATEMENTSAUGUST 31, 2011

38

Note 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

Beaumont Independent School District (District) is a public educational agency operating under theapplicable laws and regulations of the State of Texas. It is governed by a seven-member Board of Trusteesthat is elected by registered voters of the District. The District prepares its basic financial statements inconformity with Generally Accepted Accounting Principles (GAAP) promulgated by the GovernmentalAccounting Standards Board (GASB) and other authoritative sources identified in Statement of Auditing Standards No. 69 of the American Institute of Certified Public Accountants. Additionally, the Districtcomplies with the requirements of the appropriate version of the Texas Education Agency (TEA ) Financial Accountability System Resource Guide (FASRG) and the requirements of contracts and grants of agenciesfrom which it receives funds.

A. Reporting Entity

The District was formed in April 1913 by a special act of the Texas State Legislature. The District is anindependent public educational agency operating under applicable laws and regulations of the State ofTexas. The Board of the District is elected by its residents to staggered three-year terms; has the authority

to make decisions, appoint administrators and managers; significantly influence operations; and has theprimary accountability for fiscal matters. Therefore, the District is not included in any other governmental“reporting entity” as defined by the GASB Statement No. 14, “ The Financial Reporting Entity ”.

In accordance with GASB Statement 14, a financial reporting entity consists of the primary government andits component units. Component units are legally separate organizations for which the elected officials ofthe District are financially accountable, or for which the relationship to the District is such that exclusionwould cause the District’s financial statements to be misleading or incomplete. The District’s blendedcomponent unit, although a legally separate entity, is in substance part of the District’s operations, and sodata from this unit is combined with data of the primary government.

The criteria used to determine whether an organization is a component unit of the District includes: financialaccountability of the District for the component unit, appointment of a voting majority, ability to impose theDistrict’s will on the component unit, and whether there is a financial benefit or burden to the District.

For financial reporting purposes, the Beaumont Independent School District Public Facility Corporation(Public Facility Corporation) is included in the operations and activities of the District because of the fiscaldependency criteria outline in GASB Statement 14. The members of the District Board of Trustees serve asthe Board of the component unit.