Atticulo Sueldo y Salario Tar

-

Upload

laura-marin -

Category

Documents

-

view

218 -

download

0

Transcript of Atticulo Sueldo y Salario Tar

-

7/27/2019 Atticulo Sueldo y Salario Tar

1/8

-

7/27/2019 Atticulo Sueldo y Salario Tar

2/8

Employment Relations Today

perspective, the integrated communicationsand resources of a TBO providerwhich caninclude a benefits Web portal, self-serviceresources for benefit election, retirement-planallocation, and decision-making toolscan

provide a higher quality of service.Beyond simplifying administration, TBO also

offers strategic solutions. Many organizationsare dealing with such complex issues as the

potential freezing of their DB plans, addinghealth savings accounts, increasing DC plan par-ticipation, and rising retiree medical costs. Withan experienced administrative partner, a TBOstrategy can begin to address this complexity.

WHAT EMPLOYEES VALUE

For employers, a first step in reassessing theirapproach to benefits administration shouldinclude understanding the value employees

place on their employer-sponsored benefits,and how they make use of them. Mercerslatest research in this area is the 2007 Mercer Workplace Survey , a proprietary study con-ducted for Mercers outsourcing business totrack employee attitudes and behaviors aroundtheir company-sponsored retirement andhealth-benefits plans. The study is based on anational cross-section of 2,246 employees

who participate in their companys 401(k)

plans and health plans, and it has beenconducted since 2004.The results underscore the great importance

that most employees place on their company-sponsored benefits. Notably, seven in ten agreethat benefits are one of the reasons I work

where I do. More than 60 percent agreed with the statement, My benefits make me

Jeff Miller Employment Relations Today DOI 10.1002/ert

56

feel appreciated by my company. And 90 percent of participants disagree with the state-ment, My benefits dont matter much to me.

Yet, the survey also shows that when itcomes to understanding the features andchoices in their retirement and health plans,about 30 percent of employees still find it dif-ficult to understand their 401(k) plans, andnearly 40 percent find it difficult to under-stand their health plans. So while benefits arehighly valued, for many employees the bene-fits experience can be frustrating, undermin-ing the best efforts of employers to deliver acompelling and motivating benefits package.

These statistics suggest that the level of

employee satisfaction with benefits programscan have a significant impact on a companystalent-management strategies. A TBO solutioncan play an important role, especially if it

provides employees with an integrated,comprehensive view of their benefits and

provide the necessary educational programs,decision-making tools, and decision-supportresources delivered across all mediums,including online, through a full-service call

center as well as in print and onsite.Mercer case studies bear this out. For

example, a major manufacturer and world- wide supplier of automated identification anddata-capture equipment with more than2,700 employees worldwide and four U.S.locations had been administering its healthand benefits programs internally. The com-

panys goals were to (1) partner with anoutsourcing provider to gain administrative

efficiencies within the HR department and (2)support employees by providing an expandedarray of resources to help them become moreeducated and self-reliant health-care con-sumers while increasing the use of self-service tools. To meet the clients goals,Mercer developed a customized self-serviceenrollment Web site with decision-support

For many employees the benefits experience can be frus- trating, undermining the best efforts of employers to deliver a compelling and motivating benefits package.

-

7/27/2019 Atticulo Sueldo y Salario Tar

3/8

Winter 2008

tools, a fully staffed call center to fieldemployee questions, and a highly customizedcommunications campaign. The latter fea-tured postcards announcing open enrollmentdates and educational resources maileddirectly to employee homes, workplace

posters reinforcing the ease of online enroll-ment, clickable intranet banners promotingenrollment, customized information sheetsmailed to employees to encourage thoughtfulelection of benefits, and e-mail communica-tions from internal HR contacts.

The solution made an impact. Almost allemployees (90 percent) chose to enroll in thebenefits program online. Call-center volumedecreased 29 percent from the prior year,indicating the communications program hadbeen successful in helping employees tounderstand the choices in their plan and feelcomfortable about the choices they made forthemselves and their families. The internalbenefit team was thus able to focus more onstrategic benefit-plan design and less onresolving employee-service issues.

ASSESSING RETIREMENT PROGRAMS

One part of many TBO strategies is totalretirement outsourcing (TRO), which com-bines DC and DB administration services.Significantly, the confluence of the recentlyenacted Pension Protection Act and antici-

pated new Department of Labor regulationsaffecting fee disclosures in DC plans is lead-ing many plan sponsors to assess all aspects

of their retirement programs.Changes in the retirement landscape natu-rally invite confusion and uncertainty. Manyemployees use 401(k) plans as their primaryretirement vehicle (especially as DB plansbecome less common), but they still needencouragement to save and help in makingintelligent investment decisions. The Pension

A Total Benefits Strategy Is a Valuable Approach in HR OutsourcingEmployment Relations Today DOI 10.1002/ert

57

Protection Act sanctions the use of automaticenrollment and automatic contribution-rateincrease features, leading many plan sponsorsto create more user-friendly plan options andmake life-cycle funds the default investment.(Asset allocations automatically adjust in life-cycle funds, becoming more conservative asan employees expected retirement dateapproaches.)

At the same time, anticipated new Depart-ment of Labor regulations are expected tomandate increased disclosure to participantsof fees paid by plans, whether for investmentmanagement or administrative services. Tohelp protect themselves as fiduciaries, many

plan sponsors are reviewing the fees they are paying. Meanwhile, for participants, the

increased fee disclosure rules could increase

confusion and hesitation about investing inthe plan.

These new layers of complexity shouldmotivate companies to consider the benefitsof a TBO arrangement with an outsourcing

partner that has deep experience in retire-ment administration and a business modeldriven by providing high levels of service toboth plan sponsors and participants. Theseservices should include the expertise of

unbiased professionals who work withemployers to select appropriate investmentoptions with no ties to proprietary investment

products: unbundled, transparent pricing, thesize and flexibility to offer scalable solutions;high-quality employee communications;and high-impact employee communication andeducation programs.

Many employees use 401(k) plans as their primary ret ment vehicle (especially as DB plans become less com but they still need encouragement to save and help in ing intelligent investment decisions.

-

7/27/2019 Atticulo Sueldo y Salario Tar

4/8

Employment Relations Today

OVERCOMING EMPLOYEE INERTIA REGARDING RETIREMENT

The move to effective management and deliv-ery of retirement benefits in this new envi-ronment requires more than just businesslogic and the desire to have an outsourcingfirm do the hard work. Organizations need toovercome employee inertia when it comesto joining todays retirement plans, and thetrend toward automatic enrollment and other

plan features represents a major step in help-ing employees become better prepared forretirement. Fortunately, that tide is rising.

According to the July 2007 Survey of Retirement Plan Sponsors conducted by theEmployee Benefit Research Institute (EBRI)and Mercer, automatic enrollment is gainingin popularity and may soon become the norm

for DC plans. The survey, which covered 163respondents and was limited to organizationsthat sponsor DB plans in addition to DC

plans, found that 66 percent have eitheralready adopted automatic enrollment or arecurrently considering adding this feature.While thats good news on one hand,employees also need to consider whetherthese automatic enrollments are in an appro-

priate (prediversified) fund and at anappropriate deferral level with provisionsfor increases over time.

Meanwhile, other 401(k) plan options areemerging. The EBRI-Mercer survey alsofound that well over one-third of plan spon-sors have already added or are planning to

Jeff Miller Employment Relations Today DOI 10.1002/ert

58

add Roth 401(k) accounts to their DC plans.(Contributions to a Roth 401(k) account aremade on an after-tax basis, and withdrawalsare tax-free, provided the individual is atleast 59 1 2 and the account has been held forfive years or more.)

Clearly, there are now more opportunitiesfor employees to take advantage of retirementoptions, but that still presents an employeeeducation challenge, since the proliferation of choices has been observed to prevent employ-ees from choosing at all. Effective employeecommunicationswith simple and action-oriented messagesare every bit as crucial astransactional efficiencies and expertise. Fortu-nately, they are one of the components of asuccessful TBO arrangement.

Again, Mercer case histories bear this point out. For example, a leading apparelmanufacturer with 1,000 employees sought toincrease its DC plan participation by 10 per-cent, boosting diversification and participa-tion metrics by leveraging the launch of ready-mixed investment portfolios as wellas combating automatic enrollment inertia

by encouraging participants to increase defer-rals beyond the default percentages.

Utilizing a range of best-practice com-munication approaches across all mediumsbrochures, enrollment postcards, meetings, andeducational workshopsthe company experi-enced encouraging results: a 9 percent increasein overall plan participation; increased contri-bution rates and investment allocation changes;and more than 15 percent of participants elect-

ing a ready-mixed portfolio.Mercer has noted similar results in othercompanies. A 30,000-employee manufacturerof home appliances saw a 90 percent increasein participation in a single ready-mixed fund,

with a large percentage of employees alsoincreasing contribution rates.

The move to effective management and delivery of retire- ment benefits in this new environment requires more than just business logic and the desire to have an outsourcing firm do the hard work.

-

7/27/2019 Atticulo Sueldo y Salario Tar

5/8

Winter 2008

These cases indicate that as challenging asthese changing times are, plan sponsors seek-ing to attract and retain top talent must remainfocused on their primary strategy: to ensurethat their benefits programs provide a com-

petitive advantage. Together with an adminis-trative partner, plan sponsors can capitalizeon the opportunities these changes afford andhelp their employees become better preparedfor retirement.

CHOOSING AN APPROPRIATE PARTNER

If the evidence shows that employee satisfac-tion with benefits packages is important to tal-ent management, and if benefits management,communication, and administration may bebest served by the integrated approach exem-

plified by a TBO solution, then organizationsmust consider what specific advantages a

potential benefits outsourcing partner canbring to the table.

On a fundamental level, the TBO providershould offer deep, holistic benefits expertiseacross all benefits domains. This means more

than just administrative expertise, which is agiven in TBO terms, but also the ability to

provide strategic and consulting leadershipas well. Its not an accident that such mile-

wide, mile-deep capacity is a typical charac-teristic of a global outsourcing organization

with a solid rooting in human-capital andmanagement consulting, actuarial and invest-ment expertise, and dedication to continuallyimproving technology platforms for the

delivery and administration of benefitsservices.Such technical resources are crucial and

include capabilities for managing and main-taining employee records and data. From theemployee perspective, a TBO partner shouldalso offer resources that can encourage

A Total Benefits Strategy Is a Valuable Approach in HR OutsourcingEmployment Relations Today DOI 10.1002/ert

59

higher levels of employee participation andsatisfaction in self-management of benefitsretirement savings calculators, for example,and other decision-making tools. A TBO

provider should be able to offer automaticenrollment and automatic deferral-increase

programs for retirement plans, integrateretirement and health data with outside ven-dors, and provide such important service ashealth-care claims analysis.

The provider must also offer integratedresources to educate and motivate employeesefficiently across multiple channels: Web-based and print communications, call-centersupport, and employee self-service solutions.In addition, the ability to measure and reportqualitative and quantitative results is vital toany organizations assessment of not only theeffectiveness of its benefits strategy, but also of the ongoing impact and return on investment

of the TBO partnership. And finally, the clearvalue of having a single point of contact inthe coordination and management of so manybundled services cannot be overstated.

Based on internal Mercer research from2006, with senior executives responsible forevaluating and selecting providers of HRadministration service, three key selectioncriteria for outsourcing partnerships have

emerged, with high percentages of participatingexecutives rating the following as absolutely orvery important in selecting an outsourcer:

1. The ability to coordinate services througha dedicated relationship management team(84 percent);

On a fundamental level, the TBO provider should offe deep, holistic benefits expertise across all benefits dom

-

7/27/2019 Atticulo Sueldo y Salario Tar

6/8

Employment Relations Today

2. Offers products and services highlycustomized to organizational needs (72

percent); and3. Offers highly cost-effective benefit solu-

tions (71 percent).

At the same time, the TBO relationship ismore than the one-way offloading of transac-tions to an outsourcing partner. The best TBO

partnering is a superhighway of sortsfromemployer to outsourcing partner and back tothe employees, who should expect timely and

well-targeted communications. The result is amore motivated, more engaged workforce thatviews its benefits packages as a measure of employer commitment and hope for the future.

Jeff Miller Employment Relations Today DOI 10.1002/ert

60

The TBO model presents an opportunityfor organizations that have handed off only

pieces of their benefits management to out-sourcers. As they examine TBO, they maycome to see how an experienced providercan create greater efficiency, consistency,and cost savings while delivering the cus-tomized, high-quality communications andeducation programs that not only guideemployees in their benefit choices, but also

provide tools to help them fulfill retirementgoals. TBO is about many things, butmainly its about total service, betterservice, and true partnering as firms striveto fulfill their value propositions for theiremployees.

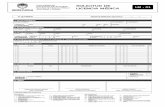

How much do you agree or disagree with the following statements?

68%

19%

18%

10%

9%

7%

22%

43%

45%

25%

21%

21%

7%

33%

31%

48%

47%

43%

2%

5%

7%

17%

23%

29%

My benefits don't matter much to me

As health-care costs rise, I would rather take a pay cutthan have my health benefits reduced

Getting health benefits through work is moreimportant to me than getting a salary

My benefits make me feel appreciated by my company

My benefits are one of the reasons I work where I do

My company should offer better benefits

Strongly Disagree Somewhat Disagree Somewhat Agree Strongly Agree

Once again this research documents the crucial importance of benefits in participantsconstellation of concerns; seven in ten agree that benefits are one of the reasons I work where I do (although even morewould like better benefits). Ninety percent of participants disagree with the statement that my benefitsdont matter much to me.

Exhibit 1. Perceptions of BenefitsSource: 2007 Mercer Workplace Survey.

-

7/27/2019 Atticulo Sueldo y Salario Tar

7/8

Winter 2008

A Total Benefits Strategy Is a Valuable Approach in HR OutsourcingEmployment Relations Today DOI 10.1002/ert

61

Jeff Miller is president of Mercers outsourcing business, based in Norwood, Massachusetts. He has over 20 years of global experience in financial services, including retirement servicesand asset-management operations, technology, and marketing and sales. He has held execu-tive positions at leading financial services firms, including Smith Barney and Putnam Invest-

ments. For more information, visit www.mercer.com.Securities offered through Mercer Securities, a division of MMC Securities Corp., a regis-tered broker-dealer and member FINRA/SIPC.

-

7/27/2019 Atticulo Sueldo y Salario Tar

8/8